page 318

©CATHY YEULET/123RF

page 319

LO10.1

Define life insurance and determine your life insurance needs.

What Is Life Insurance?

Even though putting a price on your life is impossible, you probably own some life insurance—through a group plan where you work, as a veteran, or through a policy you bought. Life insurance is one of the most important and expensive purchases you may ever make; therefore, it is important that you budget for this need. Deciding whether you need it and choosing the right policy from dozens of options take time, research, and careful thought. This chapter will help you make decisions about life insurance. It describes what life insurance is and how it works, the major types of life insurance coverage, and how you can use life insurance to protect your family.

When you buy life insurance, you’re making a contract with the company issuing the policy. You agree to pay a certain amount of money—the premium—periodically. In return the company agrees to pay a death benefit, or a stated sum of money upon your death, to your beneficiary. A beneficiary is a person named to receive the benefits from an insurance policy.

The Purpose of Life Insurance

Most people buy life insurance to protect the people who depend on them from financial losses caused by their death. Those people could include a spouse, children, an aging parent, or a business partner or corporation. Life insurance benefits may be used to:

Pay off a home mortgage or other debts at the time of death.

Provide lump-sum payments through an endowment for children when they reach a specified age.

Provide an education or income for children.

Make charitable donations after death.

Provide a retirement income.

Accumulate savings.

page 320Establish a regular income for survivors.

Set up an estate plan.

Pay estate and gift taxes.

The Principle and Psychology of Life Insurance

No one can say with any certainty how long a particular person will live. Still, insurance companies are able to make some educated guesses. Over the years, they’ve compiled tables that show about how long people live. Using these tables, the company will make a rough guess about a person’s life span and charge him or her accordingly. The sooner a person is likely to die, the higher the premiums he or she will pay.

How Long Will You Live?

If history is a guide, you’ll live longer than your ancestors did. In 1900, an American male could be expected to live 46.3 years. By 2012, in contrast, life expectancy had risen to 76.4 years for men and 81.2 for women. Exhibit 10–1 shows about how many years a person can be expected to live today. For instance, a 30-year-old woman can be expected to live another 52.1 years. That doesn’t mean that she has a high probability of dying at age 82.1. This just means that 52.1 is the average number of additional years a 30-year-old woman may expect to live.

Exhibit 10–1 Life Expectancy Tables, All Races, 2012

This table helps insurance companies determine insurance premiums. Use the table to find the average number of additional years a 20-year-old male and female are expected to live.

EXPECTATION OF LIFE IN YEARS |

||

Age |

Male |

Female |

0 |

76.4 |

81.2 |

1 |

75.9 |

80.6 |

5 |

72.0 |

76.7 |

10 |

67.0 |

71.7 |

15 |

62.1 |

66.8 |

20 |

57.3 |

61.9 |

25 |

52.6 |

57.0 |

30 |

48.0 |

52.1 |

35 |

43.3 |

47.3 |

40 |

38.7 |

42.6 |

45 |

34.1 |

37.9 |

50 |

29.7 |

33.3 |

55 |

25.6 |

28.9 |

60 |

21.7 |

24.6 |

65 |

17.9 |

20.5 |

70 |

14.4 |

16.5 |

75 |

11.2 |

12.9 |

80 |

8.3 |

9.7 |

85 |

5.9 |

6.9 |

90 |

4.1 |

4.8 |

95 |

2.8 |

3.3 |

100 |

2.0 |

2.3 |

Source: CDC/NCHS, National Vital Statistics Report, https://www.cdc.gov/nchs/data/nvsr/nvsr65/nvsr65_08.pdf, accessed April 24, 2017.

Do You Need Life Insurance?

Before you buy life insurance, you’ll have to decide whether you need it at all. Generally, if your death would cause financial hardship for somebody, then life insurance is a wise purchase. Households with children usually have the greatest need for life insurance. Single people who live alone or with their parents, however, usually have little or no need for life insurance unless they have a great deal of debt or want to provide for their parents, a friend, relative, or charity.

page 321

Estimating Your Life Insurance Requirements

In estimating your life insurance requirements, consider the insurance coverage that your employer offers you as a fringe benefit. Many employers provide employees with life insurance coverage equal to their yearly salary. For example, if you earn $55,000 per year, you may receive $55,000 of insurance coverage. Some employers offer insurance of two or more times the salary with increased contributions from employees. The premiums are usually lower than premiums for individual life insurance policies, and you don’t have to pass a physical exam.

There are four general methods for determining the amount of insurance you may need: the easy method, the DINK method, the “nonworking” spouse method, and the “family need” method.

THE EASY METHOD Simple as this method is, it is remarkably useful. It is based on the insurance agent’s rule of thumb that a “typical family” will need approximately 70 percent of your salary for seven years before they adjust to the financial consequences of your death. In other words, for a simple estimate of your life insurance needs, just multiply your current gross income by 7 (7 years) and 0.70 (70 percent).

This method assumes your family is “typical.” You may need more insurance if you have four or more children, if you have above-average family debt, if any member of your family suffers from poor health, or if your spouse has poor employment potential. On the other hand, you may need less insurance if your family is smaller.

THE DINK (DUAL INCOME, NO KIDS) METHOD If you have no dependents and your spouse earns as much or more than you do, you have very simple insurance needs. Basically, all you need to do is ensure that your spouse will not be unduly burdened by debts should you die. Here is an example of the DINK method:

page 322

This method assumes your spouse will continue to work after your death. If your spouse suffers poor health or is employed in an occupation with an uncertain future, you should consider adding an insurance cushion to see him or her through hard times.

THE “NONWORKING” SPOUSE METHOD Insurance experts have estimated that extra costs of up to $10,000 a year may be required to replace the services of a homemaker in a family with small children. These extra costs may include the cost of a housekeeper, child care, more meals out, additional carfare, laundry services, and so on. They do not include the lost potential earnings of the surviving spouse, who often must take time away from the job to care for the family.

To estimate how much life insurance a homemaker should carry, simply multiply the number of years before the youngest child reaches age 18 by $10,000:

If there are teenage children, the $10,000 figure can be reduced. If there are more than two children under age 13 or if anyone in the family suffers poor health or has special needs, the $10,000 figure should be adjusted upward.

THE “FAMILY NEED” METHOD The first three methods assume you and your family are “typical” and ignore important factors such as Social Security and your liquid assets. The nearby Figure It Out! feature provides a detailed worksheet for making a thorough estimate of your life insurance needs.

page 323Although this method is quite thorough, if you believe it does not address all of your special needs, you should obtain further advice from an insurance expert or a financial planner.

As you determine your life insurance needs, don’t forget to consider the life insurance you may already have. You may have ample coverage through your employer and through any mortgage and credit life insurance you have purchased.

Before you consider types of life insurance policies, you must decide what you want your life insurance to do for you and your dependents. First, how much money do you want to leave to your dependents should you die today? Will you require more or less insurance protection to meet their needs as time goes on? Second, when would you like to be able to retire? What amount of income do you believe you and your spouse would need then? Third, how much will you be able to pay for your insurance program? Are the demands on your family budget for other living expenses likely to be greater or lower as time goes on?

When you have considered these questions and developed some approximate answers, you are ready to select the types and amounts of life insurance policies that will help you accomplish your objectives.

LO10.2

Distinguish between the types of life insurance companies and analyze various life insurance policies these companies issue.

Types of Life Insurance Companies and Policies

Types of Life Insurance Companies

You can purchase the new or extra life insurance you need from two types of life insurance companies: stock life insurance companies, owned by shareholders, and mutual life insurance companies, owned by policyholders. Of the 868 life insurance companies in the United States, about 73 percent are stock companies, and about 27 percent are mutual.

Stock companies generally sell nonparticipating policies, or nonpar policies, while mutual companies specialize in the sale of participating policies, or par policies. A participating policy has a somewhat higher premium than a nonparticipating policy, but a part of the premium is refunded to the policyholder annually. This refund is called the policy dividend.

A long debate about whether stock companies or mutual companies offer less expensive life insurance has been inconclusive. You should check with both stock and mutual companies to determine which type offers the best policy for your particular needs at the lowest price.

If you wish to pay exactly the same premium each year, you should choose a nonparticipating policy with its guaranteed premiums. However, you may prefer life insurance whose annual price reflects the company’s experience with its investments, the health of its policyholders, and its general operating costs, that is, a participating policy.

page 324Nevertheless, as with other forms of insurance, price should not be your only consideration in choosing a life insurance policy. You should consider the financial stability of and service provided by the insurance company.

Types of Life Insurance Policies

Both mutual insurance companies and stock insurance companies sell two basic types of life insurance: temporary and permanent insurance. Temporary insurance can be term, renewable term, convertible term, or decreasing term insurance. Permanent insurance is known by different names, including whole life, straight life, ordinary life, and cash-value life insurance. As you will learn in the next section, permanent insurance can be limited payment, variable, adjustable, or universal life insurance. Other types of insurance policies—group life and credit life insurance—are generally temporary forms of insurance. Exhibit 10–2 lists major types and subtypes of life insurance.

Exhibit 10–2 Major Types and Subtypes of Life Insurance

Term (temporary) |

Whole, Straight, or Ordinary Life |

Other Types |

|

|

|

|

|

|

|

|

|

|

|

|

|

TERM LIFE INSURANCE Term insurance, sometimes called temporary life insurance, provides protection against loss of life for only a specified term, or period of time. A term insurance policy pays a benefit only if you die during the period it covers, which may be 1, 5, 10, or 20 years, or up to age 70. If you stop paying the premiums, your coverage stops. Term insurance is often the best value for customers. You need insurance coverage most while you are raising children. As your children become independent and your assets increase, you can reduce your coverage. Term insurance comes in many different forms. Here are some examples.

RENEWABLE TERM The coverage of term insurance ends at the conclusion of the term, but you can continue it for another term—five years, for example—if you have a renewable option. However, the premium will increase because you will be older. It also usually has an age limit; you cannot renew after you reach a certain age.

MULTIYEAR LEVEL TERM The most popular, a multiyear level term, or straight term, policy guarantees that you will pay the same premium for the duration of your policy.

CONVERSION TERM This type of policy allows you to change from term to permanent coverage. This will have a higher premium.

DECREASING TERM Term insurance is also available in a form that pays less to the beneficiary as time passes. The insurance period you select might depend on your age or on how long you decide that the coverage will be needed. For example, if you have a mortgage on a house, you might buy a 25-year decreasing term policy as a way to make page 325sure that the debt could be paid if you died. The coverage would decrease as the balance on the loan decreased.

RETURN-OF-PREMIUM TERM A few years ago, insurance companies began to sell return-of-premium term life policies. These policies return all the premiums if you survive to the end of the policy term. Premiums are higher than the regular term policy, but you do get all your money back.

WHOLE LIFE INSURANCE The other major type of life insurance is known as whole life insurance (also called a straight life policy, a cash-value policy, or an ordinary life policy). Whole life insurance is a permanent policy for which you pay a specified premium each year for the rest of your life. In return, the insurance company pays your beneficiary a stated sum when you die. The amount of your premium depends mostly on the age at which you purchase the insurance.

Whole life insurance may also serve as an investment. Part of each premium you pay is set aside in a savings account. When and if you cancel the policy, you are entitled to the accumulated savings, which is known as the cash value. Whole life policies are popular because they provide both a death benefit and a savings component. You can borrow from your cash value if necessary, although you must pay interest on the loan. Cash-value policies may make sense for people who intend to keep the policies for the long term or who want a more structured way to save. However, the Consumer Federation of America Insurance Group suggests that you explore other savings and investment strategies before investing your money in a permanent policy.

Remember, the primary purpose of buying life insurance is not for investment; it is to protect loved ones who depend on you for financial support upon your death. Furthermore, buying life insurance later in life can be expensive, and you may not qualify because of poor health or chronic diseases.

The premium of a term insurance policy will increase each time you renew your insurance. In contrast, whole life policies have a higher annual premium at first, but the rate remains the same for the rest of your life. Several types of whole life policies have been developed to meet the needs of different customers. These include the limited payment policy, the variable life policy, the adjustable life policy, and universal life insurance.

LIMITED PAYMENT POLICY Limited payment policies charge premiums for only a certain length of time, usually 20 or 30 years or until the insured reaches a certain age. At the end of this time, the policy is “paid up,” and the policyholder remains insured for life. When the policyholder dies, the beneficiary receives the full death benefit. The annual premiums are higher for limited payment policies because the premiums have to be paid within a shorter period of time.

VARIABLE LIFE POLICY With a variable life policy, your premium payments are fixed. As with a cash-value policy, part of your premium is placed in a separate account; this money is invested in a stock, bond, or money market fund. The death benefit is guaranteed, but the cash value of the benefit can vary considerably according to the ups and downs of the stock market. Your death benefit can also increase, depending on the earnings of that separate fund.

ADJUSTABLE LIFE POLICY An adjustable life policy allows you to change your coverage as your needs change. For example, if you want to increase or decrease your death benefit, you can change either the premium payments or the period of coverage.

UNIVERSAL LIFE Universal life insurance is essentially a term policy with a cash value. Part of your premium goes into an investment account that grows and earns interest. You are able to borrow or withdraw your cash value. Unlike a traditional whole life policy, a universal life policy allows you to change your premium without changing your coverage.

page 326Exhibit 10–3 compares the important features of term life, whole life, and universal life insurance.

Exhibit 10–3 Comparing the Major Types of Life Insurance

Term Life |

Whole Life |

Universal Life |

|

Premium |

Lower initially, increasing with each renewal |

Higher initially than term; normally doesn’t increase |

Flexible premiums |

Protects for |

A specified period |

Entire life if you keep the policy |

A flexible time period |

Policy benefits |

Death benefits only |

Death benefits and eventually a cash and loan value |

Flexible death benefits and eventually a cash and loan value |

Advantages |

Low outlay Initially, you can purchase a larger amount of coverage for a lower premium. |

Helps you with financial discipline Generally fixed premium amount Cash value accumulation You can take loan against policy. |

More flexibility Takes advantages of current interest rates Offers the possibility of improved mortality rates (increased life expectancy because of advancements in medicine, which may lower policy costs) |

Disadvantages |

Premium increases with age. No cash value |

Costly if you surrender early Usually no cash value for at least three to five years May not meet short-term needs |

Same as whole life Greater risks due to program flexibility Low interest rates can affect cash value and premiums. |

Options |

May be renewable or convertible to a whole life policy |

May pay dividends May provide a reduced paid-up policy Partial cash surrenders permitted |

May pay dividends Minimum death benefit Partial cash surrenders permitted |

OTHER TYPES OF LIFE INSURANCE POLICIES Other types of life insurance policies include group life insurance, credit life insurance, and endowment life insurance.

GROUP LIFE INSURANCE Group life insurance is basically a variation of term insurance. It covers a large number of people under a single policy. The people included in the group do not need medical examinations to get the coverage. Group insurance is usually offered through employers, who pay part or all of the costs for their employees, or through professional organizations, which allow members to sign up for the coverage. Group plans are easy to enroll in, but they can be much more expensive than similar term policies. If you leave your employer, some states require that you be allowed to convert the policy to a whole life policy with the same insurance company.

CREDIT LIFE INSURANCE Credit life insurance is used to pay off certain debts, such as auto loans or mortgages, in the event that you die before they are paid in full. These types of policies are not the best buy for the protection that they offer. Decreasing term insurance is a better option.

ENDOWMENT LIFE INSURANCE Endowment is life insurance that provides coverage for a specific period of time and pays an agreed-upon sum of money to the policyholder if he or she is still living at the end of the endowment period. If the policyholder dies before that time, the beneficiary receives the money.

page 327

LO10.3

Select important provisions in life insurance contracts and create a plan to buy life insurance.

Selecting Provisions and Buying Life Insurance

Key Provisions in a Life Insurance Policy

Study the provisions in your policy carefully. The following are some of the most common features.

NAMING YOUR BENEFICIARY You decide who receives the benefits of your life insurance policy: your spouse, your child, or your business partner, for example. You can also name contingent beneficiaries, those who will receive the money if your primary beneficiary dies before or at the same time as you do. Update your list of beneficiaries as your needs change.

INCONTESTABILITY CLAUSE The incontestability clause says that the insurer can’t cancel the policy if it’s been in force for a specified period, usually two years. After that time, the policy is considered valid during the lifetime of the insured. This is true even if the policy was gained through fraud. The incontestability clause protects the beneficiaries from financial loss in the event that the insurance company refuses to meet the terms of the policy.

THE GRACE PERIOD When you buy a life insurance policy, the insurance company agrees to pay a certain sum of money under specified circumstances, and you agree to pay a certain premium regularly. The grace period allows 28 to 31 days to elapse, during which time you may pay the premium without penalty. After that time, the policy lapses if you have not paid the premium.

POLICY REINSTATEMENT A lapsed policy can be put back in force, or reinstated, if it has not been turned in for cash. To reinstate the policy, you must again qualify as an acceptable risk, and you must pay overdue premiums with interest. There is a time limit on reinstatement, usually one or two years.

page 328NONFORFEITURE CLAUSE One important feature of the whole life policy is the nonforfeiture clause. This provision prevents the forfeiture of accrued benefits if you choose to drop the policy. For example, if you decide not to continue paying premiums, you can exercise specified options with your cash value.

MISSTATEMENT OF AGE PROVISION The misstatement of age provision says that if the company finds out that your age was incorrectly stated, it will pay the benefits your premiums would have bought if your age had been correctly stated. The provision sets forth a simple procedure to resolve what could otherwise be a complicated legal matter.

POLICY LOAN PROVISION A loan from the insurance company is available on a whole life policy after the policy has been in force for one, two, or three years, as stated in the policy. This feature, known as the policy loan provision, permits you to borrow any amount up to the cash value of the policy. However, a policy loan reduces the death benefit by the amount of the loan plus interest if the loan is not repaid.

SUICIDE CLAUSE In the first two years of coverage, beneficiaries of someone who dies by suicide receive only the amount of the premiums paid. After two years, beneficiaries receive the full value of death benefits.

RIDERS TO LIFE INSURANCE POLICIES An insurance company can change the conditions of a policy by adding a rider to it. A rider is a document attached to a policy that changes its terms by adding or excluding specified conditions or altering its benefits.

WAIVER OF PREMIUM DISABILITY BENEFIT One common rider is a waiver of premium disability benefit. This clause allows you to stop paying premiums if you’re totally and permanently disabled before you reach a certain age, usually 60. The company continues to pay the premiums at its own expense.

ACCIDENTAL DEATH BENEFIT Another common rider to life insurance is an accidental death benefit, sometimes called double indemnity. Double indemnity pays twice the value of the policy if you are killed in an accident. Again, the accident must occur before a certain age, generally 60 to 65. Experts counsel against adding this rider to your coverage. The benefit is very expensive, and your chances of dying in an accident are slim.

GUARANTEED INSURABILITY OPTION A third important rider is known as a guaranteed insurability option. This rider allows you to buy a specified additional amount of life insurance at certain intervals without undergoing medical exams. This is a good option for people who anticipate needing more life insurance in the future.

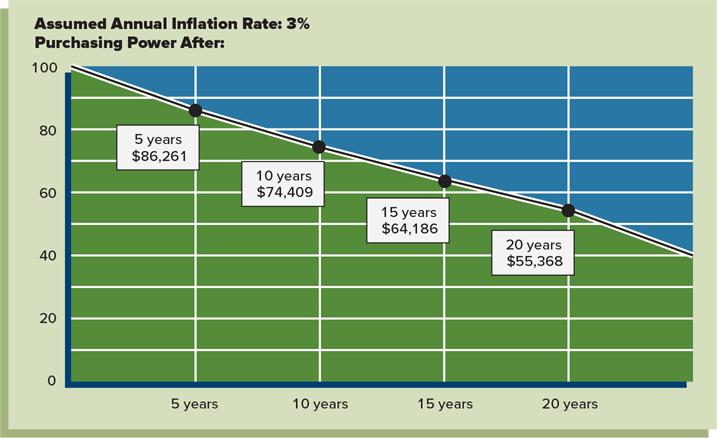

COST-OF-LIVING PROTECTION This special rider is designed to help prevent inflation from eroding the purchasing power of the protection your policy provides. A loss, reduction, or erosion of purchasing power refers to the impact inflation has on a fixed amount of money. As inflation increases the cost of goods and services, that fixed amount will not buy as much in the future as it does today. Exhibit 10–4 shows the effects of inflation on a $100,000 life insurance policy. However, your insurance needs are likely to be smaller in later years.

Exhibit 10–4 Effects of Inflation on a $100,000 Life Insurance Policy

Source: The TIAA Guide to Life Insurance Planning for People in Education (New York: Teachers Insurance and Annuity Association, January 1997), p. 8.

ACCELERATED BENEFITS Accelerated benefits, also known as living benefits, are life insurance policy proceeds paid to the policyholder who is terminally ill before he or she dies. The benefits may be provided for directly in the policies, but more often they are added by riders or attachments to new or existing policies. A representative list of insurers that offer accelerated benefits is available from the National Insurance Consumer Helpline (NICH) at 1-800-942-4242. Although more than 150 companies offer some form of accelerated benefits, not all plans are approved in all states. NICH cannot tell you whether a page 329particular plan is approved in any given state. For more information, check with your insurance agent or your state department of insurance.

SECOND-TO-DIE OPTION A second-to-die life insurance policy, also called survivorship life, insures two lives, usually husband and wife. The death benefit is paid when the second spouse dies. Usually, a second-to-die policy is intended to pay estate taxes when both spouses die. However, some attorneys claim that with the right legal advice, you can minimize or avoid estate taxes completely.

Now that you know the various types of life insurance policies and the major provisions of and riders to such policies, you are ready to make your buying decisions.

Buying Life Insurance

You should consider a number of factors before buying life insurance. As discussed earlier in this chapter, these factors include your present and future sources of income, other savings and income protection, group life insurance, group annuities (or other pension benefits), Social Security, and, of course, the financial strength of the company.

FROM WHOM TO BUY? Look for insurance coverage from financially strong companies with professionally qualified representatives. It is not unusual for a relationship with an insurance company to extend over a period of 20, 30, or even 50 years. For that reason alone, you should choose carefully when deciding on an insurance company or an insurance agent. Fortunately, you have a choice of sources.

SOURCES Protection is available from a wide range of private and public sources, including insurance companies and their representatives; private groups such as employers, labor unions, and professional or fraternal organizations; government programs such as Medicare and Social Security; and financial institutions and manufacturers offering credit insurance.

page 330If you shop for insurance on the internet, make sure that the website is secure. Look for the lock icon in the address bar or a URL that begins with “https:”, and never provide personal data if you don’t trust the site. It is not easy to find an insurance company that will sell you a commission-free policy even if you type in “no load life insurance” on internet search engines. For more information on life insurance, visit www.accuquote.com, www.acli.com, www.iii.org, www.naic.org, www.insure.com, and your state insurance department.

RATING INSURANCE COMPANIES Some of the strongest, most reputable insurance companies in the nation provide excellent insurance coverage at reasonable costs. In fact, the financial strength of an insurance company may be a major factor in holding down premium costs for consumers.

Locate an insurance company by checking the reputations of local agencies. Ask members of your family, friends, or colleagues about the insurers they prefer. Exhibit 10–5 describes the rating systems used by A. M. Best and the other big four rating agencies.

Exhibit 10–5 Rating Systems of Major Rating Agencies

You should deal with companies rated superior or excellent.

A. M. Best |

Standard & Poor’s, Duff & Phelps |

Moody’s |

Weiss Research |

|

Superior |

A++ A+ |

AAA |

Aaa |

A+ |

Excellent |

A A− |

AA+ AA AA |

Aa1 Aa2 Aa3 |

A A− B+ |

Good |

B++ B+ |

A+ A A |

A1 A2 A3 |

B B− C+ |

Adequate |

B B− |

BBB+ BBB BBB− |

Baa1 Baa2 Baa3 |

C C− D+ |

Below average |

C+ C+ |

BB+ BB BB− |

Ba1 Ba2 Ba3 |

D D− E+ |

Weak |

C C− D |

B+ B B− |

B1 B2 B3 |

E E− |

Nonviable |

E F |

CCC CC C, D |

Caa Ca C |

F |

CHOOSING YOUR INSURANCE AGENT An insurance agent handles the technical side of insurance. However, that’s only the beginning. The really important part of the agent’s job is to apply his or her knowledge of insurance to help you select the proper kind of protection within your financial boundaries.

page 331

Is it ethical for an attorney who is also a licensed insurance agent to sell life insurance to clients? Yes, according to experts, if terms are fair and reasonable to you and you consent in writing to the terms of the transactions and to the conflict of interest.

Choosing a good agent is among the most important steps in building your insurance program. How do you find an agent? One of the best ways to begin is by asking your parents, friends, neighbors, and others for their recommendations. The nearby Financial Literacy in Practice feature offers guidelines for choosing an insurance agent.

COMPARING POLICY COSTS Each life insurance company designs the policies it sells to make them attractive and useful to many policyholders. One policy may have features another policy doesn’t; one company may be more selective than another company; one company may get a better return on its investments than another company. These and other factors affect the prices of life insurance policies.

In brief, five factors affect the price a company charges for a life insurance policy: the company’s cost of doing business, the return on its investments, the mortality rate it expects among its policyholders, the features the policy contains, and competition among companies with comparable policies.

Consider the time value of money in comparing policy costs. Ask your agent to give you interest-adjusted indexes. An interest-adjusted index is a method of evaluating the cost of life insurance by taking into account the time value of money. Highly complex mathematical calculations and formulas combine premium payments, dividends, cash-value buildup, and present value analysis into an index number that makes possible a fairly accurate cost comparison among insurance companies. The lower the index number, the lower the cost of the policy. The nearby Figure It Out! feature shows how to use an interest-adjusted index to compare the costs of insurance.

OBTAINING AND EXAMINING A POLICY A life insurance policy is issued after you submit an application for insurance and the insurance company accepts the application. The company determines your insurability by means of the information in your application, the results of a medical examination, and the inspection report. When you receive a life insurance policy, read every word of the contract, and, if necessary, ask your agent for a point-by-point explanation of the language. Many insurance companies have rewritten their contracts to make them more understandable. These are legal documents, and you should be familiar with what they promise, even though they use technical terms.

After you buy new life insurance, you have a 10-day “free-look” period during which you can change your mind. If you do so, the company will return your premium without penalty.

page 332

CHOOSING SETTLEMENT OPTIONS Selecting the appropriate settlement option is an important part of designing a life insurance program. The most common settlement options are lump-sum payment, limited installment payment, life income option, and proceeds left with the company.

LUMP-SUM PAYMENT The insurance company pays the face amount of the policy in one installment to the beneficiary or to the estate of the insured. This form of settlement is the most widely used option. However, it may be a wrong option if you wish to financially protect your spouse for the rest of his/her life or until your children finish their education.

LIMITED INSTALLMENT PAYMENT This option provides for payment of the life insurance proceeds in equal periodic installments for a specified number of years after your death.

LIFE INCOME OPTION Under the life income option, payments are made to the beneficiary for as long as she or he lives. The amount of each payment is based primarily on the sex and attained age of the beneficiary at the time of the insured’s death. It is probably the best option if you wish to provide sufficient income for your spouse for the rest of his or her life.

PROCEEDS LEFT WITH THE COMPANY The life insurance proceeds are left with the insurance company at a specified rate of interest. The company acts as trustee and pays the interest to the beneficiary. The guaranteed minimum interest rate paid on the proceeds varies among companies.

SWITCHING POLICIES Think twice if your agent suggests that you replace the whole life or universal life insurance you already own. Before you give up this protection, make page 333sure you are still insurable (check medical and any other qualification requirements). Ask your agent or company for an opinion about the new proposal to get both sides of the argument. The nearby Financial Literacy in Practice feature presents 10 important guidelines for purchasing life insurance. To learn how to get the best rate on life insurance, read the nearby From the Pages of . . . Kiplinger’s Personal Finance feature.

page 334

Huddleston, Cameron, “Get the Best Rate on Health Insurance” Reprinted by permission from Kiplinger’s Personal Finance. January 2015. Copyright © 2015 The Kiplinger Washington Editors, Inc.

What factors should you consider before shopping around for the best deals in purchasing life insurance?

What two factors have the biggest impact on your insurance rate?

Why do women usually get lower rates than men?

Why do insurance companies want to know if you have had a moving violation in the past three years? After all, you are not buying car insurance.

page 336

LO10.4

Recognize how annuities provide financial security.

Financial Planning with Annuities

As you have seen so far, life insurance provides a set sum of money at your death. However, if you want to enjoy benefits while you are still alive, you might consider annuities. An annuity protects you against the risk of outliving your assets.

An annuity is a financial contract written by an insurance company that provides you with regular income. Generally, you receive the income monthly, often with payments arranged to continue for as long as you live. Annuities may be fixed, providing a specific income for life, or variable, with payouts above a guaranteed minimum level dependent on investment return. The payments may begin at once (immediate annuity) or at some future date (deferred annuity).

IMMEDIATE ANNUITIES People approaching retirement age can purchase immediate annuities. These annuities provide income payments at once. They are usually purchased with a lump-sum payment. When you are 65, you may no longer need all of your life insurance coverage—especially if you have grown children. You may decide to convert the cash value of your insurance policy into a lump-sum payment for an immediate annuity.

DEFERRED ANNUITIES With deferred annuities, income payments start at some future date. Meanwhile, interest accumulates on the money you deposit. Younger people often buy such annuities to save money toward retirement. A deferred annuity purchased with a lump-sum payment is known as a single-premium deferred annuity. A premium is the payment you make. These annuities are popular because of the greater potential for tax-free growth. If you are buying a deferred annuity on an installment basis, you may want one that allows flexible premiums, or payments. That means that your contributions can vary from year to year.

As with the life insurance principle, discussed earlier, the predictable mortality experience of a large group of individuals is fundamental to the annuity principle. By determining the average number of years a large number of persons in a given age group will live, the insurance company can calculate the annual amounts to pay to each person in the group over his or her entire life.

Because the annual payouts per premium amount are determined by average mortality experience, annuity contracts are more attractive for people whose present health, living habits, and family mortality experience suggest that they are likely to live longer than average. As a general rule, annuities are not advisable for people in poor health, although exceptions to this rule exist.

INDEX ANNUITIES A type of fixed annuity, an index annuity, has earnings that accumulate at a rate based on a formula linked to one or more equity-based indexes, such as the S&P 500. Index annuities may offer death benefit protection.

Why Buy Annuities?

A primary reason for buying an annuity is to give you retirement income for the rest of your life. You should fully fund your IRAs, Keoghs, and 401(k)s before considering annuities. We discuss retirement income in Chapter 14.

Although people have been buying annuities for many years, the appeal of variable annuities increased during the mid-1990s due to a rising stock market. A fixed annuity states that the annuitant (the person who is to receive the annuity) will receive a fixed amount of income over a certain period or for life. With a variable annuity, the monthly payments vary because they are based on the income received from stocks or other investments.

Today, variable annuities are part of the retirement and investment plans of many Americans. Before buying any variable annuity, however, request a prospectus from the insurance company or from your insurance agent and read it carefully. The prospectus contains important information about the annuity contract, including fees and charges, page 337investment options, death benefits, and annuity payout options. Compare the benefits and costs of the annuity to other variable annuities and to other types of investments, such as mutual funds, discussed in Chapter 13.

Some of the growth in the use of annuities can be attributed to the passage of the Employee Retirement Income Security Act (ERISA) of 1974. Annuities are often purchased for individual retirement accounts (IRAs), which ERISA made possible. They may also be used in Keogh-type plans for self-employed people. As you will see in Chapter 14, contributions to both IRA and Keogh plans are tax-deductible up to specified limits.

Costs of Annuities

You will pay several charges when you purchase a variable annuity. Be sure you understand all the costs before you invest. These costs will reduce the value of your account and the return on your investment. The most common costs are:

Surrender charges. The insurance company will assess a “surrender” charge if you withdraw money within a certain period, usually within 6 to 8 years. Generally, the surrender charge declines gradually over a period of 7 to 10 years.

Mortality and expense risk charge. This charge is equal to a certain percentage of your account value, usually 1.25 percent per year. The charge compensates the insurance company for insurance risks it assumes under the annuity contract. Profit from the mortality and expense risk charge is sometimes used to pay the insurer’s costs of selling the variable annuity, such as a commission paid to your financial professional for selling the variable annuity to you.

Administrative fees. Your insurance company may deduct fees to cover recordkeeping and other administrative expenses. The fee may be charged as a flat account maintenance fee (perhaps $25 or $30 per year) or as a percentage of your account value (usually 0.15 percent per year).

Fund expenses. You will also indirectly pay the fees and expenses imposed by the mutual funds that are the underlying investment options for your variable annuity.

page 338

Tax Considerations

When you buy an annuity, the interest on the principal, as well as the interest compounded on that interest, builds up free of current income tax. The Tax Reform Act of 1986 preserves the tax advantage of annuities (and insurance) but curtails deductions for IRAs. With an annuity, there is no maximum annual contribution. Also, if you die during the accumulation period, your beneficiary is guaranteed no less than the amount invested.

As with any other financial product, the advantages of annuities are tempered by drawbacks. In the case of variable annuities, these drawbacks include reduced flexibility and fees that lower investment return.

page 339