Image 4.1 Innocent foods’ promise is simple and memorable

Chapter Four

Distinctive customer experience

Standing out isn’t just about infectious communication. We are so bombarded with marketing messages that we often become quite cynical about them – even if they are engaging. Actions speak louder than words and nowhere is that more important than when it comes to brand purpose and customer experience. It is easy to claim that you stand for something but much harder to behave in a way that supports that claim. As Gav Thompson of O2/ Telefonica says: ‘Don’t tell me how funny you are; make me laugh.’

It is even harder to make your customer experience come alive in such a way that customers ‘just get’ what your brand is all about. The challenge is about standing out, or differentiating your brand, in a way that is meaningful and valuable to target customers but when you do the results are dramatic.

IBM and Ogilvy conduct an annual survey called BrandZ, which measures those brands that have strong relationships with customers.1 They found that when brands create an emotional connection to customers, as opposed to a purely functional one, cross-sell ratios increase from 16 per cent to 82 per cent and retention ratios rise from 30 per cent to 84 per cent.

The more multi-sensory the experience, usually the more memorable it becomes. We call this ‘dramatizing the customer experience’. It means looking for moments along the customer journey where you can demonstrate what your brand really stands for in a compelling way. There are two types of activities: ‘brilliant basics’ are those things that you have to deliver consistently to satisfy customers; ‘magic moments’ are those things that you may only do occasionally or at certain hallmark touchpoints. These are the most powerful and create the ‘wow’ moments that customers tell others about. These touchpoints can be formal, as in the case of O2’s ‘Priority Moments’ when customers get invitations to see their favourite bands, such as the Rolling Stones, or their favourite sports teams, as a thank you for being loyal to the brand. Or they can be very informal, when one of your people does something that creates a mini-experience for customers that epitomizes the brand values.

For example, there is a story that Linda Moir, who was formerly the director of customer experience for Virgin Atlantic, tells about the days before seat-back entertainment, when airlines would have a drop-down screen in the main cabin and schedule movies to follow the meal service. Virgin Atlantic decided to make the experience a proper movie experience and serve ice creams, just like at the cinema. That was a magic moment at that time because no other airline served ice cream on their aircraft due to the lack of freezers on board. Virgin solved the problem by packing the ice cream in dry ice.

A Virgin cabin attendant by the name of Sue Rawlings took the creation of this unique, memorable customer experience one stage further. In the galley, before serving the ice creams, she would smear some ice cream around her mouth. As she walked down the cabin with the ice cream tray, she would say loudly, so that people across the cabin looked up at her: ‘People tell me these ice creams are delicious, but I’m on a diet and never touch them. Enjoy!’

As passengers looked up, they saw the ice cream around her mouth and the smile on her face and a ripple of laughter would follow her down the aisle. Other passengers looked up to see what people were laughing at and joined in the laughter too.

The passengers who experienced Sue Rawlings’s ‘Virgin flair’ told their friends and family and the story rippled around the world, becoming viral. People who had never flown Virgin heard about it. And when they had to book a transatlantic flight and had to choose between Virgin and their competitors, they went for Virgin because they wanted the ice-cream experience.

How much does an ice cream cost compared with a new aircraft? How much did that viral story cost compared with a glossy advertising campaign? Consumers remember an emotional experience more than a functional one and people trust referrals from other customers more than they trust a marketing message. It was a great manifestation of Virgin Atlantic’s brand values of ‘Fun, entertainment, irreverence, innovation’ and serves to reinforce the brand positioning.

Compare this to Singapore Airlines, for example. Wonderful airline though it is, you could not for a moment imagine a Singapore Airlines flight attendant doing anything like that because that is not what the brand stands for. Singapore Airlines is positioned as the airline that consistently provides state-of-the-art air travel; ‘the journey is the destination’ as their famous advertising slogan expresses it. It dramatizes this by investing billions of dollars to be the launch carrier for new aircraft, such as the A380, so making a very public statement about how its brand drives its choices for the customer experience. Consistency of delivery, down to the smallest detail, is key to its brand. This includes its world-famous flight attendants, particularly the female ones, immortalized over decades as the ‘Singapore Girls’. The recruitment and training of the staff are conducted with rigour and discipline to ensure that the appearance, attitude and behaviour of the ‘Singapore Girl’ are almost predictably consistent on every flight. Little is left to chance. In contrast, at Virgin Airlines or Southwest Airlines the flight attendants are encouraged to ‘improvise’ and bring their own personalities to the job. These brands tend to be lower-cost airlines and use the personal engagement of their people as a competitive advantage.

We must stress that there is a world of difference between dramatizing the experience and providing service gimmicks. The former is absolutely aligned with the brand promise and desired experience; the latter is something designed to differentiate but without expressing what the brand really stands for.

Image 4.1 Innocent foods’ promise is simple and memorable

Innocent is a great example of getting this right. Innocent smoothies have become a case study in how to differentiate a commodity (fruit and yoghurt drinks) in a crowded market by creating a brand and associated tone of voice that tap into people’s emotions. Innocent’s brand promise is ‘tastes good. does good’.

Okay, so we get the ‘tastes good’ part, but how do they dramatize ‘does good’?

First, 10 per cent of all profits are donated to good causes. Second, they are scrupulous about sustainability in the supply chain. Third, they involve their customers in doing good together with them. Every Christmas, Innocent launches the ‘Big Knit’ where they invite customers to knit little woollen hats to decorate the bottles. The decorated bottles are marketed at a slight premium and, for every one sold, 10 pence goes to the charity Age Concern. Last year 862,763 hats were knitted and sold. This is not only a great example of infectious communication (see this link http://www.thebigknit.co.uk), it is also an example of ‘dramatizing the experience’ because the little woollen hats decorating the bottles serve to remind consumers about the feel-good factor of the brand. ‘Buy innocent smoothies because they taste good and do good’.

Any other beverage maker could copy Innocent and decorate their bottles in some way and, perhaps, even donate something to charity. But would it have the same impact? Probably not. In the first instance we doubt that nearly a million customers would voluntarily give their time to making it work (customers need to have an emotional connection with a brand before they will be willing to invest effort in supporting it); and second, we wonder if the end result would be seen as authentic in the same way as Innocent’s ‘Big Knit’. Remember, from the last chapter, you can’t fake it, force it or fudge it.

Some other ‘F’s to think about when creating a distinctive customer experience are, ‘fix it or feature it’; this is a mantra of Greg Gianforte, founder of RightNow Technologies. It means either improve something that creates hassle or dissatisfaction for customers, or turn it into a benefit and then feature it as a selling point that becomes a hallmark for your brand.

Guinness is a great example. You need to wait for Guinness to be poured in two stages and then wait for the foam head to form, which takes time. Usually, waiting for your pint to be poured is a pain for the customer and a chore for the barman. But if you want that rich creamy head that is so distinctive to Guinness there is no avoiding the two-step pour. It cannot be fixed, so Guinness features it as part of their proposition using the tagline, ‘Good things come to those who wait.’

For Guinness advocates, drinking the black stout through the creamy white head is an intrinsic part of the brand experience. ‘The wait’ as Guinness marketing people call it, is part of what makes ordering Guinness in a bar or pub unique; the wait was turned from being an inconvenience into the notion that good things are worth waiting for and, therefore, Guinness must taste better than the competitors. This taps (pardon the pun) into the emerging feeling among consumers in recent years that too much of life is a rush and that moments need to be savoured.

One of our all-time favourite ads is this Guinness one that hallmarks ‘the wait’:

The great thing about Greg’s phrase, fix it or feature it, is that it helps you to home in on every aspect of the customer experience and make a decision about each one. This analysis of your product, service or experience in a forensic way – deconstructing the experience so you can examine the detail – is a powerful discipline for ensuring that everything about your customer experience that is in your control is examined and a decision is made about it.

Can we fix this issue so that the customer is not even aware of it, or do we turn it into a ‘brand hallmark’ that differentiates us from competitors? IKEA’s infuriating requirement for customers to navigate their way completely around the store before finding the checkout is not only a fundamental part of their business model but also a hallmark of their brand experience. IKEA displays its products in complete room settings rather than by category, unlike most of its competitors. The customer is forced to visit each room in turn rather than go to the bed department, for example. This is a brand hallmark. It can be an irritant to some people but it is what makes IKEA, IKEA.

There is another application of fix it or feature it. It is one that can damage your brand if you don’t deal with it in the way we are suggesting. If your product or experience contains a feature that is in serious need of fixing and you ignore it, then your competition can feature it in their own ads as a way of attacking you to win market share. EasyJet attacked Ryanair by offering better service and the opportunity to reserve seats, which forced Ryanair to follow suit.

Traditionally, marketers communicate the obvious benefits of a product or experience, downplaying features that are harder to interpret as an advantage or that can be seen as a weakness. The fix it or feature it mantra is a powerful reminder to think about creating an experience that is memorable for all the right reasons and that becomes particularly important in a crowded or commoditized market.

Create a multi-sensory experience

Holidays are the time of year when many of us buy gaily wrapped gift packs of toiletries for relatives who will probably never use them. The products are often of poor quality and only cost as much as they do because two-thirds of the cost is in the packaging. But there is one brand – Lush – that boldly challenges this traditional practice and dramatizes its purpose and business model through a multi-sensory experience.

If you are ever lucky enough to receive a Lush bath bomb as a gift we encourage you to try it. The vibrant colours, wonderful smells and fizzing effects will convert you to the world of cosmetics Lush-style. Co-founder, Mo Constantine OBE, invented the original bath bomb in 1989 and, ever since, Lush has continued its exploration into the world of bath-time innovation and successfully exported its unique customer experience across the globe. Lush currently has over 900 shops worldwide and is present in 49 countries, with manufacturing sites across the world.

Lush was formed in 1995 and since then has spent years developing what they call ‘naked’ products that work really effectively. Why? Because these solid products don’t need preservatives or excess packaging, which is altogether kinder for the environment and allows the brand to invest 100 per cent of the cost of production in using better ingredients. As they say in their promotional materials, ‘Simple really’.

You can find out about the Lush purpose and beliefs via the following link:

http://www.lushusa.com/A-LUSH-Life/lush-life,en_US,pg.html?fid=a-lush-life

The stores are just as distinctive as the products themselves. As you walk along the high street and pass a Lush store, your senses will suddenly be bombarded by the smells, colours and hand-written notices calling your attention to the products that are displayed in all their ‘naked’ glory. Think of a fruit and vegetable stall in a market and you might come close to visualizing a Lush store. Handmade, natural and fresh merchandise; butchers’ blocks of soap; a myriad of orb ‘fizzing bath ballistics’ that are presented like perfectly round apples; chilled fish counter-style cabinets displaying Bio Fresh face masks; prices by weight, greaseproof paper wrapping (if any wrapping at all) and best-before dates. But what was the stimulus for such an innovative approach?

Creating a distinctive customer experience

Mark Constantine OBE puts it simply: ‘I’ve always loved the way fruit and vegetables are displayed in a grocery store.’ Lush started with the metaphor of a fruit and vegetable stall and this remains at its core. It is able to afford the extra cost of using natural ingredients because of the savings from eliminating packaging. This is a fundamental principle of creating a distinctive customer experience: divert funds away from the things that customers don’t value to the things that they do. This allows you to differentiate without having to charge a higher price point. The brand is therefore able to stick with its principles and remain purpose driven in the face of pressure from competitors who are less differentiated and compete primarily on price:

‘Freshness is intrinsic to Lush – it’s at the heart of our philosophy. It means we can minimize the use of synthetics and it means that we can create wonderfully effective products when the ingredients are at their most potent. When Lush products reach the customer, they are literally weeks, days or even just hours old. No product in any of our shops is more than six months old. We’ve been working with fresh produce for many years and have vast experience in how to formulate products that incorporate whole fruits and vegetables. At Lush, we believe that using the whole fruit or vegetable is infinitely more beneficial than isolating a property and removing it from a fruit, vegetable or natural material and adding it to a cosmetic product to try to recreate its function.’

Image 4.2 Bath bombs

This unique approach leads Lush to squeeze the following fresh ingredients every year: 25 tonnes of organic fruit and 50 tonnes of fresh fruit and vegetables; the oil from 20 million lemons, 6 million fresh bergamot fruits and 900,000 Sicilian mandarins; 10 tonnes of fair trade and organic cocoa butter; the juice of 90,000 zest lemons and 33,000 fresh oranges; 8,000 bunches of fresh flowers; and 20 tonnes of olive oil. For an innovative manufacturer and retailer like Lush you would expect that their focus lies solely on the product. You would be wrong: according to Constantine, ‘You build a brand around people.’ We shall say more about this in Part Three of this book (Stand firm).

The Lush approach seems to work. The Consumers’ Association – Which? – surveyed 12,504 of their members in 2014 to find out the best and worst shopping experiences in the UK. Once again, the top-rated brand was Lush with more members rating their last experience in terms of satisfaction and likelihood to recommend the brand than any other.

Involve your customers in improving the experience

History tells us that most new products fail. So how do you ensure success when you are changing 30 per cent of your products each year? Mark Constantine OBE of Lush says:

‘The key is making sure the customers clearly understand what you’re doing and debating with them beforehand to make sure the product does what they want it to do at a price they are willing to pay.’

Sometimes this approach leads to dropping a product, a move that makes every kind of sense – except to the customer. For example, Mark Constantine says:

‘We sell millions of pounds’ worth of toner every year – you’re buying some lovely essential oils, maybe a few other elements but basically it’s water and preservatives and packaging. We would like to eliminate all preservatives and packaging in the next couple of years from all of our products. So, we invented a toner tab: tiny little tabs that you dissolve in water when you want to use it. It lasted a week. It was a much nicer toner than you could make in the traditional way. There’s no preservative or packaging and the price is substantially lower as a result. Everything about it was perfect except that the customers hated it because it was less convenient. So, we continue with the bottled toner because that is what our customers want. When you get yourself aligned with the customer, it isn’t about profit and loss or pushing your product. It’s about producing what your customers want to buy.’

It is relatively easy to create affection for a smoothie brand or a retailer but what about if we were to take the most disliked sector of all? Banking. On 5 March 2010 the Financial Services Authority gave Metro Bank the first full-service banking licence granted in the UK for over 100 years. The bank launched with one ‘store’ (it thinks more like a retailer than a banker), grew to four in the first year and by 2015 had over 31 stores located across the south of England, with 10 more due to open as we go to press. It grew deposits by 118 per cent in 2014 alone and is currently planning a £1 billion flotation.

Metro Bank’s co-founder and chairman is Vernon W Hill II. He is often credited with reinventing US banking as he is also the founder and former chairman and president of Commerce Bank, which like Lush has gained a reputation for achieving high levels of customer advocacy. Metro’s purpose is to ‘Amaze the customer’. Vernon Hill explains it in this way:

‘Amazing the customer means providing unparalleled customer service, making sure every transaction goes quickly and smoothly. It means fulfilling customer needs, even anticipating them. More than that, it means turning customers into fans. We want them to tell their family members, friends and business associates about the products and superior services we provide.’

‘Fans, not customers’ is so core to how Vernon Hill thinks that he wrote a book of the same title in 2012. This belief has propelled Hill into the Forbes 20-20-20 club. This is the group of CEOs who have held the top job for 20 years, at a company with publicly traded shares for at least 20 years – and have presided over at least 20 per cent annual return on share price during his or her tenure. Just seven CEOs make the list and Vernon Hill sits in fourth place with an annualized return of 23 per cent over 30 years.

Metro Bank is still relatively small in terms of market share but is growing rapidly, unlike most of its high-street rivals and, more importantly, is achieving ‘mind-share’– a brand that is talked about for positive reasons. The fact is that consumer expectations are shaped by what they read and hear and so inevitably, small or not, banks like Metro and First Direct, which provide a best-in-class online and telephonic experience, influence what a banking experience can be like and set the benchmark for others. Perhaps it is no surprise, therefore, that Metro Bank scores the highest net promoter score (NPS) in the industry of 78.9 per cent, with First Direct following at 62.3 per cent (Satmetrix Account opening survey 2014). RBS makes do with a score of –6.3 per cent. No wonder, then, that the big five banks are closing branches.

We interviewed Vernon Hill to find out what makes Metro Bank different and how it has achieved such impressive results.

Metro Bank is the fifth new bank I’ve started from scratch. I started my first bank when I was just 26. Somehow they gave me a banking licence, opening with one office, nine people and $1.5 million in capital. At the time there were 24,000 banks in the United States and we were number 24,001. So I wondered how were we going to take this no-name, no-capital, no-brand retail bank and turn it into something special and a growth business? When we sold it in 2007 we had became the eighteenth largest bank in the United States, with 500 locations and $48 billion in assets – and we achieved that purely through organic growth rather than acquisition.

Early on we decided that this was a retailing concept that happened to be a bank, and that the customers cared more about service and convenience than they did about price. This is a non-price-driven model. Some would say that we learned to decommoditize a commodity business. We gave the consumer and the businessman a completely differentiated experience. You don’t buy iPhone 6 because it’s the lowest-price handset; you buy it because it is an entry into the Apple world. Well, we learned to deliver the Commerce Bank world.

When we sold Commerce Bank in 2007 I had nothing to do for a week. A business contact of mine in the UK had been on at me to bring this idea to Britain so I got on a plane, arrived in London and mystery-shopped the big five banks. When I stopped laughing I went to see the government. They indicated that there hadn’t been a new high-street retail bank licence issued since 1840. So I said, ‘Alright, it’s time to start a new bank in Britain.’

Metro Bank is based on the Commerce Bank model from the United States, but everything we did in the States actually works even better in Britain because British customers have not had a choice up until now. The big banks take them for granted; they see them as a target of opportunity for the next product; they think they are doing customers a favour by letting them bank. That is compounded by the fact that they have IT systems that are about a half a step up from a quill. They must be the world’s best bankers if they can operate with their IT. Finally, they have operated a cartel – and cartels typically overcharge, underserve and underinvest in the business.

As my book says, our objective is to build a business that builds fans. Fans join you, they stay with you and they bring their friends. You cannot have a growth company without building fans. And that certainly is a foreign concept in the banking business in Britain and not that common in the United States. So we set out to build this bank from scratch with modern IT and a fresh slate. I was taught at Wharton Business School that it’s easier to build a brand than it is to fix a brand, and I think there’s a lot of truth to that. As we moved from market to market, they used to tell me, ‘Oh it’s different in this market.’ When I decided it wasn’t different, that our model worked in every market, that’s when the growth curve went straight up.

What entrepreneurs do for a living is entrepreneur. We want to prove that our model is better. We want to attack the establishment and we believe that creating wealth is not the object of what we do but the result. I believe that if we create value for our consumers, they will create wealth for us.

We’re delivering the best service and convenience by every channel for business and retail consumers. It’s the way we deliver; it’s the hours; it’s never just one thing. It’s all the points of touch, not the one point of touch. Our seven-day-a-week branch bank opening hours makes a tremendous statement to the consumer. If you were to ask customers about Metro Bank they would say this is the bank that opens seven days a week and we are the bank that welcomes dogs in the branch. The British public, more than the US public, believes that if you love my dog, you must love me too.

Quite coincidentally, at this point in our interview the door opened and a small dog came running into the room only to bound into Vernon Hill’s lap where it stayed for the rest of the interview.

Image 4.3 Vernon W Hill II and Sir Duffy II

Say ‘hi’ to Sir Duffy. Sir Duffy tweets every day and people tweet back to him too. Some people think this is a marketing gimmick. It isn’t. Great brands create an emotional attachment with their customers and that’s when I believe you create real value. We do this through things like killing all the stupid bank rules, and letting our customers bring their dogs into the bank. This isn’t about marketing; it’s about how you run your business.

https://www.metrobankonline.co.uk/Discover-Metro-Bank/About-Us/

We have three main elements to how we run Metro Bank. First, you have to create a differentiated business model where the customer sees clear value. Second, you have to build a culture to match your model. We see so many businesses where the model and the culture are opposed to each other. And then, finally, you have to fanatically execute the model. The number that used to scare me the most in the United States was that we were getting 21 million in-store visits a month from customers. Think about that number. That’s like one-third of Britain walking through our doors every month. How do we make 21 million people happy and, if something goes wrong, how do we make that person more of a fan by the way we respond?

Let’s take our differentiated business model. Our competitors are busy closing branches whilst we are opening new ones. Our first job is to get people to switch banks and we’re just passing the 500,000 level this week. Every survey, and my experience, tells me that the branch is the public face of the brand and where the account switching happens. But once you’ve switched, we have to deliver to you the best experience across every channel – online, mobile, telephone, ATM – and we have to let you pick the channel. But the growth numbers we’ve seen in Britain prove that the branch is your public face. It’s for the same reason that Apple built stores.

The culture is designed to deliver the model. And if your model is superior service and convenience, you have to recruit, train and manage people to deliver uncommon service and convenience. We have a few little things we use as part of our recruitment. If you’re applying for a job and you don’t smile during the first job interview, you’re out. It’s not that hard to train people to deliver retail banking. It’s the way they deliver that is important and that comes from within. Remember, we are selling essentially a commodity product and we have to turn it into a non-commodity product. So we recruit, we train, we manage, we promote, to bring out the best in people.

Train, train, train and train some more. You simplify the delivery. When you’re at a branch you’ve got 19-year-olds opening accounts. So our philosophy is that we can’t have a rule that we can’t easily explain to an 18- or 19-year-old. You try opening a bank account in the big five in Britain – there is so much mumbo-jumbo that you don’t know what the hell is going on. So first of all your model has to be clear, it has to be simple and then you have to reward people for executing it.

British banks have morphed into a product sales channel. Their customers are targets of opportunity for the next sale. The only performance they measure is product sales. We don’t sell products. If you ask us for one we will provide it, but we reward our people for delivering service and convenience. We mystery-shop our stores physically every other day. We report net promoter scores both at the store and the corporate level. We also measure deposit growth per store, not sales per store, deposit growth.

The final part is execution. Our job is to deliver this unique service and convenience experience and to comply with the rules. And there is an endless amount of rules and regulations and they are going to get worse. So our management job is to comply but in a way that doesn’t degrade the customer experience. I’ll give you a simple example. Every customer thinks that if they wish to switch banks they need to show proof of ID, as well as proof of their address, their utility bill etc. There’s no truth to that whatsoever. You need one form of photo ID by law. With modern IT you can check all the other stuff. We can open your current account in 15 minutes. You walk out with your debit and credit card printed and your PIN number. Our competitors struggle to open an account in 10 or 12 days. If you have designed your business around service and convenience, you have to do all the other things, make money and comply with the regulations but not degrade the customer experience. It’s very easy. When Commerce Bank got very big, I spent half of my time making sure we didn’t become a bank – because I wanted to deliver a fun retail experience. I want to build fans and I don’t want to let any of the endless regulations I have to comply with degrade my service experience. For example, security is a big deal but you don’t have to let it inconvenience the customer. Our mobile app has a cute little feature. If you lose your card tonight, you can turn your card off. And when your wife finds your card tomorrow morning, you can turn the card back on.

All of these parts have to work together. Our first job is to get you to switch. Then it’s to deliver the best experience. So it’s all of the touchpoints. You can’t look at one. You have to look at all of them. And then it’s building the culture and finally executing every day. We have centralized the brand but decentralized the delivery. We have four or five regions now. The regional manager is a captain running our ship in their region. It’s their job to deliver it, it’s their job to be the Metro Bank in south London but they’re not allowed to change the model.

We serve business customers as well as consumers. On the commercial side, customers want a banker. Business people want a banker who can handle their £5 million loan, who can take care of their mortgage for their house, can give their son or daughter a car loan, can solve their cash management problems, and if something goes wrong they can call and, if they’re not happy, they can call me. That has totally been lost out of the British banking system. I’ll give you a clear example. When you’re applying for a commercial loan, you meet the lending officer who really has no authority; it’s the credit officer who actually approves it. The British banks have a rule that the credit officer is not allowed to visit the borrower. We have a rule that the credit officer must visit the borrower. That’s the two sides of the same coin.

Now, when we do something wrong, how we respond is very important. When we do something wrong we’ve got to make that customer more of a fan after we solve it. So we have to solve it right. We have a rule that says that it takes ‘One person to say “yes”, two people to say “no”.’ Now, that is a powerful statement. If you go downstairs and ask one of our store people a question, they’ve got two choices – ‘Yes sir, let me take care of it for you,’ or ‘Let me go and find somebody that can solve it for you.’ In other words they are effectively not allowed to say no. And we reinforce the message that they get in more trouble for not waiving a rule they should have waived instead of not enforcing it.

As I think about the future, we have to service our customers’ banking needs in whatever channel they want, in whatever way they want. The business hasn’t changed fundamentally: we take deposits and we make loans. It’s how we deliver these products that really matters. Your number one objective is to create a business model that creates value for your customers. And if you get that right they will create wealth for you.

So Metro Bank has thought about each touchpoint in the customer journey and where they can most effectively deliver their purpose, ‘To keep the customer at the heart of everything we do’. But note that Metro Bank does not try to compete against the high-street banks at every touchpoint of the financial services experience, just those that they have decided to play in.

Don’t ‘flat line’ the customer experience

This takes us to our final ‘F’, which is to avoid ‘flat lining’ the customer experience. When we work with organizations, one of the key steps we take is to research the current experience at each touchpoint. This creates a curved line that we like to call our heart line or ECG graph (EKG in the United States) because, like a real heart trace, it has peaks and troughs, and it is vital to avoid a flat line! A flat line at the bottom of the satisfaction scale means that you are performing very poorly and therefore unlikely to survive against better competitors. A flat line in the middle means that you are undifferentiated and likely to be mediocre in terms of customer satisfaction and loyalty, a flat line at the very top of the satisfaction scale is very difficult to achieve consistently and very expensive if you do. There are a few brands, such as Ritz-Carlton for example, that excel at most touchpoints. Of course, the pain is then experienced when the customer comes to pay because it is only by charging a very high price point that the organization can afford the level of investment required to resource these touchpoints. Don’t gold plate your customer experience. Customer experience is a neutral term and does not imply gold-plated service. Ritz-Carlton offers a great customer experience but so too does Premier Inn in the midscale sector. Their business models and price points are very different and delivered in distinctive ways. So be careful not to upgrade your customer experience beyond the point that target customers want and are willing to pay for.

For most brands it is about deciding where to ‘over-index’ and that depends on their strategy and their brand promise. Taking IKEA as an example, the pleasure of the helpful room layouts and affordability of the well-designed products is paid for by the ‘pain’ of the inconvenient store layout and requirement for self-assembly. But this is what makes the brand different and memorable. If you are a target IKEA customer (typically young couples equipping a home) you will love it, and if you are not (typically more affluent, older people with limited time), you will hate the experience. But love it or hate it, IKEA stands out from the crowd. It is this ‘light’ and ‘shade’ that create the memory of an experience. A play or book that generated exactly the same emotions in every scene would soon become boring. The ancient Greeks and Romans would design slight imperfections into their art because perfection and complete symmetry were considered boring. So, too, a customer experience that is the same at every touchpoint becomes unremarkable.

Pain is good

Sampson Lee published a brilliant book in 2015 called PIG (Pain Is Good) Strategy, in which he explores this concept in some depth and even takes it a step further, arguing that the greater the distance between the pleasure peaks and the pain troughs, the more memorable the experience becomes. So, for example, Ryanair dramatized their very low prices (pleasure) by some very unfriendly customer policies such as charging large amounts for forgetting to print your boarding card, for example (pain). There is no doubt that customers who were subjected to this policy had a very clear memory of their experience and what the brand stands for. We do not go quite as far as Sampson; we believe that satisfaction has to be at a base level in order to avoid irritating customers, but we certainly subscribe to the view that you have to be remarkable at some things and it is perfectly all right to be just okay at others.

So how do you determine which touchpoints to over-index?

Where do you over-index?

It depends on your brand purpose and promise. Understanding what your customers truly value and what you stand for as a brand becomes the lens through which to design the experience. For example, some years ago we did some research for O2, the mobile phone company. We identified that their most profitable customers were worth several times more than the average customer but received exactly the same service and were not valued in any formal way. As a result, the brand took the bold decision to significantly reduce marketing budget in order to free up the funds to invest in putting more staff into the retail stores and building a dedicated contact centre for high-value customers. They also launched their highly successful ‘Priority Moments’ proposition, which values loyal customers. O2 chose to over-index in the retail, contact centre and customer engagement touchpoints because this was consistent with their brand purpose and what customers said they valued. They under-indexed against their competitors’ spend on marketing and head office functions, but this was something that the customers didn’t notice.

Felim Mackle, the UK sales and service director for Telefonica UK, explains by saying:

‘Being in business and doing well means you have to invest. And that’s a very big management decision because, when times get tough or when you’re actually carrying out financial reviews, it would be oh so easy to cut the things that you can’t absolutely, explicitly link back to a financial return. One of the things I think O2 has done very well is to take those big decisions and make them in a very holistic way. We said, actually, that this is part of the O2 experience that we need to keep investing in.’

There is not space here to go deeply into the psychology of the customer experience, but for those who are interested we recommend reading Daniel Kahneman’s behavioural research into the ‘peak–end’ experience, where he discovered that our memory of an event is highly influenced by the peak of pleasure or pain and how the experience ended.

http://www.ted.com/talks/daniel_kahneman_the_riddle_of_experience_vs_memory?language=en

Kahneman draws the comparison between the ‘experiencing self’ and the ‘remembering self’ and makes the point that what we remember can be very different to what we actually experienced. Our memory is coloured by the highs and lows and the most recent events. This suggests that the experience we design should intentionally create some hallmark moments associated with our brand purpose and promise, avoid undermining our brand promise by having hassle associated with it, and ensure that we finish strong (most organizations do the opposite: they typically start strong with marketing and sales activity and finish weak at the point of purchase or problem resolution).

We use this principle when designing a new experience for our clients. For example, we found that one of our software clients delivered a good sales experience but a very poor technical support experience. They also failed to communicate with enterprise customers after the sale to check on how satisfied they were with the product’s performance. No surprise, therefore, that the advocacy of customers was poor as measured by NPS, and their renewal rates were low.

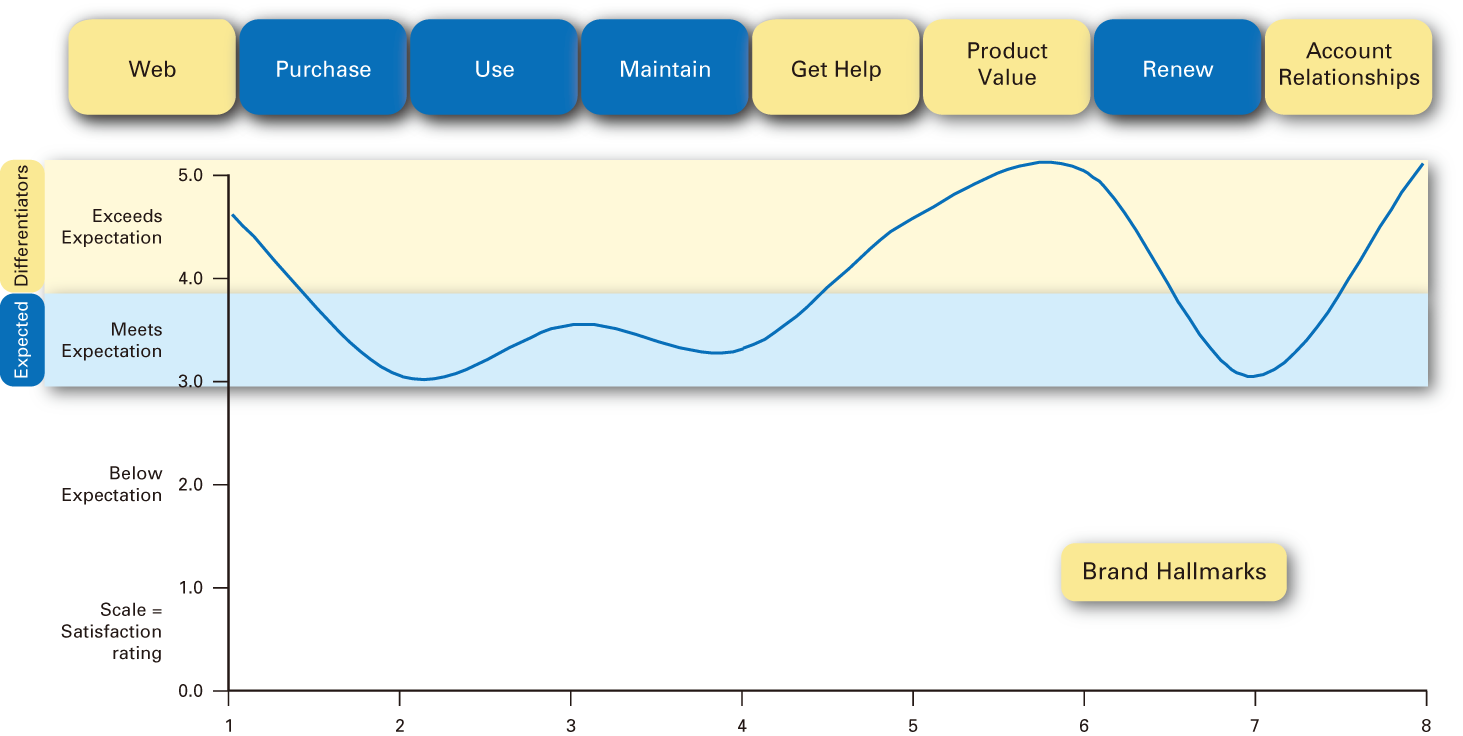

We designed a new experience to over-index the web experience to make it easier for customers to get information about the product. More importantly the ‘Get Help’ touchpoint was emphasized, so that when business customers called for technical support it was fast and effective, because when business customers have a technical issue they want it resolved immediately. We also engineered a new touchpoint called ‘Product Value’, where an account executive would contact the client on a quarterly basis to find out if the product was performing to the customer’s requirements and what else could be done to create value for the client. The result was a ‘peak–end’ experience that increased the perception of value of the product, improved satisfaction with the account relationship and led to higher renewal rates (Figure 4.1).

Figure 4.1 B2B experience curve

Behavioural scientists Richard Chase and Sriram Dasu identified five simple rules to ensure that you design an experience that maximizes the pleasure and minimizes the pain.3 We have listed these in the box below. For the sake of illustration and simplicity we have focused on the hotel industry – with a bit of creative, bold thinking, the same principles can be applied effectively to any sector.

Five simple rules to create a memorable customer experience

Finish strong

Finish on a high – do something unexpected at the end of the experience, for example, a small gift given at the point of checkout. This helps to create a positive moment at the very point you are asking the customer to part with their cash.

Get bad experiences over with early

If customers have to do something onerous, get it out of the way as quickly as possible. In the case of hotels, pre-register guests online so that their first experience of the hotel is not one of lining up at the front desk and filling in a registration form with exactly the same information they provided when they booked or stayed last time.

Segment pleasure, combine the pain

Spread the pleasure along the touch-line. So provide those little touches of fresh cookies served with coffee, cold face towels on the beach etc. They cost very little but create ‘spikes’ of pleasure. Combine the ‘pain’ by bundling internet and other facility charges into the room rate so that you experience them in one step rather than every time you wish to use them.

Build customer commitment through choice

Give guests full information about your charges (such as water sports) on your website so they are transparent and expected. Guests can then make informed choices about the package they need and, most importantly, will not be surprised by them.

Stick to rituals

Create on-brand rituals that customers associate with their stay with you. For example, a trait of the Banyan Tree Resorts is to leave a little locally made, handcrafted gift as part of the turn-down service rather than the ubiquitous chocolate. Not only does this create a little moment of surprise but also serves to highlight their support for the local community and the environment.

Of course all of this is becoming increasingly more complex because the consumer has multiple channels to deal with. They can choose to interact with the brand in store, online, via the contact centre, via social media etc. All of these channels need to convey a consistent tone of voice so that the perceptions of the brand do not change from one channel to the other. Brands such as Burberry have done an amazing job of melding these channels so that they become ‘one pure customer experience’.

We had the privilege to work with Burberry on their ‘Burberry Experience’. We identified that a common weak area for many luxury fashion brands is the ‘experiencing the product’ touchpoint before purchase. In stores this is generally the fitting-room experience and online it is the ability to really learn about the product and interact with it virtually. Burberry did a fabulous job of bringing ‘online in store’ for their new flagship store in Regent Street in London so that the experience became seamless. Radio-frequency identification (RFID) devices in the products ‘light up’ plasma screens in the fitting rooms to play videos of the products being made or shown on the catwalk. Sales associates with iPads show the customer complete ‘looks’ and find out exactly what the availability of stock is, bringing items to the fitting room for the customer to try and even ordering items for collection later or home delivery. There is not a cash register or formal point of sale; instead, the sales associates take payment wherever the customer happens to be, sitting on soft couches to do so.

So the ‘peak–end’ experience is quite different in Burberry’s flagship stores than in those of their competitors. Burberry is now taking this experience even further into the digital domain by creating experiences via social media and smartphones. In the words of Angela Ahrendts, their former CEO, Burberry has now become ‘mobile first’.

Ahrendts is now the senior vice president for retail and online sales for Apple, so you should expect some amazing things in the next generation of Apple stores.

So what are some key considerations when designing the end-to-end multi-channel experience? Tim Wade was formerly the director of marketing and e-commerce at Best Western, the world’s largest hotel brand, and was responsible for driving growth in the brand. Best Western has a great many advantages as a brand but it also has a major disadvantage when compared with corporate hotel brands that own their own properties. Tim used the principles discussed in this chapter to take on the market-leading hotel brand – and win.

The brand purpose Tim defined was ‘To make life more enjoyable’ and he set about delivering this through a completely new guest experience.

Image 4.4 Best Western hotel brand

Best Western – ‘Hotels with personality’

In 2009 PricewaterhouseCoopers (PwC) published their latest hotels report predicting the future prosperity of the UK hotel market in the forthcoming years. Contained with the report were comments from participants in the research that:

‘The budget sector will do well.’

‘The luxury sector will see growth.’

BUT… ‘The mid-market is getting killed.’

Now imagine yourself as a mid-market hotel brand building your strategy and budget for the coming year. This was Best Western, by number of hotels the largest hotel brand in the world, but firmly planted in the mid-market in Britain with around 280 three- and four-star hotels – and firmly predicted to ‘get killed’ in the toughest economic conditions for decades.

Best Western is made up of over 4,000 independent hotels around the globe and whilst each hotel has to meet strict quality controls they are free to express themselves and run their business as they see fit. In Britain, Best Western was struggling to have an identity; its brand tracking showed a mediocre and stagnant performance whilst the budget and luxury sectors expanded. In Britain, Best Western was stuck in the middle of the road, undifferentiated and in danger of getting run over by the budget hotel train. People just weren’t talking about Best Western!

From a brand perspective this is an interesting challenge; brands traditionally have been defined as a promise consistently delivered. With 280 independent hotels, from 12th-century castles to rambling country houses and contemporary city-centre pads, consistency is a challenge. Certainly with such diversity it is not possible to have consistency of the physical aspects of the experience. This is exacerbated further when Best Western doesn’t employ the people that work in the hotels and Best Western doesn’t take the financial decisions about investment in hotel assets.

So, product inconsistency was perceived as our biggest weakness, but the fact was we couldn’t fix it because of Best Western’s membership model; so we decided to feature it instead.

As always there are different perspectives and with inconsistency lies a real way to stand out from the monolithic corporate brands. As the growth of budget hotel brands rocketed, the hotel market was becoming a sea of sameness, where it wouldn’t matter which town, city or region you were in, everything was the same. This has the benefits of reassurance and predictability, which for many customers is desirable, but for those frequent travellers – those people staying in hotels week in week out – these hotels can be dull, boring and soulless. Best Western saw a great opportunity to stand out.

Focused on a core group of customers, the independently minded frequent traveller who is bored with the formulaic experience – Best Western created a new brand position and strapline. As a way to celebrate its own 280 independent hotels and the independent thinking of its customers, Best Western created ‘Hotels with personality’ – three words that were to transform the fortunes of a mid-market brand stuck in the middle of the road. This was more than just a new strapline, it was a whole new way of thinking. It was about celebrating the independence of the hotels and differentiating Best Western from all other hotel brands. It built on the brand heritage, the diversity of the hotels (and the fact that so many are historic), and the characters who choose to work in that particular hotel rather than working for a corporate brand.

Realizing that ‘Hotels with personality’ had to be more than just a strapline Best Western knew that to truly differentiate it had to be delivered through the customer experience – in fact the brand had to create the ‘personality experience’.

The customer experience has become omni-channel

Travel is always one of the key things that customers search for and talk about online and this means that, as with many other sectors, customers are adept at moving between digital, social and physical environments. In fact they do it with such ease that customers pay little attention to channel and just do what is natural and easy at that moment in time.

For Best Western the challenge of how to bring alive the ‘personality experience’ through the digital, social and physical experiences so that it differentiates was tackled in five key steps.

1 Bring the story alive

The benefit of having 280 eclectic and independent hotels is that each has a story to tell. These stories included wonderful history: the oldest purpose-built hotel in England, a hotel where allegedly Henry VIII had built a secret passageway to hide an illicit affair and stories of hotel ghosts that haunted corridors; hotels that make their own craft beer and grow grapes to make wine; and, of course, stories of wonderful characters within the hotels. It is these stories that create the personality, it is these stories that create the anticipation of a great stay and it is these stories that make Best Western stand out. So we employed a team of journalists to go out and capture all these stories from every single hotel. This created a giant storybook, which we used to power the marketing activity, social media and internal communications. Stories were our way of connecting with people no matter what channel they chose to use.

2 Empower people to tell the story

As humans the experiences we crave and remember are those human-to-human moments, so the hotel teams needed to be empowered to bring alive the story and experience for guests through their own behaviour. Rather than create robotic service procedures and scripts, we allowed people to celebrate their independence and trained them how to demonstrate this using branded experience training. This equipped them with the skills to bring their personality to work, to find and share the stories in around the hotel and get up front of any issues.

3 Engage the customer and make them part of the story

With TripAdvisor being the biggest travel site in the world, hotels cannot ignore the power of the social consumer. By bringing alive the story for guests, and focusing on the customer experience, we brought the customer into the story and encouraged them to share it socially so that they became part of it.

4 Make it personal

Travel is a very personal thing and each customer has his or her own story to tell. The key was to use technology to make the journey personal, so we connected the data and the channels together to create a single view of the customer and create bespoke communications and experiences so that each guest’s journey was unique.

5 Have some personality

Having a personality and tone of voice is vital. Humans don’t talk in corporate speak so why do brands? A ‘hotel with personality’ needs to be fun and enjoyable and everything needs to reflect this. Life is too short and busy for boring hotels, boring communication and the usual dreary monologue of marketing messages. So we aligned our marketing, our advertising, our behaviour and our measurement around the ‘personality experience’.

Best Western created a pilot of the programme in six hotels and achieved impressive results, which featured in a Forrester Case Study in 2014:4

In 2014 Best Western rolled out the programme to all its hotels and the brand continues to outperform the market.

Notes

1 Source: IBM/ Ogilvy Loyalty Index/ BrandZ survey.

2 Sampson Lee (2014) PIG (Pain Is Good) Strategy: Make customer centricity obsolete and start a resource revolution, iMatchPoint, Hong Kong.

3 Richard B Chase and Sriram Dasu (2001) Want to perfect your company’s service? Use behavioral science, HBR OnPoint © 2001, Harvard Business School Publishing Corporation.

4 https://www.forrester.com/Case+Study+Best+Western+Great+Britain+Wins+Validation+For+Customer+Experience+Strategy/fulltext/-/E-res116862.