Soldiers of the 115th Military Police Company, Rhode Island Army National Guard, prepare to enter a building in Fallujah, Iraq, while mobilized for Operation Iraqi Freedom.

Benefits of Service

We serve the Nation in the Army for a number of reasons. Duty, honor, discipline, and the love of country are just a few of them. Many soldiers initially join the Army so they can afford college or to gain job skills for later in life. Considering the pay, allowances, and other benefits, American soldiers are among the best paid in the world. This chapter highlights some of the excellent benefits of serving in the US Army.

Section I - Pay and Allowances

Basic Allowance for Housing (BAH)

Section IV - Financial Readiness and Planning

Army/American Council on Education Registry Transcript System (AARTS)

For more information on pay and allowances, see the Defense Finance and Accounting Service (DFAS) website at www.dfas.mil, and AR 37-104-4, Military Pay and Allowances Policies and Procedures - Active Component, 31 Oct 94.

For more information on financial readiness see TC 21-7, Personal Financial Readiness and Deployability Handbook, 17 November 1997.

For more information on Army housing, see the Army Housing website at www.housing.army.mil and AR 210-50, Housing Management, 26 Feb 99.

For more information on military retirement see AR 680-300, Army Reserve Retirement Point Credit System, 8 Jun 73, and AR 600-8-7, Retirement Services Program, 1 Jun 00.

7-1. The benefits of serving in the Army go beyond the paycheck you receive. Not only do you grow as a person, but you develop friendships that will last a lifetime. You also gain the satisfaction of having served your country and the pride that goes with it. Army well-being is the total package of programs and benefits with the ultimate purpose of maintaining combat readiness by caring for the needs of soldiers and their families.

7-2. Well-being is “the personal—physical, material, mental, and spiritual—state of soldiers, civilians, and their families that contributes to their preparedness to perform the Army’s mission.” Soldiers have a responsibility to ensure that personal issues do not impair their ability to deploy and conduct the mission. Army well-being helps them fulfill this responsibility.

Army readiness is inextricably linked to the well being of our people. Our success depends on the whole team—soldiers, civilians, families—All of whom serve the Nation. Strategic responsiveness requires that our support structures provide soldiers and families the resources to be self-reliant both when the force is deployed and when it is at home. When we deploy, soldiers will know that their families are safe, housed, and have access to medical care, community services, and educational opportunities. We have a covenant with our soldiers and families, and we will keep faith with them.

General Eric K. Shinseki

7-3. The goal of Army well-being is to improve and sustain the institutional strength of the Army. Institutional strength is the force behind the Army that distinguishes it from occupations and other professions. It is the force that binds us together as the Army Team.

7-4. Well-being is the human dimension of Army Transformation. As the Army changes, well-being represents our resolute commitment to prepare now to meet future needs, as well as today’s needs. Army well-being is closely linked to four key outcomes—performance, readiness, retention, and recruiting.

• Army well-being enhances performance by strengthening command climate and the bond between the leader and the led.

• Army well-being enhances readiness by producing self-reliant soldiers who are able to focus on their mission, confident in the preparedness and self-reliance of their families.

• Army well-being enhances retention and recruiting by creating the environment for positive decisions by the right men and women to join and stay in the Army.

SECTION I – PAY AND ALLOWANCES

7-5. You are among the best-paid soldiers in the world. With the other benefits of military service, the compensation provided members of the US Armed Forces compares very favorably with similar jobs in civilian life. Our country’s leaders and our fellow citizens have decided that to maintain a professional, capable, and ready Army requires good compensation in pay, allowances, and benefits. You can find detailed information on pay and allowances at the Defense Finance and Accounting (DFAS) website at www.dfas.mil and in TC 21-7, Personal Financial Readiness and Deployability Handbook.

PAY

7-6. Soldiers receive a salary, that is, pay for duties performed under a contract of service. Soldiers do not receive a wage, which is a price for a set amount of labor, usually measured in hours. The distinction is made clear in the phrase “I’m a soldier everyday, all day—24/7.” This distinction is important because the soldier has a duty to obey orders and to go where needed, regardless of when or where.

7-7. There are various types of pay. Basic pay is received by all soldiers and is the main component of an individual’s salary. Other types of payments, often referred to as special pay, are for specific qualifications or events. For example, there are special pays for aviators and parachutists. There is also special pay for dangerous or hardship duties.

BASIC PAY

7-8. Soldiers receive pay on a monthly basis (though active duty soldiers can elect to split their pay and receive a portion in the middle of the month). It is likely the largest part of your paycheck and is the amount you see on military pay charts. Nearly every year congress authorizes an increase to military pay and allowances. The DFAS website has the current basic pay charts for active duty and reserve soldiers. Basic pay generally increases every two years for soldiers in a given grade.

SPECIAL PAY

7-9. Soldiers may receive special pay for having certain skills (such as helicopter pilots) or for being in specified areas (such as in a combat zone). Table 7-1 shows some of these types of pay and why a soldier receives them. The DFAS website shows the most up-to-date amounts for these and other special pay categories. The source for this information is the Department of Defense Financial Management Regulation (DODFMR), Volume 7A: Military Pay Policy and Procedures - Active Duty and Reserve Pay (Military Pay Manual for short).

Pay Type |

Who gets it |

How much |

Diving Duty |

Qualified divers in designated diving slots |

Up to $340/month |

Sea Duty |

Soldiers assigned to a vessel at sea or in port 50 miles from home port. Varies with rank and time in service. |

Up to $400/month |

Hardship Duty |

For assignment to specific area (e.g., Kuwait outside Kuwait City) or to specific units (e.g., Joint Task Force—Full Accounting). |

$8-150/month |

Special Duty |

Recruiters, drill sergeants, nominative CSMs |

Up to $375/month |

Enlistment Bonuses |

Enlisted soldiers for specified MOSs |

Varies |

Reenlistment Bonuses |

Enlisted soldiers for specified MOSs |

Varies |

Hostile Fire/Imminent Danger |

Soldiers in combat or designated imminent danger area * |

$150- 225/month |

Overseas Extension Incentive |

Soldiers in certain locations and MOSs, who extending their overseas tour. |

Varies |

Foreign Language |

Qualified linguists in critical language MOS. May not receive pay for more than three language specialties |

$100/month for each language |

Flight |

Soldiers on flight status. Pay is prorated depending on flying hours. |

$150 – 250/month |

Parachute (Jump) ** |

Soldiers on jump status. HALO status is $225/month. |

$150/month |

Demolition ** |

Explosive ordnance disposal (EOD) specialists assigned to EOD units |

$150/month |

Experimental Stress ** |

Test subjects during testing |

$150/month |

Special Pay |

Health professionals (physicians, dentists, nurses). |

Up to $1000/month |

* In a combat zone/hazardous duty area enlisted pay is nontaxable. A portion of officer pay is nontaxable.

** Only two hazardous duty payments per month are authorized.

ALLOWANCES

7-10. Allowances are other payments to the soldier, usually nontaxable, that are in lieu of services the government does not provide. For example, if government quarters are not available, the Army pays a basic allowance for housing (BAH) to the soldier to allow him to find adequate housing off post in the civilian community. Soldiers who reside in government quarters receive reduced or no BAH. Soldiers have many different allowances available to them. Table 7-2 shows some of these. As with the different types of pay, you can find up-to-date eligibility requirements and amounts on the DFAS website and in the Military Pay Manual.

Allowance |

Who gets it |

Basic Allowance for Housing (BAH) |

Active duty soldiers who have not been furnished adequate government quarters for themselves or their dependents or who have been furnished inadequate quarters. BAH is intended to pay only a portion of the soldier’s housing costs. |

Basic Allowance for Subsistence (BAS) |

All Active duty officers and active duty enlisted soldiers who are authorized to mess separately (separate rations) or soldiers who do not have a dining facility available. |

Family Separation Allowance (FSA) |

Active duty soldiers on permanent or temporary duty for 30 consecutive days at a location where dependents may not go to at government expense and where government quarters are unavailable for the dependents. Up to $250 per month. |

Clothing Maintenance Allowance |

Active duty enlisted soldiers on the anniversary of enlistment. Intended to pay for replacement of military unique items required for wear. Increases after the first three years. |

Dislocation Allowance |

Active duty soldiers who make a permanent change of station. Intended to defray costs associated with moving that are not reimbursed through other means. Equal to two months of BAH. |

Cost of Living Allowance |

Active duty soldiers assigned and residing in specified high-cost areas. Intended to compensate for a portion of nonhousing costs that exceed the US average by 8% or more. |

Additional Active Duty Uniform Allowance |

Reserve component officers ordered to active duty or active duty for training (ADT) for 90 days or more. Payable after serving 90 consecutive days of active duty. |

Per Diem Allowance |

Soldiers on temporary duty (TDY) when government quarters and mess are unavailable. Per diem is a tax-free daily allowance for the added expenses of buying meals and/or living in hotels while on official business. |

LEAVE

7-11. Every active duty soldier may accrue (earn and build up) 30 days of leave each year. That comes out to 2.5 days per month. Reserve component soldiers on active duty earn leave, also, although not while on active duty for training unless the period exceeds 30 days. This benefit surpasses nearly any vacation plan available in the civilian labor world. When authorized to take leave, soldiers continue receiving full pay and allowances as while on duty—and accruing more leave. Soldiers who have more than 60 days of accrued leave on 1 October lose the portion in excess of 60 days. This is often referred to as “use or lose.” Soldiers can request exceptions in cases of extended deployments or other extraordinary reasons.

7-12. Soldiers may also cash in leave, that is, trade it for an equivalent amount of basic pay. Enlisted soldiers may do so when they reenlist while any soldier may do so upon departing the service. Soldiers may cash in no more than 60 days of leave in a career.

7-13. At the end of your time in the Army, you may also choose to use your accrued leave as Terminal Leave. This is when you go on leave prior to the end of your service after outprocessing the Army, but continue to receive full pay and allowances up to your actual end of service date. Many soldiers find this option very helpful when leaving the Army to go to college or when starting a new career. You may also cash in a portion of your accrued leave while taking terminal leave. It all depends on your circumstances.

SECTION II – HOUSING

7-14. Active duty soldiers and their families are entitled to healthy, safe housing to live in. An entitlement in the Army is something that must be provided and may not be taken away without due process. In the case of housing, soldiers live in government furnished quarters in exchange for their BAH, or they keep their BAH to pay rent for civilian (off-post) housing. Government housing and BAH directly result from the Constitution. The third amendment of the Constitution forbids the government from quartering soldiers in housing without the owner’s consent, so the government provides quarters or a housing allowance (BAH) to all active duty soldiers.

GOVERNMENT HOUSING

7-15. Government quarters are safe, maintained, and adequate for soldiers’ needs. In some cases, because of great need, some government housing remains in use past its expected useful life. Installations continue to maintain these quarters and they are still safe to live in. In those unusual cases where soldiers reside in inadequate government furnished quarters, they receive a portion of BAH to compensate for the inconvenience. The standard of what is considered adequate quarters is in Chapter 4 of AR 210-50, Housing Management. Many commands or installations have supplements to AR 210-50 that further define adequate and inadequate quarters. The standards of adequacy generally are qualitative in nature and assess the size, configuration, and safety of the housing as well as its condition, services, and amenities.

7-16. The Army owes decent housing to every active duty soldier and family. But living in government quarters come with responsibilities, such as following rules on appearance and use. For example, you may have to keep your grass cut to a certain length, or there may be limitations on when and how many lights you can put up for Christmas. These rules aren’t intended to be a nuisance or a restriction of freedom. They are intended to help maintain a safe and pleasant environment for all soldiers and their families. Such rules are similar to those in civilian homeowners’ associations, for example.

7-17. Army installations have a system in place to assign soldiers and their families housing, maintain that housing, and to help soldiers leave those quarters upon reassignment. In cases where quarters are not available or the soldier (SFC and above) elects to live off-post, Army installations provide assistance in finding good housing in the civilian community. Living in government housing is an excellent value. In most locations, the BAH a soldier receives to pay for civilian housing does not cover the full cost of that housing—rent or mortgage, electricity, water and sewer, maintenance, etc. On the other hand, living in government housing prevents you from receiving BAH, but you won’t have any of those bills (although telephone, internet access, and cable TV services are your responsibility to pay). You can often obtain supplies and hardware for the maintenance of your quarters at no cost to you from self-help stores on the installation.

7-18. Few installations have enough housing units to accommodate every soldier and family assigned there. That is why you will often have to wait to get into government-furnished quarters. Installations have waiting lists that show every soldier and family who have requested government quarters. Your name is put on the list as of the day you sign in at your new unit. However, an interesting exception is when you return from a dependent-restricted (unaccompanied) overseas tour. At that time, you may be put on the list as of the day you departed your previous duty station for the unaccompanied tour, for a maximum 14-month credit. Watch out though: any voluntary extensions negate this credit.

BASIC ALLOWANCE FOR HOUSING (BAH)

7-19. Some soldiers receive Basic Allowance for Housing (BAH). This tax-free monthly allowance goes to stateside servicemembers who cannot get into government quarters or who choose to live off base. For most soldiers, BAH is the second-largest part of their compensation. Allowances are based on rank, dependent status, and location.

7-20. The rates are calculated by surveying the civilian housing market in 370 locations across the United States. For example, BAH with dependents rates for senior enlisted members and officers are set by canvassing the rental costs of three and four-bedroom single-family homes in neighborhoods where the typical civilian income is $60,000 to $100,000 per year. For the BAH without dependents rate for junior enlisted personnel the survey focuses on one-bedroom apartments in neighborhoods where the typical civilian earns $20,000 to $30,000 per year.

7-21. Different types of BAH are available. There is an allowance for soldiers on active duty (BAH-I) including RC soldiers on active duty, a BAH for RC soldiers on active duty for less than 140 days (BAH-II), and a partial rate BAH. As with all pay and allowances, you can find current rates on the DFAS website. With BAH-I, you may receive a “with-dependents” rate or “without-dependents” rate.

• The “with-dependents” rate goes to soldiers with at least one family member who meets the official definition of a dependent. The allowance does not increase with additional family members.

• If a husband and wife both are on active duty and have a child, the higher-ranking spouse receives BAH at the “with-dependents” rate. The other spouse receives BAH at the “without-dependents” rate.

• The “without-dependents” rate is for single people with no family members living with them. Dual military couples without children both receive BAH at the without-dependents rate.

• BAH-Differential (BAH-DIFF) is for soldiers paying child support and not receiving BAH at the "with dependent rate." To receive BAH-DIFF, the soldier’s child support payment must equal or exceed the amount of the BAH-DIFF.

• Reserve component soldiers on active duty for fewer than 140 days are entitled to the monthly BAH-II. For BAH-II there is a married rate and a single rate.

• A soldier without dependents is authorized partial BAH (Rebate) when assigned to single-type government quarters (barracks, BOQ, BEQ) or when residing off post without a statement of nonavailability.

7-22. The actual amount a soldier pays “out-of-pocket” depends on the housing choices he makes. Thrifty soldiers can keep all the BAH due them even if their housing costs are less than their allowance. Those who choose a bigger or more expensive residence than the typical soldier in their pay grade will find that their out-of-pocket costs are higher.

7-23. Most soldiers stationed overseas who live off base receive an overseas housing allowance (OHA). While OCONUS soldiers receive OHA for the same pupose that CONUS soldiers receive BAH, OHA varies each month with currency exchange rates. Personnel assigned to unaccompanied tours overseas can collect BAH if their families live off base in the United States. In unusual cases, service secretaries can declare a tour within the United States as unaccompanied. For example, if a child is seriously ill and needs to remain near a medical center, the family can continue to receive a housing allowance in that location after the soldier has moved to another assignment.

SECTION III – HEALTH

7-24. The Department of Defense (DOD) has developed a world class health care system for servicemembers and their families. It encourages total health fitness, delivers top quality health care, and focuses on medical readiness.

TRICARE

7-25. In response to the challenge of maintaining medical combat readiness while providing the best health care for all eligible personnel, the Department of Defense introduced TRICARE (TRI—Army, Navy and Air Force and CARE—health care). TRICARE is a regionally managed health care program. TRICARE brings together the health care resources of the Army, Navy, and Air Force and supplements them with networks of civilian health care professionals to provide better access and high quality service while maintaining the capability to support military operations. TRICARE offers soldiers and their families affordable health care when they need it the most. Registration is important—be sure to enroll your family members in the Defense Enrollment Eligibility Reporting System (DEERS).

7-26. TRICARE affects soldiers and retirees in the US, Europe, Latin America, and the Pacific. Those eligible for TRICARE are—

• Active duty soldiers (including reserve component soldiers on active duty under Title 10) and their families.

• Retirees and their families (see Section VIII).

• Survivors of all uniformed services who are not eligible for Medicare.

7-27. TRICARE offers eligible beneficiaries three choices for their health care:

• TRICARE Prime—where military treatment facilities (MTFs) are the principal source of health care.

• TRICARE Extra—a preferred provider option that saves money.

• TRICARE Standard—a fee-for-service option (the old CHAMPUS program).

7-28. The main challenge for most eligible beneficiaries is deciding which TRICARE option; Prime, Extra or Standard is best for them. Active duty soldiers are enrolled in TRICARE Prime and pay no fees. Active duty family members pay no enrollment fees, but they must choose a TRICARE option and apply for enrollment in TRICARE Prime. There are no enrollment fees for active duty families in TRICARE Prime.

TRICARE PRIME

7-29. With TRICARE Prime, most of your health care will come from an MTF, augmented by the TRICARE contractor’s Preferred Provider Network (PPN). All active duty personnel are enrolled in TRICARE Prime. Soldiers receive most of their care from military medical personnel. Family members and survivors of active duty personnel may enroll. For active duty families, there is no enrollment fee for TRICARE Prime, but they must complete an enrollment form. Reserve component soldiers (and their family members) called to active duty for 30 days or more may enroll in TRICARE Prime or may be eligible for TRICARE Prime Remote.

7-30. Your primary care manager or team of providers will see you first for your health care needs. The primary care manager—

• Provides and/or coordinates your care.

• Maintains your health records.

• Refers you to specialists, if necessary. To be covered, specialty care must be arranged and approved by your primary care manager.

7-31. Advantages of TRICARE Prime:

• No enrollment fee for active duty and families.

• Small fee per visit to civilian providers and no fee for active duty members.

• Guaranteed appointments.

• Primary care manager supervises and coordinates care.

• Away-from-home emergency coverage.

7-32. Disadvantages of TRICARE Prime:

• Enrollment fee for retirees and their families.

• Provider choice limited.

• Specialty care by referral only.

• Not universally available.

TRICARE STANDARD

7-33. TRICARE Standard is the new name for CHAMPUS. Under this plan, you can see the authorized provider of your choice. Those who are happy with coverage from a current civilian provider often opt for this plan. However, this flexibility generally means that care costs more. Treatment may also be available at an MTF if space allows and after TRICARE Prime patients have been served. Furthermore, TRICARE Standard may be the only coverage available in some areas.

7-34. Active duty family members, family members of reserve component soldiers ordered to active duty for more than 30 days, and retirees drawing retired pay are eligible for TRICARE Standard. Active duty soldiers are enrolled in TRICARE Prime and not eligible for TRICARE Standard. The RC soldier ordered to active duty for more than 30 days is entitled to the TRICARE Prime benefit as soon as he is activated.

7-35. Advantages of TRICARE Standard:

• Broadest choice of providers.

• Widely available.

• No enrollment fee.

• TRICARE Extra is an available option.

7-36. Disadvantages of TRICARE Standard:

• No Primary Care Manager.

• Patient pays a deductible, co-payment and the balance of the medical bill if the provider does not participate in TRICARE Standard.

• Nonavailability statement may be required for civilian inpatient care for areas surrounding MTFs.

• Beneficiaries may have to do their own paperwork and file their own claims.

7-37. With TRICARE Extra, you will choose a doctor, hospital, or other medical provider listed in the TRICARE Provider Directory. If you need assistance, call the health care finder at your nearest TRICARE service center (TSC). Anyone who is eligible for TRICARE Standard may use TRICARE Extra.

7-38. Advantages of TRICARE Extra:

• Co-payment 5% less than TRICARE Standard.

• No balance billing.

• No enrollment fee.

• No deductible when using retail pharmacy network.

• No forms to file.

• You may use also TRICARE Standard.

7-39. Disadvantages of TRICARE Extra:

• No primary care manager.

• Provider choice is limited.

• Patient pays a deductible and co-payment.

• Nonavailability statement may be required for civilian inpatient care for areas surrounding MTFs.

• Not universally available.

TRICARE OVERSEAS

7-40. The TRICARE Overseas programs are designed to provide health care to eligible beneficiaries who reside overseas, not in the 50 United States. TRICARE has three overseas regions: Europe, Pacific and Latin America & Canada.

7-41. The main difference for overseas prime enrollees is that the co-payment for civilian care is waived and no pre-authorization is required for TRICARE covered benefits received outside of Puerto Rico, even when traveling in CONUS. TRICARE Prime enrollees in Puerto Rico who are enrolled to an MTF must have authorization from their primary care manager to see a civilian provider for other than emergency care.

7-42. Other TRICARE options:

• TRICARE Prime Remote—designed for active duty family members in remote locations. This is similar to TRICARE Prime.

• TRICARE for Life—for Medicare-eligible beneficiaries age 65 and over.

• TRICARE Plus. Enrolled beneficiaries have priority access to care at military treatment facilities; however, beneficiaries who choose to use TRICARE Extra, TRICARE Standard or TRICARE for Life may also continue to receive care in an MTF as capacity exists.

7-43. The best source of information on current health care benefits is your health benefits advisor available at your local TSC or MTF. Look for additional information on the TRICARE website, www.tricare.osd.mil.

DENTAL

7-44. The Tricare Dental Program (TDP) is a voluntary, comprehensive dental program offered worldwide for family members of all active duty soldiers. It may also be available to selected reserve and individual ready reserve (IRR) soldiers and/or their family members. Active duty soldiers get dental care through their servicing dental activity.

ENROLLMENT BASICS

7-45. The TDP offers two plans: a single plan and a family plan. New enrollees must continue in the TDP for at least 12 months. Anyone failing to pay premiums or who disenrolls for other than a valid disenrollment reason may not re-enroll in the program for 12 months.

7-46. Under the single plan, one eligible member is covered. This can be one active duty family member, a selected reserve or IRR member, or one selected reserve or IRR family member. A family enrollment consists of two or more covered family members, either active duty, selected reserve or IRR. Under the TDP, however, all eligible family members of a sponsor must be enrolled if any are enrolled, except for the following:

• Sponsors may voluntarily enroll children under four years old. Upon their 4th birthday, they are automatically enrolled.

• If a sponsor has family members living in geographically separated locations, he may enroll only those family members residing in one location (e.g., children living with a divorced spouse).

• Selected reserve and IRR sponsors can enroll independently of their family members and family members can enroll independently of the sponsor.

• Two soldiers cannot enroll the same family members. If both husband and wife are soldiers, they cannot enroll each other in the plan.

ELIGIBILITY

7-47. Active duty family members, selected reserve, and IRR members and/or their family members are eligible for the TDP if the sponsor has at least 12 months remaining on his or her service commitment at the time of enrollment. Family members of active duty, selected reserve and IRR soldiers, including spouses and unmarried children (natural, step, adopted and wards) under the age of 21, are eligible.

7-48. Child eligibility may be available after age 21 if—

• The dependent is a full time student at an accredited college or university and is more than 50% dependent on the sponsor for financial support.

• The dependent has a disabling illness or injury that occurred before his or her 21st birthday, or between the ages of 21 and 23 while enrolled as a full time student, and was more than 50% dependent on the sponsor for financial support.

7-49. Upon mobilization, RC soldiers become eligible for the same health care benefits as active duty soldiers, including dental benefits. As a result, RC soldiers enrolled in the TDP who are activated for more than 30 days automatically are removed from the program and become eligible for dental care from military dental providers. Family members of mobilized reservists become eligible for the same lower premiums that active duty family members enjoy.

REMOTELY STATIONED ACTIVE DUTY SOLDIERS

7-50. The Tri-Service Remote Dental Program (RDP) is for military personnel serving on active duty in remote CONUS locations (50 miles or more from a military base). Soldiers enrolled in TRICARE Prime Remote (medical) are automatically eligible for the RDP. RDP eligible active duty soldiers can receive emergency dental care any time they are in an active duty status. RDP is not for family members.

7-51. Soldiers that leave the Army with transitional assistance health care benefits may receive dental coverage for emergency care only. Soldiers that have served 180 days of continuous active duty or more may be eligible for dental care as a veteran’s benefit following separation from active duty. The laws governing veteran’s benefits change frequently. See current information on the Department of Veterans Affairs website at www.va.gov or visit your local VA office.

SURVIVOR BENEFITS

7-52. When an enrolled soldier dies while on active duty for a period of more than 30 days, the enrolled family members will continue to receive benefits for 3 years from the month following the month of the soldier’s death. This applies only to family members enrolled at the time of death.

7-53. This benefit also applies to enrolled family members of selected reserve and IRR—special mobilization category (IRR—SMC) sponsors who die while in selected reserve and IRR—SMC status regardless if the sponsor was enrolled at the time of death. Family members must be enrolled at time of death to receive these benefits. In these cases the government pays the entire TDP premium. The family members will be notified of coverage termination prior to disenrollment.

7-54. For additional information regarding the Tricare Dental Program, visit your local TRICARE office or the website through the Army homepage.

SUPPLEMENTAL INSURANCE

7-55. If you receive medical care outside the military system, and you don’t have any other health insurance (or a supplemental policy) to help pay your cost-shares or co-payments, you’ll face out-of-pocket expenses. Even though TRICARE pays a generous share of the cost of civilian medical bills, your share of the cost might be substantial.

7-56. Many associations, organizations, and insurance companies provide supplemental insurance. Supplemental insurance may cover co-payments and costs TRICARE does not pay. The TRICARE website has a list of some of the associations and organizations that offer supplemental insurance. Neither TRICARE nor the Department of Defense endorses any specific company, organization, or plan. Likewise, neither DOD nor the TRICARE Management Activity promotes any specific policy for purchase, nor recommends retention or cancellation of any coverage you may have. The decision to purchase supplemental insurance is yours and yours alone.

Medical Bills

SFC Willer is married and has one daughter, Linda. While on leave recently, the family was involved in an auto accident and unfortunately Linda was seriously injured. There wasn’t a military hospital located nearby and she required urgent medical attention.

Linda received proper and immediate medical care at a civilian hospital and recovered completely from the accident. But SFC Willer is now faced with substantial medical bills that he can’t afford and TRICARE will not pay completely.

SFC Willer is enrolled in TRICARE Prime and his family is in TRICARE Standard. TRICARE paid about half of the bill for Linda’s care. For care providers that are part of the TRICARE system that would be the end of the story because those providers agree to accept what TRICARE pays (along with any co-payment required). But the civilian hospital where Linda was treated is not part of the TRICARE system. It expects SFC Willer to pay what the hospital billed, above and beyond the amount TRICARE paid.

7-57. Most TRICARE supplemental insurance policies are designed to reimburse patients for the civilian medical care bills they must pay after TRICARE pays the government’s share of the cost. Before you buy any supplement, carefully consider which plan is best suited to your individual needs. Each TRICARE supplemental policy has its own rules concerning acceptance for pre-existing conditions, eligibility requirements for the family, deductibles, mental health limitations, long-term illness, well-baby care, care provided to persons with disabilities, claims under the diagnosis-related group payment system for inpatient hospital charges, and rules concerning allowable charges. In some soldiers’ situations, supplemental insurance may be appropriate while others may not need or want it. Look at your own circumstances and decide if the additional cost of supplemental insurance is something you think necessary. Either way, it is your decision.

SECTION IV – FINANCIAL READINESS AND PLANNING

7-58. First term soldiers get financial readiness training at their first duty station. Most installations also offer financial readiness training to other soldiers upon request, usually through the Army Community Service (ACS) or Community Service Center (CSC). Many units also have appointed a command financial NCO (CFNCO) who conducts training and financial counseling for assigned soldiers. The training you receive helps you manage your finances while in the service and can help you plan for the future as well. Training Circular 21-7, Personal Financial Readiness and Deployability Handbook, is a good reference for more details.

READINESS

7-59. Financial readiness for AC and RC soldiers means ensuring you and your family are provided for within the limits of your income. The reason it is a readiness issue is that soldiers with money problems may be unable to focus on their mission, especially if deployed. Training in financial matters can help you gain control over your finances and manage your money more effectively. The goal of the training is to provide you with the tools to handle your money wisely and to make informed purchasing decisions so you are better able to concentrate on your duties.

7-60. The Consumer Affairs and Financial Assistance Program (CAFAP), offered through ACS, can train soldiers and spouses in money management, proper use of credit, basic financial planning, deployment, transition and relocation, insurance options, and check writing principles. If you don’t already know how, CAFAP counselors and the CFNCO can teach you about budgeting. Budgeting can prevent financial difficulties before they arise.

7-61. Service in the Army helps to save money. For example, shopping at the Commissary is usually less expensive than off-post. The MWR facilities on base are nearly always a better value than similar businesses in the civilian community. You also have access to free legal assistance that in the civilian world could cost hundreds or even thousands of dollars. Your health care costs very little in comparison to that of civilian workers. But you should take positive steps to ensure expenses don’t exceed your income. One of the best tools is to create a budget. A budget is a list that shows your expected income and expenses on a periodic basis, usually monthly. The goal is to track your expenses and learn the discipline to spend money when you planned to.

7-62. The key is discipline. Eating out less saves money immediately. If you are considering the purchase of a vehicle, make sure beforehand that the payments fit in your budget—and don’t forget the insurance and operating costs. Save ahead of time for big purchases like TVs or appliances so you don’t have to pay interest on credit cards or loans. These few little tips can help keep you on budget. Set financial goals that are reasonable and then make a plan for reaching them. Stay on budget by avoiding unnecessary expenses and smart purchases. It isn’t easy, but soldiers have performed much more difficult tasks.

PLANNING

7-63. Soldiers, through training and discipline, are planners by nature. So it shouldn’t be any surprise that it’s important to plan for the future financially. The trouble is soldiers often don’t think of it until late in their careers. Our commitment to the Army, our fellow soldiers, and to our families occasionally leave little time for thinking about financial goals. However, someday you will leave the service and start a new career and someday you will also leave the civilian work force. The sooner you plan for that day, the more likely you will attain the goals you set.

7-64. In basic terms, there are three areas to consider: retirement planning, emergency savings, and insurance. Retirement planning is a long-term savings process to prepare for the day you are no longer in the work force or earning a regular paycheck. You should also try to save enough now to cover emergencies or unforeseen opportunities. That means having enough money in the bank, for example, to pay the deductible on your car insurance in case of an accident or to get home on emergency leave. Finally, life insurance is money that, in the event of your death, helps your family or beneficiaries get back on their feet.

SERVICEMEMBERS’ GROUP LIFE INSURANCE (SGLI)

7-65. Soldiers are involved in a dangerous profession in a dangerous world. As in civilian life, soldiers often purchase life insurance to protect their families in the case of the soldier’s death. Since World War I the government has provided insurance of some type to all members of the Armed Forces. The origins of SGLI date back to the Vietnam War. As the Armed Forces began to suffer significant casualties, the private life insurance companies were unwilling to underwrite the coverage for members of the service. This created the need for a government sponsored life insurance program to cover soldiers placed in harms way. Servicemens’ Group Life Insurance (SGLI) was instituted in 1965 to meet this need. The name changed in 1997 in recognition of the increasing numbers of women who serve in the Armed Forces.

7-66. SGLI initially covered only active duty personnel, but it has expanded over the years to cover certain reserve component soldiers. The maximum amount of protection has increased significantly since the program started. Originally, the coverage was limited to $10,000, but it has gradually increased over the years through legislation to its current maximum coverage level of $250,000. All eligible soldiers are automatically covered by SGLI for the maximum amount unless they decline or reduce the coverage in writing. The very low cost of SGLI makes it a wise choice while on active duty or in the reserve component.

7-67. The coverage expires 120 days after separation from the Army. Soldiers may continue the coverage for two reasons. First, if, upon separation, a soldier is not able to work due to disability, a disability extension of up to one year of free coverage is available. Second, any soldier can convert their SGLI coverage to either Veterans’ Group Life Insurance (VGLI) or to a commercial life insurance policy. Both the disability extension and the VGLI conversion options require an application to the Office of Servicemembers’ Group Life Insurance (OSGLI). Find more information on the VA Insurance website at www.insurance.va.gov.

7-68. Family coverage, which took effect on 1 November 2001, provides automatic coverage of $100,000 (or the SGLI coverage level of the soldier, whichever is less) on SGLI-insured soldiers’ spouses. As with the basic SGLI, soldiers may in writing decline or reduce spousal coverage. Dependent children are also automatically insured, at no cost to the soldier, for $10,000 per child.

7-69. If you wish to increase your total life insurance coverage to more than that provided by SGLI, commercial life insurance in various forms is available. Some insurance products cover you for a specified period or term and are usually the least expensive initially. Permanent insurance (for example, Whole Life) is designed to last a lifetime and may provide a cash value after a few years but is generally the more expensive option at the time of purchase. There are a number of variations of each as well. But look before you leap—make sure you really need it, can afford it, and understand what you’re paying for! For example, any insurance you purchase should have no restrictions as to occupation, aviation status, or military status (active or reserve) in peacetime or war. Read the fine print and ask questions.

7-70. As you progress in your career or even after you leave the Army, you should reevaluate both the amount and type of insurance you carry. Events such as the birth of children or buying a house may change the amount of insurance with which you want to protect your beneficiaries. It depends on what your beneficiary will need. For example, let’s say a soldier wants her spouse to be able to pay off the house and still have money available to pay for four years of college for their three children. They would add the balance of the home loan to the expected cost of the tuition, then subtract any amount the government pays in the event of the soldier’s death (so they don’t pay for more insurance than they need). A single soldier paying child support or a soldier who designates his parents as the beneficiaries each would similarly calculate how much money would be needed in the event of the soldiers’ death and insure for the amount they desire.

RETIREMENT BENEFITS

7-71. Soldiers who complete at least 20 years of military service can receive outstanding retirement benefits, including retired pay. Military retired pay has a long history that is often misunderstood. It is not a pension. Pensions are primarily the result of financial need. Military retired pay is not based on financial need, but is regarded as delayed compensation for completing 20 or more years of active military service. The authority for nondisability retired pay, commonly known as “length-of-service” retired pay, is contained in Title 10 of the US Code.

7-72. The military retirement system has four basic purposes:

• To provide the people of this nation a choice of career service in the armed forces that is competitive with reasonably available alternatives.

• To provide promotion opportunities for young and able-bodied members.

• To provide some measure of economic security to retired members.

• To provide a backup pool of experienced personnel in case of national emergency.

7-73. If you decide to make the Army a career, you will retire at a relatively young age so you will probably begin another career. In fact, the leadership abilities and experience gained in the Army often make former soldiers highly valued employees. Even former soldiers who start their own businesses have a unique edge—they are confident, smart, and have outstanding initiative.

Active Component Retirement

7-74. For soldiers who retire from active duty, your retirement system is determined by your DIEMS, or date-initially-entered-military-service. Soldiers with DIEMS before 8 September 1980, receive a percentage of their final basic pay, calculated by multiplying 2.5% by the number of years of service. Those with DIEMS on or after 8 September 1980, receive a percentage of the average of their highest 36 months of basic pay, referred to as the high-three formula. Soldiers with DIEMS after 31 July 1986 may choose between the high-three formula and the Military Retirement Reform Act of 1986 (commonly called REDUX) formula.

7-75. Under the high-three formula, monthly retirement pay is the average of the highest 36 months of basic pay, multiplied by 2.5 percent per year of service, up to a maximum of 75%. For example, a soldier who serves 24 years would receive monthly retirement pay of 60% of the average of his highest 36 months of basic pay.

7-76. Soldiers who choose the REDUX option receive a $30,000 career-status bonus (CSB) during their 15th year of service and agree to serve five more years. Retired pay then equals the number of years of creditable service multiplied by 2.5 percent, minus 1 percent for each year of service under 30, multiplied by the average of the soldier’s highest 36 months of basic pay. If you stay in for 30 years, the retirement pay will be the same as the high-three formula. The $30,000 CSB is taxable. At age 62, retired pay is recomputed under the high-three formula but will not be retroactive. Under REDUX, the longer one stays on active duty, the closer the percentage multiplier is to what it would have been under the high-three formula, up to the 30-year point at which the percentage multipliers are equal. Look for more details on active component retirement on the Army G1 website at www.armyg1.army.mil.

7-77. In addition to retirement pay, soldiers may also participate in the TriCare for Retirees health care plan and the Delta Dental for Retirees plan. For low premium rates, Army retirees can continue to receive the same level of care they and their families enjoyed while on active duty. See Section VIII for more on these programs.

Reserve Component Retirement

7-78. Reserve component soldiers may also retire after 20 years of service. Reserve soldiers earn “retirement points” that are used to calculate the amount of retired pay in the following ways:

• Inactive duty for training (IDT) points earned as a troop program unit (TPU) member or as an IRR/IMA soldier attached to a TPU.

• Active duty (AD).

• Active duty for training (ADT).

• Annual training (AT).

• Active duty for special work (ADSW).

• Correspondence course points.

• Funeral honors duty.

• Points-only (non-paid) status (reinforcement training unit soldiers).

7-79. As an RC soldier, you must earn at least 50 retirement points in a year for that year to count toward retirement. You may request retirement after you have 20 of these “good” years toward retirement. You will be eligible for a number of benefits but a monthly retirement check won’t be one of them until you turn age 60. At that time you will receive retirement pay based on the highest rank you held, the number of qualifying years of service, the pay scale in effect at age 60, and the number of retirement points you earned. More detailed information is available on the Army Reserve Personnel Command website at www.2xcitizen.usar.army.mil.

7-80. Section 3991, Title 10 United States Code provides that enlisted retirees may receive an additional 10% in retired pay (not to exceed 75% of active duty basic pay) if they are recipients of the Medal of Honor, Distinguished Service Cross, or the Navy Cross. In the case of retired Medal of Honor (MOH) recipients, this is in addition to the special pension of $1000 per month paid to all MOH recipients.

RETIREMENT PLANNING

7-81. Whether you stay in the Army or not, you should think now about that inevitable day in the future when you are out of the workforce. If you stay in the Army long enough to retire, that is part of the answer. Social Security payments won’t start until you are about age 67. But even then, these together may not be enough to live on. Either way you should consider a strategy that will provide an income.

7-82. Your installation’s Consumer Affairs and Financial Assistance Program (CAFAP) counselor or your unit’s CFNCO can describe some of the tools available to accomplish this. Some of those tools are traditional individual retirement accounts (IRA), Roth IRAs, 401(k), savings incentive match plan for employees (SIMPLE) IRAs, annuities, US savings bonds, Thrift Savings Plan (TSP), stocks, bonds, and mutual funds. The CAFAP counselor and your unit’s CFNCO are not professional investment advisors, but they are able to give generic information on investing. They are not able to advise you on a particular investment or course of action. Those decisions are yours to make. Learn as much as you can and if you want professional investment advice, seek it from licensed professionals.

7-83. An investment program is not necessarily a luxury or even expensive. The key to investing is to start early and then stick with it. For example, let’s assume you can afford to invest $25 per month and you invest in a long term tool like an IRA. Let’s further assume that IRA averages a 10% rate of return per year. If you were to start this at the age of 20, by the time you were 65 you would have $227,000. Different investments have historically provided different returns so do a little homework before choosing one.

7-84. There is risk involved. Just because a particular mutual fund, for example, had a high rate of return for the last ten years does not mean it will for the next ten. Less risky investments may not keep up with inflation. Professional investment advisors can help if you need more details. But it’s your future, your money, and your decision.

Thrift Savings Plan (TSP)

7-85. The Thrift Savings Plan (TSP) is a retirement savings and investment plan created by Congress in 1986. Participation in the TSP is optional and is offered as a supplement to the traditional military pension benefit plan. TSP offers the same savings and tax advantages that 401(k) plans provide employees of private sector companies.

7-86. Some of the benefits of contributing to the TSP are the following:

• Immediate tax savings that reduce your taxable income by the amount contributed to the plan.

• Easy to start retirement savings plan for all members of the Army regardless of number of years of service.

• Ability to transfer or rollover IRAs, 401(k), or other eligible employer plans into TSP.

7-87. All soldiers, both active and reserve component while in a paid status may contribute to the TSP. An initial opportunity occurs within the first 60 days of becoming a member of the Army. After the initial opportunity ends, you may elect to start or change contribution amounts during designated TSP “open seasons.” Also, members of the ready reserve can change or start their contributions when changes in military status occur such as transferring from the IRR to active duty, into a troop program unit (TPU), or becoming an individual mobilization augmentee (IMA).

7-88. The TSP is a defined contribution plan governed by Internal Revenue Service (IRS) codes that prohibit withdrawals of TSP money while still in the Army. The only exception to this rule is when certain types of financial hardships occur in a soldier’s life or after a soldier reaches the age of 59½. A soldier may borrow money from his TSP account after obtaining a balance of a $1,000. Loans must be paid back with interest by allotment. Both the principal and interest are returned to the soldier’s account.

7-89. After leaving the Army you have several options for withdrawing money from your TSP account. You can leave your balance in the TSP where it will continue to grow. You might decide to receive a single payment or transfer all or part of the account to other eligible employer plans or traditional IRAs. You might also decide to receive monthly payments in the amount you request or by the IRS life expectancy tables. In any case, the IRS requires that withdrawals from the account must start no later than age 70½.

7-90. Your personnel office and Army Community Service (ACS) representative can provide basic information regarding this program. However, soldiers should read the Summary of the Thrift Savings Plan for the Uniformed Services before deciding whether or not to enroll. The TSP also provides booklets on specific program features including the investment funds and loan and withdrawal programs. These booklets, along with informational fact sheets, can be viewed and downloaded on the TSP website at www.tsp.gov. The TSP website also has forms, calculators, current information on changes to the program, updates on rates of return, and access to options in your TSP account.

Survivor Benefit Plan (SBP)

7-91. Congress established the Survivor Benefit Plan (SBP) to provide a monthly income to survivors of retired soldiers when retirement pay stops. The plan also protects survivors of soldiers on ac tive duty who die in the line of duty. Soldiers on active duty pay nothing for this benefit. The benefit is paid to the beneficiary of a soldier who dies in line-of-duty (LOD) and is not yet retirement eligible (has not accrued 20 years of service) on the date of death. The beneficiariy receives 55 percent of the retirement pay the soldier would receive if retired with a total disability rating on the date of death. This means that if you died while on active duty and in the line of duty, your spouse will receive a monthly check of 41.25% (55% X 75%) of your pay at the time of your death. But Dependency and Indemnity Compensation (DIC) payable by the Department of Veterans Affairs (VA), reduces a spouse’s SBP annuity dollar-per-dollar.

7-92. Retirees pay for their survivor benefits in SBP. The cost varies with the amount the retiree elects to provide the spouse. The retiree may elect to provide up to 55% of his retired pay to his spouse. For those about to retire, this is an important decision because without SBP, the surviving spouse of a retiree no longer receives the monthly retirement check. Find out more at the website of the Army G1, Retirement Services Directorate.

7-93. The Army Continuing Education System (ACES) through its many programs promotes lifelong learning opportunities and sharpens the competitive edge of the Army. ACES is committed to excellence in service, innovation, and deployability. For more information about Army education see Appendix B or the ACES website, www.armyeducation.army.mil.

TUITION ASSISTANCE PROGRAM

7-94. The Tuition Assistance (TA) Program provides financial assistance for voluntary off-duty education programs in support of a soldier’s professional and personal self-development goals. All soldiers (officers, warrant officers, enlisted) on active duty (including RC soldiers on active duty pursuant to Title 10 or Title 32, USC) may participate in the TA program. Before obtaining TA, soldiers must visit an education counselor to declare an educational goal and create an educational plan. The counselor will help explain TA procedures, requirement for TA reimbursements, and, if necessary, officer active duty service obligation (ADSO). Find out more at your installation education center or in AR 621-5, Army Continuing Education System.

MONTGOMERY GI BILL

7-95. In some cases TA won’t cover all the approved charges for a course. Soldiers eligible for MGIB can use MGIB as Top-Up to Tuition Assistance to cover the remaining charges. Top-Up pays the remaining TA costs up to the maximum of the MGIB rate payable to eligible individuals who have been discharged from active duty. Top-Up covers only the tuition and fees approved for TA.

7-96. Soldiers eligible for the Montgomery GI Bill-Active Duty (MGIB-AD), can use these benefits while in service after two continuous years of active duty. However, using “regular” MGIB in service may not be to every individual’s advantage. In most cases the amount eligible individuals can receive after discharge from active duty will be higher, even though the charge to their MGIB entitlement will be at the same rate. Using MGIB as Top-Up to Tuition Assistance may be more advantageous than using regular MGIB while in service. Soldiers should consult with an education counselor or with VA to make the best use of their MGIB benefits.

7-97. Regular MGIB pays tuition and approved fees for approved courses. This payment can’t exceed the amount that would be payable to individuals discharged from service, so it may not cover full tuition and fees for very expensive courses.

EARMYU

7-98. In July 2000, the Army announced a new education recruiting initiative entitled Army University Access Online (AUAO), now referred to as eArmyU. This program is entirely online, offering soldiers a streamlined portal approach to a wide variety of postsecondary degrees and technical certificates. All courses allow soldiers to study on their own schedule. Highly motivated soldiers can complete degree and certification requirements regardless of work schedules, family responsibilities, and deployments. eArmyU enables enlisted soldiers to complete degree requirements “anytime, anyplace they can take their laptop.” More information on eArmyU can be found at www.eArmyU.com.

7-99. EArmyU provides soldiers 100 % tuition assistance (TA), books, fees for online courses, and, at certain installations, a technology package that may include a laptop computer and other equipment. After completing 12 semester hours of continuous enrollment, the technology package becomes the property of the soldier. Added to the existing education programs and services available, this online program helps to ensure all soldiers have the opportunity to fulfill their personal and professional educational goals while also building the critical thinking and decision-making skills required to fully transform the Army. To be eligible for participation in the eArmyU program, soldiers must be regular active duty or active guard and reserve (AGR) enlisted soldiers with at least three years remaining on their enlistment. Soldiers may extend or reenlist to meet this requirement.

ARMY/AMERICAN COUNCIL ON EDUCATION REGISTRY TRANSCRIPT SYSTEM (AARTS)

7-100. The Army can provide official transcripts for eligible soldiers upon request by combining a soldier’s military education and job experience with descriptions and college credit recommendations developed by the American Council on Education (ACE). In addition to name and SSN, the transcript contains the following information:

• Current or highest enlisted rank.

• Military status (active or inactive).

• Additional skill identifiers (ASI) and skill qualification identifiers (SQI).

• Formal military courses.

• Military occupational specialties (MOS) held.

• Standardized test scores.

• Descriptions and credit recommendations developed by ACE.

• The website for AARTS is aarts.army.mil.

SECTION VI – RELOCATION ASSISTANCE

7-101. The Army’s Relocation Assistance Program (RAP), available through ACS, helps you settle into your new home as quickly and easily as possible. Many programs and services are available. One of the first services offered was the lending closet program, which provided for the temporary loan of basic household equipment for families to use until their own furnishings arrived. Other services include relocation guidance or counseling, education, and outreach services.

THE LENDING CLOSET

7-102. The lending closet program provides basic items you need upon arrival or before departure. Dishes, pots, pans, silverware, toasters, irons, and ironing boards are just a few of the items available on loan at most installations. This important service helps you and your family adjust more quickly by providing basic household needs.

7-103. The lending closet program provides basic housekeeping items on temporary loan for a varied period of time (usually thirty to sixty days) to all incoming personnel. An extension may be available if the household shipment has not arrived within the designated time period. For outgoing families, items may be borrowed after the household shipment has been picked up. However, all items need to be returned prior to departure from the installation. The following list is a sample of the items that may be available through the lending closet:

• Coffee makers.

• Highchairs.

• Irons and ironing boards.

• Miscellaneous kitchen items.

• Plates.

• Playpens.

• Pots and pans.

• Strollers.

• Utensils.

GUIDANCE COUNSELING

7-104. Guidance counseling (through RAP) helps to ensure that soldiers and families are prepared to cope with stressors and problems they may encounter throughout all of their permanent change of station (PCS) moves. RAP tries to accomplish this by providing you with the right information at the right time, counseling people on the emotional impact of moves, and educating the public to manage and plan for military relocation.

SPONSOR TRAINING

7-105. The US Army established the Total Army Sponsorship Program to assist soldiers, civilian employees, and family members during the relocation process. Program participants are provided with accurate and timely information and other support needed to minimize problems associated with relocating to a new duty station. The program is available to the active Army, the Army National Guard, the United States Army Reserve, and to civilian employees whose assignment to a position within the Department of the Army requires a PCS.

FINANCIAL ASSISTANCE

7-106. You can never be too financially ready for your move. The government ships your household goods and gives you travel funds and even a dislocation allowance, but it may not be enough to cover all your expenses. While advance pay may seem like a great solution, remember that you must pay back this advance within 12 months, and the temporary hardship of relocating may impact your family for a long time. Moving expenses you can expect include rent, advance rent, deposits, vehicle licenses and registration, car rental, transportation from the car shipping port (stateside), temporary lodging, and meals. Plan ahead!

7-107. You can find additional information at your local ACS office, the Army Community Services website at www.armycommunityservice.org, or the website of your installation or the one you are moving to. You can also find detailed information about your next duty station through the Standard Installation Topic Exchange Service (SITES) website at www.dmdc.osd.mil/sites.

TRANSPORTATION

7-108. The Army, through your local transportation office, arranges to move your household goods and other property when you transfer to a new duty station or upon leaving the service. In some situations, you may also choose to move your property yourself in a do-it-yourself (DITY) move. But you must be proactive and plan your move with your local transportation office in a timely manner. If not, you could be paying out-of-pocket for unforeseen costs or shipment problems.

7-109. Find detailed information about transportation requirements in the Joint Federal Travel Regulations (JFTR) on the Military Traffic Management Command website at mtmc.army.mil. There you will find information dealing with any situation that you may have regarding transportation. However, the regulation is very detailed and may require you to contact your local transportation office for clarification.

7-110. Your installation transportation office (ITO) is very important to you and your family after receiving orders to move. The ITO coordinates transportation, reimbursement, or a payment in lieu of transportation. This affects members and families located in the Continental United States (CONUS) and Outside the Continental United States (OCONUS). But your active and early involvement with the assistance from your ITO is necessary to have a smooth move. Don’t arrange any travel or shipment of your property before you have proper authorization—orders—or it could be costly for you.

7-111. You read in Chapter 3 about the military justice system and the Uniform Code of Military Justice. In this section you’ll read about legal services the Army provides to soldiers. Army Legal Assistance providers worldwide advise soldiers, family members, and other eligible clients on their legal affairs in a timely and professional manner by delivering preventive law information and resolving personal legal problems.

READINESS

7-112. Active component soldiers ordered to deploy, or reserve and National Guard soldiers being mobilized know that the time to put personal and legal affairs in order may be relatively short. Most soldiers realize that problems may arise when you are suddenly separated from your family and, for reserve component members, your business and civilian job. Advance planning will help avoid many legal problems upon mobilization or deployment. In addition, taking care of personal legal affairs now will give you and your family peace of mind.

7-113. Begin planning by anticipating what would happen if you were required to be apart from your family at a distant location for an indefinite period of time, unable to remain in continuous communications with them. Anticipate and prevent legal problems that might arise by putting your personal, property, and financial affairs in order now so that there will be no confusion or uncertainty later. Issues such as wills, medical planning, living wills, general and special powers of attorney; property and financial affairs management; and the Soldiers’ and Sailors’ Civil Relief Act are very complex and difficult to deal with while deployed. Some things to do before deploying are the following:

• Check your service record to make sure the information is correct.

• Make the correct beneficiary is on your SGLI election and certificate.

• Decide whether you and your spouse need to have wills drawn up.

• Decide whether or not you want a "living will," advance medical directive, or durable medical power of attorney. These documents can authorize a person to make decisions regarding your medical care in the event you cannot make those decisions yourself.

• Decide whether or not you need to give someone a general or special power of attorney. This is a legal designation for a person to execute certain duties on your behalf while you are absent.

• Decide if you need to give someone a medical power of attorney to take action in the event your minor children (if you have any) have a medical emergency.

• Before deployment, make sure that your family members know the location of important documents such as wills, marriage and birth certificates, and insurance policies.

• Verify DEERS enrollment so family members can receive needed medical care in your absence by calling 1-800-538-9552.

• Ensure your spouse knows the location of the nearest military legal assistance office for help with any legal problems in your absence.

Soldiers of the 115th Military Police Company, Rhode Island Army National Guard, prepare to enter a building in Fallujah, Iraq, while mobilized for Operation Iraqi Freedom.

ASSISTANCE

7-114. Your installation legal assistance center can provide a great number of services that would cost hundreds, even thousands of dollars using civilian legal offices. Army legal assistance centers provide answers and advice to even the most complex problems. Such legal assistance usually does not include in-court representation.

7-115. Some of the issues that your installation’s legal assistance center may be able to help with are as follows:

• Soldiers/Sailors Civil Relief Act (SSCRA).

• Marriage/divorce issues.

• Child custody/visitation.

• Adoption or other family (as expertise is available).

• Wills.

• Advice for designating SGLI beneficiaries.

• Consumer affairs (mortgages, warranties, etc.).

• Bankruptcy.

• Garnishment/indebtedness.

• Reemployment issues under the Uniformed Services Employment and Reemployment Act (USERRA) of 1994.

• Notarization.

• Name change (as expertise is available).

• Line of duty investigations.

• Reports of survey.

• Evaluation report disputes, including relief for cause.

• Bars to reenlistment (as available).

• Inspector General investigations.

• Hardship discharge.

• Taxes.

7-116. For more information on what your legal assistance center can do for you, contact your installation center or see the Army’s legal assistance website at www.jagcnet.army.mil/legal. You can also refer to AR 27-3, The Army Legal Assistance Program.

TRIAL DEFENSE

7-117. Trial Defense Services (TDS) are a separate part of the Judge Advocate General Corps (Army lawyers). They are independent of local commands and local staff judge advocate offices so they are not exposed to any possible influence on their services. The TDS provide soldiers facing court martial, Article 15, or civilian criminal charges with advice and representation in courts martial. TDS also helps soldiers facing involuntary separation proceedings under Chapters 5-13, 15 and 18 of AR 635-200, Enlisted Personnel. TDS may also help officers under elimination actions or who are resigning in lieu of elimination (AR 600-8-24, Officer Transfers and Discharges).

SECTION VIII – AFTER THE ARMY

7-118. Some day you will leave the Army. That day may be relatively soon, at the end of your current commitment, or it may be at the completion of a long and successful career. This section describes your discharge and some of the benefits all veterans may receive as recognition of their service.

7-119. The character of your discharge, honorable, general, other than honorable, bad conduct, or dishonorable has an affect on opportunities after your service. Don’t worry—nearly every soldier who leaves the Army does so with an honorable discharge. In fact, unless a soldier has been convicted in a court martial or administratively discharged for some misconduct or a few other limited reasons, that soldier will receive an honorable discharge.

7-120. Whether you serve for 180 days or 35 years, you are a veteran. Veterans have earned every benefit the Nation and the states offer. Take advantage of them. More information is available in DA PAM 350-526, Once A Veteran, or on the Department of Veterans Affairs website at www.va.gov.

There is something different in the way [a veteran] carries himself, a sparkle to his eye, a spring to his step…which another soldier will instantly recognize.

SGT Herbert E. Smith

7-121. In the following tables you will find the eligibility of veterans with various types of discharges for various benefits from the Army or the federal government. Many states also offer benefits to veterans or retirees who reside within their state. You can find those at state veterans’ department websites.

7-122. The eligibility of benefits shown here are not the sole determining factors, but only list the various types of discharge. Many states also provide various benefits influenced by the type of discharge, but look for that information on state benefits from state agencies. The legend for these tables is as follows:

• HON—Honorable Discharge

• GD—General Discharge

• OTH—Other Than Honorable Discharge

• BCD—Bad Conduct Discharge

• DD—Dishonorable Discharge

• E—Eligible.

• NE—Not Eligible.

• TBD—To be determined by Administrating Agency.

• DV—Disabled Veteran. Eligibility for these benefits depend upon specific disabilities of the veteran.

• Notes—(#)—following Table 7-6

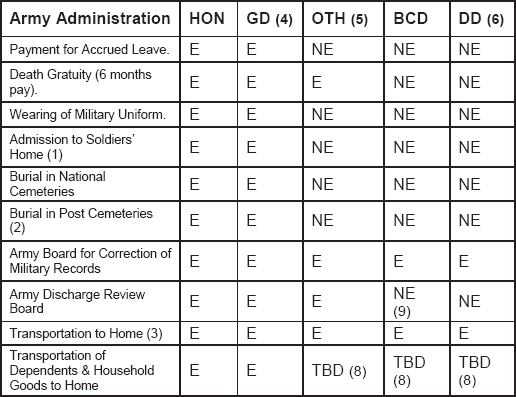

7-123. Table 7-3 shows some of the administrative effects of the types of different discharges.

Table 7-3. Administrative Effect of Discharge

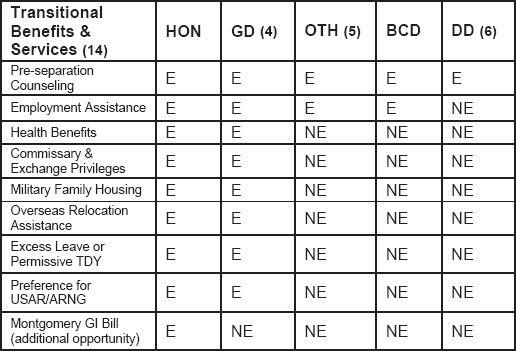

7-124. Table 7-4 shows some of the transitional benefits available to soldiers based on the character of their discharge.

Table 7-4. Transitional Benefits and Discharge

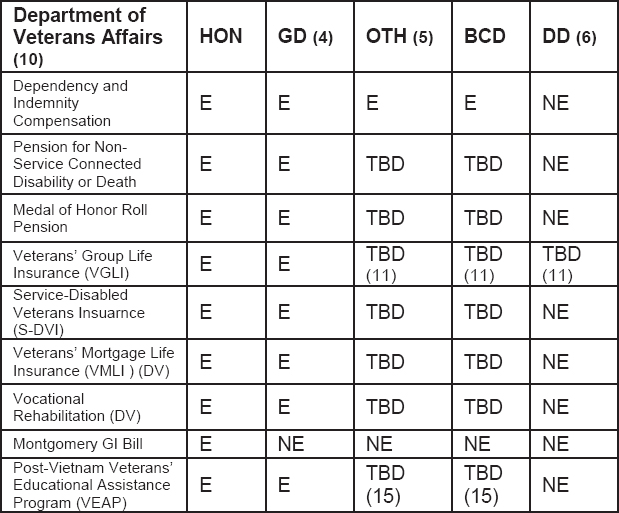

7-125. Table 7-5 shows the effect the character of a soldier’s discharge has on the veteran’s benefits he might receive.

Table 7-5. Veteran’s Benefits and Discharge

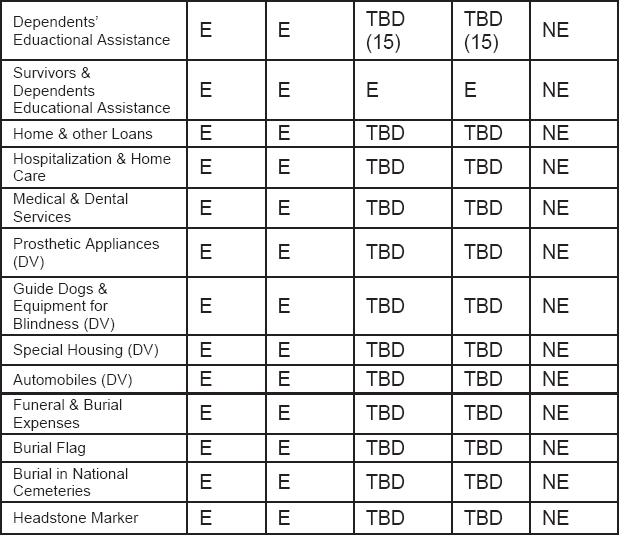

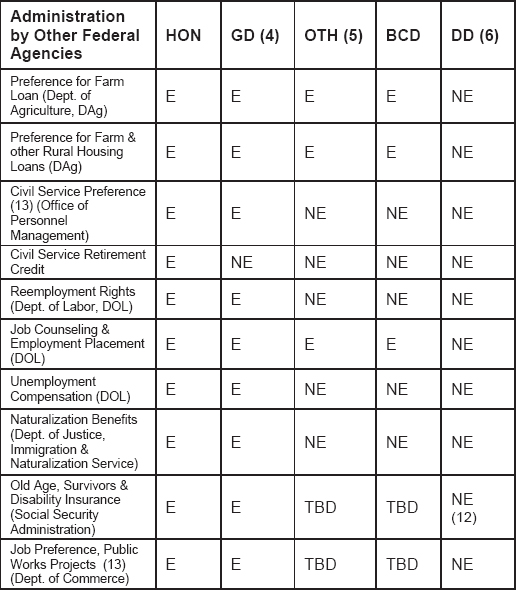

7-126. Table 7-6 shows the effects different types of discharge have on other Federal benefits.

Table 7-6. Other Federal Benefits and Discharge

NOTES:

1. The veterans must have served “honestly and faithfully” for 20 years or been disabled and excludes convicted felons, deserters, mutineers, or habitual drunkards unless rehabilitated or soldier may become ineligible if that person following discharge is convicted of a felony, or is not free from drugs, alcohol, or psychiatric problems.

2. Only if an immediate relative is buried in the cemetery.

3. Only if no confinement is involved, or confinement is involved, people or release is from a US military confinement facility or a confinement facility located outside the US.

4. This discharge category includes the discharge of an officer under honorable conditions but under circumstances involving serious misconduct. See AR 600-8-24.

5. An officer who resigns for the good of the service (usually to avoid court-martial charges) will be ineligible for benefits administered by the Department of Veterans Affairs (DVA).

6. Including Commissioned and Warrant Officers who have been convicted and sentenced to dismissal as a result of General Court-Martial. See AR 600-8-24, Chapter 5.

7. Additional references include DA PAM 360-526, “Once a Veteran: Rights, Benefits and Obligations,” and VA Fact Sheet IS-1, “Federal Benefits for Veterans and Dependents”

8. Determined by the Secretary of the Army on a case-by-case basis.

9. Only if a Bad Conduct Discharge was a result of conviction by a General Court-Martial.

10. Benefits from the Department of Veterans Affairs are not payable to a person discharged for the following reasons:

(a) Conscientious objection and refusal to perform military duty, wear the uniform, or comply with lawful orders of competent military authority.

(b) Sentence of a General Court-Martial.

(c) Resignation by an officer for the good of the service.

(d) Desertion.

(e) Alien during a period of hostilities.

A discharge for the following reasons is considered under dishonorable conditions and thereby bar veterans’ benefits:

(f) Acceptance of an Other than Honorable Discharge to avoid Court-Martial.

(g) Mutiny or spying.

(h) Felony offense involving moral turpitude.

(i) Willful and persistent misconduct.

(j) Homosexual acts involving aggravating circumstances or other.

A discharge under dishonorable conditions from one period of service does not bar payment if there is another period of eligible service honorable in character.

11. Any person guilty of mutiny, spying, or desertion, or who, because of conscientious objection, refuses to perform service in the Armed Forces or refuses to wear the uniform shall forfeit all rights to Servicemembers’ Group Life Insurance.

12. Applies to Post-1957 service only: Post-1957 service qualifies for Social Security benefits regardless of type of discharge. Pre-1957 service under conditions other than dishonorable qualifies a soldier for a military wage credit for Social Security purposes.

13. Disabled and Veteran-era veterans only: Post-Vietnam-era Veterans are those who first entered on active duty as or first became members of the Armed Forces after May 7, 1975. To be eligible, they must have served for a period of more than 180 day active duty and have other than a dishonorable discharge. The 180-day service requirement does not apply to the following:

(a) Veterans separated from active duty because of a service-connected disability, or

(b) Reserve and guard members who served on active duty during a period of war (such as the Persian Gulf War) or in a military operation for which a campaign or expeditionary medal is authorized.

14. Transitional benefits and services are available only to soldiers separated involuntarily, under other than adverse conditions.

15. To be determined by the Department of Veterans Affairs on a case-by-case basis.

VETERAN’S BENEFITS

7-127. Some of the more commonly known and used benefits include the veteran’s home loan guaranty, civil service and government contracting preferences, and education benefits. You must apply for your education benefits within 10 years after leaving the service. The specifics change from time to time, but you can see the current benefits in the Department of Veterans Affairs Veteran’s Benefits Handbook, available on the Department of Veterans Affairs website. Other government websites describing benefits to veterans are the Federal Office of Personnel Management website at www.opm.gov/veterans, or the Small Business Administration at www.sba.gov.

7-128. The Department of Veterans Affairs (DVA) has a great health care system for veterans who have service-connected conditions or disabilities. When you decide to leave the service, you will go through a process before and after discharge to determine if you have any service-connected disabilities or conditions. You will have physical examinations and a board will review your service medical file and exam results to make the determination. It is in your best interest to ensure your service medical file is complete, including any civilian treatment you may have had.