Chapter 10. Cotton

This chapter describes the market situation and highlights the latest set of quantitative medium-term projections for world and national cotton markets for the ten-year period 2018-27. World cotton production is expected to grow at a slower pace than consumption during the first few years of the outlook period, reflecting lower prices and releases of global stocks accumulated between 2010 and 2014. India will remain the world’s largest country for cotton production, while the global area devoted to cotton is projected to recover slightly despite a decrease of 3% in China. Processing of raw cotton in China is expected to continue its long-term downward trend, while India will become the world’s largest country for cotton mill consumption. In 2027, the United States remains the world’s main exporter, accounting for 36% of global exports. Cotton prices are expected to be lower than in the base period (2015-17) in both real and nominal terms, as the world cotton price is continuously under pressure due to high stock levels and competition from synthetic fibres.

Market situation

The recovery in the world cotton market continued during the 2017 marketing year following the slight increase in production in 2016, with production reaching 25.6 Mt. Global cotton production recovered by about 11.1% in 2017 due to improved yields and recovered areas. In addition, on-going stock releases helped to stabilise world consumption, although total world stocks remain at a very high level (at 19.2 Mt, still about eight months of world consumption). Production increased in almost all major cotton producing countries, including the People’s Republic of China (hereafter “China”) which recovered by 7% in 2017. Pakistan, the United States, Turkey and India increased production by 24%, 24%, 18% and 9%, respectively due to increases in yields and in the area planted.

Global cotton demand increased slightly during the 2017 marketing year to 25.0 Mt. Mill consumption estimates show an increase of 3% (to 5.3 Mt) in India and in a stable 8.0 Mt in China. Mill consumption increased in Viet Nam by 12% and in Bangladesh by 6.9% as Chinese direct investment in mills continued. The increase in Pakistan was 4%. Global cotton trade recovered by 1.0% in 2017 to 8 Mt. Increases in imports by Bangladesh, Pakistan and Viet Nam were insufficient to offset the decline in many countries’ import demand from 2016. China’s cotton support policy has continually narrowed the price gap between domestic and imported cotton, and both cotton prices were moving almost in parallel in 2017. In addition, US exports remained stable at 3.1 Mt from 2016, and Australia’s exports continued to increase by 3% in 2017 due to a recovery in production from 2014.

Projection highlights

Although the world cotton price is continuously under pressure due to high stock levels and strong competition from synthetic fibres, cotton prices are expected to be relatively stable in nominal terms during the outlook period. This makes cotton less competitive because prices for polyester are significantly lower than both international and domestic cotton prices. During 2018-27, relative stability is expected as government support policies continue to stabilise markets in major cotton-producing countries. However, world cotton prices are expected to be lower than the average in the base period (2015-17) in both real and nominal terms.

World production is expected to grow at a slower pace than consumption during the first few years of the outlook period, reflecting the anticipated lower price levels and projected releases of global stocks accumulated between 2010 and 2014. The stock-to-use ratio is expected to be 39% in 2027, which is well below the average of the 2000s of 46%. The global land use devoted to cotton is projected to remain slightly lower than the average in the base period. Global cotton yields will grow slowly as production gradually shifts from relatively high yielding countries, notably China, to relatively low-yielding ones in South Asia and West Africa.

World cotton use is expected to grow at 0.9% p.a. as a result of slower economic and population growth in comparison with 2000s, reaching 28.7 Mt in 2027. Consumption in China is expected to fall by 12.5% from the base period to 6.9 Mt in 2027, continuing its downward trend, while India will become the world’s largest country for cotton mill consumption with an increase by 42.2% to 7.5 Mt in 2027. Higher cotton mill consumption by 2027 is also foreseen for Viet Nam, Indonesia, Bangladesh, and Turkey, with consumption increasing by 74%, 45%, 34% and 17% from the base period respectively.

Source: OECD/FAO (2018), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

It is expected that global cotton trade will grow more slowly compared to previous years. Trade in 2027 is expected, however, to exceed the average of the 2000s. To obtain value-added in the textile industry, there has been a shift in the past several years towards trading cotton yarn and man-made fibres rather than raw cotton, and this is expected to continue. Global raw cotton trade will nevertheless reach 9.4 Mt by 2027, 19% higher than the average of the base period 2015-17. In 2027 the United States remains the world’s largest exporter, accounting for 36% of global exports, 1% point higher in the base period. Brazil’s exports are projected to reach 1.2 Mt in 2027, 0.5 Mt more than in the base period. This makes Brazil the second largest exporter overtaking India. The third largest exporter will be Australia with exports increasing from 0.7 Mt in the base period to 1.0 Mt. Cotton producing countries in Sub-Saharan Africa will increase their exports to 1.6 Mt by 2027. On the import side, China’s imports are expected to slightly grow to 1.2 Mt in 2027 which is still a low level in comparison to those reached during the last decade. Suppressed low domestic consumption and releases of stocks, as well as reduced producer support are behind this development. China’s dominant role in the world cotton market will be significantly challenged as other importing countries emerge. It is projected that imports in Viet Nam and Bangladesh will increase respectively by 0.8 Mt and 0.5 Mt, and Indonesia and Turkey will import 1.0 Mt and 0.8 Mt by 2027 respectively.

While continuing increases in farm labour costs and competition for land and other natural resources from alternative crops place significant constraints on growth, higher productivity driven by technological progress and the adoption of better cotton practices, including the use of certified seeds, high density planting systems and short duration varieties. Altogether, this creates significant potential for cotton production to expand in the next decade. While the medium-term prospects are for sustained growth, there may be potential short-term uncertainties in the current outlook period which may result in short-term volatility in demand, supply and prices. A sudden slow-down in the global economy, a sharp drop in trade of global textiles and clothing, competitive prices and quality from synthetic fibres, and changes in government policies are important factors that can affect the cotton market.

Price

Cotton prices are expected to be relatively stable in nominal terms especially in the latter half of the projection period, although the world cotton price is continuously under pressure due to high stock levels and competition from synthetic fibres. Cotton markets are expected to stabilise as government support policies continue in major cotton-producing countries during 2018-27.

Global cotton stocks grew slightly in 2017, but are expected to decrease to 11 Mt by 2027, which corresponds to five months of world consumption. The stock-to-use ratio is expected to drop to around 40% in 2027; substantially below the 80% observed in the base period. Relative stability is expected in China’s cotton market after the government has been shifting its cotton policy resulting in reduced stock accumulation during the projection period.

Note: Cotlook price A index, Midding 1 3/32”.c.f.r. fat Eastern ports (August/July).

Source: OECD/FAO (2018), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

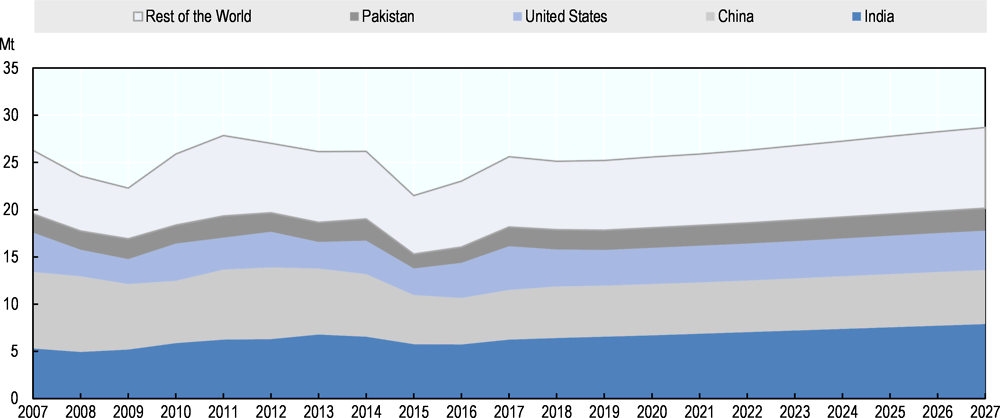

Production

World production is expected to reach 27.7 Mt in 2027, mainly sustained by yield growth, with an average increase of 1.6% p.a. over the projection period. However, world production is expected to grow at a slower pace than consumption during the first years of the outlook period, reflecting the anticipated lower price levels and projected releases of stocks that were accumulated between 2010 and 2014. Additionally, the Outlook foresees a slight decline in world cotton area in the first two years of the projection period, which is followed by a gradual increase thereafter.

Source: OECD/FAO (2018), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The global cotton area is projected to recover throughout the outlook period, despite a 1% decrease in China. The average global cotton yield will grow slowly, as production shares gradually shift from relatively high yielding countries, notably China, to relatively low-yielding areas in South Asia and West Africa.

Yield growth in China is expected to slow down from over 3% p.a. over the past decade to 1% p.a. for the next ten years. Cotton producers in China still have high per hectare yields (about twice the world average), but they are realised with relatively labour-intensive technologies. Due to small plots with limited water resource and low mechanization, cotton farmers especially in the eastern provinces face high and rising production costs.

The Outlook projections foresee that India will produce 7.9 Mt of cotton by 2027, which is approximately one third of the projected world output. Indian farmers continue to apply new technologies to improve their yield potential. The adoption of genetically modified (GM) cotton in India is part of a shift in practices and technology-use that resulted in more than doubling cotton production between 2003 and the base period. Yields are expected to grow by 1.9% p.a. during 2018-2027, which is above the annual growth rate during 2008-17, due to improved management practices. On the other hand, it is important to note that India’s variability in cotton yield is determined by the monsoon pattern in rain-fed regions. Climate change could affect this pattern and impact cotton yields in the future.

Pakistan accounts for the fourth largest share of global production. Projections indicate that Pakistan will produce 2.4 Mt of cotton by 2027. Production will increase by about 1.4% annually, as a result of area expansions and yield improvements. Similarly to Pakistan, India is expected to realise faster growth in the cotton area than in other crops. Production is projected to increase with annual growth rates of about 2.3%. However, in absolute terms, production in Pakistan is lower than in India as it lags considerably behind India in the adoption of GM cotton. African countries – mainly Benin, Mali, Burkina Faso, Côte d’Ivoire and Cameroon – are expected to contribute 2 Mt to world production by 2027, 33% above the base period. It is worth noting that the growth reported in Burkina Faso is taking place simultaneously with a move from GM cotton back to non-GM. GM cotton yielded shorter fibres than the conventional variety thus not allowing for smooth and stable thread that is essential for textile production.

Source: OECD/FAO (2018), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Consumption

Total demand for cotton, which amounted to 24.5 Mt in the base period, is expected to reach 28.7 Mt in 2027. This figure exceeds the 2007 historical consumption record and corresponds to 0.9% p.a. growth over the next ten years. However, this increase is not uniform across the period of analysis. While consumption grows faster than population in the next ten years, consumption on a per capita basis in 2027 is expected to remain below the peaks reached during 2005-07 and 2010 (Figure 10.5). Asia is confirmed as the number one area of the world for cotton consumption, mainly due to cheaper labour, lower electricity costs and weaker environmental regulations.

One of the main factors weakening the cotton consumption recovery is severe competition from synthetic fibres. Based on the assumption of relatively low oil prices, polyester prices are projected to remain significantly lower than cotton, which puts downward pressure on cotton markets throughout the projection period. In addition, cotton consumption will be influenced not only by macroeconomic trends but also by evolving tastes and preferences, including the increasing awareness with respect to marine plastic pollution. Scientific studies have demonstrated how a single synthetic garment can shed thousands of synthetic microfibers in a single wash and these microfibers get past the filter systems in treatment plants and end up in rivers and the ocean.

Source: OECD/FAO (2018), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Consumption in China is expected to fall by 13% from the base period to 6.9 Mt following the downward trend that started in 2009. China’s share of world cotton consumption is projected to fall to 24% in 2027, from 32% in the base period. As a consequence China loses its position as the largest cotton mill consumer - a position it has maintained since the 1960s – to India. India is expected to consume 7.5 Mt in 2027, increasing its share in total world consumption from 21% in the base period to 26% in 2027. Mill consumption in Pakistan is estimated to increase by 18% over the projection period, while Viet Nam is projected to keep its consumption at high levels. Chinese direct investment in mills might not continue in these countries because local prices are slowly moving closer to global levels behind gradually increasing farm labour costs in these countries for the next decade. Higher cotton mill consumption by 2027 is also foreseen for Bangladesh, Indonesia, Turkey and other Asian countries (mainly Turkmenistan and Uzbekistan).

The fastest growth among major consumers is expected in Bangladesh, Viet Nam and Indonesia, where consumption is expected to grow at 3.5%, 2.9% and 2.1% p.a. respectively, as their textile industries are expected to continue the rapid expansion that began in 2010. While Bangladesh had been widely expected to reduce its textile exports after the phase-out of the Multi-Fibre Arrangement (MFA) in 2005, its garment exports and cotton spinning have still flourished.

Trade

Global cotton trade is expected to follow the ongoing transformation of the world textile industry which began several years ago, mainly driven by rising labour costs, cotton support prices, and incentives to obtain added value in the cotton supply chain. There has been a tendency in recent years to gradually replace raw cotton trade with trade of cotton yarn and man-made fibres. However, global raw cotton trade is expected to recover to 9.4 Mt in 2027, about 19% higher than during the base period, even though this would be still below 10.0 Mt, the average level for 2011-12.

The world largest exporter throughout the outlook period is the United States, accounting for 36% of global exports in 2027 (35% in the base period) followed by Brazil and Australia (Figure 10.6). Exports from Brazil will reach 1.2 Mt from 0.8 Mt in the base period. Australia is expected to increase exports by over 2.8% annually to reach 1.0 Mt by 2027. Over the past few years, given its surge in productivity and production, India has become a major player on the world cotton market. However India’s exports are expected to fall to 0.9 Mt in 2027 and the country is expected to account for 9% of the world’s cotton exports while this share was 14% in the base period due to growing domestic uses.

Note: Top 5 importers (2007-2016): Bangladesh, China, India, Turkey, Viet Nam. Top 5 exporters (2007-2016): Australia, Brazil, European Union, India, and the United States.

Source: OECD/FAO (2018), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Sub-Saharan African countries continue to play a major role as cotton exporters. It is expected that their share in world trade will grow to 18% with exports reaching 1.6 Mt by 2027. However, trade in the region has been volatile in the past few decades. Cotton mill consumption is limited throughout Sub-Saharan Africa and many countries export virtually all their production. With the increases in productivity, in particular through the adoption of bio-tech cotton in this region, production and exports are expected to be 25% and 26% higher respectively in 2027 compared to the base period.

The transition in trade also induces changes in the composition of importers in the world cotton economy. Although China lost its position as the world’s largest importer in 2015, over the outlook period its share of world cotton imports will remains stable at about 13%. The projected 1.2 Mt of cotton imports entering China in 2027 would be far smaller than the peak imports of about 5 Mt in 2011. In contrast, Bangladesh and Viet Nam are projected to be the leading importers. By 2027, they are expected to increase their imports by 41% and 69%, accounting for over 40% of world trade.

Main issues and uncertainties

While the medium-term prospects for the world cotton market are stable, there will be potential short-term volatilities in demand, supply and prices that may result in significant short-term uncertainties in the projection period.

The demand for raw cotton is derived from the demand for textiles and clothing, which is very sensitive to changes in economic conditions. In the scenario of a sudden slow-down in the global economy, global consumption of textiles and clothing would experience a sharp drop, which would also impact the raw cotton market. As an example, the 2008-09 financial crisis, which caused average global consumption to fall by over 10%, resulted in a 40% reduction of cotton prices.

Despite the intention of the governments of Viet Nam, Bangladesh and India to promote and increase production, factors such as limited area, water scarcity and climate change constrain their efforts. Malaysia is actively pursuing a Free Trade Agreement with the European Union. This should increase Malaysia’s textile export to the European Union and subsequently increase domestic consumption of cotton.

China’s cotton policies are one of the main sources of uncertainty in the global cotton sector. In particular its stock holdings have an important impact on the world market. Building on the reforms of 2014, China may take further steps to modify its policies in the next decade. This would have important implications for the world market in general, and possibly impact specific industries in partner countries, such as the cotton spinning sector in Viet Nam.

Global cotton yields will grow slowly, as production gradually shifts from relatively high yielding countries, notably China leading to significantly higher yields, to relatively lower yielding ones in India and South Asian countries. GM adoption in the United States has reduced the cost of growing cotton, and the adoption of GM varieties specifically targeted to local production conditions in Australia has also increased productivity. In India producers adopted GM crops and updated their management practices. However, average yields remain far below those of many other cotton producers and the GM varieties are very vulnerable against adverse weather conditions, causing other countries to take a more conservative approach to GM adoption. No trade restrictions have yet been applied to cotton fibre, yarn, or other textile products made with GM cotton, but GM adoption has nonetheless been slow in many countries. The recent example of Burkina Faso, where farmers realised that the applied GM varieties had shorter fibres and led to reduced market revenues, leading them to go back to GM free varieties, shows however another level of uncertainty regarding the GM adoption. Future productivity growth in countries with low yields will in general be determined by their adoption of new technologies, including mechanisation and increased input use.