PLAYERS & INSTITUTIONS

GLOSSARY

asset-backed securities (ABS) A financial security backed by a package of assets, often individual loans such as mortgages, auto loans and credit card debt. ABS allow lenders to originate loans and then resell them on the secondary market, freeing their capital to make new loans.

Bretton Woods System A system of monetary and exchange rate management in which participating countries agreed to mutually fix their exchange rates and to intervene, when necessary, to maintain those rates. The original agreement was made at Bretton Woods, New Hampshire, in July 1944. The system failed in the early 1970s after the United States and other countries moved to floating exchange rates.

capital Financial and tangible assets owned by an individual or organization, including money, securities, real estate, machinery, trademark and patents.

collateralized debt obligations (CDOs) Complex financial securities in which asset-backed securities or corporate loans are repackaged into debt securities of varying risk and return.

commodity futures An exchange-traded agreement to buy or sell a specific amount of a commodity at a specific price on a specific date in the future.

cyber security The protection of internet-connected hardware, software and data.

equity The net worth of an individual or company, equal to their assets minus any debts. Also refers to owning stock in a company.

Global Financial Crisis 2008 International banking crisis caused by the crash in the US mortgage market that began in 2007, high borrowing by banks and other financial institutions, and overreliance on short-term lending markets. The crisis worsened after the collapse of investment bank Lehman Brothers in September 2008. This led to a global economic downturn and the failure or bailout of many financial institutions.

Great Depression A worldwide economic depression that began with the Wall Street stock market crash in October 1929 and lasted through the 1930s. It was the worst depression of the twentieth century and had a devastating effect on many countries.

hedge fund An investment fund formed by groups of individuals or institutions who pool their capital to invest in stocks, bonds, derivatives, currencies, and other assets. Managers typically receive a regular management fee and a share of profits.

insider trading The practice—usually illegal—of trading stocks and options based on material, non-public information about a company’s performance.

international monetary system A set of accepted rules, standards and conventions that facilitates payments, capital flows and trade among nations.

leveraged buyout The purchase of a company using borrowed money. The purchaser often uses the purchased company’s assets as collateral for the loan.

mortgage-backed securities (MBS) Type of investment secured by a collection of mortgages. Lenders make mortgage loans and sell them to investment banks, which combine them to create MBS.

recession A period of several quarters in which economic activity declines. The usual indicators of a recession include rising unemployment and declining production.

shadow banking Lending and other traditional bank activities when performed through non-bank institutions, often with much less regulatory oversight.

sovereign wealth fund A state-owned investment fund.

subprime borrowers Individuals with poor credit histories who are at risk of defaulting on (failing to repay) a loan.

EXCHANGES & CLEARING HOUSES

the 30-second statement

Investors face two fundamental challenges when they want to trade financial assets. They have to find a willing buyer or seller. And they need to be sure their trading partner will hold up their side of the bargain. Exchanges solve the first problem, and clearing houses solve the second. Exchanges provide a recognized venue and ground rules for trading. They also determine which assets are eligible for trading. Stock exchanges, for example, set criteria for qualifying companies. Commodity exchanges establish standard contracts (such as 1,000 barrels of Brent Oil for delivery in 12 months). Successful exchanges provide deep, liquid markets, making it easy for buyers and sellers to trade what and when they want. Clearing houses ensure that those trades settle (clear) efficiently and with as little risk as possible. A clearing house may act as a counterparty on all trades, buying from sellers and selling to buyers. Individual traders thus need not worry about who is on the other side of their transactions. Clearing houses also ensure their members – the financial firms that make trades on their own behalf and for customers – satisfy margin requirements each day. Margin allows these firms and their customers to trade more aggressively. Enforcing margin requirements protects clearing houses from unexpected financial losses.

3-SECOND PAYMENT

Exchanges provide a centralized marketplace for buyers and sellers to trade financial securities; clearing houses ensure that trades successfully settle.

3-MINUTE INVESTMENT

Successful exchanges and clearing houses offer deep markets and near-certain settlement. But they require standardized terms. Investors who want bespoke or unusual financial products typically deal outside the exchanges in the over-the-counter market. For example, a company or rich individual may negotiate a special option or futures agreement with an investment bank. New products often emerge first in the over-the-counter market. They may then migrate to exchanges in response to market demand or encouragement from financial regulators.

RELATED TEXTS

See also

3-SECOND BIOGRAPHIES

DOJIMA RICE EXCHANGE

1697–1939

In 1710, this Osaka-based exchange offered the first modern commodity futures trading

NEW YORK STOCK EXCHANGE

1792–

The world’s largest stock exchange, as measured by the value of companies trading there

30-SECOND TEXT

Donald Marron

Exchanges bring buyers and sellers together to trade oil and other assets.

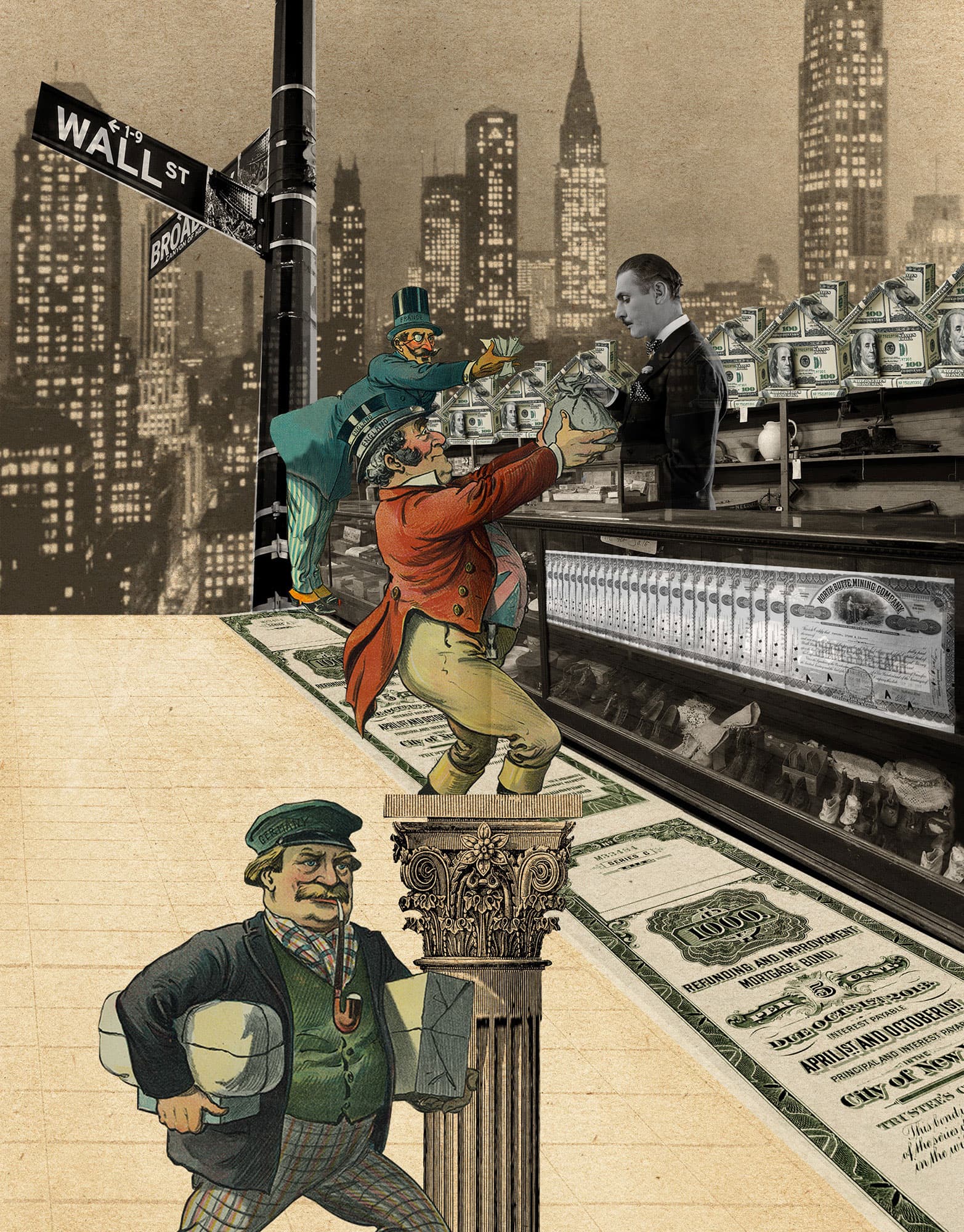

INVESTMENT BANKS

the 30-second statement

Investment banks offer sophisticated and often bespoke financial services. They raise capital for governments, non-profit institutions and corporations in the form of bonds, conventional bank debt or, for corporations, equity. One way that investment banks help companies raise equity capital is through initial public offerings (IPOs), which occur when the owners of a privately held company sell all or part of the company to outside investors. Investment banks guide IPO candidates and absorb some of the risk associated with the share prices of the company. They also advise companies looking to acquire or be acquired by other companies, and they advise companies in merger negotiations. Investment banks also work with wealthy individuals, guiding their investments and creating bespoke derivative arrangements to help them manage risk. Investment banks also invest on their own account, at times generating a potential conflict of interest between themselves and their clients. Investment banks sometimes segregate their business units to avoid the appearance of conflict of interest. Some investment banks are part of larger corporations with separate units devoted to retail banking (such as BNP Paribas) or retail brokerage services (such as Merrill Lynch), but some are independent entities.

3-SECOND PAYMENT

Investment banks are financial department stores for governments, businesses and individuals, providing a wide range of services to help their clients invest, raise capital and manage risk.

3-MINUTE INVESTMENT

In the years leading up to 2008, investment banks in New York and elsewhere created and sold trillions of dollars of mortgage-backed securities and collateralized debt obligations. The returns on those financial instruments were opaque functions of the mortgage payments made by the flood of subprime borrowers that entered the US housing market in the 2000s. Investors became skittish about the value of those instruments during the crisis and the associated panic helped fuel the recession of 2007–09.

RELATED TEXTS

See also

3-SECOND BIOGRAPHIES

GEORG VON SIEMENS

1839–1901

German banker and politician who co-founded Deutsche Bank in 1870 and helped finance the Berlin–Baghdad Railway project

TOKUSHICHI NOMURA

1878–1945

Japanese founder of Nomura Securities in 1925, which grew to include one of the largest investment firms in the world

30-SECOND TEXT

William Carrington

Investment banks provide financial services to businesses, governments and wealthy individuals.

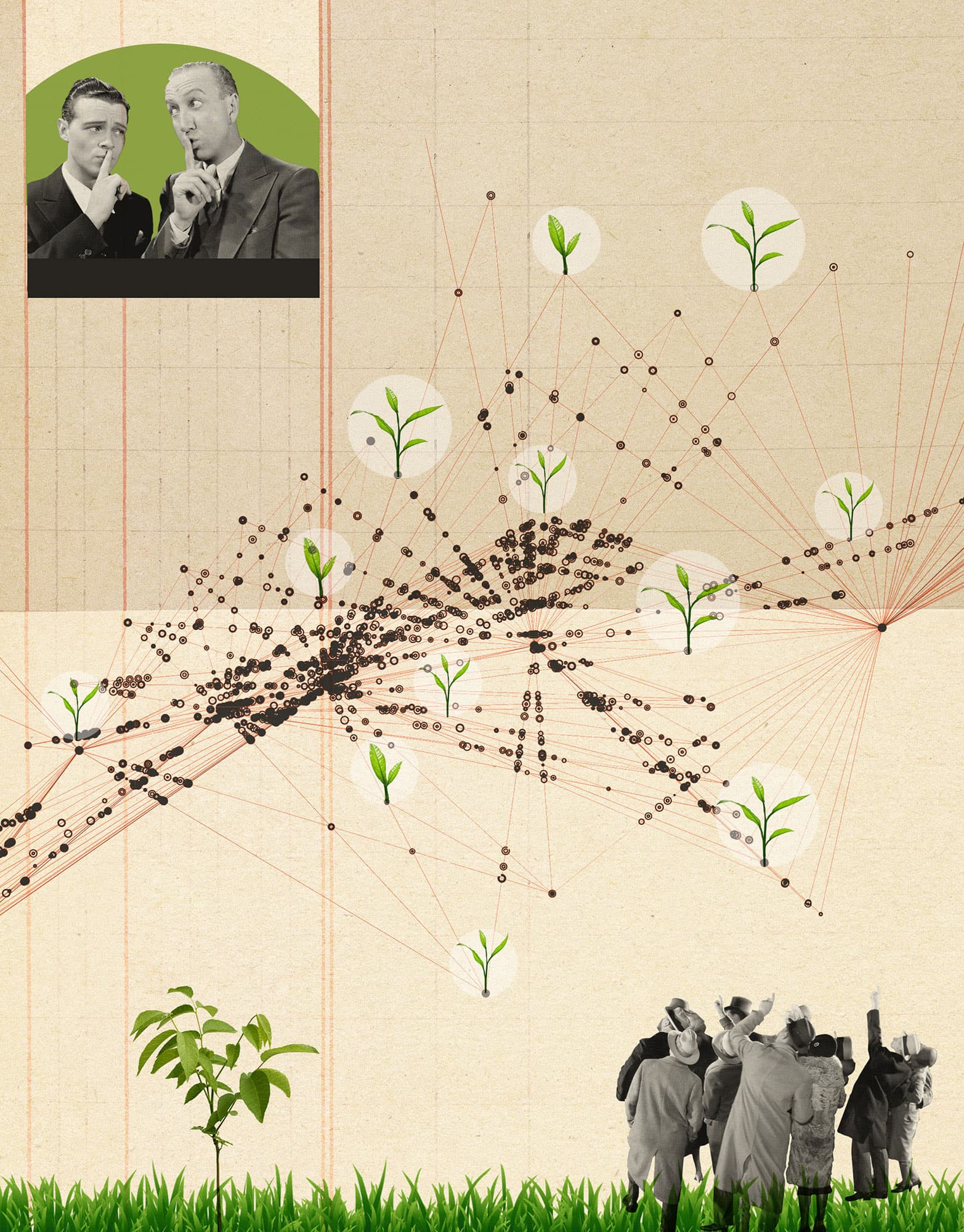

HEDGE FUNDS

the 30-second statement

Hedge funds invest capital they raise from institutions – such as pension funds, sovereign wealth funds and endowments – and rich individuals. By limiting their investor base, these partnerships operate with fewer regulatory requirements than the mutual funds available to ordinary investors. Hedge funds use that flexibility to pursue an astounding array of strategies. Some use fundamental research to buy stocks. Others rely on algorithms, data feeds and computers to make investment decisions. Some take large ownership positions and encourage troubled companies to pursue more profitable stragegies. Others short the stocks of overvalued companies. Some trade currencies, sovereign debt and global credit instruments. Others focus narrowly on specific markets. Some hold investments for years. Others buy and sell within milliseconds. Some borrow heavily. Others don’t. With so much diversity, hedge funds are not an asset class. Instead, they are an organizational form – a limited partnership in which managers receive regular fees and a share of profits – for investing in any asset. Decades ago, most hedge funds did actually hedge. They might try to buy undervalued stocks and short overvalued ones, thus hedging exposure to stocks overall. Some funds still do that today, but many do little hedging.

3-SECOND PAYMENT

Hedge funds are private pools of capital, typically open only to institutions and wealthy individuals, that pursue diverse strategies in myriad asset classes.

3-MINUTE INVESTMENT

Hedge funds are often described as secretive. That’s only partly true. Some funds avoid the limelight and do their best to keep their strategies – and their sometimes enormous compensation – out of the public eye. But others actively seek public attention to pursue their strategies. Activists publicly criticize corporate management. Short sellers denounce targets as overvalued. Some global funds fight public battles with governments over mispriced currencies and sovereign debts. And some hedge fund managers are publicly traded companies.

RELATED TEXTS

See also

MUTUAL FUNDS & EXCHANGE TRADED FUNDS

PRIVATE EQUITY & VENTURE CAPITAL

3-SECOND BIOGRAPHIES

ALFRED WINSLOW JONES

1900–89

Australian investor credited with founding the first hedge fund

GEORGE SOROS

1930–

Legendary Hungarian-American hedge fund manager, most famous for his fund’s $1 billion profit betting against the British pound in 1992

30-SECOND TEXT

Donald Marron

Sometimes secretive, sometimes public, hedge funds pool money to invest in almost anything.

PRIVATE EQUITY & VENTURE CAPITAL

the 30-second statement

Private equity (PE) and venture capital (VC) firms raise funds, most commonly from wealthy and institutional investors, and then use those funds to make equity investments in companies. PE firms specialize in large investments in mature firms, often taking public companies private through a leveraged buyout of existing shareholders. When successful, PE firms create value by exercising more focused control of businesses than can typically be provided by the diffuse ownership of publicly traded companies. PE firm’s purchases are often funded with outside debt, both from banks and bond issuance, in addition to their own equity. The use of outside debt increases the owners’ leverage and, if things go well, profit, but highly leveraged firms also risk being unable to service their debt, in which case the PE firm may lose all the value of its original investment. VC firms specialize in equity investments in start-up or early-stage companies, typically ones that have not yet sold shares to the public. In addition to financial support, VC firms often provide young firms with advice and guidance and sit on the board of the firms in which they invest. Both PE and VC firms are often organized as limited partnerships, with the investments of outside limited partners being directed by investment professionals who are general partners.

3-SECOND PAYMENT

Private equity and venture capital firms aim to earn returns for their investors through equity stakes in mature and early-stage businesses.

3-MINUTE INVESTMENT

The general partners of VC and PE funds are compensated by the limited partners under special arrangements. A common arrangement is for the fund managers to get an annual management fee of 1–2 per cent of the assets under management plus a ‘carried interest’, often calculated as 20 per cent of the partnership’s profits. Investments in these funds are often quite illiquid, meaning that investors can withdraw their funds only at times and under conditions specified in partnership agreement. Investors expect higher returns to compensate them for that illiquidity.

RELATED TEXTS

See also

3-SECOND BIOGRAPHIES

ISABELLA OF CASTILE

1451–1504

Spanish queen who funded the voyage of Christopher Columbus in 1492 in return for a private equity stake in its financial returns

HENRY KRAVIS

1944–

American investor who led the 1988 PE purchase of RJR Nabisco, an event later depicted in the book (and movie) Barbarians at the Gate

30-SECOND TEXT

William Carrington

Private equity and venture capital firms provide businesses – or exlorers – with alternative sources of capital.

FINANCIAL REGULATION

the 30-second statement

Financial regulation seeks to protect people from fraud and to protect the economy from systemic financial risks. Bank regulation has historically focused on two ‘safety and soundness’ issues. First, regulators seek to guarantee that retail depositors can get their money back, typically by providing deposit insurance. Second, regulators seek to prevent the failure of banks essential to the broader economy, typically by placing limits on banks’ risk-taking. Banks have also come under increasing consumer-protection regulation, particularly in the United States after concerns about fraud in mortgage lending. Other financial regulations seek to protect investors in securities markets, such as those for stocks and corporate bonds. These include disclosure requirements so investors have access to relevant information, and prohibitions on ‘insider trading’ by those with access to non-public information. Other financial regulations apply to companies offering insurance with long-tailed liability such as life insurance. These regulations seek to ensure that companies will have the resources to compensate families who have paid into life insurance policies for many years prior to a loved one’s death. Compliance with financial regulations is costly and, as we saw in 2008, regulators sometimes overlook major financial risks.

3-SECOND PAYMENT

Financial regulation seeks to protect consumers and investors from fraud and to protect the economy from the systemic failure of its financial institutions

3-MINUTE INVESTMENT

Systemic risk is the risk that a particular bank’s failure could adversely affect the entire economy. Large banks pose more systemic risk and so financial regulators are apt to assist large banks when they are in trouble. The tendency of regulators to assist large, troubled banks has given rise to the idea of ‘too big to fail’. That has in turn led some large banks to borrow more to become even larger, as their creditors are confident regulators will make them whole if the bank fails.

RELATED TEXTS

See also

3-SECOND BIOGRAPHIES

SECURITIES AND EXCHANGE COMMISSION

1934–

American regulator whose mission is to protect investors, maintain orderly markets and encourage capital formation

GAO XI QING

1953–

Lawyer who helped found the Chinese Security Regulatory Commission after being the first Chinese citizen to pass the New York Bar Exam

30-SECOND TEXT

William Carrington

Financial regulation aims to, and sometimes does, prevent fraud and reduce systemic risk.

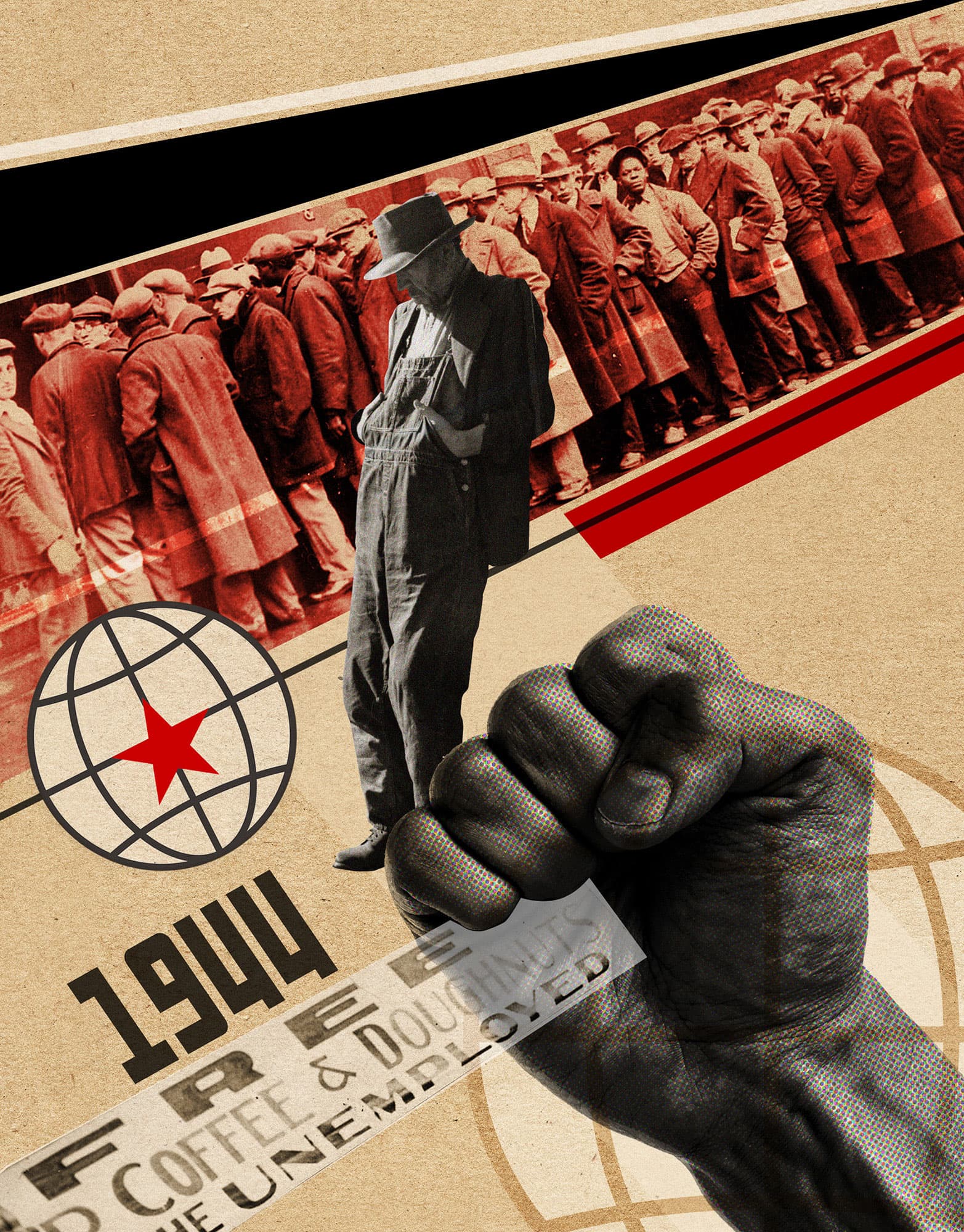

IMF & WORLD BANK

the 30-second statement

The International Monetary Fund (IMF) and World Bank were conceived at the 1944 Bretton Woods Conference to promote international economic cooperation. The goal was to avoid nationalistic economic policies that had contributed to the Great Depression. The IMF’s first mission was to oversee the Bretton Woods System of fixed exchange rates among the IMF member countries. It also worked to get rid of currency restrictions that hurt international trade. The Bretton Woods System broke down in 1971. The IMF then began lending money and offering advice to developing countries with large trade deficits or high debt levels. It promoted market-based economic reforms and helped Soviet-bloc countries transition from communism to capitalism. During the Global Financial Crisis, the IMF provided loans to both developing and developed economies hit by dramatic swings or ‘sudden stops’ in investment flows. These lending programmes filled funding gaps and IMF ‘stand-by arrangements’ boosted investor confidence. The World Bank’s original mission was to rebuild countries devastated by World War II. Its attention later shifted to economic development, in particular infrastructure investment. Today, its mission focuses on ending poverty through financial and technical assistance.

3-SECOND PAYMENT

Founded in the wake of the Great Depression, the IMF and World Bank foster global economic cooperation, support developing economies and work to end poverty.

3-MINUTE INVESTMENT

While their goals are noble, the methods of the IMF and World Bank have sometimes been called into question. Of particular concern are the conditions they demand in return for making loans. During the East Asian Financial Crisis of the late 1990s, for example, the IMF required government deficit reduction – spending cuts and tax increases – that worsened the economic downturn. World Bank loans have funded projects with harmful environmental or social consequences. They also add another burden to some countries’ already high debt levels.

RELATED TEXTS

See also

3-SECOND BIOGRAPHIES

CAMILLE GUTT

1884–1971

Belgian economist, politician and businessman who was closely involved in setting up the IMF and became the first IMF Managing Director

HARRY DEXTER WHITE

1892–1948

US Treasury official who was a key architect of the Bretton Woods System and the formation of the IMF and World Bank

30-SECOND TEXT

Gerald D. Cohen

The IMF and World Bank were conceived to avoid nationalistic policies that contributed to the Great Depression.