“KNOW YOUR MARKET AND LET YOUR MARKET KNOW YOU.”

SAI VENU GOPAL MOULI

The single most important element of long-term success on Amazon is finding a great product to sell on their platform. But how? Conveniently, Amazon.com is one of the best places to conduct product research, with automated tools in place to help you size up the competition; plus a built-in feedback loop to let you know how people feel about what’s already out there. I shake my head when I read how Amazon is the place to be if you want to make an easy million dollars. That’s just not how it works. Amazon is not a get-rich-quick scheme. At least not anymore! Like any other sales success story, in any other marketing channel, you’ve got to have a great product and there’s got to be a market for it.

One of the advantages of having sold thousands of products on Amazon over the years is learning to recognize the consistent, repeatable patterns that exist there while the rest of the Amazon.com platform evolves into something different every day. Identifying these repeatable patterns, and using them to my advantage, led me to become an Amazon Top 200 Seller. Today this experience helps me guide clients towards success with their products, whether they are new to Amazon or have been selling on the platform for many years.

I should also explain that there are plenty of Sellers who’ve had terrific financial success cherry-picking top products from dozens of unrelated product categories and slapping their brand name on them. This can be a profitable strategy, but I don’t believe it is a good way to build a lasting brand. It’s also not my style. Perhaps the biggest lesson I learned early on Amazon is the power of an enduring brand. It’s where you can really separate yourself from the competition and build a loyal customer base on and off the platform.

Over the next several pages, I’ll walk you through my tested method for finding great products and measuring their sales potential on Amazon. I will also demonstrate how to use available tools, with help from some easily downloadable software, to ensure the investment is well worth your time. We’ll also look at my favorite pastime—taking products that are flawed, but for which there is a market, and making them shine. It’s often these “ugly ducklings” that provide the greatest margins for success on Amazon. I’ll show you how to spot them and how to transform an ugly gizmo into an overnight swan.

If you lack enthusiasm for the products you sell, you will alienate your customer in one way or another. To put it more positively, having passion for what and how you’re selling is key to making your customer (and yourself) happy. If you’re already selling on Amazon, how do your current products make you feel? Are you proud of them? Do you love sharing how great they are with your friends and family? If not, then maybe it’s time for an upgrade, or maybe it’s even time to try a new line of products. The connection doesn’t have to be profound. If you’re just starting out, perhaps you bought a product that you believe, with a few minor changes, could be really special. Think about it. How many times have you purchased a product that you were really excited about only to be let down? Could you do better?

One of my favorite examples comes from the talented founders of the travel accessories brand mumi, whose award-winning designs grew out of their own real-life experience. Gabriela Mekler and Maribel Moreno discovered their inspiration while traveling abroad, where the suitcases they took with them fell short of their needs and their impeccable sense of style. There were too few options for keeping their belongings organized. When they searched for packing cubes to better organize their belongings, they found them to be really boring and uninspiring. Besides being dull, the stuff that was out there was generally flimsy and lacked function. Mekler and Moreno were so frustrated by the limited options that they decided to take matters into their own hands. The result? They turned their passion into a thriving new brand, with a loyal following of customers who can, thanks to mumi, better organize their lives on and off the road. I especially love their tagline: be mumi, be happy. And every new design they present honestly makes me feel that way.

Once you’ve found your inspiration, the next step is to find out if Amazon customers are buying the same or similar items. Sizing up the market for new and existing products is one of my favorite parts of selling on Amazon. It combines using some of the analytical tools that are already out there, along with your own creative intuition. Feeling good about a product is a critical first step, but now you’re ready to put it to the test.

To underscore the importance of choosing a product that people care about (and one for which there is an existing market), I’ll share a story about a new product idea I had some years ago. It was a line of folding leg foosball and air hockey tables, and I was absolutely certain they would take the home recreation market by storm. Can’t you just picture it? Fold up the table when you’re done with the game, then reclaim the space in your basement or den. Great idea, right? Shortly after landing an ocean container full of my bright idea, it was clear I had a problem. The tables sat in the warehouse, and they sat and sat. When they finally (and barely) started to sell, I discovered we had an even bigger issue: The legs didn’t fold completely flat, making it impossible to slide the table under a bed! What a disaster (and a very expensive education). The experience taught me to first make sure there is a market for my “bright ideas” before investing cash in developing them. I also learned that I needed better sourcing and quality control procedures, something we’ll explore in more detail in Chapter 4.

Only Steve Jobs could predict what customers wanted before they knew it for themselves. Hello, iPhone! The folding-leg folly taught me the hard way that I was no Steve Jobs, something my brothers still remind me about at the family dinner table. You may well be the next iconic innovator, but if you’re merely human like me, then there are reliable steps you can take to measure the potential of a product before you pull the trigger. And, somewhat ironically, Amazon is the best place to find out how other Sellers are performing in a targeted category. For nearly 20 years, I’ve used this same method to find my next great product. I now use this same method to calculate product potential for my clients. As you’ll discover, you just have to know where to look.

When I was approached recently by a private equity firm in New York City looking to purchase a bird feeder business, I was excited to help out. They asked me to look at the company’s current Amazon business as well as to identify areas for potential growth post-acquisition. Even though I’d never in my life searched for or shopped for bird feeders, I knew that my proven process would answer their questions, quickly. There are four steps I use to assess the market for any product before I go any further. I’ll walk you through them using the bird feeder example.

First, I begin by searching the current brand’s product(s) on Amazon, in this case: bird feeders. This particular bird feeder had special suction cups and was made of acrylic so that it could be attached to the outside of your home window. Once loaded with birdseed, homeowners would enjoy a close-up view of all sorts of birds from the comfort of their home. What a great idea! I can’t share their sales information, but I was surprised by the large number of units being sold each month. This was a sizable, respectable business.

Second, I use web-based research software that can be downloaded as a Chrome browser extension, and it will show the estimated monthly sales quantity of each item on an Amazon search results page. My favorite is Jungle Scout, and with its Chrome extension I was able to confirm the monthly sales estimates provided by the private equity firm. The company’s bird feeder was doing really well. But the firm already knew that, and that’s not why they were paying me. They wanted new opportunities.

Third, after I’ve confirmed the market performance of the existing product, I scroll down the Product Detail Page (PDP) on Amazon. The PDP is where a customer discovers the specific product details, including features, benefits, images, and price. To look for new product ideas for my client, I went to the PDP for the bird feeder they were investigating. I scrolled down the page until I found the Amazon Best Seller Rank (BSR) link with the subcategory name Birdhouses. The products I was investigating were ranked #1 for feeders and birdhouses. So how could I help them grow?

I did another Amazon Search for bird feeders, and I ran my Jungle Scout Chrome browser extension to see how other types of feeders were performing. I found several generating more in monthly sales than my client’s top-seller. But how could that be, if ours was ranked on top? I clicked on the feeder with the larger sales volume and scrolled down to view its BSR. That’s when I realized there were more than two bird feeder subcategories! This new subcategory was called Wild Bird Feeders, and the BSRs in this subcategory were outperforming the bird feeders in the Bird Feeders category. Jackpot! Now I knew how to increase, perhaps even double my client’s revenue, with just one new product, and it would fit beautifully within their brand. The difference? My client’s bird feeder was built for birdseed, whereas the other had top-sellers for hummingbird feeders with liquid feed. My client had an inviting and unique brand, with a distinctive birdseed feeder design. If they could engineer a product for hummingbirds, with similar design features to their original, then they’d likely double the size of their business overnight.

For the fourth and final step in my research, I shift to looking at the product reviews for competing products and I read every bad review for every top-selling hummingbird feeder. Across the spectrum I discovered some very interesting similarities. The biggest complaint? Hornets were getting through the holes in the feeder and they were stealing the food. Also, the products leaked and spilled feed. Some of the feeders were hard to fill. What if my client could address these issues in the form of a better design? The client loved the idea, and is now working on bringing a new kind of hummingbird feeder to the market. So long as they stay true to their brand and solve the issues raised by Amazon customers, then I’m confident the new feeder will be a hit.

This story about bird feeders offers a summary of how my research process works for people who are already selling on Amazon with an established brand. But they work just as effectively for new Sellers—someone, perhaps, with a passion for birdwatching and a creative design idea for making a better feeder. This reliable step-by-step process works wherever you are in the exploration process, whether you are a first-time Seller or looking to grow your Amazon business.

Finding out the sales potential for your product makes smart business sense. It can also save you time and money, whether you are new to Amazon or trying to improve the results of your existing products on the platform. Do you remember my not-so-brilliant idea of introducing folding leg game tables into the market? Had I first investigated the market size for such an invention, I’d have learned it didn’t exist, and I could have saved myself from making a six-figure mistake (and a lot of embarrassment at the family dinner table). You want to make sure the product you make is well-liked and is being purchased by Amazon customers. If you want to create a new product in a new market, then Rick can help you create a direct response TV campaign to educate the public; but Amazon, in my experience, isn’t where you want to create the market.

I mentioned earlier how I used web-based research software to learn which products were ranked higher than others. That software simply replicates a method my brothers and I were using called the 999 Cart Trick, long before SaaS software companies like Jungle Scout and Helium10 were around. If you want to save the software fees, the cart trick is a great place to start. Without the software, it’s quite a laborious process, checking multiple competitors across multiple categories, but the “intel” is critical and getting to it manually is a good exercise in understanding what you’re measuring. Here’s how it’s done:

If 999 products are not available, a message will appear showing you the total number of units available. By tracking the available quantity each day for seven days, you can calculate how many units are being sold daily. For example, if there are 20 products on Day 1, 18 on Day 2, and 15 on Day 3 (up to Day 7), you can estimate they are selling between two and three products a day. Once you have a daily average, you can generate a monthly average. And, Voila! You now have a reliable estimate for how much your competitor is selling on Amazon. It’s important to note that the monthly sales estimates may not hold throughout the year, especially for seasonal products. Snow shoes, for example, will move more units in January than in July.

I’ve always felt that the best way to learn is by doing. I tell my daughters the same thing, and I’m going to demonstrate the learn-by-doing adage by walking you through the same process I use when I plan to design a new product to sell on Amazon. Maybe you’ve invented something of your own? Or perhaps you’re looking to improve upon a product that is already selling well on the platform. Let’s use water bottles as an example. Just about everyone I know has at least one reusable water bottle. The range of these bottles, in terms of color, shape, and size, is also vast, and I can’t go anywhere without being reminded to stay hydrated! Water bottles are ubiquitous, which makes them a good model for our new product research.

Enter the words “water bottle” into the Amazon Search Box

What pops up is the Search Results Page (SRP) with about 70 water bottle choices on the first page. Search results can vary based on your location and previous search history, so you may want to use an incognito browser or clear your browsing history for cleaner results. Also, try to avoid spending too much time looking at Sponsored Products. A Sponsored Ad means that the Seller paid for placement on the SRP, which skews the information. Instead, look for Organic Best Sellers, products that are performing well with either a Best Seller or Amazon’s Choice tag, not a “Sponsored Ad” tag.

A note about the illustrations that follow: They are snapshots in time from Amazon.com, and I guarantee the information in these images won’t be the same by the time this book goes to print. However, the steps you’re about to follow remain the same.

Notice that on this first row of products there are three “Sponsored” products and one “Amazon’s Choice.” The Amazon’s Choice product has the #1 Organic Search Results spot for the keyword phrase “water bottles,” which means this thing must be a good seller. But how can we be certain?

Click on the Contigo AUTOSEAL Chill Vacuum-Insulated Stainless Steel Water Bottle and follow the link to the Product Details Page (PDP)

Scroll to the product detail section on the PDP.

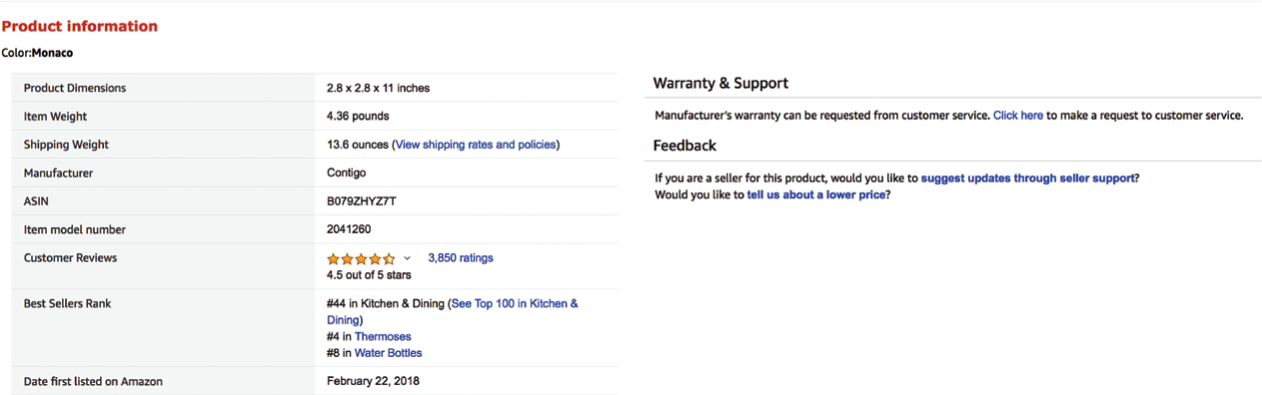

Scroll down to the Product Information Section. Note the product is ranked #8 in the subcategory “Water Bottles.” It’s also ranked #4 in “Thermoses.”

I’m also going to check the Amazon Best Sellers page by clicking on the blue sub-category name, Water Bottles. You can see that at the time of these screenshots, the Contigo Autoseal is indeed ranked #8 in the Water Bottles category.

Spend some time scrolling through this Best Sellers page.

Although your web-based research software may show you that there are better selling products from the search results outside this page, The Amazon Best Sellers Page shows 100 of the best historical sellers on Amazon over a prolonged period of time, across thousands of water bottles. Products that make it onto this page are the real deal.

As I scroll through these top sellers, I see a lot of great water bottles. There are stainless steel bottles, BPA-free plastic, silicone, insulated and non-insulated bottles. There are bottles for kids and adult bottles. There are some that allow you to filter your water and others that allow you to infuse fruit. I even see replacement parts, like caps and straws for best-selling bottles. So how in the world do I pick a bottle that could compete with this great group of products? Now we’re getting into my absolute favorite part of selling on Amazon. We’re going to look for the losers. And what I really mean by that is we’re going to look for our opportunity to create a winner.

Let’s start by looking at the great selling products with a slew of bad reviews, 4 stars or fewer. As I scroll through the Top Sellers, the following water bottles have some problematic issues, along with great sales. Here’s what I came up with:

The CamelBak Eddy Kids Water Bottle

The CamelBak Eddy Kids Water Bottle Contigo Autospout Straw Ashland Water Bottle

Contigo Autospout Straw Ashland Water Bottle CamelBak Eddy Water Bottle

CamelBak Eddy Water Bottle Pogo Plastic Water Bottle

Pogo Plastic Water Bottle Hydro Flask 21 oz. Water Bottle

Hydro Flask 21 oz. Water Bottle CamelBak Chill Bike Water Bottle

CamelBak Chill Bike Water Bottle Nafeeko Collapsible Water Bottle

Nafeeko Collapsible Water Bottle Nomader Collapsible Water Bottle

Nomader Collapsible Water BottleThis is a pretty substantial list of bottles with potentially fixable issues. The general themes among these eight bottles are “they leak” or “they have an awful taste.” Given that this group meets my litmus test for great sales and poor reviews, I’m going to choose the one that appeals to me the most: the collapsible water bottle. It just seems more convenient than lugging around a heavier, non-collapsible bottle. I also like the sales estimates for the collapsible water bottles. The Nafeeko is doing at least $30,000 per color variation, per month, while the Nomader is pulling in about $50,000 per color variation, per month. It looks like I’m not the only one who likes the idea of a collapsible bottle!

Now imagine if you solved the problems customers are experiencing with collapsible water bottles, and you followed my reliable steps for getting products ranked higher on Amazon. Then you could have a product generating between $300,000 and $600,000 a year in annual sales. Do you recall in Chapter 1 how just 200,000 Sellers are generating more than $100,000 per year in annual sales; and only 50,000 are doing $500,000+? If you can make this collapsible bottle better, and use my method for besting the competition, then you can be among the elite group of Top Sellers on Amazon.

Here’s another thing. I’ve never heard of the brand Nafeeko and my guess is you haven’t either; yet here it is doing $300,000 a year in annual sales. It’s certainly not as well-known as CamelBak or Hydro Flask, but it is competing with the Top Sellers because the people behind this brand know what they’re doing on Amazon. This is the perfect reason not to be discouraged. When you use the The Amazon Jungle Seller’s Survival Guide, you can compete with the big brands. Ready to learn more? In Chapter 4, we’ll take a closer look at what’s wrong with the Nafeeko collapsible water bottle, and we’ll talk about how to source the product and work with a factory on ways to make a better mousetrap or, in this case, a better water bottle. Let’s get started.