“AMAZON IS AN UTTER PHENOMENON AND THERE’S HARDLY BEEN ANYTHING LIKE IT IN THE HISTORY OF OUR COUNTRY.”

CHARLES MUNGER, LONGTIME BUSINESS PARTNER OF WARREN BUFFET

My journey on Amazon started in 2003, long before Jeff Bezos realized his vision of the Everything Store we know today. Amazon offered products in multiple categories, like books, electronics, even clothing, but it wasn’t anything like it is now. After the dot-com bubble burst in 2001, Amazon was hurting and relied on a deal it struck with Toys “R” Us in August of 2000 (among other deals) to keep it alive. Under that agreement, Toys “R” Us paid $50 million a year for 10 years, plus a percentage of sales, for an exclusivity provision with exceptions that made them the sole seller of toys on Amazon.

But in 2002 Amazon started allowing other businesses to list their goods on the Amazon.com platform, including toys. I know, because in the holiday season of 2003, I was making daily trips in a U-Haul Truck to a Los Angeles distribution center to fill orders for the Razor Scooters I’d sold on Amazon the night before—thousands upon thousands of them. My brothers and I were selling the same scooter on Amazon that Toys “R” Us was selling, and we were killing it! Not surprisingly, Toys “R” Us was not pleased, and they later filed a lawsuit against Amazon that took them more than a decade to win. In the meantime, Amazon doubled in size and Toys “R” Us went bankrupt.

Not only was Amazon inviting greater competition among Sellers who were selling to Amazon, known as first-party sellers (1P), but Team Bezos had opened the door to Third-Party Sellers (3P), who sold products on Amazon. Saul Hansell, in an article for The New York Times explained Amazon’s virtual surge as motivated by the desire “to replicate the success of eBay,” whose first-of-its-kind digital auction-style format was kicking Amazon’s butt.5

In 2003 we were one of the first to get a phone call from Amazon, back when desk telephones were still wired to the wall, about selling our basketball hoops in their brand new Sports & Outdoors category. At the time, the hoops, for which we were driving online traffic (at a nickel a click) were noticeably outperforming other hoops on search engines like Overture.com (later acquired by Yahoo). In fact, we were selling basketball hoops on Amazon.com before Amazon itself was selling basketball hoops on Amazon!

Of course we weren’t the only ones being recruited to expand Amazon’s stake in the virtual marketplace. Amazon was calling everyone with an online presence. What began as an easy new sales channel for us pioneers quickly became harder as more sellers flocked to sell their wares on the new online marketplace. Back then, my brothers and I were selling other people’s brands, a model that later became unsustainable for us on Amazon because every time a new Seller launched the same product, they’d do so at a lower price to win the sale. In response, we were forced to lower our prices and our profit margins began to shrink—fast. To compound the problem, Amazon itself got into the game, buying our same products from the same brands and selling them for less.

Spalding was a top-selling brand for us at the time. In fact, we sold so many Spalding basketball products online that Spalding gave us all-expense-paid trips to attend NBA All-Star games for four straight years in a row. The best part? We were booked into the same hotels as the NBA legends. I’ll never forget telling Shaq in a hotel elevator how he broke my heart when he left Los Angeles for Miami! But as competition exploded on Amazon, boosted by the Prime Free 2-Day Shipping rollout in 2005, we went from owning the coveted Buy Box for most of Spalding’s top-selling products to losing them all to Amazon, along with that all-expense-paid All-Star experience. Oh well, thanks for the memories.

We knew this would happen eventually, but we were shocked by how quickly Amazon bought and resold every brand imaginable. They had the traffic data, product data, sales data, and knowledge from 3P Sellers like us to literally take over entire categories—overnight. Add to it the tremendous buying power of Amazon; then subtract out the small guys’ ability to compete. The only way to maintain our sales and stay in the Buy Box was to lower prices. This race to the bottom became an inevitable consequence of Amazon’s Marketplace structure, and it was no doubt part of Mr. Bezos’ original vision to have the lowest prices, no matter what. This phenomenon still vexes Sellers today, and it eventually forced my brothers and me to rethink our entire approach to selling online. This process repeated itself four times over the years until we finally landed on the strategy that I will share with you in the coming chapters.

Amazon is everywhere. It is on a speedy trajectory to become the largest retailer in the United States as it continues to gain on Walmart. Nearly half of the U.S. e-commerce market share already belongs to Amazon, with eBay, once the dominant leader in the field, in a distant second position with just 6.6% of online market share.6

Ironically, in 2019 eMarketer revised this initial 49% market share estimate down to 38% following a vague comment Bezos made in his annual shareholder letter. In it he said that 58% of its e-commerce sales come from Third Party Sellers. This downward revision from such a closely followed researcher highlights a glowing problem. No one really knows how many retail sales go through Amazon.com. Only Amazon knows, and they aren’t sharing that information despite the fact that they are a publicly-traded company. Additionally, DigitalCommerce 360 reported $602 billion in 2019 online sales7 and MarketplacePulse estimated that Amazon’s Gross Merchandise Value was $335 billion.8 If these numbers are accurate, then it is clear that Amazon has increased its market share to 55%, well beyond the 2018 market share estimate. I didn’t buy what eMarketer was selling when they decreased their estimate, but one thing is clear: Amazon wants to appear a lot smaller than they actually are, especially as the trustbusters gather at their gate.

Either way, when you look at Amazon’s reported sales, it’s easy to see how big they are. But consider this: they’re even bigger than what’s being reported. Amazon does not disclose the full retail value of goods sold on its platform, known as the Gross Merchandise Value (GMV) because more than half of its sales come from Third-Party Sellers, for which Amazon must only report the fees it charges them. If I sell a $100 chair on Amazon as a 3P Seller, for example, Amazon will charge me a $15 seller fee for the right to sell my product on their website. While I must report the full $100 GMV to the IRS, Amazon need only report the $15 fee, typically 15% of GMV. With 58% of Amazon sales coming from Third-Party Sellers, the sum value of what’s not being reported by Amazon is staggering. Estimates range in 2020 from $330 billion9 to as high as $530 billion,10 which already makes them larger than Walmart. Just sayin’.

Amazon has been so successful and so dominant that the U.S. and European Union governments may be the only overseers with the power to slow the company’s upward trajectory. Mr. Bezos’s empire has a slew of detractors calling for, among other things, increased taxes on the business and, in the most extreme case, a full-blown breakup. Even if Amazon were to be brought to heel, its competitors would likely still be outrun by the Amazon equivalent of the Baby Bells, a reference to the U.S. regional telephone companies that were formed from the breakup of AT&T (“Ma Bell”) in the mid-1980s. Third-Party Sellers already sell more on Amazon than Amazon sells on its own platform, and a breakup would move Amazon.com from the #1 largest e-commerce website to the #1 and #2 largest e-commerce websites. I know a lot of 3P Sellers who would welcome the thought of not competing against Amazon on their Marketplace, but who knows what might happen if Amazon Retail has its own website and is forced to compete? We’re likely some years away from knowing how the current antitrust inquiries play out, but until then, Amazon will continue devouring the competition; of that, you can be certain.

I tell my clients, if you’re not on Amazon, your product isn’t really online. It’s a slight exaggeration, but I’m convinced that being on Amazon has become a necessity in today’s retail environment because Amazon has literally become The Internet of Products. Why? A major reason is that consumers don’t have to start on Amazon.com to wind up there. The company’s tentacles spread throughout the entire internet, and it is tough to avoid them. Forty-seven percent (47%) of people searching for a product to buy start their search on Amazon.com compared to 35% who use Google.11 And that’s not even the most amazing part. Because of Amazon’s long internet history and its massive online presence, search engines like Google and Bing give Amazon prime digital real estate on their Search Results Pages (SRPs). As a result, Amazon not only enjoys millions of unpaid organic search results links, but it also pays for clicks on those same search engines and comparison shopping engines (like Shopzilla and Pricegrabber) for top-ranking product search results. If all product searches lead to Amazon (and most do), then that’s where you need to be to sell your products. Simple as that.

The Google Search Results Page (SRP) pictured below demonstrates my point. In this scenario, a shopper enters two words into the Google search field: “water flask.” In return, several rows of information are displayed, starting with Google’s Product Listing Ads (PLAs). The pay-per-click PLA program gives priority position to products for which retailers have paid top dollar to drive traffic to their websites. In this case, Amazon has two products featured, the Hydro Flask and S’well bottles. Google AdWords Ads are displayed next, both with links to Amazon. Additionally, and as a result of Amazon’s page-rank power, Amazon products also top the free organic search results, with links back to their website. Of the nine product links for this SRP, Amazon owns five of them. Wait a minute. Is this Google or Amazon? (see image on next page)

Amazon also has millions of affiliate publishers, digital display banners (virtual billboards), review sites, and a dozen new media stories each week, all driving traffic to their platform. When it comes to consumers searching for a product to buy, Amazon has it locked down. Amazon.com has always been about selling you products and making that purchase as frictionless as possible. Every update or iteration since its inception has cleared the buyer’s path of roadblocks. Their entire e-commerce ecosystem is built around making the path to purchase as smooth and fast as possible, and no other competitor comes close to matching that experience. How do they do it?

Thirty years of purchasing data gives Amazon a tremendous advantage—especially because they are competing on their own platform against Sellers who don’t have access to the same information. They’ve been able to translate decades of Seller data into a delivery system that is custom-fit for their customer, or any customer for that matter. As a result, Amazon enjoys a much higher purchase intent than other e-commerce retailers. It’s not unusual for conversion rates to go as high as 25% on Amazon, for example, while other e-commerce sites are typically thrilled to see rates of 2 to 3%. The folks at Amazon Advertising put it best when they said that Facebook knows what you like, Google knows what you search, but Amazon knows what you buy! To further this point, Amazon Sponsored Brands, formerly known as Headline Ads, get 42% more clicks and 3.5 times the conversions compared to Google PLA Ads.12 I see these numbers every day when assessing data for my clients. Amazon has stopped at nothing to satisfy its customers. In return, their customers are more comfortable buying their products on Amazon than from any other online retailer.

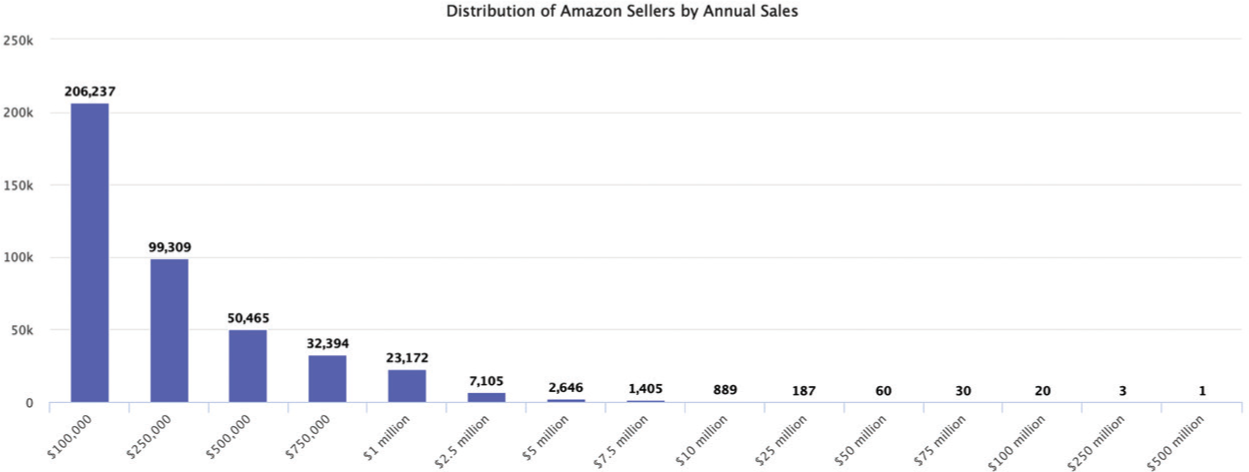

As formidable a competitor as Amazon is, with a greater number of products online than there are people in the United States, don’t let their dominance discourage you from listing your products on their platform. Here’s why. Of the 2.7 million U.S. Amazon Sellers, fewer than 7% are producing $100,000 or more in annual sales; which means 93% are treading water.

Instead of thrashing around with the bottom millions, hold your own against the Top Sellers by using strategies like ours to get to (and stay) on top. For nearly two decades, I have invested tens of thousands of hours picking and developing products to sell on Amazon. I have also created cool brands, all while negotiating an online platform that aims to eat me for lunch. The fierceness of this experience forced me to develop a battle-tested plan that has kept me in the game.

When I look back on the distance my brothers and I traveled on Amazon since we launched our first products in 2003, it honestly feels like we orbited the sun—with the scorch marks to prove it! Countless algorithm changes, platform updates, policy tweaks, and Buy Box refinements created a mess of headaches (and heartaches) over the years, while also teaching us to be responsive and poised for change. Hackers, counterfeiters, tricksters, and Amazon itself soured us at times, but they also hardened us to the realities of this savage landscape. As we navigated this unique ecosystem, we learned that the best way to survive was by following a motto I learned as a Marine: Improvise, Adapt, Overcome.

Graduating from the Amazon School of Hard Knocks, like boot camp, gave me the raw experience and fortitude necessary to succeed on the retail platform. It also forced me to work smart and create a process that is repeatable and dependable—even on a platform that is unpredictable and often contrary. Amazon is not for everybody. I get asked all the time about what it takes to become a Top Seller, and as much as I like to quantify stuff, defining the characteristics of the hundreds of Top Sellers I’ve met over the years is really tough. That said, I’m always on the lookout for patterns, and it’s hard to ignore some of the most recognizable traits of the people I’ve come to admire, both for their achievements and for the ways in which they’ve persevered on Amazon.

While hard work and perseverance are among the qualities of the Amazon Top Sellers I’ve known, it takes a whole lot more to be successful in today’s virtual marketplace. The sheer volume of competition, coupled with Amazon’s price-squeezing tactics, make it nearly impossible to prevail on attitude alone. Remember at the top of this chapter I said that the pace of growth at Amazon forced my brothers and me to rethink our entire approach to selling online? It’s true. Once Amazon started buying our products and selling them for less, all bets were off. The tireless work ethic we brought to the platform in 2003 was no longer enough to keep us on top.

Over the next decade, I concentrated on developing a winning formula. We wanted to do better than just make ends meet on Amazon, and with thousands of competitors pouring onto the platform every day, we knew we had to establish a reliable game plan. I became obsessed with our performance data, making incremental adjustments to every aspect of our selling and marketing processes, and measuring the results. Ironically, Amazon’s own customer feedback tools and limited metrics would come to feature prominently in my Seller’s Survival Guide. But the most dependable tactic? Branding. Today’s Third-Party Seller has the unique advantage of shaping their brand message and controlling the narrative about their products and services—far more than Amazon Retail and its 1P sellers. Brand-building is one area where Amazon and its minions fall short, and the steps for building an enduring twenty-first century brand are an integral part of what was to become The Amazon Jungle Seller’s Survival Guide. While my brothers and I understood how to create a cool brand, having created several of our own, it wasn’t until I met Rick Cesari, the pioneer of direct response television marketing, that my survival guide got a major upgrade.

I still remember like it was yesterday, sitting in the audience of an opening conference session led by Rick. It was the 2016 Prosper Show for Amazon Sellers, where thousands of Third-Party Sellers have access to dozens of leading solutions and industry experts, like Rick. In his captivating keynote presentation, Rick made a simple point, the gravity of which nearly floored me at the time: features tell, but benefits sell. Now Rick didn’t originate the phrase, but in the examples he shared with us that day, working with products like The Juiceman, Sonicare, OxiClean, and GoPro, Rick profoundly altered the way I marketed products going forward.

I mentioned in the introduction that I introduced myself to Rick after that presentation, where we discovered we lived in neighboring towns just east of Seattle. Our proximity nurtured a mutual friendship and weekly coffee meetings, where we exchanged strategies to boost sales and build brands. We made a deal that I would teach him everything I knew about Amazon, and he would teach me everything he knew about building great brands. It was Rick who urged me to launch my own marketing agency, and he who gave me the confidence to guide other Amazon Sellers in following the same proven formula that worked so well for me and my brothers. Additionally, I now had Rick’s direct response marketing lessons to add to my survival guide, with first-hand experience in what a difference that makes!

After meeting Rick at the conference, my brothers and I applied what we learned about highlighting a product’s benefits over its features. We changed our Product Detail Pages to tout the lifestyle advantages of our air hockey tables, for example, like bringing friends and family together, instead of focusing on the size of the blower. Within a week we saw a 400% increase in engagement on our website and a 25% jump in sales. We were no longer selling a sturdy table with a high-end blower. We were helping families make memories!

In the following chapters, we’ll walk you through the fundamental steps for finding and listing a winning product, drawing on the combined expertise and experience of a battle-tested Amazon Seller and a Product Whisperer. The Amazon Jungle Seller’s Survival Guide that Rick and I have crafted together here will put you in a position to own your own destiny as an Amazon Top Seller. More importantly, you’ll have the skillset for building an enduring brand, on and off the Amazon.com platform.

Building a twenty-first century brand requires you to authentically tell your customer why you chose the product you’re selling and how their lives will be changed for the better when they buy it. In the next chapter, I share my personal story and how it followed an unlikely path to Top-Seller status. Later we’ll share tips for writing your own back story. In Chapter 3, I’ll help you determine whether there’s a suitable market for your product and how to make your product stand out in a crowd. In Section II, “Let’s Get Started,” you’ll learn how to get your product made, plus foundational steps for getting your product listed for search and for sales whether you are new to Amazon or already have listings. In chapters 6 and 7, we’ll show you how Top Sellers consistently optimize their listings using the same Direct-To-Consumer (DTC) marketing tactics that helped Rick create so many enduring brands. In the final chapters of the book, we’ll focus on expanding your business on and off Amazon, and I’ll talk specifically about the role Amazon Ads play in fortifying your Amazon business. As I mentioned earlier, listing your products on Amazon is a fundamental feature of every product marketing plan, but limiting yourself to Amazon limits your chances of creating a brand that will thrive. In Chapter 10, Rick talks about the value of expanding your business and building your brand off Amazon, with recommended strategies from his omnichannel approach to marketing.

There is a lot of information out there about how to make your fortune on Amazon, but being successful online requires more than a mechanical list of steps for listing your products on Amazon. In these pages, Rick and I have tried to capture our combined 50+ years of selling and marketing experience and boil it down to the human element, because what matters to your customer is what sells. And it all begins with what matters most to you.