“THE MORE I LEARN, THE LESS I REALIZE I KNOW.”

SOCRATES

In our capacity as agency founders and consultants, Rick and I have had the great pleasure of speaking to many companies and brands owners. Many of those brands are well-established with a lot of success selling to buyers at big box retail stores or on television. It’s not easy these days to get a product placed in a large retail chain store, and I applaud all of you who are making it work and making a profit. Unfortunately, strategies that work for brands in brick and mortar stores don’t translate well on Amazon. Just ask Birkenstock and Nike for proof.

In 2016, Birkenstock’s CEO famously said that he would stop selling to Amazon because it was impossible to stop unauthorized Sellers and maintain a clean selling channel on the platform. In 2019, Nike pulled a page from Birkenstock’s book and took their brand off Amazon. They were (understandably) pissed that Amazon wasn’t playing fair, and they essentially picked up their toys and went home. But that’s just it. You can’t pick up all of your toys because they’re everywhere. Plus, what’s to stop a Third-Party Seller from redirecting the stuff that’s out there, back to Amazon? And when they do, you’ll no longer be there to control the messaging about your own products. Things can go downhill quickly when you leave behind a void on a platform like Amazon. Someone is going to fill it, and the problem you are running from will rapidly accelerate from bad to worse. One of Mr. Bezos’s early strategies for driving prices down was to make it easy for Sellers to attach to someone else’s product listing. The premise being that if more Sellers are selling the same product, prices will go down. Boy did they! You may recall Bezos’ infamous quote, Your margin is my opportunity. It is this ability of Sellers to attach to another product listing, coupled with Amazon’s disinterest in stopping unauthorized Sellers from doing so, that drives brands crazy.

What brands have to understand is that Amazon doesn’t need them, not even Nike or Birkenstock, because Amazon has an entire army of other Sellers waiting to snatch up diverted products and list them on the Amazon.com marketplace. James Thomson and Whitney Gibson talk in depth about ways in which brands can protect themselves on Amazon, and I strongly recommend their book, Controlling Your Brand in the Age of Amazon. These authors pioneered the tactics that protect brands on Amazon, and I guarantee you Nike and Birkenstock would be much happier today if they’d called my good friend James before making such a big mistake. Don’t sell to Amazon, sell on Amazon. Having a Third-Party Seller Central account, along with Brand Registry (and an effective legal strategy), would have helped Nike and Birkenstock clean up their Amazon channels, without waiting for Amazon to do it for them. Amazon isn’t going to work for brands in that way. Frankly, you don’t want to relinquish that kind of control, which is why I asked you to forget everything you know about retail business. Success with other sales channels, like TV and brick and mortar, does not guarantee success on the Amazon Marketplace. Hard work and an effective brand message that you control will pave the way to increased sales and greater awareness of your brand products.

Over the years I’ve sold products to large retail chains and sporting goods stores, some of which are now out of business. We always went into these stores at the high-end of the price range. We started our wholesale price high because the retail buyer always required concessions before placing the order, like return allowances or defect allowances, for example. If the product hit the shelves and wasn’t selling right away, Walmart would ask its vendors to pay for a mark down; or request money to finance “roll back” pricing deals for their customers. If you refused to pay, they’d not so gently inform you that you would not be invited back to sell there again. So everyone who has ever sold to Walmart, or other big box retailers for that matter, knows that you have to start high. If you don’t, you’ll lose a lot of money.

I give you this background because what I’m about to say next causes clients to look at me like I’ve got a foreign object sticking out of my forehead. If you begin your listing priced high on Amazon, you will hear crickets. Let me rephrase that: If you start high, your product will not sell. I get approached by brands regularly who tell me Amazon isn’t an effective channel for them. It just doesn’t work, they say. And that’s when I do a little research of my own, and I share how much business their direct competitors are doing each month in the form of sales on Amazon. This is when they usually realize that it’s not Amazon that’s ineffective; rather, it’s their Amazon strategy that is tanking. Most Top Sellers doing hundreds of thousands, even millions a month in sales know one thing: Amazon listings are an investment. With Amazon, Search Results are your new buyer, and doing things aggressively to get your products to rank high is critical to your sales success on the platform. Doing them the right way, through your own brand-registered Seller Central account, is imperative and it will turn your hard work into strong rankings. Once your products are scoring high reviews and steadily climbing in the rankings; then (and only then) can you raise your prices.

With Amazon, you are no longer selling to a human buyer. Instead you must feed the algorithm. When Top Sellers launch a new product, they do two things. First, they lower their price (or reduce their price through coupons or special deals) to a break-even point or lower. Wait, what? You want me to lose money on a sale at launch? I wish the answer wasn’t, yes, but it is, and that’s not even the worst part. I also want you to spend as much as 100% of your sales amount on Sponsored Ads in the first 30 days, post-launch. We’ll get into the nitty-gritty of Amazon Ads logic in Chapter 9, but follow my rationale here because it’s important. In the Amazon jungle, you have to look at each and every product listing as an investment on which you will temporarily lose money on each sale. Additionally, you’ll be paying twice your selling price in ads to drive traffic to your listing. The good news? As with any good investment, there is always a payoff.

What you get back for all your cash investment in your product listing is Search Results Page Rank (SRP) and Best Seller Rank (BSR). I actually like to go a step further and rank for Sub-Category Rank (SCR) as well. The more products you sell, the more likely you are to receive Amazon product reviews and ratings, and if your product is good (Product is King!) and the reviews are favorable, then Amazon customers will trust your product and buy more.

The more sales you generate with your new product, the more the Amazon ranking algorithm is going to reward your listing with better digital real estate. With this strategy, I’ve seen products go from nowhere to the second page of Search Results in just a few weeks. I’ve also seen first page SRP results and Top 100 sales rank within 30-90 days. The real growth starts when you break into the Top 20 or Top 10 in sales rank and your product reaches Page 1 for several high-volume, relevant keywords. When your product “indexes” or “ranks,” as we call it, your sales will grow exponentially. As your sales and rank grow, along with the volume of good product reviews, you gain pricing power. That’s right, now you can begin a gradual price increase back to profitability and beyond, without a decrease in sales volume. Raise your price gradually, though, or Amazon will punish your listing with a Buy Box Suppression. When Amazon suppresses your Buy Box, you can no longer drive traffic to your listing and rank can drop fast, so gradually increase your prices by 2%-3% every 2-3 days to avoid it.

Now you can see how this strategy is almost the exact opposite of selling to the big box retail stores. Rather than list your product high, only to have your profit margins whittled away by discounts and fees, you list low, generating more sales and boosting your rank. Only then, on Amazon, are you in a strong position to raise your price, gradually. I can’t emphasize this point enough: start low and temporarily exchange profits for sales and search rank. When your product breaks into the Top 10 for your Amazon sub-category, slowly begin to raise your retail price and watch your profits grow. You must remain vigilant and pay close attention to your product and your competition; and you must be willing to offer additional short-term price reductions if rank starts to stall. Dog-ear this page and come back to it regularly. The process goes against the grain of more traditional retail practice, but it was key to building my own brand of Top Sellers on Amazon.

Another parallel process worth highlighting is the continual optimization of your Sponsored Ads, which we’ll go into later. With Sponsored Ads, or pay-per-click advertising, you pay a specified amount for each click to your listing, casting a very wide net of keywords at the start. Some of these keywords will convert to sales and you’ll keep them; others won’t (and you’ll pause or negate them). This is another key part of the process that can feel counterintuitive, but it is a short-term strategy that will allow you to find the best, most relevant keywords that convert. I’m oversimplifying the optimization process for Sponsored Ads, but know that the low prices/big ad spends don’t continue forever; they are merely tools to launch us out of Siberia to the busiest corners of Main Street, USA.

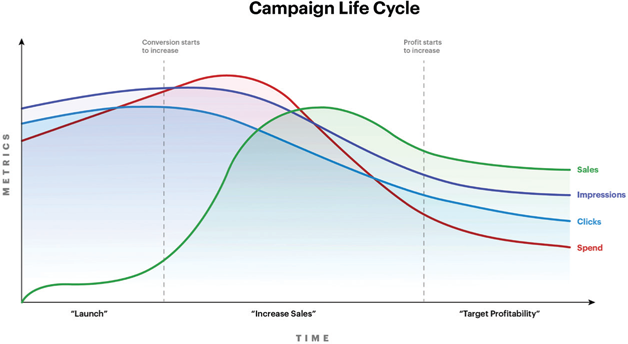

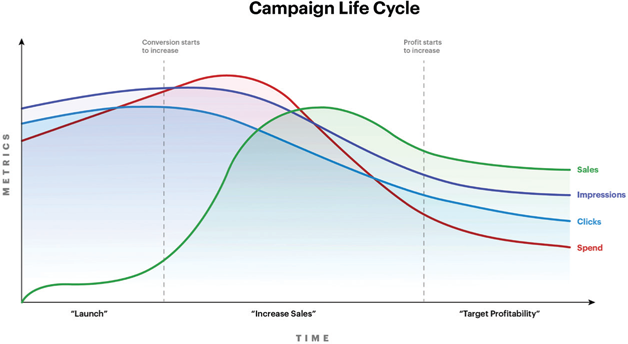

Here’s a great visual from our friends at Teikametrics about the typical product campaign life cycle. I’ve studied this process on thousands of products, and the launch path for all of them looked eerily similar to what’s pictured here in this graph. Once a great product starts to gain rank, and the sales line crosses the ad spend line (green over red), you can finally put it on the balance sheet because now you have an asset and a winner.

Now that you understand the proper mindset for Amazon success, it’s time for a deep dive into the many metrics we use to measure success and to make corrections if the metrics aren’t heading in the right direction.

In Chapters 3 and 4 I talked a lot about the importance of finding a great product, one you are passionate about, with flaws you can fix, for which there is an eager market. For a not-so-great product without a sizable market, none of these metrics matter. When you source correctly, solve problems in the marketplace, and make your product look cool and distinctive, customers will love it and sales will grow.

Product reviews are the absolute best metric to use for how well your product is performing. If your reviews, or ratings (especially with a new launch) remain above four stars, then the future is bright for your product and your listing. Studying these reviews, and learning from the bad ones, will help you improve your product each time you reorder from your supplier. Amazon’s Customer Q&A feature on the product page is another great place to search for questions your customers have about your product. This information is invaluable to Sellers because these issues can typically be solved. Related issues, like complaints about packaging or delivery can also be resolved, and if you can take this feedback and apply it, then you can resolve these problems so that the next iteration of your product won’t draw the same criticism. Stay alert and look for problems. Once fixed, I can guarantee you that your product will have won the battle.

In the previous chapter, we focused on optimizing our listings, with direct response benefits messaging and aspirational images showcasing real people interacting with our product. Even though Amazon restrictions limit what we can do with the Main Images on the PDP, they play a critical role, as do the product titles. If your product has a low click-through-rate (CTR) of 0.10%, then it’s time to try new images and/or fix the product-title wording. Amazon only displays CTRs from the Campaign Manager in Seller Central, and you’ll only see them from Sponsored Ads campaigns. At the writing of this book, they still won’t share CTR for organic listings, but you should be able to get those results by measuring the CTR in Sponsored Ads. The click-through-rate is often overlooked by Sellers, and it shouldn’t be. I’m always amazed at how even minor changes to the Main Image and product titles can improve CTR and sales. Because these two features are the most visible from the SRP, make sure they are bright, clear, and get to the point of offer. In doing so, customers looking for products like yours will be more likely to find your listing. I get particularly excited when I see CTRs above 1%. That’s confirmation that the Main Image and titles are working for me. This is when all your hard work in creating compelling products and product listing pages pays off. With on-point infographics, aspirational images, a focus on benefits, A+ content, and a strong brand page, shoppers now have every reason they need to buy your product.

There are so many ways to drive traffic to your listing on Amazon now compared to just a few years ago. A Brand Registered Third-Party Seller can now drive traffic with Sponsored Ads, Sponsored Brands (formerly called Headline Ads), Sponsored Display (retargeting ads off Amazon that bring traffic back to your listings), and Organic Traffic from great, Search Engine Optimized (SEO’d) listings. This is another place where your Amazon Jungle Seller’s Survival Guide can be especially helpful, where direct response marketing strategies can be used to separate your product from the pack. In the next chapter, Rick will talk in depth about why direct-to-consumer brand-building strategies increase sales conversions on Amazon, using video, in particular, to promote product benefits, drive traffic, and close sales.

There are many more ways to drive traffic to your listing off Amazon. In my years as a Seller, I used e-mail, press releases, social media, blog content, pay-per-click ads, and landing pages, among other channels. And as Amazon continues to reward Sellers for building brands, the best place to drive off-Amazon traffic is to your Amazon Brand Page. In 2018, Amazon released the Stores Insights dashboard to help its store owners monitor their store’s effectiveness and performance metrics. By creating links with source tags on your off-Amazon channels, you can see how well that traffic is performing. In Chapter 10, Rick shares additional marketing strategies that focus on building your brand off-Amazon, with case studies on how specific tactics work to strengthen the brand off Amazon, while also increasing sales conversions on Amazon.

Amazon Business Reports are a great place to view important page views and unit session percentages or conversion rates. If page views are going up, but they are driving conversion rates down, then it’s time to check out the quality of your traffic. I learned a painful lesson about social media traffic when I pushed thousands of clicks from social media directly to top-selling Amazon listings, only to watch the sales rank (and sales conversions) drop like a rock. I discovered that there was a lot of social media traffic coming from bots. And bots don’t buy product. As soon as I cut the social media traffic, our conversion rates, sales, and ranking went back to normal. This is another reason why I now push social media traffic to the Amazon Brand Page. I learned the hard way that not all traffic is created equal. By going directly to the Amazon Brand Page, I could strip out the bots and non-relevant/non-qualified traffic to my listings. Remember when I said that Amazon’s main focus, unlike Google and Facebook, is the sale of items? Merely generating traffic isn’t enough to lift your Amazon rank and increase sales. That traffic must convert, and the better your listing converts to a sale (compared to your competitors), the more product you will sell.

In my time building a home recreation and home fitness brand, I shipped a lot of heavy items via freight that were too large to be eligible for FBA and therefore didn’t have the coveted Prime Badge. If I had it to do all over again, I might not have gotten into the business of shipping 200 to 1,000-pound items. Instead, I would have focused my attention on products that were “FBA-able” because life is so much easier as an Amazon Seller when Amazon is handling the difficult job of picking, packing, and delivering on time.

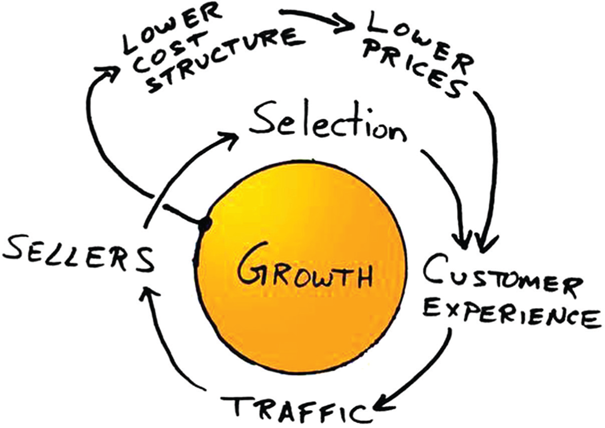

Reaching the top of the Best Seller Rank with a product you’ve designed is a really great feeling. I’d even go as far as calling it a “Seller’s high.” When you successfully apply the key steps from this Seller’s Survival Guide for finding a great product, creating a great listing, and driving traffic that converts (with fast, on-time delivery), the improvement in sales can be exponential in scale. I’ve had sales jump from two to three a day to 200 to 300 a day, depending on the size and price point. As the sales and good product reviews roll in, your listing becomes formidable, and it becomes the standard by which other Sellers must measure themselves. Long-time Sellers call it The Flywheel Effect, a phrase borrowed from Jeff Bezos himself, when he scribbled this diagram on a napkin in 2001.

I recently sketched my own flywheel diagram for listings, and I keep it on my desk as a constant reminder of the winning formula on Amazon.

I’ve shared a number of different metrics available from Amazon to help you manage your listings and to make changes for success. Given everything Third-Party Sellers do for Amazon, I believe Amazon should be even more forthcoming in the data they provide to Sellers. Recently, in a Bloomberg TV interview, I said that if Amazon is going to use our data to knock off our products, then the least they can do is share the data they have on our products and product listings. I’m not asking for the customer names and contact information; that information belongs to Amazon. But each additional metric Amazon shares with Sellers only helps Sellers improve and do better. Regardless, if you focus on the metrics that I have laid out in this chapter, and you adjust things to improve your listings, I guarantee you’ll be happy with the results. Amazon is difficult, but following the right strategy can help you beat them at their own game.