5.1 Book-Value Based Versus Market-Value Based Profitability Ratios

A profitability ratio or return establishes a relationship between an operating or financial profit and the capital engaged by the firm’s investors. A margin measures an operating or financial performance against the sales revenue of the company.

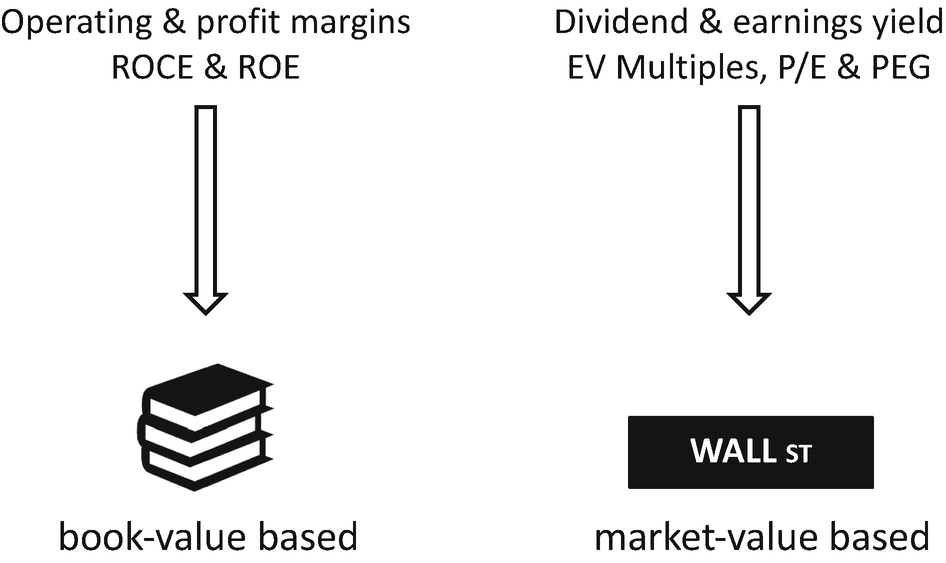

We follow a differentiated approach between performance measurement based on accounting data and performance measurement based on market data to achieve ratio consistency.

Operating or profit margins , ROCE and ROE are book-value based metrics

Dividend or earnings yields , enterprise value (EV) multiples and P/E ratio are market-value based metrics

Book-value and market-value based ratios

5.2 Book-Value Based Profitability Ratios

The key profitability ratios using book value are presented below:

Operating (EBIT ) Margin

The operating margin measures a company’s operating profitability as a percentage of its sales. As a reminder, EBIT stands for Earnings before Interest and Taxes.

Profit Margin

The profit margin measures a company’s financial profitability as a percentage of its sales.

Return on Capital Employed (ROCE)

ROCE measures a company’s operating profitability (before or after tax) as a percentage of its capital employed or net operating assets .

The definition of capital employed changes in the presence of large non-core assets and a company’s cash position. See Chap. 1 regarding financial metrics.

Fundamental relation between ROCE and WACC:

The ROCE must be higher than the weighted average cost of capital (WACC) and the net after tax cost of borrowing (if the company is significantly leveraged).

Return on Assets (%) (ROA)

ROA is similar to ROCE in that it measures asset efficiency in the generation of profit. One huge advantage of ROA is that it can be easily computed. However, this book prefers ROCE to ROA, as the ROCE numerator and denominator are perfectly coherent (i.e., operating income against operating assets ). Total assets can include large non-core or value less assets that can bias the ROA ratio.

Return on Equity (%) (ROE)

ROE measures the net income generated by a company to its shareholders as a percentage of equity.

Breaking Down ROE

ROE can be broken down into three metrics:

This equation is similar to the DuPont model but with capital employed replacing total assets. As a reminder, total assets include operating and non-core assets , while capital employed is limited to operating assets .

Price to Book Value or Ratio (P/B or P/BV)

This mixed ratio (market value versus book value) compares market capitalization to book value of equity. A ratio of less than one indicates a potential undervaluation, P/B is a fundamental metric used in value investing.

Book value per share (BVPS) = shareholders’ equity/number of shares outstanding.

5.3 Market-Value Based Profitability Ratios

The key profitability ratios using market value are listed below. P/E and EV multiples are presented in greater detail at the end of the section.

Dividend Yield (%)

The dividend yield measures the cash dividend paid out to shareholders as a percentage of the market value per share . Dividends can also be paid in additional shares (cash efficient for a company as no cash outflow is incurred and tax efficient for the shareholders as a dividend paid in shares is usually not treated as a taxable income ).

In a low interest rate environment, a dividend is a formidable competitor against a bond coupon. It provides a safety cushion against a falling share. The dividend yield and payout ratios are therefore important metrics to watch.

Earnings Yield (%)

The earnings yield measures the earnings per share generated by the company as a percentage of the share price.

Earnings yield is comparable to ROE, using market value instead of book value of equity.

Dividend Payout Ratio (%)

The dividend payout ratio measures the cash dividend paid out to shareholders as a percentage of earnings per share (EPS).

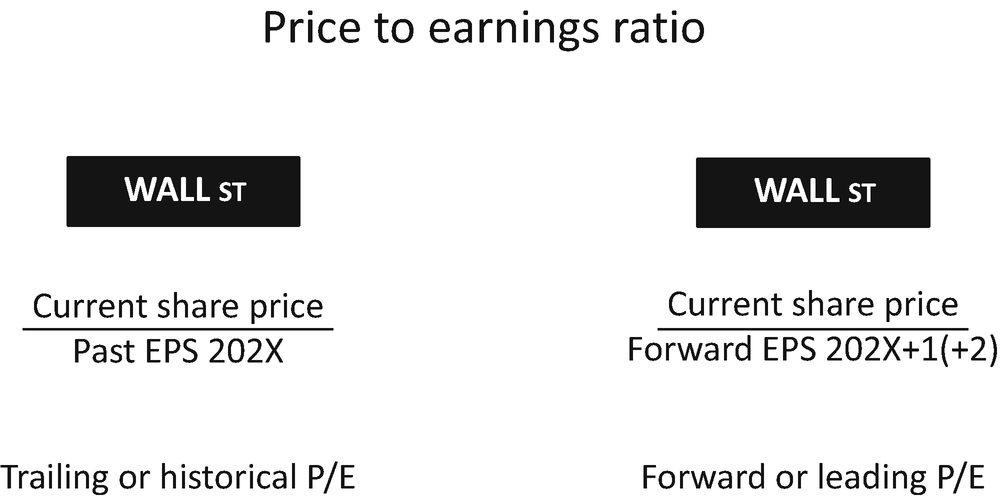

Price-Earnings Ratio (P/E)

P/E is a popular valuation metric used for investing in the stock market.

or

Market value (price) per share = current share price

Earnings per share = EPS = net income/number of shares outstanding

Market capitalization = number of shares outstanding × market value or price per share

If a company’s P/E is equal to “x,” it means that investors are willing to pay × times earnings for its shares. Simply put, it will take x years to recover the initial investment, should the stock generate the same earnings for the next x years (no growth in earnings and no dividend reinvestment considered). The P/E multiple can be trailing or forward.

Trailing versus forward P/E

Within the same sector, a low trailing company P/E suggests a relatively lower valuation compared to its peers, but it can also indicate lower expected earnings growth. Therefore, a lower valuation may be perfectly rational.

A high trailing P/E suggests a relatively higher valuation for a company when compared to its peers, but it can also indicate higher expected growth in earnings. Therefore, a higher valuation may also be perfectly rational.

Trailing versus forward P/E comparison

P/E Trailing/Forward | Year X (past or trailing) | Year X + 1 (Forward) |

|---|---|---|

Current stock price | 100 | 100 |

EPS | 10 | 8 |

P/E | 10 | 12.5 |

Sector P/E | 12.5 | 12.5 |

This stock seems underpriced based on its history (it should trade at around $125 = sector P/E of 12.5 × current EPS of 10). However, when the focus is placed on forward earnings, we see that it is priced fairly ($100 = sector P/E of 12.5 × forward EPS of 8). Because the market always anticipates future cash flows (here, a decline in EPS), a stock price of $100 looks rational.

Price-Earnings to Growth Ratio (PEG)

The PEG is the perfect companion to the P/E ratio . It measures the amount of P/E per unit of EPS growth and helps the stock screening process.

Where P/E = trailing or leading P/E

P/E and PEG ratios (SG, sector and HG)

Comparison | Company SG | Sector | Company HG |

|---|---|---|---|

P/E (leading) | 10 | 10 | 10 |

Estimated growth in EPS (%) | 7% | 10% | 13% |

PEG | 1.43 | 1.00 | 0.77 |

Intuitively, relative to the relative P/E and potential EPS growth, company HG seems underpriced, and company SG overpriced. For example, the surplus growth potential of HG (i.e., 13% > 10%) does not seem to be reflected in its current price. The same observation is made for SG: its relative slow growth potential (i.e., 7% < 10%) should negatively impact its price. A lower PEG generally indicates potential undervaluation, and a higher PEG indicates potential overvaluation.

If HG is highly leveraged, then its lower valuation may be justified.

If SG is debt-free, then its higher valuation may be justified.

Enterprise Value to EBITDA Multiple (EV Multiple)

The EV to EBITDA multiple (i.e., the Enterprise value to Earnings before Interest, Taxes, Depreciation and Amortization multiple) measures the amount of long-term capital (at market value) needed to generate one dollar of EBITDA . In parallel, it measures the total operating assets (at market value) needed to generate one dollar of EBITDA.

As an example, if the EV to EBITDA ratio is equal to ten (or 10/1), ten dollars of equity and debt (or operating assets ) produce one dollar of EBITDA. The lower the ratio, the better the EV productivity and efficiency in generating EBITDA .

The EV multiple can be trailing or forward. Enterprise value is the best alternative to pure market capitalization, as it considers not only the equity side but also the debt and cash side of a balance sheet .

If the financial market is fully efficient, the price of equity (cost of ownership of the company) should reflect the risk involved by debt. Two companies with the same forward EBITDA but with a different level of debt should not be priced the same. After all, if you own a company, you also own the debt on the balance sheet and carry its default risk.

A low EV multiple indicates that company’s operating efficiency looks satisfactory. A company with a lower EV multiple than its peers is considered undervalued. P/E and EV multiple are highly complementary but remain relative ratios, they should be further analyzed and compared with their sector average and competitors.

P/E and EV to EBITDA multiples

Key features | EV/EBITDA multiple | P/E multiple |

|---|---|---|

Investors | Stakeholder (shareholder and debt holder) | Shareholder |

Metric availability | EV computation often required | Widely used and available |

Financial leverage | EV fully considers the level of debt | Net income only considers the level of interest |

Metric volatility | Low volatility | High volatility |

Manipulation potential | EBITDA is subject to conflicting interpretations (non-standard metric) | Multiple factors |

Share repurchase or buyback through debt | Neutral | P/E is boosted |

Arbitrary and discretionary nature of taxes, depreciation and amortization | Does not include taxes, depreciation, amortization or extraordinary items | Includes taxes, depreciation, amortization and extraordinary items; accounting and financing decisions have an impact |

Cash versus non-cash | EBITDA = proxy for operating cash | Includes non-cash expenses and revenue |

Investment requirements (capex + non-cash working capital) | EBITDA ignores these! Suitable for companies with low capex; For companies with high capex needs, EBITA (i.e., EBITDA without Depreciation), EBIT or (EBITDA − capex) may be preferred. | Depreciation used as a proxy for investments; However, depreciation may significantly differ from the real capex needs. |

International comparison | EBITDA is not a normalized metric; caution is required. | May be tricky because of national differences in tax, depreciation and amortization |

Loss-making companies | Relevant if EBITDA > 0 | Not relevant |

Enterprise Value to EBIT Multiple

The enterprise value to EBIT multiple measures the amount of long-term capital (at market value) needed to generate one dollar of EBIT. In parallel, it measures the total operating assets (at market value) needed to generate one dollar of EBIT.

As an example, if the EV to EBIT ratio is equal to fifteen (or 15/1), fifteen dollars of equity and debt (or operating assets) produce one dollar of EBIT. The lower the ratio, the better the EV productivity and efficiency in generating EBIT .

Enterprise Value to Sales Multiple

The enterprise value to sales multiple measures the amount of long-term capital (at market value) needed to generate one dollar of sales. In parallel, it measures the total operating assets (at market value) needed to generate one dollar of sales.

As an example, if the EV to sales ratio is equal to five (or 5/1), five dollars of equity and debt (or operating assets ) produce one dollar of sales. The lower the ratio, the better the EV productivity and efficiency in generating sales .

5.4 Case Study (Operating, Financial Performance and Leverage)

Company Green’s balance sheet

Company Green, $1000 (market value) | Year X | Year X | |

|---|---|---|---|

Enterprise value (operating assets at Fair Market Value or FMV) | 1000 | Market value of equity | 840 |

Excess cash | 40 | Debt | 200 |

Total assets | 1040 | Total equity and liabilities | 1040 |

Company Purple’s balance sheet

Company Purple, $1000 (market value) | Year X | Year X | |

|---|---|---|---|

Enterprise value (operating assets at FMV) | 1000 | Market value of equity | 350 |

Excess cash | 40 | Debt | 690 |

Total assets | 1040 | Total equity and liabilities | 1040 |

Income statements (Green and Purple)

Company Green and Purple, $1000 | Company Green | Company Purple |

|---|---|---|

EBITDA | 250 | 250 |

Depreciation and amortization | 100 | 100 |

Operating income (EBIT) | 150 | 150 |

Interest expense | 10 | 35 |

Taxes (25%) | 35 | 28.75 |

Net income | 105 | 86.25 |

Detailed calculations of the price-to-earnings ratios

Earnings yield (Green) = $105,000/$840,000 = 12.5%

P/E (Green) = $840,000/$105,000 = 8×

Earnings yield (Purple) = $86,250/$350,000 = 24.6%

P/E (Purple) = $350,000/$86,250 = 4×

Profitability ratios (Green and Purple)

Profitability ratios | Company Green | Company Purple |

|---|---|---|

Earnings yield | 12.5% | 24.6% |

P/E | 8× | 4× |

Reminder: earnings yield and P/E are inversed ratios.

1/(8×) = 12.5% (i.e., inverse of P/E = 1/(P/E) = E/P = earnings yield)

To conclude that company Purple is the better stock selection (with the highest earnings yield and the lowest P/E) would be biased, as no risk analysis has been undertaken. The relatively low P/E may be perfectly justified by a higher risk factor.

Debt ratios (Green and Purple)

Financial leverage and debt ratios | Company Green | Company Purple | |

|---|---|---|---|

Net debt, $1000 | 160 | 650 | |

Market value of equity (MVE), $1000 | 840 | 350 | |

Enterprise value (EV), $1000 | 1000 | 1000 | |

Leverage (net debt/MVE) | 19% | 186% | < 100%, OK |

Leverage (net debt/EV) | 16% | 65% | < 50%, OK |

Equity multiplier (EV/MVE) | 119% | 286% | < 200%, OK |

Interest coverage ratio (EBIT/int exp) | 15 | 4.3 | >> 3, OK |

Interest coverage ratio (EBITDA/int exp) | 25 | 7.1 | >> 5, OK |

The debt to equity ratio is calculated as follows:

Company Green: Net debt ($160,000) << MVE ($840,000)

Company Green: Net debt/MVE = 160/840 = 19% << 100%

Company Purple: Net debt ($650,000) >> MVE ($350,000)

Company Purple: Net debt/MVE = 650/350 = 186% >> 100%

We can now infer from the previous calculations that company Purple is heavily leveraged, and there is no doubt that company Purple’s earnings yield needs to be high in order to compensate for its heavy debt load.

Profitability ratios (Green and Purple)

Profitability Ratios | Company Green | Company Purple |

|---|---|---|

Earnings yield | 12.5% | 24.6% |

P/E | 8× | 4× |

EBIT/EV yield | 15% | 15% |

EV multiple (EV/EBITDA) | 4 | 4 |

Is company Purple’s yield worth the risk taken?

Is the risk totally and sufficiently compensated?

How do Green or Purple compare with the sector and to their peers?

Conclusion According to the Limited Information Available

A risk-adverse investor would probably choose to invest in company Green’s equity, as company Green has achieved an adequate financial and operating profitability with virtually no debt.

A growth investor would probably check company Purple’s future earnings estimates and evaluate whether the company is showing superior growth. If the response is positive, buying this security with a trailing P/E at only 4× is a very attractive option.

See the following case study using forward earnings multiples.

5.5 Case Study (Forward P/E and EV Multiples)

Complimentary P/E and EV multiple approaches are now being applied to comparable companies.

Companies Serenity and Bold are direct competitors.

Which stock should an investor select: Stock Serenity or Bold?

In this case study, we use target prices , so we therefore apply forward-looking multiples .

Market valuations (Serenity and Bold)

Share price and market capitalization | Company Serenity | Company Bold |

|---|---|---|

Number of shares | 1000,000 | 1000,000 |

Share price in $ | 150 | 80 |

Market capitalization, in millions $ | 150 | 80 |

Expected earnings and dividends (Serenity and Bold)

Projected income statement, $, in millions | Company Serenity | Company Bold |

|---|---|---|

Forward EBITDA | 30 | 30 |

Estimated Depreciation and Amortization (D&A) | 8 | 10 |

Estimated interest expense | 2.5 | 8.1 |

Corporate tax (25%) | 4.875 | 2.975 |

Forward net earnings | 14.625 | 8.925 |

Forward net dividends | 6 | 6 |

Forward earnings multiples (Serenity and Bold)

P/E analysis | Company Serenity | Company Bold | Sector |

|---|---|---|---|

Forward P/E | 10.3 | 9.0 | 9.0 |

Forward earnings yield | 9.75% | 11.2% | 11.0% |

5.5.1 The Forward P/E Approach

According to a P/E approach, company Serenity appears slightly overpriced, as its forward P/E is larger, and its earnings yield smaller than the sector average. In contrast, company Bold seems fairly priced.

Here, we will use the P/E ratio derived from the sector in order to estimate a target market price.

Assumption taken: The P/E ratio of companies Serenity and Bold converge toward the forward sector average of nine times.

We use the following formula:

We start with the calculations for company Serenity

Target market cap Serenity = forward net earnings Serenity × forward sector P/E

Target market cap Serenity = $14.625 million × 9 = $131.625 million

Target share price Serenity = $131.625 million/1 million shares = $132 (rounded)

We continue with company Bold

Target market cap Bold = forward net earnings Bold × forward Sector P/E

Target market cap Bold = $8.925 million × 9 = $80.325 million

Target share price Bold = $80.325 million/1000,000 shares = $80 (rounded)

Target share prices (Serenity and Bold)

Target share price, $ | Company Serenity | Company Bold |

|---|---|---|

Current price | 150 | 80 |

Target price (P/E ratio) | 132 | 80 |

5.5.2 The Forward EV Multiple Approach

The EV mult iple approach provides a different perspective .

EV calculations (Serenity and Bold)

EV calculation, $, in millions | Company Serenity | Company Bold |

|---|---|---|

Market capitalization | 150 | 80 |

Debt | 50 | 150 |

Excess cash | 40 | 10 |

EV | 160 | 220 |

Forward EV multiples (Serenity and Bold)

Forward EV multiple | Company Serenity | Company Bold | Sector av |

|---|---|---|---|

Current EV/forward EBITDA | 5.3 | 7.3 | 6.5 |

The calculations for the forward EV multiples are outlined below:

Forward EV to EBITDA multiple Serenity = 160/30 = 5.3

Forward EV to EBITDA multiple Bold = 220/30 = 7.3

As we can see above, company Serenity has a much lower EV to EBITDA multiple and therefore looks more efficient in the management of its operating assets .

Next, we will use the EV to EBITDA multiple derived from the sector in order to estimate a target market price for each stock.

5.5.3 Target Market Capitalizations Using the Forward Sector EV Multiple

We are now calculating the target market capitalizations for companies Serenity and Bold by using the forward sector EV to EBITDA multiple.

Target Market Capitalization of Company Serenity

Assumption taken: the forward EV multiple of company Serenity converges toward the forward sector average of 6.5 times .

We use the following formula:

The calculations are outlined below:

Target EV multiple (Serenity) = forward EV multiple (sector) = 6.5 times

Target EV (Serenity)/forward EBITDA (Serenity) = 6.5 times

Therefore, target EV (Serenity) = 6.5 × $30 million = $195 million

EV = market cap + debt − cash

Target EV (Serenity) = 195 = target market capitalization (Serenity) + 50–40

Therefore, the target market capitalization (Serenity) = 195 + 40–50 = $185 million

This shows that company Serenity seems to be undervalued by $35,000,000 (i.e., $185,000,000 − $150,000,000 = $35,000,000)

The “fair value” of stock Serenity is calculated as:

$185,000,000/1,000,000 shares = $185

Thus, the market seems to price stock Serenity well below its fair value, ignoring the large cash position and its low level of debt when compared to stock Bold.

Target Market Capitalization of Company Bold

Assumption taken: the forward EV multiple of company Bold converges toward the forward sector average of 6.5 times.

We use the following formula:

The calculations are outlined below:

Target EV multiple (Bold) = forward EV multiple (sector) = 6.5 times

Target EV (Bold)/forward EBITDA (Bold) = 6.5 times

Therefore, target EV (Bold) = 6.5 × $30 million = $195 million

EV = market cap + debt − cash

Target EV (Bold) = 195 = target market capitalization (Bold) + 150 − 10

Therefore, target market capitalization (Bold) = 195 + 10 − 150 = $55 million

Here, company Bold seems to be overpriced by $25,000,000 (i.e., $80,000,000 − $55,000,000 = $25,000,000)

The “fair value” of stock Bold is calculated as:

$55,000,000/1,000,000 shares = $55

Thus, the market seems to price stock Bold well over its fair value, ignoring the larger amount of debt compared to stock Serenity and its associated risk.

Target share prices (Serenity and Bold)

Target share prices | Company Serenity | Company Bold |

|---|---|---|

Current price in $ | 150 | 80 |

Target price (P/E ratio) | 132 | 80 |

Target price (EV multiple) | 185 | 55 |

Dividend yield | 4% | 7.5% |

5.5.4 Conclusion Incorporating the Debt Situation

Both multiples establish a price range for the two stocks:

Stock Serenity [132; 150; 185]

Stock Bold [55; 80; 80]

Stock Bold is at the top of its range, stock Serenity is positioned at the middle.

Financial leverage and debt ratios (Serenity and Bold)

Financial leverage and debt ratios | Company Serenity | Company Bold | |

|---|---|---|---|

Net debt (debt - excess cash) | 10 | 140 | |

Market capitalization | 150 | 80 | |

Enterprise value | 160 | 220 | |

Leverage (net debt/market cap) | 7% | 175% | < 100%, OK |

Leverage (net debt/EV) | 6% | 64% | < 50%, OK |

“Equity multiplier” (EV/market cap) | 107% | 275% | < 200%, OK |

Interest coverage ratio (EBITDA/int exp) | 12 | 3.7 | >>5, OK |

Interest coverage ratio (EBIT/int exp) | 8.8 | 2.5 | >>3, OK |

Company Bold is heavily leveraged. In this case, company Serenity is a low risk bet as far as credit risk is concerned.

Conclusion, According to the Limited Information Available

In this example, we clearly see that the EV multiple adds value by putting debt and cash at the core of the analysis when the P/E multiple ignores them.

Stock Serenity seems to offer an upside potential (according to the EV multiple), and stock Bold may be overpriced.

As the above calculations show us, ratios do help in screening stocks, but a qualitative analysis is always necessary prior to investment (product positioning and pipeline, management team, corporate sustainability, etc.).

One possible explanation for Bold’s overpricing may be that this company is viewed as a high dividend yielding stock and therefore is a more sought-after investment. There is usually a high demand for “value” stocks, especially during times of low interest rates!

5.6 Value and Growth Investing

Each investor determines his or her own definition of value versus growth. The limits below are general rules of thumb and useful guidelines. They will however differ by industry.

Value versus growth comparison

Value and growth | Value | Growth |

|---|---|---|

P/E | < 10 | > 10 |

PEG | < 1 | > 1 |

EPS growth | Low | High |

EV to EBITDA multiple | < 10 | > 10 |

Dividend | High | Low or no div |

Beta | < 1 | > 1 |

Price to book value | < 1 | > 1 |

Volatility | Low | High |

Fundamental value | > share price | |

Product life cycle | Mid-end | Beg-mid |

Visibility | Low | High |

5.7 Key Takeaways on Profitability Ratios and Their Limitations

Profitability ratios

ROCE and ROE | EBIT/capital employed and net income/equity |

P/E | Price/earnings |

EV multiple | EV/EBITDA or EBIT |

Limitations

It is optimal to measure both the book- and market-value based profitability (when available).

For consolidated financial statements, if the net income attributable to (or available for) common shareholders is used as the numerator, then the non-controlling interest must be deducted from total equity in the ROE calculation.

Always associate net income profitability with operating profitability, as a company needs happy stakeholders (debt holders included). P/E and EV multiples are complementary.

Current net income can be distorted by non-recurring/non-operating/non-cash expenses or revenues. Normalizing adjustments may be required.

Forward (P/E or EV ) multiples are preferable but are dependent on the quality of forward earnings or EBITDA (optimistic or conservative estimates?).

Real capital expenditure (capex ) needs are to be considered when using EBITDA or EBIT -only ratios (i.e., real capex may differ significantly from depreciation and amortization charges).

Always associate profitability with risk (including intrinsic risks such as debt), as a return analysis without measuring the risk taken is meaningless. A P/E ratio cannot be analyzed without looking at financial leverage.

Remember, ratios are sector-related, so be sure to check trends and competitors.