Key Concepts

- actuarially fair

- anchoring bias

- availability bias

- behavioral economics

- diminishing marginal utility

- diversification

- expected utility

- fair bet

- focusing illusion

- hedge

- index fund

- insurance

- loss aversion

- marginal utility

- overconfidence

- premium

- representativeness bias

- risk averse

- risk loving

- risk neutral

- risk spreading

- systematic risk

- utility

Discussion and Review Questions

Learning Objective 19.1 Learn how to make good decisions when the outcome is uncertain.

- You are thinking about funding a Kickstarter campaign for a hybrid mechanical/digital calendar for which you’re willing to pay $125. To receive a calendar, the company required that you pledge $100. You think there’s about an 80% chance of the company succeeding, but if the product fails, you will not receive a refund. Is this a fair bet? Would you pledge the $100? Hint: Use your consumer surplus if the company succeeds to evaluate the bet.

- You are considering investing $2,000 in the stock market. If you invest, there is a 30% probability that your investment will be worth $3,000 and a 70% probability that your investment will be worth $1,600. Alternatively, if you did not invest, you simply keep the $2,000. Would you invest? What does your decision indicate about how you view risk?

Learning Objective 19.2 Be ready to apply five strategies for reducing the risk in your life.

- You are preparing to declare your major (if you already have, this will still be a good reflection exercise to make sure you’re making a good decision!). Apply the five strategies to reducing risk in your life to this decision. Which strategies can you use to help you reduce the risk of choosing the wrong major for you? How would you apply them?

- There were about 126 million households and 383,974 residential fires in the United States in 2017. Therefore, households faced a 0.30% chance of a fire in a year. You are looking at purchasing renters insurance that costs $100 a year and provides you with $20,000 a year in coverage in the event of a fire. Is this policy actuarially fair? Would you buy the policy? Why or why not?

Learning Objective 19.3 Prepare to overcome common pitfalls when faced with uncertainty.

- You’re a project manager overseeing five teams that are developing a new app. Each team must complete their work by July 1 in order to release the app by the end of the year. Based on your work managing the project, you know that each team has about a 75% chance of meeting the deadline.

- At your weekly status meeting, the CEO turns to you and says, “Give me your gut reaction: What are the chances we actually get this done by the end of the year?” How do you answer?

- Now work out the answer with a calculator. You can either multiply 0.75 five times or raise 0.75 to the power of five. Was your estimate correct, too high, or too low? What aspect of behavioral economics could explain your gut reaction?

Study Problems

Learning Objective 19.1 Learn how to make good decisions when the outcome is uncertain.

- You are analyzing two possible stock market investment strategies. For each of the following, identify whether or not it would be classified as a fair bet. Would a risk-averse person make either of these investments? Why or why not?

- One strategy is to invest in a blue chip stock like Microsoft that has a proven track record. There is a 25% chance that the company continues its steady growth and your wealth increases by $30,000. There is a 75% chance that the company becomes unprofitable and your wealth decreases by $10,000.

- Another strategy is to invest in a start-up. There is a 10% chance that the company is a success and your wealth increases by $100,000. However, there is a 90% chance that the company fails and your wealth decreases by $20,000.

When Devon experiences an increase in wealth, her total utility increases as depicted in the accompanying table.

Wealth level Utility $20,000 2.0 $40,000 3.8 $60,000 5.4 $80,000 6.8 $100,000 8.0 - Graph Devon’s utility function. Does it exhibit diminishing marginal utility?

- Her wealth is currently $60,000. How much would her total utility change if her wealth increased by $20,000? What if, instead, it fell by $20,000?

- Is she risk averse, risk neutral, or risk loving? Explain your reasoning.

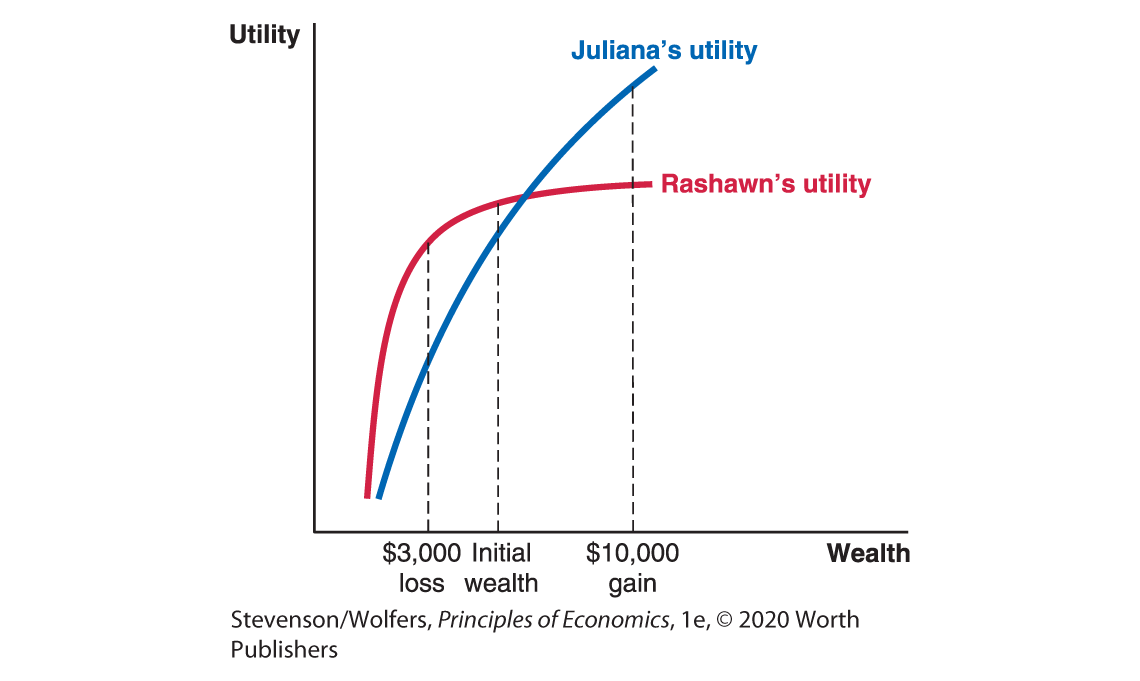

- The following graph illustrates the utility functions for both Rashawn and Juliana, who both have the same amount of wealth:

- Based on the graph, who is more risk averse, Rashawn or Juliana?

- Both Juliana and Rashawn work for the same company, which announces a new investment option for their retirement plan. This new option has a 50% chance of increasing their wealth by $10,000 and a 50% chance that it will cause them to lose $3,000 in wealth. Based on their utility functions, would either of them choose to transfer the value of their 401k into the new investment option?

- You currently have $10,000 in total wealth and rate your current utility at 4.25. You are deciding if you should invest your money in your friend’s automotive restoration business. There is a 50% probability that you will double your money, in which case your total utility will be 6. There is a 50% probability that your friend’s business will fail and you will lose the entire $10,000 and your total utility will be 2.5.

- What is the expected utility of investing in your friend’s company?

- If you are risk averse, should you take the gamble and invest in your friend’s company?

- Would your answer to part (b) be different if there was a 75% chance that you would double your money by investing in your friend’s business?

Learning Objective 19.2 Be ready to apply five strategies for reducing the risk in your life.

You are considering opening your own photography studio specializing in weddings and other events. You think that there is a 40% probability of your business being successful, at which point you will have $60,000 in wealth, and a 60% probability that your business will fail, and you will lose everything. The relationship between your financial situation and your utility is as provided in the following table.

Wealth Utility $0 0 $15,000 4.1 $20,000 5.8 $30,000 7.3 $35,000 8.5 $60,000 9.6 - You’re planning to finance the new business with all of your current wealth of $20,000.

- If your goal is to maximize your utility, should you open the business?

- Another option is to bring aboard three investors. Instead of financing the business on your own, the four of you will evenly split the start-up costs so that now you will contribute $5,000 of your $20,000 in wealth to start up the company. If the company is successful, you will add an additional $15,000 to your wealth. If the company fails, you are left with a total of $15,000 in wealth.

- If your goal is to maximize your utility, should you open the business with the three partners?

- Does the ability to spread the risk impact your decision about opening the business?

- Alexandria currently has $80,000 in wealth saved up from her private speech therapy practice. Alexandria plans on working for 15 more years and is afraid there’s a 5% chance that she will face a malpractice lawsuit during that time, which would cause her wealth to fall to $20,000 as she has to pay for legal fees and her practice suffers. If she doesn’t face a malpractice lawsuit, then she expects her wealth to grow to $120,000. She decides to buy malpractice insurance even though the annual premium of $3,200 is more expensive than the actuarially fair annual premium of $2,800. What are some reasons that she would purchase insurance that costs her more than actuarially fair insurance?

- You have $500 to invest in the stock market and are considering buying shares in Walmart and Target, both of which are trading at $50 per share. Analysts believe there’s a 50% chance of the economy growing or a 50% chance of the economy falling into a recession. If the economy grows, then the price of the Walmart stock will fall to $40 per share and the price of the Target stock will rise to $70 per share. If, however, the economy goes into a recession then the price of the Walmart stock will rise to $70 per share and the price of the Target stock will fall to $40 per share. For each of the following, determine the expected value of your portfolio.

- Buy $500 of Walmart stock.

- Buy $500 of Target stock.

- Buy $250 of Walmart stock and $250 of Target stock assuming the economy goes into recession. Does the answer change if the economy grows instead?

- Do all three possible investments result in the same expected value for your portfolio?

- Do all three possible investments result in the same level of risk?

Learning Objective 19.3 Prepare to overcome common pitfalls when faced with uncertainty.

- For each of the following scenarios, identify whether it is best explained as an example of overconfidence, availability bias, anchoring bias, representativeness bias, focusing illusion, or loss aversion.

- Dorothy watched news reports about a devastating tornado in a neighboring state and in response she decides to quadruple the amount of home insurance that she currently has.

- David is the risk manager at a mortgage company. In 2007, he was asked by his boss to estimate the probability that 20% of the company’s borrowers would default on their loans at the same time. David stated that this was extraordinarily unlikely, so the firm should not worry about loaning to too many risky borrowers. A year later, mortgage default rates were at an all-time high.

- Mandy was working at a Fortune 500 company earning $200,000 per year before she lost her job during a recession. The economy has largely recovered and she has received several job offers, but Mandy is still unemployed because she refuses to accept any job that pays her less than $200,000 per year.