Growth and development

Japanese investment begins flowing into South Korea’s economy in 1965.

1841 German economist Friedrich List argues that protecting industry would help economies to diversify.

1943 Polish economist Paul Rosenstein-Rodan argues that poor countries need a “big push” to develop through state investment.

1992 US economist Alice Amsden claims South Korea’s use of performance criteria fostered industrial growth.

1994 US economist Paul Krugman argues that the East Asian takeoff was a result of increases in physical capital rather than true innovation.

After World War II the economies of a cluster of East Asian nations grew dramatically. Led by a new set of actively interventionist governments, these countries were transformed from economic backwaters into dynamic industrial powers in just a few decades. The so-called Asian Tigers—South Korea, Hong Kong, Singapore, and Taiwan—were followed by Malaysia, Thailand, and Indonesia, and then by China. These countries achieved sustained growth in income per head faster than in any other region. GDP (gross domestic product, or total national income from goods and services) is often used to measure a nation’s wealth. In 1950, South Korea’s GDP-per-person (GDP divided by the size of the population) was half that of Brazil’s; by 1990, it was double; by 2005, three times as high. This kind of growth resulted in a remarkable decline in poverty. By the late 20th century the original four Asian Tigers had living standards that rivaled those of Western Europe, a historically unprecedented change in fortunes that has been dubbed the “East Asian miracle.”

The environment from which the Asian Tigers emerged was shaped by government intervention and dense links between the state and the economy, an economic model that came to be known as the “developmental state.” After World War II there had been huge expectations of development in poorer nations, and the goal of rapid economic advancement became the driving force behind government economic policy. Powerful bureaucracies were involved in directing the economic activities of the private sector in ways that seemed to go far beyond anything attempted in Western Europe. However, their governments preserved private enterprise, and their new model had little in common with the state planning of the communist bloc. Asian Tiger states shaped development by steering investment toward strategic industries and promoting the technological upgrading of producers. This induced a shift of workers from agriculture to the expanding industrial sector. Large investments in education gave workers the skills needed for new industries, and industrial enterprises soon began to export their products, becoming the motors for sustained, trade-driven growth.

This type of state had never been seen before. It challenged orthodox views about government’s role in the economy. Standard economics sees the state’s job as correcting market failures—governments provide public goods, such as defense and street lighting, which private markets alone tend not to deliver. They ensure that institutions such as courts function properly so that contracts can be enforced and property rights protected, but beyond that their role is minimal. Once the basic prerequisites for market activity are in place, classical economics suggests that the state should withdraw and let the price mechanism do its work. It is thought that market-friendly institutions and a limited state were key to Britain’s economic success during industrialization.

Some economists contend that this also occurred in successful East Asian economies: when these states fostered development, they did so by supporting markets, not by interfering with them. Their interventions helped to allocate resources and investment in ways that were in line with markets: in a sense the state “got prices right.” To do this, governments cultivated macroeconomic stability, vital for giving certainty to investors. They intervened to correct market failures through the provision of defense and schooling. They also built infrastructure such as ports and railways, whose high set-up costs deterred private firms. The East Asian developmental states were held to be successful because they followed the market.

Now a major center of international finance, Hong Kong plays an important role in China’s ongoing economic success while preserving its own system of government.

The New Zealand economist Robert Wade argues that the East Asian development states both led and followed markets. They drove the expansion of favored industries by providing cheap credit and subsidies. By leading markets their chosen allocation of resources was markedly different from what it would have been, had it been dictated by markets alone.

US economist Alice Amsden has characterized this as the state deliberately “getting prices wrong” in order to build new types of competitive advantage. A crucial part of this was that the new “infant industries,” pumped up with subsidies and trade protection, were eventually made to grow up. The state could enforce performance criteria on firms because it was able to withdraw preferential treatment as needed.

"The state… has set relative prices deliberately ‘wrong’ in order to create profitable investment opportunities."

Alice Amsden

Robert Wade argues that the way these states chose to lead the markets explains the creation of comparative advantages in industries where none previously existed. Initially, the prices of goods from a new industry would normally be internationally uncompetitive. In addition, the production of a new product often requires the simultaneous setting up of other industries and infrastructure. The coordination of this process is difficult if left to private firms rather than the state.

Moreover, these protected, infant industries became competitive when they were given classical incentives to learn how to become more efficient. In order to achieve the economic education of new firms and the coordination of initial production, governments needed to act in violation of narrow market prices. This occurred in South Korea’s steel industry. In the 1960s the Korean government was advised by the World Bank not to enter the steel sector because it had no comparative advantage there—others could easily beat its prices. By the 1980s Posco, a large Korean firm, had become one of the world’s most efficient steel producers.

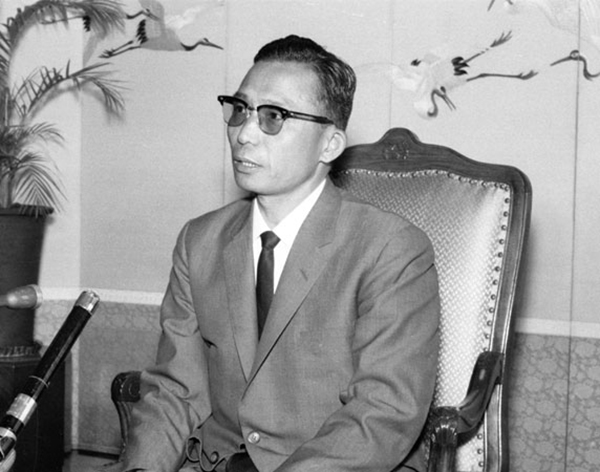

South Korea’s rapid development was initiated by Park Chung-hee, an army general, in 1961. He restored relations with Japan, Korea’s former occupier, and attracted Japanese investment.

Attempts at interventionist policies in regions outside East Asia were unsuccessful, which tarnished the reputation of the developmental state. In Latin America and Africa the preferential treatment of firms and sectors generated poor incentives: firms were shielded from competition, but the state did not enforce performance criteria. Infant industries never grew into successful exporters.

In Latin America especially, preferential treatment became linked to politics with little economic payoff: some firms received subsidies and tariff protection but did not become more productive. Over time these firms became a drain on their governments’ budgets, absorbing rather than generating resources. “Getting prices wrong” did not help to build comparative advantages in new industries. It led instead to inefficient production and economic stagnation.

In East Asia successful states seemed better able to resist pressures from private interests. After setting up its new steel firm in the 1960s, the South Korean government ensured that the firm was meeting efficiency targets. If political interests had emerged that had prevented the state from disciplining the firm, the state would have become the servant of narrow interests, not of the overall economic efficiency of the economy. The state had to remain autonomous and resist pressures for favoritism from particular groups. At the same time the state provided firms with credit and technical assistance—to do this and to monitor firms’ performance, it was necessary for the tentacles of the state to reach into the smallest cogs of the economy. The economic bureaucracy needed to hold detailed information about all potential investments, and to maintain effective relationships with industrial managers.

US economist Peter Evans has called these markers of successful developmental states “embedded autonomy.” Only when this is in place is there a chance for a state to “get prices wrong” without being co-opted by vested interests. Embedded autonomy is not easy to create, and its absence may be a factor behind the poor outcomes of state intervention in other developing regions.

The rapid rise of the Asian Tigers was based on exports. Large facilities to handle container ships, such as these in Singapore, were built by the state to promote growth.

With the East Asian financial crisis of the 1990s the developmental state model was again called into question. Many sensed that the institutions that had fostered rapid industrial growth after World War II had lost their potency by the late 20th century. On the other hand the spectacular rise of China has resurrected the idea of the developmental state, or at the very least of policies and institutions that produce rapid economic transformation while deviating from the prescriptions of standard, classical economics.

China began a series of reforms of its communist system in the late 1970s. It created its own brand of developmental state, which resembled the Asian Tigers, and had an authoritarian government that was responsible for promoting the private sector and exports. Agriculture was de-collectivized, and state-owned industries were given more autonomy and subjected to greater competition. These reforms helped unleash a vast expansion of private economic activity, without the introduction of Western-style property rights.

Alternative incentives emerged from China’s unique institutions: for example, from the “Household Responsibility System,” whereby local managers are held responsible for an enterprise’s profits and losses, without the need for private property ownership. The results have been dramatic. While China remains poor relative to Western Europe, its rapid growth took 170 million people out of poverty during the 1990s, accounting for three-quarters of the poverty reduction in developing regions.

The histories of China and the Asian Tigers show that there is no unique path to development. The way that their states intervened in the economy was very different from anything that took place in Europe when it was developing. However, it seems that all development models, even successful ones, eventually run into constraints. The benefits of the development state petered out in the Asian Tigers in the 1990s—institutions that had worked in one decade began to fail in the next. One day the Chinese state, too, may lose its potency. It may have to reinvent itself if its spectacular rise is to continue.

Like most Chinese cities, the eastern city of Hangzhou has seen rapid growth and a spreading urbanization as China has industrialized.

The South Korean steel industry was a big success of the developmental state. By 2011, South Korea was the sixth largest steel producer in the world.

The East Asian developmental states gave preferential treatment to firms in favored sectors while creating incentives for performance. They did this by requiring enterprises to meet performance criteria, partly through contests in which firms competed for prizes.

Typically, the criterion for winning was successful exports. The prize was credit lines or access to foreign exchange. In South Korea and Taiwan, for instance, firms had to show proof that they had won an export order. Only then did they receive their prize. South Korea launched competitions in which private firms bid for large projects in new industries such as shipbuilding. Successful firms received protection from the international market for a time. Performance criteria involved firms becoming internationally competitive by a certain deadline. Failing firms were punished.