6

Dot.com Wealth Secrets

THE HOUSE OF THE FUTURE

There are many reasons to envy the billionaires of Silicon Valley. They are rich and young. They are cultural icons. When their life stories are made into movies they are played by Justin Timberlake. But what I envy most are their houses, which inevitably achieve something many of us can only dream of. Even in such august company, though, the dot-com billionaires on the West Coast stand out. They have not only $50 million or so in petty cash to spend on a house but also creative flair and fascinating neuroses.

For instance: what teenage boy has not dreamed of being a samurai? The brave charges into battle, the shining swords, the red-lipped geisha, the ritual suicides. Oracle founder Larry Ellison has reconstructed a samurai villa on twenty-three acres in California, based on the architecture of sixteenth-century Japan. It is a feudal fantasy of wooden beams and earthen plaster. No cement here. Just gravel, manicured grass, a tea house, a moon pavilion, and an archery range (in a nod to progress, the rice-paper doors are covered with glass). It is his second Japanese-style dwelling, the first having been based on an imperial residence in Kyoto.

But the house of which I am most jealous is the Gates mansion in the Seattle suburbs. Its underground garage has been compared to the Batcave. Lit by natural light via tubes coming up through the ground, it has space for about thirty cars and “transforms” into a basketball court. The house itself is built into a hillside (visitors enter at the top), and on construction was appraised at $53 million. Those millions were spent on quality, not scale—initially, the main house had one bedroom and one bath. Regardless, so many beams of rare, recycled old-growth Douglas fir up to seventy-five feet in length were used in the building’s construction that dealers in boutique wood had trouble sourcing the material until the leftovers from the project were eventually put up for sale.

The feature of the Gates home that received perhaps the most press attention (and was profiled in Gates’s book The Road Ahead) is a tracking system that enables the house to follow and respond to residents’ and visitors’ movements. You tell the house once what kind of lighting and temperature you would like and carry an identity pin on your person. These settings then follow you unobtrusively as you move from room to room. Let us say you want some music. This follows you as well, transitioning seamlessly from speaker to speaker (including underwater, in the pool). From your perspective, it appears that music is playing throughout the house; from the perspective of others, it appears that you are accompanied by your own personal theme music. (“[Microsoft cofounder] Paul Allen is a Jimi Hendrix fan,” wrote Gates, so “a head-banging guitar lick will greet him whenever he visits”; Gates’s own favorite is U2.)

Artwork, on high-definition screens, also changes in response to your preferences. As Gates’s company Corbis has acquired the rights to more than seventeen million pictures and images, you are unlikely to tire of the selection. “We’ll have to have hierarchy guidelines, for when more than one person goes to a room,” said Gates when the house was under construction. One presumes that in his own home Gates ranks at the top, a constant salve to any feelings of social anxiety he may have had in high school. Thus I imagine him stepping into a crowded room: the temperature and lighting shift subtly, the art on the walls begins to change, and from the speakers one hears the pealing bell-like riffs favored by U2’s guitarist, the Edge. (In my dreams, of course, it is my own arrival that is heralded with such drama.)

Essentially it is the House of the Future, but since Gates is the world’s richest man, it probably really is the house of the future, in an exhilarating and slightly scary way. Most of the details related here date back to the mid-1990s, just after construction was completed. Indeed, many could today be replicated by an average homeowner using an Apple iPhone and a few connected accessories. Not, however, in the Gates household: “There are very few things that are on the banned list,” explains Melinda Gates. “But iPods and iPhones are two things we don’t get for our kids.”

In recent years the Gates house has undergone a major upgrade and expansion, and has been valued at $109 million, more than twice the original appraisal. A 17-by-10-foot video wall composed of multiple screens would now seem quaint and has presumably been upgraded. The identity pin has, one assumes, been replaced by something more seamless, such as face-recognition technology. There are many rumors about the upgrades, which are deliciously enticing (the Gates family now tightly controls access to the house). The media has made much of the trampoline room, and the fact that one can swim in the lap pool from indoors to outdoors by ducking under a glass wall. But the detail that most captures my imagination is the interior doors, each made of solid wood and reported to weigh more than 300 pounds, not driven by motors but rather so perfectly counterbalanced that they can be moved with the push of a finger. The shower door for the spa is reportedly the pièce de résistance of these grand portals, made of granite and clocking in at some 4,500 pounds, again counterbalanced so that it seems all but weightless.

It is this last detail that to me reveals the scope of Gates’s vision. I imagine Bill Gates ready to leave the spa, his glasses steamed up, placing a finger against the shower door, knowing that it will move but thrilled by the delicious possibility that it will malfunction, thus entombing him forever within his hillside like a pharaoh of old. The temperature perfectly as he likes it; the greatest hits of U2 playing on repeat for eternity.

THE WORLD’S RICHEST MAN

Bill Gates is, as of this writing, the world’s richest man. He has been very rich for a very long time, first reaching the top spot on the Forbes list of the world’s billionaires in 1995. He stayed there for about a decade before ceding his position to the Mexican billionaire Carlos Slim and then regaining it. Microsoft operates roughly at the epicenter of the dog-eat-dog, rags-to-riches-to-rags world of high technology, where many companies (MySpace, BlackBerry) dominate markets one day and teeter on the verge of bankruptcy the next. So how does Gates stay on top?

The story of Gates’s wealth secret is simultaneously the story of the wealth secrets of a lot of other technology-related names near the top of the Global Rich List—such as Steve Ballmer and Paul Allen at Microsoft, Larry Ellison at Oracle, Larry Page and Sergey Brin at Google, and Mark Zuckerberg at Facebook.

It is also a story of the bleeding edge of wealth secret innovation. As a result, in the early years no one understood what was going on—probably not even Gates himself. As Gates was earning his fortune, the U.S. government spent millions of dollars of taxpayers’ money in antitrust litigation, based largely on misconceptions. In 1999, a U.S. court ruled that Microsoft was a predatory monopolist and in 2000 that the company should be broken up—a ruling that fortunately was not implemented, as in retrospect it would have been largely pointless. New microeconomic theories invented in an effort to explain Microsoft’s costs to society were subsequently discovered to be wrong, misinterpreted, or both.

And at the center of all this misunderstanding is a puzzle. Microsoft is almost certainly a monopoly, having reached at one point a more than 90 percent share of the operating system market for personal computers globally. This monopoly position would seem to imply that Microsoft has hardly any effective competition, tremendous pricing power, and little need to innovate. And yet Microsoft is clearly an innovative company, pouring money into research and technology acquisitions and rolling out an unending stream of new products—some successful (the Xbox, Internet Explorer), some less so (Bing, Zune). It often charges a pittance for its products (offering the Windows 8 upgrade, for instance, at $40 in early 2014). Microsoft is, and always has been, making a huge effort to remain competitive—against competition that does not appear to exist. Why?

If solving this puzzle—of why a near monopolist makes such huge efforts to innovate against phantom competition—had been the focus of inquiry from the beginning, a vast amount of economic theorizing and lawyers’ fees could probably have been saved.

But then, wealth secrets are difficult to understand. If they were not, they would not be wealth secrets.

IN THE RIGHT PLACE

Bill Gates was always interested in making money. He came up with a variety of moneymaking schemes while still in high school. Some were simple, if clever—reselling political campaign buttons and computer memory tapes—but most were impressively complicated operations for a high schooler. For instance, together with eventual Microsoft cofounder Paul Allen, Gates attempted to create a small business offering traffic-flow measurement services to local government.

To help on another such initiative, the development of a computer program that would automate high school class scheduling, Gates hired a couple of fellow students as subcontractors. One recalls Gates confidently asserting, “I am going to make $1 million by the time I’m twenty.” Another high school friend recalls the same prediction, but with a target age of thirty; yet another recalls the predicted age as twenty-five. It was evidently an oft-repeated forecast. At Harvard University, from which he famously dropped out, Gates’s favorite hobby was poker. Even for Harvard students these were high-stakes games, with players winning or losing several hundred dollars a night. Gates liked making money, and he liked competing for it.

Even after he had become wealthy (“I have an infinite amount of money,” he once proclaimed), Gates remained interested in the topic, perhaps mainly for the competitive aspects. Flying home from a successful meeting with IBM in 1986, he impressed his colleagues by reciting from memory the percentages of their company’s stock owned by each of the technology industry’s CEOs (“to the decimal point,” recalled former Microsoft executive Mike Slade). Needless to say, Gates’s share was the largest in the industry. He was by then a billionaire. As Jim Conner, a program manager at Microsoft’s Office Product Unit, said of his boss: “This guy is awesomely bright. But he’s unique in a sense that he’s the only really bright person I’ve ever met who was 100 per cent bottom-line oriented—how do you make a buck?”

While his success was far from preordained, when Bill Gates cofounded Microsoft in 1975, he was already positioning himself to make a fortune, merely by choosing the technology sector. As we saw in chapter 5, the list of the world’s 1,600 or so billionaires is currently dominated by individuals from the emerging world (including India, China, and Russia). In the modern-day United States and Europe, well-crafted and well-enforced law and regulation make it increasingly difficult to earn a billion dollars. But among the top 100 people on the Forbes Global Rich List, the developed economies still dominate, even if only barely: 61 of the top 100 billionaires in the world are European, American, Japanese, or Australian.

It turns out that most of these 61 fortunes fall into two main categories. The first of these is the financial sector, broadly defined—8 of the 61 arise from money management, including hedge funds, private equity, and fund management. The other category is intellectual property, also broadly defined to encompass copyrights (which prevent you from copying this book), trademarks (which prevent you from opening a store called “Best Buy”), and patents (which prevent you from hiring a Chinese factory to produce a tablet computer, or anything else for that matter, using the patent-protected technologies embodied in Microsoft’s Surface).

Companies that are based in large part around intellectual property assets account for about 40 of the 61 rich-world fortunes among the world’s top 100. I would contend, admittedly somewhat arbitrarily, that these firms include consumer goods companies (LVMH, Mars—which tend to own valuable trademarks and brands), media companies (Disney, Bloomberg—which tend to own valuable copyrights), retail companies (Walmart, Aldi—also valuable trademarks), and, of course, technology companies (including Microsoft—which tend to own valuable patents). Basically, to oversimplify the situation somewhat: hedge funds and intellectual property ownership have produced more than 75 percent of the largest fortunes in Europe and North America today. And the vast majority of this 75 percent comes from intellectual property ownership.

So why is intellectual property so lucrative?

Well, it has a great deal to do with monopoly.

THE JOYS OF COPYRIGHT

Two economists at Washington University in St. Louis, Michele Boldrin and David Levine, recently caused a stir in the worlds of jurisprudence and academia with a book called Against Intellectual Monopoly, which argued that all intellectual property rights ought to be abolished. In the three years following publication the book has already been cited by more than five hundred academic studies—many of them critical of the book’s central arguments, including the contention that patents and copyrights should be known as “intellectual monopoly” instead of “intellectual property.” This would be more accurate, Boldrin and Levine contend, because “currently patents and copyrights grant producers of certain ideas a monopoly.” And monopolies, as we all know, are bad (or very, very good, depending on your point of view).

This proposed rebranding is perhaps a bit too ambitious. If intellectual property is a monopoly, it is at most a limited monopoly. Unlike legislated monopolies, intellectual property monopolies do not apply to a market (like steamboat services in New York or telephone services in Mexico), but to an idea. And in fact a patent does not really protect an idea, but only a particular implementation of an idea. The intellectual property rights associated with the Microsoft Surface tablet, for instance, do not give Microsoft a monopoly on tablet computers, or even a monopoly on the narrower category of so-called convertibles (laptop computers that convert into a tablet form, like the Surface or the Lenovo Yoga). There are plenty of similar technological toys on the market, from the iPad to touch-screen laptops. That said, as a result of intellectual property rights protections only Microsoft can produce something that is called the “Surface,” stamped with the Microsoft logo, or which uses the patented technologies that Microsoft developed or purchased in order to create the device. And thus Microsoft does have, in effect, a legal monopoly on a few potentially important things, including the Surface brand name and many of the device’s component technologies. A law that prevents you from copying Microsoft, when the company is doing something obviously lucrative, has a wealth secret ring to it.

Indeed, while Boldrin and Levine are extreme in their views, the existence of intellectual property laws is not always easy to justify. The theoretical case for some kind of government intervention is open-and-shut. Ideas are “non-excludable,” meaning that once an idea is made public, anyone can use it. And free markets tend to fail at providing “non-excludable” goods, because if anyone can use any idea that you come up with, there is no financial incentive for someone to come up with ideas. Hence ideas are what is known as a “public good.” This aspect of market failure is unfortunate, because new ideas are very valuable (including new ways of doing business, new technologies, and of course, most valuable of all, new books).

But is providing a limited monopoly to a person or corporation, via a patent or copyright, the best way to encourage the production of new ideas? It is a problem that has long troubled legal thinkers. In the early 1800s, Thomas Jefferson, the principal author of the Declaration of Independence and the third president of the United States, fretted that the state-backed monopolies of intellectual property were an “embarrassment” to American ideals of free competition.

The usual argument in favor of intellectual property laws is that they reward creativity and innovation, and that, on balance, the extra costs consumers pay for these limited monopolies will be justified by the benefits of greater innovation. Consumers may pay more for Microsoft’s Surface, but if there were no intellectual property rights, would Microsoft have developed it? If there were no copyright on this book, and anyone could copy it at no charge, would I have bothered to write it?

But oddly, it is very difficult to find real-world evidence that intellectual property laws do in fact encourage creativity or innovation. For instance, many crucial historical innovations (the cotton spinning machine, the power loom) did not benefit from patent laws, and countries and industries that were historically the most innovative do not appear to have registered more patents than other, less innovative countries and industries. While strengthening general property rights does appear to increase a country’s rate of economic growth, strengthening intellectual property rights does not appear to have the same effect. Even businesses themselves rarely report that intellectual property rights—specifically, patents—are a benefit to either competition or innovation (except in the pharmaceutical sector).

One possible reason that intellectual property laws might not work as intended is that progress in innovation over time is cumulative. Isaac Newton’s famous quote “If I have seen further it is by standing on the shoulders of giants” may well apply to innovation. If this is true, then patents, which limit people’s ability to use new ideas, could actually slow down the innovation process. For instance, after the Wright brothers obtained patents relating to their development of the airplane, progress in airplane technology temporarily stalled until the U.S. government coerced the brothers into licensing their patents to others.

One does not need to look back so far to find similar examples; some of the fastest innovation in the software industry has happened on “open platforms” such as Linux (the basis for the Google Android operating system). When Microsoft was creating a mobile phone version of Windows, it invested hugely and expected to be rewarded accordingly. But Linux was developed via repeated small innovations by thousands of users, largely uncompensated, who were immediately able to piggyback on each other’s unpatented innovations. Just as Newton stood “on the shoulders” of previous great scientists (by using their ideas), perhaps inventors work best when they do the same. The limited monopolies of intellectual property may serve to slow this process. There are, to be sure, many more arguments regarding the potential benefits of intellectual property rights, but most also suffer from a lack of strong evidence.

So why do intellectual property laws exist? An alternative way to think about this question is to look back at the era in which they were created. The origins of modern patent laws can be traced back to the British patent system of the early seventeenth century, specifically the Statute of Monopolies of 1623. This law was implemented, in part, at the behest of an increasingly powerful merchant class, which had grown tired of the habit of the English monarchy of awarding lucrative monopolies to favored friends (a practice that persisted for years thereafter in other countries, as we saw in chapter 3). England’s Elizabeth I, for example, had issued monopolies for “innovations” such as starch and salt. The new law made royal monopolies obsolete, replacing them with patents that were to be awarded based solely on the merit of an invention—not the inventor’s political connections. In a similar vein, laws for the protection of trademarks were implemented in the United States in response to merchant demands. Initially, businesses seeking to protect their brands had to resort to legal action using the preexisting laws against fraud. For example, it was fraudulent for some unscrupulous person to mix up sugar, water, and caramel coloring and claim it was a product of the Coca-Cola company. But this approach became unwieldy as companies like Campbell Soup, H. J. Heinz, and Procter & Gamble sought to grow their businesses across the United States in the late 1800s (Coca-Cola, for instance, was by that time seeking to protect its trademark with separate initiatives in forty-three states). These consumer goods companies demanded—and received—the first effective national trademark protection law in 1905.

In the United States, copyright law came into being along with the first patents, in 1790. At the time, authors enjoyed a copyright term of fourteen years (and the option to renew for an additional fourteen). This term has since been extended many times, partly at the request of authors, playwrights, and musicians, but mostly due to lobbying by media companies seeking to increase the value of their assets. The European Union recently extended copyright protection for music from fifty to seventy years and applied the extension retroactively—that is, to works already created. This aspect of the decision is particularly difficult to justify on public interest grounds. Such a retroactive extension could encourage the production of more music—for instance, the Beatles might decide to stay together longer—but only if someone can go back in time and tell them about it.

And thus, we can provide an alternate answer to the question of why intellectual property law exists. That is: intellectual property law is a tool for making money. Indeed, intellectual property law was created at the behest of people who wanted to make more money. Now, that is a motive we can relate to. The limited monopolies of intellectual property, deployed properly, spin laws into gold.

And, as the dominance of intellectual-property-rich companies on the Global Rich List suggests, this is one of the few blunt instruments for moneymaking remaining to seekers of wealth in the United States and Europe today.

BILL GATES, SUPERMAN

Many tales of Bill Gates’s exploits ascribe to him almost superhuman abilities. This is only natural: he has amassed an absurd fortune and is now in the process of giving it away via a charitable foundation that takes on superhuman challenges, such as attempting to rid the world of polio and improve the American educational system. One expects that even in the company of geniuses, Gates will stand apart.

The various stories of Bill Gates’s feats of brainpower tend to support this. He is reported to have read the World Book Encyclopedia, in its entirety, at the tender age of nine. To this day, people close to Gates report on his high-speed reading habits. An ex-girlfriend recalled that he read four weighty newsmagazines over a short lunch they had together. Some other tales of Gates’s genius may be apocryphal, such as the rumor that he had, on a whim, memorized the license plate numbers of all of Microsoft’s roughly four hundred employees in the early 1980s.

Gates’s ability to function without sleep for days on end is also the stuff of legend—and was crucial to a number of Microsoft’s early business successes. These included the firm’s first real project, a piece of software that Gates and his colleague Paul Allen claimed was nearly complete, when in fact it did not exist and therefore had to be developed in a marathon of all-day–all-night coding.

Gates was also, without a doubt, an excellent computer programmer, personally contributing to many products over the years. In 1983, when Microsoft already had more than a hundred programmers on its staff, Gates wrote the last piece of Microsoft code he would produce himself—a text editor for an underpowered computer that his staff had said was “impossible” given the constraints. Gates reportedly did it overnight. In 1986, in a bold but typically self-confident move, he challenged journalists at a press conference to a timed onstage programming competition, the nature of the program to be selected from audience submissions. Gates was hoping to demonstrate the power of the company’s new QuickBASIC software. At that point several years had passed since Gates had moved from programming into executive management. He did not win, but he came surprisingly close. Few other technology CEOs would undertake such a challenge.

While Gates is without doubt a genius, there are many geniuses in the world. Indeed the reason, according to Gates, that he decided not to go into academia was the realization that a number of his Harvard classmates were better at math than he was. We’ve seen that he was a gifted programmer, but he was far from the world’s greatest. He also demonstrated a good head for commerce, but his initial approach to leadership at Microsoft was chaotic, and projects were repeatedly saved by heroic feats of all-night programming.

Gates did, however, have one personal advantage that was almost certainly unique among technology executives, and this would be crucial to his success.

That is, his father was a lawyer.

THE DEAL OF THE CENTURY

At one point during a 1994 interview with Playboy magazine, Gates leapt to his feet and strode theatrically across his office to the bookshelf. “Let’s look around these bookshelves and see if we find any business books,” he told the interviewer, scanning the books’ spines. “Oops. We didn’t find any.”

True enough. The secrets of Microsoft’s success were not to be found in business books. The unruly start-up companies competing to define the fledgling information technology marketplace fought over two issues in particular. The first was which company would come up with the greatest market-leading innovations. The second was which company would make money from the innovations. These turned out to be two entirely distinct issues. Some companies were very good at innovating but bad at making money from that innovation. Xerox was perhaps the most infamous of these. Its PARC laboratories came up with the mouse, laser printing, Ethernet networking technology, and the graphical user interface (the predecessor to both the Macintosh and Windows operating systems). But Xerox made next to no money out of any of these (and many of Xerox’s top researchers would eventually defect to either Microsoft or Apple). Other companies were, by contrast, very good at making money from innovations, regardless of the source of those breakthroughs. Microsoft was the leader of this latter pack.

In the mid-1970s, when Microsoft was starting out, the application of intellectual property law to software was uncertain. There were a number of categories of software that could potentially be covered. First was the operating system, which, roughly speaking, allowed a computer’s brain to interact with its body, controlling access to disk drives, memory, and any other devices connected to the computer (monitors, printers, networks, keyboards). Windows, Android, and OS X are examples of operating systems. There were then programs (today usually called applications, or apps) that ran on top of the operating system. If there was more than one program running (say you were pretending to work on a word processing document but switching to Angry Birds whenever the boss looked away), the operating system would allocate the computer’s resources (such as memory) between the different programs. In the early days of personal computing, users had to make their own apps, using a programming language like BASIC (computer hobbyist magazines contained page after page of listings of exceedingly simple apps the user could type in). A programming language was essentially an app that allowed the user to build other apps. Today, most programs are still written in programming languages, but they are compiled and sold in formats that can be run directly (called “executables”), so the user never needs to know in what language the app was originally written.

When the first software patent case (for, in effect, a piece of code that could be used in many different programs) went before the U.S. Supreme Court in 1972, the patent was ruled invalid. The judges believed that, like all scientific principles, software could not be patented, as it was “pure mathematics.” Copyright laws, by contrast, did offer software companies at least some protection for their programs or operating systems, although nothing was really formalized until the 1980s. Indeed, in the late 1960s and early 1970s, software was thought to be uncopyrightable as well as unpatentable. Certainly, computer software consisted of written text in many cases, but this text was purely utilitarian, and ultimately translatable into a string of 1s and 0s. How did this software code bear any relation to the novels, poems, or plays that copyright laws were intended to protect? In the mid-1970s, however, Congress established a commission to study the issue of software copyright, and by the 1980s making direct copies of someone else’s computer code was considered illegal. By 1981, the beginnings of patent protection for software had been established, but it was not until a series of federal circuit court of appeals decisions more than a decade later that patent protection for software could truly be relied upon. Hence, when Microsoft started out, direct plagiarism of software was discouraged, but producing code that did exactly the same thing as a competitor’s code was entirely legal.

As a result, in 1975, Bill Gates was entering the high-technology equivalent of the Wild West. This is where the lawyer’s son had his chance to shine. From an early age Gates had been imitating his father’s legalese. In 1966, for instance, aged ten, Gates drew up a formal contract for unlimited but nonexclusive use of his sister’s baseball glove, complete with “on acceptance of terms” and “witness sign here,” such legalese mixed endearingly with kidspeak: “When Trey [Gates’s nickname] wants the mitt, he gets it.”

On cofounding Microsoft, at the ripe old age of nineteen, Gates was immediately preoccupied by the problem of how to make money from products that could be copied freely. He first became well known in the computing industry—indeed, achieved a degree of infamy—for writing an open letter to the industry magazine Computer Notes in 1976. He was irate, he said, that “less than 10 percent” of the people he assumed were using the BASIC programming language (BASIC was Microsoft’s first product) were paying for it. The rest were copying it. “As the majority of hobbyists must be aware, most of you steal your software,” wrote Gates, refusing to mince words. At the time, of course, most software was freely copied, and it was not clearly illegal to do so. But Gates was having none of it. “Who can afford to do professional work for nothing?” he asked. To make such assertions required some chutzpah, as Microsoft’s own product, BASIC, was explicitly based on the feature set of RSTS-11 BASIC, which had been developed by Digital Equipment Corporation. No problem with that, of course, as software was years away from being patentable, and RSTS-11 BASIC was unpatented. But still.

Many of the magazine’s readers did not agree with Gates. Indeed, there was a miniature deluge of hate mail. “Defamatory and insulting,” wrote one reader. But Gates stuck to his guns. That same year, in his first speech to an industry conference, he again railed against people who were “ripping off” his software (he was now twenty and, contrary to his most optimistic prediction, yet to earn his first million). It was ultimately a lost cause. The apps of the day, written in BASIC, were instantly copyable. The programming languages themselves, such as BASIC, were harder to replicate, but many tech-savvy hobbyists could do it. Eventually Gates wrote another open letter in Computer Notes, entitled “A SECOND AND FINAL LETTER,” which included something of an apology. In it, Gates noted that the majority of computer users were “intelligent and honest individuals who share my concern about the future of software development.”

But the young Bill Gates was not going to abandon his efforts to extract money from his computer software as easily as that. There was an alternative: he could write up contracts. With each sale of a Microsoft product would come a legal agreement which, provided buyers were willing to sign, would establish rights enforceable in court. Even in the corporate sector, this was something of a novel approach. “We never tried to patent CP/M [the industry-standard operating system prior to Microsoft’s DOS],” explained an employee of Digital Research, the company that had developed CP/M. “Nobody was patenting software then; it was almost unethical.”

But this did not stop Gates. At first he tried to draw up legal agreements with personal computer users—the end users of his software. Initially, anyone wishing to receive a copy of Microsoft BASIC had first to return a signed secrecy agreement affirming that he or she would not share the software (an approach that has recently become popular again, with websites demanding that users click “OK” or “Agree” to lengthy user agreements that few people bother to read). An article in Computer Notes warned that Microsoft “will prosecute anyone who violates their license agreement.” Sadly for Gates, this approach turned out to be impractical, since the fledgling company lacked the resources to prosecute hundreds of users for such paltry fees. Indeed, the administrative burden of sending, receiving, and filing the user agreements was so onerous that the practice was soon abandoned, over Gates’s objections.

Gates had better luck with corporations. By selling his software to corporations, which would then sell it on to end users, Gates could create proprietary rights, via legal contract, that were practical to defend. Unlike a sale of one copy of software to a user, the sale of a single software license to a company would bring in, at a stroke, tens or even hundreds of thousands of dollars, so threats of legal action were realistic. The company’s first agreement, a contract with one of the first personal computer manufacturers, MITS, was reportedly drawn up by Gates himself, with help from his father and another attorney recommended by his father. In the years to come, Microsoft would rarely produce an industry-leading breakthrough (lagging competitors in the development of graphical user interfaces, networking, the web browser, and then mobile computing). But in contract law, the company repeatedly led the field. According to two technology journalists, the contract Microsoft had signed with MITS would, in years ahead, “serve as a model for future software licensing agreements in the growing microcomputer industry, and it helped set industry standards.”

The MITS Altair 8800 computer that ran Microsoft’s (at the time “Micro-Soft”) BASIC software. The contract with MITS was Microsoft’s first. (Michael Holley. Licensed under public domain via Wikimedia Commons)

And the agreement would soon be tested in court. Microsoft wanted to sell BASIC to other companies, but MITS had little interest in helping out, and so Microsoft’s efforts were floundering. Happily for Gates, in the contract with MITS, Microsoft had included a provision stating that MITS would use its “best efforts to license, promote and commercialize the program (BASIC). The company’s failure to use its best efforts… shall constitute sufficient grounds and reasons to terminate this agreement.” Gates was not shy about legal confrontation—his first contract dispute over software had taken place in high school. Microsoft sent a legal letter to MITS informing them of the intent to terminate their companies’ relationship if “best efforts” (and other issues) were not corrected within ten days. MITS responded by taking Microsoft to arbitration. Fortunately, Gates’s legalese was first-rate: Microsoft won the dispute.

But this contract, though it set industry standards, was far from the most brilliant that Microsoft would draw up. That prize goes to the paperwork surrounding Microsoft Disk Operating System (MS-DOS, or just DOS), released in 1981. By the mid-1990s, MS-DOS was running on roughly 140 million of the 170 million personal computers worldwide. Yet Microsoft created neither DOS nor most of the ideas behind DOS; nor did it pay for the development of DOS. Hence the contracts that gave Microsoft proprietary rights to sell DOS were later hailed as the “deal of the century” or the “bargain of the century.” Of course, those accolades came with the benefit of hindsight. At the time, not even Gates realized how big DOS was going to be. Yet he drew up an indisputably first-rate set of contracts.

There were four potential claimants to ownership of DOS. The first was Digital Research, which had produced CP/M, the industry-standard (but unpatented) operating system on which DOS was loosely based. The second was Seattle Computer Products, which developed Q-DOS, the software that became DOS. The third was Microsoft, which bought a license from Seattle Computer Products to distribute DOS. (Microsoft paid $75,000 for these rights. In the next two years alone, Microsoft would earn $10 million from DOS sales.) The fourth was IBM, which had paid Microsoft to develop DOS.

The most likely winner in any contract-drafting battle was IBM, a whale among minnows. The money it was spending on the development of DOS entitled IBM to at least claim ownership of it, but in a departure from usual practice, IBM didn’t. It is unclear why not. It is possible that Microsoft negotiated rings around IBM. While the contract, in theory, gave IBM a license to sell DOS, in fact, the cleverly worded document stated elsewhere that IBM could not “publish or disseminate the source code”—with potentially unlimited liability for violations. As dissemination of the code would be necessary for such a sale, in practice, IBM could not license DOS to third parties, even if it had the theoretical right to do so. And yet it seems unlikely that IBM’s large legal team would have failed to read the fine print on the contract. Jack Sams, the IBM executive who oversaw the deal, later contended that IBM left sales of DOS in Microsoft’s hands because the company did not want to deal with the legal disputes over software ownership that would inevitably arise. We had “a terrible problem being sued by people claiming we had stolen their stuff,” said Sams.

Indeed, confirming IBM’s fears, both Digital Research and Seattle Computer Products eventually threatened legal action regarding DOS, with the former claiming that DOS was a copy of CP/M. “Ask Bill why function code 6 [in DOS] ends in a dollar sign. No one in the world knows that but me,” Gary Kildall, CP/M’s developer, later complained. Despite such complaints, in the end the threats from Digital Research did not achieve much. Lawsuits from the various heirs to Seattle Computer Products, however, timed to coincide with Microsoft’s IPO in 1986, managed to extract roughly $2 million from Microsoft.

But it could have been worse—much worse. Seattle Computer Products had initially wanted $20 million. By that time, Microsoft was earning more than $30 million each year from sales of DOS. The company’s total revenues were above $197 million, and Microsoft’s value at IPO was $520 million and rapidly rising.

The reason Microsoft, despite its apparent underpayment, had a strong claim to nearly all the revenues from DOS was, once again, Bill Gates’s contract magic. An attorney who had seen the original 1981 agreement with Seattle Computer Products noted that Gates, in handwritten alterations, changed key language to specify a sale of DOS rather than an exclusive license to distribute DOS. “That was a brilliant masterstroke on his part,” the attorney later commented, since it meant that Microsoft’s claim to the ownership of the intellectual property surrounding DOS was ironclad, regardless of DOS’s origins. Indeed, Microsoft arguably had no need to pay anything at all to Seattle Computer Products, and Gates confidently took the case to trial. Unfortunately, after some pointed references to Gates’s $550 million fortune during cross-examination (Gates claimed, on the stand, to be unaware of how much he was worth), the jury seemed to turn against him, and eventually Microsoft swallowed its pride and settled.

All told, despite this minor setback, the set of agreements surrounding DOS put Microsoft on the path to riches. Nineteen eighty-one, the year of the IBM PC release, was the year that Gates reportedly earned a million dollars for the first time. He was twenty-six—so his high school forecasts for his future success were roughly accurate. As Gates’s interviewer from Playboy would write, with verve and some hyperbole, “IBM thought they had Gates by the balls. He’s just a hacker, they thought. A harmless nerd. What they actually had by the balls was an organism that had been bred for the accumulation of great power and maximum profit, the child of a lawyer, who knew the language of contracts, and who just ripped those IBM guys apart.”

Of course, in years to come, there would be many more contracts, and many more lawsuits. But Microsoft was always ready to fight. In 1982, for instance, Microsoft sued Advanced Logic Systems (ALS) for copyright infringement. Gates continued the suit even after the company agreed to change its code, explaining that he wanted to set a legal precedent. In the view of one ALS executive, this was an attempt to “litigate a competitor out of existence,” but most likely it was a matter of principle—an attempt to firm up the then uncertain application of copyright law to software. If Microsoft wanted to make money from software, Gates would need to be a pioneer. Indeed, many more software companies would in time benefit from his efforts. As he would later explain: “Microsoft is an intellectual property company. We have no factories of any consequence or natural resources. Indeed, we have no physical assets of any kind that are important to the success of the company. Our products instead consist almost entirely of information we create.”

NETWORK EFFECTS

So why was it worth Microsoft spending so much time drafting contracts and conducting elaborate courtroom battles, when such diversions of management time and resources at times threatened to undermine the young company’s financial viability? Why did it make commercial sense for Gates to attempt to set legal precedents at his company’s own expense? After all, Microsoft was not a law firm—it was not making money off these court cases directly. Wasn’t all the time spent on contracts and lawsuits just a waste?

In one sense, of course, Microsoft did benefit from its legal maneuvering. In the late 1970s, software that had been developed without patent (such as CP/M) was being claimed by private owners. Microsoft capitalized on this moment, using clever contracts to acquire some valuable software technology at little cost. Arguably, the company thus saved itself a substantial sum of money that otherwise would have had to be invested in software development.

More importantly, by the early 1980s, Gates had managed to establish for his company the “miniature monopolies” of intellectual property rights protection for its key software products.

But this fact alone does not fully explain Microsoft’s success—how the company was able to turn these “miniature monopolies” into a very real and nearly global monopoly on computer operating systems. For that, one needs to know something about the economics of software. As Gates himself explained to an industry conference in 1981: “I really shouldn’t say this, but in some ways it leads, in an individual product category, to a natural monopoly: where somebody properly documents, properly trains, properly promotes a particular [software] package and through momentum, user loyalty, reputation, sales force, and prices builds a very strong position in that product.”

He was absolutely right, of course: he shouldn’t have said it. Never, ever, mention the word “monopoly” in mixed company. Having a monopoly in a market is a red flag, because gaining one through improper means and abusing its power to thwart competition are both illegal in the United States, Europe, and most other advanced economies. Antitrust legislation generally requires in these cases some kind of remedy, which may involve one’s precious, beautiful, mother-of-all-wealth-secrets monopoly being broken up.

But what Gates was talking about—the almost magical force that turned his hard work, clever contracts, and borrowed software into billions of dollars—was economies of scale. It was a principle that would not have been unfamiliar to Andrew Carnegie, John D. Rockefeller, or Dhirubhai Ambani. But in the software business, these effects would be multiplied.

First, software companies benefit from a phenomenon known as “network effects” (which also aided the telephone and telegraph network-building of Vanderbilt, mentioned briefly in chapter 3—I’ll come back to that again in chapter 7). Positive network effects are the additional value each user derives from a product as more individuals use it. Network effects are perhaps easiest to understand in the case of the telephone. If your telephone is not connected to a network, it is pretty much worthless. If it’s connected to one other person’s telephone, the connection is more valuable (assuming that person is someone you want to talk to). If it’s connected to everyone else’s telephone, it is hugely more valuable. So this means that the more people who are connected to a network, the more you would be willing to pay to join that network—as long as they are people you might conceivably want to talk to. The same is true, more or less, with railroads. The more cities and towns and farms that are connected via a rail network, the more valuable your connection to that network is.

In software, network effects apply in more than one way. Some of these effects are direct, and come from setting an industry standard. For instance, if you write documents in Microsoft Word, you can share them easily with other users of Microsoft Word (as I did, many times, with my editors while writing this book, while they made excessive use of Word’s “comment” feature). [It was for your own good.—Ed.] If you are attempting to collaborate closely with other individuals on the joint development of a document, using the same software is important. Swapping back and forth between different word processing programs (or even between Word on a PC and Word on a Macintosh) usually leads, after a few iterations, to a document so bug-ridden that it crashes everyone’s computers, and the intern has to retype it from scratch. So the more people use a program, the more valuable that program becomes to other potential buyers.

In software, there are also indirect network effects, which exist because some types of software, notably operating systems, become more valuable when used with complementary products. Consider an operating system like Microsoft Windows. The more applications written for Microsoft Windows, the more you would be willing to pay to own a copy of Microsoft Windows so you can use all those applications. This type of network effect is more subtle—it sometimes takes thousands of users before the pool is large enough to attract applications developers. But these indirect network effects are also powerful, because they attract not only consumers but companies, and companies make investments. If Microsoft Windows is the dominant operating system, companies writing application programs will tend to write programs for Microsoft Windows first. Each time they do, they are—in effect—adding the value of the money they invested in developing their own application to the value of Windows.

To be sure, the direct network effects in software are not as powerful as in many other industries. An unconnected telephone is pretty much useless, and so is a train track that doesn’t go anywhere, but a single copy of Microsoft Word is still an improvement on a typewriter. But there is another crucial point to note about the economics of software: it costs almost nothing to make an additional copy. While making another computer or iPhone is expensive, software can be copied almost infinitely at no cost. (Especially in an age when it is increasingly downloaded, rather than packaged in boxes.) As in most industries, at some point diseconomies will tend to set in (mostly having to do with adding features and lines of code, which makes software more prone to crashing, security flaws, and bloated development costs). But once a piece of software has been written, making more copies of it is nearly costless. As Steve Ballmer, who took over as CEO of Microsoft from Bill Gates, put it: “Software businesses are all fixed-cost businesses. And so volume is absolutely everything.”

This means that the economies of scale in software apply not only on the demand side, like railway and telephone networks, but also on the supply side, like oil refining and steel production. The more you produce, the more profit you will tend to make on each sale. This combination is very, very exciting.

As Bill Gates said, the exceptional economies of scale in software businesses should lead, under certain circumstances, to natural monopolies. The clever cartel maneuverings of Rockefeller, the Morgan-sponsored bailout of Carnegie, or the rearranging of the license maze by Dhirubhai—all these schemes to gain monopolies would be unnecessary in software. Indeed, the software business is perhaps unrivaled in the scale economies it enjoys. The company that sells the most in the market will gain an advantage not only in the appeal of its products but also in production costs. The more it sells in comparison to its competitors, the greater each of these advantages becomes. Once in a dominant position, a software company’s profitability and competitive advantage are all but unassailable. One would have to be a moron not to make money in this type of business. And Bill Gates was not a moron.

A BITE OUT OF APPLE

At the beginning, however, it was far from obvious that Gates was making good choices. In the 1970s and 1980s, Microsoft—as its name suggests—made only software, and very few people were paying for software (many end users were pirating it). The companies that made hardware (which had strong patent protection) were the ones doing well, at least at first. In 1981, Apple was making profits of $39.4 million on sales of $334 million. Microsoft’s sales at the time, at $15 million, were less than Apple’s profits.

There was a good reason for this, of course. In the early days of DOS, Microsoft was giving its products away (literally, in the case of the first MS-DOS contract, with Seattle Computer), or selling them very cheaply. Soon Microsoft was also running a publishing company, Microsoft Press, at a loss, churning out computer programming manuals and training materials. The goal was, as Gates said, to nurture a user base and community of application developers, so that network effects could begin to apply. But in the early days, the potential strength of these effects in the software industry was not obviously apparent.

Yet Microsoft very likely understood the potential gains that could come from setting a compatibility benchmark for the industry. The company’s first success with this approach, albeit on a small scale, came in the 1970s, with the programming language BASIC. The applications of the day were programs written in BASIC and shared freely (as was the ethos of the time), but to run them you needed to have BASIC on your machine. Despite the initial difficulty of getting people to pay for software, Microsoft soon began to make money. “This is a very personal business, but success comes from appealing to groups,” said Gates. “Money is made by setting de facto standards.”

And yet, even by the mid-1980s, Microsoft’s strategy was still not a clear winner. In contrast to Microsoft’s products, each new generation of Apple computers was a thing of beauty—robust, secure, and easy to use. In an iconic 1984 Super Bowl commercial, Apple introduced the Macintosh, the first widely used computer system based on a graphical user interface. In the commercial, a sprightly female hammer thrower liberated a legion of drones from the grip of—you guessed it—the industry standard.

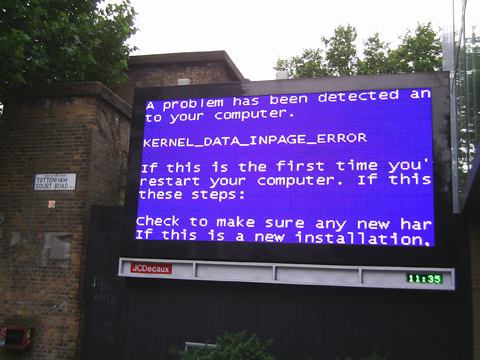

Microsoft’s response seemed ham-fisted. Its new graphical user interface, Windows, tended to crash frequently. (Older users will recall the “blue screen of death.”) Each time Windows crashed you may have (as I did) wished the suffering you experienced could somehow be visited upon the person of Bill Gates, in a form of karmic justice. Perhaps you were, as I was, mildly surprised when Gates eventually became the world’s richest man despite producing such terrible software.

But when I thought these uncharitable things, I was merely demonstrating my lack of vision. There was a method in Microsoft’s apparent madness. As Gates explained in an internal Microsoft memo from 1995: “Aspects of the [IBM] PC were arbitrary or even poor. However, a phenomena [sic] grew up around the IBM PC that made it a key element of everything that would happen for the next 15 years. Companies that tried to fight the PC standard often had good reasons for doing so but they failed because the phenomena overcame any weakness that resistors identified.” What Bill Gates was trying to say (he is not a gifted communicator) was that the existence of network effects—the mysterious “phenomena” he referred to—made it more important for a technology product to be widely used than for it to have the best features.

The Windows “blue screen of death” strikes a high-tech billboard in London. Those who are surprised that Gates became so rich selling buggy software fail to understand his wealth secret. (Allan Hailstone)

In his book The Road Ahead, Gates explained more clearly why this was the case: “A positive-feedback cycle begins when, in a growing market, one way of doing something gets a slight advantage over its competitors. It is most likely to happen with high-technology products that can be made in great volume for very little increase in cost.” This was, of course, an exact description of the economics of the software industry, although it appears to conflate economies of scale on the supply and demand sides (fortunately, Gates was not trying for an economics degree). “One of the important lessons the computer industry learned,” he continued, “is that a great deal of the computer’s value to its user depends on the quality and variety of the application software available for it. A positive feedback cycle began driving the PC market. Once it got going, thousands of software applications appeared, and untold numbers of companies began making add-in or ‘accessory’ cards, which extended the hardware capabilities of the PC.… Although buyers of a PC might not have articulated it this way, what they were looking for was the hardware that ran the most software, and they wanted the same system the people they knew and worked with had.”

Microsoft’s strategic decisions constantly reflected an understanding of this trade-off—that it was acceptable for a product to be “arbitrary or even poor” if that was what it took to increase the user base. It meant getting new products to the market fast, perhaps before they had been thoroughly debugged, in the hope that they would establish a leading position. It meant pricing low, especially for new types of products, even if that meant making less money in the early phases than the insufferable hipsters at Apple. But most of all, it meant ensuring that each generation of Microsoft products was compatible with what had gone before. When major technological advances came along—multitasking, graphical user interfaces, networking, 32-bit operating systems, multithreading—this required messy compromises. Older readers will recall with fondness (or perhaps annoyance) the various workarounds used to make programs designed for prior operating systems work with the latest Microsoft software (starting a Windows PC in “MS-DOS mode” for instance).

This approach had real costs. Windows 95, Microsoft’s 32-bit operating system, had a 16-bit subsystem (Win16 Mutex) hidden inside it, in order to operate Windows 3.0 and 3.1 applications. It crashed a lot. These problems were not unexpected because Windows 95 had to be compatible not only with earlier applications written for Windows 3.0 but also a huge variety of computer hardware. And Windows 3.0 itself was already a mess, in large part because of efforts to retain compatibility with its own predecessor, MS-DOS. Brad Silverberg, who headed Windows development, admitted that “[Windows] 3.0 was pretty big and pretty slow.” But, he explained, this was a necessary trade-off: “You can’t break compatibility.… In some ways, if we could do them over again, we know how you can do it so you could write the system faster.… But once you have those interfaces, you are pretty much locked.”

Still, the launch delays, and the bugs, and the crashes, were worth it. Any applications developed for prior Apple generations generally did not work on the newest machines. Hence the number of Apple users was inherently limited, not only to Apple products but to a single generation of Apple products. The Apple Macintosh, however cool it may have been, lacked applications, and sales were slow (after a year on the market, the Macintosh was selling a mere 20,000 units a month).

Bill Gates may not have been cool, but it did not matter. The number of users of Microsoft’s uncool, bug-ridden, user-unfriendly, but (mostly) compatible software grew and grew. Finally, the logic of increasing returns to scale began to produce the inevitable conclusion that Bill Gates had predicted. By 1988 there were 40 million computers in the world that were compatible with MS-DOS. By 1990, 50 million. By 1995, 140 million (by then, about 70 million of these were running backward-compatible versions of Microsoft Windows). At that time, there were only 30 million computers running anything other than DOS. The cumulative network effects were by this point so powerful that Apple could not hope to compete, no matter how trendy Steve Jobs’s pullovers were. If you owned an MS-DOS computer, there were superb applications for whatever you might imagine, from writing, to spreadsheets, to video games, to music composition, to turning your computer screen into an aquarium.

By 1995, Microsoft was making profit margins of 35 percent, while Apple languished at 6 percent. Adding insult to injury, the most popular applications on Macintosh computers were applications written by Microsoft. Apple’s CEO, Gil Amelio, was fired. In 1997, Apple was forced to negotiate a $150 million bailout in order to survive. The bailout was provided, humiliatingly, by Microsoft.

That must have felt really, really good.

A MODERN MONOPOLIST?

There was potentially a problem—a serious problem, threatening Microsoft’s very survival. Microsoft was by this point a near monopoly, with a 95 percent share of the operating systems market in the United States. And there are very few privately owned monopolies in business in the modern day.

This is because the great monopolies of the robber baron era have mostly been broken up. The last holdovers from the age of “monopoly capitalism” (so called because the government allowed private profit-generating businesses to operate without competition) were public utilities. These businesses were most efficient at a large scale. It was thought that consumers would benefit most if these businesses operated as the only provider in the market, or at the very least were protected from competition so they could grow to the largest scale possible. Examples included electrical power and telephone utilities, which were allowed to operate as monopolies (in fact, often required to operate as monopolies) subject to regulation of the prices they could charge. Eventually even these became an endangered species. A few survived as public companies (the U.S. rail network Amtrak; the German rail network Deutsche Bahn), but the private operators were mostly gone. The network businesses were split up. Electric power plants, railroads, and telephone service providers were made to compete over electric transmission lines, railway tracks, and local networks owned by other parties (sometimes by the government, at other times by regulated private businesses). Just about the only place one can still find unfettered monopoly capitalists is in the emerging world (although even Carlos Slim has recently had to break up his empire).

But once intellectual property rights had been established as applying to software, Bill Gates had a new kind of monopoly—a legitimate one, enshrined in law, meaning that it would be very difficult to break up. Arguably, Microsoft’s monopoly rights were enshrined in the U.S. Constitution and European Union law.

Since the 1990s, courts and government regulatory authorities have attempted to square this circle, without much success. From the lofty perspective of theory, the problem is that Microsoft operates at the intersection of two market failures: the “public good” nature of ideas, and the “natural monopoly” nature of software businesses, which are characterized by very strong economies of scale. In attempting to solve the first problem (by creating intellectual property laws), governments gave rise to the second. Efforts to solve the second problem will inevitably undo the solution to the first. Correcting both market failures simultaneously may be all but impossible.

And that is why all the lawyering was worth it. By establishing intellectual property rights in an economy-of-scale business, Gates had given himself not only a monopoly, but an untouchable monopoly. This was put to the test in the 1980s and 1990s when the company exploited its dominance in operating systems in order to gain a market-leading position in other software products (notably word processing programs, and then spreadsheets). Microsoft’s efforts in this regard reached their zenith in the “browser wars” of the 1990s, when the company crossed what many perceived to be a red line. In an effort to take market share from Netscape, Microsoft integrated the code for Internet Explorer into Windows so that it could not be uninstalled. This initiative was perfectly within Microsoft’s rights, of course. Microsoft owned the intellectual property behind Windows and could modify Windows however it wished. But it began to look as if Microsoft would be able to exploit its dominance in operating systems in order to own the Internet. A lawyer working for Microsoft’s competitors submitted a white paper to the U.S. government arguing that it was now “a realistic (and perhaps probable) outcome” that “a single company could seize sufficient control of information transmission so as to constitute a threat to the underpinnings of a free society.”

This contention was a little over the top, but something needed to be done. In 1999, a U.S. judge ruled that Microsoft was a predatory monopolist, such that some sort of legal remedy was needed. This finding was confirmed by a second U.S. court in 2001. A few years later, in 2004, the European Commission reached the same conclusion. These were more or less open-and-shut cases. In court, Microsoft claimed that it did not really have monopoly power and gave various explanations for its behaviors—arguing that it was trying to benefit consumers, and that there was no way to separate the Internet Explorer code from the Windows code. These arguments generally failed to hold up, especially after document discovery turned up various incriminating e-mails (Brad Chase, Microsoft’s head of marketing for Windows, wrote in one presentation: “The Internet is part of Windows. We will bind the shell to the Internet Explorer, so that running any other browser is a jolting experience”). Microsoft’s anticompetitive behavior was ruled to be abuse of its monopoly position by courts on both sides of the Atlantic.

The problem was what to do about it. U.S. courts had noted that the “most effective” antitrust remedy is to break up a monopoly business. The problem was, Microsoft’s monopoly was rooted in an intellectual property right granted by law, not in a physical network that could be dismembered or a portfolio of factories that could be divided. In the remedy phases of antitrust trials in both the United States and Europe, Microsoft argued that the limited monopoly enshrined in intellectual property rights would be violated by any attempt to change the company’s structure. Nonetheless, in 2000, a U.S. court ruled that Microsoft should be broken up—perhaps into an applications company and an operating systems company. Another suggested solution was that Microsoft be forced to disclose the code for Windows, so that clones of Windows could be created by other companies.

At the turn of the twenty-first century, Microsoft’s anticompetitive behavior was ruled to be abuse of its monopoly position by courts on both sides of the Atlantic—but finding a remedy has proved much harder than identifying the problem. (U.S. Department of Justice)

It seemed to be a watershed moment, but the courts backed off from imposing a breakup, in part because of concern that this would harm consumers. While Microsoft’s ownership of the Windows standard was a license to print money, it was also genuinely valuable to consumers, as Microsoft’s setting of an industry standard had fostered the development of a vast market for software applications. Moreover, because Microsoft was purely an intellectual property company, remedies that would enable the creation of Windows clones would have struck fundamentally at the company’s rights. A U.S. judge wrote that forcing the company to disclose “vast amounts of its intellectual property” to other companies was simply a bridge too far—it would amount to “an intellectual property ‘grab’ by Microsoft’s competitors.”

In the end, the courts on both sides of the Atlantic, despite ruling that Microsoft had engaged in illegal anticompetitive behavior, settled for so-called conduct remedies. That is to say, Microsoft’s monopoly would be left untouched, but the courts would monitor Microsoft’s actions and seek to force it to behave in a way that created a level playing field for competitors. For instance, Microsoft was forced to allow computer makers and consumers to remove easy access to Internet Explorer, so that competing browser producers could displace Microsoft’s browser with their products. These conduct remedies, while a burden for Microsoft, amounted to acceptance by regulatory authorities that Microsoft’s monopoly was untouchable. The company’s stock soared. Microsoft’s right to “own the standard” was upheld.

It was big news for wealth secrets. One hundred years after the great monopolies created by Morgan, Rockefeller, and Carnegie had fallen or at least been tamed by trustbusters and regulators, monopoly capitalism was back—and without any of the regulation of profits or prices that had applied to public utilities.

That meant Bill Gates was going to have serious, house-of-the-future money. It meant that he would one day be able to realize his quirky vision of swimming from outdoors to indoors with his favorite music following him all the way. “Be careful of what you do in there, since the boats on the lake can see inside,” a security guard admonished as Gates showed off his pool to a reporter from Time magazine. Gates doubled over with laughter. He spent time in there at night with Melinda, he explained.

He was living the dream.

THE LESSON IN BILL’S DOLLARS

There is always the risk, of course, that a government regulator could decide to limit Microsoft’s profitability. But there is a practical reason why this is unlikely. And it has to do with the nature of competition in the technology industries.

Microsoft’s efforts to “set the standard” to leverage network effects are an early example of what has since come to be known as a “platform strategy.” When Windows became a standard—or “platform”—it attracted an ecosystem of application developers, computer developers, chip developers, and developers of computer peripherals. The value of Windows then became not only the value that Microsoft had invested in the software’s development, but also the value that all of these companies had invested in all of their products. Once a platform takes off, its value increases exponentially. The key question in platforms (think Field of Dreams) is “If you build it, will they come?” And, as with Microsoft’s DOS/Windows standard, in the end, because of network effects, one platform usually dominates.

In the early days, the U.S. government worried that Microsoft’s monopoly would strangle innovation in the technology sector. But this concern proved to be misplaced. The government did not at first believe that Microsoft faced competition, but this was an error. The nature of competition in industries where platform strategies are used is very different from that in “normal” industries.

In most “normal” industries, companies battle over market share. In these sectors, the various competitors will tend to gain or lose market share against each other over time (think Ford vs. GM vs. Honda vs. Toyota). In platform competition, by contrast, the participants expect that one platform will emerge as dominant and eventually “own” the market. They also expect that with monopoly market share will come huge, marvelous profits. In industries where there are platforms, companies tend to compete for the market, rather than in the market.

Hence there is genuine competition in platform industries, even for monopolies like Microsoft’s, although that competition may be hard to see. Investors will be willing to put up a huge amount of capital, and take large initial losses, if they think they can create a new platform. Indeed, the more protection from competition a dominant position in a given market offers, the more incentive there is for other companies to attempt to achieve that position themselves, and the greater the potential rewards for investors willing to back the upstarts. Such markets for technology products and services are characterized by what has come to be called “catastrophic entry,” or “waves of creative destruction,” where a new competitor arises as if from nowhere, and seemingly overnight gains a dominant share.

This may be why Gates believed that Microsoft was vulnerable despite its overwhelming share of the operating systems market—there was always someone working away in a garage who could invent a platform that would knock Microsoft into oblivion. The dynamics of platform competition explain why Apple, following its humiliation at the hands of Microsoft in the mid-1990s, was able to stage a comeback. Investors bet hugely on the mere possibility that Apple would somehow manage to displace Microsoft’s platform. Against the odds, this bet appears to have come off: Apple introduced tablet computers and smartphones, and these devices are now cutting into global sales of personal computers, which suffered their worst decline in history in 2013. (Steve Jobs relished this turnaround. When asked why he was offering a version of iTunes that ran on Windows PCs, he explained that it was “like offering a glass of ice water to someone in hell.”)

That may be bad news for Microsoft, but it is actually great news for Gates’s personal fortune. Apple’s recent success demonstrates that the principle of platform competition applies to Microsoft, which implies that if the government were to attempt to regulate Microsoft’s profitability or the prices it can charge (as is usually the case for regulated monopolies), it would inadvertently remove the incentive for companies like Apple to attempt to displace Microsoft. Microsoft’s immense profitability year after year after year is the lure that draws competitors like Apple into the market, backed by the investment dollars of people determined to take a punt on gaining a fortune for themselves. It is what drives inventors in Silicon Valley garages and college dorm rooms to create innovative new platforms, ignoring their parents’ constant refrain to get a proper job. If the U.S. government had capped the amount that Gates could earn, the huge sums Apple threw into the fight to displace Microsoft would never have been invested, the garage and dorm room inventors would have gone into investment banking instead, and Microsoft’s monopoly would likely have persisted forever (or at least for a very long time).

For seekers of wealth secrets, this is the most marvelous of Catch-22 situations.

Beneath the domed ceiling of the library in the Gates home is engraved a quote from The Great Gatsby: “He had come a long way to this blue lawn, and his dream must have seemed so close that he could hardly fail to grasp it.” Gates had once dreamed of being a millionaire. He was a long way past that now.

NET NEUTRALITY

Did Bill Gates intend, when he set out, to exploit the extraordinary economies of scale in software—which, unlike perhaps any other type of business, occur on both the supply and demand sides? It seems likely. In the 1970s, his corporate motto was “We set the standard,” and at the beginning of the 1980s, he forecast that a “natural monopoly” was possible. It appears that Gates at least intuitively understood this principle of software economics before anyone else.

Did he also know that by basing his monopoly on intellectual property rights he would render it all but immune to effective antitrust remedies? This seems less likely. After all, having a monopoly is the secret ambition of every right-thinking businessperson. Probably Gates, in his eagerness, simply did not consider that, a decade later, governments would act against him. Indeed, when they did, Gates was outraged because he believed that the antitrust laws were designed to protect consumers and that he was giving consumers better products at no additional cost. If Gates had anticipated the governments’ attack, surely he would not have used the words “natural monopoly” in a public forum.

Still, Gates’s exploitation of economies of scale was without a doubt a stroke of wealth secret genius. It would not take a genius to copy Microsoft, of course. But then, because of intellectual property laws, no one can copy Microsoft; that is the whole point. Still, a very smart person could probably emulate Bill Gates, applying his approach in another market. And in Silicon Valley, very smart people are not in short supply. Among the wealthiest individuals in the world, platform strategies—usually based on intellectual property rights protections—are well represented. Nearly all of the dot-com billionaires in the top fifty spots have gained limited monopolies or appear likely to gain such monopolies in the future, and investors are backing them generously in the hope that they do so. Most of their companies (Apple, Oracle, Google, Facebook, Amazon) have been accused of antitrust violations. But even when the antitrust cases have gone against them, the basis of these monopolies in intellectual property has limited the effectiveness of remedies. Many have been forced to pay fines or disclose key technical details to competitors, but none in a way that would enable direct replication of their core products or services.

First among the companies that rule the dot-com roost is still Microsoft, which produced not only the $76 billion fortune of Bill Gates and the $19 billion fortune of Steve Ballmer but also (narrowly outside the top fifty) the $16 billion fortune of Paul Allen—about $111 billion in personal wealth in total. Google comes next, exploiting the network effects inherent in search and developing the web’s premier advertising platform (producing the $32 billion fortunes of Larry Page and Sergey Brin in the process). Google is followed by Oracle, whose founder, Larry Ellison, has a fortune of $48 billion. Oracle’s platform is in business software and hardware (where Microsoft is uncharacteristically an underdog, although gaining rapidly even as it cedes share to Apple on the consumer side). Mark Zuckerberg’s Facebook follows, with perhaps the most straightforward network-effects strategy (the more people who join Facebook, the more valuable the site is as a place to connect—and to advertise within). But simple strategies can be good, and his fortune is now estimated at $29 billion.

Of course, there are many other such strategies used by famous names in the technology sector. In the 1990s eBay boomed with a network-effects business model that increased in value the more buyers and sellers it attracted (and despite recent difficulties, the site continues to monopolize the online auction space). Twitter’s social messaging network was one of the leaders of the second wave of Internet companies, and more recently the messaging network WhatsApp famously landed itself a $19 billion valuation in only five years (by virtue of its 450 million users, which acquirer Facebook evidently judged to be an insurmountable “network effects” lead in online instant messaging).

Amazon, the famous name in high technology I have omitted until now (founder Jeff Bezos’s fortune is $32 billion), initially struggled to attain profitability. It was a retail operation, so there were no network effects to speak of, and while its virtual storefront meant its costs were lower than those of many retail competitors, the company did not benefit from the snowballing economies of scale of companies like eBay. However, user ratings (now ubiquitous on websites) did provide a platform for buyers to create value. And by 2005, after many twists and turns, the company was widely recognized as a leading exponent of platform strategies. For instance, Amazon enables third-party sellers to reach buyers on its website and third-party marketers to be compensated for advertising products sold on Amazon. Moreover, in recent years, the supply-side economies of scale inherent in retail (essentially, the ability to use one’s size to squeeze the profits out of suppliers, as with Circuit City) have also begun to kick in, enabling Amazon to both undercut its competitors and (occasionally) turn a profit.