PETER A. VICTOR AND TIM JACKSON

1. INTRODUCTION

Three major crises are confronting the world. The first is the increasing and uneven burden of humans on the biosphere, and the observation that we have already surpassed the “safe operating space” for humanity with respect to three planetary boundaries: climate change, the nitrogen cycle, and biodiversity loss. The second is the astonishingly uneven distribution of economic output, not only among nations but increasingly within them. The third is the instability of the global financial system, which came to light in 2007–2008 and which defies an obvious solution. These crises are complex and interrelated. It is tempting to try to identify “root” causes, implying that the crises can be resolved if these root causes can be fixed. However, this is misleading. These interlocking crises are the result of systems in which causes are consequences and consequences are causes. In such circumstances, the search for root causes—causes that are not themselves consequences of other causes—can be pointless and counterproductive.

It follows that meaningful attempts to address these crises must engage not only with the dynamics of the separate systems involved—ecological, economic, and financial—but also with the interrelationships between these systems. This is a far from trivial challenge. It is a challenge in particular to the discipline of economics. Arguably, one of the factors involved in the financial crisis was the failure of economics to properly integrate the financial and the real economies. Real economic growth looked healthy even as financial balance sheets were increasingly “under water.” There are now attempts to redress that failure and to understand better the linkages between these systems (e.g., Keen 2011).

Over some years, there have also been attempts—particularly within the discipline of ecological economics—to integrate an understanding of ecological limits into an understanding of the real economy. Stern’s (2007) review of the economics of climate change stands as a major synthesis in this area—albeit one that found itself outdated by more recent understandings of the science of climate change and was only loosely based on the principles of ecological economics. The main conclusion of the review—that climate change can be addressed with little or no pain to the conventional model—no longer seems so viable because the conventional model has subsequently been severely tested.

Our principal argument in this chapter is that none of these attempted syntheses of real, financial, and ecological systems has yet addressed the core structural challenge presented by the combined ecological, social, and financial crises. Specifically, we seem to be missing a convincing ecological macroeconomics—that is, a conceptual framework within which macroeconomic stability is consistent with the ecological limits of a finite planet. Despite promising developments in this direction (e.g., Jackson 2009; Victor 2008), there is an urgent need for a much more fully developed ecological macroeconomics to avert immanent and massive disaster. In what follows, we discuss some of the challenges associated with this need and outline our own approach to addressing it.

The foremost challenge of building a convincing ecological macroeconomics is that the structural need for economic growth implicit in modern economics places an increasing stress on resource consumption and environmental quality. Economic stability relies on economic growth. However, ecological sustainability is already compromised by the existing levels of economic activity. We turn to this dilemma in the next section.

Capitalist economies place a high emphasis on the efficiency with which inputs to production (labor, capital, resources) are utilized.1 Continuous improvements in technology mean that more output can be produced for any given input. Efficiency improvement stimulates demand by driving down costs, which contributes to a positive cycle of expansion; however, crucially, it also means that fewer people are needed to produce the same goods from one year to the next.

As long as the economy grows fast enough to offset this increase in “labor productivity,” there is not a problem. If the economy does not grow quickly enough, then increased labor productivity means that there is less work to go around: someone somewhere is at risk of losing his or her job. If the economy slows for any reason—whether through a decline in consumer confidence, commodity price shocks, or a managed attempt to reduce consumption—then the systemic trend toward improved labor productivity leads to unemployment. This, in its turn, leads to diminished spending power, a loss of consumer confidence, and a further reduction in demand for consumer goods. From an environmental point of view, this outcome may be desirable because it leads to lower resource use and less polluting emissions. However, it also means that retail falters and business revenues suffer. Incomes fall. Investment is cut back. Unemployment rises further and the economy begins to fall into a spiral of recession.

Recession has a critical impact on private and public finances. Social costs rise with higher unemployment and tax revenues decline as incomes fall and fewer goods are sold. Lowering spending risks real cuts to public services. Cutting social spending inevitably hits the poorest first and represents a direct hit on a nation’s well-being. To make matters worse, governments must borrow more, not just to maintain public spending but to try to restimulate demand. In doing so, they inevitably increase their own level of indebtedness. Servicing this debt in a declining economy is problematic at best. Just maintaining interest payments takes up a large proportion of the national income. The best that can be hoped for here is that demand does recover, and when it does it will be possible to begin paying off the debt. This could take decades. It took Western nations almost half a century to pay off public debts accumulated through the Second World War. It has been estimated that the United Kingdom’s “debt overhang” from the financial crisis of 2008 could last into the 2030s (Chote et al. 2009).

As the recession has shown, the financial system can become very fragile very quickly when private debt runs ahead of the capacity to repay it. According to Minsky (1994) and others, this is an integral part of capitalist economies and a major cause of instability. Crucially, there is little resilience within this system. Once the economy starts to falter, feedback mechanisms that had once contributed to expansion begin to work in the opposite direction, pushing the economy further into recession. With a growing (and aging) population, these dangers are exacerbated. Higher levels of growth are required to protect the same level of average income and to provide sufficient revenues for (increased) health and social costs.

Of course, short-run fluctuations in the growth rate are an expected feature of growth-based economies. Some feedback mechanisms can bring the economy back into equilibrium. For instance, as unemployment rises, wages fall and labor becomes cheaper. This can encourage employers to employ more people and increase output again—unless the decline in wages further reduces demand, adding to the downward spiral rather than reversing it.

In short, modern economies are driven toward economic growth. For as long as the economy is growing, positive feedback mechanisms tend to push this system toward further growth. When consumption growth falters, the system is driven toward a potentially damaging collapse, with a knock on impact on human flourishing. People’s jobs and livelihoods suffer. In a growth-based economy, growth is functional for stability. The capitalist model has no easy route to a steady-state position. Its natural dynamics push it toward one of two states: expansion or collapse.

A lack of growth is deeply unpalatable for all sorts of reasons. As a result, society is faced with a profound dilemma. To resist growth is to risk economic and social collapse. To pursue it relentlessly is to endanger the ecosystems on which we depend for long-term survival. This dilemma looks at first like an impossibility theorem for sustainable development, but it cannot be avoided and has to be taken seriously. The failure to do so is the single biggest threat to sustainability that we face.

The conventional response to the dilemma of growth is to appeal to the concept of “decoupling” or “dematerialization.” Production processes are reconfigured. Goods and services are redesigned. Economic output becomes progressively less dependent on material throughput. In this way, it is hoped that the economy can continue to grow without breaching ecological limits—or running short of resources.

It is vital here to distinguish between “relative” and “absolute” decoupling. Relative decoupling refers to a decline in the ecological intensity per unit of economic output. In this situation, resource impacts decline relative to the gross domestic product (GDP), but they do not necessarily decline in absolute terms. Impacts may still increase, but they do so at a slower pace than growth in the GDP. The situation in which resource impacts decline in absolute terms is called “absolute decoupling.” Needless to say, this latter situation is essential if economic activity is to return to and remain within ecological limits. In the case of climate change, for instance, absolute reductions in global carbon emissions of 50–85 percent are required by 2050 in order to meet the 450-ppm stabilization target defined by the Intergovernmental Panel on Climate Change (IPCC).

The prevailing wisdom suggests that decoupling will allow us to increase economic activity indefinitely and at the same time stay within planetary boundaries. However, the evidence is far from convincing. Efficiency gains abound. For example, global primary energy efficiency has increased by a third since 1980. The carbon intensity of each dollar of economic output has fallen by about the same amount. However, absolute reductions in impact have been singularly elusive. Global primary energy use, carbon emissions, biodiversity loss, nutrient loadings, deforestation, and global fossil water extraction are all still increasing. Carbon dioxide emissions from fossil fuel consumption and cement production increased by 50 percent between 1990 and 2010 (Boden, Andres, and Marland 2013).

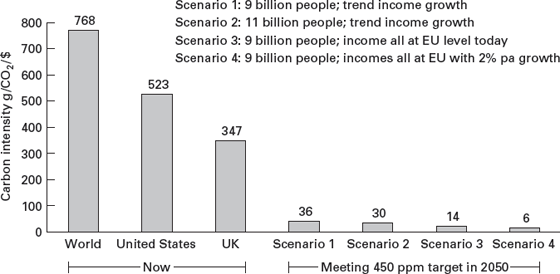

Massive investments in new technology and rapid improvements in resource productivity could, in theory, address this situation. However, the sheer scale of the challenge is daunting. In a world of nine billion people all aspiring to Western incomes, still growing at 2 percent per year, the average carbon intensity of each dollar of economic activity must decline by a factor of 130 by 2050 to give us a decent chance of meeting the IPCC carbon targets (figure 8.1).

Figure 8.1. Reduction in carbon intensities needed to achieve the Intergovernmental Panel on Climate Change targets. Source: Adapted from Jackson (2009).

This is not simply a question of technological potential. For changes of this scale to be viable, we must ask tougher questions about the potential of our economic and social systems to be able to deliver this level of dematerialization. We must begin to build system dynamics models that link the real economy, the financial economy, and ecology. It is to this task that we now turn.

4. UNDERSTANDING SYSTEM DYNAMICS

If we are to overcome the interlocking crises identified in this chapter’s introduction, we need to understand (and intervene in) the dynamics of the various systems involved. It is for this reason that we build models, be they mental or mathematical; if data are to play a major role, then computer-driven models are necessary.

Perhaps the most well-known attempt to build a computer model of the “world system” was described in The Limits to Growth (Meadows et al. 1972) using system dynamics. In system dynamics, stocks are interlinked through inflows and outflows that are driven by behavior, information, and feedback. The authors of The Limits to Growth developed various global scenarios based on assumptions about resource stocks, technology, population, pollution, and agriculture using the methodology of system dynamics. They drew attention to the “mode of behavior” of the world system as it was in 1970, which they argued is one of exponential growth followed by collapse. They also said that with appropriate and timely adjustments, expansion followed by stability was possible. With three decades of data in hand, Turner (2008) concluded that the scenarios in The Limits to Growth best matched the “standard run”—that is, exponential growth and collapse. Apparently, the mode of behavior of the world system has changed little and portentous signs of collapse are more evident than ever.

World 3—the model used in The Limits to Growth—simply (some said far too simply) described the world system in all of its complexity. However, all models are, by definition, simplifications of that which they represent, so simplification itself is hardly a relevant criticism of World 3. The question is whether the particular simplification of World 3 sacrificed structure (e.g., no price mechanism) and detail (e.g., no regions), resulting in misleading conclusions. We agree with Turner: by and large, World 3 did not result in misleading conclusions, given the scope of The Limits to Growth in which the primary focus was on the interplay between biophysical limits and economic growth. However, in relation to the three crises noted above, World 3 lacked the detail required for an examination of poverty and inequality; provided very little capacity for learning by governments, corporations, and individuals; and included nothing on finance. Clearly, World 3 was only a start.

Other models have gone well beyond World 3 in providing more complicated, data-rich representations of the world system; however, no model, to the best of our knowledge, has encompassed all three crises. GUMBO (Boumans et al. 2002) is a world system model in which the earth is divided into eleven biomes that encompass the entire surface area of the planet: open ocean, coastal ocean, forests, grasslands, wetlands, lakes/rivers, deserts, tundra, ice/rock, croplands, and urban. This spatial differentiation allows a much more detailed examination of the implications of economic growth for the biological systems of the planet and a more nuanced understanding of the reverse causalities. T21 is another example of a model that integrates economic and environmental systems in some detail (United Nations Environment Programme [UNEP] 2011). However, when applied to the world as a whole as in the study for UNEP on “green growth,” there is no regional disaggregation, thus concealing intragenerational implications of the various growth scenarios; also, there is no financial sector, so the full implications of the assumed increases in investments cannot be assessed.2

5. SYSTEM LINKAGES

Disregarding the World 3 model for a moment, it is worth considering some of the ways in which the financial system, real economy, and biosphere are linked. Money and finance have a major influence on decisions about consumption, production, investment, employment, and trade. These decisions are integral to the real economy, where raw materials are processed and goods and services are produced, distributed, and consumed. In advanced economies, besides barter (which is a fringe activity), real economic activity is always matched by a financial transaction. If the financial system fails to provide the means for such transactions, then the real economy cannot function. Providing such means in the amounts required for any particular level of economic activity is not a simple task, involving careful management of interest rates and the money supply and involving the central bank, commercial banks, and a multitude of other financial institutions. The system can go badly awry as it did in 2007–2008, when asset values dropped precipitously and credit dried up, resulting in a decline in real economic output.

There are also linkages between the real economy and the financial system that go in the other direction. For example, if a country runs a balance of trade surplus, it will be matched by an outflow of financial capital affecting investment. There may also be upward pressure on the country’s exchange rate, in turn affecting the balance of trade. More subtly, if participants in the real economy—companies and individuals—feel increasingly uncertain about the future, they will try to increase the proportion of their assets that are liquid, holding onto cash rather than undertaking longer-term investments and spending on consumption. These decisions in the real economy may reduce employment and profits, leading to more uncertainty. In other words, increasing uncertainty can have ramifications for the financial system and real economy that are reinforcing rather than self-correcting.

Links between the real economy and the biosphere are easy to identify once it is recognized that economies are embedded in the biosphere and are not independent of it as commonly assumed. Economies require a continual input of materials and energy that are subsequently disposed of back to the biosphere, usually in degraded form. When materials are embodied in built capital and consumer durables, they are retained within economies for extended periods of time. Eventually, they too find their way back to the biosphere through demolition and disposal. Reuse and recycling can extend the time that materials, but not energy, stay within economies; however, the second law of thermodynamics dictates that something is always lost in the process.

As we indicated previously, the principal avenue for escaping from the dilemma of growth is to appeal to decoupling. Our ability to decouple—particularly in absolute terms—depends implicitly on the dynamics of economic, social, and financial systems. In an assessment of decoupling as a way of reconciling continual economic growth with diminishing requirements for material and energy throughput, Jackson concluded the following:

History provides little support for the plausibility of decoupling as a sufficient solution to the dilemma of growth. But neither does it rule out the possibility entirely. A massive technological shift; a significant policy effort; wholesale changes in patterns of consumer demand; a huge international drive for technology transfer to bring about substantial reductions in resource intensity right across the world: these changes are the least that will be needed to have a chance of remaining within environmental limits and avoiding an inevitable collapse in the resource base at some point in the (not too distant) future.

The message here is not that decoupling is unnecessary. On the contrary, absolute reductions in throughput are essential. … It’s far too easy to get lost in general declarations of principle: growing economies tend to become more resource efficient; efficiency allows us to decouple emissions from growth; so the best way to achieve targets is to keep growing the economy. This argument is not at all uncommon in the tangled debates about environmental quality and economic growth.

(Jackson 2009:75–76)

The issue of decoupling is further confounded by more subtle links among financial, economic, and ecological systems. For example, it is a fundamental principle of natural resource economics that decisions about the rate at which resources are extracted from mines are influenced by the rate of interest. The same principle applies to biological resources; for example, the time period that trees are allowed to grow before harvesting for timber may depend on the rate of interest. This principle is based on the idea that owners of mines and forests have the option of extracting resources, selling them, and depositing the proceeds in a bank. An increase in the rate of interest on such deposits provides an incentive to extract resources at a faster rate in pursuit of higher profits.

The opposite happens when interest rates fall. This is not the whole story because changes in the rates of resource extraction can be expected to influence current and expected future resource prices, which complicates the connection between interest rates and extraction rates. However, the point remains that there are important links between the financial system and the burden placed by humans on the biosphere that work through the real economy. Any attempt to build a convincing ecological macroeconomics will need to understand and engage with these dynamics.

6. FOUNDATIONS FOR AN ECOLOGICAL MACROECONOMICS

Before turning to our own approach, it is worth setting out briefly some of the foundations for a systems model that addresses the challenges we have set out here. Principal amongst these is the recognition that a viable ecological macroeconomics must not rely on relentless growth in material consumption for its stability. A macroeconomy predicated on continual expansion of debt-driven, materialistic consumerism is ecologically unsustainable, socially divisive, and financially unstable.

At the same time, of course, a viable ecological macroeconomics must still elaborate the configuration of key macroeconomic variables. Consumption, government spending, investment, employment, distribution, and trade will all still matter in the new economy. However, there may well be substantial differences, such as in the balance between consumption and investment; the role of public, community, and private sectors; the nature of productivity growth; and the conditions of profitability. All of these are likely to shift as ecological and social goals come into play. New macroeconomic variables also will need to be brought explicitly into play; these will almost certainly include variables to reflect the energy and resource dependency of the economy and the limits on carbon. They will also include variables to reflect the value of ecosystem services, the stocks of critical natural capital, and wider concerns reflecting an ethical approach to nature.

The role of investment is vital. In conventional economics, investment stimulates consumption growth through the continual pursuit of productivity improvement and the expansion of consumer markets. In the new economy, investment must be focused on the long-term protection of the assets on which basic economic services depend. The new targets of investment will be low-carbon technologies and infrastructures, resource productivity improvements, the protection of ecological assets, maintaining public spaces, and building and enhancing social capital.

This new portfolio demands a different financial landscape from the one that led to the collapse of 2008. Long-term security has to be prioritized over short-term gain, and social and ecological returns must become as important as conventional financial returns. Reforming capital markets and legislating against destabilizing financial practices are not just the most obvious response to the financial crisis; they are also an essential foundation for a new ecological macroeconomy.

A new approach to investment suited to transforming the economy consistent with principles of ecology and social justice may very well entail a new approach to money itself. Contrary to popular belief, which assumes that only governments create money, in the existing monetary system virtually all money spent in the economy is created by commercial banks when they extend credit to borrowers. This circumstance has evolved out of the long history of modern money. Its implications for investment, and more broadly for how economies function in general, is still coming to light (e.g., Godley and Lavoie 2006; Minsky 1986; Ryan-Collins et al. 2012; Wray 2012). One aspect of considerable significance is the role that commercial banks play in deciding which investments to support. The financial crisis of 2007–2008 was partly attributable to the strong preference of banks to lend for purchases of financial instruments (so-called financial investment), which promised short-term returns at apparently low risk to the lender over loans to borrowers wishing to purchase real, productive assets.

Proposals for taking back control over the creation of money from the commercial banks have been around for many decades, but they are gaining impetus from publications such as Benes and Kumhof (2012) and Jackson and Dyson (2012). Under the schemes described in these publications, commercial banks would be required to maintain 100 percent reserve ratios. They would still be intermediaries in investment, but only to the extent that they managed investments on behalf of lenders explicitly prepared to place their savings at risk in investment projects. All money would be created by direct expenditure into the economy by the government working through the central bank. This transformation of the money system, for which numerous advantages are claimed, would reduce instability in the financial sector and allow the government to have a much stronger hand in steering investment toward ecologically and socially desirable projects, which commercial banks, especially under the current system, are much less inclined to support.

Above all, the new macroeconomics will need to be ecologically and socially literate, ending the folly of separating economy from society and environment. A first step in achieving this must be an urgent reform of the national accounting system so that what we measure is brought more in line with what really matters. The integration of environmental and resource variables into the national accounts and an end to the “fetishism” of GDP are essential.

However, more is required. We need to begin to build integrated systems models that incorporate the principal relationships between economic, financial, and ecological variables. These models need to be empirically grounded and calibrated as much as possible in real financial, economic, and ecological data. They must be able to address critical questions about employment, financial structure, and economic stability, as well as incorporate ecological questions about resource consumption and environmental limits.

7. TOWARD A NATIONAL GREEN ECONOMY MACRO-MODEL

Our own work on macroeconomic modeling has focused on the national rather than the global level and on developed countries. Although extreme poverty (i.e., less than $1 per day) is rare in these countries, distributive justice is a matter of growing concern, with levels of inequality not seen since the start of the Great Depression in 1929 being reached in several advanced economies (Piketty 2014). Therefore, it is important for models of developed national economies to address poverty within their own borders, along with other key aspects of their economic, financial, and environmental systems.

LowGrow, a fairly conventional macroeconomic model of the Canadian economy, was designed to answer the following question: “Is it possible to achieve full employment, achieve significant reductions in poverty and in greenhouse gas emissions, and maintain fiscal balance without relying on economic growth?” (Victor 2008; Victor and Rosenbluth 2007). LowGrow was used to simulate possible paths for the Canadian economy from 2005 to 2035, with measures introduced gradually between 2010 and 2020 to divert the economy away from “business as usual.”3

In LowGrow, as in the economy that it represents, economic growth is driven by net investment, which adds to productive assets, growth in the labor force, increases in productivity, growth in the net trade balance, growth in government expenditures, and growth in population. Scenarios of low growth, no growth, and even degrowth can be examined by reducing the rates of increase in each of these factors singly or in combination.

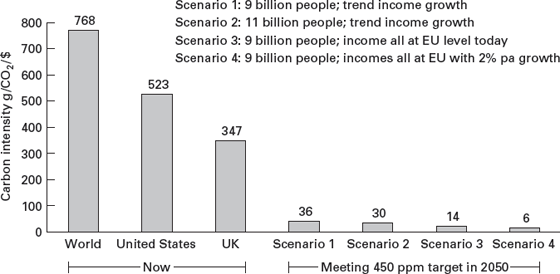

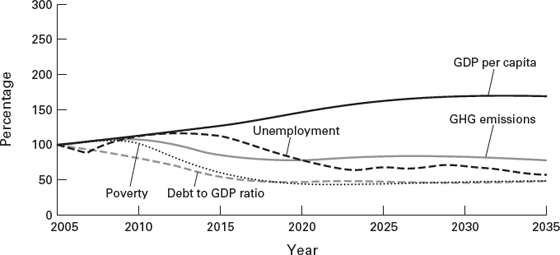

Figure 8.2 shows a “business as usual” scenario for Canada derived from LowGrow. Each of the five variables are indexed to 100 in 2005 so that changes in them can more easily be appreciated. In this scenario, where the future is projected to mirror the past, real GDP per capita more than doubles between 2005 and 2035, the unemployment rate rises then falls to end above its starting value, the ratio of government debt to GDP declines by nearly 40 percent as Canadian governments continue to run budget surpluses (which they were doing up to 2008), the Human Poverty Index rises due to the projected increase in the absolute number of unemployed people, and greenhouse gas emissions increase by nearly 80 percent.

Figure 8.2. Simulation of “business as usual” in Canada using LowGrow. Source: Adapted from Victor (2008).

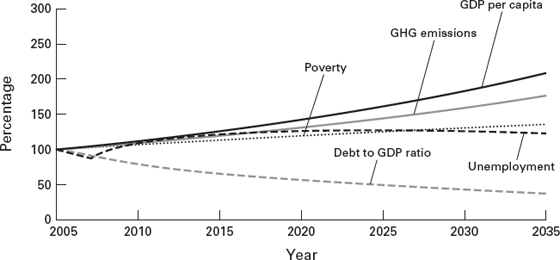

Figure 8.3 illustrates what happens to the economy if all of the growth drivers (i.e., net investment, increased productivity, increased government expenditure, a positive trade balance) are eliminated over ten years starting in 2010. The economy eventually reaches a steady state in terms of GDP per capita, but the situation is clearly unstable.

Figure 8.3. Simulation of instability in Canada using LowGrow. Source: Adapted from Victor (2008).

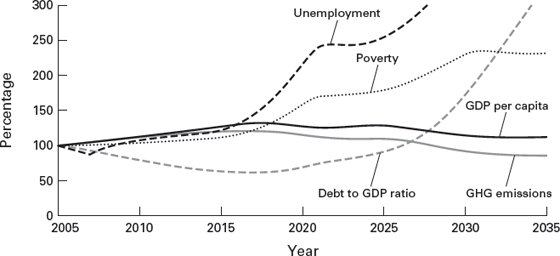

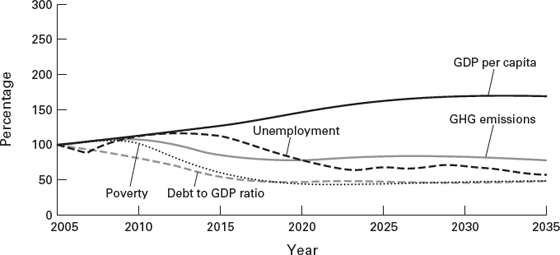

A very different scenario is shown in figure 8.4. Compared with the business-as-usual scenario, GDP per capita grows more slowly, levelling off around 2028, at which time the rate of unemployment is 5.7 percent. The unemployment rate continues to decline to 4.0 percent by 2035. By 2020, the poverty index declines from 10.7 to an internationally unprecedented level of 4.9, where it remains; the debt-to-GDP ratio declines to approximately 30 percent, to be maintained at that level to 2035. Greenhouse gas emissions are 31 percent lower at the start of 2035 than 2005 and 41 percent lower than their high point in 2010. These results were obtained by projecting slower growth in government expenditure, net investment, and productivity; a small and declining net trade balance; cessation of growth in population; a reduced work week; a revenue-neutral carbon tax; and increased government expenditure on antipoverty programs, adult literacy programs, and health care.

Figure 8.4. Simulation of a Canadian “steady-state economy” using LowGrow. Source: Adapted from Victor (2008).

In some respects, LowGrow broke new ground in terms of the question being addressed—that is, the possibility of prosperity without growth (Jackson 2009:134)—and in the modelling approach employed, which is a combination of system dynamics and Keynesian macroeconomics. In other respects, LowGrow simply pointed to the need for further, more ambitious, macroeconomic modeling.

For example, the simulations in LowGrow assume that the monetary policy of Canada’s central bank will succeed in keeping inflation at or below 2 percent per year. Beyond that, the financial system is not represented in the model. The material, energy, and land use links between the economy and the environment are dealt with in a very limited fashion. Energy-related greenhouse gas emissions are assumed to be responsive to a time-varying carbon price, and the forest stocks of Canada are simulated based on the demand for timber, regeneration, road building, and random disturbances representing risks from fire and pest infestations. These are only steps toward a more complete integration of the economy and the environment through material and energy flows and land use. LowGrow is also limited in its treatment of economic behavior. Consumption, investment, production, exports, and imports are modeled in a highly aggregated manner with, for example, no differentiation among economic sectors, products, and demographic groups, and in a deterministic manner without any allowance for the role of expectations and uncertainty.

One of the conundrums addressed in LowGrow is whether full employment is possible if labor productivity continues to rise without any increase in economic output. The “simple” solution to this problem is to reduce the length of the average work year. Then, the declining total amount of work required to produce the nongrowing economic output is spread among more, increasingly productive employees. In the scenario shown in figure 8.3, the average work year is reduced by 15 percent between 2005 and 2035, sufficient to more than compensate for the still-positive increase in labor productivity and reduce unemployment to levels not seen in over half a century in Canada.

However, should we assume that labour productivity will rise, even at a reduced rate, as we think about possible and desirable futures? As Jackson (2009) argued explicitly, an economy in which—beyond the satisfaction of basic material needs—economic activity is based around the provision of human and social services has much to recommend it. Health care, education, social care, renovation and refurbishment, leisure and recreation, the protection and maintenance of green spaces, and cultural activities are sectors that contribute positively to the quality of our lives; in addition, they are also less ecologically damaging than activities predicated on the throughput of material goods. However, what is perhaps most striking about such activities is that they are inherently labor intensive and have less potential for labor productivity growth.

An aging population will require labor-intensive services that do not lend themselves to significant increases in productivity without a considerable loss in quality as human contact is replaced by machines. Likewise, many of the tasks required to reduce the burden that humans place on natural systems, such as insulating buildings and rebuilding wetlands, can be labor intensive, again defying major productivity increases. The overall trend away from goods to services in advanced economies and its implications for reduced productivity growth, known as Baumol’s disease, further works against productivity growth at historical rates.

From a conventional viewpoint—in which labor productivity is seen as the foundation for a successful economy—this lack of potential for productivity growth looks distinctly unpromising. However, there is one clear and important advantage to these activities: they continue to employ people in meaningful jobs that improve people’s lives. In the face of rising unemployment and declining growth rates, this is a very significant advantage.

Jackson and Victor (2011) examined this issue with a simulation model based on three production sectors: a conventional sector defined by labor productivity growth (1 percent per year), which is typical of the UK economy over the last ten years; a green infrastructure sector, characterized by the same (1 percent per year) labor productivity growth as the conventional sector but based on renewable, low-carbon technologies and infrastructures; and a “green services” sector with slightly negative (–0.3 percent per year) labor productivity growth based on the expansion of community-based, resource-light, low-carbon, service-based activities.

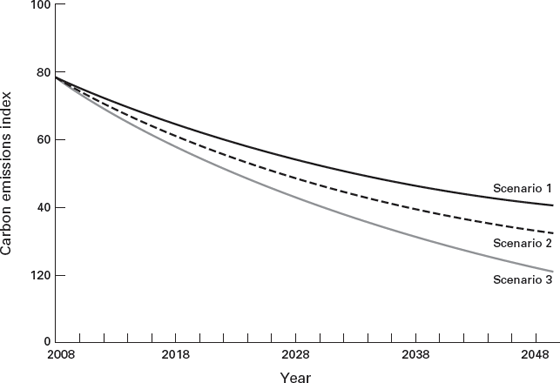

We developed three scenarios for the UK economy. The first involved simply expanding green technology. The second involved technological expansion with a reduction in working hours. The third included an addition to these two policies: a shift to “green services.” Each scenario was constrained to provide full employment, even though growth rates in each scenario were very different. Indeed, the latter two scenarios are both essentially degrowth scenarios. Carbon emissions from each of these scenarios are shown in figure 8.5. Only the third scenario, which includes the shift to green services, is able to achieve the UK’s 2050 carbon target.

This exercise illustrates the importance of considering the expansion of human and social services as the foundation for a new economy. It also shows how a vigorous policy aimed at expanding green technologies and supporting the green services sector can achieve high employment levels and ambitious carbon reduction targets, even without relying on substantial year-on-year growth rates.

Figure 8.5. Achieving the UK 2050 carbon emission reduction targets. Source: Jackson and Victor (2011).

Our initial foray into this intriguing set of issues pointed to the need for ongoing work in a variety of areas:

For instance, there is a need to understand the impacts on capital productivity, and to explore the relationship between capital productivity, resource productivity and labour productivity in more detail. The wider implications of these changes for capital markets will also need to be elucidated. More generally, this discussion raises the challenge of building a genuinely ecological macroeconomics, in which economic stability can be achieved without relentless consumption growth.

(Jackson and Victor 2011:107–108)

8. DEVELOPING A STOCK-FLOW CONSISTENT, ECOLOGICALLY CONSTRAINED MACROECONOMIC FRAMEWORK

Model building is a matter of identifying the boundaries and specifying the structure, key components, and principal behaviors of the system that is being modeled. Our current work uses system dynamics to build a national macroeconomic model that aims to address the following questions:

1. Is growth in real economic output still required in advanced economies to simultaneously maintain high levels of employment, reduce poverty, and meet ambitious ecological and resource targets?

2. Does stability of the financial system require growth in the “real” economy?

3. Will restraints on demand and supply, such as in anticipation of or in response to ecological and resource constraints, cause instability in the real economy and or financial system?

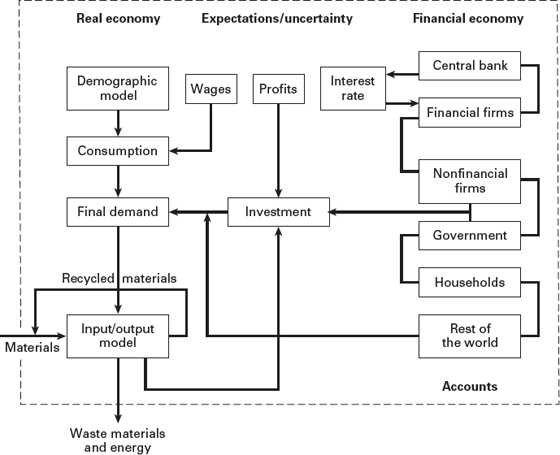

In the remainder of this section, we outline several key features of a new “stock-flow consistent” macroeconomic model that integrates an understanding of the real economy, the financial economy, and the ecological and resource constraints under which that economy must operate. A fuller description of our Green Economy Macro-Model and Accounts (GEMMA) framework (Jackson and Victor 2013) is beyond the scope of this chapter. Here, we present some of the principal features. A simplified schematic representation of GEMMA is shown in figure 8.6.

Figure 8.6. A simplified schematic diagram of GEMMA.

There are several main structural components in GEMMA. Following Godley and Lavoie (2006), GEMMA incorporates a complete and consistent set of accounts that track the financial flows relating to transactions in the “real” economy. As in the standardized system of national accounts for most countries, GEMMA records assets and liabilities, and changes to them, in balance sheets for six main sectors: financial corporations, nonfinancial corporations, the central bank, government, households, and the rest of the world.

GEMMA also includes a multisector input-output model of the real economy, which links the inputs of each of twelve production sectors to the outputs of each other sector so that the complete “supply chain” of each sector is represented. The input-output model includes material and energy flows between the economy and the environment so that changes in the real economy are automatically reflected positively and negatively in these flows (Victor 1972). Provision is also made for dynamic changes in the coefficients (e.g., input per unit of output, material/energy flows per unit of output) in the input-output model in response to investment.

Investment is critical to the evolution of any economy. In GEMMA, several categories of investments are distinguished, allowing for the generation of a wide variety of scenarios defined according to quantitatively and qualitatively different patterns of investment in the private sector.

GEMMA also includes a detailed demographic model of the size, age, and gender composition of the population. Demographic projections are useful for exploring the implications of an aging population for pensions, health care, and home services, which could pose a major challenge if growth is curtailed as part of a strategy to reduce the environmental burden of advanced economies. Demography is also related to consumption and investment—links that are also included in GEMMA in ways that permit consideration of a wide range of possible behaviors by actors in the economic system.

Current behavior is often influenced by expectations about the future. This point has been emphasized by Post-Keynesians, such as Paul Davidson (2011), in their interpretations of Keynes’s seminal writings of the 1930s. They highlight the role of uncertainty in decisions by households and corporations regarding asset allocation—in particular, about maintaining liquidity when faced with uncertainty. They have also examined the economic and financial implications of the need for corporations to make production decisions in advance of expected sales. When credit is denied, as in the financial crisis of 2007–2008 when many financial and nonfinancial corporations and households found themselves over leveraged, problems in the financial system led to serious difficulties in the real economy, from which we have yet to recover. We are making provisions in GEMMA for key decisions to be based on endogenously formed expectations.

Finally, we note that GEMMA is a model of national economies—in particular, national economies in developed countries. It is being designed to maximize the use of statistics from the Organisation for Economic Co-operation and Development, so that it can be applied to member countries without having to be built from the ground up each time. However, we live in a world with highly integrated economies; in many instances, the global implications—economic, social, and environmental—are of greatest interest. The challenge of modelling global systems in an integrated way is much greater than at the national level; attempts to do so have generally been rather highly aggregated and restricted in scope (Costanza et al. 2007). Progress is being made in this direction, but it will require a very considerable commitment of resources and a great deal of international cooperation to make the headway called for by the urgency of the situation.

9. LOOKING AHEAD

Many societies are being faced with a low-growth or no-growth economy, despite their policy intentions. In the future, some societies may choose not to pursue economic growth as a matter of policy, having understood that prosperity in its fullest sense can best be achieved through other means. Regardless of the rationale for a low- or no-growth economy, it is essential to consider its implications in advance so that the possible adverse consequences of such a change in direction can be avoided. Developing a macroeconomic framework through which to explore these possibilities will provide policymakers, scholars, and the engaged public with greater insight into these changes.

More positively, human well-being may improve as other objectives come to the fore, as suggested by the burgeoning literatures on happiness (Layard 2005) and equity (Wilkinson and Pickett 2009). Our intention in developing this work is to help illuminate these possibilities as well.

NOTES

1. The following two sections are loosely adapted from Jackson (2011) and Jackson (2009).

2. See Victor and Jackson (2012) for more details of this critique.

3. The following description of LowGrow is adapted from Victor (2013).

REFERENCES

Boumans, Roelof, Robert Costanza, Joshua Farley, Matthew A. Wilson, Rosimeiry Portela, Jan Rotmans, Ferdinando Villa, and Monica Grasso. 2002. “Modeling the Dynamics of the Integrated Earth System and the Value of Global Ecosystem Services Using the Gumbo Model.” Ecological Economics 41 (3): 529–560. doi: 10.1016/S0921–8009(02)00098–8.

Chote, Robert, Carl Emmerson, David Miles, and Jonathan Shaw, eds. 2009. The Ifs Green Budget. London: The Institute for Fiscal Studies.

Costanza, Robert, Rik Leemans, Roelof M. J. Boumans, and Erica Gaddis. 2007. “Integrated Global Models.” In Sustainability or Collapse? An Integrated History and Future of People on Earth, edited by Robert Costanza, Lisa J. Graumlich, and Will Steffen, 417–446. Cambridge, MA: MIT Press.

Davidson, Paul. 2011. Post Keynesian Macroeconomic Theory. 2nd ed. Cheltenham, UK: Edward Elgar.

Godley, Wynne, and Marc Lavoie. 2006. Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth. Basingstoke, UK: Palgrave Macmillan.

Jackson, Andrew, and Ben Dyson. 2012. Modernising Money: Why Our Monetary System Is Broken and How It Can Be Fixed. London: Positive Money.

Jackson, Tim. 2009. Prosperity Without Growth: Economics for a Finite Planet. London: Earthscan.

Jackson, Tim. 2011. “Societal Transformations for a Sustainable Economy.” Natural Resources Forum 35 (3): 155–164. doi: 10.1111/j.1477–8947.2011.01395.x.

Jackson, Tim, and Peter Victor. 2011. “Productivity and Work in the ‘Green Economy’: Some Theoretical Reflections and Empirical Tests.” Environmental Innovation and Societal Transitions 1 (1): 101–108. doi: 10.1016/j.eist.2011.04.005.

Jackson, Tim, and Peter A. Victor. 2013. The Green Economy Macro-Model and Accounts (Gemma) Framework: A Stock-Flow Consistent Macro-Economic Model of the National Economy under Conditions of Ecological Constraint. Guildford, UK: University of Surrey.

Keen, Steve. 2011. Debunking Economics: The Naked Emperor Dethroned? London: Zed Book.

Layard, Richard. 2005. Happiness: Lessons from a New Science. New York: Penguin Press.

Meadows, Donella H., Dennis L. Meadows, Jørgen Randers, and William W. Behrens. 1972. The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind. New York: Universe Books.

Minsky, Hyman P. 1986. Stabilizing an Unstable Economy. New Haven, CT: Yale University Press.

Minsky, Hyman P. 1994. “Financial Instability Hypothesis.” In The Elgar Companion to Radical Political Economy, edited by Philip Arestis and Malcolm Sawyer, 153–158. Aldershot, UK: Edward Elgar.

Piketty, Thomas. 2014. Capital in the Twenty-First Century. Translated by Arthur Goldhammer. Cambridge, MA: Belknap Press of Harvard University Press.

Ryan-Collins, Josh, Tony Greenham, Richard Werner, and Andrew Jackson. 2012. Where Does Money Come From? A Guide to the UK Monetary and Banking System. 2nd ed. London: New Economics Foundation.

Stern, Nicholas. 2007. The Economics of Climate Change: The Stern Review. Cambridge, UK: Cambridge University Press.

Turner, Graham M. 2008. “A Comparison of the Limits to Growth with 30 Years of Reality.” Global Environmental Change 18 (3): 397–411. doi: 10.1016/j.gloenvcha.2008.05.001.

United Nations Environment Programme. 2011. “Modelling Global Green Investment Scenarios: Supporting the Transition to a Global Green Economy.” In Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication. Accessed January 23, 2015. http://www.unep.org/greeneconomy.

Victor, Peter A. 1972. Pollution: Economy and Environment. Toronto: University of Toronto Press.

Victor, Peter A. 2008. Managing Without Growth: Slower by Design, Not Disaster. Cheltenham, UK: Edward Elgar.

Victor, Peter A. 2013. “Economic Growth: Slower by Design, Not Disaster.” In Encyclopedia of Environmental Management, edited by Sven Erik Jørgensen. Boca Raton, FL: CRC Press.

Victor, Peter A., and Tim Jackson. 2012. “A Commentary on Unep’s Green Economy Scenarios.” Ecological Economics 77: 11–15. doi: 10.1016/j.ecolecon.2012.02.028.

Victor, Peter A., and Gideon Rosenbluth. 2007. “Managing Without Growth.” Ecological Economics 61 (2–3): 492–504. doi: 10.1016/j.ecolecon.2006.03.022.

Wilkinson, Richard G., and Kate Pickett. 2009. The Spirit Level: Why More Equal Societies Almost Always Do Better. London: Allen Lane.

Wray, L. Randall. 2012. Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. New York: Palgrave Macmillan.