3

Social Security Disability Benefits: A Treasure That Really Has Been Buried!

During your working years when you paid into the Social Security system, did you know that you also bought a disability insurance policy? If you or a loved one suffers a disabling illness or accident, don’t forget the benefits due you!

And don’t skip this chapter just because you haven’t had a sudden illness or accident. Many disabled older Americans retire from work because their health won’t let them continue, but they don’t consider themselves “disabled” because their health problems have slowly worsened over time rather than occurred suddenly.

Let’s explode that dangerous myth right now: If your health prevents you from holding a job, you are disabled. Disabilities aren’t limited to sudden accidents or illnesses. You may be disabled by a condition that you’ve lived and worked with for years. Many people who retire from work do so for health reasons, and many of them should be able to cash in on Social Security disability benefits.

Why is this so important? Because Social Security disability benefits for many older Americans will be much higher than Social Security retirement payments. And these benefits are not only for a disabled worker; the entire family can benefit.

Even if you aren’t 62 and yet eligible for retirement checks, you may be able to collect substantial disability dollars; they are available at any age! If you qualify, you can receive the same monthly check that you would have received by retiring at age 65—100 percent of all retirement benefits.

EXAMPLE 1

You worked on a factory assembly line for as long as you care to remember. The job required you to be on your feet all day, and your arthritis finally got so bad that you just couldn’t handle the work anymore. So last year, at age 60, you retired.

Your full Social Security retirement benefit at 65 would be $800/ month; at age 62 you’ll become eligible to receive $640/month (80%; see Table 1.4) from Social Security retirement. There’s no way you’d be eligible for Social Security retirement any earlier than 62. But you can start collecting Social Security disability checks now for the full $800/ month!

As you can see from Example 1, Social Security disability benefits provide a Golden Opportunity to enhance your income. Unfortunately, every year millions of people who are eligible never apply, losing out on millions of dollars due them. Why? Most older Americans don’t understand the program. Don’t fall into the disability trap. Read on to learn if you are entitled to disability benefits; if you are, apply for them.

ELIGIBILITY

Our friends in Congress have created a complicated set of rules governing eligibility. Let’s start with a few facts about what is not required for Social Security disability benefits.

• You do not have to have been working. You may qualify even if you have been retired for a long time.

• You do not have to be 62, or any specific age for that matter.

• You do not have to be destitute. Wealth is not considered when looking at eligibility.

• You do not have to be disabled as a result of your work. This is not Worker’s Compensation—the disability does not have to be work related.

Now that we’ve told you what is not required, let’s look at what is required.

• You must have earned sufficient work credits under Social Security.

• You must be disabled.

That seems simple enough, right? Let’s take a closer look at these two requirements.

How Many Work Credits Do You Need for Disability Benefits?

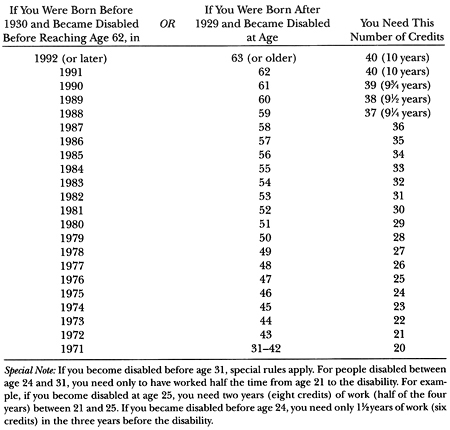

In Chapter 1, we talked about work credits for Social Security retirement benefits. The same general rules apply to disability coverage. You must have earned a minimum amount on the job to earn a “credit,” and you must have the required number of credits. You should have no trouble with work credits for disability benefits if you worked for a total of 10 years at jobs paying into Social Security, and you worked during 5 of the last 10 years.

Even if you haven’t worked a total of 10 years (40 quarters), you may still qualify, as shown in Table 3.1.

TABLE 3.1

Number of Credits Required for Disability Benefits

GEM: Part-time Work Can Pay Big-time Dividends

The requirement that you work for 5 of the 10 years prior to a disability can be an expensive trap. There’s an easy way around this, as you can see by comparing Examples 2 and 3.

EXAMPLE 2

You worked hard all your life, paying into the Social Security system for 30 years. You quit at 55 to enjoy your golden years. Unfortunately, at age 61 you suffer a disabling illness. Though you have far more than 10 years of work (40 credits), you won’t qualify for Social Security disability insurance because you have not worked during 5 of the last 10 years.

EXAMPLE 3

Let’s take the same facts as in Example 2. After you retire at age 55 from your full-time job, you continue to work part time. Your annual earnings barely exceed $2,280.

Why keep working? Those minimal earnings are enough to keep your Social Security disability insurance in force during your retirement. Earnings of $2,280 in 1992 get you four Social Security credits, the maximum number of credits you can get in a year. When the illness strikes at age 61, you become entitled to your full age 65 retirement benefits of $800/month.

Without the disability insurance, you would have received no benefits until age 62, and then only $640/month (80% of $800) for retirement benefits after that. By working part time during retirement, you saved yourself many thousands of dollars over the rest of your life.

As Example 3 demonstrates, a little part-time work after retirement can keep your disability insurance protection in force, and that can mean thousands of dollars to you in the event you become ill or injured.

* * *

What Is the Definition of Disability?

There is no easy, clear definition of a disability. The Government will say that you are disabled if you have a physical or mental impairment which both:

• Is expected to last (or has lasted) for at least one year or to result in death

• Prevents you from doing any “substantial gainful work”

How long must you be disabled to qualify? Uncle Sam expects you to be disabled for at least 12 months. Optimism about your recovery may cost you.

EXAMPLE 4

You fall down the stairs and do serious damage to your body, breaking a hip, both legs, and both arms. The doctor tells you that you should be back on your feet within nine months. In this case, you won’t qualify for disability benefits. Remember, the disability must be projected to last at least one year.

GEM: Pessimism Creates Optimism

A gloomy forecast about your health can help you get disability benefits, as Example 5 shows.

EXAMPLE 5

Let’s take the same facts as in Example 4, but your doctor predicts your disability will last over a year. With that dire prediction, you qualify for disability.

But forecasting disability is an inexact science; if it turns out the doctor was overly pessimistic, and you fully heal after nine months, the Government will come after you to get its money back.

* * *

What is substantial gainful work? To determine whether you can do “substantial gainful work,” the Government looks at whether you could earn at least $500/ month doing some type of work. Even if you can’t still do your former job, you won’t be considered disabled if you can earn $500/month doing any other job. Here’s the catch: the type of job you could do must exist in reasonable numbers in the region where you live, but there need not be any actual openings. This means that if your training and condition allow you to work as a bookkeeper, the Government will say you can do “substantial gainful work” even if you can’t find a bookkeeping job. Because you can do substantial gainful work, you won’t qualify for benefits. It’s not fair, but it’s the law.

If you are already working at a job that pays $500/month, you won’t be considered disabled—even if you are earning far less than you were before the disability.

GEM: Uncle Sam Is Crafty When It Comes to Hobbies

If you do volunteer work or spend time on a hobby or in classes at school, the Government may take these activities into consideration when determining your ability to do profitable work. You may want to put these nonprofit activities on hold for a while as you go through the disability application process.

GEM: Don’t Make a Gross Error—Use Net Earnings to Get Benefits

You can cheat yourself out of benefits by counting gross earnings rather than net income. You may qualify for disability benefits by reducing your earnings below $500/month. How can you do that? Subtract work-related expenses!

EXAMPLE 6

Suppose you are working as a bookkeeper, earning $525/month. That would probably make you ineligible for Social Security disability payments.

But you are confined to a wheelchair, for which you paid $360 ($30 a month if the cost is averaged over 12 months), and you pay $25 a month for prescribed medications that allow you to work. Deducting these amounts from your gross earnings reduces your net earnings to $470/month—below the $500 threshold. Now you should be able to pick up Social Security disability benefits.

Golden Rule: You can subtract from gross earnings the cost of items and services that enable you to work. Costs can be deducted even if you use the items in your daily living. Deductible items include:

• Wheelchair

• Cane

• Crutches

• Inhalator

• Pacemaker

• Prosthetic devices

• Respirator

• Braces

• Artificial limbs

• Special telephone amplifiers and readers for persons with hearing or seeing impairments

• Wheelchair ramps or railings at home if you work at home

• Drugs to control your impairment, reduce symptoms, or slow down the impairment’s progression

• Modifications to your vehicle

• Attendant care services, such as assistance in going to and from work, or an interpreter for the deaf

• One-handed typewriters

• Braille devices

• Expendable medical supplies (such as bandages)

• Costs for keeping a guide dog

When you make monthly payments for a deductible item (such as rental payments, installment payments, payments for services), you can subtract the monthly costs from your monthly income. If you pay a one-time cost, you may either deduct the whole amount that month or deduct 1⁄12 each month for a year.

* * *

Listed disabilities. Deciding whether an individual can do “substantial gainful work” is not an easy task. To simplify the job, Uncle Sam has created a list of disabling conditions that he says are so bad anyone with one of these must be unable to do substantial gainful work. In other words, if your disability is included in the Government’s List of Disabling Conditions, you should be considered disabled (unable to work) for purposes of getting Social Security disability benefits. Table 3.2 lists some of the more common of these. A much more detailed listing is available in Appendix 1 to Subpart P, Volume 20, of the Code of Federal Regulations, Part 404, available in your library.

Even if your specific impairment is not listed in Table 3.2, you should be considered disabled if the severity of your health problems, taken together, equals or passes the severity of these listed impairments. In measuring the severity of your conditions, and comparing them to the listed impairments, the Government looks at your ability to:

• Do physical activities, such as walking, standing, sitting, lifting, bending, pushing, or pulling

• See, hear, or speak

• Understand, remember, and respond to instructions

• Exercise judgment

• Deal with changes in a routine work setting

TABLE 3.2

List of Disabling Conditions

1. Diseases of the heart, lungs, or blood vessels that have resulted in serious loss of function as shown by medical tests and that produce a severe limitation (like breathlessness, pain, tiredness) in spite of medical treatment

2. Severe arthritis causing recurring inflammation, pain, swelling, and deformity in major joints so that the ability to get about or use your hands is severely limited

3. Mental illness resulting in marked constriction of activities and interests, deterioration in personal habits or work-related behavior, and seriously impaired ability to get along with other people

4. Brain abnormality or damage that has resulted in severe loss of judgment, intellect, orientation, or memory

5. Cancer that is progressive and has not been controlled or cured

6. Digestive system diseases resulting in malnutrition, weight loss, weakness, and anemia

7. Disorders that have resulted in the loss of a leg or that have caused the limb to become useless

8. Loss of major functions of both arms, both legs, or a leg and an arm

9. Serious loss of function of the kidneys

10. Total inability to speak

Is blindness a disability? Although blindness is not included in the list of disabilities in Table 3.2, it surely can be a disability that prevents you from doing “substantial gainful employment.” And qualifying for disability benefits based on blindness is made a little easier under some special rules.

You may be considered blind if your vision can’t be corrected to at least 20/200 in your better eye, or if your visual field is 20 degrees or less, even with glasses or contacts. A person who is blind may qualify for benefits with earnings (or potential earnings) of as much as $850 a month (in 1992).

GEM: Uncle Sam Has a Blind Spot—Apply for Disability Even with Higher Earnings

If you are earning more than $850 a month, you will not qualify for Social Security disability benefits even if you are blind. But apply anyhow! You’re not wasting your time. In Chapter 1 we explained that the amount of Social Security retirement benefits is based on an average of your earnings over the years. If you had higher earnings before becoming blind, and lower earnings after, the lower earnings (though more than $850 a month) would drag down your overall average, and so cause a reduction in your retirement benefits. But if you apply for Social Security disability benefits based on blindness, you can increase your future Social Security retirement benefits; blindness triggers an exception to the normal averaging rules so that your average earnings should not be reduced because of lower earnings in years when you are blind.

* * *

We have explained that in most cases you will not be considered disabled if you can perform any substantial work, even if you can no longer continue your prior job. The test for disability if you are blind is a little more relaxed. If you are blind and 55 or older, you are considered disabled if you are unable to work in a job requiring skills or abilities similar to those involved in your prior employment. The Government will not look to see if you could get a job in a different line of work.

Age, education, and work experience. If your impairment is listed in Table 3.2, or if it is as severe as those listed in the table, then you should be considered disabled. That’s it—the Government won’t have to get involved in evaluating nonmedical factors that may further limit your ability to work.

But if your condition is not listed in Table 3.2 or is not as bad as those listed impairments, you’re not out of luck. You may be able to prove you are disabled by showing that your physical or mental impairment and your age, education, and past work experience together render you unable to work. The Government must consider the combined effect of all your physical and mental impairments; though any one condition may not be enough, the total impact might be disabling.

EXAMPLE 7

You had been assembling electronic products in a factory. You handled tiny transistors and wires, and the work required great dexterity.

Working with a saw at home one day, you accidently sliced three of your fingers, losing most use of them. You no longer could continue your job. Though your impairment is not listed in Table 3.2, you may still qualify as disabled, based on your age, education, and past work experience. For instance, if you are 50 and otherwise in good health, the Government will probably deny disability coverage and require you to train for other work. But if you are 62, you should be able to convince the Government that you are too old to start retraining for a completely new field, and so you should get disability benefits.

What Are the Grids?

To provide some consistency in decision making, the Government adopted Medical-Vocational Guidelines, also known as “Grids.” If you can’t do heavy work—lifting or carrying objects of up to 50 pounds—and you can’t return to your former job, then the Government probably will use the Grids to decide whether your disability makes you unable to do substantial gainful work.

The Grids are made up of three tables, excerpted in Appendix 7 as Tables A, B, and C. As you can see from the tables, the less physical ability you have to work (carry and lift), the older you are, the less education you have, and the less skilled you are, the more likely you will be considered disabled.

The three tables are divided by physical ability. Table A is for people who can do, at most, only sedentary work, which generally involves sitting for as much as six hours a day, though it may involve occasional walking or standing. No lifting of more than 10 pounds at a time is usually required.

Table B is for people who can do light work, which generally requires a good deal of walking or standing, or sitting and pushing or pulling arm or leg controls. The type of work often involves lifting or carrying up to 10 pounds, with occasional lifting up to 20 pounds, but not more. Someone capable of light work will usually be considered capable of sedentary work too, unless there is some reason why not (like an inability to sit for long periods).

Table C is for people who can do medium work, which generally involves frequent lifting or carrying of objects weighing up to 25 pounds, and occasional lifting up to 50 pounds. Work may include grasping, holding and turning objects, and also bending or stooping.

To determine whether you are disabled based on the Grids, first find the table that describes the type of work you can do (sedentary, light, or medium). Then find the line that best describes your age, education, and previous work experience. Once you have located your place in the table, you can determine whether or not you are disabled.

GEM: Go “Lite”—Pick the Table Requiring the Least Physical Activity

The less physical work you can do, the more likely you’ll be considered disabled. Table A, limited to sedentary work, has eight opportunities to be disabled; Table B, for people who can do light work, has only five chances; and Table C, for people with the capacity for greater physical activity, contains only three situations in which a person would be called disabled. See Example 8.

EXAMPLE 8

You worked as a crate loader in a warehouse for your entire working career. Your education was limited to the 10th grade. Now that you are 53, the heavy lifting has taken its toll and you can no longer continue the job. Can you cash in on disability benefits?

If you can no longer lift objects of more than 10 pounds without terrible pain, you find in Table A that you would be considered disabled (based on your age, education, and work experience). But if you can lift up to 50 pounds, you’re into Table C, and that table says you are not disabled.

GEM: S-Age Advice—Avoid Disqualification Due to Age

Age is important when determining disability. The older you are, the more likely you’ll be considered disabled. The Grids are split into four general age categories: 49 and under; 50–54; 55–59; and 60 and over. If you are within a few months of the next age category listed in the Grids, and using the next category would help you qualify for disability benefits, the Government should give you the “benefits of the doubt.” See Example 9.

EXAMPLE 9

You are capable of doing light work; your education stopped at the 10th grade; and your prior work experience was in a semiskilled job, but the job skills aren’t transferable. You are only a couple months short of your 55th birthday.

Looking at Table B, you would not be considered disabled as a 54-year-old, but you would at age 55. Since you are so close, the Government should let you qualify now.

The purpose of the age differences in the Grids makes some sense: the Government assumes that the older you get, the more difficult it is to adapt to a new type of job. But even if you are too “young” to qualify for benefits under the Grids, you can still get benefits by presenting to the Government other evidence of the difficulty you would have in learning a new position. Such evidence includes occupational tests showing unusual physical deterioration (reflexes, senses, etc.) and I.Q. testing that shows less ability to adapt than others your age would have.

GEM: Transferability Means No Disability

If your prior work experience gave you skills that are transferable (usable in other types of work), you will not be considered disabled. Tables A, B, and C all disallow disability benefits for someone with transferable skills, regardless of age or education.

To qualify for benefits, you want to provide evidence that your skills from former employment were so unique or specialized that they aren’t useful in other types of work. For example, skills you picked up in mining, farming, fishing, music, dancing, professional athletics, or space exploration are usually not transferable to other types of jobs.

Note, however, when looking at your prior work experience, the Government can only go back 15 years; work experience before that time should not be considered.

GEM: Talents Aren’t the Same as Skills

The greater your skills, the less likely you’ll be able to get disability benefits. But just because you have a talent or aptitude doesn’t mean you have a skill. Skills must be learned; talents are innate. And talents should not be considered in disability decisions.

For example, courts have said that skills include the ability to do clerical work, prepare reports, read blueprints, operate a cash register, and supervise workers; all these can be learned. But manual dexterity and independent judgment, by themselves, cannot be billed as skills.

* * *

Getting Around the Grids

Let’s say that the Grids show you can work, though you really are disabled. The key to receiving benefits is to convince the Government that the Grids don’t fairly apply to you and that other factors should be considered. How can you get out of the Grids? Here are a couple of gems.

GEM: Escape Grid-Lock and Show That the Grids Shouldn’t Apply to Your Disability

The Grids are based primarily on how much you can lift or carry; your goal is to show that in your case Grids are unfair because the nature of your disability doesn’t affect your physical capacity to lift or carry. For example, mental problems, sensory or skin problems, speech, hearing or sight impairments, limitations on hands or fingers for fine activities, alcoholism, side effects of medication, postural problems, pain, allergies or intolerance to things in the environment, and limits on your ability to balance, stoop, climb, kneel, crouch, crawl or reach all can make you unable to work, though you may still be able to lift or carry heavy objects. For that reason, all of these impairments can get you out of the Grids. But you must take special care to provide as much evidence as possible of these disabilities. See Example 10.

EXAMPLE 10

Your back is strong, and you can lift 50 pounds without much trouble. But you’ve got constant, severe headaches that prevent you from holding any job. The pain makes it impossible for you to concentrate, remember, and respond to problems. Even though the Grids say you are able to work, you should be considered disabled.

GEM: Years of Hard Labor Pay Off!

You must be considered disabled if you’ve put in 35 years or more of hard, unskilled labor and can no longer continue. This is true even if you can still do less strenuous work. Don’t worry about the Grids—this one is automatic (unless you have an education that allows you to get a job that has little physical exertion).

* * *

Family Disability Benefits

The family of a worker who is disabled may also collect from Social Security. When a breadwinner is disabled, the following family members become eligible for Social Security benefits:

• Spouse age 62 or older

• Spouse, any age, caring for child under 16 or disabled

• Unmarried child under 18 (19 if in high school full time)

• Unmarried child, any age, if disabled since before becoming 18

HOW MUCH SHOULD YOU GET?

If you qualify for Social Security disability payments, how much should you get? The Government will tell you an amount. But as we warned in regard to Social Security retirement benefits, there could be a mistake—and your failure to catch it could cost you a pot of money.

Check Earnings Record and Correct Mistakes

Your first step is to get your Personal Earnings and Benefit Statement (PEBES) from the Social Security Administration. The form will explain your disability benefits. You can get your PEBES request forms by calling the Social Security Hotline, (800) 772-1213. Fill out the form and send it to the address given.

Once you get your PEBES, check your earnings record (here) and correct any mistakes (here). Social Security disability benefits, like retirement and survivor benefits, are based on your earnings over the years. A mistake in your earnings record could cut your benefits drastically.

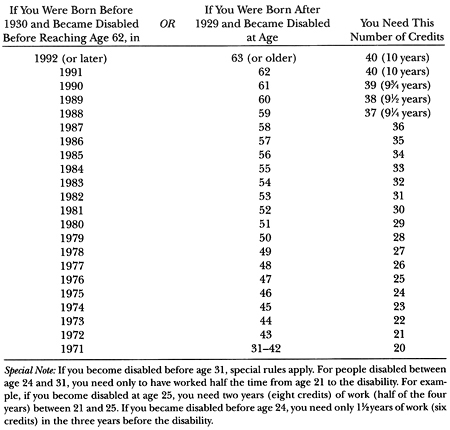

Figure Your Benefits

Even if the earnings record appears accurate, you’re not done. The Government may have miscalculated benefits. Table 3.3 lists estimated disability benefits. Check your benefits against the estimates in this table.

TABLE 3.3

Approximate Monthly Disability Benefits If You Became Disabled in 1992

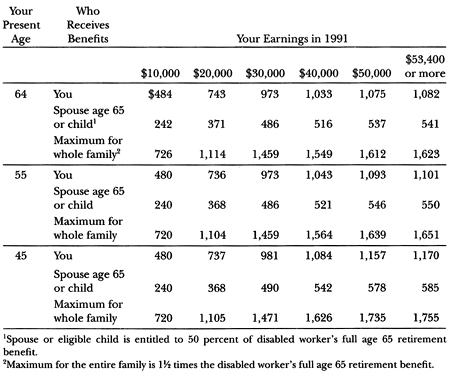

The figures in Table 3.3 are only estimates. They assume you have worked steadily until becoming disabled, and that you have received average pay increases. Disability benefits are figured as a percentage of your full retirement benefits at age 65. The percentages are listed in Table 3.4. For a more accurate estimate of your actual benefits, turn to Appendix 8. Note also that the total benefits a family can receive is limited under the Maximum Family Benefits (MFB) rule, described here.

TABLE 3.4

Family Disability Benefits

Who Gets Benefits |

|

% of Your Full Age 65 Retirement Benefit |

|

||

You1 at any age |

|

100 % |

Your spouse age 65 |

|

50 |

Your spouse age 64 |

|

45.8 |

Your spouse age 63 |

|

41.7 |

Your spouse age 62 |

|

37.5 |

Your child2 |

|

50 |

Your spouse, any age, caring for young or disabled child3 |

|

150 |

|

||

1This assumes you are the disabled individual.

2A child will be eligible for benefits if unmarried and under 18 (19 if in high school full time). An unmarried adult child may be eligible at any age if disabled since before becoming 18.

3The child must be under 16 or disabled.

HOW DO DIFFERENT GOVERNMENT “BENIES” FIT TOGETHER?

How do Social Security disability benefits fit together with Medicare? Supplemental Security Income (SSI) disability benefits? Early retirement benefits? Worker’s Compensation benefits? Veterans’ benefits? Private disability insurance? Since you generally can receive only one of these benefits, which should you take? The answers can reveal some hidden treasures.

Social Security Disability and Medicare

Most people think Medicare is only for those 65 years and up. But one important—often critical, and overlooked—disability benefit is that you can also get Medicare, regardless of your age. The value of the Medicare coverage may be worth more to you than the disability cash payments!

You can get Medicare hospital insurance protection (Part A) after you’ve been entitled to Social Security disability for 24 months (shorter if you have end-stage renal disease). Those months don’t have to be in a row; they don’t even have to be for the same disability. You may also enroll in Medicare medical insurance (Part B); you must pay for Part B, as does everyone else, but that’s another Golden Opportunity you shouldn’t miss. (Medicare is discussed in detail in Chapter 4.)

Disability vs. SSI Benefits

Supplemental Security Income (SSI), a program designed to provide a safety net for low-income people (discussed in Chapter 10), also pays disability benefits. Sometimes the SSI benefits are higher than Social Security disability payments, sometimes not. You can’t double up, so go with the most you can get.

EXAMPLE 11

Suppose that, based on your work record, your Social Security disability checks would amount to $300/month. Not bad, but let’s see how you’d do under SSI.

SSI payments are not dependent on your work record. Instead, you are entitled to a standard amount based on your other sources of income (see here). If your SSI checks would be higher than $300/month, opt for SSI; otherwise, take Social Security disability.

When comparing amounts available under Social Security disability and SSI, remember to consider reductions. SSI payments will be reduced by all sorts of income; Social Security disability will be reduced only by certain benefit payments, such as Worker’s Compensation (here).

EXAMPLE 12

Your SSI benefits would be $422/month; Social Security disability would pay $300/month. But the interest income you receive reduces the amount of your SSI to $200/month, while the extra income has no impact on Social Security disability. So the decision is clear: you’ll take Social Security disability.

Golden Rule: When you have no outside income to reduce SSI benefits, choose SSI; when your extra income reduces SSI benefits, choose Social Security disability.

When comparing Social Security disability and SSI, also keep in mind that with Social Security disability benefits your dependents may be entitled to some money. Under SSI, you are the only one entitled to benefits. So lower Social Security disability payments for you might mean more for your family.

Social Security disability may get you Medicare, but SSI is tied directly into Medicaid eligibility in many states. Medicaid (discussed in Chapter 11) provides very important medical coverage—even broader than Medicare. If you qualify for SSI, you will probably get Medicaid, too.

SSI imposes income and wealth limits on eligibility. You can qualify only if you meet those requirements. Social Security disability imposes no similar requirements. But for Social Security disability, you must have worked for a specified period to qualify (not the case for SSI).

GEM: Instant SSI Coverage for Certain Impairments—Apply Immediately!

If you have one of the following impairments, apply for SSI right now:

• Amputation of two limbs

• Amputation of a leg at the hip

• Total deafness

• Total blindness

• Bed confinement, or immobility without a wheelchair, walker, or crutches due to a long-standing condition

• Stroke more than three months ago, which has caused continued difficulty in walking or using a hand or arm

• Cerebral palsy, muscular dystrophy, or muscle atrophy, which has caused difficulty in walking, speaking, or coordination

• Diabetes, which has caused amputation of a foot

• Down’s syndrome

• Mental deficiency that causes the individual to require some special care and/or supervision

• AIDS

Why? The Government will start your SSI benefits immediately—even before making any final decision on your application. Payments for these impairments can be made for three months. If the Government later decides that you were not disabled, you keep the payments—the Government can’t ask for its money back! See Example 13.

EXAMPLE 13

You have become totally deaf. Following our suggestion, you immediately apply for and begin receiving SSI benefits of $300 a month. After looking closely at your health, the Government decides you’re not disabled. You get to keep the SSI payments already received.

GEM: Apply for SSI Now Even If Social Security Disability Will Pay More

Even if your benefits under Social Security disability will be higher than SSI, apply for both at the same time. Why? Social Security disability won’t cover the first five months from onset of the disability, while SSI will. After the five months expire, your Social Security disability should then begin.

* * *

Social Security Disability vs. Early Retirement Benefits

Let’s say you are 62 and could qualify for either Social Security disability or retirement benefits. Since you can’t take both, which is better? In almost all cases, you’ll put more dough in your pocket under the disability program than with early retirement benefits. Here’s why: At age 62, you’ll get Social Security retirement checks only equal to 80 percent of your full age 65 retirement benefits, but you’ll get 100 percent of your age 65 retirement benefits with Social Security disability. Plus—and this is a huge plus—two years after starting disability you get Medicare. Otherwise, you wouldn’t get Medicare until age 65!

EXAMPLE 14

At age 62, you have the option of taking early retirement or disability payments under Social Security. Your full age 65 retirement (benefit) is $800/month.

Early retirement will pay you $640; disability pays you the full $800. At age 64, you also get Medicare—if you take disability. There’s no Medicare until age 65 otherwise. Tough decision? No way!

GEM: At 62, Apply for Both Disability and Retirement

Even though Social Security disability pays more than early retirement, apply for both at 62. Why? Because Social Security disability won’t pay for the first five months, while early retirement will. So start with Social Security early retirement for five months and then get the higher disability payments.

If you already started taking early retirement benefits, can you switch to disability payments? The answer is yes. Would it make sense to do that? Yes!

GEM: Make the Switch to Disability Even After Starting Early Retirement Benefits

If you are disabled, normally you are entitled to 100 percent of your full age 65 retirement benefits (Table 3.4). But if you had already started taking early retirement benefits, your disability payments will be reduced by .556% for each month you received early retirement benefits. But even reduced Social Security disability payments will be higher than early retirement benefits. Example 15 shows how this works.

EXAMPLE 15

You retired at 62, taking early retirement benefits of $640/month (80% of $800). One year goes by, and then you suffer a disabling illness. If you switch to disability benefits, you’ll receive 93 percent of your full age 65 retirement amount (the 7% reduction is due to the 12 monthly retirement benefit checks you received: 12 × .556%).

Should you switch? Yes. The $744/month (93% of $800) is a lot better than $640/month! Switching to Social Security disability will put money in your pocket.

* * *

Social Security Disability and Worker’s Compensation Benefits—Both for the Asking!

If your disability is work related, you may qualify for both Worker’s Compensation and Social Security disability benefits. If so, you may be allowed to double up benefits, at least partially.

The Worker’s Compensation benefits—paid under a federal, state, or local public law—will probably offset at least a portion of your Social Security disability payments. Total benefits from these two sources cannot exceed the higher of:

• 80 percent of your earnings before the disability

• Your Social Security disability benefit

When figuring your earnings before the disability, you would usually use the higher of either:

• The average earnings from employment on which you paid Social Security taxes during the five highest paid consecutive years after 1950

• The highest single year of earnings during the five years before you became disabled

EXAMPLE 16

Your Social Security disability benefit is $600/month, and Worker’s Compensation will pay $500/month. Your earnings before the disability were $1,300/month. Do you get to keep both checks?

The answer is no, but you will get to keep all of the Worker’s Compensation and most of the Social Security disability payments. With earnings before the disability of $1,300/month, 80% is $1,040—that’s the total you can collect. Worker’s Compensation pays $500/month, leaving you to keep $540/month of your Social Security disability payments.

GEM: Get Full Benefits from Both at 65, and Maybe 62

If you first became disabled after February 1981, the offset we just described continues until you reach age 65. After you reach 65, you get to keep all of your Worker’s Compensation and all of your Social Security benefits. If you first became disabled in February 1981 or before, you can get full benefits even sooner—at age 62!

* * *

Social Security Disability, as Well as Veterans’ or Private Disability Benefits

You can keep your full Social Security disability benefits plus your entire disability payments from veterans’ benefits; private pension or insurance; and federal, state, and local government employment benefits. Unlike Worker’s Compensation, these benefits will not reduce your Social Security disability payments.

TAXES AND EARNINGS

In Chapter 1, we told you about the Government’s secret tax trap, which eats away at your Social Security retirement and survivor benefits. The same tax trap can “disable” your disability benefits. However, our gems to protect retirement benefits also can cut the taxes on your disability payments.

Earnings will reduce your Social Security retirement and survivor benefits. Supposedly, earnings will not reduce Social Security disability payments—at least that’s what they tell you. In truth, you must be careful; working may be hazardous to your health.

Earnings May Cut Your Income

If you get a job paying less than $300/month, the added income won’t affect your Social Security disability payments. If your job pays over $500/month, you almost surely will lose all of your benefits—not because of any reduction but because you will no longer be considered disabled. With earnings between $300 and $500/month, the Government may look closely at your impairment, age, education, and work experience to determine whether you should continue receiving benefits.

EXAMPLE 17

Your days of loading boxes in the warehouse are over; your back just couldn’t take it any longer. The Government has been sending you $800 a month in Social Security disability benefits.

But $800 doesn’t go very far, so you got yourself a part-time job fixing bicycles in the local hardware store. The job pays $50 a week, keeps you busy, and lets you enjoy life a little more too. Don’t worry—your Social Security disability checks are safe.

GEM: Never Take a Job Paying More Than $300 a Month, as Long as It Pays Less Than Your Benefits

If you take a job paying more than about $300 a month, the job could cost you a lot of money, as Example 18 shows.

EXAMPLE 18

You get a job paying $550/month. Since that’s over the $500/month benchmark, the Government will say you are no longer disabled and will cut off your benefits.

You were receiving Social Security disability payments of $900/ month—$350/month more than your wages. By finding a job and getting off the Government rolls, you suffer a $350/month income loss!

The system is crazy. Uncle Sam should provide an incentive for people to go back to work. Yet the system works just the opposite, as Example 18 shows. Don’t take a job for less than the amount of your Social Security disability benefits, or you may be in for a big cut in your income.

GEM: Spouse’s Earnings Can Provide Big Boost

Your husband or wife can work and earn as much as possible, without reducing your benefits at all! As long as you are getting disability payments based on your own work record, your spouse’s earnings won’t affect your benefits.

* * *

Trial Work Period

You may want to try going back to work, but are afraid that you might not be able to continue for long. If you start work, and earn more than $500 a month, will you immediately lose your benefits? The answer is no. Uncle Sam provides a nine-month trial work period. This is a free trial offer—nine months on Uncle Sam, with no money down. During that trial period, you get your disability benefits and your wages (even if over $500 a month).

EXAMPLE 19

You are getting itchy to return to the working world, and you found a job doing filing in a local doctor’s office. You’re not sure how long you’ll be able to stand on your feet before your back starts aching, but you’d like to give it a try. If it works, you could make $700/month (a lot more than your current disability payments of $500/month). Since you don’t know if you’ll be able to sustain the job, though, you don’t want to lose your Social Security disability benefits. Should you sit home? No.

Contact your local Social Security office and tell them you are starting a trial work period. You will continue to receive full benefits for nine months, plus your wages. If you make it for that long, your benefits will terminate. But you don’t have to repay benefits received during the trial period.

To qualify for a trial work period, you must tell the Social Security office. You have a right to a trial work period, but only if you notify them in writing that you’re taking it. You get only one trial work period per disability (if you recover and later suffer a different disability, you get another trial period). So use it wisely!

GEM: Trial and Errors: Months Need Not Be Consecutive

The nine months that you try your hand at working, while keeping your Social Security disability benefits, do not have to be consecutive and do not have to be for the same employer. You can work for a couple of months, take some time off, and work for a few more months. Only the months you actually work and earn more than $200 a month count against your trial period.

EXAMPLE 20

In January 1993, you take a job in a department store. You earn $500 the first month and $500 the second month. But you then must quit because it’s too hard on you.

For the next three months, from March through May, you look around for another job you might be able to handle. On June 1 you start work in a music store, earning $350/month; you continue that job through September. But again, you can no longer take the pain and must quit at the end of September. After one month off, you get a job making purchases for a day care center. The job pays only $100/month, but at least you can do it. You work there in October, November, and December.

All this time, you’ve been receiving your Social Security disability benefits. You’ve used only six months of your trial work period: January, February, June, July, August, and September. The months you were off and the months you earned less than $200 don’t count and are not subtracted from your nine trial months.

GEM: Multiply Trial Months

When figuring your trial months, count only trial work months during the last five years. Months worked more than five years earlier won’t count against you. See Example 21.

EXAMPLE 21

Let’s take the same facts as in Example 20. You had six trial work months in 1993. If you had worked five months in 1992 as well, you’d be in trouble. You would have exhausted your trial work period in July 1993. But if you had worked five months in 1987, those months would not count against you.

GEM: Put Yourself on Trial at the Start of a Month

You will use up one of your nine trial months each month you work and earn $200, even if you work only a few days of the month. As Example 22 shows, a short delay in starting work could provide you with some extra income.

EXAMPLE 22

You start work the last week of January, and you earn $250. The next eight months, February through September, you earn $1,000/month. During each of these months, you receive your Social Security disability benefits of $500/month.

Starting in October, your benefits are cut off because your nine trial months have expired. In October, you receive $1,000 earnings, but no more disability payments. The total—benefits and earnings—from January through October is $13,750.

What if you had waited a week to start your job? You would have received your $500 benefit check in January, but no earnings. For the next nine months, February through October, you’d collect $1,500/month ($1,000 earnings and $500 benefits).

Let’s compare: During the same 10 months, you would have received $14,000, even though you waited a week to start your job. In other words, the one-week delay would have saved you $250. So when working trial months, always start at the beginning of a month. You’ll come out ahead.

GEM: If There’s Pain You Can Regain Benefits

Let’s say you return to work and you complete your nine-month trial period, earning more than $500 a month. Disability benefits will then end. But work soon gets the better of you, your condition worsens, and you’ve got to stop working. Do you have to go through the whole Social Security disability qualification process again?

Thankfully, no! For 36 months following the end of your trial work period you get special treatment. You are entitled to disability benefits for each and every month in which you fail to work and earn $500—and all you have to do is ask! You do not have to reapply or go through a five-month waiting period. Just notify the local Social Security office, in writing, that you’re not working, and the checks should start flowing.

GEM: Get Three Extra Months of Benefits

At the end of your trial work period, your work will be looked at by Uncle Sam to see if you should stay on disability benefits. If you are earning less than $500 a month, you should be allowed to continue your benefits. If your earnings are more than $500 a month, benefits will be shut off. But you should get three more months of benefit checks (following the end of the nine-month trial period). If Uncle Sam “forgets,” remind him!

APPLICATION

If you believe you may be entitled to Social Security disability insurance benefits, reading this chapter isn’t enough—you must apply. Social Security disability benefits are not automatic.

The application process for disability benefits is much more complicated than it is for retirement or survivor benefits. Your application must be in writing on an official form provided by the Social Security Administration. You can get a form by calling or stopping in to your local Social Security office. Personnel in the Social Security office are usually quite willing to help you fill out the application, and you should take advantage of their assistance. In some cases, Social Security personnel may even come to your home or hospital room.

You will need the information listed in our Checklist, Appendix 6. In addition, prepare a list and description of:

1. All physical and mental problems that cause you to be disabled. (Don’t omit “hidden” impairments, like alcoholism and depression.)

2. Names, addresses, and telephone numbers of all doctors, psychologists, caseworkers, hospitals, clinics, and other institutions that treated you, and the approximate dates of treatment. Even better, get your medical records!

3. Current medications, noting side effects, and any devices needed to assist you (wheelchairs, cane, etc.).

4. Names and addresses of people who know of your disability and might be witnesses, if necessary (i.e., spouse or roommates who live with you; friends who help with transportation and shopping).

5. Names and addresses of your employers during the last 15 years.

6. The tasks you performed in each prior job.

7. Dates of any military service.

8. Dates of marriages.

9. Any other benefits you receive (or expect to receive) because of your disability. Include claim numbers.

10. Educational background.

11. Typical daily activities.

The Government will usually require an interview as part of the application process. Bring the information listed above and in Appendix 6. To help you organize your thoughts and prepare the application properly, first fill out our Disability Planning Questionnaire in Appendix 9. If you decide to consult an attorney, it will also help the lawyer focus his or her efforts and to prepare your best claim or appeal. (See here to decide when you need a lawyer.)

When you are preparing the information for your disability claim, don’t be overly shy or proud. While it is sometimes very hard to describe your health problems to a stranger—particularly federal bureaucrats—you shouldn’t hold back. Failing fully to describe your impairments may cause the Government to say you are not disabled.

As you describe your disability, don’t just focus on “exertional” impairments, such as problems you may have lifting or carrying. Consider postural limitations, mental illness, seizures, loss of feeling in a hand, depression, and anything else that prevents you from working.

GEM: Don’t Exaggerate Prior Work Experience

If you were a janitor, don’t describe your position as a “sanitation engineer”; if you were a secretary, don’t call yourself an executive assistant. While those descriptions might help when you’re applying for a new job, they can only hurt your chances for disability benefits. Remember, the Government will consider your transferable skills when deciding whether there is any substantial work you can do. The more experience you appear to have, the less likely you’ll be considered disabled.

* * *

Do your homework before applying. By making life as easy as possible for the Government bureaucrats, you also help yourself. The more facts you can bring to the interview, the better off you’ll usually be. For example, rather than just identify the hospital at which you were treated, get the medical records. Without medical substantiation, your impairments will not be considered.

GEM: Get a Letter from Your Doctor

Very often, a good, descriptive letter from someone who treated you (doctor, psychologist, nurse, caseworker) can be very useful. Unfortunately, if you simply ask “Could you please write a letter about my disability?” you may not get a very helpful response. Give your physician a specific prescription for what to include in the letter:

1. A detailed description of all of your ailments.

2. A statement of how long the ailments have lasted and are expected to continue.

3. A prognosis as to whether your ailments are stable or worsening.

4. His/her view of how your ailments affect daily activities and work ability.

5. An explanation of the tests and examinations upon which these conclusions are based.

6. A list of dates when examinations or tests occurred.

7. A description of your symptoms, including places, degree, and regularity of pain.

8. A list of the medications you are and have been taking, including the reason for the medication, the dates prescribed, the frequency they are taken, and any side effects.

In addition, ask your doctor to address the elements in the Grids, such as: how much you can carry or lift, how long you can sit, and whether you can handle fine motor activities.

EXAMPLE 23

Your doctor’s letter should not focus only on the back pain that prevents you from working. Have your doctor also describe your hypertension and ulcer, which prevent you from taking pain medication and which therefore contribute to your disability.

The doctor should provide as much support for his conclusions as possible. He or she should attach and refer specifically to medical records, test results, and clinical evaluations. The more detail your doctor provides, the more persuasive will be his report.

GEM: Get a Letter from Your Former Employer

A letter from your former employer(s) might also help your application. The letter should conclude that you can’t return to your former position owing to your disability. In addition, your former employer should:

1. Describe your former duties and responsibilities (tell him or her not to exaggerate).

2. Talk about the physical requirements (lifting, carrying, walking, standing, stooping) of your job.

3. Describe the limited nature of skills gained on the job and explain why they are not transferable (if that’s in fact true).

4. Explain the impact the disability had on your performance.

* * *

A lot of people have lost out on a lot of money because they failed to provide enough evidence with their application. Uncle Sam is not psychic. Don’t expect him to know what you didn’t say; he won’t go hunting for evidence you don’t offer.

When your application is complete, it will be forwarded to a federal Disability Determination Service (DDS) office located in your state. Personnel in that office, normally including a physician, decide whether you are disabled. The DDS may ask you, your physicians, hospitals, or other institutions for more information. The better you are prepared in advance, the faster this evaluation will go (and the more likely you will be approved). If the DDS doesn’t feel it can adequately evaluate your claim based on existing medical records, you may be asked to take a medical exam by physicians of the government’s choice. Don’t give the DDS folks a hard time—your application can be denied if you refuse to cooperate. The Government will pay for any costs involved (including travel).

What can happen at a Government-required medical exam? Take a look at Example 24.

EXAMPLE 24

The Government-hired doctor gives you a very cursory examination. You spend more time in the waiting room than in the exam. Yet, when you hear back about your disability application, it’s been denied—and the denial was based on the Government doctor’s report!

Unfortunately, the situation described in Example 24 is not so unusual. Here’s a gem to reduce the risk.

GEM: Take Notes About the Government’s Exam

You can undercut the Government doctor’s report by showing the cursory nature of the exam. Immediately after the exam, take notes that show:

• The exact time the doctor began and ended his exam.

• What parts of your body he checked.

• All the questions he asked you and the subjects discussed (related to your disability or not).

• Any tests taken by the doctor.

If your application is denied based on a Government doctor’s report, these notes may help you on appeal. They can establish that the report by the Government’s doctor shouldn’t be given much weight, since his or her exam was not thorough.

GEM: Have Tests Done by Your Doctor

While the Government has the right to have one of its doctors look you over, you have the right to ask that any required tests (EKGs, stress tests, etc.) be done by your doctor, at the Government’s expense.

GEM: Apply ASAP—There Are Deadlines to Meet!

Waiting to file an application will cost you money. If you delay longer than 17 months after the beginning of the disability, you lose money. This is because Social Security disability benefits can be paid retroactively for up to 12 months from the date you apply. There is a five-month waiting period from the onset of the disability, during which you can’t get benefits. So if you apply for benefits within 17 months of the onset of the disability, you won’t lose out; but waiting more than 17 months will cost you—as Example 25 demonstrates.

EXAMPLE 25

You suffered a debilitating stroke on May 31, 1991. It is now seventeen months later, October 1992. If you apply for disability benefits right away, you won’t lose a penny of the benefits due to you. That’s because no benefits can be paid for the first five months (June–October 1991), and the benefits, once approved, can be paid back through November 1991.

But if you wait until March 1993 to apply, you’ll have permanently lost four months (November and December 1991, January and February 1992) of retroactive benefits—that’s hundreds, maybe thousands, of dollars that were rightfully yours.

Finally, the Government usually takes a long time to decide disability applications—three to six months is not uncommon. If appeals are necessary, plan on a year or longer. So don’t delay. The longer you take to apply, the longer the wait until the checks will start to come in.

CAN YOUR BENEFITS BE CUT OFF?

Okay, your application for Social Security disability benefits has been approved and you have been cashing in. Can the Government later take your benefits away? The answer, of course, is yes. You didn’t really think we would say no, did you? But the better you understand your rights, the better able you’ll be to protect your pocketbook!

Periodic Review—Big Brother Is Watching

Uncle Sam is going to check up on you. He is hoping your condition has improved enough to allow you to work and earn $500 a month. Then, the Government can cut off your benefits if you are no longer disabled.

Even if your health has not improved, you may no longer be considered disabled, and your benefits may be terminated, if:

• Advances in medical or vocational therapy or technology make it possible for you to work and earn $500 a month or more.

• You underwent vocational therapy or training, which now allows you to earn at least $500 a month.

• New or improved diagnostic techniques reveal that your impairment is not as severe as previously believed.

Table 3.5 shows how often you can expect to hear from Uncle Sam.

TABLE 3.5

Review of Conditions of Disabled Americans

If Medical Improvement Is |

|

Expect a Disability Review |

|

||

Never expected |

|

Every 7 years |

Possible, though not expected (most people fall into this category) |

|

Every 3 years |

Expected |

|

Every 18 months |

The review is usually routine. The Government can cut off your benefits only if it decides you are no longer disabled based on new evidence; it cannot change its mind based on the information from your original application.

GEM: You Can Run, but You Can’t Hide, from a Disability Review

Some people are too smart for their own good. When they find out the Government is reviewing their disability, they hide or refuse to cooperate. This is not wise.

The Government may ask you to provide additional information, such as updated medical evidence from your doctor, as part of the review. In fact, you may even be told to go for a medical exam. Do it! Your failure to cooperate will allow the Government to terminate your benefits for that reason alone!

If you can’t get the information to the Government within the time requested, or you are unable to go to an exam, let the Government know in writing and ask for more time. Don’t just ignore deadlines set by the Government.

If the additional information required by the Government suggests that your health has improved, and you don’t feel that’s correct, insist on your right to respond by providing additional information, such as a statement from your doctor or therapist. Don’t just try to bury it; if you do, your benefits are likely to get buried, too.

GEM: Avoid Cut-off for Refusing Treatment

When reviewing your case, the Government can stop benefits if you failed to follow a reasonable treatment prescribed (not just suggested) by a doctor, which may have restored your ability to work. But if the prescribed treatment was not “reasonable,” then your benefits can’t be cut for refusing to try it. For example, if the doctor wanted to do surgery on your leg because it might allow you to stand and walk more easily, but the surgery poses a serious risk like the loss of the leg, you could refuse—without losing benefits.

And if a doctor prescribed treatment that you couldn’t afford, don’t let the Government stop your benefits. A treatment you can’t afford is not reasonable for you.

GEM: Don’t Accept a Cut in Benefits If Health Improvement Is Not Related to Work

Even if your health has improved, your benefits cannot be stopped unless the improvement allows you to work.

EXAMPLE 26

You were just over 5 feet tall and weighed 220 pounds at the time you qualified for Social Security disability benefits. You had persistent edema (fluid causing swelling) in your legs, limiting your ability to stand or walk more than occasionally.

Since then you had a vein stripping operation and lost 35 pounds. The edema has been reduced, which is a medical improvement. But though you now have less discomfort than you did before, you still suffer enough so that you can stand or walk only for short periods of time.

Although your health has improved, the improvement is not related to your ability to work, because your capacity to do basic work activities (i.e., stand and walk) has not increased. The Government can’t strip your benefits.

GEM: Use Your Age to Your Advantage

The older you are and the longer you’ve been receiving disability benefits, the better chance you should have to protect your benefits. Even if your health has improved, or if some other positive change has occurred (like improved technology or diagnostic techniques), it may not be fair to make you go back to work. The Government’s own regulations state: “[T]he longer an individual is away from the workplace and is inactive, the more difficult it becomes to return to ongoing employment. In addition, a gradual change occurs in most jobs,” so that skill acquired years ago will not “continue to apply to the current workplace.” In case you need to tell the Government where you got this information, tell them it’s in the Code of Federal Regulations, Vol. 20, Section 404.1594(b) (4) (iii).

In other words, don’t let some young bureaucrat tell you that, even though you are 60 and have been out of work for a number of years, your health has improved, so he’s cutting off your benefits.

* * *

Benefits After Disability Has Ended

If the Government decides that you are able to work, it will cut off your disability benefits. Do they stop immediately? The answer is yes, unless you take steps to have them continued.

GEM: Demand Special Payments After Termination

You have a right to Social Security disability payments for three additional months after the decision is made that you are no longer disabled. But these benefits are not automatic. You must demand these benefits, in writing, from the local Social Security office.

GEM: Retain Medicare Coverage

Even if you have recovered enough to return to work, you generally can continue Medicare coverage for 39 months after your disability benefits end. Again, Medicare won’t continue automatically; you must demand continued coverage from the Government in writing.

GEM: Appeal Quickly to Preserve Benefits

If your disability benefits are terminated and you don’t agree, you can appeal. (The appeal process after a termination of benefits is the same as for initial denials—see here.) You get 60 days to file an appeal, but waiting that long to appeal a termination of benefits can be very costly.

File your written appeal with the local Social Security office within 15 days from the date written on the termination notice received from the Government. By filing promptly, your benefits will continue during the first two appeal stages (Reconsideration and Administrative Hearing, here). You must file a written request for continuation of benefits in addition to your appeal at each stage of appeal.

What happens if you’ve continued receiving disability checks for months during these appeals, and the termination is finally upheld? Can the Government demand that you return the amounts paid since the termination notice? The answer is yes—but don’t give up hope. If repayment would cause you serious hardship, depriving you of money needed for ordinary living expenses (like food and medical costs), you should be able to obtain a waiver from the Government.

* * *

Renewed Disability

If you received Social Security disability benefits, lost the benefits (for any reason), and then again become disabled, you can reapply for disability benefits. And if the renewed disability occurred within five years (seven years if you are a disabled widow or widower) after the benefits had been cut off, the checks should start again after you are approved—without another five-month waiting period.

What about the 24-month waiting period for Medicare? If you had been receiving Medicare with your previous disability, your coverage will resume with the first monthly disability check; no more waiting is required. And if you had not yet completed the 24-month waiting period, you pick up where you left off.

EXAMPLE 27

Your first period of disability lasted 15 months; during that time, you had not yet qualified for Medicare. You will have to wait only nine more months now (24 minus 15), not the full 24 months, to receive Medicare coverage.

APPEALS: YOU CAN FIGHT CITY HALL!

What happens if your application for Social Security disability is denied (or your benefits are wrongfully terminated)? Don’t be discouraged! You’re in good company; two of every three applicants are rejected. Unfortunately, the federal government denies many applications that should be approved. And, in fact, lots of people denied the first time—one in two—are finally approved as a result of appeals!

To get the benefits you deserve, you’ve got to be persistent. You’ve got to climb a very steep cliff to succeed. Don’t give up; your tenacity will be rewarded! We’ll help you reach the summit by providing an Appeals Ladder.

There are four steps on the Appeals Ladder, and if necessary you should climb them all. Let’s take a look at each one.

Appeal Step 1: Request Reconsideration

You can ask the Government to reconsider its denial of your application within 60 days from the day you receive the rejection notice. (You actually will be given 65 days from the date stamped on the denial.) Your appeal must be in writing, either in a letter or on Government Form SSA-561-U2, available at your local Social Security office. A copy is included as Appendix 10. It’s free.

Make sure your request for reconsideration includes your name, address, Social Security number, and disability claim number. If you have any new or additional information to support your claim, attach that, too. The Government may ask you for more information, and may also schedule a face-to-face meeting with one of its representatives. There is no formal hearing, and you can’t bring in witnesses.

Your claim will not be reviewed by the same person who denied your application originally. But that probably won’t make any difference. Your application likely will be rejected again. Fewer than one in seven reconsideration requests result in a change.

But don’t give up! Your next step may be crucial.

Appeal Step 2: Administrative Hearing

This appeal may be your best chance to get benefits. Disabled Americans win more than half of all administrative hearings! (Disabled individuals won 60% of administrative hearings in 1990.)

After you receive written notice that the Government has denied your request for reconsideration (Appeal Step 1), you’ve again got 60 days to appeal. File your appeal in writing, either by letter or on Government Form HA-501-U5, a copy of which is in Appendix 11. The appeal must include your name and Social Security number, the reason why you think the denial is wrong, a summary of additional evidence you plan to provide, and the name of your lawyer, if applicable. The only cost is postage.

A hearing will take place from six weeks to 10 months after you file your appeal, depending upon where you live. Start to prepare immediately; don’t wait until you get the notice scheduling the hearing, because that may only be two or three weeks before the scheduled date.

What should you do to prepare? Get and review the entire disability file the Government has put together for your claim. You are entitled to see it by law. Make sure that all your health records (doctors, hospitals, clinics, etc.) and employment records are included. Find any negative information and prepare to overcome it. For example, if there is a harmful doctor’s statement, take it to your own doctor and have him write a rebuttal.

You may also decide to bring witnesses to the hearing. If so, you’ll again have to prepare in advance. To get a doctor, former employer, counselor, or vocational expert to testify for you, you’ll have to get on their schedule as soon as possible. You’ll need time to work with them so they understand what’s necessary for you to win. And you’ll probably have to pay them.

If you need more time to get all this information together, you may call the Social Security office and reschedule, but that may delay the hearing another few months. You may be wiser to go ahead with the hearing and ask the judge for permission to provide supplemental materials within a week or two after the hearing.

The hearing will be held by the Social Security Office of Hearings and Appeals, which is different from the office that previously considered your application. An Administrative Law Judge, who is an attorney employed by the Social Security Administration, will preside and decide the appeal.

The hearing generally will be pretty informal. You tell your story in your own words, and you may present any written materials you believe will be useful. This is generally the last time you can present new evidence. Although two other appeals remain, they are based on information already provided.

You may present witnesses to support your claim. Who might you bring?

• Friends or relatives who can describe your condition, talk about your daily activities and your limitations, and maybe even indicate how they must help you.

• Doctor, nurse, therapist, or others who can explain your disability.

• Former employer(s) who will testify about how the disability prevents you from working.

If your witnesses won’t appear voluntarily, you may subpoena (force) them. The Social Security office may help you with this, but you must let the office know that you want their help no later than five days before the hearing. However, think twice about forcing a witness to come to the hearing. An unhappy witness might cause you more harm than good.

The judge will probably ask you a lot of questions. Stay cool; don’t assume he’s the enemy; answer honestly; don’t try to be funny or flip.

The judge may also ask a “vocational expert” to present his views at the hearing as to whether there are jobs you could perform, considering your impairment, age, education, and work experience. Ask about the person’s qualifications; if you don’t like what he’s saying, you may challenge his expertise. If you fit into the Grids, no vocational expert should be involved.

You don’t have to attend the hearing; you may have someone attend for you, or you may waive it. But you’re almost always better off being there if possible.

Appeal Step 3: Appeals Council

If you lose the first two appeals, you’re still not done. You’ve again got 60 days to take another step up the Appeals Ladder to the Social Security Appeals Council. Your appeal must be in writing, in a letter or on Government Form HA-520-U6, a copy of which is in Appendix 12. Your appeal may be filed with your local Social Security office, or sent by certified mail to the Appeals Council, P.O. Box 3200, Arlington, VA 22203.

The Appeals Council does not have to consider your appeal. And even if it does, no new evidence can be presented. You may present written arguments explaining why the denials of your application have been wrong, and you may appear in Washington, D.C. (at your expense) to argue your appeal. Chances are that you’ll lose this appeal, but file it anyhow. You’ve still got one step left after this, but this step is available only if you go through with an appeal to the Appeals Council.

Appeal Step 4: Federal Court

If all else fails, you may make a “federal case” out of the denial of your disability claim. Although the burden is on you to show that your claim has been wrongfully denied, a lot of denials are reversed by federal judges.

You’ve got 60 days after the Appeals Council’s negative decision to file your case in the local U.S. District (trial) Court. You will not be allowed to bring up any new evidence during this appeal; the court will base its decision only on the existing evidence.

GEM: Get a Lawyer

Take one step yourself: file the application without hiring an attorney. We’ve explained the facts you need to present. If you win, you’ve saved a lawyer’s fee.

But if you lose, get professional help for the climb up the Appeals Ladder. Don’t be penny wise and pound foolish.

* * *

The most important function of the lawyer is to help organize and prepare your appeals. Among other things, the lawyer will help:

• Collect your medical records and organize them to support your claim.

• Prepare a description of your disability and prior work experience that best fits the Government’s guidelines.

• Explain to your doctors and former employers the nature of the Government’s disability rules that apply to your case, so they can write reports designed to qualify you for benefits.

• Make sure the physicians’ reports are supported by appropriate medical records.

• Refer you to additional doctors who regularly work with disability applicants.

• Identify witnesses for the hearing, and prepare legal papers to require them to come if they won’t attend voluntarily.

• Make sure you understand what facts to emphasize and which facts might be better left unsaid when you testify at the Administrative Hearing.

• Cross-examine Government witnesses, including doctors and vocational experts, at the Administrative Hearing.

• File appeals on time.

• Follow legal procedures that sometimes can be complicated, particularly in federal court.

Preparing for the appeals takes time. Don’t tie your lawyer’s hands by waiting too long to call him or her. As soon as your application is denied, get on the phone.

As we’re sure you know, lawyers don’t work for free. But you should only hire a lawyer on a contingency basis, which means that he or she gets paid only if you win. If you lose, the lawyer loses too. That gives the attorney a real incentive to do his best, and it guarantees that you won’t be any worse off financially if the appeals are not successful.

Although you don’t pay lawyer fees if you lose, you will probably be obligated to pay out-of-pocket costs. These may include copying charges and payments to medical doctors. Don’t let these get out of hand. Before you hire a lawyer, get a written estimate of costs. And before the lawyer starts to hire a bunch of his doctor friends, require him (in writing) to explain the need and to obtain your advance approval.

The attorney generally will get 25 percent of past-due benefits if you win. He does NOT get a quarter of each monthly disability check forever. The fee must be approved by the Social Security Administration. If they decide that the attorney didn’t do much, they can reduce the fee. Where else can you get such a bargain?

The toughest task may be to find the right lawyer—one that is experienced with disability cases. This is a highly specialized area of the law. Don’t hire your divorce or real estate lawyer for a disability claim; you could probably do almost as well yourself.

Get referrals, preferably from relatives, friends, or co-workers who have used a lawyer for a disability claim and were satisfied. Ask other attorneys you trust; your real estate or divorce lawyer might have recommendations. You may also get names of experienced lawyers from a trade union.

Ask the attorney how many claims he or she handles each week or year. If the attorney handles fewer than about 100 claims a year, keep looking. The National Organization of Social Security Claimants’ Representatives (NOSSCR) is the professional organization for lawyers in this specialty. You may call (800) 431-2804, and ask for the names of lawyers who handle disability claims in your geographic area. Then interview several, check their references, and decide which one is appropriate.

Social Security disability benefits are worth a lot to you. Make sure you get what is due you. A skilled attorney can steer you through the brush to the gold mine of benefits. And most important, don’t give up. Two of every three claimants who appeal win. The Government has made the quest for Social Security disability into a real battle, but to those who persevere go the spoils!