5

The Appeal of Medicare Appeals

It’s a safe bet that if you are reading this chapter, it’s not for pure pleasure. You have had the “joy” of playing Medicare Monopoly and you know the sad truth: Uncle Sam doesn’t play fair.

In the last chapter we discussed the rules of the game and offered gems to help you win the Medicare coverage you deserve. But even if you’ve done everything right and played according to Uncle Sam’s rules, why are you constantly getting unfair denial notices? Because the system is grossly inexact and unjust.

The following tale should help explain why Medicare is such a mess, and why appeals should be tremendously appealing to you.

THE BIRTH OF A “PROBLEM CHILD”—THE TRUTH (ALMOST) ABOUT WHY MEDICARE IS A MISFIT

In 1965, when the legislation for Medicare was being drafted, there were lots of nervous relatives “laboring” in the delivery room along with Congress—lobbyists from senior-rights organizations, insurance companies, and, of course, the medical profession. Each group was anxious to make sure baby Medicare would come out most closely resembling “their side of the family.” The commotion was tremendous; everyone had been so busy grabbing for body parts—an arm here and a leg there—that the poor child came out grossly misshapen, resembling no one but costing an arm and a leg. Today no one wants to take responsibility for causing Medicare’s disabilities.

When first conceived, the federal Medicare laws borne by Congress were very generally drawn, and actually fairly liberal in concept. But once Medicare’s adoption papers were signed by President Johnson, Congress declared the birth a great success, hired a “nanny” to raise the child, and went back to work on other important issues.

The “Nanny” chosen for Medicare was the Health Care Financing Administration (HCFA), a subdivision of the Social Security Administration. Congress gave HCFA a limited budget and said “you worry about the details of how to feed and clothe this kid.” In other words, it became HCFA’s job to translate those noble but general concepts of care that Congress had mandated into specific and cost-efficient rules and policies. Since child rearing is so difficult, HCFA decided mother’s helpers were needed. So she wrote a job description and hired private insurance companies to lend a hand, serving as her Medicare baby “carriers” and handling the messy job of claims processing (the bureaucratic equivalent of laundering millions of messy diapers).

Because HCFA also has other children to look after, she delegates. There’s no time to watch every step. As a result, her underlings have a lot of freedom on the job. For example, “Nanny” might provide the spending money and shopping list of needed health-care products and services. But her handwriting isn’t always legible, so it’s left up to her mother’s helpers to interpret the list (Medicare’s rules and policies). Being so busy, perhaps “Nanny” (HCFA) won’t even notice when a few items are “forgotten” or a less expensive brand of care is substituted for the “higher priced spread.”

The moral of this long tale of surrogate parenting is that the baby gets thrown out with the bath water. Who gets hurt? You do, because Uncle Sam’s left hands (he has two—Part A intermediaries and Part B carriers) are illegally denying you benefits provided by Uncle Sam’s right hand (the actual Medicare rules and regulations). Unless you slap Uncle’s hand by appealing incorrect claims, you won’t get paid money you are entitled to by law.

THE “HOW-WAS-I-SUPPOSED-TO-KNOW” DEFENSE, OR IGNORANCE CAN BE BLISS

When your Medicare claim for coverage is denied, you probably think you have only two options: pay the bill and figure you’re out of luck, or appeal. But there’s actually a third option: the “how-was-I-supposed-to-know-that-Medicare-wouldn’t-pay?” defense.

Before you get into the appeals process, you should always consider whether this defense applies to you. If it does, you don’t have to pay the medical bills—you’re done!

How come you never heard about this defense before? Because the Government and—more important—health-care providers don’t want you to know about it. But this is a Golden Opportunity that should not be kept secret.

“How was I supposed to know Medicare wouldn’t pay?” Do you believe that this excuse, under certain circumstances, is actually a perfectly legal basis for refusing to pay bills? It is! You can’t be forced to pay for services that “you could not reasonably have been expected to know” would not be covered by Medicare.

EXAMPLE 1

You were admitted to a nursing home and treated there. No one ever told you that the treatment is considered “unskilled” and so won’t be covered by Medicare. You read The Medicare Handbook, but nothing there explained in English that the particular care you were receiving would not be covered. How about trying the “I-didn’t-know” defense? In this case, it works!

This defense has been kept well hidden by the Government. But it can offer a wonderful opportunity to avoid paying big money for medical costs.

Not surprisingly, to use the “I-didn’t-know” defense, your case must meet certain requirements. You should not have to pay if you did not know, and could not reasonably have known, that the care you received was not covered by Medicare. In addition, the service you received must:

• Not have been reasonable and necessary according to Medicare’s standards

• Have been classified as unskilled or custodial care

• Have been covered under home health care, but you must not have been eligible for coverage because you did not meet all the home health requirements (e.g., you were not housebound or receiving skilled care on an intermittent basis)

Does the “I-didn’t-know” defense apply to all service providers? No. You are not quite that lucky. The “I-didn’t-know” defense can be used only when the provider was a:

• Medicare participating provider

• Nonparticipating provider who had agreed to take assignment on the claim

• Nonparticipating provider who (i) should have known the service wasn’t reimbursable; (ii) failed to notify you in writing; and (iii) did not get your written permission to provide the service

We now outline how an “I-didn’t-know” defense works for Part A and Part B claims.

Part A Claims

Let’s say you received care from a hospital, and then Medicare denied the claim for coverage because it was not “medically necessary and appropriate.” So the hospital billed you. You had no idea that the care wouldn’t be covered, and you had no practical way to find out; the other requirements described above are also met. What should you do?

The bill should not be your problem. In fact, you should not even have been sent a bill. Return the bill, without payment, but with an explanation of why you’re not paying (see sample letter). Make copies or write a dated note for your files outlining your action.

Here’s a sample letter that you can use:

Date

Dear Sirs:

I am returning the enclosed bill unpaid. As explained in The Medicare Handbook under the Limitation of Liability Provision, I am not responsible for paying the costs of services that I “could not reasonably be expected to know were not covered by Medicare.” I was never informed by the hospital, or my doctor, that this service was ineligible for coverage. I thought the care I received was medically necessary and appropriate for my case.

Sincerely,

Your name

Address

Medicare Claim Control #

Health Insurance Card #

Chances are you will continue to receive bills, even after sending the letter. (The hospital hopes to wear you down!) Return them unpaid, with a note citing the date of your first letter of explanation. If the harassment continues, contact a lawyer who is experienced with Medicare for advice. Don’t pay anything.

The key phrase for this very special defense is “reasonably be expected to know.” What is reasonable? Your definition and Medicare’s might differ. To succeed with this defense, you must not have been informed, in writing, that your care would not be covered (by, for example, your doctor, hospital, or insurance intermediary). If The Medicare Handbook stated in black and white that a service wasn’t covered, you won’t be able to use the “I-didn’t-know” defense. But if you were never advised that the service would not be covered, you cannot be expected to be a Medicare expert—you may have yourself a real Golden Opportunity.

Part B Claims

Medicare participating service providers. Let’s say you received care from a doctor, and then Medicare notified the doctor (or other provider) that reimbursement was denied. Again, you had no reason to know that the services would not be paid by Medicare, and the denied claim met the other standards described here. When the provider sends you the bill, what should you do?

DO NOT PAY. Chances are the provider is first going to try to pass the buck, hoping you will assume responsibility. But the bill is not your problem. Contact the provider. Since you both had expected the service to be covered, suggest that the provider submit a “waiver of liability appeal” to the carrier. Providers are permitted to try to get paid by Medicare, but they are not allowed to bill you for their work [HCFA Pub. 13-3 §3789].

Document your case. Show that you had every reason to believe the service was covered. For example, if before agreeing to the procedure you asked your doctor if Medicare would pay, and he said that previous surgeries for the same problem had been reimbursed, you should be protected. You relied on the doctor’s word; he relied on Medicare’s past track record.

Even though you aren’t liable to pay the bill, a provider’s billing department will make you think you must pay by continuing to send bills or nasty letters. If this happens, you might want to discuss the problem with a lawyer and have him send the provider a letter outlining the “I-didn’t-know” defense. Situations like these are not pleasant because you are now pitted against your service provider. But this is your money we’re talking about. Can you afford to pay hundreds of dollars that you are legally not responsible for, just to remain a “good patient”? Hopefully, your doctor will understand that this is not a personal complaint. Your doctor should not be angry with you for protecting your legal rights. If the situation becomes too uncomfortable, you might end up hunting for a new physician. That should be the highest price you pay.

Nonparticipating service providers. Let’s say you received care from a doctor who did not accept assignment. Medicare denied your claim for coverage because it was not a “reasonable” or “necessary” service. The doctor billed you for the entire cost and expects payment in full from you. What should you do?

Do not grab your checkbook yet. You might still be protected under the “I-didn’t-know” defense (see here). The most critical requirement is that the doctor should have known Medicare wouldn’t pay.

How do you prove that? Good question. You can’t exactly ask him, but you can ask the insurance carrier. Or you can do a little undercover work. Call another doctor’s office or two and say you have been told that you need a particular procedure (the one already provided), and you want to know if the service is covered by Medicare. If they all answer “No, Medicare will not reimburse,” then you have a good way to show that your doctor should have known better.

You will need to write the doctor a note that explains your reasons for either (1) not paying the bill or (2) requesting a refund. (If you’ve already paid, the law requires that the provider refund your money!) If the dollar amount in dispute is large, you might feel more comfortable having a lawyer handle the “dirty work” for you.

Here’s a sample letter (of course, you will want to modify it to suit your circumstances):

Date

Dear Dr. ____________:

I am writing concerning my bill for ________________ (name of service) on _________ (date). As you know, Medicare has denied the claim as “not reasonable and necessary.” According to Medicare law, when a service is not eligible for reimbursement, you are obliged to notify me in writing and to obtain my written agreement to pay for the uncovered procedure before it is performed. You did not fulfill these requirements. I relied on your experience, and had no reason to believe this procedure was not necessary.

Under these circumstances, Medicare does not require a patient to pay the bill, even when the doctor is a non-participating provider. I regret the inconvenience and hope this information will be helpful to you in the future.

Sincerely,

Your name

cc: Insurance carrier

Make two copies: one for your files, one to send to the insurance carrier.

When you receive additional bills, DO NOT CAVE IN AND PAY! Simply photocopy another copy of your letter of explanation, attach it to the bill, and return both to the doctor.

The “I-didn’t-know” defense won’t cover you for every denial, but in many instances it can save you a lot of money. And it makes sense, too. After all, if you had no reasonable way to learn that the service wasn’t covered, why should you be stuck for the bill? This defense provides a Golden Opportunity for fairness that should not be missed.

If this defense is not available, it’s time to consider an appeal.

THE APPEAL OF APPEALS

Congratulations! All of your Medicare claims have been filed. You pat yourself on the back because you think you are actually getting the hang of this game of Medicare Monopoly. You are feeling pretty good—that is, until the Medicare mail starts arriving. The first note informs you that your hospital admission was not considered medically necessary so you must pay the entire bill. Upon opening the second envelope, you find another “notice of noncoverage” because the doctor’s care you received was “not reasonable.” Or perhaps you do get a reimbursement check, but the amount is only a fraction of what you shelled out.

What’s going on? The rainbow pointing to the pot of Medicare gold is fading. You are frustrated, you feel defeated. You fantasize about burning all those Medicare papers, but instead you throw the entire mess into a box and hope the problems will magically disappear. Anyway, who are you to argue with Uncle Sam? He knows the rules and you don’t. Why bother fighting city hall? Right?

Wrong! Wrong! Wrong!

Throw away any assumptions that the authorities in the Medicare system have a method to their madness and really do know what they are doing. If you haven’t figured it out by now, here are the facts: You are dealing with a very imperfect system staffed by imperfect people who are relying on imperfectly programmed computers for answers. No, most of these folks aren’t out to “get you” on purpose. But they will “get you” by accident, oversight, and ignorance of the Medicare laws. As a result, the burden is on you to protect yourself. You are not defenseless. You do have a weapon for battle; it is the appeals process.

We hear you asking: “I can’t really win, can I?” Yes, you can! If you think the odds are against you, take a look at these statistics and you will change your mind: In 1990, the reversal rate for Part A claims was 52.1 percent—not bad. But the odds were even more appealing for Part B: almost 7 million requests for reviews were filed and two-thirds (65.8%) of these appeals were successful!1 Put in human terms, over 4,600,000 frustrated Americans, no different from you, fought the system and struck gold with Medicare appeals. These people recovered hundreds—even thousands—of dollars per claim. The dollars represent money that was unfairly and wrongly denied—the culprits should “go directly to jail” without “passing Go.” But they won’t, so if you don’t appeal, you can’t win—and you may lose hundreds or thousands of dollars that rightfully belong to you.

Isn’t filing an appeal difficult? No. Filing a basic appeal is actually pretty easy. There’s no risk. It’s free. You don’t need a lawyer (unless your case is complex). Remember, Uncle Sam’s game strategy is counting on the fact that you are too tired, sick, or lazy to keep playing! He wants you to think you can’t win. Don’t fall into his trap. Appeal!

This chapter explains the various appeals procedures and gives you some gems on how to be most effective. We don’t expect you to become an expert, but we do want you to become familiar and comfortable with the general rules of this part of the game. We devote a lot of attention to this subject because appeals have become the most important phase of the Medicare Monopoly game. Having the appeals “card” in your hand is like owning the “Boardwalk” of Medicare Monopoly. It’s the best card in the deck and everyone is entitled to it. Don’t forfeit your turn to reach the Medicare treasure through ignorance.

Introduction to the Medicare Appeals Process

Just like Medicare’s insurance coverage, the appeals structure is based on the Part A, Part B division of labor. While the later stages of the appeals process are largely the same for Parts A and B, there are significant differences in the initial step onto the Appeals Ladder. You need to know the game strategies for both Parts A and B in order to cash in on the golden opportunities of Medicare coverage. We have organized our discussion to address appeals under first Part A, then Part B.

Keep in mind that Part A Hospital Insurance is really a large umbrella that also covers care provided in other settings, not just hospitals. To keep the game challenging, Uncle Sam has varied the Part A appeals rules based on where the treatment is provided. But fear not, we have highlighted these variations in the Part A appeals game for you, too.

Obviously, because everyone’s medical situation is unique, our job is to help you recognize the red flags that signal you to take a closer look at a denied claim. Certain categories of supplies and services have unusually high rates of unfair denials; you’ll want to know these trouble spots.

When appropriate, we have also included references to the rules and regulations that provide the legal rationale for your appeal (the specific citations from the Government’s documents appear in brackets). Although we certainly don’t expect you to be a lawyer (heaven forbid!), we think it is important that you have these legal facts at your fingertips. This way, if you are challenged, you can point right to the source. The information can also be a handy starting point for simple Medicare research.

Remember, there are many good reasons to appeal a claim and only a few valid excuses not to! Don’t procrastinate—file those appeals! You can’t win if you don’t play the game.

Try Informal Resolution Before Starting the Formal Appeals Process

When you are denied coverage, your first step should be to try to handle the problem informally. Put on your Sherlock Holmes hat—your goal is to uncover information needed to successfully resubmit your claim. If you can win coverage without going through the formal appeals process, you’ll save time and paper.

Start with a call or letter to Medicare. We don’t have to tell you the obvious: when you must speak on the phone with anyone who has anything to do with Medicare, expect to wait! Unfortunately, we can offer no magical advice for avoiding this unpleasantry (knitting?). Social Security recommends calling at off-peak hours. Is there really such a time?

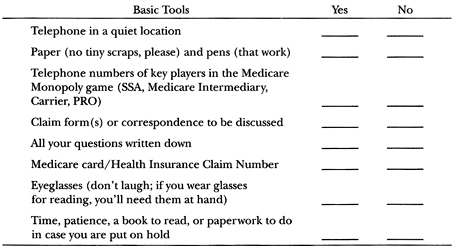

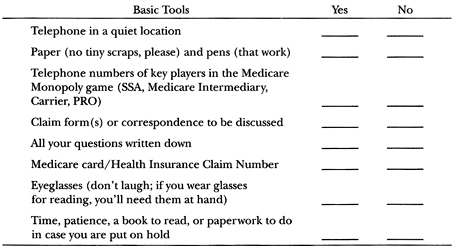

We can remind you that it’s important to prepare before you even pick up the phone. Pick a convenient time and quiet location. Gather your “tools”—pens, paper (no small scraps, please), eyeglasses, Medicare card, and claim(s) in question. Write down all the questions you have. Don’t rely on your memory—it’s too easy to get flustered. The excitement of finally hearing a real human voice can turn the most competent of us into a stammering fool! Table 5.1 provides a Checklist for Action.

TABLE 5.1

Tools of the Trade—A Checklist for Informal Action

Try to keep your cool. No matter what bad news the service representative gives you, blowing off steam won’t help. You’re the one who needs advice, and the person on the other end has the power of the hold button!

Example 2 shows a sample phone conversation; of course, you will have to modify the details to suit the unique circumstances of your case. But the point we want to make is that Medicare is just interested in facts. You need to provide specific information and ask specific questions.

EXAMPLE 2

Here’s a sample phone conversation: “Hello. I am calling to obtain more information about a claim. The Claim Control Number is _______. The Medicare Claim Number is _______.” (This information can be found on the denial notices or Explanation of Medicare Benefits you have received.)

The voice on the other end will probably ask what exactly you want to know. You will then need to identify the specific service and problem. For example,

“The claim for my post-surgical visit to Dr. Walsh was denied. Why?”

Have a pencil and pad ready to write down the reason given. If no adequate explanation can be found, request that the claim be refiled.

• Take notes on what was said during your conversation.

• Ask the representative for his or her name and write it down, along with the date and time of your call.

• Clip this information to your claim form so that you will have all the facts handy when you need to follow up.

For example, perhaps the explanation you receive is that the claim was coded as a routine office visit and routine visits are ineligible for coverage. Now you know where the likely problem spot is—the doctor’s office goofed. You will need to call whoever is in charge of the physician’s Medicare billing, tell the person what you learned, and request that the claim be corrected and resubmitted. Hopefully, your troubles now will be over, but just in case the claim gets booted out again, you will have a written record of the facts.

If your telephone call doesn’t resolve the matter, try a letter. Whenever you correspond with Medicare, be as specific as possible. For example, if your Medicare Handbook states that ambulance service is covered when your health is in jeopardy, refer to the page number in the handbook and include a letter from your doctor confirming the severity of your condition. If your claim for appeal is based on a conversation you had with someone at Medicare, then include the person’s name and the date you spoke.

Your letter can be very basic if the claim denial was due to a simple coding or computer processing error. It will need to be more detailed if the denial is based on interpretations of the Medicare rules. But don’t let that scare you—stick to the facts and be brief.

To document the “rightness” of your side of the story, you might need to include additional information, such as:

• Medical records

• Letters of support from experts—doctors, therapists, or other service providers

• Copies of prescriptions or other supply orders

A sample letter is printed here. Of course, you will want to tailor the wording to meet the specifics of your case, but it can serve as a helpful frame of reference.

Date

Dear Sir or Madam:

This is a request to review a Medicare Claim Control Number __________. My Health Insurance Claim Number is __________.

I believe there was a processing mistake because this service should be covered by Medicare. (Then refer to The Medicare Handbook or any other documentation to support your claim.) If you disagree with my opinion on this claim, please provide me with a clear explanation for the basis of your decision.

Sincerely,

Name

Address

Medicare #

_____I am enclosing additional information.

If your phone call and/or letter doesn’t get you the right result, it’s time to take more serious action. It’s time to start up the Appeals Ladder.

PART A APPEALS PROCESS: OVERVIEW

There are two doors that must be opened before you get into the formal Part A appeals process. First, you must actually receive the service you need. Second, you must be given a written notice that the service will not be covered by Medicare.

GEM: Get the Care You Need

Hospitals, nursing homes, and home-health-care agencies don’t want to get stuck with big bills that Medicare won’t pay. Rather than take a financial risk, they may simply deny you service. And when there’s no service provided, there’s nothing to appeal.

How can you get around this serious problem? Tell the provider that you’ll agree in writing to pay for the service if Medicare refuses coverage; that should be enough to get the service you need. (Waiver forms, saying you’ll pick up the tab, should be attached to bills from skilled nursing facilities.) Then demand that the provider bill Medicare—that’s your right. If the claim is then denied, you’re ready to move into the appeal process.

GEM: Don’t Pay Anything Without a Written Denial!

If the provider just told you orally that your service won’t be covered by Medicare but didn’t put the denial in writing, you don’t have to pay a penny! A no is not official—and you have no obligation to pay—until you see the news in black and white. (If the provider tries to collect from you without giving you a written denial, report the provider to the Medicare Fraud Hotline: 800-368-5779.)

* * *

If your claim for Part A services is wrongfully denied by Medicare, you get not one, not two, not three, but four more chances to get the problem straightened out. These four steps up the Appeals Ladder—Reconsideration, Administrative Hearing, Appeals Council Review, and Federal District Court—are each described, and we give you lots of “gems” to help you reach a successful conclusion.

The first step up the Appeals Ladder, called a RECONSIDERATION, is the most confusing. The rules for hospital claims differ from the rules for SNF and home-health-care claims, so for the first appeal step, we’ll talk about hospital claims separately from SNF and home-health-care claims. The next three steps are the same for all Part A claims, so we talk about these together. Ready to get started? Let’s Go!

Your Medicare claim has been denied. Who uttered the big bad words “we won’t pay”? There are three possibilities:

1. The service provider (e.g., hospital, nursing home, home-health-care agency)

2. The hospital’s Peer Review Organization (PRO) (doctors and other healthcare professionals hired by the government to handle the initial appeals for Medicare hospital claims)

3. The Medicare Part A intermediary (insurance company designated to handle initial appeals for skilled nursing facility, home-health, and hospice-care claims)

What you do next depends on who denied your claim.

If the Service Provider Says No

Let’s say the hospital denied your claim. The denial is called a “Notice of Noncoverage.” You can’t appeal to Medicare yet. Why not? Because Medicare hasn’t yet denied your claim.

The first appeal is called a Request for Reconsideration. Medicare can’t “reconsider” before it has “considered.” The provider—a hospital, doctor, etc.—is not Medicare. So before you start climbing the Appeals Ladder, you must first ask the provider to file a claim with the Medicare PRO or intermediary. The PRO or intermediary will then make an “official Medicare decision,” and if it denies your claim you then can appeal. Unfortunately, this added step can sometimes cause costly delays. For example, if you are out money and are looking for a sizable reimbursement, delays can be a real problem.

NOTE

There are two basic speeds of travel for a review request—fast and slow. An “expedited” review is Medicare’s version of the fast track. You are allowed to choose this option when you must have an answer quickly. The PRO must give you an answer within three working days of your request.

To ask the PRO for an immediate review you, too, must act immediately. You are given three days from the date you receive written notification (e.g., if you are informed on Monday, you need to contact the PRO by Thursday). The telephone number and address are on the Notice of Noncoverage.

A “routine” review is the appeal speed you must use when time is not of the essence. You are given up to 60 days from the date on your “no”-tice to file a routine appeal. The PRO must give you an answer within 30 days.

GEM: Avoid Delays by Asking for Consideration and Reconsideration Together

To save time, you can request Reconsideration at the same time your claim is first officially submitted to Medicare. Medicare can consider and reconsider your claim at the same time. Odd but true!

* * *

Hospitals and other providers can’t just assume your claim will be denied by Medicare and charge you directly, skipping the claims process. Make the provider file the claim with the Medicare PRO (you have a legal right to insist), and then make your Request for Reconsideration. And ask for an expedited review, because time may be critical.

If you are receiving care from a hospital, and then you are told the service won’t be covered, you can’t be kicked out immediately. But the Notice of Noncoverage will tell you that if you don’t leave by a particular day, you will be responsible for the costs. Again appeal immediately to the PRO and ask for an expedited review.

If the PRO Says No

The PRO is Medicare’s official voice, so if the Notice of Noncoverage comes from that source, you can file a Request for Reconsideration—without first asking the provider to submit a claim. You can only hope the PRO will change its mind.

The address and telephone number of the PRO in your state can be found in Appendix 18. Call the PRO promptly for a reconsideration.

If the Medicare Intermediary Says No

If the denial of your claim comes on an Explanation of Medicare Benefits (EOMB), rather than a Notice of Noncoverage, you know that your claim was denied by a Medicare intermediary (the insurance company chosen by Medicare to handle Part A claims). A denial on an EOMB is an “official” no, and you can file a Request for Reconsideration directly to the intermediary.

Generally, only the provider or PRO will deny claims for care at a hospital. An intermediary generally handles Part A claims for skilled nursing, home health, or hospice care.

PART A APPEALS: STEP 1—RECONSIDERATION OF INPATIENT HOSPITAL CARE CLAIMS

If your claim for inpatient hospital care was denied and you can answer yes to either of these two questions, you’ll want to consider starting up the Appeals Ladder with a Request for Reconsideration.

• Did your condition require a level of care and services that could only be provided in a hospital setting?

• Did you require the skilled services available at a skilled nursing facility (SNF) but no bed was available, so hospitalization was required?

All the basic information about starting a Part A hospital appeals process is located in an official-looking document called “An Important Message from Medicare.” You will receive this Masterpiece of Medicarese when you enter a hospital.

In the following paragraphs, we will provide our translation of “An Important Message from Medicare.” We will review each section of the document so you will know what all that Medicarese means in practical terms. Our goal is to demystify the process and show you there truly are options for action. You can then make informed decisions about which appeals strategies are best suited for you when playing the “hospital inpatient appeals” round of Medicare Monopoly. You might not feel up to handling all the details yourself, but at least you will be an informed backseat player. You can roll the dice and let someone else carry out the moves for you.

SECTION I: “YOUR RIGHTS WHILE YOU ARE A MEDICARE HOSPITAL PATIENT”

This section outlines three basic rights all Medicare hospital patients must receive by law.

Your Right to Care

You are entitled to receive all care that is medically necessary for your condition. Note the statement: “your discharge date must be determined solely by your medical needs, not by DRG’s or Medicare payments.” By law, the only reason you can be discharged from a facility is because your medical condition no longer requires that level of care. A hospital can’t make you leave just because Medicare will no longer pay for your stay.

Most of the focus of Medicare appeals is on denials of claims for coverage. But you may also appeal a wrongful attempt to discharge you. To understand why improper ejections happen, just take a quick look at how Medicare reimburses hospitals.

The government has grouped all the illnesses in the medical books into categories, called Diagnostic Related Groups (DRGs). Each DRG is assigned a price tag—Uncle Sam’s estimate of the average cost to treat patients with this type of condition. Medicare pays the hospital based solely on the DRG price tag, without regard for how long your individual stay is. A hospital makes the same amount from Medicare whether you stay two days or two weeks, so the sooner you’re out, the better for the hospital (even if not for you).

Although the law says you can only be discharged when it’s “medically appropriate,” the hospital may try to discharge you when it’s “financially appropriate.” Of course, hospitals won’t tell you this; instead, they’ll tell you you’re well enough to go. If you and your doctor disagree with the hospital’s decision, start up the Appeals Ladder with a Request for Reconsideration to the PRO (see here).

Your Right to Know

You are entitled to be “fully informed about decisions affecting your Medicare coverage and payment for your hospital stay and for any post-hospital services.” This means you have the right to know what is in your medical files. When you must fight a hospital’s decision, the law recognizes that you need access to the information that was used as the basis for denying your claim.

GEM: Get Your Medical Records

Don’t let anyone tell you that a patient can’t see his or her medical records. The Medicare law is on your side. Point out Right #2 in the “Important Message from Medicare.” If that isn’t convincing, pull out the big guns: refer directly to the law—Title 20 of the Code of Federal Regulations (C.F.R.) Section 404.1710; and the Federal Freedom of Information Act.2

* * *

Your Right to Fight

If the hospital gives you a written Notice of Noncoverage that states Medicare is no longer going to pay for your treatment, you have the right to stay and fight. Request a review by the PRO. The address and telephone number of the nearest PRO will be printed right on the Notice.

Keep in mind that your reasons for appealing must be based on medical facts. If you just don’t feel well, that’s not a “bad” enough excuse. Your physician must document that a hospital is the ONLY place that can provide the level of care you require and a discharge at this time would jeopardize your health.

The need for your doctor’s active support leads us to the next major section in “An Important Message from Medicare”:

SECTION II: “TALK TO YOUR DOCTOR ABOUT YOUR STAY IN THE HOSPITAL”

This is probably the best advice Medicare will ever give you. Medicare law states that your doctor (not the hospital or PRO) is the ultimate medical expert on matters concerning your medical condition. This means, by law, that his word carries great weight when decisions are being made about your treatment.

Because of this authority, your doctor is your best ally. If you do need to request Reconsideration with a PRO, the magic words for Medicare coverage are “medical necessity.” A detailed letter of support from your doctor that explains why your case meets Medicare’s coverage requirements is your best key to success.

SECTION III: “IF YOU THINK YOU ARE BEING ASKED TO LEAVE THE HOSPITAL TOO SOON”

In this section, Medicare talks about the importance of a written Notice of Noncoverage to trigger your right to start an appeal. The Notice is the very first Medicare Monopoly game piece you need for the appeals process. This document contains the hospital’s explanation for why Medicare coverage is ending. If you received the bad news only by word of mouth, it isn’t legal and doesn’t count. The PRO won’t look at your case without this document.

GEM: No Pay Without “No”-tice

Until you get a written Notice of Noncoverage, you don’t have to pay for any days the hospital claims are not covered.

* * *

Once you have the Notice in your hands, look for the date of notification. Make sure it corresponds with the day you actually received the written Notice. There are very tight deadlines for requesting an expedited review—the three-day countdown begins from the date printed on your notification.

If you disagree with the decision, you must act quickly and request an immediate review. If you do nothing and don’t leave by the date given, the hospital can start billing you for all the costs of your continued stay!

SECTION IV: “HOW TO REQUEST A REVIEW OF THE NOTICE OF NONCOVERAGE”

This section explains what you must do to start an appeal when you get a Notice of Noncoverage. As you will see, there are three different “exit” scenarios, each with different “actors” and deadlines for action (depending on whether your doctor or the PRO has agreed with the hospital’s decision). Most important, the time when your financial responsibility begins during the fight will also vary. Knowing Medicare’s deadlines is critical; in some situations, you will not even have a full day to respond.

After reading “How to Request a Review” in The Medicare Handbook, chances are you will be tempted just to pack your suitcase and go. Don’t. The basic appeals process is really not overwhelming; Medicare just makes it sound that way. This is no accident. The Government’s game strategy is to discourage people. But, if you are right, requesting a Reconsideration is your only option for correcting Medicare hospital mistakes.

GEM: Submit Bills to Medicare During Appeals

If you disagree with a Notice of Noncoverage and are requesting a review, make sure the hospital continues to submit all bills to Medicare during the dispute. This is essential so that you can continue to exercise your “right to a review” for those bills too. Remember, only claims that have been submitted to Medicare are eligible for the appeals process.

* * *

Scenario 1: Your physician agrees with the hospital’s decision. You receive a Notice of Noncoverage that states your doctor and hospital both think hospital care is no longer medically necessary. In this situation, the PRO’s approval is not required before the Notice can be issued. This scenario is less than ideal because it requires the fastest action on your part—you must request a review by the PRO immediately to avoid getting stuck with hospital payments. You only have until noon of the first work day after you receive the Notice to request a review.

EXAMPLE 3

You are notified by the hospital on Monday that you’ll have to leave. Your doctor agrees that hospital care is no longer needed. Better hurry to appeal—you must contact the PRO for a Reconsideration by 11:59 A.M. Tuesday.

GEM: Act Fast, but Not Too Fast

Although you don’t have much time to appeal, wait until the last minute. In Example 3, you must ask for a reconsideration by 11:59 on Tuesday. Don’t appeal on Monday. Since you can’t be charged until noon of the day after the PRO makes its decision, waiting a day to appeal will give you an extra free day in the hospital!

* * *

The reason why Medicare is so stingy with giving you time to act is simple: the assumption is that the hospital and physician are right and you can go home. Uncle Sam figures, in all likelihood, the PRO is going to agree with the decision. Since an appeal costs the government and hospital money, Medicare doesn’t want to give you any more time than is absolutely necessary.

Those are the facts but, if you feel strongly about the medical rightness of your view, don’t let Uncle Sam’s tactics scare you off: Call your doctor immediately. If he is unavailable, tell the secretary it is essential you speak with him as soon as possible about your Notice of Noncoverage. When you do talk with him, politely ask for an explanation (remember he still can be your ally). Perhaps there was an error, or upon hearing your view, he might even change his mind (in which case have him notify the hospital and you can skip the appeal). You need to be open minded, but you also need facts. And if the notice came as a complete surprise, there’s been a serious communication gap between you and your doctor and there is good cause to complain!

GEM: Talk to Your Doctor Before Problems Arise

The situation of fighting the hospital and your doctor shouldn’t happen. Good communication with your physician can avoid any unpleasant surprises and can help ensure the doctor will be on your side.

Unless you are comatose, you should always be informed about your health status. But don’t wait for a doctor to initiate a heart-to-heart talk. If your physician peeks his head in the door, asks how you are, and leaves before you have time to answer, your needs are not being met. You must take the lead. Try this: “Doctor, I see you look rushed, and I want a few minutes with you to discuss my case. What time would be convenient for you? I’ll be here all day.” (Just because you are ill doesn’t mean you need to lose your sense of humor.)

When you set a time to talk, don’t waste it. Prepare a list of your questions. Ask about discharge plans—when does he think you will be ready? If you disagree, now is the time to talk it over. Once your doctor knows your personal circumstances, he might be willing to adjust the schedule to suit your needs rather than the hospital’s. You will never know unless you communicate with your doctor.

GEM: Get Hospital Records

You are legally entitled to have your hospital records. Get them—the information may be critical to your appeal.

Once you have more facts from the doctor and/or hospital records, pick up the phone and call the PRO (phone number is on the notice) to tell them you want an expedited Reconsideration.

GEM: Reach Out and Touch Medicare

The notice states that you can “phone or write” to request Reconsideration. But how fast is the U.S. mail in your neighborhood? Unless the PRO is right next door to your hospital, you’d better not rely on Medicare’s untimely suggestion to pick up a pen; use the phone, or you will surely lose by default!

* * *

Explain why you disagree with the decision. The PRO must ask; it’s the law. Try not to get emotional—stick to the facts of your condition, since that’s all that counts. The PRO must respond to your request by phone and in writing. You cannot be held responsible for hospital care received before you get the PRO’s decision, even if you lose. But once you get the PRO’s decision, it’s a whole new game. If the PRO agrees with the Notice of Noncoverage, you can be billed for all your hospital costs beginning at noon of the day after you get the PRO’s decision.

EXAMPLE 4

The PRO rejected your appeal on Monday. If you stay in the hospital past Tuesday at 12:00 noon, the financial burden gets shifted to you.

GEM: Appeal Later

Even if you decide to quit and go home by the hospital’s discharge date, skipping this emergency Request for Reconsideration, you still have 60 days to file for any billing problems that call for a routine (nonexpedited) appeal. Do it!

* * *

Scenario 2: The PRO agrees with the hospital’s decision. Before the Notice of Noncoverage was issued, the PRO may also have reviewed your case. If the PRO agrees with the hospital that Medicare can stop paying because further care is not a medical necessity, what should you do?

Again, call the PRO immediately (phone number is on the Notice of Noncoverage) and ask for an expedited Reconsideration. Although you have three days to ask for an expedited appeal, DON’T DELAY.

GEM: Ask for an Immediate Review Immediately

The PRO is allowed to take up to three working days to respond to your request for expedited Reconsideration. Whether or not the PRO has finished its review, the hospital can start billing you on the third day from the date on your Notice of Noncoverage. (Medicare allows this because Uncle Sam operates on the assumption that the PRO’s first look was right and you are wrong.) If you wait two days before calling, and the PRO takes its three days to reply, you may get stuck paying for at least one day of care. (If you win the appeal, you are entitled to be reimbursed. If you lose, the bill is yours.) By moving quickly, you can avoid costly bills.

GEM: Appeal Later

Just as in Scenario 1, if you don’t ask for an expedited review, you are still entitled to request a routine appeal up to 60 days after notification. Do it!

* * *

Scenario 3: Your doctor disagrees with the hospital’s decision. We have saved the best of the worst for last. In this scenario, the hospital (not the PRO) has notified you in writing that it’s time to go, but your doctor disagrees because he thinks a discharge at this time would be medically unsound. At least someone’s on your side.

When you first get the hospital’s Notice telling you to leave, contact the hospital’s patient representative, or whoever handles Medicare-related issues, and say you want the hospital to request an immediate PRO review. Remember, by law you are entitled to an “official Medicare determination”—you can’t appeal directly to the PRO until you first get its official “no, you must go.”

The hospital must then notify you in writing that it has requested a review. The PRO has three working days to respond. Use the time while you are waiting for this reply to plot your battle plan. Speak to your doctor; he should be your best ally. Ask his advice about options available. Chances are, he has been through all this before.

GEM: An Appeal Gets You Extra Free Time

While you are waiting for the PRO decision, you have no legal responsibility for the hospital costs—you can’t be forced to leave or pay. Don’t let the hospital intimidate you! Even if you lose the appeal, you’ll have received an extra day or two of coverage!

* * *

If the PRO agrees with you, you WIN! But if the PRO agrees with the hospital, you’ll need to decide what to do next. Should you appeal further? Quit? Here are three options to consider:

Option 1: Leave the hospital. Perhaps filing the appeal provided the extra day or two you needed to recuperate. So, if the PRO says “go,” you might decide that going home would be okay. On leaving the hospital, if you could use some extra assistance, remember, Medicare can also cover home health care services (see here to find out if you meet eligibility requirements). Hospital social workers and discharge planners should be able to assist you and your doctor in forming the necessary home-health-care plan that meets Medicare’s reimbursement requirements (if you have not already been contacted by the planner, now’s the time to call).

GEM: Continue the Appeal from Home

If you have any bills which are being charged to you, you may choose to leave the hospital and continue the appeal from home. If you are well enough to be discharged, you may as well leave.

* * *

Option 2: Stay and pay. Remember, no one is going to force you out of the hospital. The issue is, who will be paying for your continued care—Medicare or you? If you’re in good shape financially, perhaps it would be worth it to stay and pay for an extra day or two.

Option 3: You are right—stay and fight. You can ask the PRO to take a second look (request a Reconsideration). But since it has already said no once, Medicare operates on the assumption that you are wrong. The hospital is permitted to start billing you on the third day after you received the notice. So, if the PRO takes its full three-day time limit to review your case, you might get stuck paying for one or two days of hospital care. (If you do win, the money will be reimbursed.)

GEM: Appeal If You Plan to Stay

If you believe that you should stay in the hospital longer, ask the PRO for a second look. The worst that will happen is that you’ll again be denied. But even if you are given a second no, you may pick up another couple of free hospital care days. Remember, you can’t be held liable for the days while the PRO reconsiders. So appeal—even if you lose, you win!

GEM: Show Medical Necessity

Medical necessity is the key to coverage. When you appeal, your doctor must document why hospital care is essential and respond very specifically to the PRO’s reasons for denying your claim.

SECTION V: POST-HOSPITAL CARE

This last section of “An Important Message” attempts to answer the question: “Is there life after hospitalization” as far as Medicare is concerned?

If you still need medical care, but no longer require hospitalization, your doctor can discharge you to either a skilled nursing facility or your home with care services. Hospital discharge planners or social workers can help with this process. In either situation, some supplies and services you need might be eligible for insurance coverage under Medicare or supplemental insurance policies. But the reimbursement rules are strict, so you better make sure you know what is covered, or you will get stuck paying. Ask for help—you’ll need it!

SECTION VI: ACKNOWLEDGMENT OF RECEIPT

Medicare wants your signature. When you sign on the line, you are simply agreeing that someone handed you “An Important Message from Medicare.” Uncle Sam isn’t interested in whether you understand his message or not; he just wants to know whether the hospital has met its legal obligation. It’s okay to sign—you aren’t giving any rights away, so don’t worry.

If your first step up the Appeals Ladder for a hospital claim is not successful, don’t panic. There are three more “bites at the appeal.” We’ll tell you about your remaining appeal options for hospital claims starting at here.

PART A APPEALS: STEP 1—RECONSIDERATION OF SNF AND HOME-HEALTH-CARE CLAIMS

The first appeal step—Request for Reconsideration—is much simpler for SNF and home-health-care claims. The reason is simple: unlike hospital appeals, there is no PRO involved with these claims.

In this section, we tell you how you can start up the Appeals Ladder if you have been wrongfully denied coverage for SNF or home health care, and when you should consider doing so. The Golden Rule is: if you want to win, you have to play the game. This means you have to file papers; we will tell you when and how.

How Do You Begin an SNF or Home-Health-Care Appeal?

You must first get an official no from Medicare. If the SNF or home-health-care agency tells you that a service will not be paid for by Medicare, that is not an official denial. You are legally entitled to a decision by Medicare. (Section 3439.1 of the Medicare Intermediary Manual.)

Tell the SNF or home-health-care agency to submit a “no-payment” claim to the Medicare intermediary. This request forces the provider to file your claim so that you can get an official decision from Medicare. The intermediary’s response is called an “official initial determination.” If the intermediary then says “the SNF or HHA is right; the service isn’t eligible for coverage,” the news may not be good, but at least you have an official Medicare denial. Now you can ask Medicare for a Reconsideration of the decision.

GEM: Don’t Pay Until Medicare Decides

The SNF or HHA probably will keep sending you bills. Hang on to your checkbook—you don’t have to pay until the official Medicare decision arrives.

* * *

Once you receive the official no from Medicare on SNF or home-health-care claims, it’s not too difficult to start the appeals process. Uncle Sam has prepared a form called Request for Reconsideration of Part A Health Insurance Benefits (Form HCFA-2649). This is the same form, mentioned earlier, that can be used for services or a hospital. This multipurpose form also can be used for all Part A–covered services received at a skilled nursing facility (SNF), home-health agency (HHA), or health maintenance organization (HMO).

Actually, you are not even required to use the form. A letter from you is fine too, as long as it contains all the basic information. A letter should include your Medicare card number, the date(s) of service, a simple explanation about why you are asking for a review, and any documentation to support your request. Staple your letter to a copy of the EOMB (never part with your original forms). Since HCFA 2649 is pretty simple, if you have one handy use it. You then won’t have to worry about accidentally omitting some needed fact and having your claim rejected again.

You can find a copy of Form HCFA-2649 in Appendix 13, along with an easy-to-read explanation of how to fill it out.

When Should You Appeal SNF Claim Denials?

If your claim for SNF care was denied and you can answer yes to these four questions from The Medicare Handbook (page 15), you’ll want to consider an appeal.

• Were you hospitalized first for at least 3 days and entered the SNF within 30 days of your hospital discharge?

• Was the SNF Medicare certified?

• Did your doctor certify that you needed SNF care?

• Did you need and receive SNF level care (e.g., skilled nursing or rehabilitation services that could only be provided by trained professionals such as physical therapists or registered nurses) on a daily basis (at least 5 days per week)?

When Should You Appeal Home Health Service Denials?

If your claim for home health services was denied and you can answer yes to these four questions from The Medicare Handbook (page 16), you should appeal.

• Are you housebound? (Although you don’t need to be bedridden, Medicare is very literal about this. Leaving home must require a considerable and taxing effort. You meet the standard if you cannot get out without assistance from others or you need a wheelchair, crutches, etc. Trips out for medical treatment are okay as are occasional “walks” outside.)

• Did your doctor prescribe the care because it was medically necessary, and was a home-health-care plan developed?

• Do you need intermittent or part-time skilled care? (Skilled services are those tasks that can only be performed by, or under the supervision of, a nurse or therapist; housekeepers do not meet the standard.) See here for an explanation of this type of care.

• Is the home health agency (HHA) a Medicare-certified provider?

What Are the Red Flags for Identifying Unfair Denials?

When it comes to SNF and home health care, there’s good news and bad news. First, the good news: if you are eligible, Medicare will cover a wide range of skilled services in a nursing home or your own home. The bad news is that the Medicare insurance intermediaries who process your claims are often overly strict in interpreting the rules. As a result, many valid claims are unfairly denied. (Remember, Medicare law requires that your overall condition must be considered [42 C.F.R. §409.33(a) (1)].

There are a number of red flags that should alert you to an unfair denial. Be particularly suspicious if your claim for SNF or home health care is denied for any one of these reasons:

RED FLAG 1. “Your condition is ‘stable’ or ‘not improving.’”

Restorative potential cannot be used as the deciding factor for coverage. If SNF or home-health-care services will help maintain your present functions or slow deterioration, you should be entitled to coverage. [42 C.F.R. §409.32(c)]

Action: Resubmit claim (fill out a Request for Reconsideration form) along with a note stating that, under Medicare law, “no improvement” denials are illegal. Also include an explanation of why the service is needed to maintain health.

RED FLAG 2. “The amount of time allowed for reimbursable home health care has been exhausted.”

As Table 5.2 shows, there are limits on Medicare reimbursement for SNF coverage. But you can receive up to 35 hours per week of home-health-care services for as long as necessary (if you meet the eligibility criteria outlined here). Home health agencies will often try to impose arbitrary ceilings on the number of weeks of care you can receive at home. These limits are unfair and not legally authorized. Don’t accept this reason for a denial.

Action: Insist that the home health agency continue to provide care. Have your doctor write a letter explaining why you need the services and why it would be unsafe for the agency to stop. If the agency ignores you, call your State Department of Health, or agree to sign a form saying you’ll pay privately if Medicare denies the claim and then demand they bill Medicare.

RED FLAG 3. “Service provided was not medically reasonable or necessary.”

This is one of the most popular excuses for denying a claim. Your physician is the expert. If he believes the service was essential for your care, then don’t let the insurance intermediary “play doctor” and deny your claim as unnecessary.

Action: Have the SNF or home health agency resubmit the claim along with a letter from your doctor explaining why the care is essential.

RED FLAG 4. “Services received could have been performed by family members.”

There is no Medicare law that requires your family to perform health-care services. It is illegal to penalize you for having relatives.

Action: Have the SNF or home health agency resubmit the claim along with a letter from your doctor stating that it is inappropriate for family to provide the services you need.

RED FLAG 5. “Services provided were available elsewhere.”

The intermediary is telling you that you didn’t need SNF or home-health-care services because you could have received the same services, for example, as an outpatient at a hospital. Even if this is true, you have the right to choose where to receive a service.

Action: Resubmit the claim along with a letter from your doctor, SNF, or home-health-care provider stating that you are entitled to receive the services at a location of your choice.

RED FLAG 6. “The care you received does not meet Medicare’s definition of a ‘skilled service.’”

Medicare looks very closely at the type of care you receive and will only reimburse for services that must be provided or supervised by a nurse or other healthcare professional. If you only need custodial, nonskilled care, you are out of luck.

But as we explained in Chapter 4, Medicare wrongfully denies many perfectly legitimate claims for SNF and home-health-care coverage based on a misreading of the definition of skilled care or a misunderstanding of the care you received. We have described many common situations in which you should be covered for SNF (here) and home health care, and we suggest you go back to those sections now.

A particularly high number of wrongful denials for SNF and home-health-care services occur because intermediaries fail to recognize that Medicare will pay for skilled care to oversee unskilled services and observe and assess a patient’s condition. Take a look at the following examples:

EXAMPLE 5

The plan of care developed by your physician to promote recovery and ensure your safety consists solely of a health professional overseeing several unskilled personal care services (e.g., bathing and feeding). You are entitled to coverage, as long as the doctor can show that the complexity of your case requires observation and management by a skilled professional [42 C.F.R. §409.33) (a) (1)].

EXAMPLE 6

You have just arrived at home after lung surgery. Your condition is not completely stable. You need to be monitored by someone trained to recognize postoperative treatment complications, so that necessary modifications in care can be made promptly. Your doctor is justified in requesting skilled professional observation [42 C.F.R. §409.33(a) (2)].

EXAMPLE 7

You are a newly diagnosed diabetic, and you need training in insulin injection as well as other health-care techniques. Or your leg was amputated, and you must learn how to walk and care for your prosthesis. Only a trained professional can adequately perform these educational tasks. Teaching of essential self-maintenance skills should be covered, and a denial of claims for these services is wrong [42 C.F.R. §409.33(a) (3)].

Action: Resubmit claim, add any helpful documentation, and note that service is covered as “skilled care.”

RED FLAG 7. “You were not ‘housebound.’”

Perhaps this is a new form of faith healing. If Medicare tells you that you don’t really need to be home, you then will be able to throw away your crutches and walk out the door! Does Uncle Sam actually think people would become prisoners at home just to collect a few dollars?

Action: Resubmit the claim along with a letter from your doctor or home-health-care provider that verifies your homebound status. (See here for definition of housebound.)

RED FLAG 8. “Services do not meet Medicare’s definition of ‘intermittent or part-time care.’”

Intermediaries became so overly zealous in their use of this excuse that the HCFA was sued. A coalition that included angry congressmen, the AARP, and the National Association of Home Health Care Agencies took the complaint to court and won! The judgment required that all past claims denied using the “not-part-time” excuse be reopened.

Action: If you have been unfairly denied coverage for this reason, dig out your papers. Resubmit your claim, explaining that your care meets the Medicare requirements. (See here for definition of intermittent or part-time care.)

We have now told you how to take the first step up the Part A Appeals Ladder for hospital care appeals and for SNF and home-health-care appeals. Unfortunately, you may not get satisfaction after only one step. To reach approval of your claim and get the coverage that’s legally yours, you’ll probably have to continue up the ladder.

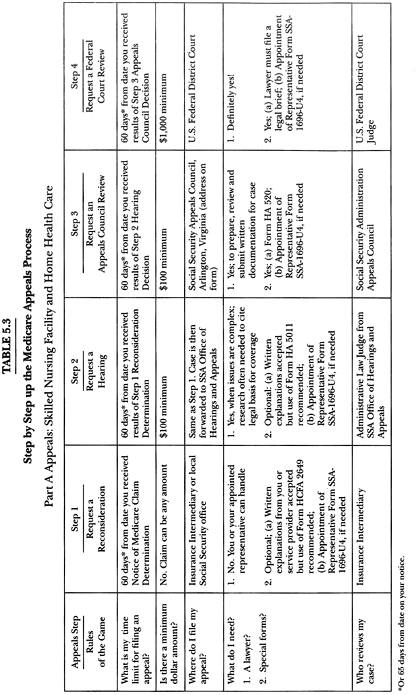

The steps for hospital, SNF, and home-health-care appeals are the same from this point forward, so we discuss them together. Tables 5.2 and 5.3 summarize the steps up the Appeals Ladder for Part A claims. The steps are also similar to the corresponding steps described in Chapter 3 for Social Security disability appeals, and the gems there are generally applicable here, too.

STEP 2—THE ADMINISTRATIVE HEARING

The second appeal step (after Reconsideration) is an Administrative Hearing by an Administrative Law Judge (ALJ) from Social Security. Starting at this second level, “money talks.” The ALJ will only listen to your complaint if your claim meets a $100 minimum ($200 for hospital claims). Arriving at this figure is not as simple as you might think; any unmet deductible and co-insurance will reduce your claim, perhaps below the minimum.

EXAMPLE 8

Your bill for service is $100. But $50 still remained on your annual deductible. So your claim is really only $50, which is too little for an Administrative Hearing. Sorry.

GEM: Accumulate Claims to Meet the Minimum

Several Part A denials can be lumped together to reach the minimum. For example, you can add the fees for a series of home health visits to qualify for an Administrative Appeal.

* * *

Once you have done Medicare math and determined that you meet the dollar minimum, you have 60 days from the date on the denial notice to ask for an Administrative Hearing. To start the process, you need to get a Part A Request for Hearing form (Form HA 5011) from the Social Security office. (See Appendix 11 for a copy of this form.)

What Should You Do with the Form?

The Request for Hearing form is pretty simple to complete. You check off what Part A service the claim is for (e.g., hospital, SNF, home health care); whether you are submitting new evidence; and whether you want to attend the hearing. There is also space for you to explain why you disagree with the initial decision. Of course, you need to have a “good” reason for requesting a hearing. For example, you might write: “The service in question was medically necessary. Attached is a letter of documentation from my doctor.” Editorial comments such as “I think you are wrong; Medicare doesn’t know what it is doing” might be true, but won’t win you a reversal!

GEM: Use Medical Records for Support

We have already told you that you have a legal right to request your medical files so you can see all documents the insurance carrier used as the basis for making its decision. (Requests can be made using the federal Freedom of Information Act; 42 U.S.C. §1305, 20 C.F.R. §404.1710.) Check your medical records and use them to support your appeal.

* * *

Once you have completed the form, bring or mail it to the local Social Security office. (As always, make sure you keep a copy of everything you submit.) You will then be contacted by the ALJ about setting up a time and place to study the evidence and take testimony. The ALJ is not a local Social Security office employee; he or she is assigned a region to tour.

An Administrative Hearing can be held in various places, such as the local Social Security office, a hotel room, or even your own home, if necessary. You might want to request that a location be selected as convenient to you as possible.

If necessary, Medicare will also conduct hearings over the phone. This can save time, but you need to decide if the telephone is the most effective way to present your case. For example, if you are hard of hearing, a telephone hearing would not be the best choice!

While it is not always necessary to attend a hearing, your chances of success are better when you meet the judge face to face. For example, if your claim for physical therapy was denied as unnecessary, you and your doctor might want to demonstrate the range of your mobility to substantiate the need for treatment. Or an ALJ might benefit by coming to your home to see why receiving services there is more suitable for you than going to an outpatient care facility.

What Happens at a Hearing?

The rules are really very loose. First, the ALJ will look at all the facts that were previously considered. He or she then can look at new evidence. If the additional information is submitted by the service provider, the judge must notify you ahead of time so that you have time to respond to the new facts presented. If possible, before the hearing date, make an appointment with the ALJ to review your case file. You can copy any documents free of charge [20 C.F.R. §404.946(b)].

At the hearing you can introduce any information that relates to your claim; you will not be limited by the usual evidence rules that apply in court [20 C.F.R. §404.950 (c)]. Documentation doesn’t need to be presented in a fancy lawyer’s brief. You may bring statements from any folks with useful information. For example, if you are contesting a “not-housebound” denial, a letter from a “nosey” neighbor supporting the fact that you are confined to home would be perfectly appropriate. Or you might want the neighbor to appear as a witness for you, describing how he or she only sees you out two times a month when the home health aide lifts you onto the wheelchair and takes you out for some air. Your witnesses don’t have to have official titles to be legitimate [20 C.F.R. §404.950(e)].

Unwilling witnesses can even be subpoenaed, and the Government will pay for all the costs to do it [20 C.F.R. §404.950 (d)]. You will need to put your request to subpoena witnesses to the judge in writing, in advance of the hearing, explaining why this person’s presence is essential to your case. Although an ALJ may give you a hard time, the right to subpoena witnesses is yours. But think twice before trying to force unwilling witnesses to the hearing; they probably won’t be too happy, and may not help your case.

The judge can ask questions of any witness. He is allowed to bring in an outside medical expert who will look at the facts of your case and offer his opinion. You or your representative can also question this expert. If this advisor’s views differ from your own doctor’s, you might remind the judge that Medicare law requires your own physician’s views to be given stronger consideration because he has cared for you and knows your case better than anyone else.

Who Attends the Hearing?

No, it’s not like a Perry Mason trial—you won’t find yourself in a courtroom packed with curious bystanders. Medicare hearings are “intimate affairs,” closed to the public. You will find the ALJ, an assistant to help with a tape recorder and paperwork, and perhaps the court’s medical advisor.

Do You Need Professional Help?

No. If you decide to ask for help, you can choose anyone to be your advocate—a person doesn’t need a Harvard law degree (or any degree for that matter!) to be a patient’s representative. However, whoever you choose must be officially appointed by you. This can be done at the time you submit your request for a hearing. Simply attach a note signed by you or use the Appointment of Representative form (Form SSA-1696-U4). (See Appendix 15 for a copy of the form.) Additional forms can be obtained from your local Social Security office.

Of course, you want to choose someone you trust, but the person also should be assertive because it will be the advocate’s job to prepare your case for the hearing. This includes obtaining and submitting all appropriate documentation, making sure he or she knows or learns the rules, checking filing deadlines, and meeting any other requirements for the hearing. By law, your representative must be given access to your appeal file when it is requested, so he or she shouldn’t take no for an answer [20 C.F.R. §404.1710]!

You should also know that advocates are entitled to be paid for their work. Although it might be a labor of love, don’t assume your representative is doing this job for free. Make sure you both understand and agree to terms in writing. Medicare puts a ceiling on how much an advocate can be paid—25 percent of the past due benefits awarded to you. It is illegal to be charged more [20 C.F.R. §404.1720].

If you have hired a lawyer and win your case, Uncle Sam will reimburse fees at the rate of $100 an hour. The lawyer must file certain forms to get paid. Again, don’t assume anything. Talk over fees and who will pay beforehand, so you don’t get stuck with a bill. Always get a lawyer experienced with Medicare (not your friend’s fresh-out-of-law-school nephew); a specialist should be familiar with the system and what needs to be done.

While you can handle the hearing yourself, we generally don’t advise it. Unless the claim is too small to warrant getting anyone else involved, get an experienced advocate to help.

Do You Have to Attend the Hearing?

No. If you have chosen someone to serve as your representative, you don’t have to be there. Also, if your case “speaks for itself”—the evidence you have submitted is extremely strong and the use of witnesses won’t add anything—you can request that the judge rule without having an oral hearing. Opting for this can protect you from surprises. Remember, the judge is allowed to ask your witnesses any questions he desires (does witness Aunt Sophie talk too much?), and he can also bring in his medical expert (someone who is not “on your side”). You eliminate these unknowns when you skip the oral hearing.

On the other hand, the hearing gives you a chance to make your case forcefully. Your presence and testimony, and the testimony of others, may be very useful to convince the ALJ to approve your claim.

GEM: Pursue an Administrative Hearing

If even the thought of going before a judge makes your knees quake, take courage by thinking of this statistic: Your chance of winning after only the first appeal Reconsideration is one in two—50 percent.3 When people persevere and go on up to the second step, an Administrative Hearing, the chance of striking gold is even higher. Those odds are too good to pass up, so don’t!

STEP 3—THE SOCIAL SECURITY APPEALS COUNCIL REVIEW

If your Administrative Hearing did not resolve your complaint satisfactorily, your next step up the Appeals Ladder is a request for an Appeals Council Review. Keep in mind that, at this point, you are getting down to really serious business. You definitely will want assistance. You need either a professional with expertise in Medicare or a lawyer to prepare your case.

What Happens at a Review?

The review (held at the Appeals Council’s office in Arlington, Virginia) is a “paper hearing”; no oral testimony is allowed. Your case will stand or fall based solely on what written facts are presented. Clear documentation and citation of the specific Medicare law(s) that support your case (or that have been violated) are essential. The Appeals Council is allowed to choose which cases to review; not every appeal request is accepted. The council also may decide to send your case back to step two, for a new review by an ALJ.

What Are the Basic Requirements?

To pursue an Appeals Council Review, you will need:

1. Medicare expertise—guidance from someone knowledgeable in Medicare law, preferably a lawyer.

2. An accurately completed Form HA-520—Request for Review of Hearing Decision/Order (see Appendix 12 for a copy of form), or a letter to the ALJ requesting a review.

3. To submit any additional written evidence to support your claim. These materials can be attached to your form or mailed within 15 days of filing. (Given the high risk of papers getting separated and lost, it’s wiser to send your entire case at the same time. If you can’t, make sure any items being mailed separately are clearly marked with your name, Social Security number and claim number; attach a note stating that Form HA-520 has already been mailed and this material is to be added to your appeal documents.)

4. To make copies of all materials you have submitted, so that you will have an accurate record.

5. To use registered mail.

6. To meet filing deadlines. After receiving your ALJ hearing decision, you have 60 days to request an Appeals Council Review.

STEP 4—THE REQUEST FOR JUDICIAL REVIEW

This is the “Supreme Court” of the Medicare appeals process. It is your last step up the Appeals Ladder—your final chance to make sure justice is done.

What Happens at a Judicial Review?

You are taking your case to Federal District Court, and you must be represented by a lawyer. Your attorney will prepare a detailed brief and argue your case. Obviously, you only proceed to this stage when the legal merits of your claim are very strong. If you win your case, Medicare will reimburse your legal fees (but at Uncle Sam’s approved rates, which are probably lower than your own lawyer’s, so discuss fees with your attorney beforehand).

What Are the Basic Requirements?

To pursue a Request for Judicial Review, you will need:

1. A minimum claim of $1,000 or more.

2. Medicare expertise: a lawyer experienced with the Medicare appeals process.

3. To meet filing deadlines. You have 60 days after the Appeals Council Decision to request a Judicial Review.

PART B APPEALS: OVERVIEW

When you believe a claim is unfairly denied or paid at less than you were due for any service that falls under the Part B umbrella (see here for detailed list of services), you should first try to identify the source of the error and to work out the problem informally. Because a claim passes through many hands, there are lots of opportunities for human error. Unfortunately, the mistake that took only a second to make may take weeks or months to correct.

Was the claim form completed properly? That’s a possible source of the problem. Ask the service provider who submitted the claim to check for any error. Or request a copy so you can double check. Is all the information there? Is it legible?

If the claim form was accurately completed, and the service should be covered, resubmit the claim. Just write a cover note: “Please review. This is a covered service.”

If the problem can’t be resolved informally, you must climb the Part B Appeals Ladder to reach the pot of gold. Table 5.4 summarizes the steps up the Part B Appeals Ladder. The steps are very similar to those for Part A. To correct Medicare’s mistakes, you must start at the bottom rung of the ladder (a Request for Reconsideration) and if necessary work your way up to the fifth step (a Judicial Review). As you might guess, each step up gets increasingly complex. But fear not, the first level is very do-able. You do need patience—you do not need a law degree.

The tips provided in this section will focus on the bottom steps of the ladder—what you can do yourself. If you are not satisfied with the outcome of a review and want to move up to the higher steps, it’s a wise idea to seek advice from “appealing” individuals—folks with some Medicare expertise. (Check with your community’s nearest senior citizen center, contact AARP, call the county bar association, or get recommendations from friends for lawyers who handle these kinds of claims.)

Remember, it’s part of Uncle Sam’s Medicare Monopoly strategy to intimidate you. He doesn’t want you to think it’s an easy climb up the Appeals Ladder. Although it’s not effortless, we are not talking Mount Kilimanjaro, either. It’s worth a try. Remember the Golden Rule: you can’t win if you don’t play the game!

When Should You Appeal?

There are many reasons why Medicare claims can be denied. Some are valid excuses and some are not. Unfortunately, when an unfairly denied claim arrives on your doorstep, it does not present itself in a color-coded envelope with neon lights that flash “UNFAIR.” An incorrect decision comes disguised looking like any other Medicare correspondence—official—and as a result, too many of us believe the information inside must be the official last word on the matter. Don’t let appearances fool you. There is plenty of room for official error!

Since Medicare’s mistakes will never be as glaringly apparent as neon lights, we must look for more subtle signs of bureaucratic bungling. So, what should you keep your eyes open for?