Let’s Get Digital

■ ■ ■

What happens to all your digital accounts, services, and property after you die? Way back at the beginning of Level 1, we stressed the importance of sharing passwords and codes (see here). We’ve even peppered many of the sections with (passwords!) to emphasize how prevalent they’ve become in our lives. Now we’re ready to cover the accounts and services those passwords unlock, and what you want done with them today or after you’re gone. The official name for this is a Digital Estate Plan. (Note how the words estate plan can be off-putting but become infinitely cooler once you put the word digital in front of them.)

Why You Need a Digital Estate Plan

With the lines increasingly blurred between our on- and off-line lives, it’s more important than ever to have a plan for your digital holdings. With one in place, all your digital accounts and services can be deleted, managed, or transferred to someone else after you’re gone. You can also ensure that all paid or recurring services are closed and not draining money from your bank account or racking up credit card debt. Finally, a plan will provide guidance and direction about what you want done with your digital assets and overall online presence.

In the same way that you need to organize your physical possessions, if you don’t get a handle on your digital life, you’re leaving a huge mess for your family when you sign off from this world.

How to Classify Digital Assets and Accounts

Although there are likely many different components to your digital world, we’ve narrowed it down to two overarching types.

Hardware: Computers, smartphones, external hard drives, tablets, digital music players, e-readers, digital cameras, wearables, and other digital devices

Online accounts & services: Email and communications, social media, shopping, entertainment, online storage, and accounts associated with your day-to-day life

Yes, we managed to squeeze all this stuff into two neat, compact points. But we’re fully aware that, in practice, it’s a large, virtually invisible universe to process. For this section, we’re drilling down on digital accounts that often play by their own set of rules, which is why you might want to keep this next part a secret.

Digital Estate Laws & How to Bend Them

Things are about to get a little legislative, so hang tough, because it’s worth it. Almost all fifty states have passed laws that give a person’s family (or executor) the right to access and manage some of their digital assets after they die. Much of this is to the credit of a nonprofit called the Uniform Law Commission. They created the Revised Uniform Fiduciary Access to Digital Assets Act (2015), which is aimed at allowing executors, trustees, or the person appointed by the court (conservator or fiduciary) access to a deceased person’s digital assets. Although it’s not yet the law of the land, and there are still stipulations and complexities involved, it shows there’s been forward momentum and progress regarding the issue.

To give you some perspective: When we first started Everplans in 2012, fewer than a dozen states had these laws. Now, almost all of them do.

Even with these laws in place, many of the accounts we use on a daily basis are governed by the “terms of service” or “privacy policy” of that particular service (such as Gmail, Facebook, or Amazon), which still want to determine what should be done with an account after a subscriber’s death. Although massive services like Facebook offer something called a Legacy Contact, and Google has an Inactive Account Manager, this supposes that you take the time to get your digital affairs in order ahead of time. Since people don’t often do this, and legislation may not fully (or quickly) solve the problem, you might need to take things into your own crafty hands. This means sharing passwords and instructions with someone else. Digital services don’t like it when people do this, but there are things they do that we don’t like either.

How This Helps After You’re Gone

(Mapping your digital existence)

■ The maze that is your digital life, which also includes physical backups, can be navigated by someone other than yourself.

■ Your family will know what to keep, transfer, cancel, memorialize, and delete.

■ They can avoid some of the frustrating steps these services have in place when all you want done is to have an account shut down.

■ The person you name as Digital Executor can use this information to help settle your estate.

To be fair, many companies have these rules in place to provide security or privacy. If multiple people can access the same account, it’s more likely to be compromised. That’s all well and good, but giving up this much control over your information can be hard for many to accept, which is why you may have to paint outside the lines on occasion to get what you want. For example, think about all the digital purchases you’ve made up until this point of your life—books, music, games, movies, and TV shows—that simply evaporate once you’re gone.

Before the digital age, entertainment was physical. You bought albums, books, DVDs, or any other type of media, and those things were yours. You could keep them forever, give them to a friend, donate them, or burn them. If they got ruined or destroyed—like a tape you played so much it broke—you had to buy a new one, which was also yours to do with as you pleased.

It doesn’t work that way anymore. If you’ve ever made a digital purchase, you’re basically renting that thing for the duration of your life. When you die, you can’t pass it down the same way you would an actual book or album. It’s more convenient to be able to carry a library’s worth of books on your tablet, but the sense of ownership has become muddled.

Sharing (Passwords) Is Caring

So, what can you do if you’re worried about losing your digital assets one day? Many people share the details of the accounts that contain purchased media with an heir who can take ownership of that account. All they have to do is log in and change the email address, and it’s theirs. It might get a little messy having more than one account, but it’s better than letting media worth hundreds or thousands of dollars disappear or need to be repurchased.

Some of our most cherished possessions are books handed down from our grandparents and parents. If every cookbook of the future is digital, and the companies that provide those books get them back when you die, how is that fair to your kids?

Perhaps this won’t matter as much to future generations as it does to us, since the delivery of media has changed drastically over the years. Or maybe it’s up to us to keep the concept of permanent media alive.

Take Netflix, for example. You pay around $10–$15 a month to access thousands of movies and TV shows and have no expectation of ownership. Each month new programming is added, and movies and shows are deleted because Netflix no longer has the rights to them. Most of the time you never even notice when something’s removed—unless it’s a movie you always like to watch when you’re sad, or the one show that got your kids to settle down for an hour or two. You might feel disappointed for a moment, but then you find something else to watch (because there’s always something else to watch!).

It’s hard to tell at this point if companies like Amazon and Apple will pivot toward tighter or looser control over media ownership. At least for now, the only surefire way to acquire books, movies, and music that you can share and bequeath is to buy the real deal or create a Digital Estate Plan that accounts for all these things.

In some instances, the device itself can be preserved and frozen in time. For example, some people might turn off the Wi-Fi for Grandma’s Kindle so it never accidentally syncs to the Amazon servers, ensuring that you don’t lose the dozens of books she downloaded (and put a sticker on the device “Grandma’s Library—Never Sync!”). It seems low-tech, but so is printing words on sheets made from dead trees and gluing them together. Whatever you choose to do, just have something in place, unless digital purchases don’t matter to you as much as they do to many collectors.

Get a Password Manager, the Remix

Far be it from us to tell you what to do, or to repeat what we already stressed in Level 1 (see here), but in this instance we’re willing to go all in on password managers. Currently, everything digital requires some sort of password or code. Although the world is starting to transition toward fingerprint ID and facial recognition, the backup entry is always a password or code. To remind you, once again, why it’s important:

■ You need to remember only one password.

■ You can easily share some or all of your passwords with someone you trust.

■ You can auto-generate strong passwords for greater security.

If you’re still unwilling to hop aboard the password manager express, you’ll need to provide instructions alongside each of your accounts in whatever password storage method you choose. It’s easy to include in a digital document or note-taking app, but if it’s a handwritten list, you’ll need to find space on the page for it. If you don’t keep track of your passwords anywhere, then we’re calling your family right now and staging an intervention.

Don’t Forget Your Gadgets: Include access codes to all your devices (computers, smartphones, tablets), since your family may need to use them to access your accounts or services, especially if they exist only as a mobile app.

Classifying Each Account

Not all digital accounts and services are created equal. You should be able to classify each of your accounts as you start to peel away each layer:

1 Personal: Emails, texts, photos, document storage

2 Value (with a credit card attached): iTunes, Amazon, eBay, domain names

3 Social: Facebook, Twitter, Instagram, LinkedIn

4 Transferable: Streaming services, food delivery, travel

As a reminder, we’re not including off-line services that might be in your name and benefit others in your household, such as utilities, banking, house and car payments, and health insurance. These, as we already mentioned, need to be associated with the service they provide, since the process to transfer or close them is more nuanced. (And by nuanced we mean “pain in the butt,” which is covered in the “Money You Owe” section.)

How each of these are managed will vary, depending on the nature of the account or service. You may want some assets to be archived and saved, others to be deleted, erased, or ignored, and others transferred to family members, friends, or colleagues. Ideally, you should specify what needs to be done for each digital account or asset. If that’s too much to ask, you should focus only on the ones that matter and let the rest disappear, never to be logged in to again. But first, you need to get a full picture of what you have.

Your Digital Account Matrix

It’s backbreaking work to clean out another person’s packed house. It’s mind-breaking work for your family to manage your digital estate if they don’t know what you have and what you want done with it all.

The most efficient way to begin organizing your digital accounts and services is to focus on the ones that provide the most value to you right now. Even though you may have dozens (or even more than a hundred) accounts, this short list will provide the most value to the people who have to deal with them when you’re gone. The rest will fall into place, or by the wayside, as nature intended.

We’ve done our best to list as many digital accounts as possible to put you on the right track, but they’re always changing. If we had written this section in the early 2000s, MySpace would have been at the top of the list and we’d look like idiots. For this reason, please cut us some slack if we highlight something that doesn’t have relevance by the time you read it.

Here are the main things you need to consider for each account you have:

Level of importance: If you were to delete it today, how would it affect your life? One way to clean things up is to kill the useless accounts as you’re getting a plan in place.

Single sign-on: Do you use the credentials for this account to log in to other accounts, such as using your Google account to log in to eBay?

Payment method: Is there a credit card, a bank account routing number, or another form of cash attached to a given account? If you canceled the card or closed the bank account, would it interrupt or delete the service?

Ultimate fate: Should it be deleted or transferred, or do you just not care?

This covers all the bases on general organization, but like we said earlier, not all accounts are created equal, and some require special treatment. Let’s start with those.

The Big Five

The majority of your accounts can be organized into neat categories, like communication, shopping, and entertainment. Then there are the “mothership” accounts that stand above all the rest because they provide multiple services and play by their own set of rules. Here they are:

Remember when you first heard the word Google and how ridiculous it sounded? Now it’s almost dizzying how interwoven it is into our digital lives.

Gmail: If you’re one of the 1.5 billion people who use Gmail as your primary email, you understand its importance. Aside from general communication, this is how you might get your billing statements and confirm your accounts. If someone needed to reset a password to gain access to an account, this is likely where it would go down. If you’re a private person who doesn’t want their email to be read, you can use their Inactive Account Manager option (see here).

Other Google Services: Google Drive, Chrome, Contacts, Calendar, Maps, YouTube, Android, Home, Nest, Chromecast, and Photos. As you can see, Gmail is only the tip of the iceberg. You can identify the rest of the services associated with your account when you log in and view this page: myaccount.google.com. Or maybe you could think about it like this:

❏ Do you have documents and spreadsheets uploaded to Drive?

❏ Are your passwords saved in Chrome?

❏ Are you concerned about your browser history because you never bothered using Incognito, which allows you to view whatever you want without saving it?

❏ Is your calendar loaded with appointments and contacts?

❏ Do you subscribe to YouTube services (music, TV), and is it connected to a Chromecast so you can watch it from the comfort of your couch?

❏ Do you have a Google Home device that provides Amazon Echo-like functionality and home automation?

❏ Do you back up all your images and videos using Google Photos?

❏ Do you use an Android-based phone that ties all these services together in a mobile environment?

❏ Do you sign into other sites or apps using your Google account?

❏ Do you also use it for work?

❏ Are you scared yet?

Depending on the depth of your digital relationship with Google, you can see why granting someone access to your account and telling them what you want done with it after you’re gone could be the most important aspect of your Digital Estate Plan. Google is so pervasive, it even has a way to somewhat painlessly allow a person you trust to manage your account after you’re gone.

Inactive Account Manager: Google’s post-death solution is based on your level of inactivity, which means people use Google so frequently (checking Gmail on a phone, doing a search, or watching a YouTube video while logged in) that not using it for a period of time is considered odd behavior. You can set your inactivity time from three months to a year and a half. If you don’t access any of their services within that time frame, Google sets off a series of events that will either delete your entire account or share it with someone you named as a “trusted contact.”

To set up Inactive Account Manager, Google “inactive account manager” or use this link: myaccount.google.com/inactive. From there, it walks you through the steps.

Tread Lightly Before You Delete: You have to be very careful not to jump the gun and delete a Google account unless you’re sure you won’t need it. The same rule applies to all primary email accounts that serve as a major source of information. It’d be like torching a filing cabinet filled with every contact and correspondence you have just because you wanted it gone. What’s the rush? You can always delete it later. Better to keep it active and secure until you’re sure it’s no longer required.

There are other, more important services than Facebook, but with 2.6 billion users (many of them real people, not fake profiles), it carries a lot of weight. It’s also become a major source of single sign-on, which is when you use Facebook to log in to other sites, so you don’t have to create a new set of credentials.

Facebook has also become the hub for millions of people’s online identity, a kind of modern phone book without the need for a phone. You can pretty much get in touch with anyone at any time, as long as they regularly check Facebook. It’s possible that Facebook and its other popular messaging platform, WhatsApp, could be just as important as a primary email account.

Memorialization & Naming a Legacy Contact: Memorializing a Facebook account after death has become a standard practice. Anything the deceased posted is still visible, and, depending on their account settings, a “Remembering” badge is added to the profile and friends can still add memories and comments on their wall. If a Legacy Contact was appointed, that person can update the main photo, respond to friend requests (but can’t add new friends), and include a pinned post at the top of the profile (for example, a final message). They can’t access any direct messages, which are kept private. To have full access, a person would need the login information (passwords!).

Instructions to Delete: If you want to remain virtually visible to the world, take the memorialization and Legacy Contact path. If you want your account deleted the way Facebook suggests, name a Legacy Contact and select the option that you want your account deleted. If you want to do it unofficially, give the person in charge of your digital estate your login info and have them delete it the same way you would if you were still alive. This person would need access to your email and phone if two-step verification is required to complete the process.

Warning: Time Is Not on Your Side. Although Facebook has been working to make the process better, there’s a chance that anyone can submit a memorialization request and make it a huge pain to get it unmemorialized. It’s sometimes done by a person who may not have even been close to the deceased. They just want to play TMZ and break the news about a death without perhaps considering what the family or close friends may be going through. If this happens to you, your family will be at the mercy of Facebook, so beware.

AMAZON

What started as a place to buy books in 1994 has become a superstore behemoth with more than 100 million Prime members. Although the majority of people use it to shop, Amazon has found a way into almost every aspect of our lives, including streaming (Prime Video), music (Amazon Music), digital books (Kindle), photo storage (free with Prime), groceries (Amazon Fresh and Whole Foods), and hardware that’s either connected to your TV (Fire), guarding your home (Ring), or listening to you right now and awaiting instructions to tell you the time, weather, or a joke (Echo). It also has an entire world you might not know about called Amazon Web Services, which provides cloud computing to a decent-sized chunk of the internet (Everplans included).

Although much of it operates within its own ecosystem—you might not use your Amazon account to log in to other accounts, for example—Amazon is a massive universe that allows you to share your account and benefits with two adults, four teens, and four children via Amazon Household. If the main account holder dies, it can get tricky, which is why each (trusted and responsible) member of the household should have access to the main account.

Purchased Content: Like most of the digital media purchases we mentioned earlier, these are a one-time agreement between Amazon and the person who bought it. When you delete an account, all that goes away. If you’ve been building a substantial library of digital books over the years—Kindle was released in 2007—you can’t put them in a box and hand it to your grandkids to enjoy. This is why you might want to keep the account alive, either by having someone take it over or by removing any payment options (a credit card is required only for Prime) and keeping it dormant to access those purchases.

If you want to let a Prime subscription lapse, it’s not the end of the world, but you should check a few things beforehand. Will any auto-deliveries be interrupted? Do you need to download any backed-up photos? There are also video watchlists and music playlists, but anything subscription based can be re-created on another person’s Prime account.

Sellers: There are 5 million marketplace sellers on Amazon, which range from individuals operating like they would on eBay to small businesses using it for distribution. We had a Side Mission (see here) about running a small business, but here’s a little insight into any moneymaking (or losing) ventures: They have to be included as part of your estate. We talked about how an executor must gather up all the assets. Money (including points or gift card balances) in a seller’s account is considered an asset.

Instructions to Delete or Transfer: Before you delete an Amazon account, be aware of all the implications. It might be easier to simply take it over if you want to keep using it. That way you don’t have to set up the same exact thing again. You’ll need to change the email to your own, which means you should have access to the previous email in case it requires verification. (Passwords to the rescue again!) Any canceled credit cards will need to be updated to prevent a disruption in service.

APPLE

As one of the most valuable companies on the planet, Apple has created its own world of products that work together from platform to platform. If you’ve got an iPhone, MacBook, iPad, Apple Watch, or Apple TV and use any of Apple’s services (iCloud, Safari browser, Apple Music, photos, games, video . . .), then you’ll want to follow a route similar to the one you did with Amazon.

The Keys to the Apple Kingdom: The Apple ID is digital gold and grants access to all of these services. Anyone who might be taking control of your iKingdom needs the username and password, as well as the associated email account (to update or reset the password) and the access code to the iPhone (if two-step verification is enabled—something you will have already taken care of because you’re so on top of all this).

Instructions to Delete or Transfer: Once again, don’t do this on a whim, because once it’s closed, or inaccessible, it’s almost impossible to get it back. For a company that was built to make computing easy, deleting an account is confusing and arduous. For this reason, you may want to tell the person to change the email on the account to their own—or one they set up on the side—just to keep them from spending hours or days trying to figure it all out. What you should do is outline all the things that need to be managed, such as photos, texts, contacts, passwords, and everything else associated with that Apple ID. If you’ve made a lot of purchases, mainly because iTunes was the first legit marketplace for downloadable music, you might want to do the same thing we did with the Kindle: Freeze it in time and keep using it without connecting it to the internet.

We’re fully aware that some of these solutions seem crazy in an era with such amazing technology. The problem: These companies, along with the majority of the human race, don’t want to think about death. However, as more and more people who use these products start to leave us, they’re going to have to come up with better solutions, like offering an easy way to merge or transfer these accounts into your own. If they included a feature like that, it would render this entire section of the book completely unnecessary, but that’s a sacrifice we’re willing to make. (We’re so noble sometimes.)

MICROSOFT

Microsoft might not be happy following Apple, but they’re still doing just fine, mainly because more than 1.5 billion people use the Windows platform. They have Outlook.com (formerly hotmail.com), Office, Skype, Xbox, LinkedIn (betcha didn’t know Microsoft owned that), and other services that fall into many of the same categories we already covered.

The Keys to the Micro Kingdom: The Microsoft ID (formerly known as Passport) consolidates every Microsoft service, much like all the other major “special treatment” providers we’ve mentioned. A person with this will have full access to all the Microsoft services you have.

Instructions to Delete or Transfer: We think you know the drill by now. The few differentiators with Microsoft are Office, Xbox, and LinkedIn. If you pay for a LinkedIn Premium account, you’ll want it canceled. If you pay for an Office 365 subscription or Xbox Live account, you’ll have to make arrangements for those too. Otherwise, you can either have someone take them over by changing the email and payment options or let them all disappear into the abyss.

Don’t Go Overboard!

You don’t have to be an overachieving completist. When you take an inventory of all your accounts (detailed in the next six pages), make a quick decision using these criteria:

If I delete this right now, what are the consequences? If the answer is “My entire digital world would collapse” or “It has a lot of my personal information that I’d like deleted,” then you know it requires effort. If the answer is “Nothing at all,” then you can let it slip away like a thief in the night.

Does anyone else need it? You might not care about an account, but someone in your family might need it. This also opens a door—or portal, if we wanted to sound extra futuristic—to having a digital estate conversation with your family so you can all be on the same (web)page.

Finally, feel free to include some personality in the instructions. A little levity can help keep the person tasked with the job from getting depressed while shutting down and deleting your digital universe. (For more digital matrix info, go online here: incasethe book.com/digital-account-matrix.)

Plan of  Attack

Attack

Doing the Digital Dance

Time: You can tear through this much more quickly once you organize all your passwords from Level 1. To speed things up even more, recognize early in the process which accounts really matter and which simply need to be shut down or transferred (see “The Big Close-Out” chart that follows).

■ If you’re keeping track of accounts using a password manager, add your instructions in the Notes field.

■ If you opt for a digital or hard copy document, include the word Instructions under the login info and then add them.

■ If your password list is handwritten, you may need to start a new document, since there might not be room on the page (or sticky note).

Limit yourself to thirty minutes for each account that really matters. The ones that don’t have much significance but still require instructions should take less than five minutes per account. For the ones that really don’t matter, keep it under thirty seconds (Delete or Ignore will suffice).

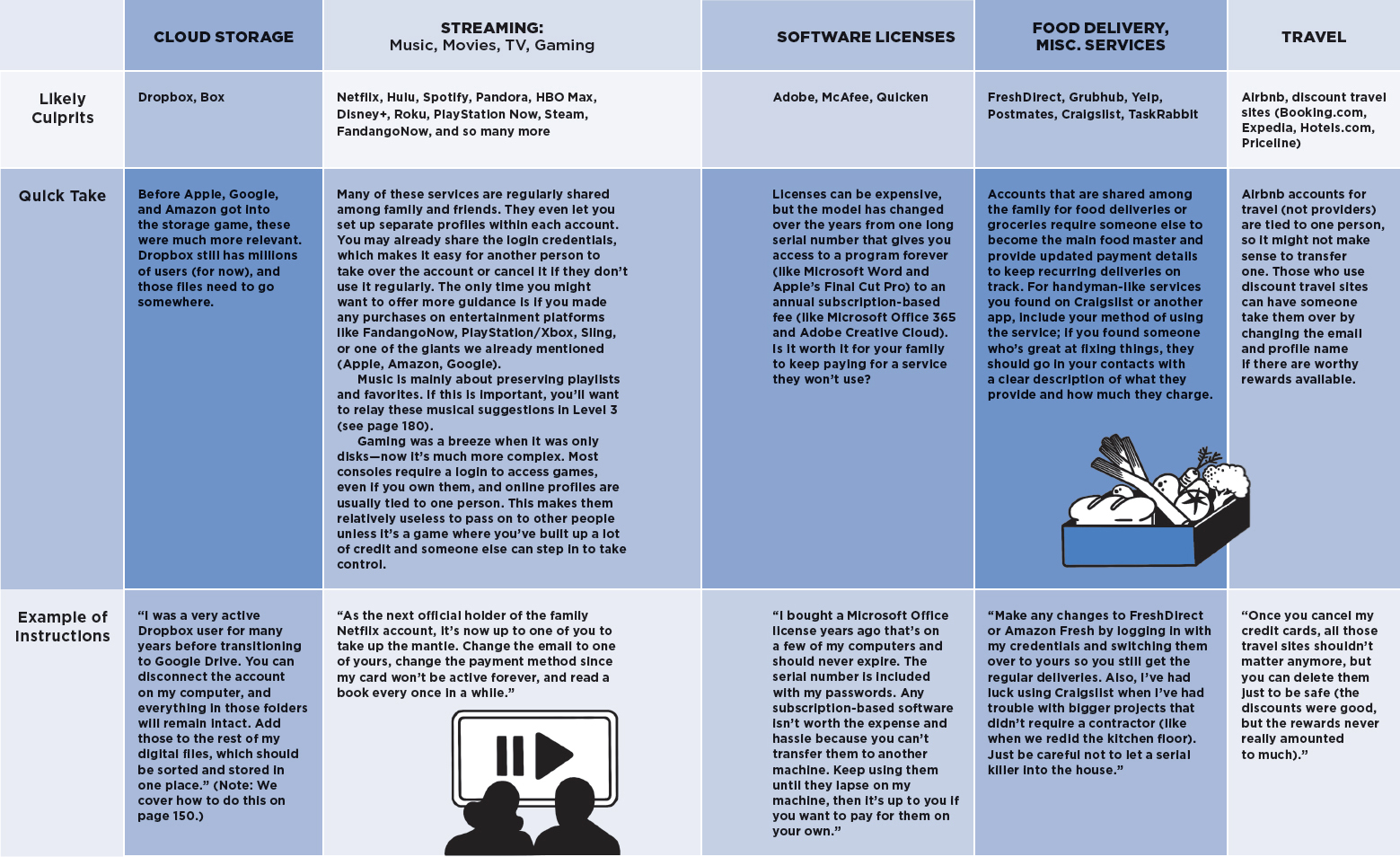

THE BIG CLOSE-OUT SECOND LEVEL

Now that we’ve gotten those monsters out of the way, let’s dig into the categories. We’re presenting them in a stylish chart to give you a sense of what type of account fits into each category, a quick take, and examples of instructions you should leave behind. If any of these types of accounts applies to your digital life, make a mental note of what you want done with it. If it doesn’t, that’s one less thing to worry about.

Physical Files: Backups & Hard Drives

Today, the cloud dominates file storage, but it wasn’t always that way. Here are the types of storage devices you’ll find either belonging to someone over forty or in a museum: floppy disks, Zip and Jaz drives, CD-ROMs, and DVDs. If you had an external hard drive, it meant you were a big spender, because they were pricey. As they became more affordable (thanks, Black Friday deals), they were a necessity to protect your data. It became normal to have a drawer full of these metal boxes loaded with data from every computer you ever had.

It’s hard enough to sort through physical possessions. Add in terabytes of unsorted data, much of which could be duplicates, and it’s a herculean task to behold. Sure, there could be gems hidden on those backups, the same way you might find a priceless heirloom in a box in the attic, but searching through every file could take a lifetime. You and your family have better things to do.

Then there’s the question of why you need a backup hard drive in the first place. To restore a current computer if it has a meltdown, right? That means backups for older computers aren’t of any use beyond nostalgia and peace of mind. The operating systems and programs probably won’t even work anymore.

Then there are the memories: mainly documents, photos and videos, and emails (if you can still access them). If you care about these things, you’ll be interested in our photo-sorting method in Level 3 (see here). If you want a quick solution, here’s one idea: Gather up all the external drives you have and light them on fire, then run away. (And yes, we’re joking. Please do not do this!)

OK, here’s the real process: Begin by gathering up all the external drives you have in one box. This includes thumb drives too. Go through them, one by one, and start sorting. Anything you want to keep—mainly photos, videos, and documents—should be moved into a folder on your desktop titled “Stuff from External Drives” or some naming convention so you know what it is. Once you complete a drive, reformat it so there’s no going back. Repeat until all the drives are empty. Use one of the drives to back up your current computer, because it’s important to do it for computers still in use. Now instead of having twenty external drives, there’s only one and it’s filled with items worth keeping.

Not very scientific, but there’s really no other way. If you’re the sentimental type, you will waste hours stuck in memory holes. You’ll probably want to keep everything or find it too daunting and want to give up. If that’s the case, then don’t even bother looking and just reformat the drive.

“You want me to delete everything?!” you just thought, incredulous. “Are you people monsters?”

Perhaps, but here’s reality: If you haven’t needed these drives for years, why do you need them now? We completely understand the hoarding mentality (just ask our coauthor Adam, the man saves everything), but what would your family do if they were tasked with making sense of decades of hard drives? You haven’t touched them in years, so why should they? It’s up to you to mine the drives for what’s important. If you don’t want to do it, then let them go.

One last point about external hard drives, and it may get a little adult. Back when the internet first started, the naughty materials people currently access online would be downloaded. Perhaps some of these drives are loaded with stuff you don’t want your family to see. We read a thread on Reddit about what was found on dead people’s computers, and it was overwhelmingly porn related. We tastefully tackle this topic near the end of the book (see here), but now that we teased it here, does that give you enough motivation to start sorting and deleting? Thought so!

Naming a Digital Executor

Once you’ve identified what you want done with all the accounts that matter, you need someone who’ll make the instructions you leave behind a reality. Enter the Digital Executor—the person you designate to help manage and settle your digital estate. It sounds a lot more official than it is, especially since it’s not legally binding in most states. But you didn’t get this far in life by following the rules, did you? Also, most Wills include this option, so you won’t have to do much extra work to get it done.

Do This: Appoint this person in your Will or make it clear to your executor that they’re also responsible for your digital accounts and assets.

Don’t Do This: Include passwords or what you want done with your digital accounts in your Will. As we’ve already mentioned, a Will becomes a public document and you don’t want this private information floating around for identity thieves to steal.

So Do This: All the instructions you leave behind should be in a separate place, whether in the Description (or Notes) field of your password manager alongside the account or in a document where you keep all your passwords. As you add new accounts, or rethink the importance of accounts you already have, updating your records should become part of your regular password storage process.

Plan of  Attack

Attack

Picking Your Digital Docent

Time: No extra time is needed if you include this as part of your Will and plan to use the same executor. If you want to keep the two separate, allocate around two hours to decide who should be tasked with managing your digital affairs, write up a cover page that explains your Digital Estate Plan, and let that person know they’re the chosen one.

Logging Off

If the concept of sharing your digital information with another person makes you uncomfortable, then you’re being completely sane and normal. And here’s the thing: You don’t have to provide access to these accounts right now, but you do need to organize everything in one place to save your loved ones a ton of headaches down the road.

The whole point of a Digital Estate Plan is to allow someone you trust to close down your accounts, repurpose devices, and transfer services without going completely crazy. There’s a reason why some of the most popular pages on the Everplans website involve closing digital accounts after someone dies (and we have instructions for more than 200 of them!). We’ve also received countless emails from people begging us to help them close an account when someone they loved passed away without leaving any details behind. As sad as it makes us feel, there’s nothing we can do at that point. They’re at the mercy of Twitter or Facebook or the hundreds of other possible services that don’t make it easy for a person who’s grieving.

You don’t need to personally experience this sort of frustration and pain to spring into action. Take the time to get everything in order and you’ll be lifting a huge virtual weight off whoever you leave behind. Plus, we won’t receive as many depressing emails about closing accounts anymore. This is what people refer to as a classic win-win.

■ ■ ■