Chapter 7

Accepting Payments

In This Chapter

Anticipating your online customers’ purchasing needs

Anticipating your online customers’ purchasing needs

Applying for credit card merchant status

Applying for credit card merchant status

Finding shortcuts to processing credit card data

Finding shortcuts to processing credit card data

Providing shoppers with electronic purchasing systems

Providing shoppers with electronic purchasing systems

Delivering your products and services

Delivering your products and services

Starting a new business and getting it online is exciting, but believe me, the real excitement occurs when you get paid for what you do. Nothing boosts your confidence and tells you that your hard work is paying off like receiving the proverbial check in the mail or having funds transferred to your business account.

The immediacy and interactivity of selling and promoting yourself online applies to receiving payments, too. You can get paid with just a few mouse clicks and some important data entered on your customer’s keyboard. But completing an electronic commerce (e-commerce for short) transaction doesn’t work the same way as in a traditional retail store. Online, customers can’t personally hand you cash or a check. You, the seller, can’t verify the user’s identity by looking at a signature or photo ID.

In e-commerce, both buyers and sellers have the same concerns they’ve always had. Customers need a reliable way to pay you securely without worrying that their credit card information might be stolen. The seller needs to know that the customer isn’t using a stolen credit card. Luckily, online payments are safer than ever, and more options exist than ever before.

To get paid promptly and reliably online, you have to go through some extra steps to make the customer feel secure — not to mention protecting yourself, too. Successful e-commerce is about setting up the right atmosphere for making purchases, providing options for payment, and keeping sensitive information private. It’s also about making sure the goods get to the customer safely and on time. In this chapter, I describe how you can implement these essential online business strategies.

Sealing the Deal: The Options

As anyone who sells online knows, the point at which payment is transferred is one of the most eagerly awaited stages of the transaction. It’s also one of the stages apt to produce the most anxiety. Customers and merchants who are used to dealing with one another face to face and personally handing over identification and credit cards suddenly feel lost. On the web, they can’t see the person they’re dealing with.

For customers, the good news is that paying for something purchased over the Internet is getting to be a matter-of-fact thing. Security has improved dramatically. For merchants like you, there are some basic concerns: You want to make sure that checks don’t bounce and purchases aren’t made with stolen credit cards.

In giving your customers the ability to make payments online, your goal is to accomplish the following:

Give the customer options. Online shoppers like to feel that they have some degree of control. Give them a choice of payment alternatives: Phone, check, and credit cards are the main ones. Some also like a choice of online payment services; they want to see that you accept Google Checkout as well as PayPal, for example.

Give the customer options. Online shoppers like to feel that they have some degree of control. Give them a choice of payment alternatives: Phone, check, and credit cards are the main ones. Some also like a choice of online payment services; they want to see that you accept Google Checkout as well as PayPal, for example.

Keep payments secure. Pay an extra fee to your web host, if necessary, to have your customers submit their credit card numbers or other personal information to a secure server — a server that uses Secure Sockets Layer (SSL) encryption to render personal data unreadable if stolen.

Keep payments secure. Pay an extra fee to your web host, if necessary, to have your customers submit their credit card numbers or other personal information to a secure server — a server that uses Secure Sockets Layer (SSL) encryption to render personal data unreadable if stolen.

Make payments convenient. Shoppers on the web are in a hurry. Give them the web page forms and the phone numbers they need so that they can complete a purchase in a matter of seconds.

Make payments convenient. Shoppers on the web are in a hurry. Give them the web page forms and the phone numbers they need so that they can complete a purchase in a matter of seconds.

Though the goals are the same, the options are different if you sell on eBay or on another website that functions as an e-commerce marketplace. If you sell on eBay, either through an auction or an eBay Store, you can take advantage of eBay’s fraud protection measures: a feedback system that rewards honesty and penalizes dishonesty, fraud insurance, an investigations staff, and the threat of suspension. Of course, you might still run into buyers who try to cheat you. But the safeguards mean it’s feasible to accept cash and personal checks or money orders from buyers. If you don’t receive the cash, you don’t ship the merchandise. If you receive checks, you can wait until they clear before you ship.

On the web, you don’t have a feedback system or an investigations squad to ferret out dishonest buyers. You can accept checks or money orders, but credit cards are the safest and quickest option, and accordingly, they’re what buyers expect. It’s up to you to verify the buyer’s identity as best you can to minimize fraud.

Enabling Credit Card Purchases

Having the ability to accept and process credit card transactions makes it especially easy for your customers to follow the impulse to buy something from you. You stand to generate a lot more sales than you would otherwise.

But although credit cards are easy for shoppers to use, they make your life as an online merchant more complicated. You have two options:

Let your customers pay with a credit card through an online payment service. This requires them to sign up with the same online payment service. But they gain protection from the payment service’s security methods.

Let your customers pay with a credit card through an online payment service. This requires them to sign up with the same online payment service. But they gain protection from the payment service’s security methods.

Sign up with your own merchant account. This lets you shop around and choose the service with the lowest fees or the best service. But you have to jump through some hoops to get such an account.

Sign up with your own merchant account. This lets you shop around and choose the service with the lowest fees or the best service. But you have to jump through some hoops to get such an account.

I don’t want to discourage you from becoming credit card–ready by any means, but you need to be aware of the steps (and the expenses) involved, many of which may not occur to you when you’re just starting out. For example, you may not be aware of one or more of the following:

Merchant accounts: You have to apply and be approved for a special bank account called a merchant account for a bank to process the credit card orders that you receive. If you work through traditional banks, approval can take weeks. However, a number of online merchant account businesses are providing hot competition, which includes streamlining the application process.

Merchant accounts: You have to apply and be approved for a special bank account called a merchant account for a bank to process the credit card orders that you receive. If you work through traditional banks, approval can take weeks. However, a number of online merchant account businesses are providing hot competition, which includes streamlining the application process.

Fees: Fees can be high, but they vary widely, and it pays to shop around. Some banks charge a merchant application fee ($300–$800). On the other hand, some online companies, such as 1st American Card Service (

Fees: Fees can be high, but they vary widely, and it pays to shop around. Some banks charge a merchant application fee ($300–$800). On the other hand, some online companies, such as 1st American Card Service (www.1stamericancardservice.com), charge no application fee. But other fees do apply (see the next bullet point).

Discount rates: All banks and merchant account companies (and even payment companies such as PayPal) charge a usage fee, deceptively called a discount rate. Typically, this fee ranges from 1 to 4 percent of each transaction. Plus, you may have to pay a monthly premium charge in the range of $30–$70 to the bank. Although 1st American Card Service saves you money with a free application, it charges Internet businesses a 2.19 percent fee that it calls a discount rate, plus 25 cents for each transaction, an $8 monthly statement fee, and a minimum charge of $15 per month.

Discount rates: All banks and merchant account companies (and even payment companies such as PayPal) charge a usage fee, deceptively called a discount rate. Typically, this fee ranges from 1 to 4 percent of each transaction. Plus, you may have to pay a monthly premium charge in the range of $30–$70 to the bank. Although 1st American Card Service saves you money with a free application, it charges Internet businesses a 2.19 percent fee that it calls a discount rate, plus 25 cents for each transaction, an $8 monthly statement fee, and a minimum charge of $15 per month.

American Express and Discover: If you want to accept payments from American Express and Discover cardholders, you must make arrangements through the companies themselves. You can apply online to be an American Express card merchant by going to the American Express Merchant Homepage (

American Express and Discover: If you want to accept payments from American Express and Discover cardholders, you must make arrangements through the companies themselves. You can apply online to be an American Express card merchant by going to the American Express Merchant Homepage (https://merchant.americanexpress.com/accept-card/accepting-american-express-cards?inav=merch_ga_acceptcards) and click Apply Now (or something similar) link. At the Discover Card Network merchant site (www.discovernetwork.com/merchants) click the Start Accepting link and find your existing "acquirer" or bank that you use for other credit cards, so you can expand your account with that bank to accept Discover.

Software and hardware: Unless you depend on a payment service such as PayPal, you need software or hardware to process transactions and transmit the data to the banking system. If you plan to accept credit card numbers online only and don’t need a device to handle actual “card swipes” from in-person customers, you can use your computer modem to transmit the data. 1st American Card Service lets you use software dubbed Virtual WebLink for processing transactions with your browser, but you have to purchase the software for $39.95 and pay the usual discount rate and fees. This particular package includes a Virtual WebTerminal that lets you enter information manually and send it to the credit card network. Other systems require you to get a hardware terminal or phone line, which you can either purchase for $200 or more or lease for anywhere from $17 to $26 per month, depending on the length of the lease.

Software and hardware: Unless you depend on a payment service such as PayPal, you need software or hardware to process transactions and transmit the data to the banking system. If you plan to accept credit card numbers online only and don’t need a device to handle actual “card swipes” from in-person customers, you can use your computer modem to transmit the data. 1st American Card Service lets you use software dubbed Virtual WebLink for processing transactions with your browser, but you have to purchase the software for $39.95 and pay the usual discount rate and fees. This particular package includes a Virtual WebTerminal that lets you enter information manually and send it to the credit card network. Other systems require you to get a hardware terminal or phone line, which you can either purchase for $200 or more or lease for anywhere from $17 to $26 per month, depending on the length of the lease.

New payment systems provide more options

As we move farther into the web’s second decade, the payment landscape hasn’t changed dramatically. But things have shifted a bit. The changes actually give buyers and sellers more options:

More and more people are paying bills online. This change has been taking place over several years and consumers are increasingly at ease with the process.

More and more people are paying bills online. This change has been taking place over several years and consumers are increasingly at ease with the process.

PayPal is not the only game in town. This payment service is owned by eBay, but it can be used by anyone who wants to send or receive money online. PayPal is used by millions of auction sellers every month, but e-commerce store owners can use it, too.

PayPal is not the only game in town. This payment service is owned by eBay, but it can be used by anyone who wants to send or receive money online. PayPal is used by millions of auction sellers every month, but e-commerce store owners can use it, too.

Google is gaining. Google Payments charges fees that are no lower than PayPal. Yet, shoppers and sellers alike flock to it. It provides an alternative to PayPal, which isn’t popular with many buyers and sellers.

Google is gaining. Google Payments charges fees that are no lower than PayPal. Yet, shoppers and sellers alike flock to it. It provides an alternative to PayPal, which isn’t popular with many buyers and sellers.

In-person payments are a square deal. Lots of sellers also sell at flea markets and art fairs. They can now accept face-to-face credit card payments thanks to a device that connects to a smartphone and processes the payment by connecting to a credit card service. The best-known of these services is called Square Register (

In-person payments are a square deal. Lots of sellers also sell at flea markets and art fairs. They can now accept face-to-face credit card payments thanks to a device that connects to a smartphone and processes the payment by connecting to a credit card service. The best-known of these services is called Square Register (https://squareup.com/). But other, similar options are springing up, such as LevelUp, Bank of America Mobile Pay on Demand, and PayPal Here.

Overseas consumers are using new and innovative payment systems. At some point, if you accept payments from overseas, you might be asked to accept Western Union money transfers or other payment schemes. It’s the wave of the future as e-commerce becomes globalized.

Overseas consumers are using new and innovative payment systems. At some point, if you accept payments from overseas, you might be asked to accept Western Union money transfers or other payment schemes. It’s the wave of the future as e-commerce becomes globalized.

The steps in the upcoming section, in which I explain how to create your own merchant account, are useful if you run a brick-and-mortar business that is tied to your online store. But if you don’t want to go through the trouble, you might consider a payment service such as PayPal or Google Payments.

Setting up a merchant account

The good news is that getting merchant status is becoming easier for e-commerce enterprises because banks have accepted the notion that businesses don’t have to have a physical storefront to be successful. Getting a merchant account approved, however, still takes a long time, and some hefty fees are involved as well. Banks look more favorably on companies that have been in business for several years and have a proven track record.

Traditional banks are reliable and experienced, and most are likely to be around for a while. The new web-based companies that specialize in giving online businesses merchant account status welcome new businesses and give you wider options and cost savings, but they’re new; their services may not be as reliable and their future is less certain.

You can find a long list of institutions that provide merchant accounts for online businesses at one of the Yahoo! index pages:

The list is so long that knowing which company to choose is difficult. I recommend visiting Wells Fargo Bank (www.wellsfargo.com). which has been operating online for several years and is well established. The Wells Fargo website provides a good overview of what's required to obtain a merchant account.

MyTexasMusic.com, the family-run business I profile in Chapter 2, uses a web-based merchant account company called GoEmerchant.com (www.goemerchant.com) to set up and process its credit card transactions. (The site also accepts PayPal payments.) This company offers a shopping cart and credit card and debit card processing to businesses that accept payments online. MyTexasMusic.com chose to use GoEmerchant after an extensive search because it found that the company would help provide reliable processing, while also protecting the business from customers who purchased items fraudulently.

One advantage of using one of the payment options set up by PayPal Payments (www.paypal.com/webapps/mpp/merchant) is that the system (which originated with the well-known companies CyberCash and VeriSign) was well known and well regarded before PayPal acquired it. I describe the widely used electronic payment company in the section "Choosing an Online Payment System," later in this chapter.

In general, your chances of obtaining merchant status are enhanced if you apply to a bank that welcomes Internet businesses, and if you can provide good business records proving that you’re a viable business that makes money.

Finding a secure server

A secure server uses some form of encryption, such as SSL (which I describe in Chapter 6), to protect data that you receive over the Internet. Customers know that they’ve entered a secure area when the security key or lock icon at the bottom of the browser window looks locked.

If you plan to receive credit card payments, you definitely want to find a web hosting service that can protect the area of your online business that serves as the online store. In literal terms, you need secure server software protecting the directory on your site that receives customer-sent forms. Some hosts charge a higher monthly fee for using a secure server; with others, the secure server is part of a basic business website account. Ask your host (or hosts you’re considering) whether any extra charges apply.

Verifying credit card data

Unfortunately, the world is full of bad people who try to use credit card numbers that don’t belong to them. The anonymity of the web and the ability to shop anywhere in the world, combined with the ability to place orders immediately, can facilitate fraudulent orders, just as it can benefit legitimate orders.

Protecting yourself against credit card fraud is essential. Always check the billing address against the shipping address. If the two addresses are thousands of miles apart, contact the purchaser by phone to verify that the transaction is legit. Even if it is, the purchaser will appreciate your taking the time to verify the transaction.

ClearCommerce (

ClearCommerce (www.fisglobal.com/EMEA/UK/product-merchantacquiring-clearcommerce): This company sells both an automated payment system and payment authentication software that work with credit cards and banks.

PCCharge, VeriFone Payment Processing Software (

PCCharge, VeriFone Payment Processing Software (www.verifone.com/products/software/pc-payment-software/pccharge): This software enables individuals who use the VeriFone payment service to accept payments online as well.

Payment Software for Windows (

Payment Software for Windows (www.firstdata.com/en_us/products/merchants/support/payment-software-3.html): Formerly known as ICVERIFY, this software verifies the address of the person making an online purchase as a defense against fraud.

Processing the orders

When someone submits credit card information to you, you need to transfer the information to the banking system. Whether you make this transfer yourself or hire another company to do it for you is up to you.

Do-it-yourself processing

To submit credit card information to your bank, you need point of sale (POS) hardware or software. The hardware, which you either purchase or lease from your bank, is a terminal — a gray box of the sort you see at many local retailers. The software is a program that contacts the bank through a modem.

The terminal or software is programmed to authorize the sale and transmit the data to the bank. The bank then credits your business or personal checking account. The bank also deducts the discount rate from your account weekly, monthly, or with each transaction.

If you have a small-scale website — perhaps with only one item for sale — you can use an online payment gateway, which enables you to add a Pay button to a catalog page that securely processes a customer's payment information. When you receive the information, you can manually submit it for payment by using a program such as First Data Global Gateway Connect (Virtual Terminal). The transaction is then processed on one of First Data's secure servers. Both you and your customer receive e-mail notifications that the transaction is complete. You can find out more on the First Data website at www.aboutcsi.com/secure-transaction-processing.html.

Automatic processing

You can hire a company to automatically process credit card orders for you. These companies compare the shipping and billing addresses to help make sure that the purchaser is the person who actually owns the card and not someone trying to use a stolen credit card number. If everything checks out, the company transmits the data directly to the bank.

You can look into the different options provided by VeriFone, Inc. (www.verifone.com), or AssureBuy (www.otginc.com) for such services.

Choosing an Online Payment System

Some organizations have devised ways to make e-commerce secure and convenient for shoppers and merchants alike. These alternatives fall into one of three general categories:

Organizations that help you complete credit card purchases (for example, VeriSign Payment Services).

Organizations that help you complete credit card purchases (for example, VeriSign Payment Services).

Escrow services that hold your money for you in an account until shipment is received and then pay you, providing security for both you and your customers.

Escrow services that hold your money for you in an account until shipment is received and then pay you, providing security for both you and your customers.

Organizations that provide alternatives to transmitting sensitive information from one computer to another. A number of attempts to create “virtual money” have failed. However, companies such as PayPal let customers make payments by directly debiting their checking accounts.

Organizations that provide alternatives to transmitting sensitive information from one computer to another. A number of attempts to create “virtual money” have failed. However, companies such as PayPal let customers make payments by directly debiting their checking accounts.

To use one of these systems, you or your web host sets up special software on the computer that actually stores your website files. This computer is where the transactions take place. The following sections provide general instructions on how to get started with setting up each of the most popular electronic payment systems.

Shopping cart software

When you go to the supermarket or another store, you pick goodies off the shelves and put them in a shopping cart. When you go to the cash register to pay for what you’ve selected, you empty the cart and present your goods to the cashier.

Shopping cart software performs the same functions on an e-commerce site. Such software sets up a system that allows online shoppers to select items displayed for sale. The selections are held in a virtual shopping cart that “remembers” what the shopper has selected before checking out.

Shopping cart programs are pretty technical for nonprogrammers to set up, but if you're ambitious and want to try it, you can download and install a free program — Perlshop (www.waveridersystems.com/perlshop4/). Signing up with a web host that provides you with shopping cart software as part of its services, however, is far easier than tackling this task yourself.

PayPal payments

A good deal of this chapter is devoted to PayPal and its solutions for online buyers and sellers. PayPal is becoming a bigger player in the field of e-commerce. When it purchased the security company Verisign’s payment services, it became even bigger. That’s not necessarily a bad thing: The more users you have who take advantage of the same services, the more routine payments become, and the more customers trust the whole payment process.

PayPal's Payments page (www.paypal.com/webapps/mpp/merchant) includes services such as Payflow, which lets your company accept payments online, and Website Payments, which facilitates payment with either credit cards or a PayPal account. Options include

E-mail Payments: Your customers pay through e-mail communications; you don’t even need to have a website.

E-mail Payments: Your customers pay through e-mail communications; you don’t even need to have a website.

Website Payments Standard: Your customers choose an item to buy and are sent to PayPal’s site, where they can pay with a credit card or their PayPal account, if they have one.

Website Payments Standard: Your customers choose an item to buy and are sent to PayPal’s site, where they can pay with a credit card or their PayPal account, if they have one.

Website Payments Pro: Your customers choose an item to buy from a shopping cart you have on your site. They pay with a credit card on the site (PayPal processes the payment in the background) or to PayPal if they prefer to use their PayPal account.

Website Payments Pro: Your customers choose an item to buy from a shopping cart you have on your site. They pay with a credit card on the site (PayPal processes the payment in the background) or to PayPal if they prefer to use their PayPal account.

Trying one of the following Payflow Payment Gateway options is free for 30 days to see how it works with your own business, but both options require that you have a merchant account. (If you don’t have one, VeriSign suggests several financial institutions to which you can apply.) The Payflow services do carry some charges and require you to do some work, however:

Payflow Link: The smallest and simplest of the VeriSign payment options, this service is intended for small businesses that process 500 transactions or fewer each month. You add a payment link to your online business site and you don’t have to do programming or other site development to get the payment system to work. You pay a $179 setup fee and a $19.95 monthly fee.

Payflow Link: The smallest and simplest of the VeriSign payment options, this service is intended for small businesses that process 500 transactions or fewer each month. You add a payment link to your online business site and you don’t have to do programming or other site development to get the payment system to work. You pay a $179 setup fee and a $19.95 monthly fee.

Payflow Pro: With this service, you can process up to 1,000 transactions per month, and any additional transactions cost 10 cents each. To use this option, you begin by installing the Payflow software on the server that runs your website. The customer then makes a purchase on your site, and the Payflow software sends the information to VeriSign, which processes the transaction. Payflow Pro carries a $249 setup fee and costs $59.95 per month.

Payflow Pro: With this service, you can process up to 1,000 transactions per month, and any additional transactions cost 10 cents each. To use this option, you begin by installing the Payflow software on the server that runs your website. The customer then makes a purchase on your site, and the Payflow software sends the information to VeriSign, which processes the transaction. Payflow Pro carries a $249 setup fee and costs $59.95 per month.

You can sign up for a trial of Payflow Link or Payflow Pro on the Payflow Payment Gateway page (www.paypal.com/webapps/mpp/payflow-payment-gateway).

PayPal’s personal payment services

PayPal was one of the first online businesses to hit on the clever idea of giving business owners a way to accept credit and debit card payments from customers without having to apply for a merchant account, download software, apply for online payment processing, or some combination of these steps.

PayPal’s person-to-person payment services are ideal for transactions on eBay and other sites. In this sense, PayPal is essentially an escrow service: It functions as a sort of financial middleman, debiting buyers’ accounts and crediting the accounts of sellers — and, along the way, exacting a fee for its services, which it charges to the merchant receiving the payment. The accounts involved can be credit card accounts, checking accounts, or accounts held at PayPal into which members directly deposit funds. In other words, the person making the payment sets up an account with PayPal by identifying which account (credit card or checking, for example) a payment is to be taken from. The merchant also has a PayPal account and has identified which checking or credit card account is to receive payments. PayPal handles the virtual “card swipe” and verification of customer information.

PayPal is best known as a way to pay for items purchased on eBay. eBay, in fact, owns PayPal. But the service is regularly used to process payments both on and off the auction site. If you want to sell items (including through your website), you sign up for a PayPal Business or Premier account. You get a PayPal button that you add to your auction listing or sales web page. (If you sell on eBay, this button is provided automatically.) The customer clicks the button to transfer the payment from his or her PayPal account to yours, and you’re charged a transaction fee.

Setting up a PayPal account is free. Here’s how you can set up a PayPal Business account:

1. Go to the PayPal home page (www.paypal.com) and click the Sign Up Now button.

The PayPal Account Sign Up page appears.

2. Choose your country of residence and your language, and click the Get Started button beneath PayPal for Business.

The Choose a PayPal Payments Solution page appears.

3. For this example, click the Get Started button beneath Standard.

The Sign Up for PayPal Payments Standard page appears.

4. Click Create New Account, verify your country and language preference, and click Create New Account.

The Business Account Sign Up page appears.

5. Follow the instructions on the two registration form pages and set up your account with PayPal.

After you fill out the registration forms, you receive an e-mail message with a link that takes you to the PayPal website to confirm your e-mail address.

6. Click the link contained in the e-mail message.

You go to the Enter Password page.

7. Enter your password (the one you created during the registration process) in the Password box and then click the login button.

You go to the My Business Setup page.

8. Click the Merchant Services tab at the top of the My Account page.

9. Click Create payment buttons for your website link.

The PayPal Payments Standard: Setup.

10. Click Create a Button; then provide some information about the item you’re selling, including

• Enter a brief description of your sales item in the Item Name box.

• Enter an item number in the Item ID box.

• Enter the price in the Price box.

• Choose a button that shoppers can click to make the purchase. (You can choose either the PayPal logo button or a button that you’ve already created.)

11. When you’re done, click the Create Button button.

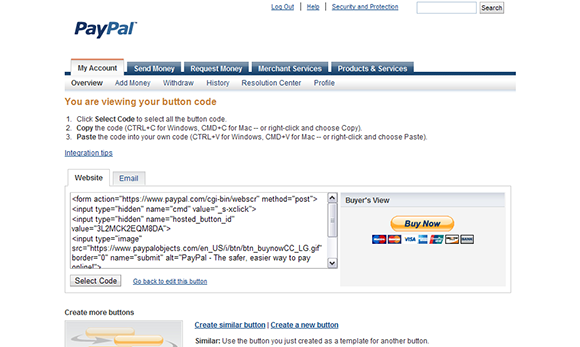

You go to the You Are Viewing Your Button Code page, as shown in Figure 7-1.

Figure 7-1: Copy this code to your sales catalog web page to enable other PayPal users to transfer purchase money to your account.

12. Copy the code in the Website box and paste it onto the web page that holds your sales item.

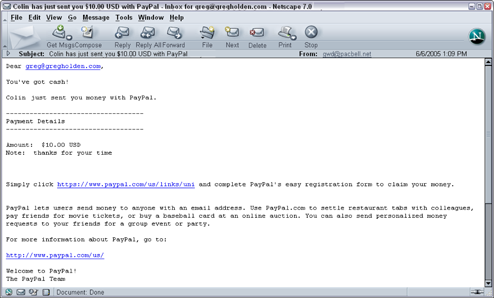

That’s all there is to it. When you receive a payment through eBay, you receive an e-mail notification. An example of an e-mail I received is shown in Figure 7-2. When someone sends you money directly through PayPal, you see that, too. You can then verify the payment by logging in to your account on the PayPal website.

Figure 7-2: When you receive payment through eBay or directly from an individual, you receive a message like this.

You should realize that accepting money on PayPal is not free. Buyers don’t pay to use PayPal, but sellers do. I have a Premier account, and every time I receive money from an eBay transaction, PayPal takes its fees off the top. For a purchase of about $23, PayPal takes about $1 in fees, for example. On the plus side, PayPal does make a debit card available that you can use to make your own consumer purchases with the money in your account.

Google Checkout

Google seems to have a finger in just about every pie when it comes to e-commerce. Payments are no exception. Google Checkout (checkout.google.com) is a convenient and safe way to pay online. The process of signing up for Google Checkout is relatively easy because you probably already have a Google password to check your Gmail or perform other services with Google. If you don't, just go to the Google Checkout home page and click Sign Up Now to obtain one.

Google Checkout was originally seen as a quick payment system for Google itself. If you saw something on a Google search results page and wanted to buy it, you could do so immediately through Google Checkout. But the service also functions as a full-fledged payment system much like PayPal: You sign up for Google Checkout and add “buy” buttons to your sale pages. Buyers can then click these buttons and pay you through Google Checkout. The service registers buyers and their credit card accounts, as well as sellers and their account information. Google Checkout receives payments and passes them on to sellers, and for its efforts, it subtracts a discount rate.

One big difference between Google Checkout and PayPal is in the method of payment. Google Checkout accepts only credit card payments. PayPal, on the other hand, also allows withdrawals from bank accounts as well as “eChecks” (payments taken from a buyer’s checking account and deposited in the seller’s account after a suitable time for the “check” to clear).

Another difference between Google Checkout and PayPal is customer service. You can reach a PayPal service person on the phone, but you can’t reach Google Checkout this way.

An article on CNET (news.cnet.com/8301-30684_3-10348805-265.html) reported on problems with recurring payments not being processed by Google Checkout for weeks at a time. Trying to reach a human being at Google to discuss the problems seems nearly impossible for the average merchant. (Writers like me can sometimes get a response from a PR person.)

On the plus side, Google Checkout is integrated with Google’s popular AdWords system. If you have an active AdWords account, your discount rate is lowered.

Micropayments

Micropayments are very small units of currency that are exchanged by merchants and customers. The amounts involved may range from one-tenth of one cent (that’s $.001) to a few dollars. Such small payments enable sites to provide content for sale on a per-click basis. For users to read articles, listen to music files, or view video clips online, some sites require micropayments in a special form of electronic cash that goes by names such as scrip or eCash.

Micropayments seemed like a good idea in theory, but they’ve never caught on with most consumers. On the other hand, they’ve never totally disappeared, either. The business that proved conclusively that consumers are willing to pay small amounts of money to purchase creative content online is none other than the computer manufacturer Apple, which revolutionized e-commerce with its iPod music player and iTunes Store. Every day, users pay $1.29 to download a song and add it to their iPod selections. But they make such payments with their credit cards, using real dollars and cents.

In other words, iTunes payments aren't true micropayments. But it's just about the only system I know that deals in small payments for items purchased or downloaded online that's really successful. While I was updating this book some news came out about a promising micropayment system called Tinypass (www.tinypass.com). It's used by Andrew Sullivan, one of the most successful bloggers around, to move his blog The Dish to a "paywall" system. Regular readers are asked to subscribe for $19.99 per year to read the blog without ads and without restrictions. Visitors are allowed to read a certain amount each month for free; after that, they must subscribe. In just a month, The Dish had collected more than $480,000 in subscriptions, so this is a case where micropayments are working. If you blog or plan to sell content, look into Tinypass.

Other payment options

A number of new online payment options let people pay for merchandise without having to submit credit card numbers or mail checks. Here are some additional options to consider:

Dwolla (

Dwolla (www.dwolla.com): This relatively new and increasingly popular payment services is great for small-scale sales— for transactions under $10, there are no fees. For a sale of more than $10, the fee is 25 cents.

Amazon Payments (

Amazon Payments (payments.amazon.com): Amazon enables users who sell online to accept payments from customers on their websites. Fees start at 2.9 percent plus a 30-cent transaction fee for payments over $10.

InspirePay (

InspirePay (www.inspirepay.com): Sometimes, shopping cart–based online payments aren't appropriate. Buyers who purchase a group of items from you at wholesale, for example, might prefer an invoice. If that's the case, and if your business also has a payment service in place (such as a merchant account, PayPal, Google Checkout, or Dwolla), consider InspirePay. Users create an InspirePay page, then request payment by sending the buyer a link. For a sale of $60, the link would take the form https://inspirepay.com/pay/mark/$60.00. In this case, when the recipient clicks on the link, InspirePay pays the sender $60.

ClearTran (

ClearTran (www.bnymellon.com/cleartran/): This service enables shoppers to make purchases by sending online checks to merchants. The shopper notifies the seller about the purchase and then contacts a special secure website to authorize a debit from his or her checking account. The secure site then transmits the electronic check to the merchant, who can either print the check on paper or save the check in a special format that can be transmitted to banks for immediate deposit.

Which one of these options is right for you? That depends on what you want to sell online. If you’re providing articles, reports, music, or other content that you want people to pay a nominal fee to access, consider a micropayment system (see the preceding section). If your customers tend to be sophisticated, technically savvy individuals who are likely to embrace online checks or billing systems, consider ClearTran. The important things are to provide customers with several options for submitting payment and to make the process as easy as possible.

Fulfilling Your Online Orders

Being on the Internet can help when it comes to the final step in the e-commerce dance: order fulfillment. Fulfillment refers to what happens after a sale is made. Typical fulfillment tasks include the following:

Packing up the merchandise

Packing up the merchandise

Shipping the merchandise

Shipping the merchandise

Solving delivery problems or answering questions about orders that haven’t reached their destinations

Solving delivery problems or answering questions about orders that haven’t reached their destinations

Sending out bills

Sending out bills

Following up to see whether the customer is satisfied

Following up to see whether the customer is satisfied

Order fulfillment may seem like the least exciting part of running a business, online or otherwise. But from your customers’ point of view, it’s the most important business activity of all. The following sections suggest how you can use your presence online to help reduce any anxiety your customers may feel about receiving what they ordered.

Providing links to shipping services

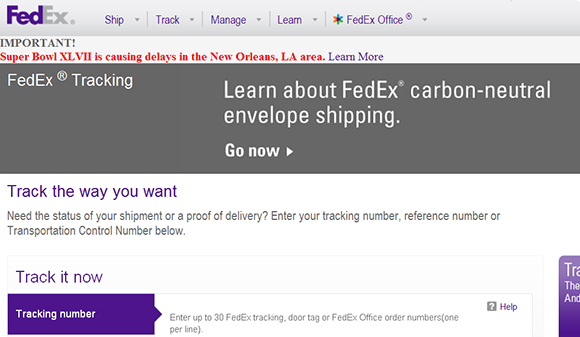

One advantage of being online is that you can help customers track packages after shipment. The FedEx online order-tracking feature, shown in Figure 7-3, gets thousands of requests each day and is widely known as one of the most successful marketing tools on the web. If you use FedEx, provide your customers with a link to its online tracking page.

Figure 7-3: Provide links to online tracking services so that your customers can check delivery status.

The other big shipping services have also created their own online tracking systems. You can link to these sites, too:

United Parcel Service (

United Parcel Service (www.ups.com).

U.S. Postal Service Express Mail (

U.S. Postal Service Express Mail (www.usps.gov).

DHL (

DHL (www.dhl-usa.com). Be aware that DHL no longer accepts deliveries from the United States to a domestic U.S. address but will ship to/from other countries.

Presenting shipping options clearly

In order fulfillment, as in receiving payment, it pays to present your clients with as many options as possible and to explain the options in detail. Because you’re online, you can provide your customers with as much shipping information as they can stand. Web surfers are knowledge hounds — they can never get enough data, whether it’s related to shipping or other parts of your business.

When it comes to shipping, be sure to describe the options, the cost of each, and how long each takes. Here are some more specific suggestions:

Compare shipping costs. Use an online service, such as InterShipper (

Compare shipping costs. Use an online service, such as InterShipper (www.intershipper.com), that allows you to submit the origin, destination, weight, and dimensions of a package that you want to ship via a web page form and then returns the cheapest shipping alternatives.

Make sure you can track a package. Pick a service that lets you track your package’s shipping status.

Make sure you can track a package. Pick a service that lets you track your package’s shipping status.

Be able to confirm receipt. If you use the U.S. Postal Service, ship the package “return receipt requested” because tracking isn’t available — unless you use Priority Mail or Express Mail. You can confirm delivery with Priority Mail (domestic) and Parcel Post.

Be able to confirm receipt. If you use the U.S. Postal Service, ship the package “return receipt requested” because tracking isn’t available — unless you use Priority Mail or Express Mail. You can confirm delivery with Priority Mail (domestic) and Parcel Post.

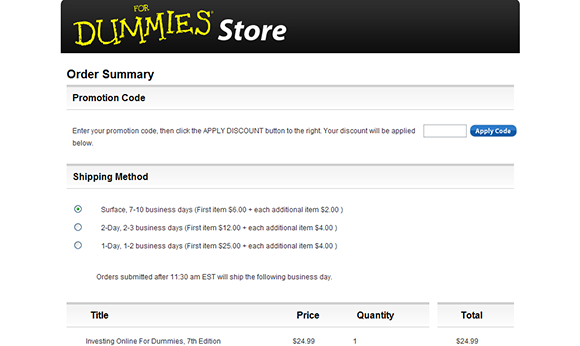

Figure 7-4: Tables help shoppers calculate costs, keep track of purchases, and choose shipping options.

Joining the International Trade Brigade

International trade may seem like something that only multinational corporations practice. But the so-called little guys like you and me can be international traders, too. In fact, the term simply refers to a transaction between two or more individuals or companies in different countries. If you’re a designer living in the United States and you create some stationery artwork and web pages for someone in Germany, you’re involved in international trade.

Keeping up with international trade issues

If you really want to be effective in marketing yourself overseas and become an international player in world trade, you need to follow the tried-and-true business strategies: networking, education, and research. Join groups that promote international trade, become familiar with trade laws and restrictions, and generally get a feel for the best marketing practices around the world.

Here are some suggestions for places you can start:

The Market Access Unit page of the Irish government's Department of Enterprise, Trade, and Employment website (

The Market Access Unit page of the Irish government's Department of Enterprise, Trade, and Employment website (www.entemp.ie/trade/marketaccess): This page contains links to the European Union's Commercial Policy as well as requirements governing Export Licensing and Import Licensing.

Small Business Exporters Association (

Small Business Exporters Association (www.sbea.org): This group of small and midsize business exporters is devoted to networking, assistance, and advocacy.

globalEDGE (

globalEDGE (globaledge.msu.edu/reference-desk): This site is published by Michigan State University and includes hundreds of international trade links.

Newsletter Access (

Newsletter Access (www.newsletteraccess.com/subject/intertrade.html): This website has information on how to subscribe to more than 9,000 different newsletters that discuss international trade issues.

Researching specific trade laws

Rather than wait for overseas business to come to you, take a proactive approach. First, do some research into the appropriate trade laws that apply to countries you might do business with. The Internet has an amazing amount of information pertaining to trade practices for individual countries.

You can seek out international business by using one or more message boards designed specifically for small business owners who want to participate in international trade. These message boards let users post trade leads, which are messages that announce international business opportunities.

For example, at the TradersCity Import and Export Trade Leads board (www.traderscity.com/board), you may find a message from a Finnish company selling surplus paint, a U.S. company that needs office equipment, or a British company offering X-ray equipment for export. Advertisements on this site typically include the URL for the business's website. The site does not charge a fee to post notices.

Exploring free trade zones

A free trade zone (FTZ) is an officially designated business or industrial area in a country where foreign and domestic goods are considered to be “outside” the territory covered by customs. You don’t have to pay customs duty, taxes, or tariffs on merchandise brought into, handled, or stored in an FTZ. You can find FTZs in many countries as well as in many U.S. states.

The purpose of FTZs is to reduce customs costs and make it easier for businesses to send goods into foreign countries. You can store your items in FTZs for a while, exhibit them, and, if necessary, change them to comply with the import requirements of the country in question, until you want to import them into that country.

Shipping Overseas Goods

It never hurts to state the obvious, so here goes: Don’t depend on ground mail (appropriately nicknamed snail mail) to communicate with overseas customers. Use e-mail and fax to get your message across — and, if you have to ship information or goods, use airmail express delivery. Surface mail can take weeks or even months to reach some regions of some countries — if it gets there at all.

Your customer may ask you to provide an estimate of your export costs by using a special set of abbreviations called incoterms. Incoterms (short for international commercial trade terms) are standardized acronyms originally established in 1936 by the International Chamber of Commerce. They establish an international language for describing business transactions to prevent misunderstandings between buyers and sellers from different countries. Incoterms thus provide a universal vocabulary that is recognized by all international financial institutions.

Incoterms are most likely to apply to you if you’re shipping a large number of items to an overseas factory rather than, for example, a single painting to an individual’s home. But just in case you hit the big time, you should be aware of common incoterms, such as

EXW (Ex Works): This term means that the seller fulfills his or her obligation by making the goods available to the buyer at the seller’s own premises (or works). The seller doesn’t have to load the goods onto the buyer’s vehicle unless otherwise agreed.

EXW (Ex Works): This term means that the seller fulfills his or her obligation by making the goods available to the buyer at the seller’s own premises (or works). The seller doesn’t have to load the goods onto the buyer’s vehicle unless otherwise agreed.

FOB (Free on Board): This term refers to the cost of shipping overseas by ship — not something you’re likely to do in this high-tech day and age. But if you sell a vintage automobile to a collector in France, who knows?

FOB (Free on Board): This term refers to the cost of shipping overseas by ship — not something you’re likely to do in this high-tech day and age. But if you sell a vintage automobile to a collector in France, who knows?

CFR (Cost and Freight): This term refers to the costs and freight charges necessary to transport items to a specific overseas port. CFR describes only costs related to items that are shipped by sea and inland waterways and that go to an actual port. Another incoterm, CPT (Carriage Paid To), can refer to any type of transport, not just shipping, and refers to the cost for the transport (or carriage) of the goods to their destination.

CFR (Cost and Freight): This term refers to the costs and freight charges necessary to transport items to a specific overseas port. CFR describes only costs related to items that are shipped by sea and inland waterways and that go to an actual port. Another incoterm, CPT (Carriage Paid To), can refer to any type of transport, not just shipping, and refers to the cost for the transport (or carriage) of the goods to their destination.

If the item you're planning to ship overseas by mail is valued at more than $2,500, the United States requires you to fill out and use the Automated Export System (AES) and submit it to a U.S. customs agent. The AES collects Electronic Export Information (EEI). To use the AES, you need to obtain either filer certification or, if you create computer programs, software certification. You have to file for certification and take a short test. Links to detailed instructions on how to use the AES are available on the U.S. Census Bureau's website (www.census.gov/foreign-trade/aes/documentlibrary/index.html). You can file your electronic export data with the AES through the U.S. Customs Service's website (www.cbp.gov/xp/cgov/trade/automated/aes/).

Some nations require a certificate of origin or a signed statement that attests to the origin of the exported item. You can usually obtain such certificates through a local chamber of commerce.

Some purchasers or countries may also ask for a certificate of inspection stating the specifications met by the goods shipped. Inspections are performed by independent testing organizations.

Getting Paid in International Trade

Having an effective billing policy in place is especially important when your customers live thousands of miles away. The safest strategy is to request payment in U.S. dollars and ask for cash in advance. This approach prevents any collection problems and gets you your money right away.

What happens if you want to receive payment in U.S. dollars from someone overseas but the purchaser is reluctant to send cash? You have a couple of options:

You can ask the purchaser to send you a personal check — or, better yet, a cashier’s check — but it’s up to the buyer to convert the local currency to U.S. dollars.

You can ask the purchaser to send you a personal check — or, better yet, a cashier’s check — but it’s up to the buyer to convert the local currency to U.S. dollars.

You can suggest that the buyer obtain an International Money Order from a U.S. bank that has a branch in his or her area, and specify that the money order be payable in U.S. dollars.

You can suggest that the buyer obtain an International Money Order from a U.S. bank that has a branch in his or her area, and specify that the money order be payable in U.S. dollars.

Suggest that your customers use an online currency conversion utility, such as the Bloomberg Online Currency Calculator (www.bloomberg.com/markets/currencies/currency-converter) to do the calculation.

You can also use an online escrow service — such as Escrow.com (www.escrow.com) or Skrill (formerly Moneybookers.com; www.moneybookers.com) — to hold funds in escrow until you and your customer strike a deal. An escrow service holds the customer's funds in a trust account so that the seller can ship an item knowing that he or she will be paid. The escrow service transfers the funds from buyer to seller after the buyer has inspected the goods and approved them.

If you're doing a lot of business overseas, consider getting export insurance to protect yourself against loss from damage or delay in transit. Policies are available from the Export-Import Bank of the United States (www.exim.gov) or from other private firms that offer export insurance.

Watch for credit card fraud — criminals using stolen numbers to make purchases. You, the merchant, are liable for most of the fictitious transactions. Cardholders are responsible for only $50 of fraudulent purchases. To combat this crime, before completing any transaction, verify that the shipping address supplied by the purchaser is the same (or at least in the same vicinity) as the billing address. If you’re in doubt, you can phone the purchaser for verification — it’s a courtesy to the customer as well as a means of protection for you. (See the upcoming section

Watch for credit card fraud — criminals using stolen numbers to make purchases. You, the merchant, are liable for most of the fictitious transactions. Cardholders are responsible for only $50 of fraudulent purchases. To combat this crime, before completing any transaction, verify that the shipping address supplied by the purchaser is the same (or at least in the same vicinity) as the billing address. If you’re in doubt, you can phone the purchaser for verification — it’s a courtesy to the customer as well as a means of protection for you. (See the upcoming section  Do you use an accounting program, such as QuickBooks or MYOB Accounting? The manufacturers of these programs enable their users to become credit card merchants through their websites.

Do you use an accounting program, such as QuickBooks or MYOB Accounting? The manufacturers of these programs enable their users to become credit card merchants through their websites. To work smoothly, some electronic payment systems require you to set up programming languages such as Perl, C/C++, or Visual Basic on your site. You also have to work with techy documents called

To work smoothly, some electronic payment systems require you to set up programming languages such as Perl, C/C++, or Visual Basic on your site. You also have to work with techy documents called  A shopping cart is often described as an essential part of many e-commerce websites, and web hosts usually boast about including a cart along with their other businesses services. You don’t

A shopping cart is often described as an essential part of many e-commerce websites, and web hosts usually boast about including a cart along with their other businesses services. You don’t