Chapter 12

Sensing Risk

In the decade before I led the creation of NGS, Procter & Gamble’s GBS had religiously driven constant change cycles between 2002 and 2015. The organization design was proactively tweaked every twenty-four months. Over time, the early model of saving costs via offshore services centers evolved to a mostly outsourced model. That was followed by the evolution to a fully value-driven model to provide business growth services, in addition to cost savings. The next evolution delivered additional improvements to operational excellence and speed of delivering big ideas. The NGS evolution to the fourth generation of shared services was the latest in this journey.

Though P&G’s GBS had the luxury of transforming itself proactively, many of the examples cited in this book, starting with John Stephenson, did not. One of the reasons why digital transformations end up being Stage 4 “one-hit wonders” is that they don’t appreciate the risk of disruption in time to transform on their own terms. Consequently, enterprises fall victim to the boiling frog syndrome (i.e., frogs jump out when placed directly in hot water but get boiled to death when placed in cool water that’s boiled slowly).

The good news on the Fourth Industrial Revolution is that there are quality early-warning signals available. What’s lacking is the new discipline to read them continuously.

What if there were higher-quality early-warning systems available for potential disruption? Better still, what if these were already available and the only action necessary was to be disciplined about reading them? That’s the good news on the Fourth Industrial Revolution. There are quality early-warning signals available. What’s lacking is the new discipline to read them continuously.

The Discipline of Measuring and Acting on Disruption Risks

The phenomenon of needing to reinvent a company isn’t new. It’s the accelerated frequency to reinvent that’s different. Most enterprises, whether public, private, or nonprofit, already have a strategic planning process. The strategic plan is intended to capture risks, among other things. Proactive leaders sense the risk of digital disruption intuitively, like specially talented frogs in a slowly boiling vessel who think “hmmm, it’s getting warm in here” (to use a really bad analogy). Adding a digital disruption metric to the strategic plan would obviate the necessity to act based on just intuition alone.

Adding a digital disruption metric to the strategic plan would obviate the necessity to act based on just intuition alone.

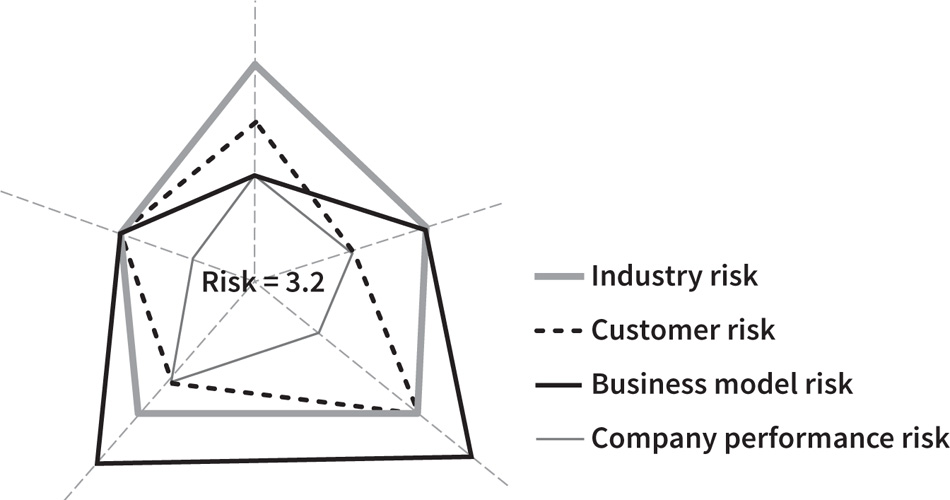

I call that metric the “digital disruption index.” It’s a composite number on a five-point scale that is the average of four individual ratings, best visualized on a spiderweb chart (see figure 25). The warning signs can come from the following risk areas:

![]() Your industry trends

Your industry trends

![]() Your customers information

Your customers information

![]() Your business model trends

Your business model trends

![]() Your digital business performance and digital organization feedback

Your digital business performance and digital organization feedback

The digital disruption index can be used to visualize these four risk elements to provide a more comprehensive measurement of threat levels. The larger the area of each of the four shapes, the higher the risk. So, in figure 25, the area for Company Performance Risk is relatively small, but the risk of two other factors—Industry and Business Model—needs attention. Reviewing the details of these risks periodically helps avoid the “boiling frog syndrome” of disruption.

P&G GBS’s Intuitive Risk Identification

In 2015, when GBS president Julio Nemeth was convinced that the current model needed to be disrupted, he had based it entirely on intuition. However, when we look at GBS in light of the four risk areas mentioned above, it becomes evident that there were signs that the current P&G GBS model would decline over time.

Figure 25 Digital disruption index

![]() Industry trends: The business process outsourcing (BPO) industry, which is a major supplier to shared services, was already showing signs of turmoil. While the global industry continued to grow, global services providers like IBM and HP were entering challenging times. Although BPO providers in India still grew, their margins had declined after the initial boom of the post-2008 recession. In parallel, the VC/start-up market was also evolving. Enterprise IT solution activity from start-up companies was growing, signaling the availability of newer generations of GBS capabilities.

Industry trends: The business process outsourcing (BPO) industry, which is a major supplier to shared services, was already showing signs of turmoil. While the global industry continued to grow, global services providers like IBM and HP were entering challenging times. Although BPO providers in India still grew, their margins had declined after the initial boom of the post-2008 recession. In parallel, the VC/start-up market was also evolving. Enterprise IT solution activity from start-up companies was growing, signaling the availability of newer generations of GBS capabilities.

![]() Customer information: The consumer electronics boom had resulted in higher expectations on user experience. In addition, the growing awareness of the urgency of digital disruption among business unit leaders meant that much more innovation was expected.

Customer information: The consumer electronics boom had resulted in higher expectations on user experience. In addition, the growing awareness of the urgency of digital disruption among business unit leaders meant that much more innovation was expected.

![]() Business model trends: The growing need to apply digital capabilities to the product side of the P&G business (e.g., ecommerce, digital advertising, digital supply chain, etc.) meant that business units were working directly with several IT vendors once again. The previous P&G model of the GBS/IT organization being the funnel for all digital capabilities would no longer be sufficient.

Business model trends: The growing need to apply digital capabilities to the product side of the P&G business (e.g., ecommerce, digital advertising, digital supply chain, etc.) meant that business units were working directly with several IT vendors once again. The previous P&G model of the GBS/IT organization being the funnel for all digital capabilities would no longer be sufficient.

![]() Business performance results: While GBS happily continued to exceed financial and service level goals, there was a starting trend for a growing amount of the savings to be delivered by cutting project work.

Business performance results: While GBS happily continued to exceed financial and service level goals, there was a starting trend for a growing amount of the savings to be delivered by cutting project work.

Julio’s decision to proactively disrupt GBS, though based on an intuitive hypothesis, can be codified for ongoing risk identification based on these four signals. Let’s examine each one in more detail.

Warning Signs from Your Industry’s Trends

The fact that no industry is safe from digital disruption is widely understood now. While the initial digital disruption examples may come from media, finance, entertainment, retail, technology services, and manufacturing, nobody is immune. The more relevant question is which specific processes within an industry are being disrupted, and when. There are several signals for these specific disruptions already available from industry data, including:

![]() Digitalization potential of core processes

Digitalization potential of core processes

![]() Volume of digitally native start-ups

Volume of digitally native start-ups

![]() Number of successful disruptive start-ups

Number of successful disruptive start-ups

![]() Overall industry growth and profitability

Overall industry growth and profitability

![]() Adjacent industry disruption

Adjacent industry disruption

![]() Venture capital business trends

Venture capital business trends

Most of these indicators are easily available, but the newer source of information that I would highlight is venture capitalist data (see sidebar).

Warning Signs from Your Customers

There’s a common thread across many of the usual list of disruptors— Craigslist, Netflix, Hulu, Amazon, Alibaba, Uber, and others. They all identified an opportunity to improve customer experience. There’s a new CX (customer experience) law of digital disruption floating around: any customer experience that involves friction points that can be improved through digitization will be.

Here’s the fine print, though: the driver for change isn’t necessarily how poor or expensive the previous service was; it’s how much it can be improved. The newspaper classified ad experience wasn’t particularly terrible. It’s just that free online classifieds would always be better. That led Craigslist and other online classified ad outlets to decimate print classifieds.

The driver for change for customers isn’t necessarily how poor or expensive the previous service was; it’s how much it can be improved.

There’s a huge difference between measuring customer satisfaction scores and customer experience. A good customer satisfaction score or a strong product performance score isn’t a guarantee of undying customer loyalty. A single-minded focus on eliminating customer friction points is a better bet.

Customers have long been the most reliable sources of early-warning signals. However, beyond traditional market share information or customer satisfaction scores, there’s a new breed of customer experience metrics that are more reliable indicators of potential digital disruption. Measures such as social customer influence and customer engagement, especially when monitored across adjacent industries, are a good indicator of potential disruption as well as the degree to which CX could disrupt you. The customer effort score (CES)—the amount of effort needed to accomplish a task—is another good indicator, especially when compared to digital alternatives. A high CES score says that you might be exposed to a disruption driven via CX.

So, the metrics that should be included in the customer experience digital risk index are:

![]() Customer experience digitalization potential

Customer experience digitalization potential

![]() Customer service friction points

Customer service friction points

![]() Social customer influence, customer engagement

Social customer influence, customer engagement

![]() Customer effort score

Customer effort score

Warning Signs from Your Business Model

Leaders already know which business model threats could upend their organizations. The stories of companies being “Uber-ed” overnight might make for good reading but, in reality, don’t hold up to close scrutiny. The issue for most organizations isn’t the awareness of the threat to their current business model; it is the underestimation of the proximity of the threat.

The fact is that any attempt by nimble competition to better meet your customers’ needs—usually via an alternative path to market or method of value creation—can eventually disrupt your business model. The only question is timing.

Measuring the trends in alternative business models via the following provides a good indication on how imminent the business model changes are:

![]() Channel evolution

Channel evolution

![]() Value proposition changes

Value proposition changes

![]() Shifts among start-ups on key activities for business execution

Shifts among start-ups on key activities for business execution

![]() Shifts in key resources used for the business

Shifts in key resources used for the business

![]() Changes in possible partnerships

Changes in possible partnerships

Warning Signs from Digital Business Performance and Digital Organization Feedback

These metrics reflect the levels of digital investment and its results in your products, processes, and people. A seminal study in 2015 by the IBM Institute for Business Value called “Redefining Boundaries— Insights from the Global C-suite Study”49 collected and analyzed data from more than 28,000 interviews with C-suite executives. They identified the “Torchbearers,” approximately 5 percent of their respondents with strong innovation reputations who outperformed their peers in terms of revenue growth and profitability. Based on their analysis, Torchbearers invested 24 to 40 percent more than Market Followers on “big-bet” emerging technologies. Torchbearers also paid 22 percent more attention to feedback from their customers than Market Followers, mostly by paying 22 percent less attention to direct competitors.

In addition to measuring the levels of investments in emerging technology, you also need to examine where your major technology investments are going. If most of the tech investment (in both IT and non-IT budgets) has been directed toward improving the bottom line, that may be a problem. Enterprises don’t necessarily need the exact Google ratio of 70-20-10 between operational costs, continuous improvement costs, and disruptive innovation costs. But if the enterprise is unable to reinvest a significant chunk of productivity savings into customer service, growing the business, and creating new business models, then it is at risk of a downward spiral toward digital disruption.

The digital investment metrics here should include the following:

![]() Levels of investment in emerging technology

Levels of investment in emerging technology

![]() Investments in a digital workforce

Investments in a digital workforce

![]() Percentage of the business that is digitally based

Percentage of the business that is digitally based

![]() Amount of digital investment that is ultimately customer focused

Amount of digital investment that is ultimately customer focused

![]() How much of the digital investments are sustainable ongoing

How much of the digital investments are sustainable ongoing

On the last point about sustainable digital investments, there may be a need to “save to reinvest,” i.e., drive further savings (including in other IT areas) to free up the cash.

Why Are the Warning Signals Ignored?

As mentioned earlier, leaders have a sense of their organization’s digital disruption peril already. The bigger question is how much they are reacting to it, and if not enough, then why. The answer to this tends to be sociological—fear, inertia, and misjudgment. Fear about cannibalizing existing products and about the cost of change. Inertia caused by complacency that the current strategy has historically worked. And finally, misjudgment on the potential impact of digital disruption and an optimistic view of the organization’s ability to withstand the new competition. In the rest of the chapter, I dig deeper into these factors and suggest an antidote—a disciplined approach to address this as part of the annual strategic planning processes.

Fear

Concerns about product cannibalization, the high cost of change, and risk to operations tend to be endemic to the prevailing culture and, to be fair, may arise from the nature of the industry and its business model (especially in industries that get high scrutiny, e.g., defense, finance, health care, etc.). The answer isn’t to become reckless risk takers but to have a disciplined approach to balancing governance expectations with disruptive innovation. Disruptive start-ups haven’t shied away from these industries, which implies that disciplined disruption is possible. The real risk is to let these concerns become a hindrance for change, as is illustrated by the case studies on Bausch & Lomb and Research In Motion in the sidebar.

Inertia

Unlike the sociological factor of a fear of change which is driven by a desire to be cautious about the effects of modification, inertia has no redeeming qualities, especially in the digital era. The root causes of complacency and an endemic lack of urgency will eventually have significant consequences. Clayton Christensen’s groundbreaking work, The Innovator’s Dilemma (see sidebar), helps explain some of the factors behind inertia not just in individual organizations but also in entire industries. However, the intent here is to explain, not justify, inertia and to raise awareness of its threat in the digital era.

Misjudgment

Even very smart people will occasionally make huge mistakes when grappling with the future. Consider the confident prediction in 2007 of Steve Ballmer, CEO of Microsoft: “There’s no chance that the iPhone is going to get any significant market share.” He wasn’t the only smart person to misjudge a trend. The sidebar has several other entertaining examples.

The issue of misjudgment is often related to the fact that the human mind finds it easier to comprehend linear increments (e.g., 1, 2, 3, 4, 5 . . .) rather than exponential increments (1, 2, 4, 8, 16, 32 . . .). The classic example here is Kodak, which invented the first digital camera in 1975 but chose not to push digital photography at the time.50 Instead, in 1981 Sony introduced the first electronic camera. Kodak’s market research at the time estimated that they had at least ten years before the digital impact would become significant. Although that was correct, what was missed was the exponential growth of digital technology after impact. The exponential pace after a decade meant that catching up became close to impossible. It’s critical to watch for exponential trends.

The Discipline of Addressing Fear, Inertia, and Misjudgment

Enterprises that plan to sustain their superiority after digital transformation can address these risks systemically with a slight tweak to their annual strategy planning exercise. I introduced the metric of the digital disruption index earlier in the chapter. This must be incorporated into the annual strategy planning. Specifically, the competitive intelligence assessment within the strategy exercise should include a thorough review of the digital disruption index as well as plans to address threats adequately.

Reviewing the absolute score of the digital disruption index and its trend provides discipline on how urgently to react.

Chapter Summary

![]() Separating the hype on digital disruption from reality is a challenge. When, where, and how much to react to disruptive threats is a dilemma. Act ineffectively and you risk wasting your resources and being disrupted anyway.

Separating the hype on digital disruption from reality is a challenge. When, where, and how much to react to disruptive threats is a dilemma. Act ineffectively and you risk wasting your resources and being disrupted anyway.

![]() The digital disruption index provides a disciplined metric to sense and address the risk of digital disruption on an ongoing basis. It includes measurement across four areas:

The digital disruption index provides a disciplined metric to sense and address the risk of digital disruption on an ongoing basis. It includes measurement across four areas:

![]() Industry trends: Beyond the usual metrics, look for trends in VC investments as well. Also, invest in the data sources that are used by VCs to help you focus on the right disruptions.

Industry trends: Beyond the usual metrics, look for trends in VC investments as well. Also, invest in the data sources that are used by VCs to help you focus on the right disruptions.

![]() Customers: Customers of your enterprise and those in adjoining industries will provide the best data. Newer metrics, such as customer experience and customer effort score, indicate possibilities for disruptions in the business model.

Customers: Customers of your enterprise and those in adjoining industries will provide the best data. Newer metrics, such as customer experience and customer effort score, indicate possibilities for disruptions in the business model.

![]() Business model: Assessing parts of the current business model, such as evolution of channels, partners, and activity systems, can provide useful insights on threats.

Business model: Assessing parts of the current business model, such as evolution of channels, partners, and activity systems, can provide useful insights on threats.

![]() Digital business and organization: Understanding the state of investments in digital business and digital literacy helps give a sense of the risk of underreaction to digital disruption.

Digital business and organization: Understanding the state of investments in digital business and digital literacy helps give a sense of the risk of underreaction to digital disruption.

![]() Sociological issues such as fear, inertia, and misjudgment explain why action against digital risks is often insufficient. The discipline of adding the digital disruption index metric to the annual strategy planning exercise can help.

Sociological issues such as fear, inertia, and misjudgment explain why action against digital risks is often insufficient. The discipline of adding the digital disruption index metric to the annual strategy planning exercise can help.

Your Disciplines Checklist

Evaluate your digital transformation against the questions in figure 26 to follow a disciplined approach to each step in Digital Transformation 5.0.