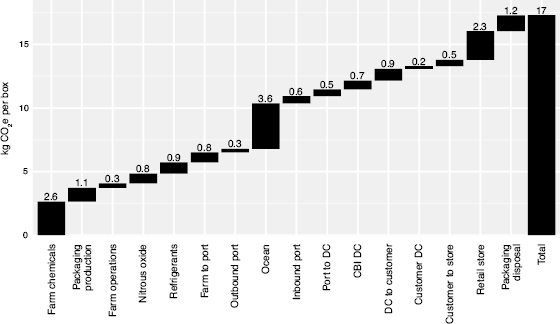

Figure 3.1 Carbon footprint breakdown of a box of bananas sold in the United States.

Source: A. Craig. “Measuring Supply Chain Carbon Efficiency: A Carbon Label Framework.” Diss., Massachusetts Institute of Technology, 2012.

In 2012, Friends of the Earth, a US environmental NGO, attacked major electronics companies, such as Apple and Samsung, over tin mining on the island of Bangka in Indonesia.1 Bangka, along with a sister island and the surrounding seabed, provide about one third of the world's tin supply.2 The NGO showed how the soft shiny tin has a tarnished record for being very hard on the environment. “Massive tracts of the island are stripped down to their tan sands, resembling images beamed back to Earth from Mars …” proclaimed an August 2012 Bloomberg article.3 In addition, while searching for tin offshore, illegal miners built thousands of floating shacks powered by diesel pumps to dredge tin ore from the seabed. The island's mining industry has contaminated rivers and damaged 65 percent of the area's forests and 70 percent of its coral reefs.4 Unsafe working conditions, lack of clean water, and damage to centuries-old fishing ground have harmed the island's communities.

The tin supply chain is literally a melting pot, owing to the opaque web of smelters, brokers, and myriad middlemen who are involved in the global tin market. No one knows whether the tin in any particular Apple or Samsung smartphone or any other electronic product came from Bangka or not. For Apple and many other companies that outsource the manufacturing of electronics to contract manufacturers, the tin mines are at least five tiers deep in the supply chain, and yet, NGOs such as Friends of the Earth hold these companies responsible. Tin-based solder connects electrical components to circuit boards in virtually every electronic product on the planet, and that fact connects electronic product makers to solder suppliers, tin refiners, tin smelters, tin ore buyers, and mines around the world.

Because NGOs hold brand-name companies responsible not just for their own actions, but also for the actions of all their suppliers, environmental sustainability is first and foremost a supply chain issue. “Apple has started to recognize that supply chain problems start well before factories—the next step should be extending this scrutiny to other raw materials used in its products and packaging,” said Julian Kirby of Friends of the Earth.5 Tin in electronics isn't the only deep-tier sustainability issue that bedevils large swaths of the economy. Greenpeace's attack on Nestlé over palm oil cultivation practices (see chapter 1) similarly affects other food, cosmetics, and cleanser companies that depend on natural oils. Illegal logging potentially impacts all supply chains that handle wood, cardboard, or paper—essentially all products that require packaging.

Companies under attack often consider such activist actions unfair and unfounded, because these companies typically have no connection to the offending deep-tier suppliers and may not even know who they are. Yet, the lion's share of the carbon footprint of many manufacturers is indeed in their upstream supply chain: the processes of their suppliers, suppliers’ suppliers, and so on. For example, the carbon footprint in the internal operations of brand-name makers of consumer discretionary products (such as apparel, automotive, home appliances, entertainment products, and others6) is only 5 percent of the total carbon footprint of these products, according to CDP.7 Consequently, understanding and determining the environmental impacts caused on behalf of a company or a product requires assessing the entire supply chain “from cradle to grave.”

Bananas are the most frequently purchased grocery item in the United States.8 They are also popular in the rest of the world: In 2013, more than 17 million tons of bananas were exported worldwide.9

The carbon footprint of bananas seems simple to assess, given that a banana has a single “part,” does not require assembly, and comes in its own “packaging.” Furthermore, bananas appear to have a simple supply chain with a few easy-to-trace major suppliers. Four of the five top banana exporters cluster in the warm and moist climate regions of Central and South America. Ecuador tops the list, followed by Costa Rica, Colombia, and Guatemala. Collectively, these four countries supplied 57 percent of the world's banana exports in 2011.10

When researchers at the MIT Center for Transportation and Logistics (CTL) assessed the greenhouse gas (GHG) emissions of the banana supply chain, they found that this simple product hides a bunch of complex issues. CTL partnered with Chiquita Brands International Inc. and Shaw's Supermarkets for several years to explore and calculate, in detail, the full carbon footprint of the average banana from Chiquita's plantations to Shaw's produce aisles.11 The researchers documented each supply chain activity that generated greenhouse gases and estimated its emissions in CO2e (CO2 equivalent).12 As it turned out, bananas were not quite the natural product they seemed to be, but rather a manufactured one due to the variety of processes involved in growing bananas and getting them to the retail shelf. These activities included various production processes, applied chemicals, and transportation.

Originally native to Southeast Asia, bananas and their cultivation have spread to many tropical areas, such as Chiquita's Costa Rican plantations, which were the subject of the MIT study. Nature supplies the three main ingredients to making bananas: carbon dioxide, water, and sunlight. The banana plant removes carbon dioxide from the air and water from the ground as it grows. As each banana plant matures, it flowers and produces a cluster of 50 to 150 bananas hanging on a heavy stem. When people eat the energy-rich banana and metabolize it, they return the absorbed CO2 back into the atmosphere. At first glance, this natural carbon cycle makes a banana appear to be carbon neutral. But it takes more than just air, water, and sunlight to make bananas, and it takes a lot more to deliver bananas to banana eaters.

Growing bananas successfully requires other inputs, such as fertilizers, as well as large amounts of organic matter and nutrients, such as nitrogen and potassium, along with pest-control products. For example, Costa Rican farms use translucent blue insecticidal bags to cover banana clusters, protecting them from a myriad of insects and pests that could ruin the fruit as it matures.

When a banana cluster reaches the right stage of development—still green, but approaching ripeness—farm laborers cut it down and take it to a sorting station. To transport bananas within the farm, workers hang them on an overhead metal track and manually pull a long line of banana clusters through the field. At the farm sorting station, workers divide the clusters by hand into supermarket-sized bunches. Bunches are then manually inspected for appearance and sorted by size. Any fruit with cosmetic imperfections is set aside for processing into products such as banana purees. Workers clean the remaining fruit in large water tanks and then transport the bunches to packing stations. Packers load the sorted and quality-controlled bananas into 40-pound boxes and stack 48 boxes on each pallet.

At the completion of the agricultural production stage, only 4.8 kg 13 of CO2e (less than one-third of the total carbon footprint) per box of bananas has been emitted, on average. High levels of manual labor at the plantation imply modest electricity and fuel consumption by farm vehicles. These plantation operations contribute just 0.3 kg of CO2e to the carbon footprint of a box of bananas. Production of the chemicals used at the farm, such as fertilizers and pesticides, emit 2.6 kg of CO2e. Nitrogen fertilizers also cause the emission of nitrous oxide, a gas that is 300 times more potent as a greenhouse gas than CO2.14 Although only a few grams of N2O per box escape, they are equal to 0.8 kilograms of CO2e. Manufacturing the bananas’ blue plastic pest-protection bags and cardboard boxes adds another 1.1 kg of CO2e, bringing the total to 4.8 kg of CO2e for each 18 kg box of bananas. But the banana's journey is far from over, which means the carbon footprint accounting is far from complete.

At the end of the production line, workers load the one-ton pallets of bananas onto trucks to haul them east to the Costa Rican port of Puerto Moín, in Limón, on the Caribbean Sea. To prevent premature ripening, Chiquita chills its bananas for some stages of the journey. Plantation trips that take more than two hours from the farm to the port require refrigerated trucks. Trips of two hours or less need no refrigeration, so assessing the carbon footprint requires accounting for the two types of trips separately, because they generate different amounts of GHGs both from fuel consumption and from the GHG emissions from leaking refrigerants. On average, the trip from the farm to the port adds another 0.8 kg of CO2e.

Once the bananas arrive at the port, workers load them into refrigerated shipping containers. Refrigerant gases used to chill the bananas during the journey add 0.9 kg of CO2e. Each 40-foot container holds 20 pallets—more than 38,000 pounds of bananas or 960 boxes. Cranes then load hundreds of banana containers onto small, fast ocean vessels. Operations at the port contribute 0.3 kg of CO2e.

At the time of the MIT research project, Chiquita used dedicated ocean ship carriers, the “Great White Fleet,” in order to ensure freshness for the consumer.15 The smaller ships used by Chiquita consume more fuel per ton of freight moved than do large freighters. In addition, Chiquita's vessels were routinely only partially loaded on the return trip (the southbound backhaul trip).16 Despite the added costs, the need for freshness drove the required speed of the maritime system.

On average, ocean shipment for US-bound bananas added 3.6 kg of CO2e, more than any other single activity in the supply chain. Overall, transportation and handling between the farm and US ports accounted for roughly another one-third of the bananas’ total carbon footprint, or 5.6 kg of CO2e per box. On average, by the time a box of bananas reaches a North American port, it has accumulated 10.4 kg CO2e. The journey, however, still isn't over.

At a port in North America, the banana containers are unloaded from the ship and transported to one of Chiquita's refrigerated distribution centers. At the distribution center, workers stack pallets of fruit in sealed ripening rooms that hold about one truckload each. A typical distribution center includes a half-dozen such rooms, each at a different stage of ripening. Shortly before shipping the bananas to retailers, Chiquita injects about one quart of ethylene gas into the room to restart the banana ripening process. Chiquita precisely controls the number of days of exposure to ethylene gas, ranging from two to five days, to achieve one of the three shades of green/yellow requested by its retail customers: hard green, green, or yellow. In some cases, Chiquita ships the fruit unripened, and retailers put the bananas in ripening rooms at their own distribution centers.

When the bananas reach the retailer's desired color, the retailer delivers the bananas to its stores. For example, each day at the Shaw's Greater Boston-area distribution center in Methuen, Massachusetts, thousands of boxes of bananas are loaded onto trucks with an assortment of other perishable items destined for Shaw's retail grocery outlets. In total, more than a million boxes of bananas pass through this distribution center each year.

Transportation from ports to the distribution network and on to the retail outlet adds an average of 2.0 kg of CO2e to the carbon footprint of the fruit's journey. Additional emissions come from operations at the North American ports, ripening centers, and distribution centers, which contribute another 1.5 kg of CO2e. Activities at retail stores, where consumers finally get their hands on the product, add another 2.3 kg of CO2e. Disposing of the plastic and cardboard needed to protect the produce adds the final 1.2 kg of CO2e. In total, the final carbon impact of the average 18-kg box of US-bound bananas is around 17 kg17 of CO2e. This is the average footprint of the banana up to the store shelf.

Moving a banana box across the world from farm to retail store accounts for roughly 40 percent of the environmental impact. Other impactful processes include the production of chemicals, such as fertilizers and pesticides, which takes place in large manufacturing plants far from Chiquita's banana farms. Figure 3.1 shows the accumulated carbon footprint of the average box of Chiquita bananas sold in the United States, split among its main components.

Figure 3.1 Carbon footprint breakdown of a box of bananas sold in the United States.

Source: A. Craig. “Measuring Supply Chain Carbon Efficiency: A Carbon Label Framework.” Diss., Massachusetts Institute of Technology, 2012.

Finally, as comprehensive as the MIT analysis was, it limited the scope of direct data collection to the primary actors to ensure tractability. Even so, the researchers identified 56 primary materials and processes across 16 major supply chain stages that were required to grow a banana and deliver it from farm to consumer. The banana supply chain is part of a much larger global commercial and industrial network that provides fertilizers, water, energy, vehicles, packaging, and a myriad of other ingredients needed to plant, grow, harvest, and ship the bananas. The fruit's carbon impact also began before its growth on a farm: at fertilizer factories, forests, paper mills, coal mines, and power plants.

Using specialized Life Cycle Assessment (LCA) software18 designed to estimate environmental impacts [see the section “Life Cycle Analysis (with Paralysis)”], the original 56 materials and processes in the data collection phase expanded to include more than 1,500 supply chain activities spanning the globe, all of which are ultimately required to produce and deliver bananas. The software helped the researchers trace the contribution of each of these supply chain processes and materials that ultimately add up to the banana's final carbon footprint and, in turn, reveal the true complexity of the supply chain of even the simplest of products.

Even with the software, the assessment excluded a number of minor items, such as the iconic Chiquita stickers on the bananas and the plastic or paper grocery bags consumers use to carry their bananas home. It did not include the bananas’ share of the GHGs emitted by shoppers’ cars when they drove to and from the store. It did not include the footprint of any electricity used by the consumer to blend the banana into a daiquiri or bake it into bread, and it did not include the footprint of methane emissions from the decay of discarded bananas or banana peels. Although it may be argued that these largely post-retail footprints are out of the control of Chiquita and Shaw's, that does not stop NGOs, as well as governments, from holding companies responsible for creating products that might be used irresponsibly or have high impacts during use or disposal. Chapters 7, 8, and 9 consider the opportunities companies have to redesign their operations, products, or market messages to reduce impacts in these later stages of the product's life cycle.

As mentioned in the preceding sections, one would be hard-pressed to find a seemingly simpler product to assess than a banana. Yet, calculating the carbon footprint for even a “simple” product is further complicated by temporal and geographic variations of the underlying supply chain. The estimated 17 kg of CO2e is the average carbon footprint of a box of bananas grown by Chiquita in Costa Rica and sold in the United States.

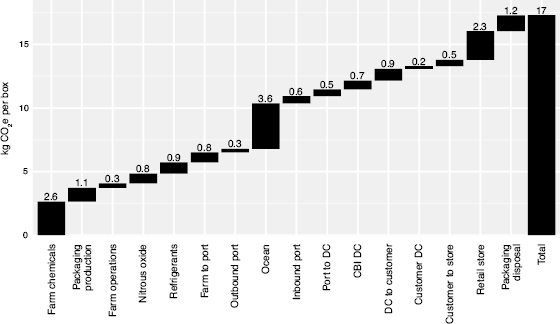

In reality, each box of bananas has a very different carbon footprint depending on where in the United States, or around the globe, the fruit is sold. For example, bananas sold in grocers in New Orleans—near the port that is closest to the Costa Rican export location—have a carbon footprint of only about 14 kg of CO2e per box. Bananas sold in Seattle—with a longer ocean voyage, lower return-trip utilization, and longer (1,100-plus miles) drive from the nearest distribution center—had a 21 kg carbon footprint per box. Figure 3.2 depicts the variation in carbon footprint of Chiquita bananas, depending on the locations of the domestic port of entry, distribution centers, and retail customers across the United States. The concentric circles reflect driving distances from distribution centers, and the other boundaries reflect the service areas of different distribution centers.

Figure 3.2 Carbon footprint of a box of bananas sold across the United States.

Source: A. Craig. “Measuring Supply Chain Carbon Efficiency: A Carbon Label Framework.” Diss., Massachusetts Institute of Technology, 2012.

The footprints for Chiquita's worldwide operation vary significantly across its network. The company manages hundreds of farms and employs six ocean transportation services that unload bananas at five US and eight European ports. The company also operates nine distribution centers in the US and 11 in Europe, from which it supplies bananas to hundreds of retail chains that distribute bananas to thousands of retail outlets.

Carbon isn't the only footprint of concern. Chiquita assessed its own water footprint of its bananas in a study analogous to the carbon footprint one.19 Chiquita's assessment included separate estimates of the volumes of three categories of water. “Green water” is rainwater that naturally falls on Chiquita's land. In contrast, “blue water” is fresh water drawn from surface or ground water such as lakes, rivers, and aquifers. The use of green water is generally considered more sustainable than blue water use, although a company's consumption of green water will inevitably reduce the amount of blue water available to other downstream users. Finally, “gray water” is waste water emitted as run-off or sewage that might contaminate blue water supplies or require treatment of some type. All three types of water footprint affect downstream water users, such as farms, industry, and cities, as well as downstream wetlands and estuaries.

As with the carbon footprint of bananas, the water footprint of bananas varied significantly by location: from 440 to 632 liters per kilogram of bananas (53 to 76 US gallons per pound). Plantations in Costa Rica and Panama use less water and only use green water. Those in Honduras and Guatemala require more water and depend on blue water for artificial irrigation. Crop water accounted for 94 to 99 percent of the total water footprint, a pattern not uncommon for agricultural products. The remainder was process water that is used to cool and wash the bananas. This number, too, varied between 1.6 and 35.6 liters per kilogram of bananas, depending on the design of the washing system and the adoption of recirculation to reuse wash water. Chiquita also noted that the water footprint varies unpredictably from year to year as a function of rainfall, heat, humidity, and crop yield.20

Although Chiquita owns much of the banana supply chain, its operations account for a little less than half of the banana's total carbon footprint. This is actually a relatively high figure due to Chiquita's “shallow” supply chain (including only two basic tiers) and the company's direct control over it. For many companies and many supply chains, the company's suppliers and customers along the supply chain contribute, on average, three times as much to a product's carbon footprint as the company's own operations.21 As mentioned in chapter 2, this ratio is significantly larger for companies such as Cisco, Apple, Microsoft, and most apparel and shoe companies, who outsource most or all of their manufacturing and transportation activities. Also, as indicated in the introduction to this chapter, in the consumer discretionary product industry the footprint outside the company is 19 times greater, on average, than the footprint inside the company.22 Carbon footprint and other environmental impacts are truly supply chain attributes.

The Greenhouse Gas Protocol23 for assessing and reporting carbon footprints formalizes this notion of footprints inside and outside the company as a set of three scopes. Scope 1 carbon emissions are those that arise from sources that are owned or directly controlled by the company. Examples include furnaces, boilers, on-site power plants, fuel burned by the company's vehicles, and emissions of non-CO2 GHGs, such as refrigerants, N2O from fertilizer, and VOCs (volatile organic compounds) by the company's assets. Scope 2 includes indirect carbon emissions that arise from purchased electricity, heat, or steam used directly by the company. These depend on the carbon-intensity of electrical grid power and other third-party energy sources.

Scope 3 encompasses everything outside of the company's own operations, such as production of purchased material and parts and the provision of services by external vendors (such as transportation by vehicles not owned by the company). It also includes customer use and disposal.24 It includes both the upstream and downstream parts of the entire supply chain, including end-of-life. In addition, Scope 3 includes the carbon footprint of capital goods, such as the company's factory equipment, office buildings, and vehicles that are not manufactured by the company. It also includes items such as business travel, employee commuting, franchises, and the carbon footprint of investments on the company's balance sheet (e.g., cross-holdings in another company). The protocol defines 15 categories of emissions within Scope 3 to facilitate comparable assessments and reporting across companies.

Note that the definitions of the three scopes by the Greenhouse Gas Protocol are not based on a supply chain view. In particular, such a perspective would segregate upstream impacts from downstream impacts. These are in fact commingled in Scope 3. Moreover, a supply chain angle would separate variable cost impacts from fixed cost impacts, but the Protocol also commingles the company's internal capital expense impacts into Scope 3. That is, the Protocol makes Scope 3 into a catchall that makes it hard for customers of a company to understand which of the company's impacts are ascribable to that customer.

The assessment of the carbon footprint of bananas is an example of an LCA, which is the systematic appraisal of all of the inputs and outputs associated with sourcing, making, delivering, using, and returning or disposing of a product. Many consumers, companies, and policy makers wonder about the environmental impact of their choices: “Is it always better to buy a locally produced item than an item transported from afar?” (see chapter 5.) “Is a plastic pouch refill better than a traditional disposable plastic bottle for liquid products?” (see chapter 8). The intricacies of the analysis of the banana's footprint demonstrate that these simple questions rarely have simple answers, and simplistic intuitions can easily lead to incorrect conclusions. Only a comprehensive, systematic analysis of the product supply chain can ultimately lead to the right decision.

LCAs typically focus on a single category of environmental impact (such as carbon emissions, water consumption, or land use) as a prelude to understanding or mitigating that particular impact. In the context of climate change, the most common LCAs estimate the carbon footprint of a product. LCAs gained popularity during the energy crisis of the 1970s and during the period of heightened environmental interest that followed in the 1980s.

An LCA is different from product life-cycle management (PLM)25 in several regards. LCAs concern the material and environmental inputs and outputs of a single unit or specific quantity of a product. The scope of an LCA spans raw materials, parts, a unit of the finished good, consumer use, and on to the disposal of the unit under consideration. In contrast, PLM concerns the overall timing and management of a product, model, or SKU (stock-keeping unit). The scope of PLM spans R&D conception, engineering design, factory manufacturing, servicing, and eventual obsolescence of that type of product.

In 1919, Jack Cohen started selling groceries from a stall in London's East End.26 Five years later, he founded Tesco using the first three initials of his tea supplier, T. E. Stockwell (tea was Tesco's first own-branded product) and the first two letters of his last name. Tesco rose to the top of British retailing by focusing on its customers with innovations like loyalty schemes (the “green shield” cards), and using consumer-buying data to adapt early to consumer trends.27 The chain grew both organically and through acquisitions, becoming the United Kingdom's largest retailer and the third largest in the world.

The grocer, however, did not have a good year in 2006. In that year the company was implicated in two scandals over the treatment of workers in Bangladesh factories,28 including the use of child labor.29 Moreover, when the National Consumer Council evaluated the UK's eight leading supermarket chains in 2006 on their environmental friendliness,30 Tesco earned an overall score of “D,” with a “D” on transport, a “C” on waste, and a “C” on sustainable farming. Fearing consumer backlash, Tesco rushed to respond.

In 2007—just as the fourth Intergovernmental Panel on Climate Change (IPCC) report stated that it is “unequivocal” that the earth's climate is warming—Tesco CEO Sir Terry Leahy stunned the press with his plan to seek or develop a carbon footprint label based on an LCA of the GHG emissions of every one of the 50,000 to 70,000 products Tesco sold. “Too often on issues like sustainability, Tesco has come to be portrayed as part of the problem,” Leahy later said in prepared remarks to selected stakeholders.31 “This could not be more wrong. When you want to reach and empower the many, Tesco is a big part of the solution, not the problem,” Leahy added.32

Consumers have a new need, he argued. They want to live more sustainably, including making more environmentally conscious purchase decisions. Tesco's LCA-driven carbon footprint information on the label would empower consumers to reduce their carbon footprint by selecting less carbon-intensive products. “Our role as a business is to give them the information and the means to achieve this change,” Leahy said.33

Around the same time, Walmart partnered with Environmental Defense Fund (EDF) to evaluate the carbon footprint of the supply chain for entire classes of its products. During a meeting at the company's Bentonville, Arkansas, home office, in front of an audience of 1,500 suppliers, associates, and sustainability leaders, Walmart President and CEO Mike Duke announced a plan to develop a “worldwide sustainable product index.”34 Duke echoed Leahy's enthusiasm as he spelled out a plan to document not only the carbon footprint of each product from more than 100,000 suppliers, but to also evaluate products for their consumption of natural resources, material efficiency, and their impact on people and communities.

Both announcements flabbergasted Guardian environmental commentator George Monbiot, who asked days after Leahy's announcement: “If Tesco and Walmart are friends of the Earth, are there any enemies left?”35 The two firms, he noted in the same 2007 column, were holding themselves to “higher standards than any government would dare to impose on them.”

True to its word, Tesco designed a black foot-shaped logo for its labels with a number informing consumers of the product's carbon footprint so that consumers could see—simply and directly—the environmental impact of the products they chose to buy.

They could then compare those products and, if they desired, purchase the one that would put less carbon into the atmosphere. Consumers might simply switch from one brand of milk to another, or perhaps they would give up their can of India-grown cashews in favor of a Cadbury product made closer to home with a lower carbon footprint. Furthermore, manufacturers might notice consumers’ preferences for “greener” products and work to reduce their own carbon footprint, leading to a competition between manufacturers to be more sustainable, and resulting in industry-wide carbon emission reductions. In addition, consumers might flock to Tesco's stores, recognizing the company as a leader in providing consumers with environmentally responsible choices.

Meanwhile, the Carbon Trust was poised to introduce its own carbon footprint assessment service. The British NGO began operations in 2001 with the main goal of helping companies calculate and understand their carbon footprints.36 In March 2007—just weeks after Leahy's announcement—the Carbon Trust added a carbon certification label to its portfolio of offerings.37

Given the proximity of the announcements and their similar goals, it made sense for Tesco to work with the Carbon Trust, according to Martin Barrow, head of footprinting at the Carbon Trust. Tesco and the Carbon Trust agreed to start by labeling a batch of about 100 products. That goal grew to 500, “and then the intent was to slowly expand,” Barrow said.38

To assign a number to each product's black foot label, the Carbon Trust developed and used an LCA standard known as PAS 2050,39 which calls for a meticulous investigation into a product's complete life cycle.40 The PAS 2050 manual illustrates the assessment process with a simplified example of a single croissant. Although intended to help companies understand the processes involved, the example also showed just how complex and laborious this process could be.

The croissant example included a multicolored flowchart with 25 interconnected processes representing inputs, outputs, conversions, storage, transport, and waste.41 It included details such as any potential heating and freezing by consumers after they purchased the croissant, as well as the carbon produced by the packaging during transport and decomposition at a landfill. Each of the chart's 25 boxes required significant research and data collection.

Furthermore, the accompanying text admitted that the simplified chart entirely omitted butter, a key ingredient in flaky croissants and a major source of the pastry's carbon footprint. To include butter, the guide commented, would require accounting for the carbon footprint of the butter factory, the dairy farm that produced the milk, the hay fields that fed the cows, and all the associated transportation, handling, and storage processes.42 Those cows might be in the UK or some other country—adding both to transportation costs and to variations in dairy operations practices. Moreover, the footprint might vary during the year if the cows grazed on nearby pastures in the summer but needed hay trucked in for the winter.

In summary, what Tesco and the Carbon Trust had agreed to do was to map the complete supply chain of every single product in the store and gather data on every supplier within these supply chains. These supply chains were not limited to Tesco's Tier 1 suppliers, with whom Tesco communicates on a regular basis. Tesco also needed to interview and gather data from deeper-tier suppliers. Helen Fleming, Tesco's climate change director, told The Grocer that it took “a minimum of several months’ work” to calculate the single number to be placed on each black foot label.43

The first batch of carbon-labeled products landed on Tesco's shelves in August 2009 to much fanfare.44 Store employees called attention to the labels by mounting special displays that jutted perpendicular to the shelves. That, combined with the accompanying media spree, highlighted Tesco's efforts to the chain's consumers. Meanwhile, a collaborative team of Tesco employees and Carbon Trust consultants labored behind the scenes to prepare the next round of carbon labels.

On the surface, the plan seemed ambitious, yet achievable. A large and powerful retail chain with significant control over the market had partnered with a respected nonprofit to pursue a labeling plan that it believed its customers cared about. A framework for the project existed, and Tesco seemed to have the will to carry it through. But, in hindsight, the plan hinged on some wishful thinking.

The number of carbon-labeled products on Tesco's shelves never accelerated as intended. Leahy, who had been Tesco's CEO since 1997, left his post in March 2011.45 Tesco ended the carbon footprinting program a year later, after labeling only 500 products.46 The chain achieved a rate of only 125 products labeled per year.47 At that pace, the company would have needed more than seven centuries to label all 90,000 SKUs in its stores.48 And that is assuming, of course, that Tesco made no changes to its product assortment and that Tesco's suppliers made no changes to the ingredients or manufacturing processes of any of the labeled products during all those centuries.

Walmart's program did not fare any better. As Tesco's labeling program began to unwind, Walmart's labeling project also quietly died. In 2014, for example, the Walmart corporate page about the sustainability index included no reference to labeling products based on their environmental impact. Instead, it spoke of “developing a sustainable standard for products” in cooperation with The Sustainability Consortium.

Interestingly, despite the failure of Tesco's effort, its green image improved. Concurrent with the 2009 rollout of its newly carbon-labeled products, the Carbon Trust awarded the grocer its Carbon Trust Standard.49 In giving the award, the Trust noted that Tesco had made significant progress in reducing its “carbon intensity.”

Tesco's LCA plan failed because the company badly underestimated the effort required for each LCA and overestimated the response of consumers, other retailers, and product makers. In an attempt to explain the failure, Fleming said in her January 2012 interview with The Grocer:50 “We expected that other retailers would move quickly to do it as well, giving it critical mass, but that hasn't happened.” Tesco had hoped that the labels would change consumer behavior in ways that would motivate others to label their products, too. Consumers, however, were not buying the labeled products in larger numbers than unlabeled ones.

As the Chiquita example shows, an accurate LCA of the environmental impact of each product requires large amounts of data and extensive analysis. Cost estimates for a single footprint assessment range from $10,000 to $60,000 per product,51,52 making it impractical unless the LCA technology and data collection become cheaper or other players join in the efforts.

Others thought Tesco's labels weren't good enough, demonstrating, again, that il meglio è l’inimico del bene: “The perfect is the enemy of the good” (see chapter 1). Environmentalists raised two main objections. First, the PAS 2050 methodology used by the Carbon Trust excludes some major categories of footprint. “In making a T-shirt, none of the machinery used to make it is taken into account [in PAS 2050], but this machinery can have an enormous carbon footprint. The efficiency of the machine is taken into account, but the impact of producing and maintaining the machine is not,” said Dr. John Barrett from the Stockholm Environment Institute (SEI) at York University, UK.53 Second, “a low carbon footprint on a product does not mean the product is entirely environmentally friendly. There could be other issues of deforestation, use of water, and social impact to do with the product,” said Friends of the Earth food campaigner Richard Hines.54

Companies can assess their approximate footprint without the excessive costs of tracing each ingredient across every link in the supply chain. A more pragmatic, although less rigorous, approach can be useful for uncovering “hot spot” areas (e.g., ingredients, locations, products, or processes) with the highest environmental impacts. These are the areas where mitigation initiatives may make the greatest difference or where the company has the greatest vulnerability of being attacked for its environmental impact. Several techniques provide footprint estimates that, while not precise enough to differentiate between, say, two brands of milk, can identify large hot spots, thus enabling pragmatic action.

“How much does your morning glass of orange juice contribute to global warming?” asked a January 2009 New York Times article about a study released earlier that year.56 PepsiCo, in partnership with the Earth Institute at Columbia University, investigated the environmental footprint of 20 of PepsiCo's Tropicana Pure Premium orange juice products. The study concluded that the average 64 oz. carton of Tropicana Pure Premium orange juice sold in the United States was responsible for a 1.7 kg carbon footprint.57 Thirty-five percent of that impact—the biggest hotspot—came from the fertilizer used to grow the oranges.58

The orange juice study was so successful that PepsiCo executives wanted to repeat it for all products across the company.59 Instead of attempting a detailed LCA, however, Columbia and PepsiCo again partnered to create a new “fast” approach to LCAs that balanced the thoroughness of full LCAs with the speed and cost needed by PepsiCo. The technique begins with the bill of materials (BOM) for each product—1,137 of them in Pepsi's case—taken from the company's enterprise resource planning (ERP) system. It then matches the material data with known emissions factors for materials and processes to fill in a standard data structure of emission factors estimates. The data structure also includes an estimate of the accuracy of the emission factor for each material and process. For materials or processes with no readily available emission factors, the team developed a “generic” model for estimating the carbon impact based on attributes such as price,60 weight, density, and type. Because the “generic” estimates included in the system are not as accurate as estimates based on specific data, analysts would do further assessments whenever a “generic” material was likely to be a significant contributor to the final carbon footprint of the product. That is, the company would spend effort on accuracy if the accuracy would make a difference to the overall footprint estimate.

This fast carbon footprinting procedure allowed PepsiCo to identify its carbon “hot spots” across its entire portfolio because, according to the Earth Institute team, “the approach dramatically reduces the number of required manual entries, up to approximately 1,000-fold.” Another benefit of the system is that any updates of the central emissions database of any input—be it the carbon footprint of sugar or the adoption of lightweight bottles—are propagated to all products that use the material.

Specialized software applications can also speed footprint assessments. Applications such as SimaPro61 and GaBi62 come preprogrammed with databases like ecoinvent63 that pull existing LCA studies from multiple sources. Although such LCA software enables faster insights, the applications rely on general data sets that are not specific to the processes, companies, or supplier locations studied. This increases the margins of error but can still provide an option for informed decision making, especially in terms of “order of magnitude” decisions.

Although fast footprinting cuts the time and effort of assessment and consequently enables analysis across a broad product portfolio, it still requires significant technical knowledge, time, and effort to develop. Other approaches require even less expertise to use, relying on far more accessible pieces of information within the organization: money flows.

Ocean Spray, the Massachusetts producer of bottled juice drinks and fruit snacks, assessed its full supply chain emissions using an LCA variant called economic input-output life cycle assessment (EIO-LCA).64 EIO-LCA provides an alternative to the kinds of laborious LCAs used in the banana and Tesco examples. EIO-LCA is less data intensive, but in many ways it can be even more complete.65

EIO-LCA builds on the work of Nobel Prize-winning economist Wassily Leontief, who divided the economy into sectors and traced the dependence between various sectors using trade data.66 For instance, a box of Chiquita bananas requires a set of inputs such as chemicals at the farm, cardboard for the box, trucks for transportation, and numerous other materials, each coming from their respective sector or industry. Those inputs, in turn, have their own inputs, such as the steel and electricity needed to manufacture trucks that come from other sectors. Thus, each industrial sector can be characterized by the relative amounts of goods that it purchases as inputs from other sectors. These relationships create a tangle of interdependencies as they are traced up the supply chain. Truck manufacturers, for example, may purchase steel to build trucks, and steel makers may purchase trucks to transport their steel. Leontief developed a mathematical economic input-output model that tallied how a dollar of output produced by one sector depended on fractions of dollars of inputs from each of the other sectors of the economy, all the way upstream through the supply chain.

EIO-LCA extends Leontief's work by using sector-level environmental impact data. This environmental data is combined with the original Leontief EIO model to estimate environmental impact per dollar spent in each sector of the economy. Carnegie Mellon University offers a free version of the EIO-LCA model online for noncommercial use, as well as licensing the underlying data and methods.67

For Ocean Spray, the use of EIO-LCA meant that it could estimate the carbon footprint of its entire upstream supply chain using just the records of financial transactions from its ERP system. Working with MIT researchers, Ocean Spray collected data on all of its financial transactions for one year.68 This included more than 400,000 transactions with suppliers, each of which was categorized and matched to one of the 500 economic sectors represented in the EIO-LCA model. The sector data and dollar value of the transactions were enough for a rough estimate of the carbon footprint of all the upstream activities.

EIO-LCA can be more comprehensive than the traditional LCA used by Tesco and Chiquita for three reasons. First, it automatically aggregates the environmental impacts in the depths of the supply chain that an LCA might miss owing to lack of visibility, such as if a supplier refuses to respond to a request for LCA-related data. Second, in using ERP data—not only BOM data—it encompasses more of the company's impacts, such as indirect materials and overhead activities. Finally, the use of cost data, instead of material quantity data, also implies that EIO-LCA includes the footprint of capital equipment, assuming that the cost of capital equipment is amortized into suppliers’ and service providers’ prices.

EIO-LCA is, however, less accurate than a deep LCA analysis, in that the economic input-output data only track aggregate interactions between industrial sectors and assume that all the products from a given sector have the same environmental impact per dollar cost. For example, fossil fuel diesel and biodiesel might be assigned the same impact per dollar if both are considered to be coming from the “fuel” sector. New sectors need to be created to reflect closely related materials that actually have significantly different environmental impacts per dollar. Another shortcoming of the EIO-LCA method is that it excludes downstream activities such as consumer use and disposal.

To get a more complete assessment, Ocean Spray combined its EIO-LCA approach with a traditional process-based LCA of its own operations and downstream activities, such as distribution, use, and disposal. Ocean Spray concluded that 71 percent of the total emissions came from purchased products and inputs (in other words, from the upstream supply chain), in line with industry averages. Another 17 percent came from downstream emissions related to distribution, use, and disposal of the products Ocean Spray sold. Only 11 percent came from Ocean Spray's own operations.

Like the simplified approach described in the previous section, EIO-LCA can help pinpoint processes that create significant environmental stress and which can be studied further for improvements. The combined approach is sometimes referred to as a hybrid LCA. It uses the faster and broader EIO-LCA for an initial screening69 and then resorts to a more detailed study of high-impact areas using a standard, process-based LCA, such as those performed by MIT (on Chiquita bananas) or Tesco's efforts.

Early LCAs, such as the Chiquita and Tesco examples, took months to perform, which limited their usefulness and financial feasibility. These LCAs cost too much and were out of date by the time they were completed. “Existing solutions do not allow carbon footprint measurements to be integrated within IT operations systems across the whole product life cycle, for each and every product,” said Jean-Marc Lagoutte, CIO of Danone.70 At the same time, the growing amount of LCA-related data (published analyses, sustainability vendor databases, and CDP disclosures) have increased the availability of environmental impact data that can be used in LCAs.

Danone, software provider SAP, and third-party experts developed a software system that takes BOMs and transactional ERP data, supplier survey data, and emissions factors data from a variety of sources71 to quickly and (relatively) inexpensively estimate the end-to-end LCA of Danone's products. The companies do not detail the specific methodology used (which presumably involves simplifications similar to those in EIO-LCA or PepsiCo's “Fast LCA”) or its accuracy (which is unknown).72

Each of Danone's country business units has a carbon master who is responsible, in part, for conducting this LCA twice a year. Using this system, Danone has assessed the end-to-end footprints of the 35,000 products that account for 70 percent of the company's revenues.73 “By making this analysis part of our IT infrastructure, we gain valuable insights for decision-making; it becomes a catalyst for change in the company as a whole,” said Myriam Cohen-Welgryn, vice president of Danone Nature.74 Although the use of approximations may prevent accurate estimates of absolute emissions levels, SAP says the tool is a way to “highlight trends and rank-order emissions activities and supplier footprints to help identify opportunities for improvement.”75

Stonyfield Farm Inc., a Danone subsidiary, found a new use for this system: analyzing the day-to-day changes in the LCA of the company's yogurt products.76 With this system, Stonyfield claims to automatically estimate the end-to-end footprint of individual production orders. “Now we're able to get an immediate understanding of the climate impact of every single ingredient in our products as they're made, which allows us to both react quickly toward reducing impact and adjust our approach to making a continually lower-impact yogurt,” said Wood Turner, Stonyfield's vice president of sustainability innovation.77 However, it is not clear if the accuracy of the method allows for such an exact appraisal.

In 2012, the French cosmetics company L’Oréal pledged that by 2020 it would reduce its per-product waste and water usage, as well as the company's absolute carbon footprint, by 60 percent from its 2005 baseline.78 To achieve such reductions, the company needed to understand the impact of both its own operations and those of its suppliers, which required a uniform approach to gathering and evaluating data regarding those impacts. “We use one scorecard, and that scorecard was developed by L’Oréal and CDP,” said Miguel Castellanos, the company's environmental health and safety director.79

CDP is a UK-based nonprofit established in 2000 with a simple goal: to ask the world's largest companies to disclose their carbon emissions and share actions they are taking to mitigate this impact.80 In 2002, when CDP sent out its first questionnaire, 221 of the 500 companies contacted responded.81 By 2015, participation had grown to 4,500 companies, representing over 50 percent of the market capitalization of the world's 30 largest stock exchanges.82 Part of the increase arose from the demands of institutional investors for companies to respond to the CDP questionnaires. In 2014, more than 767 institutional investors representing over US$92 trillion in assets83 were behind CDP's information requests.

L’Oréal was an early respondent and in 2008 decided to go further. It joined CDP's supply chain program to encourage its suppliers, who might not be large or publicly traded companies and thus out of reach of the CDP, to report their emissions. By 2013, Castellanos said, the company had sent CDP-based questionnaires to 173 of its suppliers, and 152 of them responded.84 In that same year, the company sent a new L’Oréal/CDP scorecard investigating water usage to 17 of the company's suppliers; 15 of them responded.

Using the CDP's standardized reporting system allows suppliers to provide the same information, in the same format, to all their customers.85 The comprehensive 17-page 2014 CDP questionnaire on climate change includes 86 questions covering management, strategy, policy, and communication of climate change risks, tailored to address inquiries of multiple customers and stakeholders. In addition, to make sure that all respondents calculate GHG emissions consistently, the CDP questionnaire leverages another level of standardization: the Greenhouse Gas Protocol mentioned earlier in this chapter.

An architect designing an energy-efficient building has many choices for structural materials, windows, insulation, lighting, and fixtures that will help minimize energy use and therefore the carbon footprint of the building as it is used by the occupants. In many product categories, a few simple metrics provide a good estimate of this use-phase footprint. With lighting, for example, the wattages of competing products with the same brightness provide an excellent estimate of carbon footprint: higher wattage options consume more electricity, which, in most locations, implies burning more fossil fuels.

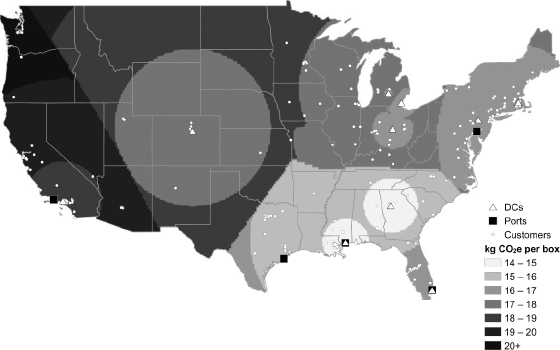

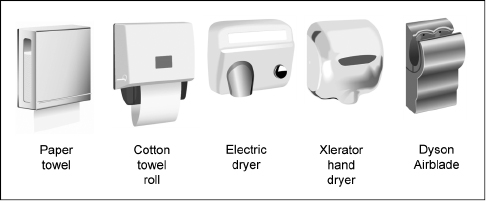

Assessing the footprint of alternative hand-drying systems in the bathroom is harder than assessing lighting, owing to the heterogeneous options such as disposable paper towels, reusable cotton cloth rolls, hot-air electric dryers, Excel's Xlerator, and Dyson's Airblade (see figure 3.3). The first two options use no electricity in the bathroom but do require deliveries of disposable or reusable materials. The middle option is the ubiquitous old-design electric dryer, which was added to the choice set to provide a familiar baseline. The last two options have similar wattages, making the choice among these options not obvious without careful analysis.

Figure 3.3 Hand dryers compared in MIT's LCA study

Dyson, the maker of the Airblade, believed that its product was superior to the other four options in terms of its total life cycle carbon footprint. To justify these claims, the company commissioned the MIT Materials Systems Laboratory to conduct a careful and independent assessment of the footprint of manufacturing, servicing, and using the Airblade and the four other common hand-drying systems. In 2011, MIT published its assessment titled, “Life Cycle Assessments of Hand Drying Systems.”86 As a result of the study, The Guardian proclaimed, in November 2011: “Paper towels least green way of drying hands.”87

Performing this assessment began with a series of important questions: what constitutes use; how will consumers use each product; what is the impact of each use; and what is the total amount of use? Assessing the use phase can be difficult. For example, whereas the upstream footprint involves hundreds or thousands of suppliers, the downstream side might encompass hundreds of millions of consumers.

First, the researchers chose the unit of usage to be a pair of dried hands. But this raised the question of what constitutes “dry.” NSF International, an independent standards organization, defines hands as “dry” when they hold less than 0.1 g of residual moisture in a room-temperature environment.88

Next, the researchers had to estimate how people used each of the five methods to dry their hands. Using a variety of data from previous studies, the researchers determined that the average bathroom visitor uses two paper towels or one cotton towel to dry their hands. Electric hot air hand dryers take 31 seconds to evaporate the water on a user's hands. Both the Xlerator and the Airblade use a high-speed stream of air to blast droplets of water off the user's hands. Unlike the Xlerator, the Airblade focuses its 400 mile-per-hour stream of air into narrow sheets, or blades. The unconventional design requires users to draw their hands upward through the air blades. The Xlerator hand dryer required 20 seconds whereas the Airblade required only 12 seconds to dry a pair of hands—a significant improvement over other electric hand dryers.

To be able to fairly compare different choices, the researchers had to estimate an additional dimension of usage: how many pairs of hands would each method dry in its lifetime? The researchers used the five-year warranty typical for commercial electric hand dryers as the estimated life span of these products during which the dryer would be used 350,000 times.89 With those usage estimates in place, measuring each method's inputs and their environmental impacts was the next step. In the case of hand dryers, this meant constructing a thorough list of all of the materials used to make and operate the machines—everything from metal, plastic, and adhesives to electronic components to the packaging in which the machines were shipped.

Each method had different usage footprint issues. Paper towels required a steady stream of paper, which might include some recycled content, and they also needed a waste bin and daily replacement of the bin liner bag. Cotton roll towels lasted an average of 103 uses before being replaced, but consumed bleach, starch, and hot water to wash the towels after each use. For both disposable and reusable towels, fuel consumed during towel delivery accounted for a large portion of their environmental impact. The Airblade machine itself, with its robust construction and advanced electronics, had high initial carbon emissions during the manufacturing process compared with the simple sheet metal box of the paper towel dispenser.

For the three types of electric hand dryers, the largest share of carbon footprint came from electricity consumed during usage (over 91 percent in the case of the Airblade90). This is where, as Dyson expected, its product outperformed all others. Not only did the Dyson Airblade draw electricity for a shorter time than its competitors, it drew less electricity when on. The Airblade drew 1,400 watts91 during its 12-second blast. The Xlerator drew 1,500 watts for 21 seconds plus 1.5 seconds of half-power spin-down. The traditional hand dryer drew 2,300 watts for its 31-second cycle, almost five times the total energy used by the Airblade.

Ultimately, the study found that the Airblade did indeed have the lowest average carbon impact. The per-use carbon footprint for the plastic-bodied model, the study found, was just 4.19 g CO2e; the aluminum-bodied model generated only slightly more: 4.44 g per use. The Xlerator had a 7.85 g per-use carbon footprint. Cotton roll towels generated 10.2 g per use; paper towels generated 14.6 g per use; and traditional hot-air electric dryers generated 17.2 g per use.

As with the banana LCA, the average numbers don't tell the whole story. In theory, the rankings of these choices might be different if the numerical values (e.g., the carbon footprint of electricity, time spent drying hands, number of hands dried over the life of the appliance) were different. To test this possibility, the researchers also performed a sensitivity analysis using a Monte Carlo simulation that compared the hand drying systems across a wide range of scenarios. They found that the Airblade was environmentally superior to the Xlerator in 86 percent of the scenarios and better than any of the remaining three drying systems in 98 percent or more of the simulated scenarios.

As in the case of Tesco's black foot carbon labeling project, the hand dryer LCA required considerable effort. The research team arrived at this and related conclusions after roughly 10 man-months of study. The report underwent a critical external expert panel review, whose feedback was incorporated into the final report. The final assessment report spanned 113 pages, complete with 42 charts, 48 tables, a 40-page appendix, and 3 pages of references. Dyson insisted on a strenuous assessment; strong claims about superior sustainability can attract allegations of bias or greenwashing from skeptical environmentalists (see chapter 9). Dyson “wanted the report to be bulletproof,” said Jeremy Gregory, one of the report's authors.92

Polycarbonate is a transparent thermoplastic polymer invented in 1898 but not commercialized until 1953. It is prized for its tough, shatter-resistant strength and its resistance to heat and flame. As a result, polycarbonate is a safer choice than glass and other plastics, making it ideal for a wide range of products from baby bottles to Blu-ray disks.93 About one billion kilograms of polycarbonate are produced annually. Yet, although polycarbonate is not likely to shatter and physically harm users of these products, it is less clear whether the plastic might chemically harm them. Polycarbonate can contain traces of bisphenol A (BPA) from the manufacturing process and can release that BPA as the plastic ages or is exposed to heat, cleansers, or other substances. BPA is also found in many other products, such as some epoxy resins used in food cans and in many varieties of paper, such as those used for cash register receipts.

BPA is a very controversial chemical because in the human body it acts like the female hormone estrogen. Thus, it has the potential to affect the development of reproductive organs in fetuses, babies, and children; affect the reproductive performance of adult men and women; and affect the progression of some types of cancer. It has thus been categorized as an endocrine disruptor.94 Research shows that people who handle these kinds of products (e.g., retail cashiers) accumulate detectable BPA levels in their blood.95,96

Various governments, including both the US and the EU, place some restrictions on BPA in food-related products but have not entirely banned its use. For example, BPA has been banned in baby bottles and sippy cups (in the US, the EU, and numerous countries in other regions).97 Yet, consumer activist groups, such as the Natural Resources Defense Council and the US Public Interest Research Group, think these regulators have not gone far enough and are pressuring companies to stop using BPA entirely.

BPA is but one example of a widely used but controversial chemical. Each industry has its own alphabet soup of chemicals that have created concerns for regulators and NGOs.98 These potentially toxic materials in the supply chain can affect the health of plants, animals, and people. Toxins include airborne emissions (e.g., mercury from coal-fired power plants, particulates from diesel-engine trucks, and sulfur emissions from ocean freighters), wastewater (e.g., cleansers, wash-water contaminants, solvents, eutrophy-causing ingredients, and pesticide run-off), and solid waste (e.g., electronics, metals, and plastics).

Assessing a company's environmental impacts serves many different purposes. L’Oréal used its assessment to define baselines for goals and then measure progress against that baseline. PepsiCo used assessment to identify “hotspots”—those areas of the company's activities, supply chain locations, or products that have particularly large environmental impacts—to help prioritize its improvement efforts. Tesco used assessment to create transparency of carbon footprints so that consumers could make sustainable choices. Dyson utilized assessment to make strong claims about its product's sustainability to the marketplace. Thus, assessment supports some combination of improvement (chapters 4 to 8), management of sustainability efforts (chapter 10), and as messaging concerning the company's sustainability (chapter 9). Implicit in these uses of assessment is an assumption that the measured impacts matter.

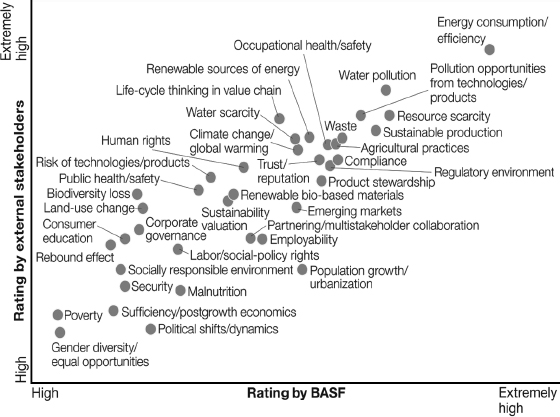

As the largest chemical company in the world, BASF SE has significant environmental impacts of many different types and in many different locations. In order to most effectively improve sustainability, BASF needs to know which aspects of sustainability matter the most—both to the company and to its various stakeholders. To answer this question, the company performs an annual materiality assessment.99 Through a set of workshops and interviews, the company winnowed down a long list of potential impacts to 38 topics. Next, it surveyed 350 external stakeholders worldwide and 90 internal experts. The company collected data on the relevance of the 38 topics to BASF and to its external stakeholders, as depicted in figure 3.4.100

Figure 3.4 BASF environmental materiality assessment

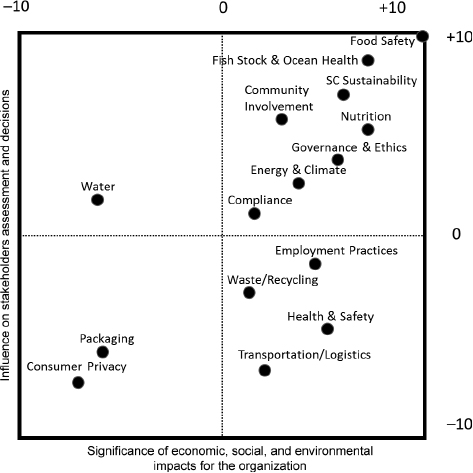

Different companies worry about different types of environmental impacts throughout their supply chain. Companies such as Apple, Tesco, and Chiquita focus on their carbon footprint; Coca-Cola, AB InBev, and Nestlé worry about water consumption, especially in drought-prone regions; and many companies that use agricultural products consider their land-use impacts, such as from growing palm oil, cotton, or coffee. Chicken of the Sea, the leading North American seafood supplier, uses internal versus external stakeholders’ assessment, looking at 15 different topics. Each topic was ranked between −10 and +10 in terms of materiality, leading to a chart similar to the one depicted in figure 3.5. A materiality assessment helps the company focus on important issues and set meaningful goals that matter to the company or its stakeholders.

Figure 3.5 Chicken of the Sea's materiality assessment

In BASF's materiality assessment (figure 3.4), the highest-rated issue by both the company and external stakeholders was energy consumption or efficiency. Thus, a major focus of BASF's sustainability is eco-efficiency goals—reducing the quantity of resources consumed both to save money and curtail the environmental impact. These include 2020 goals to improve production process energy efficiency by 35 percent and reduce GHG emissions per metric ton of sale by 40 percent relative to a 2002 baseline.

A company might define multiple numerical reduction goals to address its respective environmental impacts and cost components. For example, in 2013, toymaker Hasbro Inc. defined four numerical goals to achieve by 2020, all measured against a 2012 baseline. The four goals were: to lower global Scope 1 and Scope 2 GHG emissions from owned/operated facilities by 20 percent, decrease energy consumption at owned/operated facilities by 25 percent, cut water consumption from owned/operated facilities by 15 percent, and reduce waste to landfill at owned/operated facilities by 50 percent.101 A well-formed environmental goal includes some dimension of sustainability (e.g., carbon footprint), a scope (e.g., owned/operated facilities), a target value (e.g., a 20 percent reduction compared to a baseline), and a time frame (e.g., from 2012 to 2020). In some cases, environmental goals might define an efficiency target rather than total reduction. For example, as mentioned in chapter 2, AB InBev and Coca-Cola define their water sustainability goals in terms of water efficiency—the number of liters of water needed to produce one liter of beer102 or soda,103 respectively.

Other issues in the materiality assessment might be of great concern to outside stakeholders but provide limited direct benefits to the company. Nevertheless, the risks of disruptions to reputation, demand, or supply arising from NGO action, regulation, community disapproval, or consumer boycott might motivate the company to incur higher costs in order to mitigate and manage these risks. Eco-risk mitigation goals and initiatives often include codifying, implementing, and enforcing restrictions against activities that might attract the attention of NGOs and the media, such as deforestation, hazardous waste dumping, and contamination by disfavored substances. These initiatives can also include design changes to eliminate known or suspected toxins associated with sourcing, making, using, or disposing of a product.

These environmental risks often lead companies to commit to an absolute goal within some time frame, such as Chicken of the Sea's commitment to dolphin-safe tuna, Campbell's goal to eliminate BPA from the linings of soup cans,104 or McDonald's announcement to shift toward chicken raised without antibiotics.105 Coca-Cola is committed to replacing every drop of water it uses. Other companies, such as Walmart,106 P&G,107 and General Motors108 have “zero waste” goals. Rather than try to explain the basic concept of risk and to convince consumers, NGOs, or regulators that some level of a toxic substance or environmentally damaging activity is acceptable, these companies pledge to completely eliminate the contentious input or activity. To measure progress toward an absolute goal, companies typically assess the percent of products sold or percent of facilities that have achieved the goal in question.

A materiality assessment can lead the company to the realization that a subset of the market might care very much about particular attributes and be willing to prefer or pay for products that offer these attributes. For example, BASF's assessment (figure 3.4) noted stakeholder interest in issues such as pollution control, renewable bio-based materials, and agricultural sustainability. These are all issues that BASF might address through specific product lines and innovations. The result is eco-segmentation initiatives in which the company designs and sells products with one or more sustainability-related attributes, such as being energy-efficient, toxin-free, sustainably farmed, organic, or packaged in bio-based or recycled material. The higher costs of these products are typically defrayed through premium prices that green segment customers are willing to pay.

Other companies use eco-segmentation initiatives as part of their long-term risk management. The offering of Tide Coldwater laundry detergent and Pampers Cruiser diapers by consumer goods giant P&G allows the company to understand the technology and the market associated with green products. This knowledge positions the company to react quickly if and when consumers’ preferences change or when regulations demand such products.

“If there aren't fundamental changes in agriculture and fishing, then we won't have a business worth being in within one to two decades,” said Antony Burgmans, chairman of Unilever. “No fish, no fish sticks,” he added.109 Grim assessments of the state of marine resources led Unilever to partner with the global conservation organization WWF in 1996 to create the Marine Stewardship Council (MSC), the first certification body for sustainable seafood.110

Both eco-risk mitigation and eco-segmentation initiatives may involve certification to provide independent evidence of the company's actions or product attributes (see chapter 9 for more on certification and labels).

Whereas environmental impacts, such as carbon footprint, water use, and energy are readily measured and managed via numerical reductions in the quantities of consumption or emissions, some categories of impacts have a strong nonquantitative element. For many categories of agricultural, natural, and food products, how a resource is harvested may matter more than how much of the resource is harvested. Thus, the goal might be codified not as a quantity to reduce, but rather as a complex set of practices or performance indicators to implement. For example, MSC certification requires a sufficiently high score on 31 performance indicators related to a sustainable level of harvesting of the target fish species, avoidance of environmental damage to other seafood species and marine habitats, and fishery management.111 Certifications for agricultural crops, such as palm oil, cotton, coffee, cocoa, beef, and forest products include practices related to land use, water use, pesticides, fertilizers, harvesting, and waste management. These certifications are intended to ensure the future productivity of farm lands, forests, and oceans.

By looking deep into both the upstream and the downstream of a supply chain of a product, including the consumer use and end-of-life phases, a company can assess where its environmental impact is the largest (and where it may be most vulnerable to accusations of excessive environmental impact). Such assessments can highlight opportunities for reducing the company's environmental impact or selling products that offer sustainability attributes. Unilever determined that its carbon footprint is divided very unevenly across the supply chain and life cycle of its products. On average, the footprint of a Unilever product is 29 percent from raw materials, 2 percent from manufacturing, 2 percent from logistics, 5 percent from retail, 62 percent from consumer use, and less than 1 percent from product disposal.112 Such assessments help a company determine the locations and magnitudes of its environmental impacts, allowing it to design meaningful sustainability initiatives.

Assessment and goal definition are the first steps in a company's environmental journey. Sustainability initiatives can take place in any and all phases of a company's supply chain. These activities are discussed in the following chapters using the four operational processes of the SCOR model framework of source, make, deliver, and return, as well as in product design. Periodic reassessment—such as Danone's twice-a-year LCA—tracks progress toward meeting the company's goals for management, disclosure, and marketing purposes.