Startup Expenses and Financing

One of the more appealing aspects of starting a personal training business is that it requires relatively low startup costs—unless you want to open your own studio. So what do you need in the way of cash and available credit to open your doors? It will depend on what equipment you already own, the services you want to offer, and whether you’ll be homebased or working out of a commercial location. In general, homebased personal training businesses can cost as little as a few hundred dollars, or thousands. However, opening your own studio can run tens of thousands of dollars or more. Owning a franchise can cost even more than that. Get in Shape for Women franchise owner Abby Guinard says that in order to be successful with a franchise, you need to start out well capitalized. She and her partner started with a $200,000 investment. They are now one of the franchise’s top locations. Two years into opening they had a full gym and couldn’t take on new clients.

As you consider your own situation, don’t pull a startup number out of the air; use your business plan to calculate how much you’ll need to start your ideal operation. Then figure out how much you have. If you have all the cash you need, you’re very fortunate. If you don’t, you need to start playing with the numbers and deciding what you can do without, or you’ll need to decide where to look for outside funds. In this chapter, we’ll discuss sources of financing for your new business.

We’ll also discuss the equipment you’ll need to get started. Management and administration will be critical parts of your operation, and you’ll need the right tools to handle these important tasks. Your office equipment needs will vary significantly depending on the size of your operation. You’ll also need exercise equipment. The cost of such equipment will vary, from very little for a homebased operation to thousands of dollars’ worth of sophisticated machines if you are going to open a studio. Use the information in this chapter as a guideline, but make your final decision on what to buy based on your own situation.

Diana Broschka and Phil Martens initially approached Twin Cities residents who were supportive of the 1999 creation of his G-Werx machine. Those private investors liked the idea of 501F1T but told the team to prove themselves before they would invest.

Broschka and Martens continued to socialize and distribute their business plan very selectively. Though it showed deep accountability, Broschka points out that in late 2007 and early 2008, private investment dollars were hard to come by in their networks.

They turned to the banks next and US Bank was first on the list, being Martens’ banking institution at the time. While US Bank saw merits in the plan and program, they did not think the team’s three years of previous business operations at a starter location were indicators of future success.

Through a recommendation in their network they approached a neighborhood bank for a SBA loan and were approved with the caveat that Broschka would co-sign the loan and participate in the business. That is how Broschka, who according to the business plan was meant to be a short-term consultant, segued into a 50-percent ownership. After Broschka eventually wound up infusing $45,000 of her own money, they forged ahead, both taking less than sufficient salaries and compensation, which over time could be viewed as additional investment in the business.

aha!

![]()

![]()

Looking for startup cash? Consider a garage sale. You may have plenty of “stuff” you’re not using and won’t miss what can be sold to help accumulate the cash you need to get your business off the ground.

Jennifer Brilliant, the personal trainer in Brooklyn, works at her clients’ locations and uses whatever items are at hand as training equipment, so her startup costs were nominal. She says it cost her less than $500 to register her business and have business cards and fliers printed. Even today, she owns very little in the way of equipment. If clients want or need items such as weights, mats, or aerobic equipment, they purchase those items themselves.

Guinard, the owner of a Get in Shape for Women franchise in Massachusetts, had owned a very successful marketing firm and started out very well capitalized from the success of that business.

By contrast, another trainer we talked with needed about $100,000 to open his studio; half that went for equipment, the other half for build-out. Thanks to his previous success with contracting to a health club chain, he was able to self-finance his new venture.

Most of the personal training entrepreneurs we talked with used their own savings and equipment they already owned to start their businesses. Because the startup costs are relatively low for homebased personal training businesses, you’ll find traditional financing difficult to obtain. Banks and other lenders typically prefer to lend amounts much larger than you’ll need and are likely to be able to qualify for.

You might want to start your business on the side, while working a part- or full-time job, so your personal living expenses are covered. But if you plan to plunge into your new business full time from the start, be sure you have enough cash on hand to cover your expenses until the revenue starts coming in. At a minimum, you should have the equivalent of three months’ expenses in a savings account to tap if you need it; you’ll probably sleep better if you have 6 to 12 months of expenses socked away.

As you’re putting together your financial plan, consider these sources of startup funds:

![]() Your own resources. Do a thorough inventory of your assets. People generally have more assets than they immediately realize. This could include savings accounts, equity in real estate, retirement accounts, vehicles, recreation equipment, collections, and other investments. You may opt to sell assets for cash or use them as collateral for a loan. Take a look, too, at your personal line of credit; most of the equipment you’ll need is available through retail stores and suppliers that accept credit cards.

Your own resources. Do a thorough inventory of your assets. People generally have more assets than they immediately realize. This could include savings accounts, equity in real estate, retirement accounts, vehicles, recreation equipment, collections, and other investments. You may opt to sell assets for cash or use them as collateral for a loan. Take a look, too, at your personal line of credit; most of the equipment you’ll need is available through retail stores and suppliers that accept credit cards.

![]() Friends and family. The logical next step after gathering your own resources is to approach friends and relatives who believe in you and want to help you succeed. Be cautious with these arrangements. No matter how close you are, present yourself professionally and put everything in writing. Be sure the individuals you approach can afford to take the risk of investing in your business.

Friends and family. The logical next step after gathering your own resources is to approach friends and relatives who believe in you and want to help you succeed. Be cautious with these arrangements. No matter how close you are, present yourself professionally and put everything in writing. Be sure the individuals you approach can afford to take the risk of investing in your business.

![]() Clients. If you’re a successful personal trainer looking to expand your business, your clients may be potential investors, says Steve Tharrett, president of Dallas-based Club Industry Consulting (www.clubindustryconsulting.com) and a consultant to health clubs. “I know a lot of personal trainers who have clients with a high net worth,” he says, “and the clients believe in them so much that they will give the trainers the financing to start up.” Again, it’s essential that you put everything in writing.

Clients. If you’re a successful personal trainer looking to expand your business, your clients may be potential investors, says Steve Tharrett, president of Dallas-based Club Industry Consulting (www.clubindustryconsulting.com) and a consultant to health clubs. “I know a lot of personal trainers who have clients with a high net worth,” he says, “and the clients believe in them so much that they will give the trainers the financing to start up.” Again, it’s essential that you put everything in writing.

![]() Partners. Though most personal training businesses are owned by just one person, you may want to consider using the “strength in numbers” principle and look around for someone who wants to team up with you in your new venture. You may choose someone who has financial resources and wants to work side by side with you in the business. Or you may find someone who has money to invest but no interest in doing the actual work. Be sure to create a written partnership agreement that clearly defines your respective responsibilities and obligations. See the sample General Partnership Agreement, Figure 8–1, on page 97.

Partners. Though most personal training businesses are owned by just one person, you may want to consider using the “strength in numbers” principle and look around for someone who wants to team up with you in your new venture. You may choose someone who has financial resources and wants to work side by side with you in the business. Or you may find someone who has money to invest but no interest in doing the actual work. Be sure to create a written partnership agreement that clearly defines your respective responsibilities and obligations. See the sample General Partnership Agreement, Figure 8–1, on page 97.

![]() Government programs. Take advantage of the abundance of local, state, and federal programs designed to support small businesses in general, and health- and fitness-related programs in particular. Make your first stop the U.S. Small Business Administration; then investigate various other programs. Women, minorities, and veterans should check out niche-financing possibilities designed to help these groups get into business. The business section of your local library is a good place to begin your research.

Government programs. Take advantage of the abundance of local, state, and federal programs designed to support small businesses in general, and health- and fitness-related programs in particular. Make your first stop the U.S. Small Business Administration; then investigate various other programs. Women, minorities, and veterans should check out niche-financing possibilities designed to help these groups get into business. The business section of your local library is a good place to begin your research.

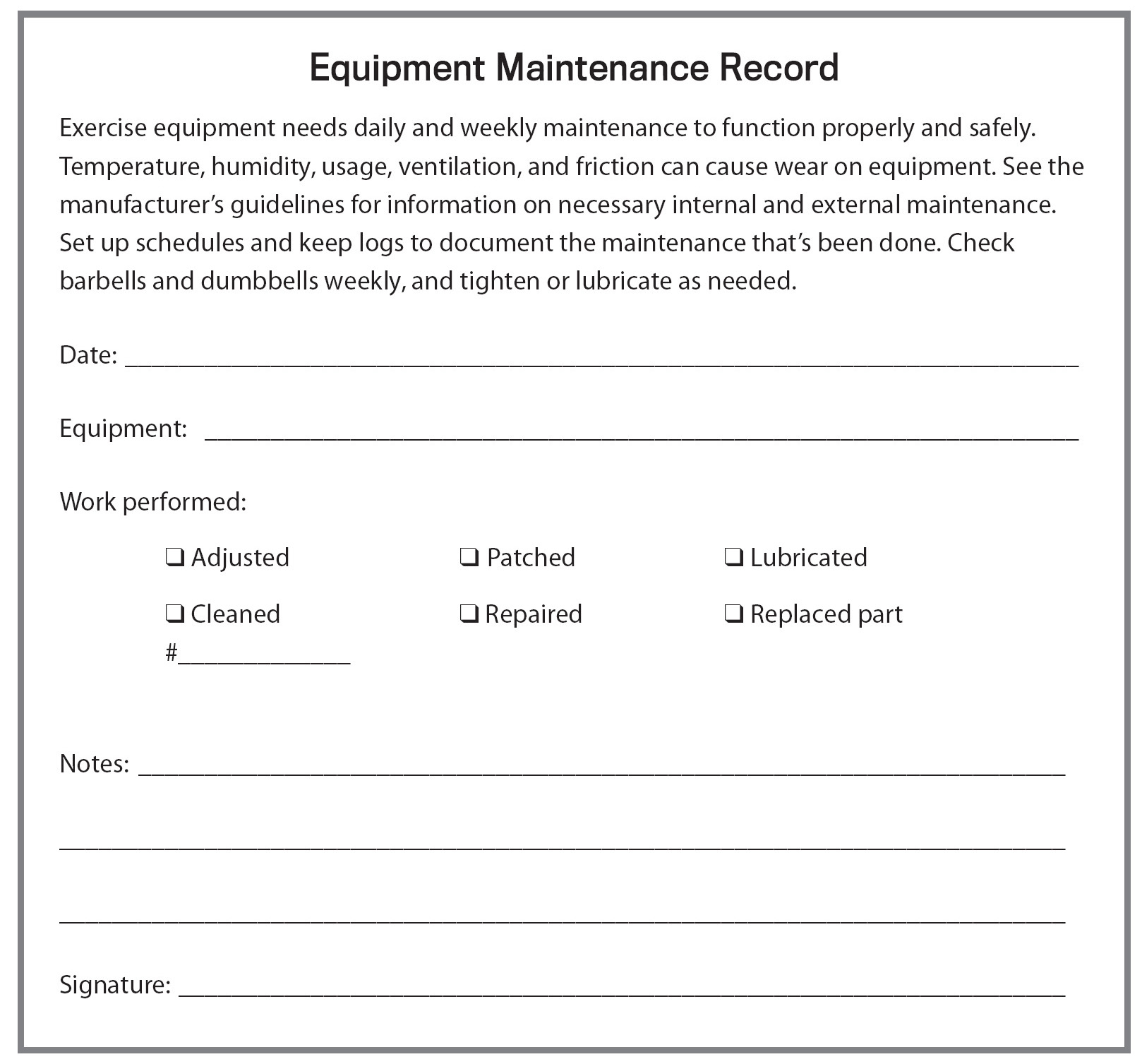

As tempting as it may be to fill up your office with an abundance of clever gadgets designed to make your working life easier and more fun, you’re better off disciplining yourself to buy only the bare necessities. You can use the “Equipment Maintenance Record” we have provided in Figure 8–2 on page 98 to keep you on track. Consider these basic items:

FIGURE 8–1: Sample General Partnership Agreement

FIGURE 8–2: Equipment Maintenance Record

![]() Computer and printer. A computer is an essential piece of equipment for any business; this is obviously so if you have a website. It also will help you handle the financial side of your business and produce marketing materials. You don’t necessarily need the “latest and greatest” in computing power, but for a reasonable price you can get a desktop computer with the most current version of Windows and plenty of memory.

Computer and printer. A computer is an essential piece of equipment for any business; this is obviously so if you have a website. It also will help you handle the financial side of your business and produce marketing materials. You don’t necessarily need the “latest and greatest” in computing power, but for a reasonable price you can get a desktop computer with the most current version of Windows and plenty of memory.

![]() Software. Think of software as your computer’s brains, the instructions that tell your computer how to accomplish the functions you need. There are many programs on the market that will handle your accounting, customer information management, and other administrative requirements.

Software. Think of software as your computer’s brains, the instructions that tell your computer how to accomplish the functions you need. There are many programs on the market that will handle your accounting, customer information management, and other administrative requirements.

Most personal trainers can run their companies with a word processing program like Microsoft Word (the entire Microsoft Office Suite with Excel, Access, and PowerPoint runs around $300 to download); an accounting program (such as Intuit QuickBooks or Sage50, which run about $25 per month for basic online QuickBooks subscription to $250 per year for a Sage50 subscription); and either a general customer contact management package or a client management package designed for personal trainers, which typically cost $200 to $900. Software can be a significant investment, so do a careful analysis of your needs and then study the market and examine a variety of products before making a final decision.

One of the ways Martens and Broschka spent invested money was on fitness studio member management software, which they purchased before even opening their doors. Broschka says, “We could’ve selected a host of software applications across a spectrum of costs but decided to go with the more expensive software from an industry leader (www.motionsoft.net), knowing it was more than we needed but that we would grow into it. I am a software, data, and management process professional so I understand and invest in the value of systems and tools to effectively and efficiently manage our operations.”

Always seeing the potential to nurture a relationship, Broschka adds, “We hope to soon be featured on their website as one of their gym clients.”

Most new computers come with basic business software already loaded. If you’re running a one-person operation, that may be all you need. But if you want to grow your company, you should take a look at industry-specific software packages designed especially for personal trainers, such as those from Aspen Software or BSDI.

![]() Photocopier. The photocopier is a fixture of the modern office, and you’ll use one to give clients copies of their records. You can get a basic, no-frills personal copier for less than $400 in just about any office supply store. More elaborate models increase proportionately in price. If you anticipate a heavy volume of photocopying, consider leasing. You could just use the copying or scanning function of your computer printer—it depends on how much copying your system requires. Printer photocopiers are a bit slower and ink for printers is often more costly than the per-impression toner for a photocopier.

Photocopier. The photocopier is a fixture of the modern office, and you’ll use one to give clients copies of their records. You can get a basic, no-frills personal copier for less than $400 in just about any office supply store. More elaborate models increase proportionately in price. If you anticipate a heavy volume of photocopying, consider leasing. You could just use the copying or scanning function of your computer printer—it depends on how much copying your system requires. Printer photocopiers are a bit slower and ink for printers is often more costly than the per-impression toner for a photocopier.

![]() Credit card processing equipment. Credit and debit card service providers are widely available, so shop around to understand the service options, fees, and equipment costs. You will need to also pay a transaction charge, which might be a flat rate (perhaps 20 to 30 cents) per transaction or a percentage (typically 1.6 to 3.5 percent) of the sale.

Credit card processing equipment. Credit and debit card service providers are widely available, so shop around to understand the service options, fees, and equipment costs. You will need to also pay a transaction charge, which might be a flat rate (perhaps 20 to 30 cents) per transaction or a percentage (typically 1.6 to 3.5 percent) of the sale.

Another option is the Square, a point-of-sale convenience for the iPad, iPhone, or Android. It is a postage-stamp sized card reader that plugs into the audio port, and has an interesting fee arrangement. There are no contracts or monthly fees beyond the per-card swipe rate of 2.75 percent, plus $.15 cents. Square’s newest readers include swipe or chip reading capabilities. Check out the many additional features of Square at www.squareup.com.

![]() Postage scale. Unless all your mail is identical, a postage scale is a valuable investment. An accurate scale takes the guesswork out of postage and will quickly pay for itself. It’s a good idea to weigh every piece of mail to eliminate the risk of items being returned for insufficient postage or overpaying when you’re unsure of the weight. Light mailers—one to 12 articles per day—will be adequately served by inexpensive mechanical postal scales, which run about $25. If you’re averaging 12 to 24 items per day, consider a digital scale, which is somewhat more expensive (ranging from $30 to $90 for a basic model) but significantly more accurate than a mechanical unit. If you send more than 24 items per day, or use priority or expedited services frequently, invest in an electronic computing scale (ranging from $50 to $400 depending on what your needs are), which weighs the item and then calculates the rate via the carrier of your choice, making it easy for you to make comparisons.

Postage scale. Unless all your mail is identical, a postage scale is a valuable investment. An accurate scale takes the guesswork out of postage and will quickly pay for itself. It’s a good idea to weigh every piece of mail to eliminate the risk of items being returned for insufficient postage or overpaying when you’re unsure of the weight. Light mailers—one to 12 articles per day—will be adequately served by inexpensive mechanical postal scales, which run about $25. If you’re averaging 12 to 24 items per day, consider a digital scale, which is somewhat more expensive (ranging from $30 to $90 for a basic model) but significantly more accurate than a mechanical unit. If you send more than 24 items per day, or use priority or expedited services frequently, invest in an electronic computing scale (ranging from $50 to $400 depending on what your needs are), which weighs the item and then calculates the rate via the carrier of your choice, making it easy for you to make comparisons.

![]() Postage meter. Postage meters allow you to pay for postage in advance and print the exact amount on the mailing piece. Many postage meters can print in increments of one-tenth of a cent, which can add up to big savings for bulk-mail users. Meters also provide a professional image, are more convenient than stamps, and can save you money in a number of ways. Postage meters are leased, not sold, with rates starting at about $30 per month. They require a license, which is available from your local post office. Only four manufacturers are licensed by the U.S. Postal Service to manufacture and lease postage meters; your local post office can provide you with contact information. Most postage meters these days operate by downloading the postage to your computer where you print indicia on the envelope or print labels for packages.

Postage meter. Postage meters allow you to pay for postage in advance and print the exact amount on the mailing piece. Many postage meters can print in increments of one-tenth of a cent, which can add up to big savings for bulk-mail users. Meters also provide a professional image, are more convenient than stamps, and can save you money in a number of ways. Postage meters are leased, not sold, with rates starting at about $30 per month. They require a license, which is available from your local post office. Only four manufacturers are licensed by the U.S. Postal Service to manufacture and lease postage meters; your local post office can provide you with contact information. Most postage meters these days operate by downloading the postage to your computer where you print indicia on the envelope or print labels for packages.

![]() Paper shredder. A response to both a growing concern for privacy and the need to recycle and conserve space in landfills, shredders are becoming increasingly common in both homes and offices. They allow you to efficiently destroy incoming unsolicited direct mail, as well as sensitive internal documents such as old client records, before they are discarded. Shredded paper can be compacted much more tightly than paper tossed in a wastebasket, which conserves landfill space. Light-duty shredders start at about $30, and heavier-capacity shredders run $150 to $500.

Paper shredder. A response to both a growing concern for privacy and the need to recycle and conserve space in landfills, shredders are becoming increasingly common in both homes and offices. They allow you to efficiently destroy incoming unsolicited direct mail, as well as sensitive internal documents such as old client records, before they are discarded. Shredded paper can be compacted much more tightly than paper tossed in a wastebasket, which conserves landfill space. Light-duty shredders start at about $30, and heavier-capacity shredders run $150 to $500.

![]() Broken-In or Broken?

Broken-In or Broken?

Should you buy all new equipment, or will used be sufficient? That depends, of course, on which equipment you’re thinking about. For office furniture (desks, chairs, filing cabinets, bookshelves, etc.), you can get some great deals buying used items on Craigslist, eBay, and Freecycle.org. You might also be able to save a significant amount of money buying certain office equipment used rather than new. However, for high-tech items such as your computer, you’ll probably be better off buying new. Don’t try to run your company with outdated technology.

Use caution when buying used exercise equipment. You may get some good deals, but you need to be sure the equipment is in good condition and safe. If you don’t have the knowledge to evaluate the equipment, find someone who does before you buy used.

The Amazon marketplace positions so many vendors to compete with one another that it’s a snap to find low prices on exercise equipment and office needs. It’s also easy to compare the features of many products. To choose the right vendor to purchase from, look for ones that have received five-star ratings from as many buyers as possible.

To find good used equipment, you’ll need to shop around. Certainly check out used office furniture and equipment dealers. Also check the classified section of your local paper under items for sale, as well as notices of bankrupt companies and companies that are going out of business for various reasons and need to liquidate.

save

![]()

![]()

Freecycle (www.freecycle.org) is a community with a mission to keep usable goods out of landfills and has many free office goods posted for the taking. Craigslist (www.craigslist.org) has a free section that in major cities is chock full of free goods, like printers, office furniture, and anything else you can imagine. It just takes a little patience and hunting to get what you want.

aha!

![]()

![]()

The Mac OS X (version 10.11.5 was released in spring 2016) operating system comes with easy-to-use movie (iMovie) and soundtrack making software (GarageBand) that you can use to throw sharp presentations together for showcasing vendors to clients, appealing to audiences in social media forums, and creating content for your website and blog. New Apple computers come with the software pre-installed, and typically you can have old versions upgraded for free. It has enough storage to handle your accounting and spreadsheet software and prompts you to connect to whatever wifi signal you are closest to by name.

The ability to communicate quickly with your customers, employees, and suppliers is essential to any business. Advancing technology gives you a wide range of telecommunications options. Most telephone companies have created departments dedicated to homebased small businesses. Contact your local service provider and ask to speak with someone who can review your needs and help you put together a service and equipment package that will work for you. Specific elements to keep in mind include:

![]() Telephone. If you are homebased and going to your clients or leasing space/use of another fitness center, you will need no more than your smartphone to conduct business. Unlimited text messaging and a significant data plan will cost somewhere around $100 per month. If you are opening a commercial location, a two-line speakerphone would be the minimum you would want to hold you through the startup period. As you grow and your call volume increases, you’ll add more lines. You might pay as much as $300 to $700 for a system but shop around and compare rates.

Telephone. If you are homebased and going to your clients or leasing space/use of another fitness center, you will need no more than your smartphone to conduct business. Unlimited text messaging and a significant data plan will cost somewhere around $100 per month. If you are opening a commercial location, a two-line speakerphone would be the minimum you would want to hold you through the startup period. As you grow and your call volume increases, you’ll add more lines. You might pay as much as $300 to $700 for a system but shop around and compare rates.

Your telephone can be a tremendous productivity tool, and most of the models on the market today are rich in features you will find useful. Such features include automatic redial, programmable memory for storing frequently called numbers, and speakerphone for hands-free use. You may also want call forwarding, which allows you to forward calls to another number when you’re not in your office, and call waiting, which signals you that another call is coming in while you are on the phone. These services are typically available through your telephone company for a monthly fee. Most phone sets these days come with a built-in answering machine, but if your call volume gets heavy you will either need to be diligent about clearing messages out regularly or make sure you get a large capacity voice recorder.

If you’re going to be spending a great deal of time on the phone, perhaps doing marketing or handling customer service, consider a headset for comfort and efficiency. A cordless phone also lets you move around freely while talking. These units vary widely in price and quality, so research them thoroughly before making a purchase.

![]() Email. Email is a standard element in any company’s communications package. It allows for fast, efficient, and traceable 24-hour communication. Check your messages regularly and reply to them promptly.

Email. Email is a standard element in any company’s communications package. It allows for fast, efficient, and traceable 24-hour communication. Check your messages regularly and reply to them promptly.

![]() Website design and hosting. Fees for designing and hosting websites vary widely. Having your site independently designed can cost anywhere from $500 to $5,000 or more, depending on the features you select. Hosting through an independent service can range from $15 to $500 per month.

Website design and hosting. Fees for designing and hosting websites vary widely. Having your site independently designed can cost anywhere from $500 to $5,000 or more, depending on the features you select. Hosting through an independent service can range from $15 to $500 per month.

tip

![]()

![]()

If you travel to your clients’ locations, turn your cell phone off when you arrive. Don’t let your session be interrupted by a call.

Because what you sell is a service, you’ll require very little in the way of office supplies—but what you need to keep on hand is important. You’ll need to be sure to maintain an adequate stock of marketing materials, including brochures, business cards, and other sales collateral materials. Have a good supply of important forms, such as: the informed consent release, assumption of risk, and health assessment questionnaire, which you’ll find examples of in Chapter 10. You’ll also need to maintain an ample supply of administrative items, including checks (although these are starting to phase out in lieu of direct deposits, online banking services, etc.), invoices, receipts, stationery, paper, and miscellaneous office supplies. If you’re starting out as a solo operator, you should be able to have these items printed for $200 to $300; if you’re starting out with a studio and employees, you’ll likely need a larger quantity and the price will increase accordingly. Local stationery and office supply stores will have most or all of the miscellaneous office supplies you need. Many certifying organizations will have sample forms you can purchase or use as a guide to create your own. You’ll find an “Office Supplies Checklist,” Figure 8–3, on page 104 to help you organize your needs.

You’ll also need basic office furniture, including a desk ($200 to $800), chair ($60 to $250), and locking file cabinets ($50 to $400). Used furniture is just as functional as new and will save you a substantial amount of money. You could get all of your office equipment for free if you had the time to shop and wait. The free section on Craigslist recently unearthed some beautiful, matching reception area chairs, rolls of new plush carpet, and oak desks in perfect condition in several cities. Start collecting now and save.

Lynne Wells, a personal trainer in New York City, started with a few Thera-Bands™ and gradually accumulated other items, such as stability balls and balance disks. She teaches her clients not to depend on special equipment, but rather to work with what they have. “Soup cans make great weights,” she says. “Chairs are good, so are pillows. I even had somebody working off a toilet seat one day.” She says it’s just a matter of learning how to give your clients a great workout by teaching them to use their bodies instead of equipment.

FIGURE 8–3: Office Supplies Checklist

Commercial-grade exercise equipment can be a significant investment. For example, treadmills range from $1,800 to $7,000; elliptical machines range from $1,800 to $5,200. Stationary bicycles can run $1,000 to $3,000. Climbers go for $2,000 to $5,000. A packaged set of weights with a rack will run about $600, a set of kettle bells run about $180, and weight benches go for $200 to $600 or more. See the “Fitness Equipment Checklist,” Figure 8–4, on page 105 for some typical exercise equipment you may want to invest in.

Sometimes the very thing you have trouble deciding to take an investment risk on becomes your main source of income. It’s a good thing that Broschka and Martens were persistent until they got a bank to support their dreams. Broschka says, “The G-Werx Workout Program is our claim to fame. We generated more than 75 percent of our revenue from it and sustained our business on this one program through a tough economy.” Broschka elaborates on the special talents that allowed this to happen: “That Phil is the inventor of G-Werx Gym, creator of G-Werx Workout Program, and Founder of 501F1T is unique in and of itself. It is rare when a fitness professional develops a machine and program, and opens their own studio.”

FIGURE 8–4: Fitness Equipment Checklist

save

![]()

![]()

Many exercise and fitness equipment and product manufacturers offer discounts to personal trainers, but few will make that fact widely known. When shopping, ask about professional discounts.

![]() Feeling at Home

Feeling at Home

If a client asks you to help set up a home gym, keep these ideas in mind:

![]() Determine space requirements. Elliptical trainers typically use less floor space than treadmills. At the same time, an elliptical may require a higher ceiling. Many treadmills can be folded for storage. Adjustable dumbbells and/or resistance tubing also can save space.

Determine space requirements. Elliptical trainers typically use less floor space than treadmills. At the same time, an elliptical may require a higher ceiling. Many treadmills can be folded for storage. Adjustable dumbbells and/or resistance tubing also can save space.

![]() Have a ball. A stability ball is relatively inexpensive, doesn’t take up much room, and allows for functional and core exercises. Plus, it adds an element of fun to workouts.

Have a ball. A stability ball is relatively inexpensive, doesn’t take up much room, and allows for functional and core exercises. Plus, it adds an element of fun to workouts.

![]() Buy more floor. Not only does rubberized flooring offer cushioning, it also protects carpet and hardwood floors from sweat. Perform Better (at www.performbetter.com) has interlocking flooring.

Buy more floor. Not only does rubberized flooring offer cushioning, it also protects carpet and hardwood floors from sweat. Perform Better (at www.performbetter.com) has interlocking flooring.

![]() Get inspired. Hanging motivational posters or quotes on the wall can help a client get inspired and stay focused.

Get inspired. Hanging motivational posters or quotes on the wall can help a client get inspired and stay focused.

If you’re going to conduct training outside your own studio, you’ll need reliable transportation. For most personal trainers, a small, sturdy economy car will be sufficient. If you transport equipment, it will need to be large enough to accommodate whatever you take along.

You can use your own vehicle if it is suitable, or lease or purchase one that will better meet your needs. Either way, keep good records of your automobile expenses because they are tax deductible. Depending on the type of car and driving you do, it will cost you anywhere from 30 to 50 cents per mile to operate your vehicle (that includes the cost of the vehicle, maintenance, insurance, fuel, etc.).

warning

![]()

![]()

Most of the equipment you need can be purchased at retail stores and charged on credit cards—but too much debt can doom your business before it gets off the ground. Only use your credit cards for items that will contribute to revenue generation. And have a repayment plan in place before you buy.

Keep in mind that your vehicle contributes to your overall image, so keep it neat and clean at all times. Proper mechanical maintenance is also important; it’s not very impressive when you have to call a tow truck because your car broke down at a client’s home, or when you’re late to an appointment for the same reason.

To promote your company, consider investing in a magnetic sign you can attach to your vehicle when you’re working. When your car is parked in front of your client’s house for an hour or so several times a week, that sign lets the neighbors know how to reach you. Be sure, however, that your auto insurance policy covers your vehicle when it is used for your business.

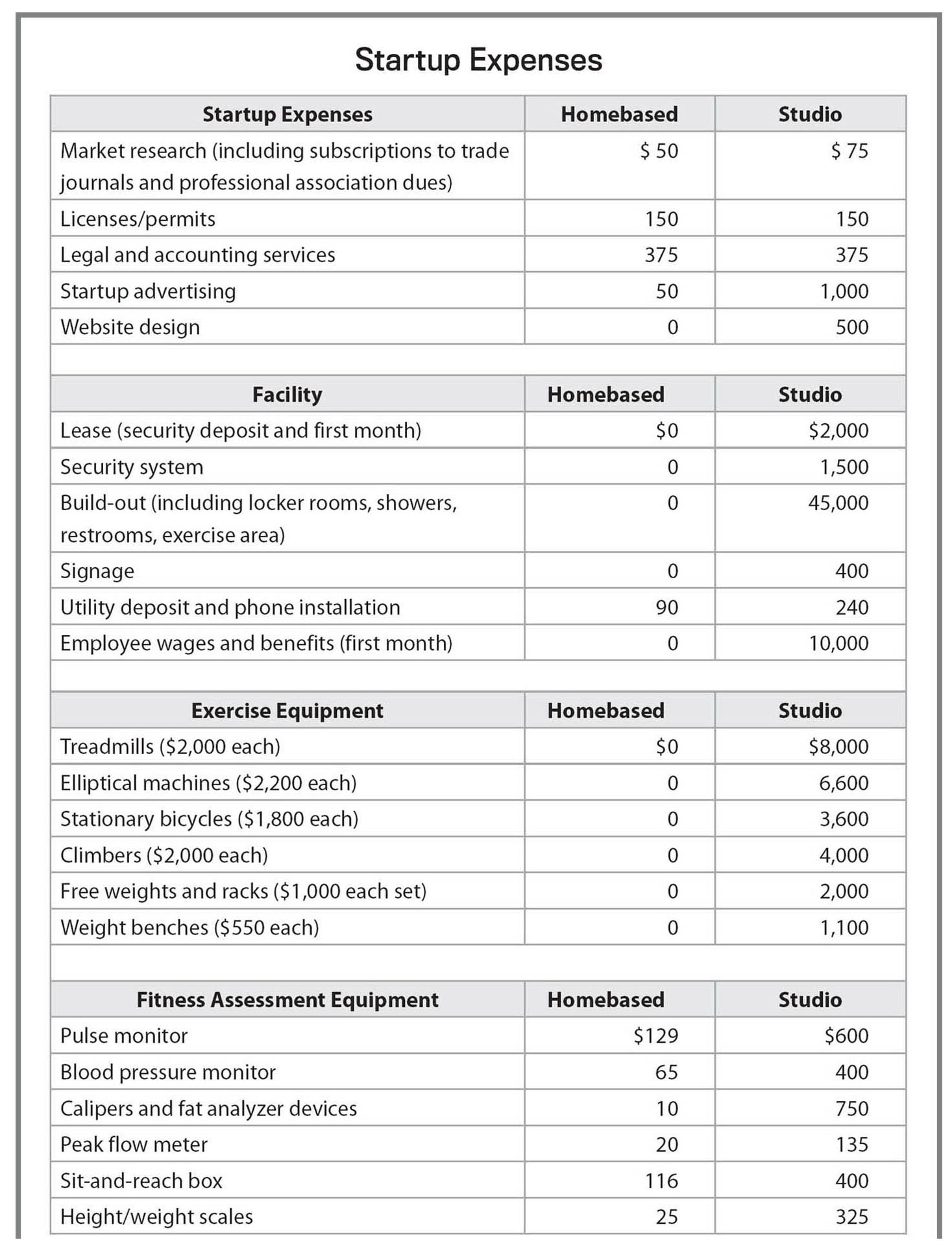

The startup costs for two hypothetical personal training businesses are listed in “Startup Expenses,” Figure 8–5, on pages 108 and 109. The low-end estimate represents a sole proprietor working from a homebased office with no employees. He has 20 to 25 clients at any given time and estimated annual revenue of $75,000. The high-end estimate represents a business whose owner has opened a 2,500-square-foot studio serving 80 to 100 clients. This owner has a staff of three trainers (one full time, two part time) and one part-time administrative assistant, and estimates annual revenue to be $360,000.

In addition to startup costs, you’ll also have ongoing monthly expenses to consider. For a discussion of these operating expenses and how to keep track of your financial records, refer to Chapter 12.

FIGURE 8–5: Hypothetical Scenarios of Startup Expenses