2

The Consumer’s Spatial Behavior

Any marketing approach must be preceded by an analysis of buyer behavior, which is the main driver of marketing systems (Alderson 1965). But this type of analysis too often remains “aspatial”. Introducing space into this approach is increasingly necessary in order to capture the consumer en route and thus make geomarketing more dynamic, because it is often too static and descriptive. This is all the more useful as changes in behavior in our societies impose new rules of the game (Levy 1996). It is therefore necessary to focus more on trajectories than territories (Golledge and Stimson 1997). After having defined and clarified the main concepts related to the consumer’s spatial behavior, Chapter 2 addresses the first “spatial” phase of this behavior (i.e. his movement to the point of sale or behavior outside the store), then the second phase (in this case, his or her movement within the point of sale or behavior in the store).

2.1. The main concepts of out-of-store spatial behavior

A spatial marketing approach must therefore also begin with an understanding of the spatial behavior of buyers and more specifically of consumers, this book being more focused on consumer marketing. Marketing researchers have focused on understanding why people buy (e.g. the famous article “Why do people shop?”, Tauber 1972), and how they buy. The “how they move to and through the point of sale” has been neglected, although it can help to answer at least part of these two questions. Geographers have explored these questions in more depth on travel in general without focusing on the act of purchase. They analyzed individuals’ approaches based on work in environmental cognition, thus developing behavioral geography (Golledge and Stimson 1997; Golledge 1999). They have also modeled these behaviors (Fotheringham 1983). They have thus constituted both conceptual and methodological sources of interest for spatial marketing.

The consumer’s spatial behavior is explained by a number of common concepts such as attraction, gravitation, spatial interaction, distance and mobility. None of these concepts are really easy to understand, and even distance can cause such distortions that behavior is sometimes very poorly understood.

2.1.1. Attraction, gravitation and spatial interaction

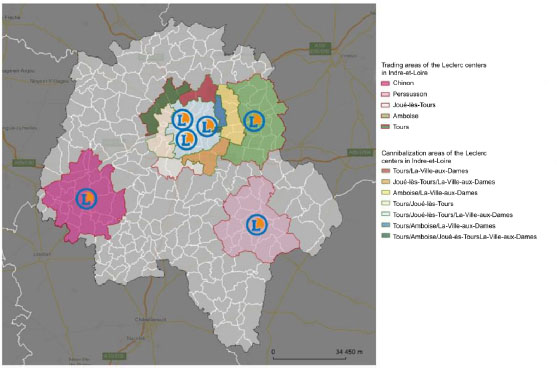

Studying store attraction, a strategic element of retail marketing (Jallais et al. 1994), is all the more difficult in an urbanized environment. Figure 2.1 shows that E. Leclerc hypermarkets can, in rural areas, have a trading area, in other words an attraction, quite simple to represent on a map, whereas in urban areas where several E. Leclerc stores coexist, the delimitation of these areas and therefore the understanding of the attraction is more complex.

The consumer’s spatial behavior requires an understanding that is all the more precise as he or she is increasingly mobile. Attraction is a concept that can be treated spatially or otherwise. Psychosociologists consider it as a first evaluation of a person or object following contact. This evaluation is based on two basic dimensions: the ability and willingness to facilitate the needs and goals of the person who perceives this attraction (Montoya and Horton 2014). Psychoanalysts, on the other hand, prefer to speak of the attraction that objects or places can exert on individuals, of attraction for people and of attraction for what is often inaccessible (Pontalis 1990).

Geomarketing requires us to consider attraction in its spatial dimension. Physics helps to better understand this concept. Newton was the first to model attraction, called gravitation at the time, on the planets and its famous formula gave birth much later to models used in marketing and especially in geomarketing. Gravitation comes from an old French word, grave, which refers to an object with sufficient mass to attract others. Einstein challenged this theory in 1905 by showing, from the theory of limited relativity, that the gravitational relationship is curvilinear. But the work on the gravitation of retail stores remains valid, because the distances are very small compared to those of astronomy.

Figure 2.1. The attraction of the E. Leclerc hypermarkets in Indre-et-Loire (37) (source: with the kind permission of Articque). For a color version of this figure, see www.iste.co.uk/cliquet/marketing.zip

Models have been developed to explain and predict consumer spatial behavior. Some of these models are conceptually based on the idea of attraction, which can be expressed in gravitation and/or spatial interaction. “Spatial interaction is a broad term encompassing any movement over space that results from a human process” (Haynes and Fotheringham 1984). Gravity models are the most commonly used spatial interaction models in geomarketing. They make it possible to integrate absolute distances measured in space or time and distances relative to the fixed points studied: two points A and B, cities or stores, can be located at the same metric or temporal distance as two other points C and D, other cities or stores; but points A, B, C and D are generally very different and gravity models are able to take this relativity into account through the consideration of their respective masses.

This attraction can be explained by three structural factors (Cliquet 1992):

- – the classification of goods and services;

- – the principle of least effort;

- – distance.

Knowing that distance is perceived as an effort (Proffitt et al. 2003), promotions are also attraction factors and can change a consumer’s itinerary, but, unless the customer switches permanently from one point of sale to another (which is what all store managers are looking for), this attraction phenomenon generally remains temporary(Cliquet 1992, 2002a).

The classification of goods refers to the central place theory (Christaller 1933). This classification was developed as early as 1923 in the first issue of the Harvard Business Review. The proposed typology (Copeland 1923) distinguishes three categories of goods:

- – commodity goods: purchased routinely and effortlessly;

- – shopping goods: requesting a collection of information;

- – specialty goods: chosen according to the importance of the brand.

It is immediately apparent that each product category will generate different types of movement and therefore spatial behavior for consumers. Commodity goods require little effort because their purchase is routine. Speciality goods mainly involve identifying the stores that sell the desired brand. A priori, commodity and speciality goods can be modelled using gravity-based models. On the other hand, shopping goods require data collection that may require consumers to visit various stores before making a decision, although the use of the smartphone may help them in their collection, this being true for all goods.

Traditional consumer behavior models are most often based on the essential role played by the brand, thus focusing efforts on speciality goods: but these models are essentially “aspatial”, because they do not take into account geographical space in favor of the virtual space of brands. However, retailers have developed real brand strategies with their private labels and above all brand strategies that enable them to build customer loyalty (Filser 1994) in a given geographical area. Moreover, consumers do not always have the leisure or the means to chase after brands: they are increasingly receptive to retailers’ strategies to the point that it is often the fascia’s attractiveness that prevails over that of the brand. It should be noted that, on the one hand, the increasing mobility of consumers and, on the other hand, the use of the Internet to purchase an ever-increasing number of goods can help transform the content of the three goods categories (commodity, shopping and speciality).

The principle of least effort is well known to psychologists (Zipf 1949). It is associated with the distance or travel time that humans, like animals (Tsai 1932), seek to minimize. Loyalty to the brand is often explained by the principle of least effort: we speak of reactive loyalty. However, consumer loyalty is increasingly hampered by the desire for variety research (Lancaster 1990; Aurier 1991; Kemperman et al. 2000; Siriex 2000), which is reinforced by retailers’ differentiation strategies (Cliquet et al. 2018).

It is clear that behind, on the one hand, the classification of products and its impact on the way consumers move, and on the other hand, the principle of less effort during these moves, lies distance. This has been the subject of numerous studies and paradoxically remains the variable that is often the most difficult to capture.

2.1.2. Distance

The concept of distance can be qualified in different ways in the context of organizations and some authors distinguish between geographical, cognitive or social distances (Douard et al. 2015). Studying consumer spatial behavior has long been reduced to analyzing the geographical distances travelled between home and the point of sale. The law of retail gravitation (Reilly 1931) imposed this constraint, because gravity is defined by distance and mass (here, the point of sale).

The extraordinary development in number and especially in size of the modern retailing formats in the 1960s quickly imposed a new vision of this distance. Indeed, and to use Braudel’s (Braudel 1986) words: “The true measure of distance” is “the speed at which people move”. In other words, it is the travel time rather than the distance of the journey that matters. Research then sought to better understand these travel times in general by tracing isochrones (Chabot 1938), then applying them to marketing issues (Brunner and Masson 1968). Thus, it is easy to obtain maps broken down according to this “time distance” between home and point of sale of all the main residential areas around a store (Cliquet et al. 2006).

Distance can also appear as a variable that can be measured from one point to another using an apparatus: it is the absolute distance (Haynes and Fotheringham 1984). But it also has a relative value that depends on the nature or position of the extreme points, hence the notion of spatial interaction. Its use in models to predict consumer behavior then becomes much more difficult to control. Indeed, distance in the absolute or metric sense of the term has been the subject of much work since the law of retail gravitation (Reilly 1931) that Converse (Converse 1949) was able to formalize. And even if this law was used for a long time to locate malls (McKenzie 1989) or supermarkets in rural areas (Giraud 1960), the notion of temporal distance (Huff 1964) was gradually preferred to correspond to the movement of consumers by car.

2.1.2.1. Geographical and temporal distance

Geographical or metric distance is used when considering the respective situation of points of sale within a network, particularly when it is composed of franchisees (Darr et al. 1995; Darr and Kurtzberg 2000). Time distance is also often disappointing as an explanatory factor for spatial behavior. There is a perceptual bias that differentiates us from our contemporaries and requires us to evaluate time and many other things specific to our personality, culture, mood, etc., and consumers do not all have the same perception of time (Bergadaà 1988, 1989). In fact, decisions are not made according to reality, but according to the subject's perception of it, particularly in spatial matters (Brunet 1974). However, this perception of distance can be very different from one individual to another, whether in its metric or temporal measure (Croizean and Vyt 2015). A subjective measure of perceived distance gives much better results than an objective measure and allows for the measurement of a much larger number of variables (Cliquet 1990). And as we have seen, depending on the type of products sought by the consumer, the understanding of distance in his behavior will be different: commodity goods are more sensitive to distance whatever its measure, but especially its perceived measure. On the other hand, shopping goods, which require several trips to different points of sale, are marked by a distance-related threshold effect (Malhotra 1983) in that consumers agree to visit stores within such a long radius (perceived), but beyond that, they do not move as in the furniture market (Cliquet 1990). Finally, so-called speciality products, such as luxury or very strong branded products, may lead buyers to no longer take distance into account. It has been suggested that ICT would limit travel, but it has been found that cyber shoppers spend as much time traveling for their purchases as before (Allemand 2001).

2.1.2.2. Distance in psychosociology

But distance is not only measured geographically or temporally. It also plays a role in the psychology of human relations and is often referred to as cultural distances (Benabdallah and Jolibert 2013). A distinction is made between social or sociospatial distance (Hall 1966), psychological distance (Mulder 1958) and psychic distance (Johanson and Wiedersheim-Paul 1975). Social or sociospatial distance has been defined as characterizing human relationships and as one of the components of “proxemics” (Hall 1968). Psychological distance is related to power relations between individuals (Poitou 1966) and is often confused with psychic distance. It has been shown, during an experiment in a restaurant in France, that there is a preference for a greater distance from other customers and staff, especially when customers are part of a group (Clauzel and Riché 2015).

2.1.2.2.1. Social or sociospatial distance

Social or sociospatial distance has been studied under the concept of “proxemics” (Hall 1968) defined as “the interrelated observations and theories of humans use of space as a specialized elaboration of culture” (Hall 1966). Proxemics is more about the “how” than the “why”, the structure than the content. It reveals a distinction related to social distance that can be summarized from work done in the United States (Hall 1966):

- – intimate distance: less than 46 cm, less than 18 inches;

- – personal distance: from 46 cm to 122cm, 1.5 to 4 feet;

- – social distance: from 120 cm to 370cm, 4 to 12 feet;

- – public distance: over 700 cm, 25 feet or more.

Depending on the country where you are and the dominant culture, these social distances can be very different, for example between China and Japan, between North and South Europe. Ignoring these differences can lead to misunderstandings or even mistakes.

2.1.2.2.2. Psychological distance

Psychological distance (Mulder 1958) aims to explain the hierarchy in power relations. The desire for power drives individuals to want to reduce psychological distance from supervisors and increase psychological distance from subordinates, especially in cases where promotions within the organization are made difficult or even impossible (Poitou 1966).

2.1.2.2.3. Cultural distance

Cultural distance requires overcoming differences in appreciation among consumers, employees or partners in the target country. The literature provides many examples and international comparisons (Usunier and Lee 2013; Meyer 2015). One model may have shown that cultural distance is an antecedent of psychological distance (see below) (Souza and Bradley 2006). The analysis of cultural distances is of real importance in the internationalization process (Beugelsdijk et al. 2018):

- – both in the pre-decision phase:

- - the choice of locations;

- - the choice of ownership levels (company-owned units, franchised units or joint ventures);

- - the organization of expansion in foreign countries, in other words the choice of entry mode and expansion mode (Picot-Coupey et al. 2014);

- – and in the expansion phase itself:

- - the integration of the subsidiary (or of the joint venture or of the franchised unit) into the organization (transfer of practices);

- - the measurement of the performance effects of cultural distance both at the level of the subsidiary (or of the franchised unit) and the organization as a whole.

From this research, it appears that, if a company is less inclined to invest in countries where the cultural distance is large compared to its own, it does not give up making investments of a completely new type in these countries. Moreover, cultural distance does not act negatively or positively over time, but depends on how it is treated (Beugelsdijk et al. 2018).

2.1.2.2.4. Psychic distance

Psychic distance must also curiously awaken the geomarketer’s interest. Indeed, some companies have experienced many export difficulties due to a lack of knowledge of this complex aspect. Psychic distance has been highlighted in what is now known as the Uppsala model (Johanson and Vahlne 1977). This psychic distance can be measured using an index rather than a scale (Brewer 2007). It has been shown that psychic distance explains the performance of some major international retailers, particularly in terms of financial and strategic efficiency (Evans and Mavondo 2002) and that it is of crucial importance in alliance strategies for research and development in industries with high levels of knowledge management (Choi and Contractor 2016).

2.1.2.2.5. Institutional distance

Finally, institutional distance can constitute an obstacle in some countries insofar as the international exporting firm is caught between the need for performance and the reality of social acceptance, in other words, its legitimacy in a country that is not its own and where habits, if only contractual, are not the same as in the country of origin: governance choices can then prove crucial (Yang et al. 2012).

2.1.3. The notion of shopping trips

It is important not to confuse the shopping trip with path-to-purchase. In what follows, the shopping trip involves a strong spatial dimension (Frisbie 1980) while path-to-purchase contains a spatial part, the shopping trip. Path-to-purchase begins, according to consumer behavior theories, with stimulus and motivation, and continues with the formation of attitude and intention before the actual purchase (Engel and Blackwell 1982), followed by product consumption, redemption and recommendation (Shankar et al. 2011). All this can now be done via the Internet without leaving home. The purchasing behavior cycle includes information seeking, evaluation, goods category and/or brand decision, store selection, in-store journey, purchase and post-purchase (Shankar et al. 2011) to which the out-of-store journey should be added before the choice of the latter.

Among the non-store routes, we can distinguish multi-object paths that aim to take advantage of an outing to visit several stores, and single-object paths that consist of going to a single store. Traditionally, several attributes are supposed to guide the consumer in his spatial shopping choices for his multi-object tours (Timmermans 1980):

- – parking facilities;

- – obstacles due to traffic;

- – distances between stores;

- – the availability of specialized brand stores;

- – the presence of large retailers;

- – product prices;

- – the quality of the products;

- – the choice among the products;

- – the quality of services;

- – the windows;

- – the number of stores.

Most of the consumer’s spatial behavior models focus on the single-object path. A Logit-based model shows the value of integrating multi-object pathways to better understand the competitive structure of markets (Popkowski Leszczyc et al. 2004) and to develop more refined strategies for attracting consumers.

Now, with the possibilities offered to consumers to use tablets and smartphones, the routes are more complex to analyze. And at this stage, it is necessary to open a parenthesis about “multichannel”. Marketing channels have increased in recent years. In addition to the store, consumers can use their laptop, smartphone or tablet to access the Internet or social networks, while the traditional telephone or mail is losing momentum. These channels allow the consumer, thanks to these new technologies, to stay connected and move from one channel to another without losing information very quickly (“omnichannel” approach). All this is done anytime and anywhere according to the acronym ATAWAD (anytime, anywhere, any device) presented by Xavier Dalloz in 2002 and completed in the form ATAWADAC (anytime, anywhere, any device, any content) developed by Mick Levy in his blog1. Companies must therefore adapt to this new situation.

For a while, the firms simply managed these various channels into as many silos, each silo living its life more or less independently of the other channels. However, not only is this management expensive, but it does not attract the customer. In order to overcome this inefficiency, firms have connected these channels in a movement of “interchannel” way that must be made profitable this time by developing a crosschannel approach. Firms, whether producers or distributors, must now respond with their “crosschannel” approach to the “omnichannel” approach of consumers.

That being said, let us come back to the notion of shopping trips. This route has evolved considerably in recent times and it is possible to define shopping trips by distinguishing between traditional and omnichannel routes. Consider a new product (clothing, small appliances or electronic product). The traditional route may be as follows:

- – information (press, radio, television);

- – physical research of possible points of sale;

- – price comparison in stores;

- – choice of store;

- – purchase of the product.

So, what about the “omnichannel” path?

2.1.3.1. The omnichannel path

In reality, the omnichannel path may be as follows (omnichannel path 1):

- – information (press, radio, television and especially tablet or smartphone);

- – search for points of sale on tablets or smartphones;

- – price comparison on tablet or smartphone in stores;

- – choice of store;

- – purchase of the product in the store;

- – providing an opinion on a social network;

- – response to a customer satisfaction survey proposed by the store.

This omnichannel path could also take other forms (omnichannel path 2):

- – information (press, radio, television and especially tablet or smartphone);

- – search for points of sale on tablets or smartphones;

- – price comparison in tablet or smartphone stores;

- – choice of store;

- – product testing in the store;

- – purchasing the product on the Internet at home or in any other place;

- – providing an opinion on a social network;

- – response to a customer satisfaction survey proposed by the store.

Or (omnichannel path 3):

- – visit to a store;

- – discovery of an interesting product;

- – price comparison in competing stores on tablets or smartphones;

- – choice of store;

- – purchase of the product in the store;

- – providing an opinion on a social network;

- – response to a customer satisfaction survey proposed by the store.

Or why not (omnichannel path 4):

- – visit to a store A;

- – discovery of an interesting product;

- – price comparison in competing stores on tablets or smartphones;

- – choice of store;

- – purchase of the product thanks to the smartphone in store B;

- – providing an opinion on a social network;

- – response to a customer satisfaction survey proposed by store B.

We can see that a growing number of consumers are adopting shopping and browsing paths involving all points of contact, whether physical or virtual, at their disposal in order to follow the evolution of their retailers and brands without having to travel except when the need arises (Cliquet et al. 2018). This is referred to as omnichannel behavior, which must be fluid, frictionless and seamless (Brynjolfsson et al. 2013), hence the need to enrich these new routes (Picot-Coupey et al. 2016) to increase their value for the customer (Hunneman et al. 2017). In any case, firms must adapt to multichannel competition by making it easier for their customers to access the different channels they use through the most efficient crosschannel strategy (Picot-Coupey et al. 2016).

2.1.3.2. The ROBO or ROPO path

We could thus conceive many other paths under the acronyms ROBO (Research Online Buy Offline or Research Offline Buy Online) or ROPO (Research Online Purchase Offline or Research Offline Purchase Online) (Kalyanam and Tsay 2013) that could lead to showrooming, a situation in which the store is only used to display products, purchases being made on the Internet. And with regard to the multichannel 4 path, some brands have been able to develop store concepts in which the customer can use the product, then buy it on the Internet, as the store does not have any stock and may offer interactive terminals to order the product to be delivered at home (e.g. this is the case with Decathlon stores). And we understand the logistical challenge of the “last mile” (Durand et al. 2013) or how to deliver as quickly as possible so that the customer can enjoy the product when he gets home: some people no longer talk about the “last mile”, but rather about the “last hour” or even the “last minute” when the buyer is in a hurry and in this case, the price is higher, as the mobile pump operator Gaston2, who delivers fuel to the home, practices in Paris. Here again, we see the importance of distance, whether it is metric or temporal and beyond the control of space: the trade war that is starting in Paris, between Carrefour and Casino on the one hand and the newcomers Amazon and E. Leclerc on the other, for the fastest and cheapest delivery will illustrate this.

We can see how much understanding of consumer spatial behavior, both in physical and virtual space, can be a determining factor for retailers and ultimately also for all firms, some of which sell their products directly on the Internet (Collin-Lachaud and Vanheems 2016). We can also see the growing importance of logistics (Huré et al. 2012), which has become the very heart of companies like Amazon. However, the consequences of these new spatial behaviors on store management must be qualified. The major trips have long been distinguished from filler trips (McKay 1973; Frisbie 1980; Kahn and Schmittlein 1989; Kahn and Schmittlein 1992). It has thus been shown that the type of shopping trip has an influence on unplanned or impulse purchases (Kollat and Willett 1967). The presentation of the product can still be a factor of attraction for the customer without him/her being informed about competing offers.

2.1.4. The notion of mobility

In the early 2000s, it could still be said that the mobility of individuals was increasing sharply (Moati 2001). The French traveled an average of 14,300 kilometers per year (compared to about 9,000 kilometers in the early 1980s), slightly more than the European average, but half as much as in the United States, with most traveling within an 80-kilometer radius from home. The French traveled an average of 23 kilometers per day during the week (excluding long-distance travel), a third more than 25 years earlier (Orfeuil 2001), even though travel times remained more or less stable thanks to advances in both individual and public transport, as well as the number of trips (Lauer 1998). While commuting accounted for the bulk of these trips, it was still observed in the early 2000s that the share of commuting tended to decline in the face of purchasing or leisure-related mobility (Marzloff and Le Carpentier 1999). Indeed, from 1982 to 1994, the number of trips per person per day for business purposes decreased by 20% while those for leisure increased by 33%; trade accounted for 20% of weekday trips and 25% on weekends (Desse 2001). The time spent on transport remained stable. Since travel was no longer concentrated at certain times of the day and week, it tended to spread over time, making off-peak and rush hour concepts irrelevant. The “tyranny of distance” (Leo and Philippe 2000) tended to be reduced in consumer behavior.

2.1.4.1. Complex mobility

We now speak of complex mobility with less “pendular” paths, no longer being simple round trips, the spatial norm of movement is no longer radial, but with loops (Viard 1994). The intensification and complexity of mobility is also due to social transformations, with the arrival of women on the labor market and new organizations (flexible working hours, continuous working day, telecommuting, 35-hour work week). Peregrination is becoming the dominant mode of operation: shopping trips are part of more complex chains where distance can play a role in assessing consumer values (Brooks et al. 2004) with consequences on the location of points of sale and prices (Popkowski Leszczyc et al. 2004).

This peregrination is the result of the crossover of urban space use strategies by households and an increasingly fragmented supply of shops and services throughout the urban region. Depending on the workplace, the mode of transport, but also more individual variables (age, household composition, etc.), the intensity of peregrinations can vary (Desse 2001). We can therefore distinguish an “insular” mobility, characterized by a routine journey and timetable from a mobility of “archipelagos” or “networks”, characterized by paths less concentrated in space and time (Allemand 2001). Semiotics has been used as a tool to understand, for example, mobility within tourist behavior (Graillot 2001). As early as the 1980s, firms had understood the importance of mobility in their segmentations (Sevosi and Troiani 1987).

What is the situation today? The INSEE survey on the evolution of mobility carried out among 20,200 households and 18,600 individuals in 2007–2008 (Hubert 2009) compared to the 1993–1994 survey shows that daily mobility is decreasing in 79 points of urban areas with more than 100,000 inhabitants at the 1999 census; the next survey is 2018–2019. But, on the contrary, it continues to increase in rural or poorly urbanized areas. In these latter areas, where households will move to escape high rents and housing prices, access to shops has increased by 5%, as has the number of cars in these rural and peri-urban households. On the other hand, in many large urban areas where transport has improved, consumers are increasingly preferring local shops for time saving reasons (Gahinet 2014). Mobility is expected to drive an explosion in services by 2030, according to a PricewaterhouseCoopers (PwC) study (Bourassi 2019).

An increasing number of urban-area hypercenters have been able to organize themselves around pedestrian sites and dedicated tramway-type public transport. It can therefore be said that city dwellers change their behavior in order to travel lesser distances. People are becoming aware of the futility of some travel (Amar 2010) and are seeking to be more productive in their travels, especially in terms of relationships or “reliance”. There is undoubtedly an awareness among city dwellers of the pollution and the extent of carbon footprints (Heitz et al. 2010). But, even for the inhabitants of peri-urban areas, it has been observed for several years that “Fordian” transport, that is, the same for all at the same time, is no longer conceivable (Ascher 2000). The choice of a store is more based on opportunities: consumers shop in a supermarket because it is on their route, and because they have time to stop there at that particular moment (Desse 2001). These mobility times are therefore now at the heart of the new rationales for setting up shops (Gasnier 2007).

Mobility studies are often based on transversal work or photos at a given moment without any follow-up of these mobilities. In order to fill this gap, recent research (Louail et al. 2014) has relied on data from mobile digital media, such as smartphones, messages and geolocated photos from Twitter or Foursquare. Based on credit card transactions in the Barcelona and Madrid regions and socio-demographic data, it has been shown that types of mobility vary according to age, gender and activity (Lenormand et al. 2015).

2.1.4.2. Inequalities in mobility

There are inequalities in mobility. In order to better understand its sources, sociology has proposed the concept of “motility”, defined in biology as “the ability of living beings to produce movement” (Kaufmann et al. 2015, p. 21). As transport and communications accelerate, it is clear that spatial mobility and social fluidity are not always in line with each other. Motility is then defined “at the individual level […] as the way in which an actor appropriates the field of mobility possibilities and uses it to develop personal projects” (Kaufmann 2011). Motility can be broken down into several concepts: access, knowledge, skills and appropriation (Kaufmann et al. 2015). We can then try to bring this idea closer to that of capability (Sen 1985), defined as the individual’s freedom of choice, and put forward the idea of spatial capability in relation to the social inequalities linked to the difficulties encountered by individuals who lack the motility necessary to develop their projects. This makes one more aware of the futility of certain public policies that do not take into account the motility of individuals facing, for example, unemployment.

2.1.5. Ubiquity

Ubiquity, from the Latin ubique meaning “everywhere”, is today a concept at the very heart of the activity of mobile commerce (or m-commerce) and its issues. Ubiquity can be defined as the ability to be everywhere at the same time. This definition shows to what extent space and time are intimately linked, including in the behavior of individuals. It also indicates that ubiquity can be interpreted as an “antimobility”: indeed, there is no need to move, the ubiquitous individual, we refer to as the “ubinaut” (Badot and Lemoine 2013), is endowed with the power to be everywhere at once and instruments such as tablets or smartphones allow him to act in a kind of “dynamic immobility”. The smartphone makes it possible to buy products when you want, as with the computer and especially where you want, hence the term ubiquitous consumption (Cox 2004). As early as 2002, five years before the emergence of smartphones, the idea of uber-commerce (or u-commerce) appeared (Watson et al.2002) (see Chapter 5), which would correspond to a kind of “overtrade” that would encompass and go beyond traditional commerce, providing all the necessary information, thus pushing the limits of rationality (Simon 1957). Ubiquity, a synthesis between time and space, can also be analyzed as a combination of time and spatial convenience, notions that have been used to understand the intention to use mobile phones to access financial services (Kleijnen et al.2007), or smartphones to shop (Cliquet et al. 2013). Ubiquity can also be perceived as the main characteristic of mobile services (smartphone, tablet, etc.) and can be broken down into (1) continuity in the ability to maintain the quality of access to services without interruption, thus allowing simultaneous tasks; (2) immediacy through the speed of data transmission; (3) portability or ease of transporting mobility instruments;and (4) the ability to optimize searchability in an information system (Okazaki and Mendez 2013).

2.1.6. Other concepts related to the consumer’s spatial behavior

The study of the consumer’s spatial behavior implies the presence of other concepts: market area, trading area and isochrones, spatial area of indifference, sales leakage, market saturation, notions of customer stock and customer flows as well as peregrinations.

2.1.6.1. The market area

The market area, or local market, represents a geographical commercial entity, generally located around a city, whose size depends on its population and which is delineated according to the distance from other local markets. These markets are frequented by local consumers and constitute a meeting point, a centrality, that facilitates shopping (Berry 1967). This notion of market area or local market can be compared to that of area of influence (Noin 1989) in commercial matters. The work of a company specializing in geomarketing, Astérop, had served as the basis for an article in the newspaper Le Monde (Brafman 2008) in which it was shown that there were 629 local markets in France. At a time when there were fears of renewed inflation, the aim was to show that this inflation had local structural causes, that is, around 60% of local markets were under the influence of a single retailer, 25% under the influence of two retailers and the rest was experiencing real competition.

2.1.6.2. Store trading area and consumer supply area

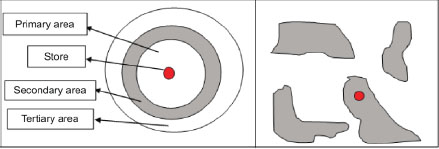

The trading area refers to the territory from which the customers of a point of sale originate (Applebaum and Cohen 1961; Huff 1964). The trading areas of the points of sale were long considered to be formed by three concentric circles in order to estimate potential sales (Applebaum 1966):

- – the primary area, where approximately 60 to 70% of the clientele is concentrated;

- – the secondary area, with between 15 and 25% of the clientele;

- – the tertiary or marginal area, with the rest of the clientele.

These primary, secondary and tertiary areas were quickly measured in terms of time (Brunner and Masson 1968) giving rise to the isochrones. But with the advent of geomarketing, the actual shape of trading areas has changed considerably (see Figure 2.2).

Figure 2.2. Theoretical and actual trading areas. For a color version of this figure, see www.iste.co.uk/cliquet/marketing.zip

In the left part of Figure 2.2, the theoretical trading area is represented by concentric circles with the primary, secondary and tertiary areas according to a well-known method, while the right side of Figure 2.2 shows a fully exploded real trading area. Indeed, by using geomarketing software and geocoding customer addresses using loyalty cards, it was discovered that the trading areas were composed of “pieces” representing an archipelago and not concentric circles. The trading areas are still often represented in theory.

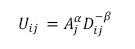

In Figure 2.3, we see that the decomposition of the market area studied into geographical cells, which can be IRIS or cantons, allows the borders of the trading area to be refined very quickly using an address file and geomarketing software. It is also possible to take into account the sales surface area of the points of sale and to nuance the strength of attraction with the help of colors.

Figure 2.3. Shopping area of stores according to their surface area (source: with the kind permission of Articque). For a color version of this figure, see www.iste.co.uk/cliquet/marketing.zip

These representations may take time. The representation of these “pieces” of trading area can be accelerated by using filtering and convolution techniques (Baray 2003a) (see Chapter 4).

Faced with the store’s trading area, a customer travel area can be defined as a consumer supply area (Bellanger and Marzloff 1996; Michaud-Trevinal and Cliquet 2002; Moati 2011). This radius varies according to the goods category. It can be linear in the case of commodity goods, if the traditional classification of goods (Copeland 1923) is used, whereas it will be considered as a threshold (Malhotra 1983) beyond which the consumer will refuse to seek information in the case of shopping goods. There is a linear function with speciality goods as long as they are not out of stock (Campo 2000b).

2.1.6.3. The principle of spatial indifference

Derived from the expression “just noticeable distance” used in psychophysics according to Weber’s law, the principle of spatial indifference postulates that the consumer does not necessarily choose the nearest store, but rather that there is a spatial zone of indifference. It is an area in which the marginal cost of reaching another store is considered minimal (Nystuen 1967), and where the consumer is required to make several trips in order to minimize his total shopping cost (Keane 1989) either by purchasing complementary products or by visiting several points of sale to find goods (Craig et al. 1984) as within the furniture market (Cliquet 1990).

The spatial area of indifference corresponds to threshold effects (Malhotra 1983), because the client does not accept moving beyond a certain distance. From now on, supermarkets are suffering from the shrinking size of this area and have difficulty attracting customers: their trading area is being reduced in favor of convenience stores located in the consumer’s supply area, which means that consumers can better manage their time (chronos), go whenever they want (kaïros) (Gahinet and Cliquet 2018) and control their space (choros).

2.1.6.4. Market saturation and sales leakage

Retail leakage refers to the fact that consumers prefer to shop in a local market other than the one closest to their home. It can also affect national markets: Singaporeans sometimes prefer to shop in Malaysia (Piron 2001). There are many reasons for this. The first reason is probably the saturation of the market (Duke 1991). To counter this saturation, merchants should differentiate themselves according to the type of customers they are missing. To do this, we can rely on a leakage analysis (Ohmae 1982) which consists of studying different client segments (Duke 1991): the clientele that the firm cannot target, the one that it can target but without success, the one that it has managed to win and the one that is loyal to it. In terms of spatial marketing, this means analyzing the trading areas, that of the trader involved and those of his competitors. It may then be that by offering, for example, a product not yet available in the market in question, promotional campaigns and better adapted pricing and quality policies, that the attraction will work again.

A second reason is the lack of supply. Some local markets are often mainly occupied by businesses belonging to a single retail group: this has an impact on local prices (Gullstrand and Jörgensen 2012) and can encourage consumers to “look elsewhere”. A third more recent but increasingly important reason is undoubtedly the increased mobility of consumers to both their workplace and their leisure space, which forces stores to attract not only consumers from their trading area, but also those who pass near the point of sale. We then come to deal with the notions of customer stock and customer flow (Cliquet 1997a). All these aspects not only affect retailers but also have a strong influence on local public policies in terms of retail attraction within cities and regions.

2.1.6.5. Customer stock and customer flows

The business model of a point of sale is most often based on attracting and capturing a stock of customers residing in a specific geographical area: the trading area. This model is changing significantly as consumers become more mobile. And many businesses must not only manage their trading area, but also capture the “flows” of customers passing through their commercial space and take an interest in the movements of consumers. However, even if what follows can be challenged by the Internet, few sectors are strictly “stock” (insurance, driving schools, etc.) or “flows” (hotels) (Cliquet 1997a). “Flows” related to commercial and service activities tend to increase with consumer mobility. Before dealing with these new mobilities, it is important to be familiar with the traditional approaches that have led to the modeling of consumer behavior.

2.2. Models and theories of spatial consumer behavior outside the store

There are now huge, so-called massive or Big Data, databases available, which can provide opportunities that are still under-exploited to better understand the evolution of market areas. Retailers who scan customer purchases every day in their stores at each checkout are at the forefront of billions of data points and thus possess a considerable amount of information. It is necessary on the one hand to know how to process and analyze these huge amounts of data and on the other hand to have the necessary conceptual background to take advantage of these analyses. The results of such work should improve decision-making, whether in terms of store location (see Chapter 4) for retailers, or for most other B2C (Business to Consumer) companies in terms of managing the elements of the marketing mix: distribution of new products, pricing, advertising or direct marketing campaigns, merchandising, sales force (see Chapter 3). The use of geomarketing software (i.e. digital maps) is not enough to understand and predict the spatial behavior of consumers outside the store (i.e. between home and the store) not to mention workplaces or leisure areas.

In marketing, the approaches to understanding the movements of individuals related to the store selection process are varied, both methodologically and in terms of applications. They are based both on the work of geographers who have drawn heavily on analogies with physics (gravity models, entropy models), as well as on psycho-sociological observations and studies, not to mention the contribution of economists, if only through the idea of maximizing utility and the theory of revealed preferences (Samuelson 1938), although this is still the subject of debate (Hands 2014). The division of the trading area into concentric circles was modeled (Maillet 1967) and segmented according to access times (Brunner and Masson 1968). Some methods are sometimes still relevant in the work of practitioners and in particular in studies prior to the establishment of a new point of sale, because they are mandatory in the French CDAC (Commissions départementales d’aménagement commercial, or local retail planning committees). Other approaches aim to model the consumer’s spatial behavior. Thus, models of consumer spatial behavior have been enriched: new variables and estimation algorithms have been introduced. They have greatly improved the understanding of consumers’ spatial behavior. While some of these models have provided encouraging results, it can be noted that the applications are limited to a few sectors of activity and specific spatial configurations (Cliquet 1997b). But above all, these models are based on a static geography. They are similar to a capture of customer stock residing in a given geographical area and do not make it possible to integrate the parameters related to the mobility of consumers who move quickly, according to complex trajectories. Even if it is difficult to model, mobility has become an essential variable to adjust the borders of a retail territory (Marzloff and Bellanger 1996) and define new implementation strategies (Gasnier 2007).

The models that will be presented are linked to the attraction of the point of sale; they are therefore based on the capture of customer “stocks”. They do not take into account the consumer’s supply areas (Cliquet et al. 2018, p. 97). We will thus try to lay the foundations for a more dynamic geomarketing approach, based on customer flows in order to take into account the mobility described above.

2.2.1. Gravity modeling or customer stock management

The mathematical formulations of these models will be presented in Chapter 4. The law of retail gravitation (Reilly 1931), developed by analogy with universal attraction, was the first attempt to model consumer spatial behavior, but at the city level. Other models were then proposed which are now integrated into geomarketing software. They attempt to measure the capture of a stock of customers residing in a market area (Dion and Cliquet 2006). Two approaches are opposed: one is deterministic and the other probabilistic, the first having given rise to the second.

2.2.1.1. The deterministic approach

The deterministic design is the basis for the simplest store selection model based on the assumption of the nearest mall. This premise, which underlies the law of retail gravitation (Reilly 1931) (see Chapter 4), which is more useful for setting up a point of sale than for understanding the consumer’s spatial behavior, is linked to the central place theory (Christaller 1933) and the principle of least effort (Zipf 1949). This view states that an individual goes to the nearest town to provide him with the products he wants in a store he is supposed to be faithful to, provided that the products correspond to his needs in terms of utility. It is then necessary to remember the warning that the product, in this case the store, does not provide any utility, but has characteristics (Lancaster 1966).

This deterministic concept, which only takes into account distance to explain consumer spatial behavior, has only been empirically validated in the case of a limited number of outlets in sparsely populated market areas with poorly developed means of transport: this is particularly the case in rural areas (Guido 1971) or in developing countries (Mexico, India or Kenya) (Hubbard 1978). But the presence in the model of only one variable, distance, reduces any real possibility of prediction. From this observation of impotence, an idea emerged: that of spatial indifference. We no longer speak of absolute distance, but relative between different possibilities of choice, in this case points of sale (Craig et al. 1984); but the application of this concept is difficult in reality even if we find it slightly in line with the idea of threshold (Malhotra 1983) or maximum distance beyond which the customer no longer moves to find the “ideal” point of sale that corresponds to his wishes.

Moreover, the desire to optimize distance is reflected, for the consumer, in the need to carry out multi-purpose shopping trips (Popkowski Leszczyc et al. 2004), which means that the central place theory (Ghosh 1986), a well-known phenomenon (Lösch 1941), must be revisited. This “multi-store” behavior by consumers can lead them to frequent malls further away than stores close to their homes: they no longer seek to optimize the utility of a single product to be purchased in a single point of sale by reducing transport time and cost, as stipulated in the central place theory (Christaller 1933), but the combined utility (Lancaster 1966) of the characteristics of several points of sale. A model incorporating this evolution has been proposed (OʼKelly 1981), which concerns a large number of consumer trips, even if these malls are no longer as successful due to traffic difficulties and time wasted, to the benefit of convenience stores (Gahinet 2018).

Other authors have attempted to integrate multiple-purpose travel, either in a very limited way without taking into account the topography of the site (Eaton and Lipsey 1982; Kohsaka 1984), or by taking into consideration the total cost of the shopping operation (Ghosh and Craig 1986), or by using a probabilistic gravity model (Popkowski Leszczyc et al. 2004), or by implementing a specific methodology called conjoint analysis (Dellaert et al. 1998). But multistores mean less travel and more product stocking. This probably explains the situation in Japan where driving is very difficult. Consumers prefer to walk to convenience stores: retailers such as Carrefour or Walmart should have understood this phenomenon when they set up large stores unsuccessfully in this country, probably forgetting the globalization versus localization dilemma (Aoyama 2007).

Consumers must therefore optimize transport and stocking costs, without forgetting to minimize product prices.A model makes it possible to qualify the frequency and nature of journeys with many empirical validations (Ghosh and Craig 1986). We can see how much the modeling of consumers’ spatial behavior has evolved from the use of a single point of sale to buy a single product to the use of a set of points of sale to acquire many products. But the urban context and increasing consumer mobility will force people to seek less restrictive models based, among other things, on probability theory (Wong and Yang 1999).

2.2.1.2. The probabilistic approach

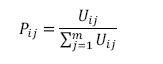

The modeling of consumers’ spatial behavior requires the consideration of spatial and non-spatial elements through the use of a utility function. We then speak of spatial choice models, the general formula of which is as follows:

where

- – Uij is the utility of a store j for a consumer i;

- – Aj is a measure of a store's attractiveness j;

- – Dij measures the distance between a store j and a consumer i;

- – α and β are parameters reflecting, respectively and at the same time, the consumer’s sensitivity to the attractiveness of the store and to distance.

It is important to be aware that attraction studies are always difficult to conduct at the product level. Concerning the nature of the products, Lancaster (1966) noted that:

- – the product does not provide any utility to the consumer, but it has characteristics that generate utility;

- – a product has several characteristics that are also present in other products;

- – products combined with each other may have characteristics, and therefore a utility, different from the characteristics of the products taken separately.

Consequently, it will not always be easy to study the attraction of a particular product, hence the importance of focusing on points of sale.

Unlike deterministic models, probabilistic spatial choice models are defined at the individual level according to revealed preference theory (Samuelson 1938). Moreover, the preferences that condition consumer spatial behavior concern places, in this case points of sale, and are not assessed in terms of allocation (Golledge et al. 1997).

2.2.1.2.1. Huff’s model

Based on the basic gravity model (Reilly 1931), the store’s attractiveness was defined by its sales surface (Huff 1964). According to this theory, a store with a large sales surface offering a deeper and wider assortment will be more attractive to the customer, who will be willing to extend his radius of action by agreeing to cover a greater distance to satisfy his needs and desires. The consumer is in the position of choosing between, on the one hand, a smaller distance and store size and therefore a narrower assortment, and on the other hand, a larger distance and store size and therefore a more attractive assortment. In Huff’s model, distance is measured by access time (transport costs can also be used). In addition, we consider the probability that a consumer will visit a store, which means that this individual is likely to frequent several different points of sale unlike the deterministic model: he will choose according to the sales surface of this store and the distance in time to travel. The probability that he or she will be a customer of a point of sale will therefore be equal to the ratio between the utility of this store and the sum of the utilities of the other points of sale. This choice can be expressed by the following formula, which links probability and utility:

Many empirical studies have been and still are based on Huff’s model. Geomarketing software is not to be outdone and offers a simple or sometimes more complete application by adding variables other than mass (sales surface) and time distance. Details are provided in Chapter 4.

A large number of studies use the Huff model with its two variables (sales surface and distance) to validate the attraction of stores in a market area. But in fact, there are often more variables that can explain consumers’ spatial behavior. Some of these variables are store-related and can be integrated into an attraction model (see section 2.2.1.2.2, the MCI model) and others are situational, environmental and individual (Granbois 1984) and can possibly be taken into account when geographically dividing the market area. This division into cells can be simplified by making a typology of these cells according to variables of these types (Cliquet 1990, 1995).

Some geomarketing software has integrated Huff-type models by adding other variables; in this case, are the rather drastic conditions of use of this model always respected? Specifically for the Huff model, since this model is not linear, estimation of coefficients related to store size and distance is not possible with conventional econometric techniques (Huff and Batsell 1975; see Chapter 4).

2.2.1.2.2. The MCI model

The MCI (Multiplicative Competitive Interaction) model (Nakanishi and Cooper 1974; Cliquet 1990) integrates variables other than distance and store sales surface. It is based not only on Huff’s model in its design, but also on other previous work (Hlavac Jr. and Little 1966; Urban 1969; Kotler 1991). The MCI model can be a spatial or “aspatial” model. Table 2.1 provides a list of variables already integrated by researchers into MCI-type models for four different types of outlets.

Table 2.1. Variables used to validate MCI-type models

(source: Cliquet 1997b)

| Malls (Weisbrod et al. 1984) | Supermarkets (Jain and Mahajan 1979) | Banking branches (Hansen and Weinberg 1979) | Furniture stores (Cliquet 1990, 1995) |

|

Number of vehicles owned by the household. Travel time from home to the store. Total transit time. Cost of the trip per $1,000 of income. Total number of employees of stores. Presence of general goods and clothing. Other products of comparison. Shops for low-income people. Planned mall. |

Image of the store (product quality, prices, staff reception, etc.). Store layout (sales area, number of boxes, etc.). Appearance external and internal). Accessibility (location at an intersection). Services (credit cards, cheque acceptance, butcher’s department, deli department). Employee breakdown (black/white). |

Location. ATM. Pedestrian counter. Novelty. Bank fascia. |

Product quality. Average level of prices. Promotional offers. Service offers. Accessibility of the store. Immediate availability of the goods. Width of the assortment. Reputation of the store. Interior decoration. Credit facilities. Competencies of the salesmen. Distance beyond a certain threshold. |

Table 2.1 shows that many variables have been introduced into spatial MCI models, as this model can also be used in an “aspatial” way as an attraction model for promotions (Nakanishi 1972) or in political science (Nakanishi et al. 1974). One of these variables was found to be very important for understanding the attractiveness of the outlet: the store image (Stanley and Sewal 1976; Jain and Mahajan 1979; Nevin and Houston 1980), as it attracts consumers located at distances further away than expected by deterministic models. This image can concern both quality and prices, the services offered, the means of payment, the number of cash registers or the number of employees (Jain and Mahajan 1979). And like Huff’s model, the MCI model is a so-called disaggregation model because the probability it provides concerns only one consumer. But it is easily possible to obtain aggregated results on a large number of individuals by simply multiplying them according to the number of consumers located in each homogeneous cell and also by taking into account their socio-demographic characteristics (Cliquet 1990, 1995) to partly respond to comments on the need to introduce variables external to the stores (Granbois 1984). We then obtain market shares with the advantage of a real logical consistency, because their sum is equal to 1 (or 100%) (Naert and Bultez 1973) which was not always the case for other models (Weiss 1968; Lambin 1970; Wildt 1974). The MCI model also emphasizes the importance of competitive interactions, because “marketing effectiveness depends on what competitors do” (Kotler and Dubois 1981).

Other disaggregation models, such as discrete choice models for example, the MultiNomial Logit (MNL) model, which is similar in structure to the MCI (Cooper and Nakanishi 1988), have been used to show that supermarket choice behaviors are fairly stable over time (over 4 years) and over space (Canada, United States and Norway) (Severin et al. 2001).

2.2.1.3. Subjective approach and attraction models

The previous models, the Huff and MCI models, have been presented as providing a probability that an individual will choose an object, a store, but it could be a product or a politician in an election (Nakanishi et al. 1974), based on elements totally external to the person making the choice: all these elements are measured in an “objective” way, in other words not subject to opinions or in more technical terms measured on ratio scales. Indeed, a store sales surface is measured in square meters (or square feet) and the distance in kilometers (miles) or minutes: no “subjectivity” is involved. However, the individual does not make his choices according to the reality of things, but according to the way he or she perceives them. It has been shown through neuroscience how much feelings and emotions are involved in decision-making (Damasio 1994): “[…], in some ways, the ability to express and feel emotions is essential to the implementation of rational behaviors.” To simplify, we perceive a reality that can lead to the occurrence of an emotion that triggers a decision in the form of a choice. Perception is a sensory input that can be a prerequisite for action (or the decision to act), but not always essential for decision-making, since dreams can lead to the same phenomenon (Brémond 2002).

With regard specifically to the choice of a point of sale, the Huff and MCI models do not include any perception variables, but only “real” variables without it being clear whether the latter have a direct impact on the individual's choices. In addition, these models often result in relatively low explanation rates. The process of choosing a store has been studied using a model of exploring the information flows that an individual must manage before visiting a store (Monroe and Guiltinan 1975) and it shows the importance of perceptions.

2.2.1.3.1. The MCI or subjective MICS model

Several attempts have been made to introduce psychological variables into point-of-sale choice models (Aaker and Jones 1971; Fressin 1975), but without convincing results. The test was nevertheless interesting insofar as it made it possible to highlight the idea that retailers could also play on the image of their fascia(s). Perceptions of either distance or travel time were then turned to realize that they were as important as objective data on these same variables (McKay and Olshavsky 1975). It has been found that models incorporating subjective variables, perceptions, give better results (Cadwallader 1981). Perceptions of distance, whether geographical or temporal, may be totally different from reality (Croizean and Vyt 2015): two people living in the same building may not estimate distance, in kilometers or minutes, in the same way and the difference may be twofold. These differences in perception may be due to the time of day at which the journey is made, the personal ability to assess, the number of obstacles encountered (bends, intersections), the context, etc. (McKay and Olshavsky 1975; Raghubir and Krishna 1996), not to mention the possible interaction effects between these variables (Cadwallader 1995).

The subjective MCI makes it possible to avoid the constraints imposed by objective models. The latter, like all gravity models, assume that the consumer is rational in his choices and in his relationship to space (Golledge and Stimson 1997) and that his or her preferences are fixed and transitive, in other words, if an individual prefers store A to store B and prefers store B to store C, he or she will always prefer store B to store C. However, the reality is much more complex and there is no evidence that the consumer optimizes his or her store choices explained by the theory of bounded rationality (Simon 1957). The study of cognitive biases in judgments in uncertain situations (Tversky and Kahneman 1974) had challenged these assumptions, particularly in cases where there are many options. Our perception, and therefore the decision-making process and judgment, can be disrupted by environmental pressures (Fotheringham 1985). This difficulty has led some researchers to develop hierarchical models implementing the theory of information integration.

2.2.1.3.2. The theory of information integration

Given the limits of rationality of individuals (Simon 1957) and thus their ability to process the environmental data around them and make optimal choice decisions, choice has been addressed as a process rather than an end: this is the subject of information integration theory. This takes into account the learning process in terms of data processing by an individual (Miller 1996), especially when data are numerous, hence the so-called functional measurement approach, which allows the selection of essential attributes during a selection process. In the presence of too much data, the individual can apply a hierarchical process, hence the name of hierarchical models, allowing him to make a first selection of similar choice possibilities, in order to facilitate his choice (Recker and Schuler 1981; Fotheringham 1988; Golledge et al. 1997). But the implementation of this theory is difficult and a large number of options have been compared with a trout stream (Louvière 1974): which one to choose? The diffusion of the use of smartphones and tablets can allow individuals to make this selection and then their choice.

But all these models correspond only to customer stock management and are absolutely not adapted to “customer flow” management (Cliquet 1997a). These flows tend to increase with the growing mobility of individuals and the opportunities offered by mobile technologies.

2.2.1.4. Customer flows

The mobility of individuals has become one of the most striking phenomena in societies, whatever their level of development. Many economists, geographers, sociologists and psychosociologists have studied this phenomenon (Gasnier 2007; Hubert 2009; Amar 2010; Kaufmann 2011; Viard 2011; Kaufmann et al. 2015; Lenormand et al. 2015). With regard to trade, this mobility induces “flows” of customers who behave very differently from customers located in trading areas that practitioners know how to identify and that theoretists have been able to capture using methodologies based on both maps and more or less sophisticated models. Insofar as this phenomenon is growing and the proportion of customer stocks tends to decrease in proportion to customer “flows”, it is becoming necessary for retailers to change their strategies for locating points of sale in order to adapt to this new situation.

2.2.1.4.1. Consumer mobility and “temporary” attraction

Insofar as consumer mobility imposes a new dynamic in the understanding and prediction of consumer behavior, it is necessary to evolve geomarketing in its usual definition linked to digital mapping towards spatial marketing encompassing methodologies that are often yet to be invented and made operational: the development of dynamic maps in software is an important first step. From a more strategic point of view, this evolution requires us to revisit the traditional logics that govern decisions to set up points of sale. Gravity attraction has not disappeared, but it tends to give way to other forms of attraction resulting from people’s movements towards their workplace, their children's school or their leisure places. These transhumances can be either regular in a pendulum movement (Viard 1994), or more episodic based on a desire to “browsing” to spend time on a business trip or to discover a city during a holiday stay. In a country like France, which welcomes well over 80 million visitors per year as the world’s leading tourist destination, neglecting such flows is unthinkable. For a long time now, the strategies of Parisian department stores have been targeting foreign visitors, who represent about 60% of their customers. But apart from the flows of foreigners, the internal flows of residents on French territory are increasingly important. And the use of mobile technologies further accentuates this phenomenon.

Market areas are no longer just places where we live, but also places that we cross and capturing these customer flows becomes a major challenge for retailers. The major difficulty in analyzing and predicting these flows lies in their great heterogeneity. Retail stores could be classified according to the proportions of stocks and customer flows (Cliquet 1997a). These proportions between stocks and customer flows can vary according to the time of day, the days of the week and the periods of the year (holidays or journées de RTT in France). The gravity phenomenon is not the only cause, because, for example, for speciality goods according to the classification of goods (Copeland 1923), the consumer will be more attracted by the fascia than by distance: gravity and attraction are therefore more or less mixed and this is why we prefer to speak of polarity and polar attraction (Cliquet 1997a). The polar attraction and the temporary attraction can be contrasted, knowing that they may overlap when, for a speciality good, the fascia sought by the consumer is not located in the market area where he resides: this is called retail sales leakage.

2.2.1.4.2. Modeling the temporary attraction for new location strategies

Geographers talk about differential locations: the stock-flow distinction is one of them. If the modeling of gravity and more generally polar phenomena is now operational, one may wonder what the situation is with the modeling of the transient attraction. Only the geography and economics of tourism (Sheldon and Var 1985; Eymann 1995; Eymann and Ronning 1997) have developed work on transient attraction. The hotel business was also the subject of forecasts for its customer flows. A regression model (Kimes and Fitzsimmons 1990) was validated using data from a hotel chain. A regression revealed the most significant variables and the model was applied to new locations. But such a methodology is based on the idea that current hotels have ideal characteristics, which remains to be proven, especially if a new concept developed by a competitor appears on the market (Cliquet 1997a). Retail and service activities must also be able to benefit from modeling linked to customer “flows” (Cliquet 2002b). In the meantime, the strategies for locating points of sale are evolving and moving closer to consumers’ spatial behavior. Networks like Zara or H&M go so far as to set up three or four stores on the same street. They hope to “capture” their interests as they pass in front of the second, third or even fourth store. Entire chains have set up in high-traffic areas such as stations where ephemeral or pop-up stores are also opened (Picot-Coupey 2014). Even very large malls, such as the West Edmonton Mall in Canada (Andrieu et al. 2004) or the Minneapolis megamall in the United States (Hetzel 2002), are integrating this new customer concept. Initially, the Mall of America, designed by Triple Five and opened in August 1992, had a projected trading area of 1,200 km radius (Cliquet 1992). Consumers from Chicago come to spend several days in this huge mall. Foreign tourists, and particularly Japanese tourists, are now part of the temporary clientele of this Mall of America. Auchan has set up its hypermarket, Val d’Europe, near Disneyland Paris. This means that not only small areas are affected by this phenomenon. It can thus be seen that the attraction of flows requires a good control of the attraction for places outside the traveler’s habits, and in this case, the minimization of distance or costs is no longer of much interest in a process of modeling the temporary attraction.

Attraction in the gravitational sense is strongly challenged by the consumer’s growing freedom of movement and information. Technology, both in transport and in the media, allows consumers to manage their time differently: from the notion of “chronos” to that of “kairos” (Gahinet and Cliquet 2018), in other words from a linear quantitative measurement of time to an approach centered on the opportune circumstance or the idea that “it is the right time”, with technology enabling these opportunities to be better seized. Trade will therefore have to “re-enchant” itself by dramatizing the offer in order to make the points of sale more attractive, if not attractive in the gravity sense. This does not mean that the consumer no longer travels or that he or she only travels wisely. Just as his or her curiosity allows him or her to discover new information thanks to the mobile Internet (Cochoy 2011), he or she continues to explore new spaces with more efficient means of transport.

It has been shown that the further away the consumer travels from home, the less sensitive he or she is to time gain or loss (Brooks et al. 2004): this result is based on the theory of reference dependence (Tversky and Kahneman 1991). This is reflected in the purchase of their products by the fact that they will be willing to travel a longer distance to buy clothing while they will be more sensitive to the time spent shopping for food (Brafman 2008). GPS, on smartphones or car dashboards, makes it possible to track consumer progress and this helps to improve, for example, the location of malls (Moiseeva and Timmermans 2010).

Among the most advanced research in flow modeling (Hodgson 1990) are studies on the location of service stations (Kuby and 2005): some are interested in electric vehicles (Tu et al. 2016) or even hydrogen (Köhler et al. 2010). This research is based on the median (Hakimi 1964), coverage models (Murray 2016), multi-agent systems (MAS) (Nigel and Doran 1994) in which optimization algorithms or metaheuristic methods are integrated (Hansen and Mladenović 1997). These methods will be found in Chapter 4 on location and georetailing.

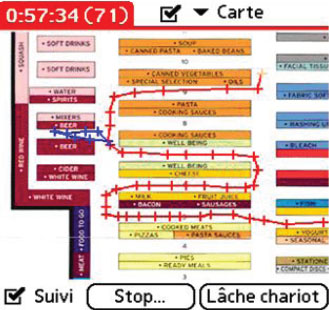

2.3. The consumer’s in-store spatial behavior

Knowing spatial behavior in stores requires studying consumers’ in-store shopping trips. However, while the shopping trip has been the subject of much research and has existed for a very long time, the same cannot be said for the in-store experience. However, retail companies have clearly understood the importance of examining these in-store purchasing paths in order to adapt their internal layouts. This is all the more crucial as many points of sale, and in particular larger ones such as hypermarkets, are faced with drastic reductions in their sales area, especially for non-food products: the end of hypermarkets has long been predicted (Cliquet 2000). This perspective is now gaining more and more followers, including from the retailers themselves where, not to mention the “end”, we are talking about a necessary drastic evolution of the commercial concept. But the question remains as to how to make this transition. The difficulties of large groups such as Auchan, Carrefour, Casino, Metro or Tesco are clear proof of this.

Consumer satisfaction when shopping in a store is influenced, among other things, by price, service and convenience, but shopping trip is also important: if we use the distinction between major and convenience routes, a major route buyer (coming to refuel) is less interested in service than convenience, with price remaining a determining factor in choice, especially for exceptional occasions, as reported in a study conducted in the Netherlands (Hunneman et al. 2017).

The relationship between promotions and in-store shopping trips revealed that promotion at the point of sale had a greater influence on shopping fill-in trips than on major shopping trips, whereas the opposite was true when coupons were used (Kahn and Schmittlein 1992). On the other hand, consumers on these two types of shopping trips are also attracted by price promotions, but “bounty hunters” are much more so (Walters and Jamil 2003).

Further study of in-store trips requires observation, as behavioral models related to the store atmosphere do not consider the layout of the sales area and the way in which the consumer appropriates the space. This space does not always have the same function, and in supermarkets, we distinguish between active entertainment spaces and functional spaces that correspond, for the customer, to two appropriation strategies: an active play strategy and a functional strategy (Bonnin 2003).

A better understanding of the spatial behavior of consumers in stores has often consisted of simulating it using more or less remunerated guinea pigs in laboratory stores, these behaviors being observed by consultants: it is useless to specify the cost of these simulations, the artificial nature and subjectivity of the observations, the impossibility of storing these data and the need to renew them regularly. The methods for monitoring the spatial behavior of consumers in stores have never really given satisfaction to researchers and practitioners. The protocol method has been tested: it is based on information processing theories applied to consumer behavior (Faivre and Palmer 1976). It aims to understand how an individual treats information by asking him, at the time of performing an action, to verbalize aloud (Jolibert and Jourdan 2006) what he is doing, either in a real situation or in a laboratory, in order to reconstruct the internal information processing processes used to make a decision (Evrard et al. 2009). This method has been used in supermarkets (Payne and Easton Ragsdale 1978), but it generates scientific bias (Jolibert and Jourdan 2006), as consumers seek to rationalize their choices when they feel they are being monitored; the analysis of the data collected remains subjective; experimentation can take a long time, because the observer must describe what he is doing and what he thinks about the observer, which limits the size of the sample and therefore the scope of the results; research is most often carried out in artificial contexts (laboratory), because in reality, it would be difficult to impose this type of method on consumers shopping and on retailers who run the store.

It was also possible to analyze consumer paths in two stages (Michaud-Trevinal 2013). First, data are collected through direct non-participating observation. Then, the results are analyzed on the one hand using a semiotic square (Floch 1989) to highlight the interactions between shoppers and points of sale and on the other hand by a cluster analysis in dynamic clouds validated by a multiple discriminant analysis. We were able to distinguish four types of paths within a mall (Michaud-Trevinal 2013):

- – “passing” path: the shopper crosses the mall and targets a specific destination while remaining insensitive to offers;