Avoiding Stranded Assets

![]()

Ben Caldecott

At the turn of this century, coal mining firms in Australia believed they had a bright future ahead. China’s economy was headed into overdrive, and its leaders looked overseas for energy to fuel the unprecedented growth. Australian coal miners jumped at the opportunity. By 2013, Australia had become the largest supplier of coal to China, accounting for more than 30 percent of China’s imports. Australian companies drew up plans to pursue 89 new mining projects that would more than double their country’s coal output, largely for overseas markets like China’s.1

Australian coal miners now have many reasons to fret over their expanded Asian market. As the Chinese government has stoked economic growth in recent years, it also has paid increasing attention to the country’s environmental challenges, including the need to clean up China’s notoriously polluted air. The government has passed a series of air pollution regulations, including an aggressive 2013 tax on the dirtiest elements of coal combustion, and in 2014, it agreed jointly with the United States to curb greenhouse gas emissions—moves that together are dampening Chinese demand for coal.2

Investors in Australian coal mining companies are already anxious. What will happen to their firms’ expansion plans, and to the increase in company value that the planned investments represent? What will happen if Australian coal companies cannot find other customers to replace Chinese demand? Citizens and policy makers have questions, too. Would Australian society have been better off if another sector had been the target of investment capital? How can future investments be steered toward projects that support the country’s interest in creating a sustainable economy?

In sum, what happens to investors, businesses, and society if Australian coal assets become “stranded assets”—assets that have suffered from unanticipated or premature write-downs, devaluations, or conversion to liabilities?3

The stranded assets dilemma is much larger than Australia, deeper than coal, broader than investors, and generated by factors beyond government policy. Across all continents, environmental and resource changes—from water scarcity to species losses to growing levels of greenhouse gases in the atmosphere—raise questions about the wisdom, from a societal as well as an individual investor perspective, of long-term investments that may lock economies into environmentally unsustainable economic activity. Visionary management of policies, companies, and investments is needed to ensure that new investments are consistent with environmental health and resilience, and that economies are weaned, smoothly and efficiently, off investments that are harmful to sustainability.

Ben Caldecott is a programme director at the University of Oxford’s Smith School of Enterprise and the Environment, where he founded and directs the Stranded Assets Programme. He also is an adviser to The Prince of Wales’ International Sustainability Unit.

Risks That Lead to Stranding

Stranded assets can be caused by many different types of risks, but, increasingly, environment-related risks are stranding assets. This trend is accelerating, potentially representing a discontinuity that is able to profoundly alter asset values across a wide range of sectors. A stranded asset can start as a positive contributor to a firm’s balance sheet, when environmental risks are underappreciated and unreflected in the asset’s valuation. But as the risk becomes more apparent (sometimes over a short period), the asset becomes less attractive, to the extent that it may be abandoned before the end of its useful life. Today’s financial and economic markets face extensive exposure to environment-related risks, many of which could result in stranded assets.

Stranded assets can include capital stock investments (such as extraction, production, and transport infrastructure), as well as current asset inventories (such as oil or mineral reserves, agricultural land, or natural resource inputs), that determine how firms may be valued. They are often large investments, characterized by fixed or sunk costs, and are relatively illiquid—they cannot quickly be converted to cash. Importantly, stranded assets can generate ripple effects well beyond their owners. (See Box 4–1.)

Table 4–1 shows a typology for different environment-related risks that could produce stranded assets. While the set of risks is diverse, they are not independent; correlations and connections among the risks are likely, although the extent of these interdependencies is yet to be determined and is an important area for future research. A critical issue for policy makers and financial institutions is to understand how this broad spectrum of risks might converge to imperil valuable assets.4

Box 4–1. The Tentacles of Stranded Assets

Stranded assets often produce collateral damage, in the form of lost physical, natural, social, and human assets. For example, fallowed cropland is a stranded economic asset if driven by, for example, overpumping of groundwater, a natural asset. Such fallowing, across a large number of farms, can weaken rural farming networks (a social asset) and lead to loss of income or employment for farmers (human assets). While most discussion of stranding focuses on stranded financial and economic assets, the environmental, social, and human assets that can be damaged by stranded financial and economic assets are of critical importance as well.

![]()

Table 4–1. Environment-related Risks That Could Produce Stranded Assets

![]()

Set of Risks |

Subset |

Examples of Assets Potentially Stranded |

|

||

Environmental change |

Climate change |

Coastal zones more prone to storm surges and flooding |

Natural capital depletion and degradation |

Forestry holdings |

|

Biodiversity loss and decreasing species richness |

Pharmaceuticals |

|

Air, land, and water contamination |

Farmland; tourist and recreational holdings |

|

Habitat loss |

Holdings of species-sensitive real estate |

|

Freshwater availability |

Cropland; certain industrial operations |

|

|

||

Resource landscapes |

Shale gas |

Coal |

Phosphate |

Farmland |

|

Rare earth metals |

Electric motor manufacturers |

|

|

||

Government regulations |

Carbon pricing (via taxes and trading schemes) |

Coal-fired power plants |

Subsidies (e.g., for fossil fuels and renewables) |

Investments in fossil fuels and renewables |

|

Air pollution regulation |

Power plants and other polluting infrastructure |

|

Disclosure requirements |

Companies with poor sustainability performance |

|

International climate policy |

Fossil fuel power plants |

|

|

||

Technological change |

Falling clean technology costs |

Fossil fuel reserves |

Disruptive technologies |

Distribution and transmission assets |

|

Electric vehicles |

Car manufacturers |

|

|

||

Social norms and consumer behavior |

Fossil fuel divestment campaign |

Fossil fuel companies |

Product labeling and certification schemes |

Genetically modified agriculture |

|

Changing consumer preferences |

Less energy-efficient products |

|

|

||

Litigation and statutory interpretations |

Carbon liability |

Fossil fuel companies |

Litigation |

Owners and operators of polluting assets |

|

Changes in the way laws are applied or interpreted |

Investments made under and dependent on previous legal interpretations |

|

|

||

Source: See endnote 4. |

||

|

||

Fossil Fuels

The most publicized case of potential asset stranding is associated with upstream fossil fuel reserves: oil, natural gas, and coal left in the ground because of international climate change policy. Stranding of fossil fuels grew in public awareness after 2000 and gained widespread attention in 2011 with the publication of the Carbon Tracker report Unburnable Carbon: Are the World’s Financial Markets Carrying a Carbon Bubble? and its popularization by U.S. environmentalist Bill McKibben. The report used simple but compelling logic to question the wisdom of continued investments in fossil fuels.5

The argument used by Carbon Tracker is as follows: to prevent global average temperatures from rising more than 2 degrees Celsius (°C) above preindustrial levels in the decades ahead—an internationally recognized goal—global carbon dioxide (CO2) emissions need to be kept under 565 gigatons. Yet proven reserves of fossil fuels held by governments and private companies totaled five times this amount, or 2,795 gigatons. Thus, if the entire stock of proven fossil fuel reserves were burned, global temperatures likely would rise by more than is acceptable for climate stability. Stated differently, adhering to a carbon budget that limits temperature increase to 2°C requires that some 80 percent of proven fossil fuel reserves remain unburned—which would make them stranded assets.6

The idea that “unburnable” fossil fuel reserves could become stranded assets has been taken up by a number of high-profile actors and has helped spark a significant discussion on the risk of investing in fossil fuels. HSBC research concluded in 2012 that a global peak in coal consumption in 2020—a necessary condition for the transition to a low-carbon economy—would devalue existing share prices of coal assets on the London Stock Exchange by 44 percent. Ratings agencies like Standard & Poor’s have begun to express concern that stranded asset risk could lead to credit downgrades. And the International Energy Agency acknowledges that a significant fraction of fossil fuel reserves is unburnable. Such concerns are not accepted unanimously, however, with fossil fuel companies claiming that they are based on oversimplified analysis. Each year, energy companies continue to spend more than $600 billion to find more fossil resources.7

Stranding of fossil fuels can happen to coal, natural gas, or oil, virtually anywhere in the world, and can be driven by any number of drivers—from climate concerns to regulations to the relative prices of other resources. Consider the following cases:

Coal in the United States. Between 2009 and 2013, 20.8 gigawatts (GW) of coal-fired power plants—some 6.2 percent of the 2009 U.S. coal fleet—were retired and another 30.7 GW were “slated” for retirement, with most estimates suggesting further retirements of 25–100 GW by 2020. The U.S. Energy Information Administration projects that 60 GW of coal will be retired by 2020, and a 2013 study by researchers with the Union of Concerned Scientists indicates that 59 GW of coal units are “ripe for retirement,” in addition to the 28 GW already announced for retirement before 2025. Another 2013 study by Synapse Energy Economics takes into account a wider range of costs—including cooling water, water effluent controls, and coal ash—and estimates 228–295 GW of vulnerable capacity.8

The loss of coal capacity in the United States has several drivers:

• Regulation. In June 2014, the U.S. Environmental Protection Agency unveiled a new proposal to reduce CO2 emissions from U.S. power plants 30 percent from their 2005 level by 2030. The biggest advances toward that goal can be made by reducing consumption of coal, an especially dirty fuel. The U.S. coal fleet produces 39 percent of the nation’s electricity but is responsible for 74 percent of domestic power plant emissions.9

• Low natural gas prices. The shale gas boom has provided a cheaper and cleaner alternative to coal. A 2013 report from Bloomberg New Energy Finance predicts that U.S. natural gas prices will remain low (less than $5 per million Btu) until 2024, and forecasts that natural gas power plant capacity in the country will rise to 134 GW by 2030.10

• Technological advance. Renewable energy is an increasingly attractive alternative to fossil fuels. Wind energy costs have declined by some 80 percent in the last three decades, and the costs of solar photovoltaics (PV) have fallen rapidly because of a steep drop in manufacturing costs. As a result, solar PV capacity in the United States has reached 8.9 GW, and rooftop PV installations are predicted to grow to 10 percent of the U.S. capacity mix by 2030.11

Max Phillips (Jeremy Buckingham MLC)

A shale gas well installation in Pennsylvania.

The U.S. government still expects 30 percent of electricity to come from coal in 2030. Already, however, significant investment has been stranded, and the coal industry has recognized that even more is at risk. Nick Atkins, chairman and CEO of American Electric Power Co., admitted in May 2014 that, “it’s a critical issue for us not to strand all that investment that we made and secondly to make sure the grid can operate in a reliable fashion through this transition.”12

Natural gas in Europe. Over the course of 2013, a large number of recently built, high-efficiency combined-cycle gas-turbine power plants across the European Union (EU) were closed prematurely or mothballed, including new, high-efficiency units—such as Statkraft’s 430 megawatt (MW) Knapsack 2 plant, and Vattenfall’s 1,300 MW Magnum unit—that were mothballed immediately upon commissioning. An estimated 51 GW of the EU’s generation capacity is currently mothballed, and 60 percent of EU gas-fired capacity does not cover its fixed costs and could be closed within three years.13

The change of fortune for gas was driven by:

• Decreased electricity demand. As a result of the financial crisis, electricity demand dropped and has not recovered to pre-crisis levels.

• Renewable energy deployment. The intermittency of renewable energy and its priority in the order of power dispatch has affected capacity requirements and market price volatility.

• Lack of a carbon price incentive. The global financial crisis and subsequent slow down in economic growth resulted in less demand for carbon permits in the EU, which led to a significant and prolonged fall in European carbon prices. The lower the carbon price, the more competitive that coal is relative to natural gas.

• Cheap coal from the United States. As a result of the U.S. shale boom, profits of natural gas-fired power plants fell to the point of being uneconomic in comparison to coal power. Thus, while the fortunes of coal have been declining in the United States, they were advancing in Europe.

Mothballing has resulted in significant write-downs on natural gas-fired power assets. The top 16 EU utilities reported €14.6 billion (around $17.5 billion) in impairments on generation assets over the course of 2010–12. Along with credit downgrades and the revision of dividends to preserve balance sheets, major utilities have curtailed planned capacity investments significantly, contributing to increasing fears about system security and the risk of blackouts in EU countries.14

Oil worldwide. Oil faces growing pressures on a number of fronts. For example, analysts estimate that if atmospheric concentrations of CO2 are capped at 450 parts per million (the maximum level thought to be consistent with limiting temperature increase to 2°C), there would be $28 trillion less in oil revenues over the next two decades, compared with business as usual.15 Other pressures include:

• Climate regulation. It has been estimated that global oil reserves can supply 1.8 times the oil allowable under a carbon budget determined by a 2°C goal for maximum temperature increase. Thus, if a global climate change agreement is reached, a sizable share of oil reserves will become stranded assets.16

• Rapidly rising costs of access to oil. As oil sourcing has shifted from low-hanging fruit to unconventional oil, such as shale oil and oil sands, and as companies turn to deep-water projects to produce conventional oil, extraction costs have increased markedly. Since 2000, oil industry capital investments have risen by 180 percent, largely to access these more challenging supplies, but the global oil supply has inched up only 14 percent. One analyst suggests that more than a third of potential production through 2050 will be high cost, requiring investment of $21 trillion and a minimum market sales price of $95 per barrel.17

• Geopolitical risks. Geopolitical risk is a growing concern with the increase in political instability. Through 2025, oil companies have $215 billion of capital expenditures planned in countries whose geopolitical risk Goldman Sachs rates as “high” or “very high.”18

These factors increase the likelihood that newer oil holdings will not be exploitable and that their value will disappear from balance sheets.

Natural Capital

Economic assets also can be stranded as various elements of the biosphere—including land, air, water, and organisms—are polluted, depleted, or driven to extinction, diminishing their contributions to economic activity. (See Box 4–2.) But because the contributions of natural capital to economic health are often underappreciated and undercounted, the value of natural capital typically is poorly represented in decision making, and the connections between natural capital and stranded assets often are hard to identify. Still, the linkages among natural capital, economic activity, stranded assets, and financial performance are becoming more apparent as losses of nature’s goods and services grow in size and visibility.19

Nature is an economic player, through its contributions of goods (such as wood, water, and air) and services (from crop pollination to flood control). Nature’s goods and services, often called natural capital, provide ongoing life and resilience to ecosystems—as well as essential inputs to the world’s economies.

But this asset base is being steadily eroded. The United Nations’ 2005 Millennium Ecosystem Assessment calculated that 60 percent of the 24 ecosystem services that it assessed were being degraded or used unsustainably, suggesting widespread neglect of natural capital. This is costly: a 2013 report from TEEB found that in 2009, unpriced natural capital costs associated with primary production (agriculture, forestry, fisheries, mining, oil and gas exploration, utilities) and processing (cement, steel, pulp and paper, petrochemicals) totaled $7.3 trillion annually, the equivalent of 13 percent of global economic output that year.

Source: See endnote 19

Environment-related risks and stranded assets can affect the financial system in several ways. A rapid devaluation of assets can spread across sectors as mispriced environment-related risks are reassessed. Generally, such contagion begins in a specific sector where mispricing is obvious and disproportionately large, then spreads to other sectors and jurisdictions. Nervousness about the future value of oil reserves could, for example, affect the value of companies that provide services to oil companies. And in China, water scarcity is prompting strong national controls on water use, which could close coal-fired power plants. Closures could ripple across global coal markets and affect major coal-exporting countries.20

A second transmission mechanism is the potential of natural capital degradation to trigger capital flight in resource-reliant economies, which in turn could lead to loss of income and economic instability. If a country or region experiences significant degradation of natural capital stocks and flows, capital may flow outward from the area as investors reallocate current and planned investments, divest from assets, or reorient operations to new nodes of production with a more reliable supply of natural resource inputs. In countries that are heavily reliant on industries built on natural capital stocks and flows, such capital flight could have serious macroeconomic consequences, affecting inflation, exchange rates, and international competitiveness, thus triggering fiscal and monetary policy responses.

A third pathway is through trade and global supply chains. The globalization of key commodity supply chains and the growing financialization of commodity markets have increased exposure to climatic shocks in particular. This process of “hazard globalization” represents a new dimension of environment-related risk transfer through which natural capital degradation could affect regional social, economic, and political volatility, which, in turn, may have implications for global financial stability.21

The environment’s connection to the economy is illustrated using the case of the Arab Spring, the social uprisings in the Middle East and North Africa. An important driver was significant increases in the price of food, which, in turn, were linked to shifting weather patterns. Global wheat prices doubled from 2010 to 2011 in response to weather-induced supply shortages: drought and heat waves cut wheat production in Russia by 32.7 percent and in Ukraine by 19.3 percent, while cool, damp weather reduced output in Canada by 13.7 percent and excessive rain cut Australian output by 8.7 percent.22 Tightened supplies prompted Russia to restrict wheat exports even as drought-stricken China turned to world markets to meet domestic demand. The spike in demand for wheat in international markets sharply affected major importers like Egypt, where a typical household spends 38 percent of its income on food, and this was a contributing factor to unrest in that country.23

Agriculture

Agriculture can undergo extensive asset stranding because of its dependence on natural capital. The 2013 Trucost/TEEB study Natural Capital at Risk pegs the total natural capital cost from agriculture—the “environmental and social costs of lost ecosystem services”—at $2.4 trillion per year. The report compared the costs of natural capital loss to revenues for various sectors, and agriculture was the sector most exposed. (See Table 4–2.) The natural capital cost of cattle ranching and farming, for example, is more than seven times greater than the revenues produced by these activities. The impact of agriculture on natural capital prompts the question: How would investment in agriculture be affected if the costs of natural capital were folded into the balance sheets of firms related to agriculture?24

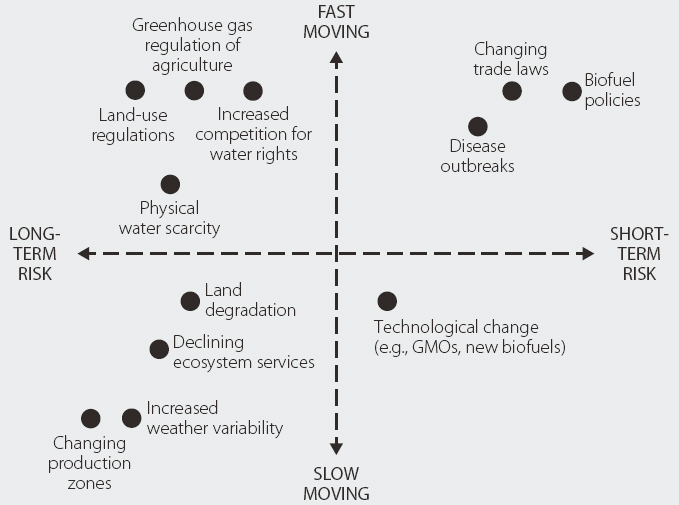

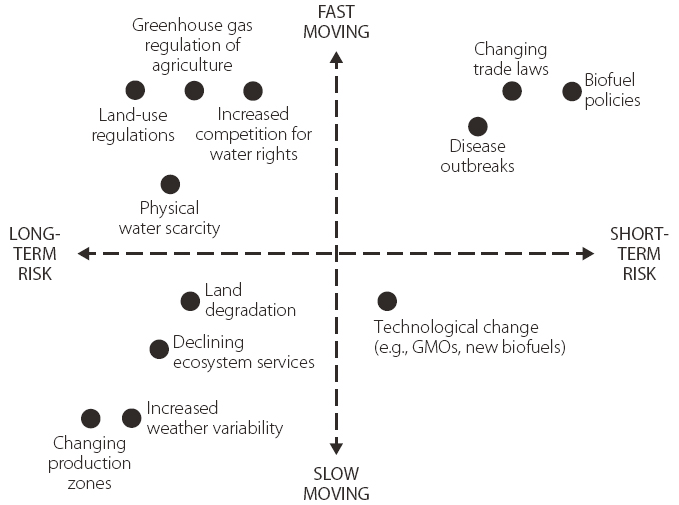

Multiple environment-related risks could strand agricultural resources. A helpful way to think about risks to agriculture is to organize them by how quickly they can emerge and how long they might be a threat. (See Figure 4–1.) Economic drivers, such as regulations, are relatively fast-moving risks that can be put in place suddenly, perhaps through a change in government or the adoption of an international agreement. On the other hand, physical risks such as a changing climate tend to manifest themselves over a longer period. Risks also can be classified as short term or long term. Classic problems of the commons such as declining ecosystem services, water quality, and land degradation are long-term risks, while disease risks and changes in oil prices are short-term in character.

![]()

Table 4–2. Direct Environmental Damage as a Share of Revenue for Select Economic Activities

![]()

Sector |

Impact |

|

|

Natural Capital Cost as Percent of Revenue |

|

|

|

Cattle ranching and farming |

710 |

Wheat farming |

400 |

Cement manufacturing |

120 |

Coal power generation |

110 |

Iron and steel mills |

60 |

Iron ore mining |

14 |

Plastics material and resin manufacturing |

5 |

Snack food manufacturing |

2 |

Apparel knitting mills |

1 |

|

|

Source: See endnote 24. |

|

|

|

Figure 4–1. Time Horizons for Environment-related Risks in Agriculture

Environment-related risks can have a significant effect on agricultural commodity prices. Three droughts in Australia between 2001 and 2007, and a heat wave in central Asia in the summer of 2010, drove down global stocks of several agricultural commodities (especially rice and wheat), which raised prices and led some major producing countries to institute export bans and export taxes. Meanwhile, government-mandated production of fuel crops, especially corn in the United States and edible oils in Europe, put further pressure on food supplies and food prices. Thus, international food prices underwent the longest sustained cyclical rise in real agricultural commodity prices of the past 50 years: by 2011, the FAO Food Price Index had reached more than double its 2000–02 level. The boom spurred an increase in the value of underlying agricultural assets such as farmland. The Savills index of average global farmland values, a leading global reference, has risen over 400 percent in the last 10 years.25

The boom in prices creates an attractive investment environment in the short term, but the environmental factors—especially climate change—are a cause for concern over the longer term. By 2050, it is very likely that climate change will increase the incidence of extreme drought, especially in the subtropics and low to mid-latitudes. Increased water stress is expected to affect twice the land area affected by decreased water stress.26

According to the Intergovernmental Panel on Climate Change, the share of the global land surface in drought is predicted to increase by a factor of 10 to 30, from around 1–3 percent of the land surface today to around 30 percent by the 2090s. The number of extreme drought events per 100 years and the mean drought duration are likely to increase by factors of 2 and 6, respectively, by the 2090s. Snow melt will come earlier and yield less in the melt period, leading to increased risk of droughts in snowmelt-fed basins in summer and autumn, when demand is highest. Water supplies from inland glaciers and snow cover are projected to decline in the twenty-first century, continuing a twentieth-century trend. This will reduce water availability during warm and dry periods—when irrigation is most needed—in regions supplied by melt water from major mountain ranges.27

The assets most vulnerable to increasing weather variability and changing production zones will be those characterized by high fixed or sunk costs and those of low liquidity that are tied closely to the value of land. Natural assets, such as farmland that is economically marginal in times of good weather conditions and high commodity prices, have been assessed as likely to be highly vulnerable to asset stranding from weather variability. This has particular relevance in the context of the current agricultural commodity and investment boom, which has stimulated new investment, some of which is likely to be unsustainable if commodity prices fall toward more long-term trends.

Other natural assets that may be highly vulnerable to asset stranding are poorly defined water entitlements attached to the land. If weather patterns change, resulting in reduced access to water, such informal allocations may be appropriated by higher-value users such as urban consumers.

Avoiding Stranding

The move away from polluting and resource-intensive economic activity has clear implications for existing assets and for future capital investment. While problematic for some firms and sectors, there is no reason why the stranding of polluting and inefficient assets should hinder economic growth and development.

Better understanding the process of value destruction and value creation in an economy can help policy makers secure an optimal rate of asset stranding given a country’s level of economic development, targeted rate of economic growth, and sustainability concerns. Too little asset turnover could leave economies with insufficiently productive assets and significant environmental degradation, while too much could result in unmanageable losses for companies and financial institutions, as well as challenging social issues due to job losses and displaced industries. Employing the right tools in the right way is critical for transitioning away from at-risk assets. (See Box 4–3.)28

Another dimension related to securing an optimal rate of asset stranding is the avoidance of lock-in. Policy makers should avoid picking technologies and infrastructure that might quickly become outdated or inappropriate from a societal perspective.* An example could be new-build coal-fired power stations, given ever-increasing concerns about air pollution and water scarcity as well as the availability of cost-competitive alternatives. Lock-in of this kind is expensive for society as a whole and ties up capital that could be deployed productively elsewhere.

The profile of a transition pathway is also important. The value lost through asset stranding should ideally be more than offset by new value creation in other areas, and this should happen smoothly over time. This is preferable to a transition that is staggered or “lumpy,” or one where value destruction overwhelms value creation, even if only temporarily. Without a smooth and gradual profile, it will be harder to secure political and societal support. An analysis of stranded assets can help to reveal the potential profile of a transition pathway, and also help to identify winners and losers across sectors. Identifying the groups affected (particularly negatively) can allow for the provision of targeted transitional help—another way of ensuring sustained support during a transition that might involve painful losses for some firms.

In terms of the financial system, better understanding the materiality of environment-related risks and the levels of exposure in different parts of the system will help regulators manage scenarios that could result in financial instability. Within financial institutions, revealing and better pricing environment-related risks will improve risk management and hedging, potentially improving system resilience as well as portfolio performance. Higher risk premiums for assets that are more exposed to environment-related risks also may have the added benefit of shifting capital allocations away from sectors that could be considered environmentally unsustainable, and toward assets that are more in line with a cleaner and more sustainable economy.

One way to shift away quickly from environmentally unsustainable assets is to pay owners to shut them down, using a tool known as a reverse auction. Bids represent the price that owners are willing to accept to give up an asset such as a logging permit, an oil well, or a coal-fired power plant. The lowest bid wins. Reverse auctions already have been used successfully to shrink fishing fleets in overfished areas, and to buy back pumping licenses in areas suffering from water stress. The funds used to pay for reverse auctions could come from special levies—for example, on electricity bills—or from foreign assistance (in the case of developing countries) or other sources.

If analysis of coal-fired power plants is any indication, the cost of such an approach may be manageable. In forthcoming research, the Stranded Assets Programme at the University of Oxford’s Smith School of Enterprise and the Environment conservatively estimates the compensation bill for prematurely closing all existing sub-critical coal-fired power plants—the least-efficient plants—by 2025 at $47 billion in the United States and $106 billion in India. The cost tends to be lower in the United States because coal-fired power stations are older and owners are willing to accept less compensation for early retirement. As a result, even a small pool of funds to finance auctions could quickly close a large number of coal plants.

Premature closures would need to be accompanied by support for individuals and communities that are negatively affected, for example by job losses. Lost generation capacity also would need to be replaced by cleaner alternatives, and the rate of replacement likely would be the biggest constraint on the pace of any closure plan. These challenges need to be integrated into any broader coal-closure strategy.

Source: See endnote 29.

In addition to the implications for financial markets, environment-related risks and stranded assets will affect company strategy. Companies that are exposed to environment-related risk factors or that are dependent on clients exposed to these risks may need to adapt their business models. Exporters, particularly those exposed to environmental regulation in key export markets, could be particularly vulnerable.

Also at risk may be companies that depend on imported resources that could be affected by greater price volatility in international commodity markets due to environmental change. Ultimately, firms that are better able to manage emerging environment-related risks could secure significant competitive advantages over time. In a recent meta-analysis, 80 percent of the studies reviewed indicate that the stock-price performance of companies is influenced positively by good sustainability practices.29

![]()

* The corollary of this is that, in some cases, it might be better to “sweat” existing assets until viable long-term replacements can be found. In other words, instead of investing in an intermediate option that may need to be replaced relatively quickly, it could be better to defer investment.