7 |

Pivot 1: Land + |

THE FIRST PIVOT REQUIRED TO WIN IN B4B IS TO RETHINK HOW customer-supplier partnerships will be developed. The core sales motions within established suppliers have a lot of inertia to them. Suppliers adjust their pricing continuously, reinvent their marketing every few quarters, and reengineer their product lines every few years. However, the core sales model in those same companies today would still look very familiar to Mr. Patterson.

If customers were not changing their expectations much or quickly, this would not be a problem. Suppliers and customers could just continue with the sales and purchasing processes that have gotten them to where they are. The challenge is that consumption-based business models are crossing the chasm, and the new customer expectations that come along with them are beginning to represent a material part of many suppliers’ sales pipelines.

Beginning at Level 3, B4B is likely to drive a fundamental redesign of sales methodologies, roles, coverage models, organization structures, and compensation plans. In this chapter, we lay out a playbook for what the sales force of the future may look like as these changes take hold. Specifically, we propose a new mandate and a more modern set of partnering motions for Level 3 and Level 4 suppliers and their customers to consider. It will be up to suppliers to determine how aggressively they shift their go-to-market strategy toward this new model, and if they must execute both the old and the new sales playbooks in parallel for a time. It will be up to customers to decide if that supplier is moving fast enough.

Selling Has Proved Difficult to Innovate

Before we jump to the prescription, let’s spend a few minutes on what sales looks like in nearly every high-tech and near-tech company we know. It’s not that sales is broken, per se; it’s just proven to be hard to innovate.

For most sales organizations, the last major innovation was called solution selling. The term itself is attributed to a sales manager at Wang Laboratories in the 1970s.1 Through its various iterations, solution selling taught sales teams to group their offerings as packaged solutions instead of individual point products. Sales reps were told to ask customers what keeps them up at night, and then find something in what the customer said that linked back to one of the prepackaged solutions in their bag.

Did this work? Absolutely. It was definitely an improvement over what might be called “product selling.” That went something like this: “Let me show you all the amazing features, speeds, and feeds that my product has, and I am sure you need at least one of them.” Solution selling started with the customer’s challenges, not the product’s features. That was a definite improvement.

However, we argue that its effectiveness began to decline about a decade ago. Customers had heard the word “solutions” used ad nauseam. They often began to feel like the supplier’s sales rep was pushing something again. This time, it was a package rather than a product. To further complicate matters, it became clear that many of the “solutions” were less integrated in practice than in Power-Point. They were more like preset order bundles than faster ways to achieve business value.

Some symptoms of a solution selling model slowly running out of gas are worth highlighting. Over the last decade, we have witnessed four troubling trends in high-tech and near-tech sales organizations:

1.Drive-By Selling: The cardinal rule of solution selling is to qualify up front whether the customer has budget for the solution the sales rep is selling. The unintended consequence has been that sales reps actually spend less time on what might classically be considered “selling.” If customers do not have budget ready to commit, they are encouraged to find a customer that does. We call this “drive-by selling.” At a time when our products are more complicated than ever, some suppliers are actually teaching their sales teams not to spend time helping customers understand the offer’s advanced value so that the customer can create new budget to invest in them.

2.Overlays on Overlays: At the same time that some customers have become immune to solution selling, complexity has raced to the stars. In response, high-tech and near-tech sales leaders have added specialized sales overlays to try to close the gap. For some suppliers, these overlay teams are in the form of vertical industry experts. For others, they are product specialists focused on sets of technologies or “architectures.” These suppliers have ended up with 16-legged sales calls: an account manager, a sales engineer, an industry expert, a technical solutions expert from each of the three major technologies a customer cares about, a services sales rep, and a business development manager from the internal consulting organization. When the sales team members outnumber the customer in a sales meeting by two to one, you know you have a problem. These overlays are the best response suppliers have been able to come up with so far. But they are neither meeting most suppliers’ substantial growth expectations nor remediating their declining sales productivity.

3.Increasing Channel Concentration: To help resolve this complexity, many customers are now placing their trust in systems integrators or cloud service providers. From the customer’s perspective, this gives them “one throat to choke,” that is, a small number of trusted advisors that can work across multiple product companies or across the individual business units within product companies. Product companies, in turn, are seeing a dramatic increase in channel concentration where fewer and fewer go-to-market partners represent more and more of their business. The impact of this is profound. Near-term, it forces product companies to succumb to aggressive reseller discount pressure as these channel partners leverage their scale. Longer-term, it can even lead to channel partners “designing out” premium products in favor of third-party offerings or even their own technology. Some very large customers are taking a similar approach. Google’s engineering of its own networking gear and column-based database are good examples.

4.Rising Cost of Sales: For all of the reasons we mentioned in Chapter 3, many shareholders are starting to question the continued viability of high-growth promises by high-tech and near-tech suppliers. Those above-market growth rates have historically been the basis for above-market valuations. However, these growth rates are now in the low single digits (or worse) for many of the industry leaders. Without this growth, the suppliers’ overlay sales teams have swollen the cost of sales and have driven increasingly higher expense-to-booking (E:B) ratios. This is what keeps the suppliers’ heads of sales, CFOs, and CEOs most on edge. Their sales teams have been running as hard as they can up a down escalator for some time. E:B ratios seem to be getting higher, not lower, and the trend seems to be accelerating.

We think the advent of Level 3 and Level 4 operating models are a good time for a ground-up rethinking of the sales model. Trying harder, tweaking compensation, augmenting coverage, adding overlays, and bundling products just will not get us where we need to go in B4B.

The New Sales Discussions

We have tried to put into Figure 7.1 a synthesis of what high-tech and near-tech suppliers are hearing their customers say. This is not easy, of course, because customers and suppliers are often using different words to describe what is fundamentally the same thing.

Imagine a speedometer for the sales discussions between the two parties. One needle shows the chronology of sales discussions on the traditional offer of high-tech and near-tech Level 1 or 2 offers. The other shows the evolution of customer interests in the consumption-based models of B4B. Each needle sweeps in a progression from the earliest customer discussion at the bottom to the last stage discussion at the top.

FIGURE 7.1 The New Spectrum of Sales Discussions

The left side of Figure 7.1 is familiar to most high-tech and near-tech suppliers. Some customers are happy just to have the supplier sell them a product with a view that their internal staff or a third party will make that product valuable to them (Level 1). Others want their supplier to do more, such as “Install it for me,” “Fix it for me,” or even “Refresh it for me” (Level 2). However, if customers just wanted the left side of the speedometer, we would not be writing this book.

On the right side, some customers are just now beginning to try cloud and consumption-based models while others are already done with that stage. The latter may be shifting whole parts of their high-tech and near-tech installed base to the consumption-based models of B4B. In IT, that means their massive server farms, storage area networks, enterprise applications, and mission-critical equipment are all up for grabs. Capital budgets are being cut, and “pay as you grow” is the new mantra. In hospitals, this may mean that suppliers will own, manage, or even operate entire layers of equipment such as smart beds or CT scanners. Manufacturing customers may want to purchase all-in bundles in which they pay a precision measurement component supplier just a few cents for every unit of production-line output that meets a certain quality standard.

As Figure 7.1 illustrates, customers who are considering these models can generally be segmented into four levels of expectations in terms of what they want their supplier partners to do for them. The simplest is “Let me try it.” As we will discuss below, there is a spirit of “fit for purpose” and experimentation that is essential for customers who are new to Level 3 and Level 4 offers. Next are customers who say, “Manage it for me,” or “Drive my full adoption” (Level 3). A few customers have already moved to Level 4 of B4B. They are contracting directly for the business outcome they seek to achieve.

So here is the rub: Some supplier sales motions are stuck in an approach invented for the left side of Figure 7.1 when many of their largest customers have moved over to the right side. Customer expectations and the sales discussions that link to them have changed more in the last five years than in any previous five-year period. It is time for a new plan.

The New Sales Mandate

So if a supplier and a customer could get together, take out a clean sheet of paper, and describe how a supplier’s sales organization could best benefit both sides in the new world, could they agree on something? If so, what would they write? What would that new sales mandate be? In 40 words or less, here is a starting point from which they could work:

Sales will help customers capture the maximum amount of value from an advanced technology in the minimum amount of time. By doing so, Sales will accelerate the growth of our partnership over every one-quarter, one-year, and three-year time horizon.

This mandate differs from the current practice for most suppliers we know in four key ways. First, it forces sales teams to get on the customer’s side of the table by truly understanding the value they seek to achieve. It is no longer good enough to stop listening when the business problem is clear enough to pull a “solution” out of your bag.

Second, this mandate requires sales reps to become experts in the business value generated by the advanced capabilities of their offers. When we say “advanced capabilities,” we don’t mean just the faster speeds and feeds. We mean the capabilities that can return 10 times the potential investment for customers. Those advanced capabilities are what venture capitalists focus their companies’ sales teams on; suppliers and customers should too.

Third, this new sales mandate balances the three horizons of growth that shareholders on both sides care about most. Too many sales teams today are winning the battle (making the quarter) but are losing the war (underperforming against longer-term growth expectations). In valuation terms, these sales teams deliver the “E,” near-term earnings, but not the “P/E,” the price/earnings multiple that speaks to how confident shareholders are in the company’s long-term prospects for profitable growth.

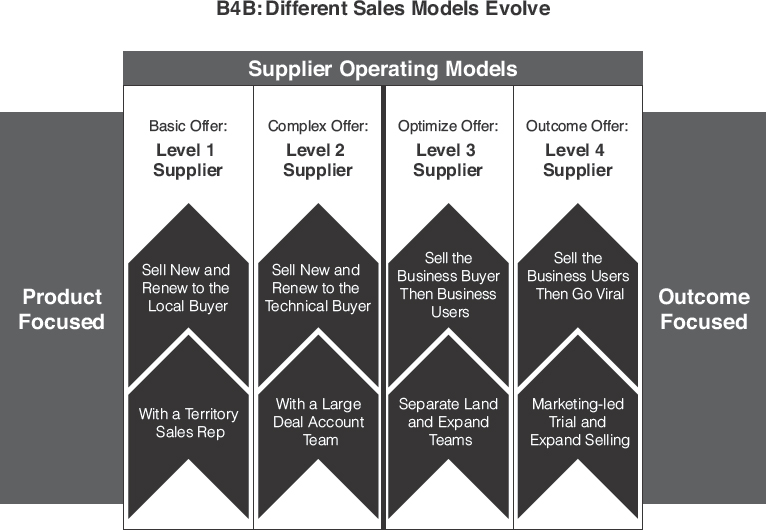

Just delivering on these three new sales mandates is going to require fundamental changes in suppliers’ core sales motions. In many cases, suppliers may need more than one sales model (as shown in Figure 7.2). Make the transition early and powerfully enough, and suppliers will accelerate their growth, especially at Level 3. Stick to the current approach too long, and you will be faced with an untenable cost of sales when customers shift their buying behavior to consumption-based models.

FIGURE 7.2 B4B: Different Sales Models Evolve

Finally, the new mandate positions the sales organization for a world of consumption-based business models. Customers are “voting with their feet” at an ever-increasing rate. When they do not realize the value they seek in the time frame they expected, they simply stop paying for the offer and adopt someone else’s. One of the authors experienced this firsthand, writing off a brand-new $20 million CRM system from a leading enterprise software company within 90 days of going live. In this case, the frontline sellers revolted over the complexity of the system that the first supplier created. It was forcing them to spend two-plus hours per day on data entry instead of on selling. The big winner was salesforce.com, which, with full frontline and senior executive support, had a replacement system up and running in 90 days for a multibillion-dollar company. Such an extreme example might have been rare in 2005 when it happened. Today, it is anything but.

This new sales mandate is right for the times ahead. To see how these new practices might differ, let’s contrast some of the traditional selling motions of Levels 1 and 2 with the new models being developed by leading Level 3 and 4 suppliers.

The New Sales Motions: Land + Expand

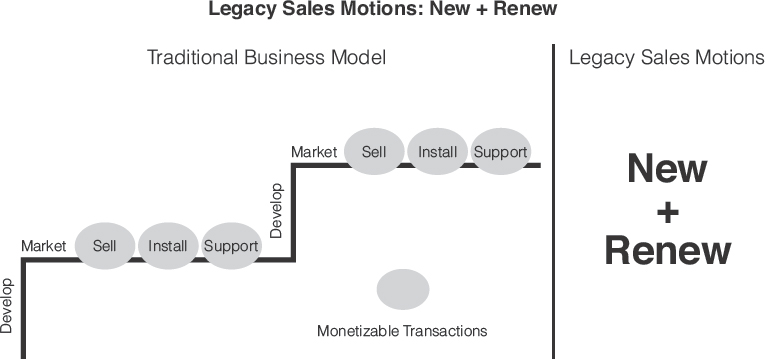

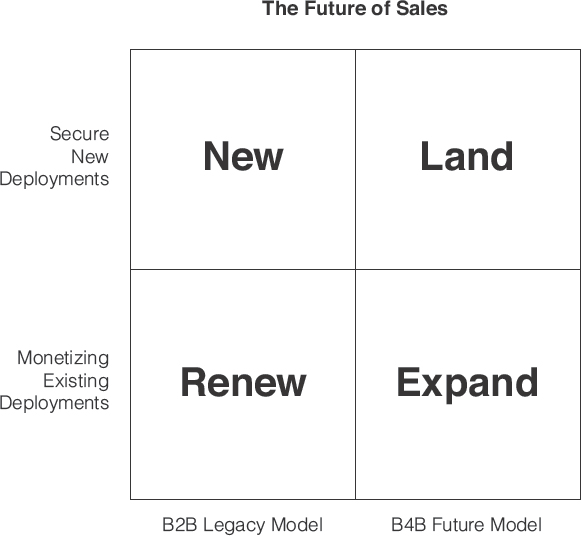

Most high-tech and near-tech suppliers we know run a common set of sales motions that we call New + Renew. The “New” sales motion sold both new deployments of the supplier’s products and the service contracts attached to them. The “Renew” sales motion administered and renewed those service contracts for as long as possible.

This made a lot of sense at Levels 1 and 2. The new team did the heavy lifting: selling the customer on the product, generating substantial up-front cash flow, and growing the installed base. Their compensation was front-loaded to reflect the value they secured for the supplier.

The renew team helped the customers stay “on contract” so that the installed products continued to work as intended over their life cycle. They also occasionally sold some incremental project-based services around the product. However, their main focus and most of their compensation were ultimately tied to making sure annual service contract renewal rates stayed high and service margins stayed strong.

The new sales team was where the tough selling action was, and the renew sales organization focused more on installed base and contract management. Inside many suppliers, the new team was considered to be the senior team and the renew team was seen as the junior team. As shown in Figure 7.3, this might have made sense when your business model was highly dependent on product sales and product-attached services.

FIGURE 7.3 Legacy Sales Motions: New + Renew

Consumption-based business models have flipped this on its head. In an “as-a-service” world, the initial deal is really an option on future revenue and profit. The big, profitable financial outcome for the supplier is by no means guaranteed as it was in the old world. The lifetime value of a customer is now predicated on their full, widespread adoption of the advanced capabilities of the offer and the rapid achievement of their business value goals.

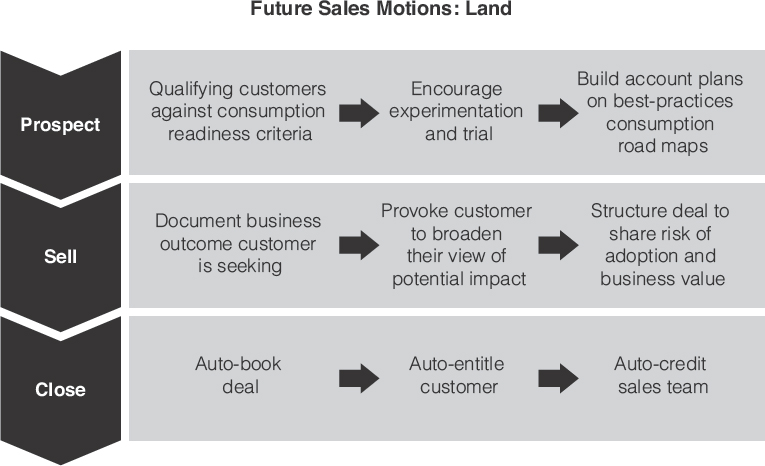

Few sales organizations are ready for this fundamental transformation in how customers are evaluating, acquiring, deploying, adopting, managing, and evolving their solutions. As shown in Figure 7.4, this future business model demands that high-tech and near-tech suppliers add two new sales motions: Land + Expand.

So let’s spend some time on what these Land + Expand sales motions will look like and how they are different from the model suppliers have been running for so long.

FIGURE 7.4 Future Sales Motions: Land + Expand

Key Capabilities for the Land Sales Motion

Over the last 18 months, we have been working with many hightech and near-tech early adopters of Land + Expand selling. Some were pure SaaS companies, whereas others were making a transition to consumption-based models. Once these suppliers started with consumption-based business models (or acquired companies that did), they found that they had to run a “land” sales motion that looks a lot like Figure 7.5.

FIGURE 7.5 Future Sales Motions: Land

A few new sales capabilities and activities are called for in land selling.

As we mentioned in Chapter 6, many customers may like the idea of consumption-based pricing models but might not want to make minimum commitments. Because consumption-based pricing shares and aligns risk, suppliers then earn the right to ask up front about the customer’s adoption preparedness. For the supplier, expending the resources to pursue customers that think they want a Level 3 partnership, but can’t or won’t successfully consume it, is a bad decision. That customer adds cost to the supplier’s sales and services motions without adding any incremental revenue. In those cases, exiting from the sales cycle early is actually better than winning the deal. This is going to take a lot of maturity for both suppliers and customers to accept. But it is necessary.

Second, customers who are excited about the new business models often do not know exactly what to ask for. As part of the land sales motion, suppliers need to create options for customers to explore the potential of their solutions at a minimal cost. This is a proven play in the B2C e-commerce world. An increasing number of Level 3 SaaS suppliers such as salesforce.com have been making available free trial options of their offers. Level 4 suppliers such as Amazon are using a similar approach. They have innovated enterprise infrastructure through per-minute billing options and automated tools that suggest to customers the specific price plan that would drive their lowest cost based on their actual usage. Can you imagine if your cell phone company did that? You would never be on the wrong pricing package again. This is the new face of what, in the old world of selling, would have been called “lead generation.” This is using a marketing-led approach to get customers to experience their service platform, knowing that it will ultimately sell products.

Third, consumption-based models bring down the cost, complexity, and risk of high-tech and near-tech solutions. For those who remember their Economics 101 class, when cost/complexity/risk fall significantly, demand generally goes up dramatically. Economists call this the shape of the demand curve as customers who were put off by previous offers flood the market. You will call this sales velocity. In land selling, sales professionals need to be constantly aware of this increase in addressable market. They need to provoke customers to think differently about the pace at which their offers can add value and, therefore, the pace at which customers should be consuming them. In the land sales motion, we call these best-practice consumption road maps. The Land + Expand selling model often helps reduce presales costs to the supplier because not everything has to be worked out up front. The customer is not risking overspending or underspending. They can start with the basics and grow into a complex solution over time. That should help reduce the need for all the overlay sales capabilities that are required to ensure a complete enterprise solution design before the customer can comfortably commit.

Finally, in B4B, the new sales organization’s new best friend is named “auto,” as in auto-quote, auto-configure, auto-close, auto-book, auto-provision, auto-entitle, and auto-sales credit. When a new deal is just an option on future revenue but not a guarantee of it, you really cannot afford a lot of friction in sales operations. Sales needs to be frictionless and scalable. Too many suppliers making the pivot to B4B are still using their legacy IT systems that require multiple people to manually touch most of the deals. This reduces profitability in the near-term and inhibits suppliers’ ability to scale over the long term.

So the capabilities and activities required in the “land” sales motion of B4B are often different from those of the “new” sales motion that most suppliers are familiar with. Often, these differences may even affect how the supplier organizes its sales function.

Organizing for Land Selling

Land selling demands an organization that can overcome an ever-increasing range of competitive offers to make a supplier the leader in the markets in which it competes—one that constructively resets the buying criteria customers are using as they migrate their purchases of high-tech and near-tech to Level 3 and beyond. It is also one that helps each customer capture the maximum amount of business value in the minimum period.

Emerging Level 3 leaders are generally setting up two separate sales teams: a land team that owns selling new customers or securing commitments for major new deployments from existing customers, and an expand team that maximizes the lifetime value delivered to customers and their increasing consumption of offers. This runs contrary to how most high-tech and near-tech companies are structured today. Most have a product sales team and a services sales team. In a B4B world, the line between what is a product and what is a service is so blurry that it may no longer be the right concept around which to organize.

Salesforce.com has used this approach to outgrow both tech industry incumbents and attackers alike, redefining a big swath of the software industry in the process. Specifically, Land + Expand enabled salesforce.com to broaden its reach from the SMB customers of its early days to include huge deployments in large, global enterprises. At salesforce.com, the land sales team grows the customer base, whereas the expand team, what it calls the “Customers for Life” team, accelerates customer adoption, business value, and advanced feature consumption. The same organization also renews and expands customer contracts.

In this model, the land team owns selling in three deal categories: first-time purchases to new “logos,” the significant expansion of existing purchases to new regions or divisions that have not previously adopted them, and major cross-sells of adjacent offers (e.g., service cloud sold into a sales cloud customer at salesforce.com). Either way, the land sellers are securing for the supplier options on long-term revenues.

Many sales professionals from traditional B2B selling models are successfully transitioned into these land selling roles. The good ones know that B4B has been coming for several years. Companies are finding that their best sellers, once trained in the land sales motion, are able to ramp up quickly.

B4B favors sellers that have consistently invested in building new skills, relationships, and competencies over time. They speak the language of the customers through vertical industry knowledge and business acumen. They have relationships both in the technical departments of customers and in the lines of business. These key relationships allow them to land new deals as decision-making power shifts. They understand and practice provocation-based selling2 to create new budgets for customers, not just solution selling to consume budgets that already exist.

So we’ve covered how to organize a land team and with whom to staff that team. We’ve left the biggest issue for last: how to compensate those land sellers. Now let’s agree up front that legacy sales compensation just does not work very well in consumption- or outcome-based pricing models. A specific example might help demonstrate why.

We recently came across a single sales region within a major tech supplier that had more than 10 consumption-based deals in its pipeline, each of which was shown as having a value of more than $25 million. That’s the good news. The customers were excited about this supplier’s newly introduced and recently acquired cloud-based offers and were ready to move ahead with major deployments. In fact, they were mostly swapping out legacy deployments and shifting to consumption-based models for the replacement solutions. The customers really felt that in moving to a diversified portfolio approach including both traditional and consumption-based offers, the supplier in question had “heard their feedback.” Customer interest was so high that there were “Way to go!” voice mails from senior execs for all involved.

Here was the problem: Although these deals had the potential for $25 million, the customers did not want to be legally bound to the full number of users from Day 1 of these deployments. In fact, some of them might actually start with only a small number for the first quarter or two. These customers liked the pay-as-you-grow approach that they had experienced with other Level 3 suppliers. In fact, one of the CIOs in question even explained to the supplier’s regional executive that, in this new world, his internal IT organization had to “earn in” with their lines of business over time. There was no way he could sign a binding up-front commitment even if he wanted to. His internal customers were free to adopt at the speed that made sense for their respective businesses.

So how do suppliers successfully compensate these land sales professionals when that type of customer commitment is the new reality? Well, matching sales professionals’ incentive compensation to the timing of revenue seems to make sense, until a supplier actually tries to do it. At that moment, their best salespeople walk out the door to a competitor still executing on the CapEx model. Yet, relaxing their booking criteria to include “pro forma” or “planned” consumption over the typical three to five years of these deals does not make sense either. That would fail to incorporate the substantial risks of full adoption of advanced capabilities and fast time-to-business value that stand between the pro forma deal size and the actual one.

What most companies are experimenting with is a hybrid between the two. That is, giving their land sales professionals a partial incentive on the overall breadth of the customer relationship in parallel with more traditional incentive compensation on committed bookings. This aligns compensation with what you really want them to do: setting up customers for full consumption of your solutions over time while also locking in some up-front commitments. Maybe that ratio could be 50:50.

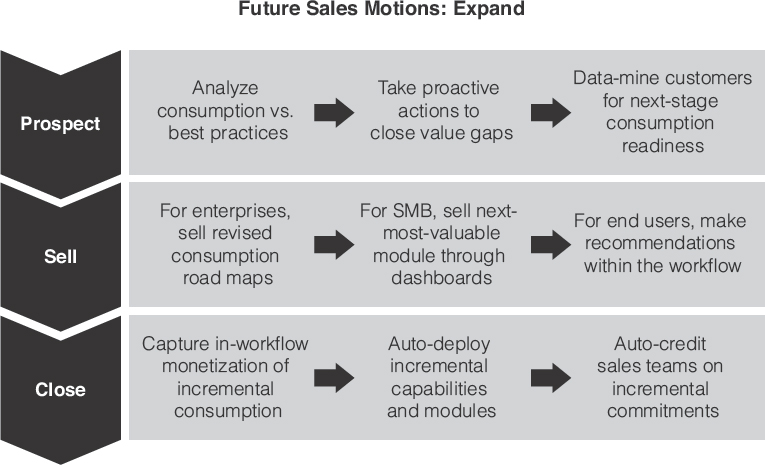

Key Capabilities for the Expand Sales Motion

Once a supplier has landed a new customer or a major new deployment of their platform within an existing customer, the real work begins. Again, new capabilities are needed. This is the period of true value capture for both sides—the supplier and the customer. The supplier needs to exercise all those options on revenue that the land sales motion has delivered. As you will see in the following discussion, one of the biggest changes in B4B is that simply renewing a customer or just keeping them “satisfied” is just not good enough anymore. Both are table stakes. If the expand sales motion is executed well, then renewals either go away entirely or become non-events. Let’s dig into how the expand sales motion, shown in Figure 7.6, connects customer value to supplier revenue.

FIGURE 7.6 Future Sales Motions: Expand

Few Level 2 suppliers have a sales motion in their company today that looks like the one shown in Figure 7.6. They may have some activities underway in separate groups that reflect parts of it. However, we have not seen a single company, at any level, pull all of this together at scale yet. There are three major areas to focus on: adoption services, expand coverage models, and in-the-workflow commerce.

First, the expand sales motion is predicated on customers’ full adoption of the advanced capabilities of supplier offers and the rapid capture of the full business value customers were seeking when they first deployed their solution. Without those two achievements, there is no ongoing customer relationship under B4B, let alone expansions of it. So the expand sales motion actually starts on Day 2 of the customer life cycle with your company. This is also where the critical role played by the adoption services organization pays off.

To enable this “Day 2 mind-set,” product companies must have the capability and the data to fully instrument their solutions (a topic we cover in detail in Pivot 3: The Data Handshake) so that they can assess where every customer is relative to best-practice adoption and value capture. They will use these insights to take action with customers early on in order to close any gaps utilizing all the service activities we’ll define in Pivot 2: Adoption Services. These actions might be as simple as incremental online training for a given set of users or a corrective action plan discussion at the next quarterly business review. They could be as sophisticated as using every inbound customer support call to position one incremental advanced feature that a specific user is not yet using. There is much experimentation going on, but it all resolves down to this: Level 3 and Level 4 leaders are putting themselves fully in service to the achievement of their customers’ desired business outcomes.

Second, suppliers are rethinking their coverage models under B4B. As we wrote in Consumption Economics, the balance of power for high-tech and near-tech decision making is swinging from central command and control to decentralized business departments and users.3 As a result, suppliers are rapidly learning they must love the little dots of upsell and cross-sell revenue much more than they used to. In the expand sales motion, this means that the number of customer employees or the total customer revenue is no longer a sufficient way to segment your sales team. To maximize the lifetime revenue of a customer, suppliers now need to sell both high and broad—large transactions and little ones.

Even large corporations are going to look and feel like many smaller companies in terms of how they make high-tech and near-tech purchase decisions. So although their land sales teams are covering the major corporate buying centers, suppliers need expand sales teams covering all those departments and users that will ultimately be making more and more purchase decisions on their own. In health care, this could be individual hospitals in a hospital group or in individual departments within a hospital. In manufacturing, this could be each of the major factories and the functional groups within them.

So when you see the terms “enterprise,” “SMB,” and “end users” in the preceding sales motion, similar expand motions could now be needed all within a single large customer corporation. Enterprise could be the corporate buying center in which the expand sales motion does high-touch selling of large extensions to the consumption road map that your land team first positioned with the customer. SMB could mean the presentation of specific next-most-valuable modules to a specific department. End-user selling could mean helping customers to fully consume both the advanced capabilities they have already paid for and the next-in-line ones they have not yet purchased. This is expand sales coverage in B4B.

An essential part of expand selling is the enablement of in-the-workflow commerce capability. Few enterprise high-tech and near-tech suppliers are able to meet these expectations today. It requires the modularization of both their offers and the pricing plans associated with them. It requires new management tools that help companies define which sets of modules should be available to which end-user communities. It requires expand selling algorithms that make intelligent, user-specific suggestions within the workflow. Finally, it requires a commerce engine that can either “bill back” to a central funding source pre-negotiated with the customer or charge an end user’s credit card directly. Almost every Level 3 or Level 4 supplier we know is leaving money on the table by not yet enabling users to get the exact set of features they need given their specific role, working style, and level of sophistication. Once again, a capabilities-led approach to transformation makes sense.

Finally, customers must also be willing to change their command-and-control thinking as it relates to technology spending. The era of one-size-fits-all-users is over. The new generation of consumer devices has created a completely different set of expectations for how much end users should be able to tailor the tools that allow them to do their jobs. This is true in every industry and nearly every country. No two iPhones are alike within a couple weeks after leaving their shiny white box. They don’t just look different. They function differently too because consumers pick the apps they want to use. This App Store mind-set is coming to the business world. What it means for the expand sales motion is that end users and the departments in which they work will need substantial latitude in order to efficiently grow their consumption of value.

So customer executives must find innovative but controllable approaches to enable this new path to full end-user productivity. They simply can’t require an employee end user to march a purchase order through the purchasing department every time he or she wants to add a new feature set. They need to develop a more modern approach that allows the little dots of consumption to be auto-approved and auto-controlled. This is a part of Pivot 3: The Data Handshake.

Organizing for Expand Selling

Before talking about organization, per se, suppliers need to list the capabilities that their expand sales team needs to have. This is the same approach we suggested in Chapter 6. By doing this, they can identify where in their current organization these capabilities likely exist today—the “what” before the “who,” if you will. To execute the expand sales motion, suppliers are going to need four main capabilities: annuity selling skills, low-cost customer interactions, sophisticated propensity to buy models, and modular offer management.

The need for annuity selling skills is obvious. In our experience, many sales professionals who have grown up in product sales roles do not prefer to play the expand role. They have grown up with an idea of “lead gen” driving demand. The idea of working tirelessly to create incremental demand within existing customers via best-practice consumption models runs against what many in product sales know how to do, and maybe even like to do. Plus, their high compensation expectations may make such a role economically unfeasible for them. A low cost-per-customer touch is critical given that many expand offers are going to be those little dots or “micro transactions” we talked about earlier. Suppliers simply cannot afford to run the expand sales motion effectively without a huge number of customer touches at a low cost per touch. Levels 3 and 4 call for the enablement of “volume operations selling,” not “complex systems selling.” It means that suppliers could soon generate a billion dollars in revenue through a million incremental bumps in consumption, not just through another 50 big deals.

Insightful, big data and analytics-driven “propensity-to-buy models” are needed to ensure that the expand sales motion never feels as though “we have this next module on sale for a limited time.” Suppliers need the capability to be on the customers’ side of the table with a fact-based understanding of their current usage and adoption and the uncanny (data and analytics on top of Success Science) ability to know what customers need next (even before they do).

Finally, modular offer management capabilities are going to be important in reconstituting a supplier’s monolithic solutions into the bite-sized chunks of capability that customers can buy in the expand sales motion. No product manager has ever been given that challenge. Most are still stuck in “good/better/best” bundles.

So suppliers will need at least these four major capabilities to be successful in executing this new expand sales motion at scale.

Let’s now turn our attention to where they might have those capabilities today. The biggest concentration of annuity selling skills today is likely within a supplier’s services sales force. However, this organization will not be a perfect fit. Too many sellers in service sales have “made their number” over the years simply working on (single-dimension) maintenance contract renewals. They certainly have not had the same (multi-dimension) focus on expand selling that we are talking about here. They have been satisfied with continuous improvement in the renewal rates on offers initially sold by others. So if this group is going to be the seed for a supplier’s new expand sales team, there is going to be some substantial rework required in incentives, training, metrics, and skills.

As we discussed in the last chapter, beyond purely electronic interactions, the lowest cost-per-customer touch in a supplier today is likely in your customer support organization. In fact, inbound calls from customers are among the greatest underleveraged opportunities for the expand sales motion that are immediately available to them. Interestingly, salesforce.com figured this out very early by structuring the Customers for Life team to include both expand selling and customer support. This positions them to use every inbound customer interaction to not just get the customer’s case resolved, but to also drive their adoption of advance capabilities and incremental consumption. This is the purest form of B4B, but one with lots of potential upside still to be realized. The hand-offs are not perfected. There is still a lot of work to be done to effectively and productively link adoption services with expand selling. Suppliers will need to make some changes in how support engineers are trained, how they are measured, what consumption analytics they monitor, what actions they take, and how they share leads with expand selling teams. There is a fine line between supporting and commercializing a trusted advisor relationship, one that cannot be crossed without great damage to the partnership. The guiding principle we provided in Consumption Economics was this: Helping will sell, but selling won’t help.4

Propensity-to-buy models are a new capability for most tech suppliers. They might have done some analysis of what the characteristics of their best prospects are versus their worst ones. However, they have likely never made the investment in the data scientists needed to run a powerful B4B expand sales force. We’ll cover this in more detail in the next chapter.

Finally, modular offer management skills might exist in two places inside supplier organizations today. If they have a group called services product management, services product marketing, or services portfolio management, they might have already started down this path toward deep modularization of their offers. That is, taking products and wrapping them in consumption-based service offers that are more readily consumable. The other place where they may have existing capabilities is in their field marketing teams who are often tasked with developing offers for market or regional segmentation. Either way, these groups have likely been thinking incrementally within the context of a supplier’s existing offers and business model. Now they need to go further. They need to ask the question, “What would Apple do?” as they develop the path from the “one-size-perfectly-fits-few” offers of today to the highly modular ones of tomorrow.

So while most suppliers are not starting from scratch in building an organization that can execute expand selling at scale, our bet is that there is a lot of organizational resistance to bringing all of this together. As we just said, we hear over and over again the debate about the “separation of church and state” issue of blending customer support with expand selling: “Won’t that decrease our customer satisfaction?” “Won’t customers be frustrated with us for selling them when they don’t want to be sold to?” “Our compensation systems and metrics just won’t allow us to mix these teams.” The reality is that, done right, the expand sales motion will drive higher customer satisfaction, broader adoption, and faster business value capture. Here is the bottom line in our view: This approach actually reduces customer risk. They get just what they need, just when they need it. And we are not talking about doing that according to some high-level technology architecture road map, but at the actual business user level where it really makes a difference.

Put simply, this is a far better way for customers to purchase and consume technology. Customers should thank suppliers for going with them to B4B instead of staying with the current high-risk, high-complexity approach.

The other area of resistance is the question of where all this new capability should report to inside the supplier. There are really three options.

Option A for suppliers is to continue having the land sales team report to the overall head of sales and the expand selling team report to the head of services. This is the least disruptive to the status quo and may be the best answer if they expect to have at least three to five years during which consumption-based models represent only a small portion of overall revenues. That means they assume that Level 1 or 2 CapEx models will continue to be where the buying action is going to remain for an extended time. It could also be the right answer if other major changes are going on in their product sales organization. Finally, the services organization may also be a safe place to incubate and debug the Land + Expand sales motion until the company and customers are ready for it. But this option requires a head of services that is up to the task both in terms of their buy-in to the “helping can sell” mentality as well as their sales management skill set. If that executive is in place today, Option A is a great answer.

Option B entails moving away from the organizational separation of product and services sales by putting all sales under one leader and reconstituting the frontline selling resources into future-state Land + Expand teams. We think the power of this model is that suppliers will find that the faster they get to the true expand sales motion, the more they can accelerate both their legacy and consumption-based business revenues. That’s because driving full adoption of advanced features and rapid time-to-business value will accelerate refresh cycles on the old model, not just incremental consumption on the new one. The biggest danger in this model is that it separates adoption and support services from expand selling—services loses its responsibility for driving revenue and profit, becoming just another cost center for suppliers’ CFOs to micro-manage. Remember, beginning at Level 3, the supplier’s whole offer starts to become one great big service platform. The last thing you want to do is to cost-manage that customer experience into nothingness. Very strong and clear accounting linkages need to be made between the investment in services and the revenue generated by the separate expand sales organization. The supplier cannot conclude that adoption services and expand selling are two separate thoughts.

Option C is a middle ground that works best for suppliers structured around two or three major divisions in which the supplier levels differ. Basically, they maintain the New + Renew sales motions within the sales force for their Level 1 or 2 CapEx business units while building the new Option A or B Land + Expand sales motions for their Level 3 or Level 4 as-a-service division(s). This model works best when as-a-service businesses compete in different markets than the CapEx businesses do (at least over the next three to five years) and sell in different buying centers. Citrix is a good example here. It’s enjoyed exceptional growth running a version of Land + Expand in their SaaS/Go-To-Meeting division in parallel with a more traditional model in its IT infrastructure businesses. It is sometimes easier to incubate a new model for a part of the business than trying to move the whole company to B4B selling all at once.

Bringing It All Together

The sales pivot of B4B may very well be the hardest one for suppliers and customers to stomach. Land + Expand selling requires the development of a clean-sheet model for the activities of the supplier sales professionals and the people who support them. It repurposes product sales, service sales, and customer support teams in a significantly different way for a very different outcome, that is, maximizing customer adoption of your advanced capabilities en route to more business value for customers and more revenue for suppliers. For customers, this means empowering business buyers and end users to make more technology decisions. It means updating heavy, old purchasing processes to handle little dot transactions. It also means that they must get comfortable with suppliers engaged more actively in expanding the partnership.

Put simply, Land + Expand is a different approach for a different mandate, as shown in Figure 7.7.

FIGURE 7.7 The Future of Sales

Most high-tech and near-tech suppliers will be running four sales motions instead of two for an extended period of time. Remember, it is and, not or. They will still be executing New + Renew selling for legacy Level 1 or 2 operating models and Land + Expand for their new Level 3 or 4 businesses.

How much experimentation a given supplier does in parallel inside separate teams or divisions in the near term will need to be traded against the simplicity of moving their whole go-to-market model to Land + Expand. Running in parallel is less disruptive to their next-quarter financials, but it will ultimately slow their progress in pivoting to B4B. We are working with a number of executive teams right now on how to think through that trade-off.

But the deciding vote will ultimately be cast by customers. They will be “voting with their feet” through the pace at which they move to new Level 3 and 4 suppliers. The key for suppliers is to accurately anticipate and plan for that transition. It is better that they learn Land + Expand selling one year too early rather than one year too late.