8 |

Pivot 2: Adoption Services |

THE SECOND PIVOT IS THE CREATION OF A NEW SERVICE OFFER called adoption services.

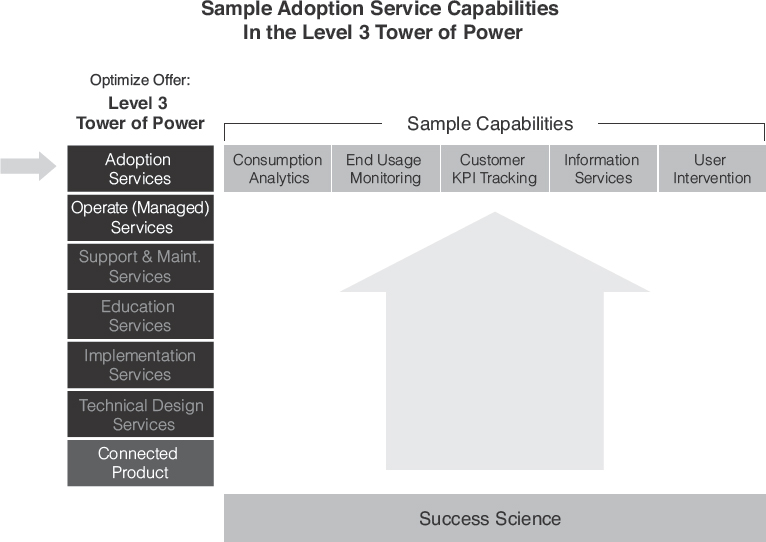

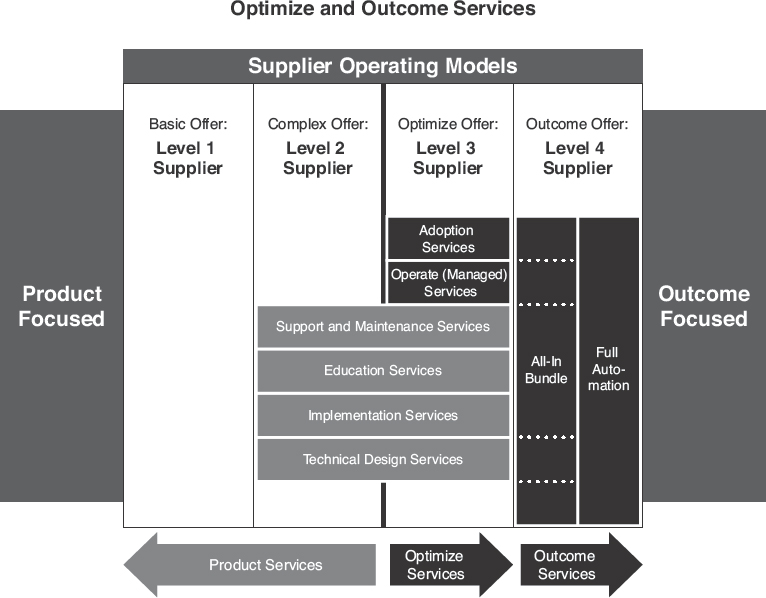

Adoption services are part of a class of services that we call optimize services. As we covered in Chapter 5, there are two service lines within this class, as shown in Figure 8.1.

FIGURE 8.1 Optimize and Outcome Services

As you can see, adoption services are most likely to be found beginning at Level 3. It is a natural fit. This is because how the supplier adds value and how they recognize revenue begin to change at this level. At Levels 1 and 2, the customer assumes almost all of the responsibility for operating the product and achieving the business outcomes. But beginning at Level 3, the supplier’s operating model starts to absorb some of those responsibilities. By either remotely operating the technology or guiding the practices of end users, the supplier becomes actively involved in ensuring that the products are functioning effectively and that the important advanced capabilities of the product are being used. As we argue in Chapter 10, this model can lead to significant improvements in overall ROI for the customer.

From the supplier’s standpoint, ensuring that the products are successfully adopted becomes more than an altruistic objective. Beginning at Level 3 and continuing in Level 4, the revenue a supplier receives from its customers is increasingly tied to the successful consumption of the product. Although we have talked about consumption-based pricing models throughout the book, it is worth repeating that the risk of owning technology is rapidly shifting from customers to their suppliers. Pricing schemes commonly used at Levels 3 and 4 can already be seen heading in this direction. Even Level 2 suppliers are seeing customers and competitors exerting pressure on their traditional pricing models. Here are six summary statements about pricing pressures that we see playing out in the tech industry today which lead us to conclude that adoption services make economic sense for suppliers:

•OpEx spending is replacing CapEx spending.

•Unit prices are heading down because of competitive pressure.

•Customers want to pay only for what they use: Use more; pay more. Use less; pay less.

•If they don’t use it or they don’t like it, they want to stop paying. Although suppliers are currently trying to enforce large, minimum commitments, customers are increasingly resisting them.

•Unit prices are shifting from single, fixed-price bundles to multiple tiers or optional add-ons. A common example is when SaaS prices move from a single per-user-per-month price to several options based on levels of functionality.

•Large-scale customers are talking to their strategic suppliers about gain-sharing arrangements.

In short, it seems that more and more every quarter, consumption equals revenue. Typically, at Levels 1 and 2, customers agree to purchase their products and services up front. The supplier only has to worry about customer satisfaction in order to preserve their potential for revenue in some future period. At Levels 3 and 4, all this changes. The supplier’s current revenue is now dependent on how much each customer consumes each day. How fast, how well, how often, and how much customers consume will soon become four important questions facing a supplier. Once that observation becomes clear to the CEO of a high-tech or near-tech supplier, the very next question they ask is, “How do we make it go faster?” In Consumption Economics,1 we alluded to the moment when a CEO realizes that the company must drive for faster results on these critical KPIs, and then realizes that he or she has no gas pedal.

Adoption services are a CEO’s new gas pedal.

Let’s define it a bit. Adoption services are project and annuity services designed to accelerate and optimize a customer’s business outcome from technology by achieving widespread use of its capabilities.

Adoption services is not (necessarily) a separate service organization. It is a line of services that can be offered on top of existing organizational infrastructures within the suppler. Project-based adoption services can be offered by the existing professional services organization. Annuity-based adoption services can be offered by the existing customer support organization, both central support and field services. They can be offered to customers on a direct basis from the product supplier, or they can be offered through its channel of resellers.

The adoption services portfolio will develop over time, but there are three minimum offers:

•Adoption Planning: a project-based service offered by professional services designed to plan the optimal adoption of a new technology deployment. This plan will direct the adoption activities of both the supplier and the customer.

•Consumption Monitoring: an annuity service offered by the customer support organization designed to report to the customer on current adoption or utilization levels. This service reports on equipment activity levels for hardware and end-user adoption (EUA), feature or capability adoption, and volumes for software. Ideally, this reporting should trend actual results versus the intended results of the adoption plan.

•Consumption Optimization: an annuity service offered by the customer support organization (both central support and field services) designed to intervene with end users or with the technology itself to optimize a customer’s business outcome through widespread use of its capabilities.

Adoption services should be engineered to follow a simple construct we call PIMO: plan, implement, monitor, and optimize. But more on PIMO in a minute.

Key Capabilities for Adoption Services

Like all elements of the transformation of supplier models to Levels 3 and 4, adoption services will require a mix of capabilities. Some already exist. Some are new.

The six capabilities listed in Figure 8.2 are new to most high-tech and near-tech service organizations. Let’s look at them briefly.

FIGURE 8.2 Sample Adoption Service Capabilities in the Level 3 Tower of Power

The tie-in to Success Science is absolutely critical to both the effectiveness and the efficiency of adoption services. In Chapter 5, we defined Success Science as a constant process, not a one-time project, which synthesizes multiple data and information inputs in a structured manner to articulate a solution’s key success factors and the best practices to achieve them. Once understood, Success Science provides the sheet music that orchestrates the supplier delivery organization’s reproduction of those conditions with as many customers as possible.

You can think of Success Science as the brain and adoption services as the arms and legs of a supplier’s outcome-driven operating model. It should be the place where best practices for every single step of the customer life cycle are maintained. These best practices should be driving the design and execution of the adoption services portfolio. They should also be driving myriad practices at each individual customer. PTC’s Best Practice Academy is a nice start on this concept. It doesn’t just concern itself with teaching an employee of one of its manufacturing customers a few features; it also endeavors to teach them things such as assembly structure methodology best practices. By having this kind of content available, both the supplier’s consultants and the customer’s management can work together to get the optimum benefits from the software’s great features.

A second important capability cuts across all three offers in the adoption services portfolio. Customer KPIs are the vital signs of their outcome. Many of these important KPIs will be identified in the Success Science process. But others may be unique or particularly important to that customer. They also may change over time. A supplier must have the capability to identify customers’ KPIs as part of an adoption planning project, track their progress as part of the consumption monitoring service, and be able to improve them as part of the consumption optimization service. Doing this effectively and at scale depends on the robust data handshake that we cover in Chapter 9. It also relies on several internal product capabilities that many Level 1 and 2 products simply don’t have. We believe that redirecting R&D activities to build these capabilities is hugely important to most every supplier we know.

End-user monitoring and intervention are two other essential capabilities most high-tech and near-tech products lack. Yet it is a common capability in B2C e-commerce. These give a whole new power to the operating model of Level 3 and 4 suppliers. In e-commerce, if a consumer has things in his or her shopping cart, hits the CHECKOUT button, and then doesn’t complete the transaction, the retailer’s website has a pop-up chat box appear to provide live assistance. Somehow, large online retailers can afford to do that 24/7 for millions of customers conducting low-value transactions. Yet inside many businesses today, highly skilled and compensated employees waste precious time struggling with mastering a new software feature, programming a new production run, or making copies of a complicated document. The math makes no sense. If suppliers could intervene for a fully burdened cost of $100 to get a $40,000-per-hour production line running an hour sooner, why aren’t they? If a supplier can record a nearly free, 60-second YouTube video that saves a $200,000-a-year engineer 30 minutes on a computer-assisted design (CAD) project, why doesn’t that supplier record it? Soon live video and remote operation will allow suppliers to actually do complex work for customers. Imagine needing 500 copies of a complex document from a high-end production print machine. Why not just hit a “Do it for me!” button on the machine, show the original document to the remote adoption services representative on a built-in webcam, and let them program the machine’s operation remotely? With growing customer awareness of the high “slow-time” costs that come with employee end users struggling to adopt advanced capabilities, end-user monitoring and intervention are going to be welcome new capabilities.

Another emerging adoption service capability is in the area of information services. Stated simply, information services improve customer data or give that data added dimension. Suppliers could accomplish this by supplementing, cleaning, or analyzing customers’ data. There are many suppliers offering excellent examples of information services. Eloqua, a marketing automation SaaS provider, offers an augmentation service called DemandBase that automatically adds key firmographic data to lead form submissions to build out the profile of a sales prospect. ServiceSource, a recurring revenue management SaaS provider, offers a data service option for pulling, cleaning, and enhancing renewal and subscription data for its Renew OnDemand customers. Philips Healthcare offers its hospital customers utilization services that measure and benchmark actual scanner performance, identifying improvement opportunities that can be used to set direction for department operation. GE Healthcare offers an information service called DoseWatch, which tracks, reports, and monitors the radiation dose delivered to patients. This is a critical activity that hospital staff used to do manually, which costs time and creates patient risk due to inaccuracies.

DoseWatch improves the hospital’s performance, effectiveness, and safety. Information services such as these can be monetized separately or can be included as part of a larger adoption service offer.

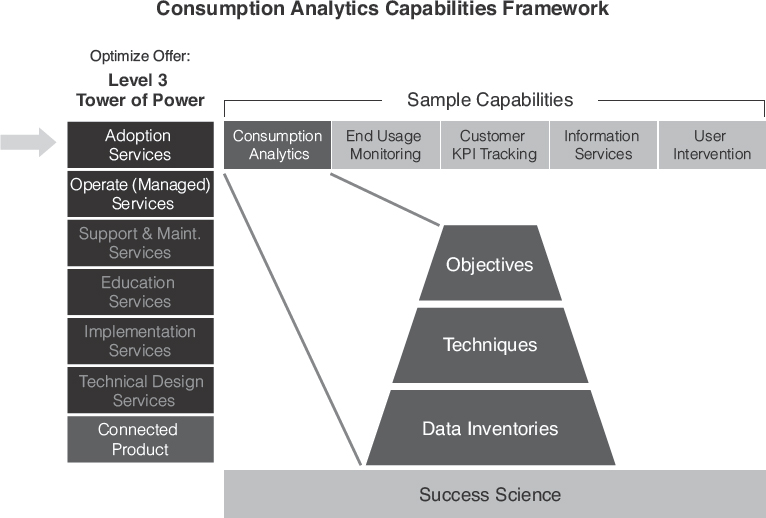

The last of our example capabilities is one we would like to spend a little more time on. It has to do with the subject of analytics, specifically consumption analytics.

At TSIA, we are studying how big data analytics can be used to improve the efficiency of supplier services and improve the business outcomes of customers. We have organized our research framework into three simple tiers, as shown in Figure 8.3.

FIGURE 8.3 Consumption Analytics Capabilities Framework

The top layer of the framework is about establishing the analytic objectives. We have identified three broad objectives on which service organizations should focus their analytics:

•Service Efficiency: Analyze case information, plus asset signals, to optimize service delivery. Feed learnings to R&D to improve future serviceability of products.

•Customer Adoption: Analyze usage information, plus customer support requests, to optimize customer adoption of product capabilities. Feed learnings to R&D to improve future product designs.

•Customer Business Outcomes: Analyze customer success across the base; find differentiating practices and develop service offers to replicate them across the largest possible number of customers.

To pursue those objectives, we apply two classes of analytic techniques:

•Descriptive Analytics: These include basic reports and alerts for metrics, scores, and KPIs, combined with data reduction and customer segmentation techniques.

•Predictive Analytics: These include more advanced abilities such as model-driven scoring, A/B testing, multivariate models, and rule learning.

Finally, we have identified seven sources of data inventory:

•Product

•Environment

•Interactions

•Usage

•Process

•Customer

•Industry

By executing against this simple three-tiered structure, suppliers can mine the huge volumes of data being generated by connected products to improve customer outcomes and internal operating costs. If both sides can agree to a data-handshake strategy, the benefits can be enormous.

Consumption analytics, along with connected product and the data handshake, are the technical breakthroughs that will reinvent the customer-supplier partnership. Before now, even the most caring suppliers simply could not actively participate in improving customer outcomes on any kind of scale. They simply could not afford to have customer service reps calling up every end user of every customer every day to ask them if they needed any help. Before now, about the best they could afford to do was respond to in-bound assistance requests and send out customer satisfaction surveys. This was the economic limit of the partnering potential of Level 1 and Level 2 operating models. But now, a whole new world of partnership opportunities is opening up thanks to software and the Internet eating the world. Consumption analytics are a core capability to enable these possibilities. Real-time data and analytics will feed a scoring system that can measure the health of adoption and will target needed optimization activities.

Several Level 3 companies have begun their consumption analytics capabilities journey by developing an engagement model that predicts whether subscribers renew or don’t renew. They identify certain “sticky” functionality that, once adopted, makes it highly likely that a particular customer will renew. Then, by monitoring the adoption levels of all customers on those key features at various points in time and comparing them to an ideal-state model, they can predict which customers need additional support. They can then execute prescribed customer outreach activities to remediate the adoption latency.

PIMO

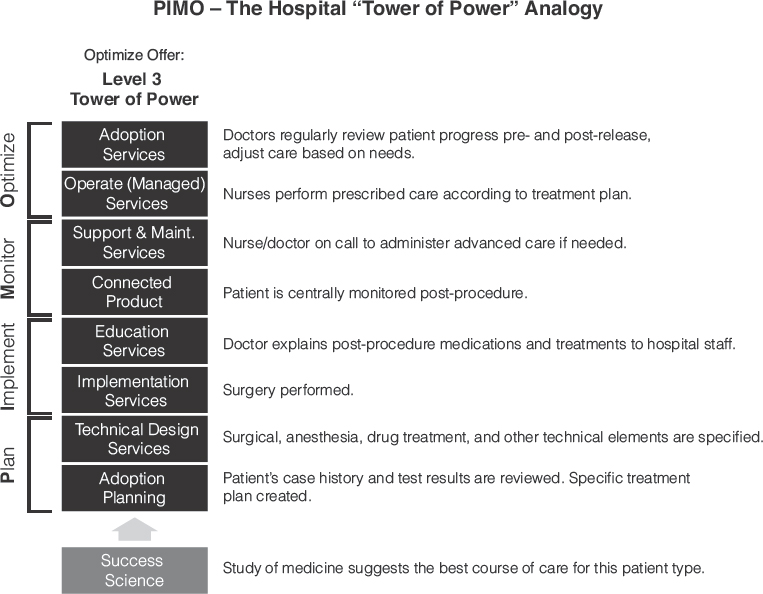

In Chapter 5, we drew an analogy between the Tower of Power at Level 3 and the process that a hospital uses to optimize the likelihood of a positive outcome for a patient. We want to use that analogy again to illustrate how a high-tech or near-tech customer might experience adoption services during a deployment life cycle (see Figure 8.4).

FIGURE 8.4 PIMO: The Tower of Power Analogy

PIMO is an acronym for plan, implement, monitor, and optimize. We know this is an obvious way for both suppliers and customers to think about the deployment of a technology solution. However, we argue that in Level 1 and 2 operating models, it is rarely done to its full potential.

In our hospital analogy, the plan phase would consist of both a technical plan for treatment that might specify the surgery, medications, and so on, as well as an overall treatment plan, which might specify the post-surgical care and lifestyle changes for the patient. The implement phase would include performing the actual procedure and educating the patient and recovery staff about results, findings, and required actions. In the monitor phase, what hospitals might call the recovery phase, the patient is closely monitored. Assistance is immediately available should post-procedure complications develop. Concurrently, the optimize phase begins when prescribed treatment care is performed and changes in patient lifestyle are initiated. Doctors regularly review progress and make adjustments as needed. Both hospital staff and the patient may receive updated instructions from the doctor. The optimize phase lasts as long as is required to achieve the desired outcome. For a simple procedure, it may be a period of weeks. For a complex and critical procedure, the optimize phase may last a lifetime.

We think that this sequence is highly analogous to how technology deployments should be thought of. But because Level 1 and Level 2 suppliers have historically preferred to stay close to their products, their involvement in this life cycle has been intentionally limited. As indicated by the black boxes in Figure 8.4, these suppliers have leaned toward activities tied directly to the product, not to the customer. They offer services to design the technical solution, implement it, train on it, and keep it operational. What they have not typically done is to prepare the customer’s internal organization for success, to manage and/or operate the technology, or to ensure successful outcomes. This gap is what optimize services are meant to address.

At Level 3, this means that the three new adoption service offers join operate (managed) services to provide far more supplier engagement in the full life cycle. So now, in the:

•Plan Phase, adoption planning joins technical design services and implementation planning.

•Monitor Phase, consumption monitoring joins remote system uptime monitoring.

•Optimize Phase, consumption optimization and operation services join customer service activities such as support and field service.

We believe these will be natural additions to the service portfolio for companies at Level 3. At Level 4, these same activities should also take place either as part of an all-in bundle or, ideally, as part of the “full-automation” offer. We think the adoption planning service is the low-hanging fruit of the three adoption service offers. By working closely with the technical solutions architect, the result is a plan to develop the complete business solution, to smooth the edges of complexity on both sides, and to make the outcome frictionless. Rather than “implement first, optimize later,” customers and suppliers can work on both concurrently. The adoption plan can identify the good business processes that the customer wants to amplify and the bad processes they want to engineer out using process charts or consultants. This service should also select the best deployment plan, identify key KPIs, and determine which party is responsible for each. The adoption plan can also chart the key functions that are critical to important job roles for the customer so that consumption optimization can focus on driving them.

Organizing for Adoption Services

As we have stressed repeatedly to our high-tech and near-tech member companies, building out new organizations every time a new service line comes along is not a winning strategy for a maturing industry facing declining prices and tightening margins. Adoption services provide the perfect opportunity to break the cycle. As we said, we believe there will be both project-based and annuity-based adoption services. There are already organizations at both delivery modes within most tech suppliers; no need for more.

What is needed is for suppliers to chart a course toward a converged services model. This approach could reduce their total service delivery costs across all their service lines by 10% to 20%, or more, while simultaneously improving their effectiveness. It will also facilitate the capability to create virtual, cross-service-line teams that can focus on a single customer. From a customer standpoint, these are exactly what they need and want from a supplier. For most Level 2 suppliers today, service focus = service organization. This means that customers, or third-party systems integrators, are left to act as the general contractor. They must work with all the service “subs” inside the supplier’s organization. They talk to separate service salespeople, have separate “go-to” contact points. It makes no sense. But suppliers don’t often organize their service delivery from a customer perspective; they organize their service delivery to maximize financial command and control. That was both understandable and common in the era of Levels 1 and 2 operating models. But we don’t think it is right for B4B.

Generally speaking, we think that the current professional services organization should house the adoption planning offer. We think the current customer (or tech) support organization should house the consumption monitoring offer. Finally, we think the current customer support and field services organizations should house the consumption optimization offer. Each of the existing organizations will need to add new capabilities to their repertoire. We have covered a few of those new capabilities in this chapter.

Adoption services are also offers that product companies might elect to turn over to their reseller channel, at least for some customer segments. There are many good reasons for considering this approach. Many supplier executives may prefer this because it reduces internal complexity. Others may need the resellers to offer their core products and, especially in an era of OpEx pricing models, they would like to entice them with other ways of making money. It gives their channel partners a new revenue stream to supplement their eroding product-attached service revenue. Some product companies are taking a similar tact with operate or managed service offers. However, there are two challenges that must be addressed in order to make resellers successful in adoption services.

The first and most challenging is the access to customer data and personnel. Both consumption monitoring and consumption optimization are dependent on constant visibility into customer utilization. As we have discussed, this may make some customer executives uncomfortable. In those cases, it is going to require the product company to put in place lots of safeguards and agreements in order to ease those concerns. The challenge may be even greater for a reseller, particularly a smaller one. Customers will need a lot of convincing that a small reseller can actually implement and operate a complex data protection and end-user intervention program. We believe that this is a problem in which the product company is in the best position to solve for its resellers.

The second challenge is the link to Success Science. The “smarts” that enable all three adoption services should be developed and maintained through the Success Science process we described in Chapter 5. That is going to be a labor- and skills-intensive process. It may not be practical for the reseller to build this capability for itself. Once again, we think the product company must come to its aid.

Both of these challenges can be boiled down to a simple question: Who puts up the capital to get resellers into the adoption services business? We think the best approach is for the product companies to build an adoption service SaaS application and then grant or sell access to its resellers.

Inside that application, resellers would find the tools, frameworks, and best practices created by the product company’s Success Science team. This will enable the resellers to build their adoption planning offer without needing to fund a Success Science process themselves. On top of that, we think the product company must build a consumption monitoring and optimization engine. Inside that engine would be the data-handshake utilities. We think that in most cases it makes sense for product companies to handle the complex data security and access issues directly with customers. Their sheer size and credibility may increase the customer’s confidence. Last, this engine should have all the functionality needed for the reseller to operate its consumption monitoring and optimization adoption service offers. Suppliers would build it and may operate some aspects of it. Resellers would have a license to use it in whole or in part. This application, built and owned by the supplier, puts resellers “in the business” of adoption services. We think many product companies will elect to charge their reseller partner for this application.

This approach overcomes the capital limitations that many smaller resellers may face. It means that only one Success Science and consumption engine needs to be built, not one at every reseller. We think it has the best chance for success. We believe that customers will be more comfortable with that approach and that resellers will be more successful as a result. For the product company, it is an alluring addition to attract resellers to its core product offer.

As we said, if the product company elects to deliver adoption services directly, the organizational approach to who builds and manages these offers should be straightforward. What will be far more important to consider is how to manage the very close dependencies between adjacent organizations within the supplier. We think there will be six critical operational adjacencies that successful adoption service organizations will face:

•Adoption Services → Land + Expand Selling: to get adoption planning projects attached to the land sale and to execute on expand selling opportunities, i.e., micro upsell and cross-sell transactions (the little dots)

•Adoption Services → Professional Services: to make sure that the technical design services and implementation project plan consider and coordinate with the adoption planning project plan

•Adoption Services → Education Services: to receive targeted education content that can be delivered on a just-in-time basis to end users

•Adoption Services → Marketing: to drive targeted feature promotions at selected end users based on both known best adoption practices and/or according to the adoption plan

•Adoption Services → Customer Service: to be able to route inbound “how-to” cases from customer support to the consumption optimization team and to utilize field service personnel if on-site consumption optimization activities are required

•Adoption Services → Success Science: to receive its best adoption practices and to feed data and results for further research

The Skills Gap

One of the biggest challenges facing suppliers in this pivot is a slightly ironic one. Because they have always preferred to stay close to their products rather than close to the outcome, they have staffed accordingly. This means that suppliers are loaded with technical experts in their service organization who have deep knowledge of the product. They know how to troubleshoot it, to debug it, to customize it, and to fix it. In fact, nearly everyone is an engineer of some sort or another. They have impressive technical certifications and have been thoroughly trained on the product’s design and ideal operation.

But they may not have any idea how to get a business outcome from it.

Obviously, mastering a mechanical near-tech product does not require a deep knowledge of the industry it is being used in or the business processes surrounding it. It usually just needs to be installed properly. But the more software that is involved, the more chances there are for suboptimal utilization. That’s not because it is broken. It is because the customer’s employees are not taking full advantage of its advanced capabilities. That might be easy to remedy with a little bit of just-in-time education. But often the issue is more complex. There may be so many features that the customers don’t really know which ones are best to master. They don’t know which advanced capabilities might best benefit them based on their industry, their job role, or their end-customers’ requirements. They may not know what the best-practice business process is that should be implemented to maximize its usefulness.

So there is actually a skills gap on both sides of the equation. The supplier is loaded with technical experts who know the product, and customers are loaded with people who know their job and industry well but who may not know how to map the product’s features to it in the optimal way.

Adoption service experts would ideally have both. So how do we solve this? In two ways: The first is that the Success Science team must take on this mapping assignment as a key deliverable. It must provide consumption road maps and training that the adoption service employees can learn and use. The second is that the supplier needs to stop hiring service employees from other tech companies and start hiring them from the industries they serve. Suppliers have plenty of existing training material on the products. They do not have plenty of training material on the industries they serve or the business processes within them. They should hire for that experience and should train for the product knowledge.

This is the fastest path to building a nucleus of consumption optimization expertise. Having industry experience in customer markets is almost a requirement for Success Science engineers. It will also be prized background for adoption service staff.

What Adoption Services Mean to Customers

As we mentioned, we think that customers will be excited to have their suppliers more engaged in delivering optimal business outcomes from their technology investments. Improved adoption of existing technology could lead to significant improvements in revenue or lowering of costs. The payoff should be clear and measurable. Demonstrating returns in such a precise manner is how suppliers should explain the virtues of adoption services. They should be able to point out to customers how these new services will improve specific KPIs that matter to them.

In turn, customers must agree to the grand bargain. They must also be willing to engage in adoption planning side by side with the supplier’s adoption consultants. Although the adoption plan will direct the activities on both the supplier and the customer side, it is primarily what happens on the customer side that will determine the speed and scope of the outcome. This means that managers must be engaged in the plan and held accountable for its execution. If it is application software, they must take the time to plan ideal consumption road maps for key employee job roles. End users must also be brought into that process. Obviously, the difficulty in developing and executing the plan will be directly tied to the amount of end-user software in the offer. The more end-user features, the more important the adoption plan.

Adoption services are real. They are happening today. Salesforce.com is using consumption analytics to create engagement dashboards; Apple is doing targeted, feature-specific marketing; Best Buy’s Geek Squad is producing and delivering targeted, two-minute “how-to” videos; and Taleo is monitoring customer KPIs and intervening with end users to help improve them. We already mentioned how GE and Philips are actively involved in helping hospitals improve safety and be more efficient. All of this is really happening. But no one has put it all together. No one has really built the Frankenstein’s monster model that is possible today. Now is the time.

For Suppliers, Adoption Services Will Soon Be Essential

There are three final reasons why suppliers at every level should embrace adoption services. And they are all important ones. The first is that the brief history of Level 3 and 4 business models has already shown us that it is very important to diversify a supplier’s revenue. The simple XaaS price list is prone to commoditization and prices wars. If suppliers have not found other services to monetize that add value to customers, then they are more exposed to this risk. We know of some cloud service offers that have faced as many as six price cuts in a single year. By standing up valuable new adoption service offers, suppliers can add more legs to their revenue stool. That creates a more stable base.

The second motivation is going to be competitive. If two suppliers are competing for the business of a large customer and only one offers these services, who do you think will win? Although we acknowledge that few suppliers truly offer all these services today, we predict that they will rapidly become table stakes in many large deals. This will give a competitive advantage to suppliers who host the customer’s technology, have developed their data handshake, and don’t have as many technical support cases to burden their resources. This is why SaaS has decided advantages over other architectures. Those new table stakes won’t make Level 2 companies happy, but we think the market won’t be very patient with excuses like architectural limitations that keep them from offering things such as consumption monitoring or consumption optimization.

The third reason, as we mentioned in Chapter 3, is because of the growing evidence that traditional Level 2 service offers, such as customer support, maintenance, and professional services, will soon be growth challenged. Many Level 2 suppliers are relying on product-attached services growth and profits to offset declining fundamentals in their product businesses. Without them, their overall financial picture weakens considerably. We think optimize services is the answer to their problem. We have already documented the rapid growth rates of operate (managed) services. We expect similar growth rates for adoption services. Suppliers must move their service portfolio to the right, away from their products and toward their customer’s outcome. While these two offers are natural activities beginning at Level 3, they can also be beneficial to Level 2 suppliers and their customers. Without them, Level 2 suppliers may lose out to Level 3 competitors. Without them, Level 2 suppliers might be unable to offset the erosion in their current service portfolio. Without them, Level 2 suppliers might be in trouble.