CHAPTER 6

NEXT GENERATION DEFINED CONTRIBUTION PLANS: WORKPLACE SAVINGS 4.0, MARKET INNOVATION, AND POLICY SUPPORT

The enterprise that does not innovate ages and declines.

He not busy being born is busy dying.

Evolving steadily over more than three decades since the emergence of the first 401(k)s, America’s defined contribution savings system has arguably become the greatest wages-to-wealth machine in the history of finance. Just 11 years after being blessed by the Pension Protection Act of 2006, DC savings plans have reached $7.3 trillion in assets in the first quarter of 2017, while IRAs, mainly filled by savings rolled over from DC plans, hold an additional $8.2 trillion. No other nation on earth has anything comparable.

And this tidal wave of retirement assets is still rising, even as hundreds of billions of dollars are drawn out each year to fund American retirees’ current living expenses. Intense competition among providers to serve this rising wave of DC savings continues to drive positive changes for workplace savers. Fees and administrative costs of workplace savings plans, for example, have been falling for a generation (Figure 6.1). For retirement services providers, such price compression is a relentlessly rising cost of doing business, and it shows no sign of stopping.

FIGURE 6.1 Price competition drives down fees for mutual funds in 401(k) plans

Source: Sean Collins, Sarah Holden, James Duvall, and Elena Barone Chism. 2016. “The Economics of Providing 401(k) Plans: Services, Fees, and Expenses, 2016.” ICI Research Perspective vol 23, no. 4 (June 2017).

Market-driven innovations that improve workplace plans’ services and customer experience are continuous. Service providers routinely roll out easy-to-understand calculations that show how retirement savers are progressing toward their lifetime income goals. Same with better planning and analytical tools, including health cost estimators. Access to automated online investing with robo-advisors is growing. So are new offerings by workplace plans of triple-tax-free health savings accounts (HSAs) that allow those with high-deductible health plans to save money for out-of-pocket medical expenses. And more plan sponsors each year are thinking about or experimenting with ways to include annuities and other guaranteed income strategies within plans and on into workers’ retirement years.

Bringing DB Features to DC Plans

Market forces seem, in fact, to be bringing to defined contribution plans many of the best aspects of traditional defined benefit pensions. In many plans today, for example, auto-enrollment and automatic savings escalation are getting close to matching the near-universality of the best DB plans of the past. Extensive experience now shows that very few workers deliberately choose to opt out if they are auto-enrolled in savings plans and have their savings set to rise over time. Contrary to the fears of some policy makers and plan sponsors, workers don’t resent these features; they welcome them. Why? Because these nudges built into plan designs make it easier for workers to reach the goals they want to reach.

Similarly, the rapid spread of target date funds as the default choices within plans is providing millions of workplace savers access to professionally managed asset allocation. Since target date funds automatically reduce risk as their owners’ retirement date nears, they require no more attention from these savers than they might have paid to the investment choices made by traditional DB pension managers. Their lifelong strategic investment patterns are built in and roll along automatically.

The Proven Path to Retirement Security

A decade after the PPA, a consensus view is emerging in the world of retirement policy. It holds that, taken together, the best practices found in fully automatic, high-savings-rate plans can achieve these plans’ key goal: accumulating sufficient assets to provide a worker with reliable income replacement for life. The basic design debate is over. The results of what amounts to a vast, real-time experiment are in. Full auto plans that lift savings rates to 10 percent or more clearly can, in fact, solve the accumulation challenge. The code has been cracked.

But even though we’ve identified and test-driven practical, proven accumulation solutions that are working well for millions, we have a long way to go to fully implement these solutions among all workplace plans. Ten years on from the PPA’s endorsement, adoption of fully automatic plan designs has slowed to a crawl. Fully 66.7 percent of large plans (5,000 or more participants) have adopted auto-enrollment for their employees’ savings plans. But among employers overall, just 57.5 percent of those who offer workplace savings plans now automatically enroll their workers, and too many of these employers limit auto-enrollment in savings plans to new hires (49.6 percent). Even among large plans, barely 22 percent include automatic savings escalation in their plan designs. And auto-escalation features drop away rapidly among the savings plans offered by smaller firms (12 percent).

This failure to adopt proven plan designs has many causes: force of habit, inertia, caution, or fear of change. Many human resources and benefits executives, for example, may hesitate to propose a full auto plan design because shifting to such a model would increase their company’s cost of offering matching funds once the full auto design lifts employees to saving at a much higher rate. Some CEOs might hesitate for similar reasons.

These concerns are sorely misplaced. The real risk, long-term, lies in not adopting proven plan designs that will bring employees reliably toward retirement readiness. Business leaders, especially CEOs, should recognize that designing workplace savings plans that have a real shot at bringing employees up to full retirement readiness is too important a decision to be delegated to HR departments or benefits planners who may feel pressure—or even compensation incentives—to contain costs. These professionals need CEO support to see and do the right thing. And even if there are added costs for increased savings matches, CEOs can feather those costs smoothly into multiyear compensation planning more easily than their HR teams might be able to do without top-level support.

Clearly, it’s in the common economic interest of all businesses, large or small, and of their workers, to see near-universal adoption of fully automatic savings plan design. We would all benefit from an increased sense of security, more widespread ownership, stable consumption in retirement, and more rapid economic growth funded by higher savings. But as we see the uptake of fully automatic plan designs slowing down, further progress will require fresh rounds of market innovation, regulatory guidance, and legislative support.

At Empower Retirement, we’ve laid out a broad set of goals for the next generation of workplace savings—Workplace 4.0—building, as earlier generations did, on great ideas already proven in the market or emerging from market innovation. We are pushing for reforms that can finish the job the PPA did so much to advance. We aim to first imagine, and then help flesh out, a robust workplace savings system that reaches all working Americans. We’re advocating for reform and innovations that go beyond accumulation to solve the even more complex challenge of distribution, reliable lifetime income, the holy grail of twenty-first-century workplace savings. Figure 6.2 shows that vision in a nutshell.

FIGURE 6.2 Workplace Savings 4.0: Reforms to keep America’s retirement promise

First, Do No Harm

Future tax reforms must preserve and expand the existing savings incentives that have helped fuel the rise of today’s multitrillion-dollar workplace savings system. Given the undeniable need to increase, not discourage, more retirement savings, the tax deferrals that help people fill up their 401(k)s or IRAs should be sacrosanct—politically untouchable. And the truth is, these incentives actually do foster family and personal solvency, which, in turn, strengthen the nation’s whole balance sheet.

We should never pit national solvency and personal solvency against each other, as some recent tax reform proposals have done. It is terribly shortsighted policy to suggest cuts to personal savings incentives to “pay for” other, unrelated tax breaks. To reduce that constant temptation, we also need to correct the misleading and potentially damaging ways that Congress currently accounts for savings incentives in its budgeting process. The following box, “Honest Arithmetic for Savings Tax Deferrals,” gives a brief look at why that arcane “inside baseball” element of congressional budgeting matters a great deal.

Apart from protecting existing savings incentives, the most pressing goal for future retirement policy should be to close the yawning “coverage gap” and provide access to some form of payroll deduction savings plan for the tens of millions of working Americans who have no on-the-job savings plans today. We can do that by adopting legislation to require that all employers provide automatic IRA payroll savings deductions on the job. We can pass legislation enabling unrelated small businesses to band together to form multiple-employer savings plans. We should be open to fresh ideas to meet this challenge—at the national level.

Unless Congress does act to close the workplace savings coverage gap at the national level, we can anticipate continued movement by some states to try government-sponsored plans aimed at covering the uncovered. This could lead to a complex, far less effective patchwork of state solutions, exempt from the investor protections already provided under ERISA.

We could easily see the emergence of an unfair, two-tier retirement savings structure. Workers in large firms would enjoy robust ERISA-regulated 401(k)s with high returns, while millions of small business employees would be relegated to second-rate state-sponsored plans with lower returns, higher costs, and the risk of never reaching retirement readiness.

For all these reasons, we believe that Congress should take the rise of these new state plans as a wake-up call to provide national solutions, including creative ways to offer the large, fast-growing number of part-time, contract, and “gig economy” workers options for direct deduction to retirement savings from their 1099 payments. Ideally, I would like to see every worker who is subject to pay FICA taxes to Social Security also enjoy the option of saving for retirement easily and automatically.

A third step toward the vision for Workplace 4.0 would be to use regulatory and legislative support to require all existing workplace savings plans to adopt fully automatic plan design features. This could be achieved through a combination of regulatory guidance and leadership, plus a new round of pension reform from Congress. The logic of requiring these best practices by law seems to me as irrefutable as the mandate we impose on families to vaccinate their children against polio, measles, and other serious diseases. Once you know what works, there’s almost a fiduciary duty to advocate for its universal adoption.

Ten years after the PPA, the time has come for major new pension legislation that can apply proven best practices to all workplace plans, and increase the tax-based incentives for employers to offer plans and for participants to enroll and save more. Increasing incentives to employers for offering plans and for matching workers’ savings makes sense precisely because the companies that do these things are directly contributing to the larger national goal of retirement security for all.

The next major pension reform should not only finish the work the PPA did in solving the challenge of accumulation, it should go on to offer support for greater adoption of lifetime income options, in plans and beyond. And it should offer strong tax advantages for workers who choose to purchase guaranteed income product options that draw down a retirement portfolio. We might, for example, allow retirees to draw the first $10,000 in income from such guaranteed sources tax free, so as to powerfully encourage them to consider buying such income products.

What Could Workplace 4.0 Policy Reforms Achieve?

To assess the potential impact of the reforms proposed by Empower Retirement’s Workplace Savings 4.0 policy agenda, we asked Jack VanDerhei of the Employee Benefit Research Institute (EBRI) to run them through EBRI’s highly respected Retirement Security Projection Model®, a tool that analyzes retirement income adequacy under various policy scenarios. The findings were powerful.

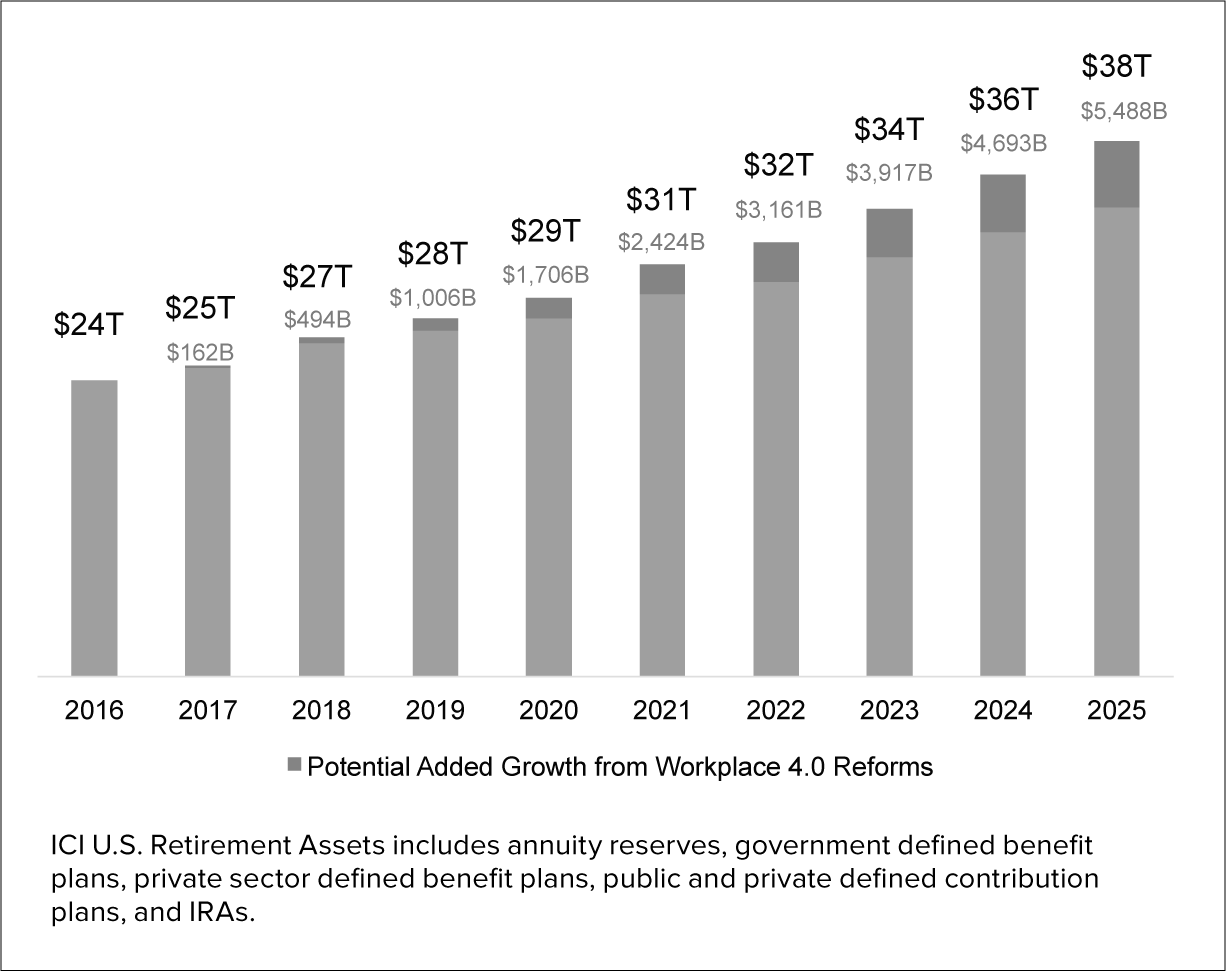

EBRI’s model suggests that a full Workplace Savings 4.0 reform agenda could lift annual retirement savings in America by nearly $700 billion dollars a year within three years—with continuing gains in later years (Figure 6.4). That is a huge increase—133 percent in fact—in the savings flowing through qualified retirement plans and IRAs into our stock and bond markets; it would be a major spur to new capital formation coming entirely from retirement savers.

FIGURE 6.4 Impact of Workplace Savings 4.0 policies on retirement

Source: EBRI estimates.

The added savings from these reforms could raise total American retirement savings by more than $5 trillion by the middle of the 2020s, providing a steadily rising flow of investment capital to our securities markets. As we’ll see in Chapter 8, these added savings, in turn, would contribute to funding higher investment, rising productivity, and economic growth, while providing retirees with more robust assets from which to draw lifelong income (Figure 6.5).

FIGURE 6.5 Total U.S. retirement assets with projected growth from Workplace Savings 4.0 reforms

Source: EBRI estimates.

From the point of view of working Americans, EBRI’s analysis suggests that the 4.0 reforms would take a huge bite out of the nation’s retirement savings shortfall, reducing it by nearly 50 percent for all workers 30 to 50 years old, and by more than 30 percent even for older workers 55 to 64 years old. Younger workers, of course, have many more years for contributions to grow before they need to draw on them for retirement income. But Workplace Savings 4.0 reforms would offer significant help even for those within just a few years of retirement (Figure 6.6).

FIGURE 6.6 How much Workplace Savings 4.0 reforms would reduce retirement savings shortfalls—by age group

Source: EBRI Retirement Security Protection Model® Version 2659.

Perhaps the single most powerful impact suggested in the Workplace Savings 4.0 agenda is that of allowing retirees to draw funds from their qualified plans tax free if used for medical insurance or other health costs. That such a change would have great weight is not wholly surprising, since many estimates of total healthcare costs for retirees range from $250,000 on up.

Taken together, Workplace Savings 4.0 reforms would effectively solve most of the challenge of inadequate retirement income, except for those retirees stricken with chronic illness. According to EBRI’s analysis, a majority of the savings shortfall that would remain, even if 4.0 reforms were adopted, is due to the crushing costs of long-term nursing home care. This is a highly unpredictable cost/risk for most people and is currently very difficult to insure against. Fostering the growth of an efficient, nationwide market for affordable long-term-care insurance is a worthy goal that will likely require major federal legislation so retirement savers can better protect their futures.

Adoption of the full 4.0 agenda would not be a perfect solution. It would leave long-term care as the last frontier of full retirement security. But it would be a huge step forward, and it would provide confidence-building proof that Americans can take on major challenges—and solve them.

Lifetime Income: The Holy Grail

The core goal of what we call Workplace Savings 4.0—the “holy grail” of the next generation of workplace savings in America—is to convert accumulated assets into guaranteed lifetime income. Through the same mix of market-driven innovation, academic research, and smart policy formation that led to the PPA, we can achieve in DC plans the lifetime income predictability that a minority of workers once enjoyed through traditional pensions.

Unfortunately, there is no one-size-fits-all model for attaining guaranteed lifetime income. Nor should there be in a dynamic and diverse financial services marketplace. What we will see, I hope, is a cross-silo collaboration of asset managers, insurers, and financial advisors that delivers a broad range of guaranteed-income solutions. We can foresee lively competition that will apply effective and transparent algorithms to convert tens of trillions of dollars in retirement assets into secure individual income streams or “personal pensions,” customized to fit a wide variety of individual and family goals.

Guaranteed lifetime income is at the core of Workplace Savings 4.0 because it is the basic goal of all retirement savings programs and the deepest concern of American workers themselves. Survey after survey tells us that most Americans’ greatest fear about retirement is running out of money before they run out of time. In fact, multiple surveys tell us that people fear poverty or severe financial stress in old age more than they fear death itself.

And the challenge of drawing down a lifetime’s savings so that it lasts a lifetime is far more daunting, and individualized, than that of piling up assets while still working. Post-PPA experience suggests that we essentially know what it takes to accumulate enough raw savings: full auto plans with 10-percent-plus savings rates will do that. But the PPA provided virtually no guidance, guidelines, or policy support for how to convert those assets into reliable lifetime income, leaving it to individuals to figure it out.

It is particularly important that we focus on converting defined contribution savings into income today, because for a generation, we have experienced the steady erosion of traditional guaranteed income sources.

As of 2016, current retirees draw nearly two-thirds of their retirement income from Social Security and defined benefit pensions. But both of these sources will continue to shrink in terms of income replacement for decades into the future. Defined benefit pensions are steadily disappearing except for government workers, and even in the public sector, they face dim prospects. With multiple funding crises afflicting public DB plans—in Puerto Rico, Detroit, Illinois, and many other cities and states—there is a rising drumbeat for these programs to be reformed or even converted into DC plans.

What’s more, the contribution of Social Security to income replacement is projected under current law to fall from roughly 36 percent today to just over 29 percent in 2037 because of increases in the age of eligibility and deductions for the rising cost of Medicare benefits. That’s not to mention the longer-term challenge of Social Security system solvency (see Chapter 2: “Retirement’s Bedrock: Social Security”), which will require congressional action for current benefit schedules to be honored.

The diminishing ability of DB pensions and Social Security to replace future retirees’ incomes is opening a guaranteed income gap that will continue to expand in coming years. For most Americans today, and for nearly all private-sector workers in the future, DC plans will be the primary source of retirement income. That’s why it’s critical that we get to work on ways to dramatically improve the ability of DC plans to step into this widening gap and deliver reliable lifetime income solutions for generations to come.

Fortunately, the policy, academic, and professional practice communities are already engaged in debate and experimentation to address the challenges of distribution and lifetime income. Broad agreement is emerging that we must expand the range of retirement income solutions in plans to include a full range of fixed, variable, and deferred-income annuities along with guaranteed payout plans that can be customized by investors and their financial advisors.

By dramatically increasing the availability of guaranteed lifetime income options in defined contribution plans, we could replicate one of the best elements of traditional defined benefit pensions—assured flows of lifetime income.

Indeed, the most significant advantage of DB plans may be that by linking all participants in a common pool to purchase lifetime income, these plans can accurately estimate the collective lifespan of participants, as a group, and match investments and assets to that average lifespan. By contrast, individual 401(k) savers can’t be sure how long they will live. Workers in retirement must then either save more or draw down income very cautiously from their savings because of longevity risk, the very real possibility that they may live far longer than their peers and so outlive their savings.

Incorporating pooled lifetime income options like annuities into DC plans could dramatically reduce every saver’s individual longevity risk. What’s more, working income guarantees into a DC plan would also limit another key hazard that all retirees face—“sequence of returns” risk. That is the damage that a series of sharply down years in the securities markets can inflict if they come early in retirement.

Managing “Sequence of Returns” Risk

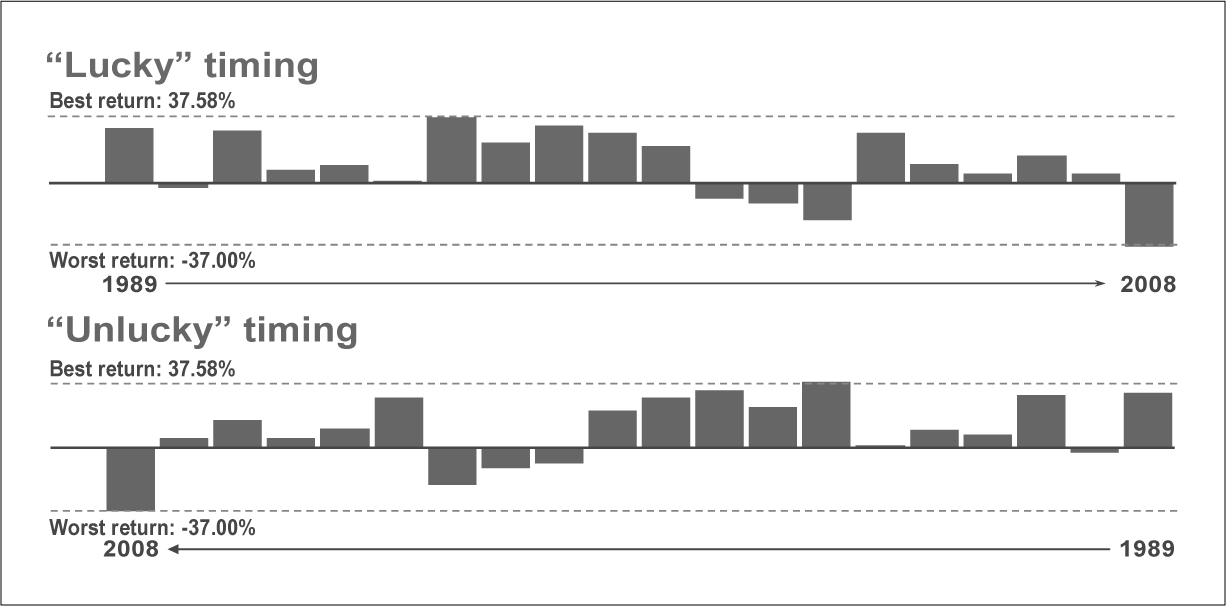

The most dangerous, and too-little-known, risk to retirement savers lies in the sequence of investment returns in markets in the years just after retirement. Figure 6.7 shows two series of investment returns. The top shows the historical returns of the S&P 500 from 1989 to 2008. The bottom sequence shows those same annual returns in reverse order. Both series have the same average return of 10.36 percent over 20 years. But the impact of these returns on a retirement portfolio is radically different.

FIGURE 6.7 Sequence-of-returns risk: the retirement timing “lottery”

Source: Putnam Investments estimates.

To illustrate the impact that a returns sequence can make, we show a hypothetical all-equity portfolio worth $1 million invested from 1989 to 2008 in the S&P 500, and then reverse the sequence of returns. If the investor retires in 1989, his timing is wonderfully lucky. Starting with a portfolio of $1 million, withdrawing 5 percent a year, and stepping up at 3 percent annually to cover inflation, his investments return more than $1.3 million in income over 20 years, taking advantage of strongly positive early-year returns to total more than $3 million at the end of 20 years (Figure 6.8).

FIGURE 6.8 The impact of sequence-of-returns risk

Source: Putnam Investments estimates.

When we flip this sequence of these returns so it runs from 2008 to 1989, the average yearly return over the period is exactly the same: 10.36 percent. But if we assume the same initial withdrawals and inflation adjustments, this unlucky (and ill-timed) retiree would be flat broke after just 19 years after drawing just $1.1 million in income from the original $1 million portfolio.

That’s sequence-of-returns risk in a stark example. It’s the chronological equivalent of a lottery ticket. So how can we manage this risk? There are many ways, but for simplicity’s sake let’s just consider what a retiree might achieve by partially annuitizing his retirement assets.

In this case, the investor converts 50 percent of his initial $1 million portfolio into a guaranteed income product and draws the remainder of his income from the remaining equity portfolio (Figure 6.9). Let’s further assume that he has to endure the “unlucky” sequence of returns we’ve seen above.

FIGURE 6.9 Insuring against sequence-of-returns risk: the unlucky (but secure) investor

Source: Putnam Investments estimates.

Here’s the result: The total 20-year income matches that of the investor who has a lucky sequence of returns—over $1.3 million—and the initial $500,000 in equity assets actually grows to over $680,000.

How is that possible? The reason is that committing 50 percent of his assets to guaranteed income helps avoid half of the huge initial losses in this sequence. And since substantial income is drawn from the guaranteed source, the equity portfolio is drawn down more slowly, leaving the bulk of those assets more time to recover from the initial difficult years.

Admittedly, there’s a much smaller equity balance at the end than the lucky investor would achieve. But bear this in mind: This unlucky investor has survived a dangerous sequence of returns; his liquid assets have risen, not fallen, let alone been totally drained, and he still owns a guaranteed income contract that provides a substantial degree of lifetime income security.

There are, of course, fees and expenses associated with any guaranteed income product. And such products are subject to the claims-paying ability of the insurance issuer. But as this example demonstrates, guaranteed income options in a retirement plan can mitigate the risk posed by a damaging sequence of returns while also fending off the worst retirement risk of all: total depletion of assets in late old age. Such significant personal and social gains seem to me to merit serious policy and tax incentive supports.

Solving the “Annuity Puzzle”

Despite the powerful benefits that adding some form of guaranteed income can provide, retirement savers have not exactly rushed to buy annuities. Nor have most plan sponsors chosen to offer any form of income guarantees in their plans, though the most recent Lifetime Income Solutions Survey by Willis Towers Watson did show that over half of plan sponsors anticipate offering a guaranteed income solution in the future. In the meantime:

- One-third provide in-plan managed account services with a non-guaranteed payout.

- Only 22 percent offer an in-plan asset allocation option with a guaranteed minimum withdrawal or annuity component.

- Only 6 percent of employers offer out-of-plan annuities at the time of retirement.

- Less than 10 percent offer an in-plan deferred annuity investment option.

Why haven’t workers and plan sponsors more fully embraced annuities or other forms of guaranteed income solutions? Given the powerful advantages of pooling longevity risk, that’s something of a mystery, which is why economists call the reluctance of consumers to buy guaranteed income products “the annuity puzzle.”

Two powerful reasons that plan sponsors cite are fiduciary risk (81 percent) and cost (67 percent), precisely the impediments that once held back the adoption of automatic enrollment and savings escalation in the years before the PPA. For individual investors, guaranteed income solutions have too often been associated with complexity, opacity, high distribution costs, and hidden fees. Given the choice, even most defined benefit plan participants choose lump-sum payouts over annuitization.

Consumers are often reluctant to sacrifice liquidity or to let go of the wealth illusion that large lump sums of money can generate, especially compared with the modest returns that annuities offer in today’s ultra-low interest-rate environment. Some also fear the single-provider risk that an insurance company could fail to meet its annuity obligations. Those fears need to be addressed.

The challenge for America’s next major pension reform, then, is to go beyond ensuring that all American workers have access to fully automatic savings plans on their jobs. Workplace Savings 4.0 should offer a framework of guidelines, guardrails, and incentives that extend beyond workers’ careers to help them successfully convert their life savings into lifetime income.