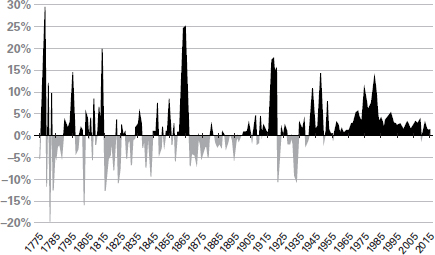

Figure 2.3 US inflation from 1775 to 2015 – annual percentage change in overall US consumer-price index

Source: Zumbrun, J (2015) A brief history of US inflation since 1775, The Wall Street Journal, 14 December, reprinted with permission of The Wall Street Journal, Copyright © (2015) Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number 4282560442295

What’s clear from the above is that the United States has embraced inflation much more than deflation and specifically around periods of debt burden, eg immediately post-war. When this happens the international lenders lose money. They may get paid back the say $100 they lent, but that same $100 buys far less once inflation is accounted for. Naturally, investors are nervous that the United States may choose this path again. Some would argue that it already has. After all, the solution to the financial crisis was simply to pursue inflationary policies, which would raise asset prices. This is exactly what happened. Following the United States’ lead, governments around the world injected some $24 trillion into the world economy, most of which remains in place. Never in human history have so many nations injected so much capital, so consistently, for so long. According to A History of Interest Rates by Sidney Homer and Richard Sylla, interest rates post the financial crisis dropped to the lowest levels recorded since the Holy Roman Empire (Figure 2.4).31