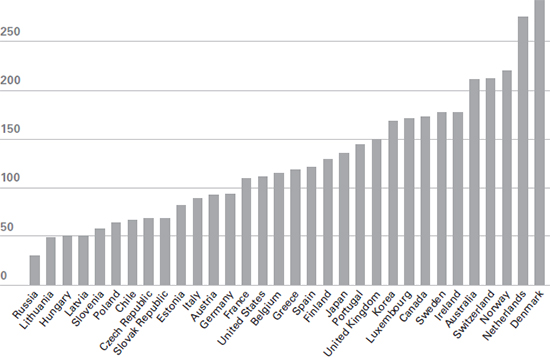

Figure 2.5 Household debt (2015) – total debt as a percentage of net disposable income

Source: OECD (2018) Household debt (indicator), doi: 10.l787/f03b6469-en (accessed 5 February 2018)

Living in the present, but destroying the future

Has there been wilful collusion by commercial, political and economic leadership in the process of indebting the poor? It would be too complex for an outright conspiracy, but it’s difficult to conclude that this eventuality wasn’t at least foreseen as an option by such intelligent leaders. Surely they knew that the purpose of their policies was to induce inflation. The process of impoverishing those least able to compete is hardly a new one. This time, though, it’s different in terms of scale and location. It involves the Western democracies. This is the stuff of which political revolutions are made.

Not content to damage the present by unleashing a bit of inflation, leadership has arguably also conspired to destroy pensions and state retirement programmes. These are almost universally underfunded. This problem is slowly revealing itself. US pension funds in cities such as Dallas and Los Angeles are slowly admitting that they cannot make good on the promise of retirement because they are so woefully underfunded. Strikingly, this is occurring while stock markets hit record high valuations when you’d expect it to be easiest to meet performance and funding targets.

Pensioners globally are beginning to ask how and why their savings have evaporated. In some cases, low interest rates were the culprit. In others, it could be mismanagement or even theft. In the United Kingdom, we’ve seen examples of large firms where a new majority owner could strip all the cash out even when the pension fund suffered a shortfall. Business moguls are now being vilified for doing this. Witness Sir Philip Green, the founder of Topshop and owner of BHS, who was investigated for paying himself some £400 million (via his wife who is domiciled in Monaco, an offshore tax haven) while leaving the pension fund of BHS underfunded by between £70 million and £570 million at various points.40

All this brings forth demands that governments protect the public from the offshore banking system, from the greed of shareholders, from the tax consequences. Leaders may have yet to realize that pacifying their workforce is the least of their problems. Pacifying those who used to work for them may prove more intractable.

In addition, everyone in the financial world knows that pension funds everywhere are claiming that they are achieving performance that is vastly beyond reality. Why? Because the interest rate environment cannot achieve what pension funds need to meet current cash pay-outs. Pensions are claiming to achieve some 8.5 per cent returns in a world where equity and bond prices are high and not rising very much. They assure us that the returns will be there in 5–10 years. But can we trust this?

Perhaps this, then, is the triumph of Western Reductionism in its ultimate incarnation. We’ve perfected the art of financial analysis but forgotten to do the basics. Join the dots. Look after the elderly, the infirm and the poor. Live within our means.

It’s fair to say that faith, trust and belief in economic leaders are at a historically low ebb. The cynicism and breakdown in trust have reached epidemic levels. The data about the economy and the story of the individual are two very different things. Leaders pay too much attention to the quantifiable, which leaves them vulnerable to the things that affect the quality of life of their followers.

How can they feel that deflation is certain even when the risks of inflation are becoming more apparent, even in the data? Could this be yet another surprise that will leave leaders blindsided and obvious? Perhaps engaging in scenarios about inflation and deflation would strengthen the ability to face an unknown future? Preparedness might be a better option than prediction.

Leadership implications of these economic changes

Leaders in the 21st century need to know not just where they are, but how their teams feel. They need to make sure they are navigating from the right spot and in the right way. This means more study. It means more listening. It means they must appreciate that the performance of the economy, as expressed by numbers, and the story about the economy, as expressed by feelings, may not match up. The perception and the reality may have profoundly diverged both in the mind of the leader and in the minds of their stakeholders. In response to such rapid economic change, it’s easy but dangerous to fall back on old notions of what reality looks and feels like.

The paradoxes here are striking. Debt drives us apart even as the internet glues us together. Inflation pushes prices up, even as we expect the internet to drive them down. Data tell us one thing and people tell us another. We look at historic national data even when the internet has created a global economy. Perhaps the hardest aspect to make sense of is that the world is becoming more interconnected and more insular at the same time. It’s another of the internet-driven paradoxes.

We try to address the pain but perhaps the world economy is already fixing many things all by itself? We engage in greater defence spending at the very moment that interconnectedness is producing ever more GDP. Many cry for nationalist solutions at the moment that globalization is redistributing wealth and power to many who have not had it before.

Conclusions

Leaders need to understand the forces that buffet people. Falling back on yesterday’s truths about the world economy will quickly expose their lack of understanding. It’s the classic Western Reductionist mistake again. Historic data are linear but history is rarely linear at all.

This perception reality gap is the challenge leaders face when it comes to the world economy. Globalization is set to persist in the longer term, but it is occurring in new ways. The United States and Mexico are now able to compete against established emerging markets. China is entering the world stage as producer of global brands and high-end manufactured goods. The story of the world economy we like to fall back on no longer matches the story that is unfolding.

We cannot separate the economic from the behavioural, cultural, political or technical. We know that after 9/11, the political response was to cut worldwide rates of interest to zero and everyone was expected to borrow and spend. This created a huge credit boom which caused the banks and building societies to collapse under a mountain of bad debt. The political response to 2008 was to lower interest rates, in some cases to zero. Savers and citizens were punished while debtors and risk takers were rewarded. The big institutions got bailed out and the small citizens were left with the bill. There’s a word that ordinary people had for the financial crisis response. Many called it ‘nuts’. The shortfall in expert economic leadership was all too obvious. The leaders who pursued these policies say it would have been ‘nuts’ not to. The problem is that few saw these crises coming despite the indicators being there. Massive banks with brands were destroyed because of overconfidence that nothing could go wrong. Everything was logical, linear and just elegantly extrapolated into a fantasy future.

Let’s suppose for a second that it is all nuts. Literally, it is nonsensical behaviour. Even nonsensical behaviour can be managed if there is confidence that somehow, nuts though it is, it still works. Confidence, though, isn’t a conclusion. It’s a feeling. It’s an emotion lurking among all the data, the indicators, the analysis and the logic. This is one reason why leaders need to deal in feelings as well as facts. They need to assess confidence. They need to assess the confidence in them.

If worldwide economies were growing more strongly, the massive debt and historic technological changes would be less of a problem. From the United States to Europe to China, all the indicators are clear. The world economy is growing again. The world economy is picking up, at least so far. So, what leaders need to do is help guide people into the future by envisaging it, explaining it and understanding how people feel. It may be a more unstable world, but that brings opportunities that wise leaders can pursue. In part, they must dive deeper into technology. This is what underpins innovation and economic growth, and creates many of the problems, as we’ll see.

Endnotes

1 https://www.forbes.com/quotes/6957

2 Strauss, W and Howe, N (1997) The Fourth Turning: An American prophecy – what the cycles of history tell us about America’s next rendezvous with destiny, Broadway Books, New York

3 http://lyricsplayground.com/alpha/songs/s/shewaspoorbutshewashonest.html

4 Sinclair, U (1935) I, Candidate for Governor: And how I got licked, repr. University of California Press, 1994, p 109

5 https://www.wired.com/2002/03/schumpeter

6 http://www.businessinsider.com/henry-blodget-our-debt-will-kill-us-2009–10?IR=T

7 https://www.nytimes.com/2017/11/05/world/paradise-papers.html

8 https://www.ft.com/content/168c88f6-01c7-11e6-ac98-3c15a1aa2e62

9 https://tradingeconomics.com/united-states/inflation-cpi

10 https://www.ft.com/content/21dabb8e-f0d5-11e7-b220-857e26d1aca4

11 https://www.cnbc.com/2018/01/30/chart-of-surging-us-health-care-costs-explains-why-buffett-getting-involved.html

12 http://money.cnn.com/2018/01/30/news/companies/amazon-berkshire-jpmorgan-health-insurance/index.html

13 https://www.forbes.com/sites/joelkotkin/2017/10/19/rising-rents-us-housing-crisis/#502d293c1ef5

14 http://www.nydailynews.com/new-york/nyc-rents-soar-incomes-decline-article-1.1765445

15 https://www.cnbc.com/2018/01/19/how-rent-in-cities-like-new-york-and-san-francisco-changed-in-2017.html

16 http://www.pewresearch.org/fact-tank/2017/07/19/more-u-s-households-are-renting-than-at-any-point-in-50-years

17 http://www.pewresearch.org/fact-tank/2018/01/31/more-adults-now-share-their-living-space-driven-in-part-by-parents-living-with-their-adult-children/

18 https://www.bloomberg.com/news/articles/2017–10-18/xi-renews-call-housing-should-be-for-living-in-not-speculation

19 https://www.standard.co.uk/news/london/london-is-most-expensive-city-for-renting-in-europe-for-third-year-in-a-row-a3741731.html

20 https://www.globalagriculture.org/whats-new/news/en/32979.html

21 https://seekingalpha.com/article/125866-thinking-small-to-gain-big

22 http://www.latimes.com/business/la-fi-laz-shrinking-toilet-paper-20150121-story.html

23 https://www.iif.com/publication/global-debt-monitor/global-debt-monitor-january-2018

24 https://www.theguardian.com/business/2016/jun/16/chinas-debt-is-250-of-gdp-and-could-be-fatal-says-government-expert

25 https://www.theguardian.com/business/2017/aug/15/imf-warns-china-debt-slowdown-financial-crisis

26 https://www.cbsnews.com/news/most-americans-cant-afford-a-500-emergency-expense

27 https://www.msn.com/en-gb/money/personalfinance/seven-in-10-uk-workers-are-chronically-broke-study-finds/ar-AAv9tH3?li=AA54rU&;sa=U&;ved=0ahUKEwjWq-Ta-u3RAhWBwLwKHdTgDBIQFgiXATAW&%252525253Busg=AFQjCNGtalDGc78eftzTQy-u3Pbx5pqueg

28 https://seekingalpha.com/article/4141548-u-s-national-debt-will-jump-617-billion-5-months

29 https://www.wealthenhancement.com/blog/understanding-the-differences-between-efficient-and-inefficient-debt

30 https://allthingsliberty.com/2015/02/how-was-the-revolutionary-war-paid-for

31 http://www.businessinsider.com/chart-5000-years-of-interest-rates-history-2016–6

32 https://ftalphaville.ft.com/2013/08/06/1593422/guest-post-dual-mandate-right-goals-wrong-agency

33 https://www.kornferry.com/press/korn-ferry-2018-salary-forecast-smaller-real-wage-increases-across-most-parts-of-the-world

34 https://www.forbes.com/sites/kenrapoza/2017/08/16/china-wage-levels-equal-to-or-surpass-parts-of-europe/#5f4a34d53e7f

35 https://www.washingtonpost.com/news/fact-checker/wp/2017/09/08/president-trumps-repeated-claim-of-credit-for-foxconns-deal-in-wisconsin/?utm_term=.4351788c7c1e

36 https://www.forbes.com/sites/greatspeculations/2016/09/28/how-the-internet-economy-killed-inflation/#3f680489788b

37 http://www.bbc.co.uk/news/business-43254537

38 https://www.bloomberg.com/news/articles/2017–08-08/aging-populations-set-to-spur-higher-interest-rates-says-study

39 http://lyricsplayground.com/alpha/songs/s/shewaspoorbutshewashonest.html

40 https://www.ft.com/content/2b219156-0287–3419-b309-06d5bb3a4f6f