5.4 Price Elasticity of Supply

So far we’ve focused on how responsive buyers are to changes in prices. But you also know that the prices sellers face matter for their decisions. The law of supply tells you that when the price rises, the quantity supplied will also rise. As with buyers, we want to be able to measure by how much sellers will respond, and understand what drives whether their response is likely to be small or large.

Measuring Responsiveness of Supply

The price elasticity of supply measures how responsive sellers are to price changes. Specifically, it measures by what percent the quantity supplied will increase following a 1% price change. The larger this percent change in quantity supplied, the more responsive sellers are to price changes.

To measure the price elasticity of supply, observe how the quantity supplied responds to a price change. Specifically, you can measure the price elasticity of supply as the ratio of the percent change in quantity supplied to the percent change in price as you move along your supply curve. That is:

For instance, when the price of gas rises by about 20%, the quantity supplied typically rises by about 2%. Putting these numbers together reveals that the price elasticity of supply of gas is 0.1

Do the Economics

When demand for Uber increases—for example when it rains, when a concert or sporting event ends, or during busy commuting times—Uber responds by raising prices. If you’ve ever used Uber, you probably know this as surge pricing. The argument for surge pricing is not just that it reduces the quantity of rides demanded (think back to our earlier estimate of the absolute value of the price elasticity of demand for Uber rides) but also that the higher prices increase the quantity of rides supplied by drivers.

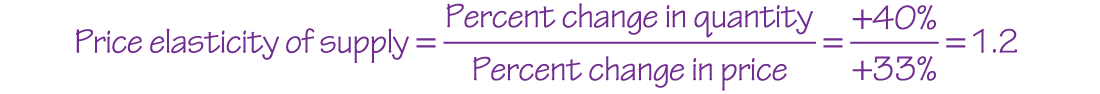

Following the end of an Ariana Grande concert in New York City, demand for rides rose. In response, Uber increased prices by 80%. This price increase led to a 100% increase in Uber drivers supplying rides. Use the percent change in the price and the percent change in the quantity supplied to calculate the price elasticity of supply for Uber rides:

Price elasticity of supply is positive.

You’ll notice that the price elasticity of supply is a positive number. That’s because changes in price lead to changes in quantity supplied in the same direction as you move along a supply curve: Raising the price increases the quantity supplied, while lowering the price reduces the quantity supplied. Just as with the price elasticity of demand (and every other elasticity as well), a bigger absolute value of the price elasticity of supply means that the quantity is more responsive to price changes. However, since the price elasticity of supply is positive, there’s no need to take the absolute value.

Quantity is relatively unresponsive when supply is inelastic.

Airports are a nightmare at Thanksgiving. Even if you book your flight home months in advance, you’ll likely find that tickets are more expensive than they are for other weekends. And if you don’t book ahead of time, you may find that flights are sold out. The airport is teeming with people who have been bumped off an oversold plane or who are struggling to get rebooked if they missed a connecting flight. With all this extra demand and higher prices, why don’t airlines just add more flights? The answer is that many airlines simply don’t have the ability to sell very many more tickets in response to higher prices.

Airports, not airlines, control how many flights can go out of each gate, and there are a limited number of gates available. Many airports operate at near capacity much of the year, making it hard to add extra flights at busy times. Airlines could fly larger planes, but where would they get the bigger planes for just a week or two? And their supply of pilots and flight attendants is limited, as safety laws limit the hours crewmembers can work. In short, it is really difficult for airlines to increase the quantity of flights supplied by much in response to higher prices at busy times of the year.

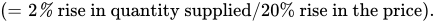

When suppliers can’t increase the quantity supplied by much in response to higher prices, economists describe their supply as inelastic. Just as with the price elasticity of demand, we say that supply is inelastic whenever the magnitude of the percent change in quantity supplied is smaller than the percent change in price. This means that supply is inelastic if the price elasticity of supply is smaller than 1. As Figure 7 shows, this corresponds with a relatively steep supply curve.

Figure 7 | Inelastic and Elastic Supply

Quantity is relatively responsive when supply is elastic.

Marcus runs a catering business out of what used to be a restaurant. The space is more than he currently needs, but he couldn’t find anything smaller at a lower price. With the economy improving, more people want to host catered events, and the prices that he can charge are rising. These higher prices make it profitable for him to expand, so he quickly hires more people to help in the kitchen, and he is grateful that the kitchen has room to expand. He doubles his bookings right away and is considering leasing an even bigger space for the coming year if prices continue to rise.

When suppliers like Marcus are very responsive to price, economists describe their supply as elastic. Just as with the absolute value of the price elasticity of demand, we say that supply is elastic whenever the magnitude of the percent change in quantity supplied is larger than the percent change in price. This means that supply is elastic if the price elasticity of supply is larger than 1.

Perfectly elastic and inelastic supply represent the extremes.

As with demand, there are two extreme cases. When the supply curve is completely horizontal it means that the price elasticity of supply is infinite—any change in price leads to an infinite change in quantity supplied. Economists call this perfectly elastic supply. When the supply curve is completely vertical it means that the price elasticity of supply is zero—no matter what the change is in price, the total quantity supplied is unchanged. Economists call this perfectly inelastic supply.

For any two supply curves passing through the same point, the supply curve that is relatively flatter at that point will have more elastic supply at that point than the supply curve that is relatively steeper. Figure 7 summarizes the difference between perfectly inelastic, inelastic, elastic, and perfectly elastic supply. As you read through this table, test yourself on what each of these concepts means.

Determinants of the Price Elasticity of Supply

The price elasticity of supply reflects how willing businesses are to increase the quantity supplied in response to a higher price. To assess this, put yourself in the shoes of a supplier, and think about how you would respond to a higher price. If you increase your production, your profits will likely rise, but by how much depends on how rapidly your marginal costs rise. And that, in turn, depends on how flexible your business can be.

Price elasticity of supply is all about flexibility.

Your business’s flexibility is the underlying determinant of your price elasticity of supply. It describes how easily and cheaply you can mobilize resources to expand production when prices rise, and how easily you can cut your expenses or repurpose your resources when the price falls. The more flexible you are, the greater your price elasticity of supply will be.

Recall how hard it is for airlines to respond to an increase in ticket prices at the holidays. An airline such as United typically lacks the flexibility to adjust the supply of airline tickets because it doesn’t have much flexibility to add more workers, more planes, or more flights. Similarly, when prices fall, United is equally inflexible. It could fly its planes less full, but that yields very little savings because it is still paying for the airplane, flight attendants, fuel, and airport. And it can’t easily repurpose its planes to other tasks, because what else can you use a 747 for? (It’s not going to be a very effective crop duster!) If United cuts back on the number of flights without repurposing its planes, it has to pay for storage of the plane; it’s also likely that it has union contracts that will make it hard to cut back on staff. Both of these factors reduce the cost savings from cutting back on flights. All of this inflexibility means that the supply of flights is relatively inelastic.

By contrast, recall that Marcus easily expands his business when prices rise because he has a lot of flexibility in how he runs his catering business. When the price he gets for catered food rises, he finds it easy to buy more raw ingredients, hire more staff, and make more food. The extra space in his kitchen means that he doesn’t face capacity constraints. Likewise, if the price of his goods were to fall, he can simply cut back on production. It’s not a big deal, because he can simply order less from his suppliers. His staff are mostly hourly workers, so he can easily cut their hours as well. All of this flexibility means that the supply of catered meals is relatively elastic.

Bottom line: Flexibility determines the price elasticity of supply. It’s an idea that underpins each of the following five determinants of the price elasticity of supply.

Supply elasticity factor one: Inventories make supply more elastic.

If your business’s product is easily stored, then you can use inventories to provide the flexibility to respond quickly to price changes. For instance, oil refineries can immediately dial up supply by selling stored inventories of gas when the price is high. They can also dial it back down by stockpiling inventories when the price is low. As a result, the quantity supplied can respond rapidly to price changes, yielding more elastic supply.

Inventories provide flexibility by breaking the link between production and supply. They allow you to adjust the quantity you supply, even if it is difficult to adjust your production. But it’s a form of flexibility that not all companies have. A refinery can get away with selling gas that it manufactured a month ago. But if a catering company tried that with their sandwiches, the health department would shut them down.

Supply elasticity factor two: Easily available variable inputs make supply elastic.

If the variable inputs you need to expand production are easily available, then your supply will be more elastic. This is because you’ll be able to increase production swiftly in response to a price rise. For instance, Marcus’ catering company can easily hire more workers and buy more supplies when the price of catered meals rises. As a result, he has the flexibility to increase the quantity he supplies in response to a price rise. By contrast, while it’s easy for airlines to buy more fuel, it’s harder to get more pilots or more planes. The problem is not that these inputs are impossible to get, but rather that the extra cost involved makes expanding production not worthwhile.

It’s also important to think about reallocating your existing resources, because that can give you greater flexibility to respond to changes in the prices of specific products. For example, if the price of flights between Detroit and Phoenix rises, United could reallocate its resources, shifting the planes, pilots, and gas from other routes to flying between Detroit and Phoenix instead. By contrast, we’ve seen that if the price of all airline tickets were to rise, it would be difficult for United to expand its total number of flights, because this would require more pilots and planes. As a result, supply in narrow categories like Detroit-to-Phoenix flights is often relatively elastic, even as the supply of broader categories—like airline tickets generally—is relatively inelastic.

Supply elasticity factor three: Extra capacity makes supply elastic.

Sometimes a business has fixed inputs, such as a factory in which it manufactures goods or an office for its workers. Marcus’s catering business has a kitchen in which his workers prepare meals. In the short run, these fixed inputs provide a constraint on a business’s ability to expand production. That means that if a business is already using its fixed input at full capacity, it will be difficult to respond even if a business can easily access more of its variable inputs. If, on the other hand, it has extra capacity, then its supply will be more elastic.

One of the reasons that Marcus’s catering company can easily adjust production as prices change is that he has a larger kitchen than he needs. This extra capacity gives him the flexibility to respond to higher prices by hiring more kitchen staff and catering more events. But there’s a point at which he’ll use up this extra capacity, and once he runs out of kitchen space, he won’t be able to increase production—at least not without a costly investment in renting a new kitchen. At that point, his price elasticity of supply will become inelastic.

It’s worth thinking broadly about what capacity constraints might limit your flexibility. For instance, a key constraint on airlines is that they need an airport gate to load and unload their passengers. And there are only a fixed number of gates in each city, meaning that many airlines can only sell more tickets by buying bigger planes.

Supply elasticity factor four: Easy entry and exit make supply more elastic.

So far, we have focused on how existing businesses can change production in response to changing prices. However, the quantity supplied in the market is also a function of the number of suppliers. When the price rises, new businesses may enter the market, and when it falls some businesses may exit. Market supply will be more elastic when it is easier for businesses to enter or exit a market.

The flexibility to freely enter the catering market is one of the key reasons that supply is quite elastic. If you want to start a catering company, you’ll need cooking skills, business know-how, a kitchen, and around $100,000 to cover startup costs. It’s not easy, but there are enough people with these skills and assets that when prices rise, you’ll see people start new catering companies. The entry of new businesses leads to a rise in the total quantity supplied at a higher price.

By contrast, it is rare to see new airlines start in response to high prices. After all, a single Boeing 747 costs over $300 million, and you’ll probably need a few of those to get started. And who’s got that sort of cash lying around?

Supply elasticity factor five: Over time, supply becomes more elastic.

Supply adjustments often take time, and so the quantity supplied will adjust by a lot more over a period of several years than it will over several days. As a result, the price elasticity of supply is typically larger when you’re looking over a longer time horizon.

Think about how the influence of each of the factors listed above varies over time. How do managers respond after a price rise? That afternoon, the only way to increase the quantity supplied is to run down your inventories. Over the next few days, you might think about how to expand your production. In the longer run, you can also expand your capacity by building a new factory. And in the long run, high prices will lure new businesses into the market. The result is that the price elasticity of supply may be quite small in the short run, but it is typically much larger over the long run. How long does it take to get the full adjustment? Again, it depends. You can set up a new catering business relatively quickly, so the long run for catering may be only a year. Building new oil refineries takes much longer, and so the long run for gasoline can be more than a decade.

Calculating the Price Elasticity of Supply

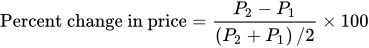

Just like with the price elasticity of demand, it’s useful to have a consistent measure of the price elasticity of supply between two points. To do this, we once again need to use the midpoint formula to calculate the percent changes in price and quantity. As a refresher, to calculate the percent change in quantity between any two points, Q2 and Q1, divide the difference between the two points by the average of the two points. Thus, the formula for calculating the percent change in quantity is:

Similarly, to calculate the percent change in price between any two prices, divide the difference between them by the average of the two price points. Thus the formula for calculating the percent change in price is:

Basically, the midpoint formula you learned for demand works equally well for supply and it’s just as useful.

Once you’ve calculated the percent change in quantity and percent change in price using the midpoint formula, you’re ready to calculate the price elasticity of supply given what you already know—it is simply the percent change in quantity supplied divided by the percent change in price.

Do the Economics

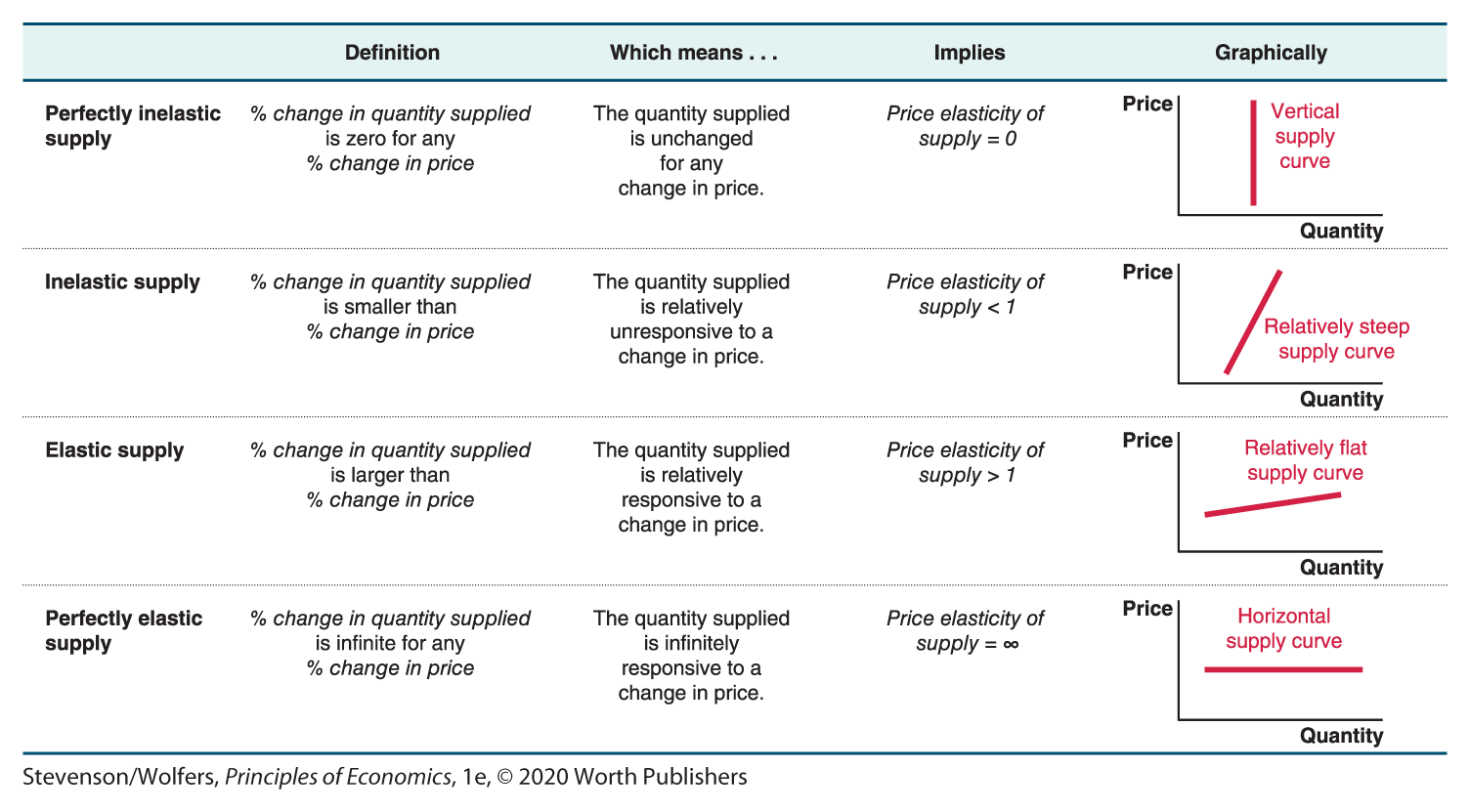

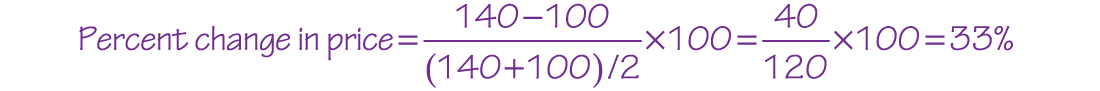

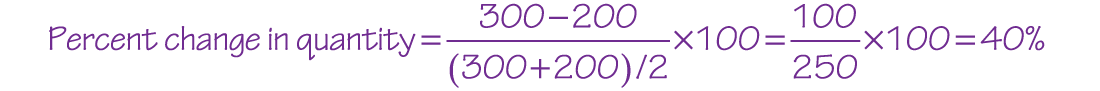

Let’s calculate the change in Uber drivers supplying rides when the price rises using the midpoint formula. Usually an Uber driver can expect to earn $100 driving a 6-hour shift. But surge pricing on particularly busy nights mean that Uber drivers can expect to earn $140 driving a 6-hour shift. Typically, there are 200 drivers on the road, but surge pricing leads that to rise to 300 drivers. Calculate the price elasticity of supply of Uber drivers using the midpoint formula.

Step one: What was the percent change in the price?

Step two: How much did the quantity supplied change as a percent, in response?

Step three: Calculate the elasticity: