12.3 Institutional Factors That Explain Why Wages Vary

The labor market is shaped by laws and institutions that tend to moderate the economic forces of supply and demand. As we turn to exploring these laws and institutions, we’ll focus on their implications for wages. But it’s worth noting that any force that pushes wages above the equilibrium wage leads the quantity of labor supplied to exceed the quantity of labor demanded. In fact, the idea that unemployment is caused by the market wage getting stuck above its equilibrium level is a key topic we’ll return to in macroeconomics.

Government Regulations

The government regulates the labor market in many different ways. It sets a minimum wage that employers can pay workers, including requiring that many workers are paid an overtime rate when they work more than 40 hours a week. The government decides minimum education or training necessary for many jobs. It sets safety standards. And it requires information to be disclosed—like how employees have been injured on the job and differences in the average pay of men and women. These rules shape the labor market and help determine how many workers are hired and the wage they’ll be paid.

The “fight for $15” began when 200 fast food workers walked off the job to demand $15 an hour and union rights. It became a social movement for higher minimum wages.

Licensing laws restrict supply.

S_ _ _ happens. But only if you are licensed.

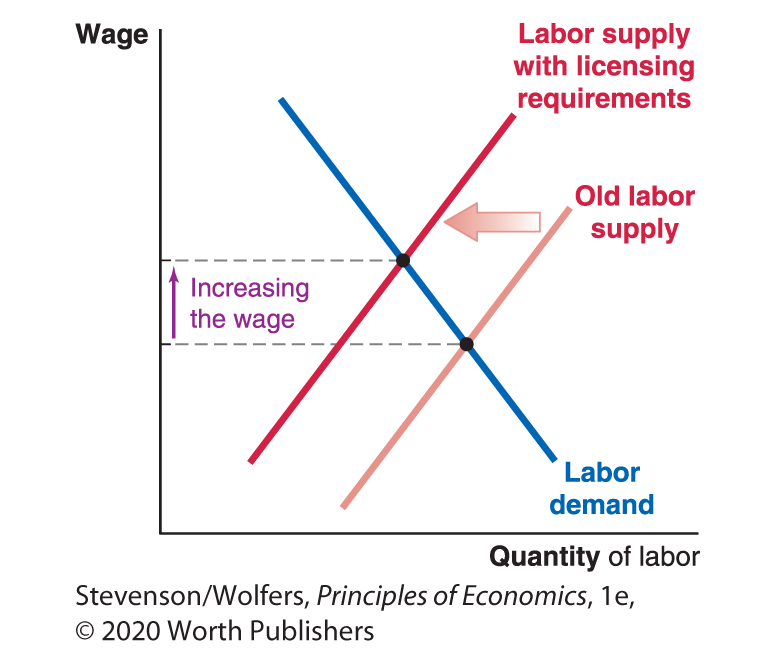

You probably know that to start working as a doctor, you need to be licensed. The rationale is that this will protect patients from being operated on by quacks. In the case of doctors, such a requirement helps keep you safe. But there’s another effect. If it’s difficult to get a license, there will be fewer doctors. And licensing laws don’t just apply to doctors, but to nearly one-third of the workforce, including some interior decorators, manure applicators, and even fortune tellers. As Figure 3 shows, these licensing requirements decrease labor supply, thereby raising the wages of those who do get licenses—perhaps by as much as 15%. So licensing laws increase safety and raise costs. Is it worth it? It probably depends on the job and who you ask.

Figure 3 | Occupational Licensing

Minimum wage laws raise the wage above equilibrium.

The federal minimum wage law says that, as of 2018, your employer can’t pay you less than $7.25 per hour. However, there are exceptions—mainly for jobs where you can make up the difference in tips, such as waiting tables. Some states require employers to pay a minimum wage that is higher than the federal minimum wage. By the end of 2018, the highest minimum wage in the United States was $15, required by California cities like Berkeley, Emeryville, and San Francisco. Overall, California has a minimum wage of $11. The highest statewide minimum wage was $11.50 in Washington, although the District of Columbia had a minimum wage of $13.25. Many states have passed legislation that requires their minimum wage to increase over time. A minimum wage is an example of a price floor, which we studied in Chapter 7.

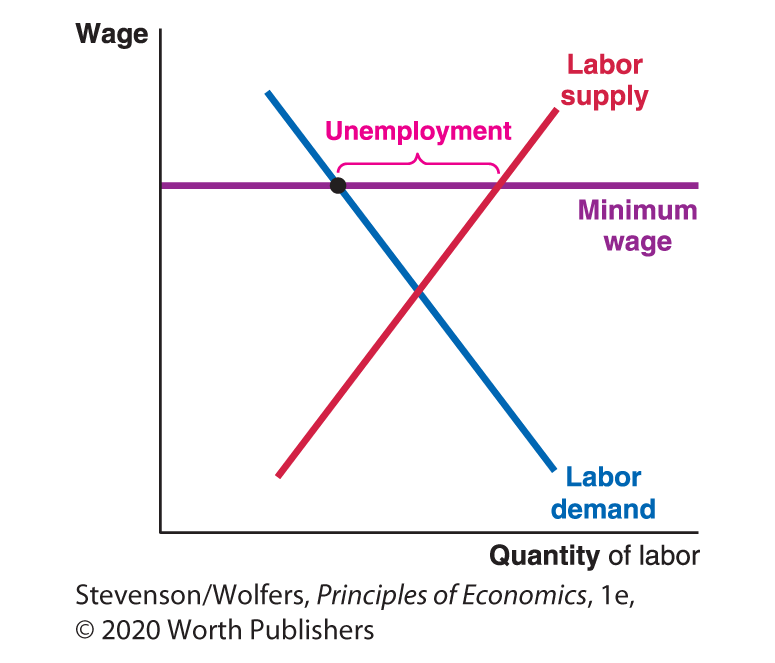

A high enough minimum wage will push wages above the equilibrium wage. As Figure 4 shows, in a competitive labor market this will cause a decrease in the quantity of labor demanded and an increase in the quantity of labor supplied, thereby creating unemployment.

Figure 4 | Effect of Minimum Wages

The minimum wage is a hotly contested political issue. Opponents of a higher minimum argue that setting the minimum wage too high will lead to unemployment, which is even worse than a low-wage job. Proponents of a higher minimum wage argue that many workers earn low wages because they lack bargaining power. The minimum wage offsets some of this disparity in bargaining power, ensuring that the working poor earn a wage high enough to lift them out of poverty.

Economists have conducted hundreds of studies to try to evaluate the effects of raising the minimum wage, and there’s an ongoing debate about the evidence. On average these studies show that a higher minimum wage reduces employment, but quite a few studies show that this effect is quite small, and in some cases it may be barely detectable. However, there are also studies suggesting that the longer-run effects may be larger than what we see in the short run, since it can take a while for businesses to adapt to the higher cost of workers. Whether the minimum wage has small or large effects on employment depends on the elasticity of labor demand. The evidence so far suggests that labor demand is relatively inelastic, but it becomes more elastic over time. Recall that you learned this idea in Chapter 5—in the short run demand tends to be more inelastic than it is in the long run. But even in the long run, it’s not clear how elastic labor demand is and the elasticity of labor demand remains an important part of the minimum-wage debate.

Many studies also show that the minimum wage is a poorly targeted antipoverty policy because many minimum-wage workers are either part of a higher-income household or will quickly find a higher-wage job. Thus, another important part of the minimum-wage debate is a value judgment as to whether it’s worth trading off somewhat higher wages for some workers for a higher risk of unemployment for others.

Unions and Workers’ Bargaining Power

Government regulations give workers the right to jointly negotiate for better pay and conditions. That’s where unions come in: They’re organizations representing workers who band together to ensure that they are able to jointly negotiate with their employers.

Unions boost the wages of their members.

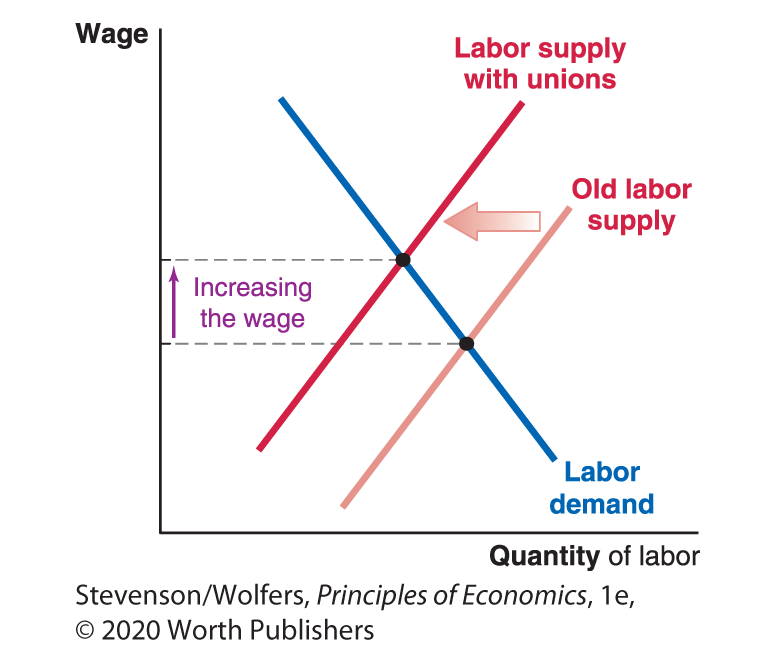

The logic of unions is that when workers band together they have more bargaining power and can push for a better deal. Think about it: If you alone threatened to go on strike unless your boss gave you a pay raise, she would probably just fire you. But if every worker at your company does this together, then your boss is likely to be more responsive. Effectively, the union is working to raise the wage at which their members are willing to supply labor. As Figure 5 shows, by shifting the labor supply curve upward or to the left, unions raise the wages of their members.

Figure 5 | The Effect of Unions

On average, unionized workers earn 10 to 20 percent more than a comparable worker in a comparable non-union job. Union contracts also tend to require smaller wage differences between high-paid and low-paid workers. However, only around 11% of U.S. workers are unionized, down from rates that were more than three times as high during the 1950s. Unions remain an important force in some parts of the economy, including the public sector, education, transportation, utilities, construction, and telecommunications. Unions also play a larger role in many European countries, including France, Germany, Italy, and Sweden.

Unions can make businesses more productive.

Managers often resist unions because they’re worried that the greater bargaining power of workers might reduce their profits. But by providing a voice for their members, unions can improve communication between management and workers. When workers and their bosses communicate well, they can often find more efficient ways to do things; thus improved communication can lead to greater productivity, which can boost profits. So if you’re managing a firm with historically hostile labor relations, realize that working toward a more productive relationship might be in your best interest.

Having considered workers’ bargaining power, let’s turn to evaluating the bargaining power of their employers. To do that, we’ll need to detour to a place that’s sometimes called Chocolate Town, USA.

Monopsony and Employers’ Bargaining Power

Hershey, Pennsylvania, is the home of the Hershey’s Kiss, and about 14,000 people live there. Consider your career options if you were a resident of Hershey. You could work at the Hershey chocolate factory, the Hershey corporate offices (which employ about 4,500 people), or the Hershey theme park (which employ up to 8,000 more), Hershey’s Chocolate World, the Hershey Schools, the Hershey Museum, or Hershey Gardens. In each case, you would be working directly or indirectly for the Hershey Trust. There are a few other employers in town, but not that many.

Monopsony power reduces wages.

This means that the Hershey Trust has a lot of bargaining power. If it decides to offer low wages, your only options are to accept that low wage, get by without a job, or leave town. So even if your marginal revenue product is $1,000 per week, you might accept a job paying only $600 per week. This is an example of monopsony power—a business using its bargaining power as a major buyer to pay lower prices, including lower wages. (And if monopsony sounds like an odd word, it might help to realize that just as a monopoly is the only seller of a good, a monopsony is the only buyer.)

While Hershey is an extreme example, the same ideas apply in many other labor markets. The federal government is the dominant employer in Washington, DC. Universities are the main employers in towns like Ann Arbor, Ithaca, and Chapel Hill. A few tech behemoths such as Google, Facebook, and Apple play a major role in hiring tech talent in Silicon Valley. And monopsony power appears to be becoming more important in specific sectors of the economy. For instance, in the retail sector, mom-and-pop stores used to compete with each other for the best talent, and this competition would drive wages up. But today, many towns are dominated by one or two big-box stores like Walmart, and many of those big companies use their monopsony power to pay lower wages.

There’s a vibrant debate about how important monopsony power is in the broader labor market, and there are good arguments on both sides. Consider, for example, the market for teachers. By one view, the local school board is a lot like Hershey and has a lot of monopsony power, because it employs nearly all the teachers in the district. An alternative perspective suggests that teachers still have a lot of bargaining power because if they’re unhappy with their pay and conditions, they can threaten to move to other districts or change occupations.

Monopsony power affects whether minimum wages hurt employment.

The importance of monopsony power can change the debate about the minimum wage. If monopsony power is holding down wages, then minimum wages that push companies to pay higher wages won’t necessarily lead to less employment. Instead, these laws might simply ensure that workers get a better deal from their bosses. Indeed, monopsony power can lead some businesses to cut back their hiring to keep wages low. A higher minimum wage can even help eliminate this incentive, thereby boosting employment.

EVERYDAY Economics

The importance of asking for a raise

Many workers—particularly women—are reluctant to bargain for higher wages without a union. But you shouldn’t be. Linda Babcock, who is a professor at Carnegie Mellon University, noticed that the starting salary of her male students was about $4,000 higher than that of her female students. This surprised her, given that the women in her class were typically at least as talented as the men. So she asked them about how they had negotiated their pay. A majority of men—57%, to be precise—had negotiated for a higher salary than they were initially offered, while only 7% of women had done so. Those who had negotiated had succeeded in raising their salary offer by $4,000 on average! These differences in bargaining potentially explain part of the male–female wage gap. This study is the foundation for the advice that Babcock now gives all of her students: If you want a higher wage, ask for it!