22.3 The Analytics of Economic Growth

So far we’ve explored the ingredients that determine how much a country produces at a given point in time. Now it’s time to see what happens when we put these ingredients together to answer the question: Where does economic growth come from, and will it continue?

Analyzing the Production Function

We’ll return to the production function, because it determines the roles that new ideas, labor, human capital, and physical capital play in determining output. This framework generates a number of important insights into the process of economic growth.

Insight one: Constant returns to scale means doubling inputs will double output.

Most economists believe that doubling all of the physical inputs to the aggregate production function—doubling the labor, physical capital, and human capital used—will lead to twice the output. This implies that the production function has constant returns to scale, which means that increasing all inputs by some proportion will cause output to rise by the same proportion. The replication argument explains why. If you want to double the output of your factory, you can simply replicate everything you’re already doing—opening a second, identical factory that will produce just as much as your first, using just as much labor, human capital, and physical capital. In total then, you’ll be using twice the inputs—twice the labor, human capital, and physical capital—to produce twice the output. You can also apply this argument at the level of the whole economy, so that replicating each individual business would yield an economy that is twice as big and that uses twice the inputs to produce twice the output.

This means that if the U.S. population (and therefore the U.S. workforce) grows, and the capital stock grows enough that capital per person stays the same, and investment in education also rises in proportion so that human capital per person is unchanged, then GDP per person will stay the same.

Insight two: There are diminishing returns to capital.

If you double all your inputs, then you’ll double all your outputs. But what happens if you just double your physical capital and don’t change the number of workers? You’ll produce more, but you won’t produce twice as much. Increasing only physical capital will produce a less than proportionate increase in output. Precisely how much extra it produces depends on how much capital you have to begin with.

The law of diminishing returns says that when one input is held constant, increases in the other inputs will, at some point, yield smaller and smaller increases in output. In this case, if there’s a fixed number of workers and technology isn’t changing, successive increments of physical capital will yield smaller and smaller boosts to what each worker produces. Similarly, with a fixed capital stock, adding more workers will yield smaller boosts to production. This doesn’t mean that more capital or more workers aren’t helpful, but just that each additional investment is less helpful than the previous one when at least one factor of production is held constant.

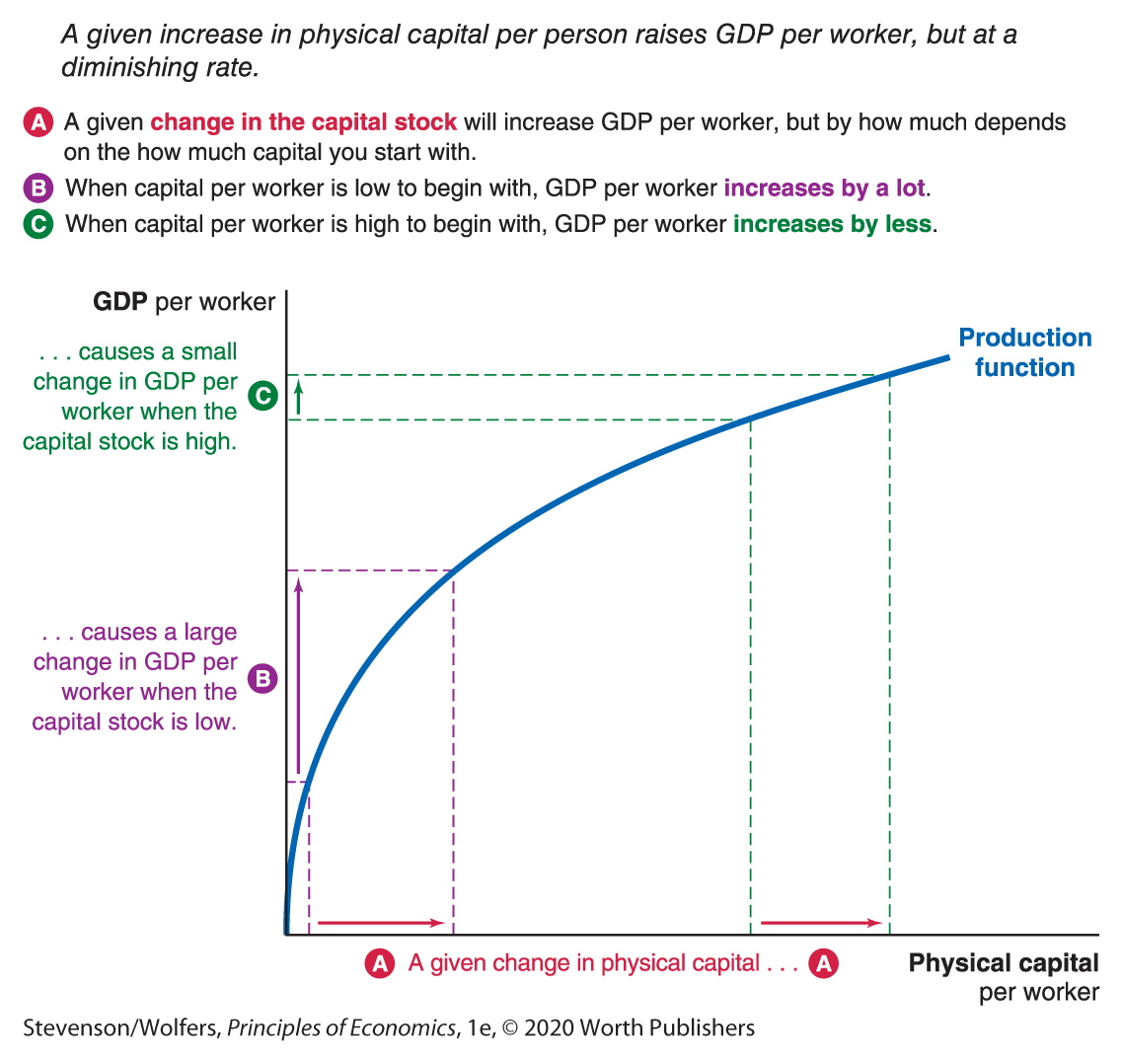

Figure 10 shows the relationship between the amount of physical capital per worker and the output they produce—in other words, GDP per worker. When workers don’t have many tools to work with, the marginal benefit of adding one more unit of capital per person will lead to large gains in output. But once each worker has a lot of capital, adding more capital has a smaller effect. This is just the idea that more tools are helpful, but at some point, extra tools won’t make that much of a difference.

Figure 10 | Diminishing Returns to Capital

Insight three: Poor countries can enjoy catch-up growth.

South Korea is no longer a poor country, thanks to catch-up growth.

Diminishing returns means that additional investments in physical capital don’t much boost output in rich countries which already have a lot of capital. But it can lead to a much bigger gain in output for poor countries which have very little capital to start with. So if a relatively poor country starts investing in machines, factories, and other equipment, it will experience relatively rapid output growth.

Indeed, this is the story of South Korea’s extraordinary growth that rocketed it from a poor country to a rich one. In 1970, South Korea had very low levels of capital per person. Over the next thirty years, GDP grew by a factor of 12, fueled by a 27-fold increase in the quantity of capital. A comparison with the United States makes the point clearly. Capital per person increased by roughly $65,000 in both South Korea and the United States, but because the United States already had abundant capital, it didn’t generate growth anywhere near as impressive.

The rapid growth that occurs when a relatively poor country invests in capital is known as catch-up growth. It raises the possibility that if poor countries make similar investments to rich countries, the gap between poor and rich countries will narrow.

Capital Accumulation and the Solow Model

Our analysis so far suggests that capital accumulation can play an important role in boosting output. But can capital accumulation, by itself, serve as an engine for ongoing growth in output per person? To answer this question, we’ll need to jointly consider both the production function (which describes how more capital creates more output) and the process of capital accumulation (in which more output leads to more investment in physical capital). The set of insights that we’ll gain from simultaneously analyzing the production function, investment, capital accumulation, and economic growth is sometimes called the Solow model.

Insight four: The capital stock will grow as long as investment outpaces depreciation.

A country’s capital stock evolves over time as a result of investment and depreciation. Investments in new equipment and structures boost the capital stock and, therefore, the economy’s capacity to produce output. But machines break down, factories crumble, and roads get potholes, so each year some proportion of the existing capital stock is destroyed by depreciation.

This means that the capital stock will grow—that is, capital will continue to accumulate—as long as investment exceeds depreciation. And the production function tells you that as long as capital per person is growing, then so is output per person, and so living standards are rising. Put these pieces together, and it says that the economy will keep growing as long as investment exceeds depreciation.

Insight five: Capital per worker will eventually stop growing.

This machine makes her more productive, but how many can she use at once?

Sadly, this won’t continue forever. First, there’s the problem of rising depreciation: As the capital stock grows, there are more machines, and if a fixed fraction of them fail each year, total depreciation will grow. That means the economy will need to generate larger and larger amounts of investment merely to replace the capital lost to depreciation. Second, there’s the problem of diminishing returns: Each increment of capital creates a smaller and smaller increment to output. If businesses devote some share of their output to investment, then these smaller boosts to output will yield successively smaller boosts to investment.

This combination of diminishing returns and depreciation means that at some point the amount of new investment the economy generates will no longer exceed the amount of capital lost to depreciation. When investment and depreciation are equal, the capital stock stops growing.

Insight six: Capital accumulation can’t sustain long-term economic growth.

The key question the Solow model asks is whether capital accumulation can generate sustained economic growth. Will a burst of investment set in motion a virtuous cycle, in which the increase in capital leads to more output, and that output is used to fund more investment which will further increase the capital stock, which in turn will further boost output, and so on?

That virtuous cycle exists, but we’ve discovered that eventually this process peters out. Each successive cycle of increased capital yields successively smaller boosts in output, and so smaller boosts in investment. But on each successive cycle the economy’s depreciation bill keeps rising. Eventually the process stalls because the economy grows to the point where new investment in capital merely offsets depreciation. The capital stock remains at a rest point that we call the steady state. And when the capital stock stops growing, then—in the absence of technological progress or other factors changing the number of workers or their skills—output will stop growing too. Economic growth has petered out, and the economy has come to rest.

We’ve discovered that while capital accumulation alone can’t support sustained economic growth, it can explain why poor countries will experience rapid growth as they catch up or converge to the rich countries. But capital accumulation can’t explain why rich countries such as the United States and much of Europe have enjoyed sustained economic growth. That means we’re going to need to look elsewhere to figure out what’s driving the ongoing rise in output per person in the advanced economies.

Technological Progress

The key to sustained economic growth is technological progress. The development of new production methods creates new ways to combine existing resources to produce more valuable output. Businesses can use these new and improved recipes to produce more output from any given set of inputs.

Technological progress shifts the production function.

That means that technological progress shifts the production function, increasing the output that’s produced from any given level of inputs. As Figure 11 illustrates, this shifts the production function upward, boosting the amount of output each person produces, for a given level of capital per person.

Figure 11 | Technological Progress Shifts the Production Function

Technological progress can make investing in capital more productive and more valuable. Specifically, notice that the new production function in Figure 11 is steeper, which means that the extra output you get from investing in one more machine has risen. As a result, a burst of technological progress will also spur a burst of new investment, and the economy will grow toward a new and higher steady-state level of capital. So technological progress both leads to more output from existing inputs, and also spurs capital accumulation, raising the level of inputs.

Figure 11 illustrates that one burst of technological progress can push the production function up, which will raise the level of GDP. And so it follows that sustained and continual bursts of technological progress will lead to sustained growth in GDP. By this view, the key to sustained economic growth is sustained technological progress, continually pushing the production function up.

Technological progress relies on new ideas.

Marie Curie’s ideas about radiation led to discoveries, and eventually treatments, that could cure cancer.

Now that you know how important technological progress is to economic growth, a natural question is: How do we get it? New technology is fundamentally about new ideas. It is new ideas that create new ways to transform existing physical inputs into more valuable outputs. But where do new ideas come from, and how do they power economic growth?

Two things drive technological progress: how quickly new ideas are created, and how many resources are devoted to generating new ideas. Workers can produce either goods and services or new ideas. So the number of workers focused on new ideas can rise both from a rising population, and also by allocating resources away from producing goods and services toward producing new ideas. There’s a trade-off here: In the short run, if everyone produced goods and services, our economy would produce more goods and services. But in the long run, with no one investing in technological progress, there would be no economic growth. But if enough resources are devoted to ongoing research and development, that will yield a steady stream of new ideas, powering ongoing economic growth.

The absence of technological progress explains why growth took so long to occur.

The insight that technological progress requires resources can help explain why the world went millennia without generating economic growth: When people were in a battle to survive, there were no spare resources to devote to generating new ideas. And so subsistence living begat subsistence living.

This insight also explains why the agricultural revolution was the catalyst that sparked the modern era of sustained economic growth. Improvements in agriculture allowed societies to produce enough food that it freed people to pursue other tasks, including generating new ideas. And those ideas spurred the Industrial Revolution, which led to the modern era of sustained economic growth. It’s a process that builds on itself, as the more an economy is already producing, the easier it is to sacrifice production today in order to invest in generating the ideas that will power future economic growth. You can think about all this through the lens of the opportunity cost principle—the true cost of something is the most valuable alternative you must give up. Back when humans weren’t producing enough food to prevent starvation, the opportunity cost of producing new ideas instead of farming was producing less food, which translated to starvation, and death. Today, the opportunity cost of having people work on innovation is lower, and so we do more of it.

Technological progress allowed us to break the cycle of poverty.

Some wonder if there are any limits to how fast the economy can grow. They worry that if the economy grows too quickly, we may run out of the things we need, such as oil, land, and other natural resources. Thomas Malthus, an eighteenth-century economist, feared that living standards could never truly improve because as more food was produced, the population would grow, which would require more food production. He believed that food production would never successfully outpace population growth, so the world was forever doomed to subsistence living. Malthus was wrong about the future, but he was right about the past. Remember that for more than a million years, there was so little economic growth that GDP per person remained near the minimum necessary to sustain life. The reason for this is that for most of history, there was little technological progress.

Malthus was wrong about the future because technological progress in agriculture vastly outpaced population growth. The earth’s ability “to produce subsistence for humanity” was much greater than he ever thought possible, and that change occurred because of new ideas about how to produce more with less. We now grow food using a small fraction of the resources that were required in Malthus’s time.

If there are no limits to technological progress, there are no limits to economic growth.

Modern-day concerns about the limits of economic growth have often focused on energy consumption. Not only might greenhouse gases warm the planet, but energy use gives off waste heat, and so the more energy we use, the hotter the planet will become. But it turns out that even as countries like the United States have continued to grow, we haven’t increased our energy consumption much. Indeed, the consumption of fossil fuels in the United States declined over the last two decades. On a per person basis, U.S. energy consumption peaked in the 1970s. This doesn’t mean that you shouldn’t worry about pollution; it just means that you can’t conclude that it means economic growth is limited.

If new ideas are the engine of economic growth, then our ability to combine existing resources in ever more productive and valuable ways is only limited by our imagination. As long as we keep coming up with new ways to do more with less, the economy can keep growing. As a result, most economists expect that we will enjoy ongoing economic growth and continually rising living standards for the foreseeable future.

Ideas can generate unlimited growth.

Society’s ability to continually produce new ideas is the key to unlocking long-run growth. And idea-driven, rather than capital-driven, economic growth can be sustained because ideas are different from physical capital in three ways:

- Ideas can be freely shared. My use of a new idea doesn’t make it harder for you to use that idea. Economists refer to this as nonrival, which means that one person’s use of an idea doesn’t subtract from another’s.

- Ideas do not depreciate with use. An idea doesn’t wear out the way a factory does.

- Ideas may promote other ideas. Ideas can beget new ideas through spillover effects. For example, Apple’s invention of the iPhone spurred app creators to invent new applications for smartphones. Ideas can also beget new ideas by lowering the opportunity cost of producing new ideas. This means that ideas can create a virtuous cycle of more ideas, more growth, and then even more ideas.

The fact that ideas can be freely shared means that any new idea can be deployed across thousands or even millions of producers, making the entire economy more productive. Because ideas don’t depreciate with use, we don’t need ongoing annual investments to be able to keep using an idea. This means that unlike investment in physical capital, all new investment in ideas will boost the stock of ideas, which generates higher levels of output. As long we continue investing in the research and development that generates the ideas that fuel technological progress, the economy will continue to grow. And the insight that ideas may promote other ideas means that the process of discovering new ideas can be self-sustaining, leading economic growth to be self-reinforcing.

EVERYDAY Economics

Innovative companies make time for new ideas

You may think it’s just a washing machine, but it started with an idea.

Successful managers know that new ideas are the key not just to economic growth, but to the growth of their own business. Google founders Larry Page and Sergey Brin recognized the trade-off workers face between producing goods and services and producing new ideas—and they wanted to ensure that their employees spent time working on new ideas. That’s why Google embraces the “20% rule,” which empowers all employees to spend up to 20% of their workweek dreaming up and developing their own ideas for new products. Google argues that this option helps keep their highly creative employees engaged in generating new ideas. It also ensures that workers maintain control over their creative energy and some of their work time. Does it work? It sure seems to: Gmail, Google Maps, and Google News all started as projects that employees pursued in their 20% time.

Lots of companies implement similar tactics to ensure that their employees devote some time to developing new ideas. For example, the CEO of Bosch Group asked its entire workforce to form into teams that were tasked with trying to come up with ways to compete against Bosch. They took the best ideas these teams came up with and gave a selected group of people eight weeks leave from their regular duties to see if they could turn the idea into a new or improved product for Bosch.

The bottom line is that it takes time to come up with new ideas, and smart managers make sure that their workers have time to innovate.

The problem with ideas is that they are often nonexcludable, which means that it’s hard for you to prevent others from using—and profiting off—your idea. It’s a problem that can lead people to underinvest in coming up with new ideas, creating innovations, and bringing them to the market. Here’s why: If you invent a safe self-driving car, you can sell those cars and potentially make a nice profit. But the faster others can copy your idea and get their competing cars ready to sell, the smaller your profits will be. You might be better off copying someone else’s idea, rather than spending a lot of your time and resources coming up with a new idea. And so the nonexcludability of ideas creates an incentive to imitate rather than innovate.

As a result, businesses will devote fewer resources to innovation than is in society’s best interests. To see this, let’s apply the core principles of good decision making to the question of how much your business will invest in research and development. Apply the marginal principle, which says to break the question of how much to invest down to: Should I invest one more dollar? Next, apply the cost-benefit principle and conclude that you should if the marginal benefits to your business of the additional dollar invested exceed the marginal costs you pay. This leads to the right decision for you, but the wrong decision for society if others benefit from your research and development. Because ideas can be copied and innovations have spillover effects, others benefit from your investments in generating new ideas. Yet those benefits are not included in your personal cost-benefit calculation. That’s why market forces tend to lead businesses to invest too little in generating new ideas.

But well-designed intellectual property laws can help ensure that more innovation occurs. Indeed, institutions—the “rules of the game”—play an important role in fostering economic growth, and so our next task is to explore their effects.