27.3 The Stock Market

This stock certificate represents partial ownership in Nike.

While Nike’s early years were bumpy, it grew quickly into a major force. In a bit more than 15 years, Phil Knight had grown from selling shoes out of the back of a van to being the CEO of a company selling nearly half of all running shoes in the United States. But Nike’s impact beyond the United States was more limited, and that bugged Phil, who had global ambitions for his company. It would take a lot of money to aggressively expand into Europe and elsewhere—more money than Nike had. So Phil decided to sell Nike stock to the public, using the money raised to fund his ambitious global expansion plans. Let’s see what this entails.

What Do Stocks Do?

A stock represents partial ownership in a firm. When you own stock in a company, you own a share of the company, which is why a stock is also sometimes called a share. In 2019, there were roughly 1,600,000,000 shares in Nike, each worth roughly $65 each. That means for $65 you can own 1/1,600,000,000 of Nike. As a partial owner of Nike, you’ll make money if it makes money, and you’ll lose money if it loses money. Think of your Nike stock as a claim to a (very small!) share of Nike’s assets and its future profits.

A stock entitles you to a share of future profits.

You stand to benefit from your ownership in two ways.

First, there are dividends. At the end of each year, Nike’s management tallies up its profits and may pay some of it out to shareholders as a dividend. Nike usually pays a dividend every three months, and over the course of the year, the dividend adds up to an annual return equal to the value of about 1% or 2% of the value of the stock. The profits that Nike elects not to send out as dividends are called retained earnings, and Nike reinvests these remaining profits into the company.

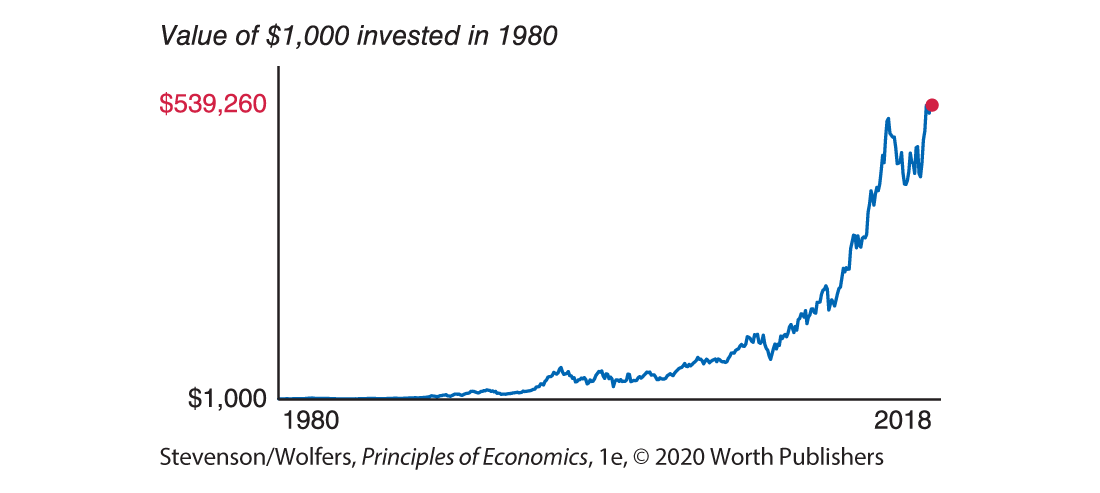

Figure 3 | Nike’s Stock Goes

Data from: Bloomberg.

This brings us to the second way you can profit from owning stock: The value of your shares can rise. As the outlook for Nike’s future profitability grows, so will the value of the company, and hence so will the price of your stock. Figure 3 shows that Nike’s stock price has gone “swoosh”: If you had been smart enough to buy $1,000 in Nike stock in 1980, your investment would be worth over $500,000 today!!!

Stocks perform three key functions, which we’ll review here.

Function one: Stocks channel funds from savers to investors.

The primary reason that businesses issue stock is to raise money to fund their investments. When a business issues stock, it is essentially expanding by taking on new partners who will each own part of the company. When Nike decided to issue stock, it offered 2.7 million shares for sale to the general public at $11 per share, which raised $30 million, and it used this money to fund its expansion plans. Thus, stocks provide a similar function to banks and bonds, channeling unused funds from savers to investors.

When companies raise money by issuing new stock, they usually sell those shares directly to the public through what’s known as an initial public offering (or “IPO,” for short). IPOs aren’t sold through the stock market. Typically IPO shares are handled by an investment bank or broker dealer, who sells the shares, typically to big institutional investors.

Function two: Stocks spread risk.

Issuing stock is like taking on new business partners. The new stock holder provides additional cash that will allow the business to grow. What shareholders get in return is a share of whatever the company produces. If the company has a great year, shareholders have a great year. They may receive more in dividend payments or they may see the value of the stock go up. In short, they gain when the company gains. But when the company has a bad year, shareholders have a bad year. Poor performance might mean that smaller dividends are paid and the value of the stock might decline. Stocks therefore spread the risk of business performance across many shareholders, reducing the risk that any one person faces.

Function three: Stocks reallocate control.

As a shareholder who owns part of Nike, you also get a chance to have a say in how it’s run. Not directly—being a shareholder doesn’t make you a manager. But shareholders get to vote in shareholder meetings. Nike’s management reports to a board of directors that’s elected by the shareholders. You’ll also get to vote on major issues like whether to merge with another company, and what to pay senior management. Each share buys you one vote, although all shareholders—no matter how small—are entitled to turn up to the annual meeting to ask questions.

She’s buying used goods.

The stock market creates liquidity and makes it easier to own stocks.

The stock market is a market for second-hand stock, where people buy and sell existing stocks. This means that when you go to the stock market to buy Nike stock, your funds aren’t going to Nike to help it open a new factory; you’re simply buying from an existing shareholder who owns some Nike stock they want to sell. Just as Toyota gets nothing when you buy a pre-owned car, Nike gets nothing when you buy pre-owned stock.

The stock market still plays an important role, but it’s different than you might have guessed. Around $500 million worth of stock in Nike is bought and sold each day. All of this trading creates liquidity, meaning that if you need access to your cash, it will be easy to sell your Nike stock at something close to a fair price. Part of the reason that people were willing to buy Nike stock in their initial public offering is that they knew that if they wanted their cash back, they could easily sell their stock on the stock market. Liquidity makes investing in Nike a less risky bet.

Comparing Stocks and Bonds

Let’s step back to compare bonds and stocks more completely, so that you can choose which works best for you. It’s a decision that you’ll face both as an investor choosing where to invest your money, and as an entrepreneur deciding how to fund your next big expansion.

Bonds pay certain annual interest payments, while stocks pay uncertain dividends.

Both when a company borrows money by issuing bonds and when it issues new stock, it gets money to fund its investments, and is committed to make future payments to whoever provides that funding. But borrowing commits you to a known set of future payments: A bond specifies exactly what interest payments (the coupon payments) will be made each year. In contrast, a stock pays a dividend that depends on how the company is doing. If Nike has a bad year, it might not pay a dividend to its stockholders, but it’ll still have to make the specified interest payments to its bondholders. And if Nike has a good year, it may issue a really big dividend to stockholders, but it’ll give bondholders nothing more than the promised interest payment. For an investor, this makes bonds a safer bet than stocks. But for a company looking to fund a big expansion, getting funding from stocks instead of bonds is less risky because it means offloading some of your risk onto your shareholders.

Bondholders get paid before stockholders if a company declares bankruptcy.

Second, there’s the question of who gets what if the company goes bust. When a company declares bankruptcy, its assets are sold and used to pay off its debts. Because a bond is a debt, bondholders get paid out of the proceeds of this sell-off. If there’s not enough money to fully repay the bondholders, they’ll get partial payment. But the stockholders get nothing unless there’s money left over after the company pays all its debts. This makes bankruptcy a much greater financial risk for stockholders than it is for bondholders.

Stockholders help control how a company is run.

Third, a bondholder has no say in how a company is managed, while a stockholder is a partial owner, and hence has some say in how it’s run. Corporate raiders will often use this power to try to force a company to make changes that they believe will enhance their profits. And this can make many entrepreneurs—particularly those who value total control over their company—nervous about issuing stock. In some cases, shareholders have voted in a corporate board that then fired the founder of a company from his or her own firm!

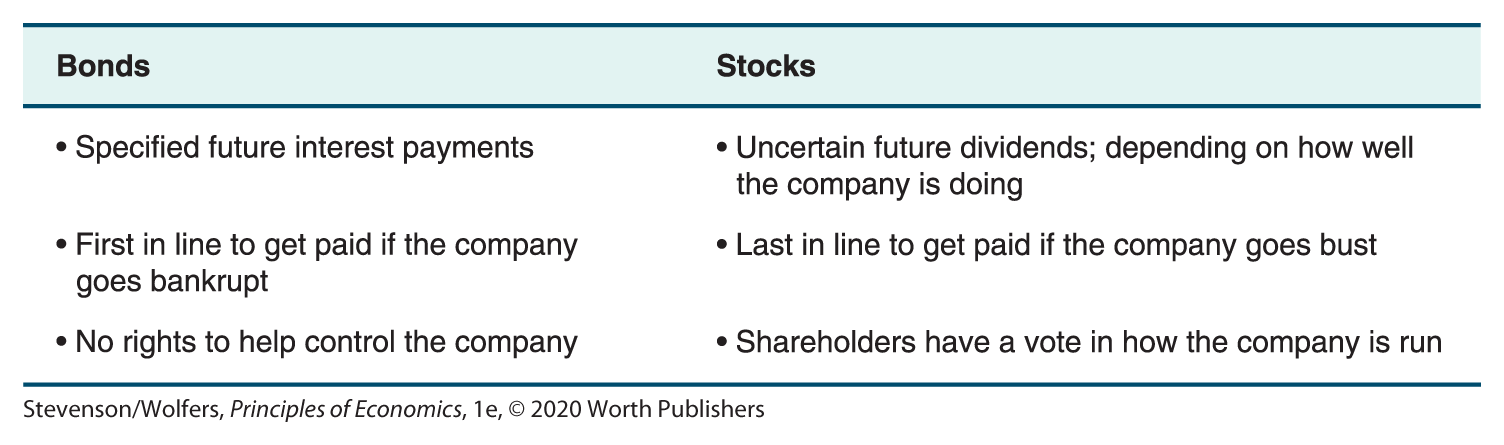

Figure 4 summarizes the major differences between bonds and stocks. As you’ll see, it’s all about the difference between lending money to a company and owning part of that company.

Figure 4 | Bonds versus Stocks

Understanding Stock Market Data

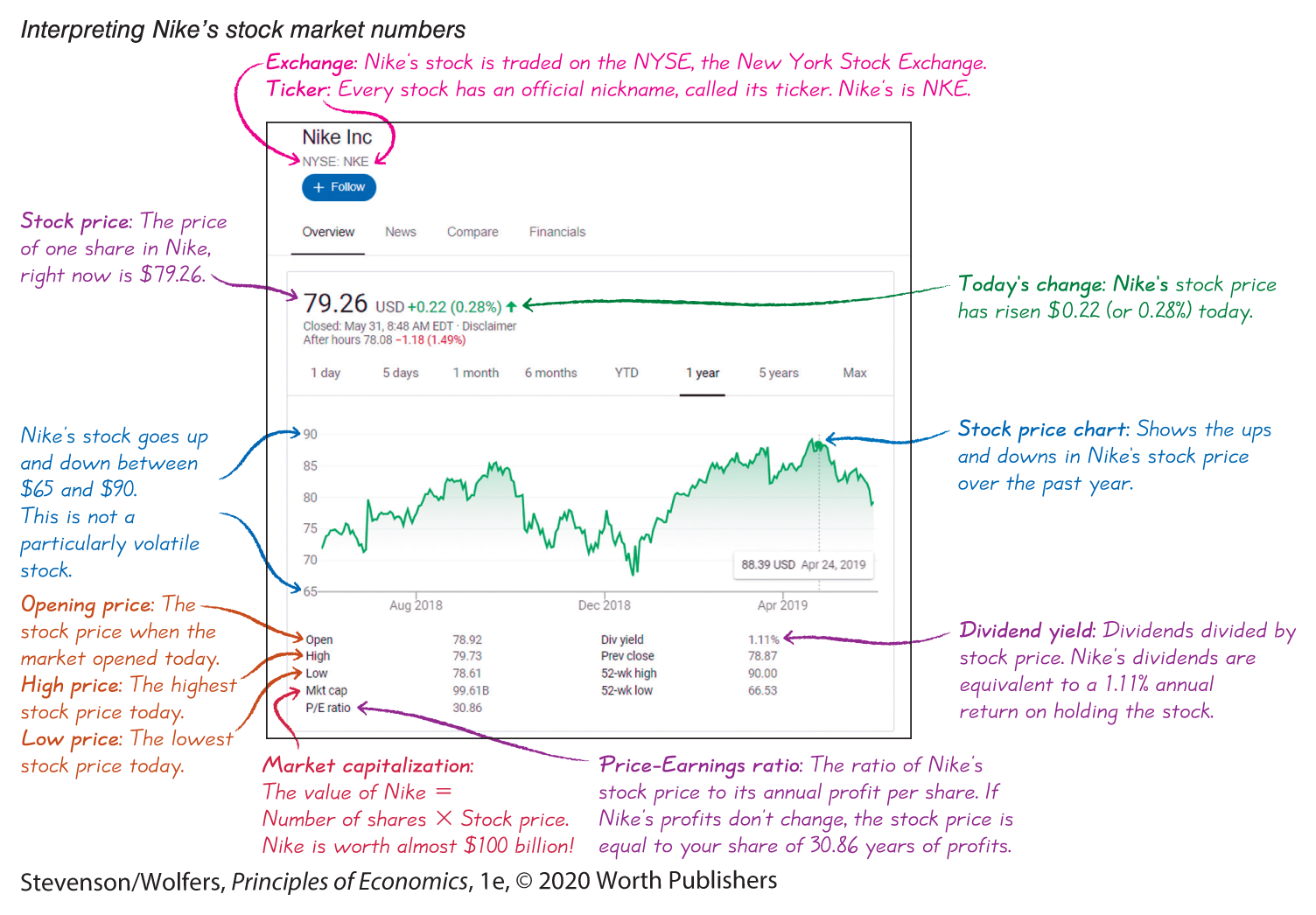

Okay, let’s dig into a bit of the jargon surrounding stocks and the stock market. Figure 5 shows you a snapshot of the stock market downloaded from Google Finance. I’m going to make it easy to interpret.

Figure 5 | What Do All Those Numbers on Google Finance Mean?

- The current stock price tells you how much your stock is worth.

- The opening price, high price, and low price summarize what has happened to the stock price during today’s trading session: what it traded for at the start of the day, the highest price it sold for today, and the lowest price it sold for today.

- You can get a better sense of how risky a stock is by evaluating its ups and downs over a period of several months or years. This is what a stock price chart can show you.

- Market capitalization tells you the value of the entire company. It’s the number of stocks, multiplied by the stock price.

- Figure 5 also shows some important ratios like the price-earnings ratio, which we’ll turn to in the next section.