28.2 Exchange Rates

How expensive are apples in Japan compared to in New York?

When the Mathisons sell their apples for $20 a bushel to a grocery store in New York, they get paid $20. (To be extra clear, we’ll write this as “US$20,” which should be read as “twenty U.S. dollars.”) But if a Japanese customer offers to pay them ¥2,400 per bushel, they have to decide whether that’s a better deal. (¥ is the symbol for yen, which is the currency used in Japan, just as US$ is the symbol for U.S. dollars.) When the Mathisons are comparing prices in different currencies they’re going to need to find a way to, yep you guessed it, make an apples-to-apples comparison. So they’re going to need to figure out the value of a dollar relative to the yen.

Exchanging U.S. Dollars for Foreign Currencies

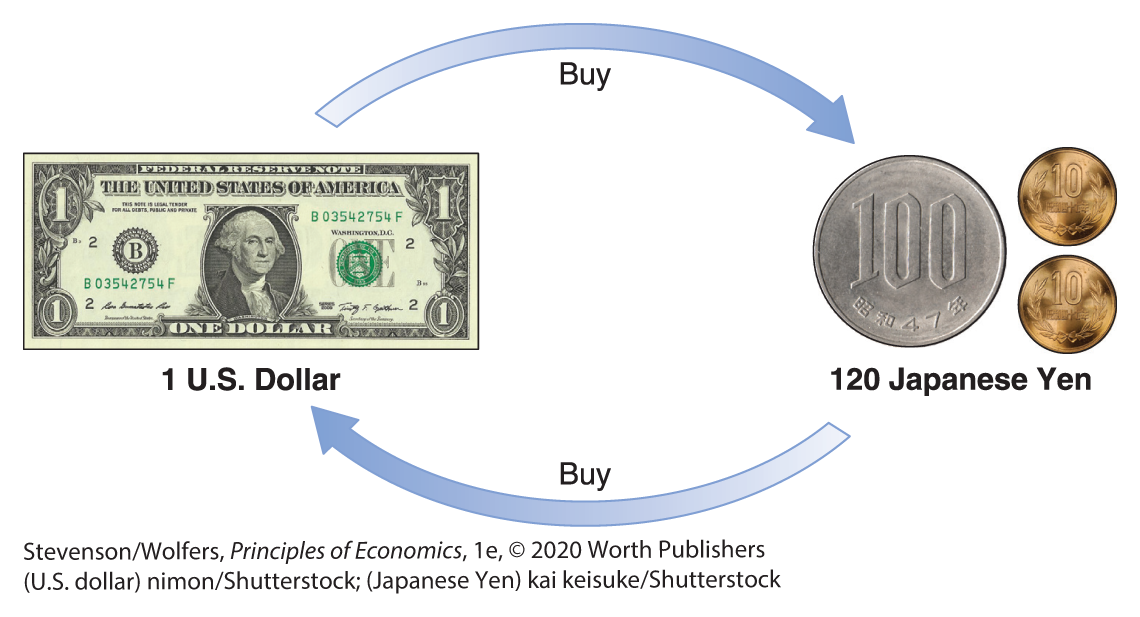

The price of a country’s currency (in terms of another country’s currency) is called the nominal exchange rate. The word “nominal” often gets dropped, so when you hear someone talk about the “exchange rate,” they typically mean the nominal exchange rate.

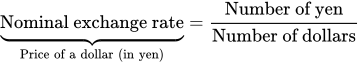

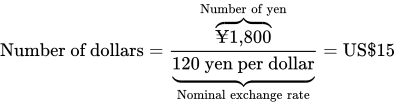

The nominal exchange rate formula describes the price of a country’s currency.

We’ll focus on the price of a U.S. dollar, since that’s the currency that matters most to you. If the price of a U.S. dollar is 120 yen, then the nominal exchange rate is 120 yen per U.S. dollar. This means that you can buy one U.S. dollar for ¥120. You can exchange yen for dollars, or dollars for yen, so this also means that with one U.S. dollar you can buy ¥120.

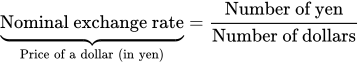

Just as you can exchange ¥120 for US$1, you can also exchange ¥240 for US$2, ¥360 for US$3, and so on. The nominal exchange rate defines the ratio at which you exchange units of a foreign currency like yen for U.S. dollars. This gives us the nominal exchange rate formula:

Rearrange the nominal exchange rate formula to convert dollars into yen.

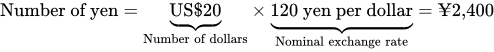

If the Mathisons are selling a bushel of apples for US$20, a Japanese grocery store owner needs to figure out how many yen it’ll cost them. You can rearrange the nominal exchange rate formula to tell them how many yen they’ll pay:

Let’s try this out. If the exchange rate is ¥120 per U.S. dollar, then the price of a US$20 bushel of apples in yen is:

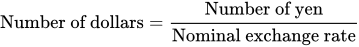

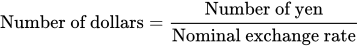

Rearrange the nominal exchange rate formula to convert yen into dollars.

A potential Japanese client might suggest to the Mathisons that she’ll buy their apples if they beat her current supplier’s price, which is

So if the Mathisons have been offered a price of

Apples for sale in Japan.

Don’t accidentally get the exchange rate backwards.

So far, we’ve focused on the price of a dollar, which is the number of units of foreign currency you can buy with a dollar. You can also think about the price of a yen, which describes how many dollars it costs to buy one yen. Instead of saying that one dollar costs 120 yen, you can say that one yen costs 1/120 of a dollar, or US$0.0083. Both are correct; they’re just different perspectives.

When you look up an exchange rate, make sure to pay attention to whether you’re learning the price of a dollar (which is measured in yen), or the price of a yen (measured in fractions of a dollar). Getting this wrong could lead to some costly mistakes!

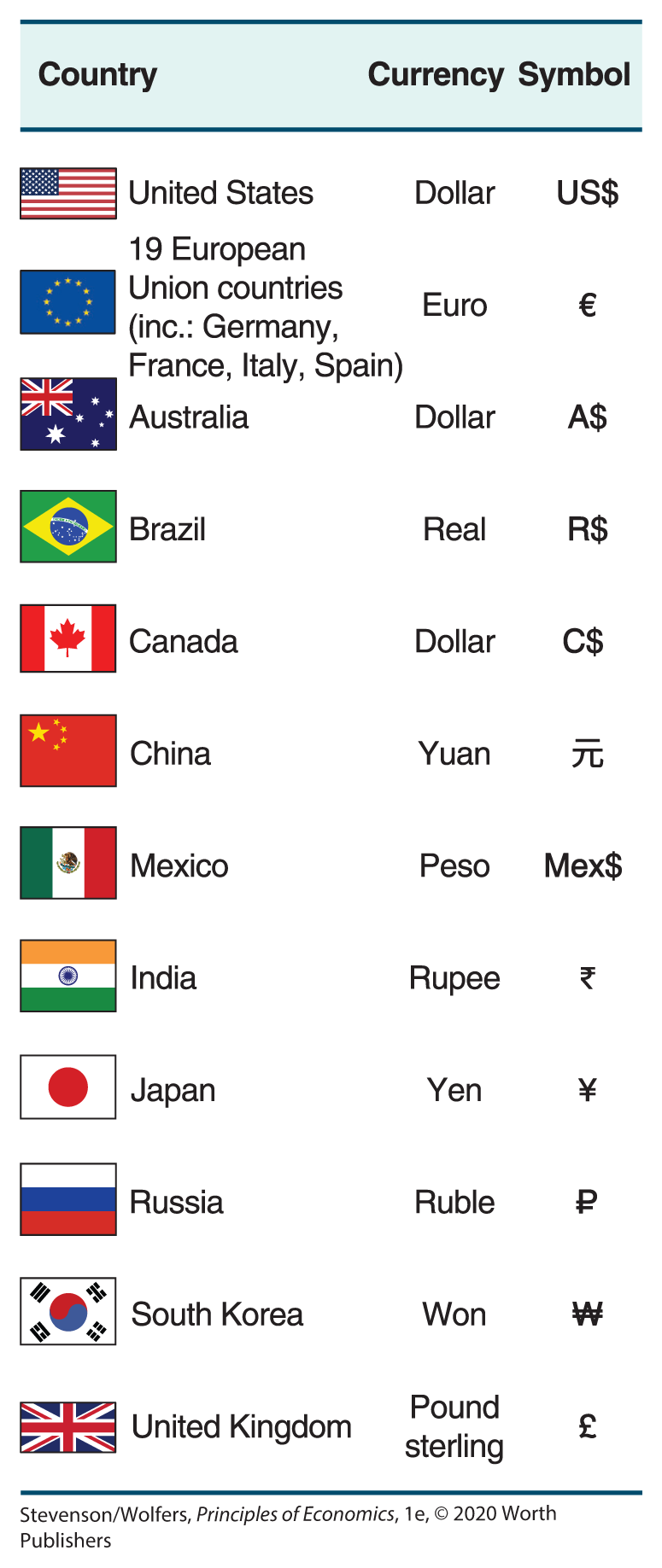

EVERYDAY Economics

What’s that currency called?

The United States calls its currency the dollar. But it’s not the only dollar. A bunch of other former British colonies—including Australia, Canada, and New Zealand—also call their currencies “dollar.” These dollars all have different values, and so it’s common to put the country’s initials before the dollar symbol to keep them straight. (So the U.S. dollar is called the US$, and the Aussie dollar is the A$.) Pay attention when you visit a country that uses “dollars,” because some countries—Ecuador and El Salvador, for example—gave up on their own currencies and use actual U.S. dollars.

Peso is also a common name for a currency. Mexico, Argentina, Chile, Colombia, and Cuba all also have pesos (which have different values). Eight countries have rupees including India, Pakistan, and Indonesia. Japan has the yen. China has the renminbi, which is the official name of the currency and means “the people’s currency.” But renminbi are measured in yuan. The British call their currency the pound sterling, or pound for short. While most countries have their own currency, many European nations gave up their individual currencies in 2002 and adopted a new European currency called the euro whose symbol, €, looks like the first letter of “€urope.” As of 2019, nineteen countries that are part of the European Union use the euro, although some European Union members don’t use it. Several other (mostly small) countries also use the euro. This new super-currency is now the second-most traded currency in the world, behind the U.S. dollar.

Recap: The three uses of the nominal exchange rate formula.

Let’s recap. The nominal exchange rate formula is incredibly versatile, because it serves three purposes:

It defines the nominal exchange rate:

You can rearrange it to convert dollars into yen:

You can rearrange it to convert yen into dollars:

Of course, you can apply this formula to any other country. Just replace the word “yen” with “peso,” “yuan,” “euro,” or whatever currency you’re using to measure the price of a U.S. dollar. Let’s try it out.

How expensive are apples in Germany?

Do the Economics

- The Mathisons are trying to make a deal to sell apples in Germany. If they charge US$20 a bushel, how many euros will a bushel of apples cost a German grocery store if the nominal exchange rate is 0.90 euros per U.S. dollar?

- The Mathisons have to pay a local logistics company €900 to help them with some customs paperwork. How much is this in U.S. dollars?

- A British logistics company has offered to do this paperwork for £600 instead. If the nominal exchange rate is £0.75 per U.S. dollar, which is a better deal?

Exchange Rates and the Price of Foreign Goods

Exchange rates are among the most important prices in the economy because when an exchange rate changes it will automatically affect how much it costs to buy millions of imported or exported goods.

Currencies appreciate when they become more expensive and depreciate when they become cheaper.

Be careful, it’s easy to get confused when you’re describing exchange rate movements. For instance, when the rate at which you exchange yen for dollars rises from ¥100 per dollar to ¥120, then the rate at which you exchange dollars for yen falls from US$0.010 per yen, to US$0.008: Rather than argue about whether to describe this as a rise or a fall, economists use different words altogether.

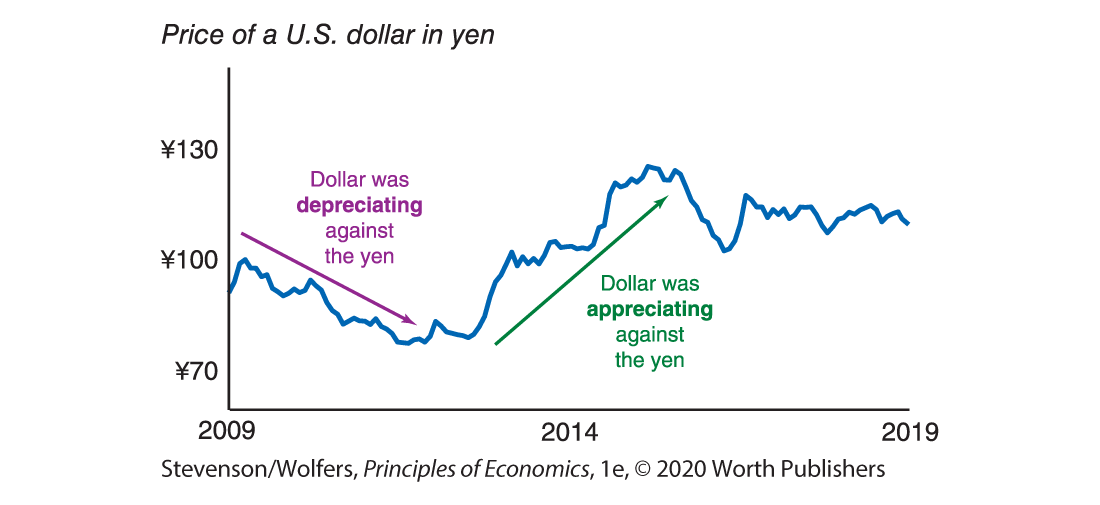

When the number of yen you’re charged to buy one dollar goes up—that is, the price of a dollar rises—we describe this as an appreciation of the dollar. We say it appreciates because a dollar is now worth more yen (and anyone holding dollars would appreciate that!). Figure 7 shows that the dollar appreciated against the yen for much of 2013 through 2015.

Figure 7 | Japan/U.S. Nominal Exchange Rate

Data from: Federal Reserve Board.

Conversely, when the number of yen that are needed to buy a dollar goes down—that is, the price of the dollar falls—we describe this as a depreciation of the dollar. The dollar is like a used car, because when it depreciates, it’s worth less. Figure 7 shows that the dollar depreciated against the yen for much of 2009 through 2011.

An appreciating dollar makes imports cheaper and exports more expensive.

When the dollar appreciates, the goods we import from other countries become cheaper in U.S. dollars. For instance, importing a ¥48,000 Nikon camera costs US$480 when the exchange rate is 100 yen per dollar, but that falls to US$400 when the price of a dollar appreciates to 120 yen. Some people describe an appreciation as leading to a stronger dollar; it’s stronger because it buys more foreign goods and services.

While an appreciation in the dollar is good news for importers, it’s bad news for exporters. For instance, the Mathisons sell their apples at US$20 per bushel, which translates to ¥2,000 per bushel for their Japanese customers when the exchange rate is 100 yen per dollar, but that price rises to ¥2,400 per bushel when the price of a dollar rises to 120 yen. As a result, an appreciation of the dollar causes American exports—like the Mathisons’ apples—to become more expensive for foreign buyers. The problem is that while Japanese customers pay more in Japanese yen, the Mathisons don’t get any more dollars per bushel.

A depreciating dollar makes imports more expensive and exports cheaper.

When the dollar depreciates, the goods we import from other countries become more expensive in terms of U.S. dollars. Some people refer to a depreciation as leading to a weaker dollar because it buys fewer foreign goods. While a depreciation is bad news for importers, it’s good news for American exporters. Even if they don’t adjust the price they charge in U.S. dollars, foreign buyers will find that they now pay less in their currency, leading them to buy more of our exports. Figure 8 summarizes these different ways of describing changes in the exchange rate, and what they mean.

Figure 8 | Different Ways to Describe a …

Interpreting the DATA

Tracking the value of the U.S. dollar

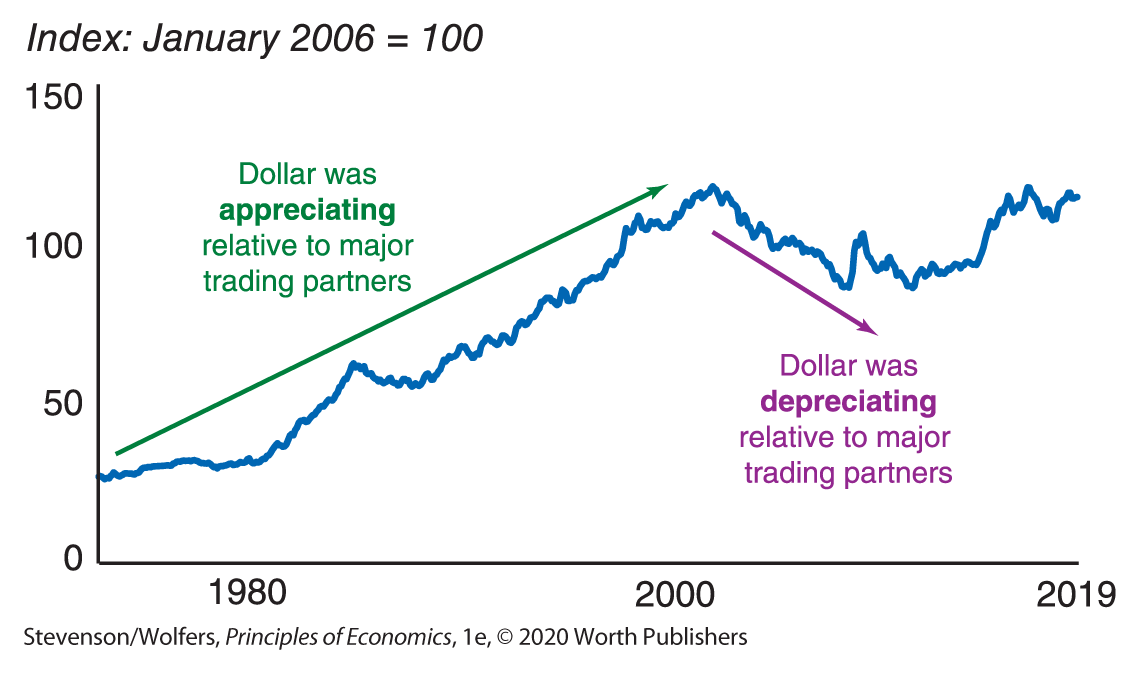

On any given day, the dollar trades against many different currencies. It might appreciate against the yen, depreciate against the euro, not change against the yuan, and also rise or fall relative to each of dozens of other currencies.

In order to keep track of the overall strength of the dollar, economists have compiled a summary measure of the value of the U.S. dollar called the trade-weighted index. Think of this as being the price of U.S. dollars in terms of a basket of currencies, with each country’s weight in that basket reflecting their importance as a trading partner. It effectively averages many different exchange rates into a single index that describes the international value of U.S. dollars. Figure 9 shows this index which describes whether, on average, the U.S. dollar has appreciated or depreciated over time. You can check out the latest value by looking it up here: https://fred.stlouisfed.org/series/TWEXBGSMTH

Figure 9 | U.S. Nominal Exchange Rate: Trade-Weighted Index

Data from: Federal Reserve Board.