34.1 The Federal Reserve

Central banks determine a country’s monetary policy, which is the process of setting interest rates in an effort to influence economic conditions. In the United States, the Federal Reserve is our central bank. It was created by Congress, which gave it instructions to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” The Fed interprets this to mean it should try to smooth business cycles—so that it keeps unemployment as low as is sustainable, while also keeping inflation low and stable.

The Federal Reserve’s headquarters in Washington, D.C.

The Fed can’t change inflation, output, or unemployment directly. Instead, it uses interest rates as a tool to influence the economy. Interest rates determine the opportunity cost of spending money today. For borrowers, higher interest rates mean a higher cost of credit. For savers, higher interest rates mean forgoing more interest in order to spend money today. Thus, the Fed uses the interest rate to nudge people and businesses to spend more or less today, which in turn affects output, unemployment, and inflation. It’s a task made more difficult by the imprecision of data and the difficulty of forecasting the future.

In practice, this means the Fed balances risks: The risk of setting a too-high interest rate that leads the economy to produce at a level below potential, versus the risk of setting a too-low interest rate that causes output to exceed the economy’s potential output thereby sparking inflation. The Fed’s mandate is to promote “maximum employment” while ensuring “stable prices.” The maximum sustainable level of employment occurs when the economy’s output is equal to its potential output, so the Fed will need to pay a lot of attention to GDP even though output is not in its formal mandate.

Let’s explore the Federal Reserve System and the process by which the Fed gathers information, weighs the risks, makes decisions, and then communicates its analysis and decisions to the public.

The Federal Reserve System

Congress created the Federal Reserve System in 1913 in the wake of chaotic bank runs that led many banks to go bankrupt, wreaking havoc on the U.S. economy. The goal was to create a system that would provide more stability in the banking sector and thus in the macroeconomy. At the time nearly everyone agreed that a central bank was necessary, but there was disagreement about how centralized its power should be, and how a central bank should balance the needs of the banks with the broader needs of the public.

The result was the Federal Reserve System—a central bank with many checks and balances. The Federal Reserve System is comprised of the Board of Governors in Washington, D.C., and twelve Federal Reserve district banks scattered across the country. The Board of Governors is an independent government agency that guides the operation of the Federal Reserve System. It ensures that monetary policy fulfills the instructions given by Congress. The Board of Governors also oversees the operations of the Federal Reserve district banks.

The Federal Reserve system is regionally diverse.

San Francisco Fed President Mary Daly prefers smooth pavement … and smooth business cycles.

The district banks were designed to avoid concentrating too much control in one part of the country. Even though monetary policy decisions reflect national economic conditions, there are differences across the country, and each of the twelve Fed bank presidents brings information from their district to policy discussions. The Federal Reserve bank in your district is the eyes and ears for your community. A local board of directors, comprised of business leaders and other local community members, chooses the Fed bank president for each district, with oversight from the Board of Governors.

Sometimes people get confused because commercial banks—the banks you use every day because they offer services like checking accounts to the general public—play an important role in the Federal Reserve System. They hold stock in their districts’ reserve bank and help elect some of its directors. But commercial banks can’t profit from their stock in the district reserve banks, nor can they sell it. Ownership of a certain amount of stock is simply a requirement by law of membership in the Federal Reserve System. The unique structure of the district Federal Reserve Banks came out of the desire to solve the problem of instability in the banking system. Making financial institutions an integral part of the system ensures clear and frequent communication between the banking system and the Federal Reserve System.

Central bank independence is important for macroeconomic stability.

The Federal Reserve Board of Governors is at the helm of the Federal Reserve System, and it’s an independent government agency. It’s independent for a reason—to free it from short-term political pressures. A problem with political pressure is that policy makers can achieve temporarily higher output by overheating the economy, which might unleash future inflation. But this short-run choice to allow higher inflation will eventually lead to higher inflation expectations, which causes higher inflation that persists long after the temporary blip in output dissipates. As a result, in the long run output isn’t any higher, but inflation is. The problem is that politicians often think too much about the short run—the next election—and may overweigh the benefit of a short-run output boost relative to its long-run inflationary cost. For example, President Trump pressured the Fed to lower interest rates in the run-up to the 2020 election.

Research shows that countries that give their central banks more independence have lower inflation rates on average. That means that if you reduce independence, you should expect higher inflation. And, as you learned in Chapter 24, higher inflation is costly.

There is a lot of government oversight of the Fed.

Just because the Fed is independent, you shouldn’t think that there isn’t government oversight. The governors are selected by the president of the United States. The U.S. Senate must confirm the president’s nominations. There are seven governors of the Federal Reserve and they each serve a term up to 14 years. The president, with confirmation by the Senate, selects one of the governors to serve a four-year term as the Fed chair.

The Fed’s governors are chosen for their knowledge of monetary policy and their specific perspectives or areas of expertise, all of which shape their assessments. For instance, one governor, Michelle Bowman, had spent her earlier career overseeing banks in Kansas. Another governor, Lael Brainard, spent her career working on international economic issues.

The Fed is also audited by the General Accountability Office (the GAO), which reviews the Fed’s finances and activities. By law, the Federal Reserve board chair must testify before Congress at least twice a year. As Fed Chair Jerome Powell said in his 2018 testimony, “Transparency is the foundation for our accountability.” Because the Fed is transparent about both its actions and its interpretations of economic data, anyone can evaluate the Fed’s decisions. All of the materials from monetary policy meetings are released within five years of the meeting.

The Federal Open Market Committee

The Fed governors and the district Fed presidents form the Federal Open Market Committee (FOMC), whose purpose is to decide on U.S. interest rates. They all participate, but only the Fed governors, the New York Fed bank president, and a rotating group of four district Fed presidents vote on policy decisions. The Fed chair runs the FOMC and is the most important spokesperson for the Fed. The FOMC meeting is that meeting mentioned at the start of the chapter—the one that’s one of the most important meetings in the world—so let’s take a look inside it.

Step into the meeting.

The conversations around this table will shape the world economy.

When you walk into an FOMC meeting, you’ll see a big table with the members and participants seated around it. The Fed chair sits in the middle and decides who’s going to speak and in what order. These decisions sound minor, but they can have a bigger impact on outcomes than you might expect. Former Fed chair Alan Greenspan used to tell everyone what he thought the right monetary policy decision was first, making it awkward for other members to discuss alternatives.

When Ben Bernanke took over as Fed chair in 2006, he took a more democratic approach. In order to foster debate, he waited to share his views until he’d heard everyone else speak. His successors, Janet Yellen and Jerome Powell, have followed a similar approach, resulting in a wider range of views and data being brought into the discussion. Research also shows that greater gender and racial diversity in meetings can improve decision making, and the Fed and Congress have made progress in bringing greater diversity to the FOMC in recent years.

The past three Fed chairs each tried to foster debate.

So now that you know who’s at the meeting, let’s turn to what they talk about. To decide monetary policy, each member must be prepared to answer three questions:

- What are your forecasts for the U.S. economy?

- What are the right policy choices given the economic outlook?

- How should the Fed communicate its plans effectively to the public?

Each member prepares their answers to these questions in advance, and they’ll often arrive at the meeting with quite different views. The meeting is a time for them to discuss their answers to these three questions, develop a consensus view, and make a decision. Let’s see how.

Question one: What are your forecasts for the U.S. economy?

The Fed chair asks everyone to share their views on current economic conditions and their short- and medium-term forecasts for the economy. Each member brings different information, perspectives, and backgrounds. They’ve each been prepared with reams of data and analysis of that data by expert economists on their staff. The Fed bank presidents also talk to businesses and financial institutions in their districts to get a better sense of their local economic conditions. And each participant brings unique knowledge about the various factors that influence the U.S. economy, from conditions in other countries to stability in the financial sector. The Fed tracks literally thousands of variables, each of which provides clues about the future path of inflation and unemployment. People arrive at the meeting with different forecasts reflecting their unique knowledge, different readings of noisy data, and what they expect to happen if their preferred monetary policy decision is implemented.

Interpreting the DATA

How good are the Fed’s forecasts?

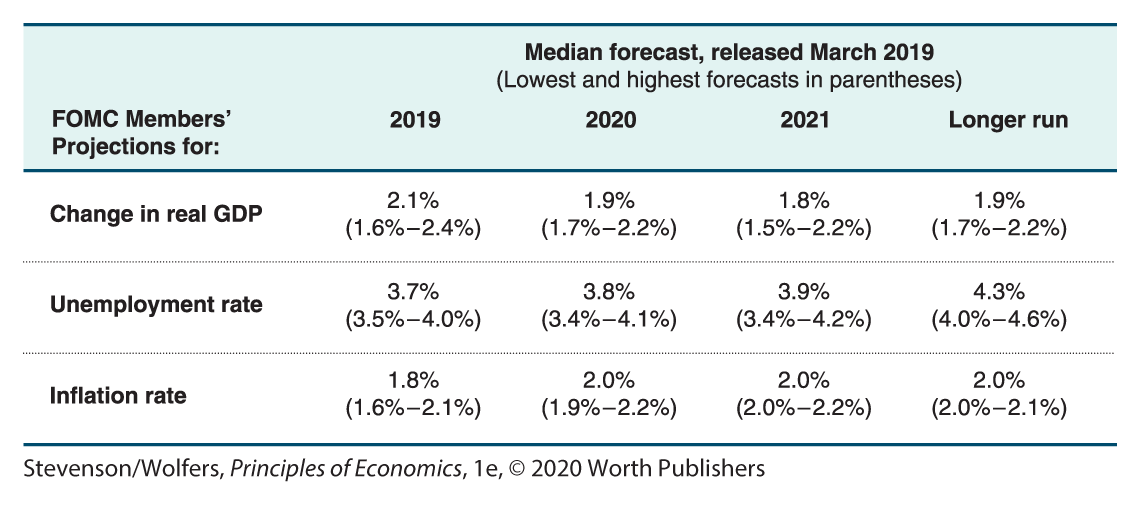

Let’s take a look at some of the forecasts that FOMC members bring into an FOMC meeting. Figure 1 shows their forecasts of economic growth, unemployment, and inflation in each of the next few years, as well as what they expect will occur, on average, in the longer run. These forecasts were prepared for the March 2019 meeting. The top number in each cell is the median forecast, meaning half expect something higher and half expect something lower. The range of forecasts is shown in parentheses.

Figure 1 | FOMC Members’ Projections for the Economy

Data from: Federal Reserve Board.

Notice that the Fed produces forecasts for the next three years. That’s because it wants to identify and counter economic problems before they emerge. If the Fed forecasts trouble in a year or two, then it wants to take action today.

Even the most careful forecasts are often wrong, so if you want to find out if these Fed forecasts were right, use the FRED database to look up what economic growth, the unemployment rate, and the inflation rate really were in each of these years: https://fred.stlouisfed.org/.

Question two: What are the right policy choices given the economic outlook?

Once the committee has debated projections for the economy, it’s time to turn the discussion to what they should do about it. The FOMC’s primary tool is to influence the real interest rate. Recall that the real interest rate is the opportunity cost of spending and it tells you how much more you’ll be able to buy if you spend your money next year, instead of this year. Similarly, businesses care about the real interest rate, since it represents the opportunity cost of making an investment. That’s why the real interest rate is effectively the price that determines this year’s aggregate expenditure.

The FOMC will raise the real interest rate when it wants to induce people to spend less today and save more for later. It’ll do this because reducing spending today reduces output, which lowers inflationary pressure. And the FOMC will lower the real interest rate when it wants to stimulate greater spending, which will lead to higher output and higher employment. In the long run, stable inflation and maximum sustainable employment are both achieved when output is equal to potential output.

When recessions hit, the FOMC has to determine whether to lower interest rates, and by how much. This isn’t a decision that happens in just one meeting. Rather, it’s an ongoing process in which the FOMC constantly assesses (and re-assesses) whether it has taken sufficient action and should keep interest rates where they are, or whether even lower rates are warranted. Similarly, as the economy recovers, the FOMC will gradually return interest rates to normal, attempting to steer the economy back to maximum employment without unduly risking higher inflation. So discussion at most meetings focuses on where the economy appears to be relative to where it was at the previous meeting, and assessing outcomes of the decisions that were made in previous meetings. Had they raised rates enough? Not enough? Too fast or too slow?

Once the members have debated the options and assessed the risks associated with each possible action, the Fed chair typically recommends a course of action, and the FOMC votes on it. Not all of the Fed bank presidents get to vote, but they’ve all participated equally in the discussion. The New York Federal Reserve Bank president always votes, but the other 11 bank presidents take turns rotating on and off as voting members.

Question three: How should the Fed communicate effectively to the public?

A former Fed chair once made an offhand comment about interest rates at a party. Unfortunately, he was talking to Maria Bartiromo, a CNBC anchor. When she told her viewers his comment the next afternoon, stock prices plunged, and bond yields rose to a four-year high. He learned an important lesson: Even offhand comments by a Fed official can move markets. There are billions of dollars to be made from correctly guessing before anyone else when interest rates are going to change. These financial stakes lead those working in financial markets to hang on every utterance coming out of the Fed. But the Fed doesn’t want to create excess volatility through misinterpretations of loose party talk.

So what should the Fed say? For much of its history, the Fed took pride in Fedspeak, a communication style that relied on intentionally vague and bureaucratic language. The idea was that vagueness would reduce market reactions to anything a Fed official said because no one could be sure what it meant. (Fed Chair Alan Greenspan was so accustomed to Fedspeak that he had to propose to his wife, news anchor Andrea Mitchell, twice because she failed to understand what he was saying the first time.)

Alan Greenspan: “If I turn out to be particularly clear, you’ve probably misunderstood what I’ve said.”

Over the past few decades, the Fed has changed its communication policy to move away from Fedspeak and to aim for much greater transparency. Today, the Fed strives to clearly communicate its analysis, decisions, and objectives. This transparency is crucial for accountability. If you disagree with the Fed’s policy decisions, you can pinpoint exactly what you are disagreeing with, if you understand why it made those choices.

After each meeting, the Fed issues a statement and the Fed chair holds a press conference announcing and explaining its decisions. After every other meeting, it publishes its forecasts. In between meetings, Fed officials give speeches that often explain their thinking. And twice a year the Fed chair testifies before Congress to explain the Fed’s monetary policy actions and plans.

Janet Yellen: “We’ve made a commitment … that we would do our best to communicate as clearly as we could.”

These communication choices reflect strategic decisions: The Fed wants to convince people that it will follow through and achieve its goals. Businesses will be more likely to hire if they believe the Fed will deliver a strong economy, and they’re more likely to restrain their price increases if they believe the Fed will meet its goal of price stability. Expectations are an important factor shaping economic decisions, and the Fed is trying to shape those expectations. If the Fed can convince people to expect maximum employment and stable prices, then those outcomes become more likely.