Big Rock #1: Only buy stocks in a market uptrend. Take defensive action as a downtrend begins.

Big Rock #1: Only buy stocks in a market uptrend. Take defensive action as a downtrend begins.The buying and selling checklists in this book—and all the stock screens and tools you’ll find in IBD®—are based on the CAN SLIM® Investment System, developed in the 1960s by IBD founder and chairman William J. O’Neil.

For years now, I’ve had the privilege of helping people get started with CAN SLIM investing—at workshops, in videos, at IBD Meetup groups, in a monthly newsletter, and on our radio show.

There’s one piece of advice I give to anyone just starting out: Don’t overcomplicate it! Keep it simple.

Yes, there are important details and some things that take a little time and effort to learn, like how to read a stock chart. But all of them can be broken down into a few simple concepts you can learn step by step, using checklists to guide you. And that’s what we’ll do together throughout this book.

I love the saying, “Put the big rocks in first.” You can always add the tiny pebbles—the details—later, but when you’re getting started, make sure you stay focused on what matters most.

When it comes to understanding why the CAN SLIM Investment System works so well and how you can use it to make money in the market, it comes down to 3 “big rocks” you always want to put in first:

Big Rock #1: Only buy stocks in a market uptrend. Take defensive action as a downtrend begins.

Big Rock #1: Only buy stocks in a market uptrend. Take defensive action as a downtrend begins.

Big Rock #2: Focus on companies with big earnings growth and a new, innovative product or service.

Big Rock #2: Focus on companies with big earnings growth and a new, innovative product or service.

Big Rock #3: Buy stocks being heavily bought by institutional investors. Avoid those they’re heavily selling.

Big Rock #3: Buy stocks being heavily bought by institutional investors. Avoid those they’re heavily selling.

As you go through this book—and, most importantly, as you start using the checklists and Simple Weekend Routine to invest—always keep those 3 “big rocks” in mind.

They may not make sense to you just yet (they will very soon)—or maybe they seem overly simplistic at first. But IBD’s study of every top stock since 1880 shows that always starting with these 3 core tenets is the key to making money in the market.

CAN SLIM investing is based on two simple ideas:

To find tomorrow’s big winners, look for stocks with the same traits past winners had just before they launched their big runs.

To find tomorrow’s big winners, look for stocks with the same traits past winners had just before they launched their big runs.

To know when it’s time to sell, look for the same warning signs these past winners flashed when they eventually topped and began to decline.

To know when it’s time to sell, look for the same warning signs these past winners flashed when they eventually topped and began to decline.

What Does a Winning Stock Look Like Before—and After—It Makes Its Big Move?

In the late 1950s, Bill O’Neil was a young broker who asked a simple question: What common traits do the best stocks have before they make their big price moves?

To find out, he began studying the biggest winners of all time. These were stocks that went up 100%, 300% or much more very quickly, often in just 1 or 2 years.

These were the days before personal computers and the Internet, so Bill covered his office walls and cabinets with charts and reams of data. He studied every available performance metric to see which ones truly mattered— to see what characteristics and telltale signs these top-performing stocks displayed just before they rocketed higher. He found:

The best stocks display seven common traits just before they make their biggest gains.

Each letter in CAN SLIM stands for one of those traits, and they form the basis of the rules you’ll find in the Buying Checklist.

Bill also studied what happens to leading stocks after they’ve had a big run. Just as they share certain traits before they surge, they also flash similar warning signs as they top and begin to decline. Those signals form the basis of the sell rules you’ll find in the Selling Checklist.

Over 130 Years of Market History

The study O’Neil launched in the 1960s continues to this day and now covers every market cycle and top-performing stock from 1880 to the present.

Whether it’s Bethlehem Steel in 1914, Xerox in 1963, Google and Apple in 2004, Priceline.com in 2010, SolarWinds in 2011, or 3D Systems in 2012, year after year, decade after decade, the biggest winners display these same 7 CAN SLIM traits just before they launch their massive runs.

The company names will change, new technology and industries will emerge, but the basic profile and attributes of an emerging big winner always look the same. So once you understand what to look for, your search for the next game-changing stock won’t be based on hunches or hype. It’ll be based on history and a targeted checklist of specific, telltale signs.

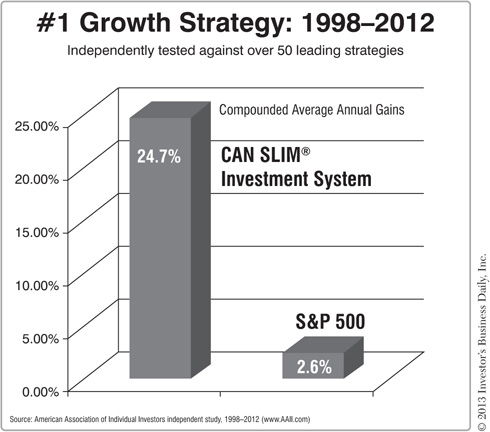

Only about 1% to 2% of all stocks will have these CAN SLIM characteristics. But as the results of an independent study by the American Association of Individual Investors (AAII) show, it pays to be picky: If you stay disciplined and look for stocks with CAN SLIM traits, you will spot today’s most promising stocks in the early stages of their big moves.

#1 Growth Strategy from 1998–2012

Since 1998, the American Association of Individual Investors has been conducting an ongoing, real-time study of over 50 leading investing strategies. From 1998–2012, AAII found the CAN SLIM Investment System was the #1 growth strategy, generating an annualized return of 24.7%.

Think about all of the roller-coaster rides we had in the market during those 15 years: The dot-com boom and bust, the 2003 bull market, the housing and financial crisis in 2008, and the bull market rebound in 2009.

The CAN SLIM Investment System’s independently tested performance through all those cycles shows that if you stick to the Buying and Selling Checklists we’ll cover together in this book, you can make—and keep —significant gains in any type of market.

In How to Make Money in Stocks: A Winning System in Good Times or Bad, Bill O’Neil gives a detailed description of each of the 7 CAN SLIM traits and countless historical examples of winning stocks that shared those characteristics. It’s the definitive guide to CAN SLIM investing by the man who developed it, so I strongly encourage you to read that book.

Since the purpose of this book is to show you how to quickly get started with the CAN SLIM Investment System, we’ll take a slightly different approach.

Again, let’s keep it simple and stay focused on what really matters most. Here’s how we’ll do that.

First, I’ll give a brief overview of the 7 CAN SLIM traits and show how they relate to the 3 “big rocks” I noted earlier. We’ll also go through some CAN SLIM case studies so you can see how top stocks in the 2009–2012 bull market had these same traits before they surged.

Then in the next chapters, we’ll go step by step through routines and checklists that will help you systematically spot today’s CAN SLIM stocks and pinpoint the best time to buy—and sell—them.

The 7 Traits and the 3 Big Rocks

See the Buying Checklist for the specific numbers and ratings needed to meet the benchmarks for the 7 CAN SLIM traits.

Big Rock #1: Only Buy Stocks in a Market Uptrend.

Take Defensive Action as a Downtrend Begins.

The “M” in CAN SLIM—market direction—may be the last letter, but in many ways it’s the most important. To a very large degree, the difference between making or losing money comes down to simply staying in sync with the direction of the overall market (i.e., the major indexes like the S&P 500 and Nasdaq).

We’ll get into what steps you can take to handle changes in market direction later, but understand up front that:

You do not need to be fully invested in the stock market at all times. Make money when the market is trending up—and protect your profits when the market starts trending down.

Sounds obvious, right?

But the reality is, many people pay no attention to the overall market direction and just blindly “buy and hold.” That’s because they don’t understand how market cycles work. They don’t realize that when the overall market trends down for an extended period, about 75% of all stocks go down with it.

Investors with a “buy and hold” strategy may make money when the market is going up, but they often end up giving it all back (and then some) when it goes down.

It’s time to step off that roller coaster and start using buy and sell rules based on how market cycles actually work.

You’ll learn how to do that in this book:

The Buying Checklist pinpoints the best time to get into the market.

The Buying Checklist pinpoints the best time to get into the market.

The Selling Checklist shows you when it’s time to lock in your gains and move to the sidelines.

The Selling Checklist shows you when it’s time to lock in your gains and move to the sidelines.

Big Rock #2: Focus on Companies with Big Earnings Growth and a New, Innovative Product or Service.

Big, accelerating earnings growth is the #1 factor to look for in a stock. And it’s innovative companies with game-changing new products that generate that type of explosive profitability.

That’s why the first three CAN SLIM traits are so important:

Think about it: If a stock’s share price goes up 100%, 200% or more, there has to be a reason. There has to be something that is making mutual fund managers and other big investors continue to push the stock higher.

History shows the main cause is earnings growth. And that was proven again in the 2009–2012 bull market. The biggest winners—stocks like Baidu, F5 Networks, Apple, Priceline.com, SolarWinds, Rackspace Hosting, Alexion Pharmaceuticals, Lululemon Athletica, Chipotle Mexican Grill, and Michael Kors—tended to be highly profitable companies whose earnings growth was not only strong but accelerating as their share prices rose higher. And they all had new, innovative products or services that made them leaders in their industries.

Big Rock #3: Buy Stocks Being Heavily Bought by Institutional Investors. Avoid Those They’re Heavily Selling. “Institutional investors”—primarily mutual funds but also hedge funds, banks, pension funds, insurance companies, and other large “institutions”— account for the bulk of all trading. They provide the buying power or fuel a stock needs to make a big, sustained upward move. And when they sell, it’s their heavy dumping of shares that drives a stock down.

That’s why it’s absolutely critical to watch what they’re doing—and you’ll see how to do that using IBD SmartSelect® Ratings and charts when we get to the Buying Checklist.

For now, just understand you essentially want to ride their coattails. You want to buy stocks fund managers and other big investors are heavily buying, since those are the stocks most likely to make a big gain. And just as importantly, you want to sell and get out of the way when you see fund managers start to unload their shares, since those stocks will likely drop sharply.

The next 3 CAN SLIM letters outline the kind of institutional buying you want to see in a stock before you invest:

Follow the Funds!

“It’s key to buy the better stocks mutual funds buy and avoid ones they may be selling on a heavy basis. Trying to go against this monumental amount of trading will only hurt your results. ”

—WILLIAM J. O’NEIL, IBD CHAIRMAN AND FOUNDER

Bottom line: Make sure some mutual fund managers are moving heavily into a stock before you buy. And when they start to sell aggressively, move to the sidelines and get out of the way.

A new crop of leading stocks emerges in every bull market cycle, giving you new opportunities to make money.

Some will be household names, but many will be companies you’ve likely never heard of. You may not be familiar with their products or services, but now that you know the 7 CAN SLIM traits to look for, you’ll know how to spot them—and you’ll see where to find them using the Simple Weekend Routine (Chapter 4).

Below are profiles of 3 CAN SLIM winners.

One is a company we all know—Apple. But back in 2004 when it launched a massive run that would turn it into the world’s most valuable company by 2012, was it on your radar screen?

You’d probably heard of the iPod and iTunes, maybe even used them. But as an investor, did you make the connection that with a revolutionary, extremely popular new product (the “N” in CAN SLIM), Apple could become a big stock market winner?

The iPod generated explosive earnings growth, and that was followed by even more profits with the release of the iPhone. Those two game-changing innovations revolutionized the music and mobile phone industries, leading to a 1,418% rise in Apple’s share price in less than 4 years.

But even if you missed that entire move, Apple still offered new opportunities to get in during the 2009–2012 bull market. (As you’ll see later in the book, it’s rare for a stock that leads in one bull market cycle to come back and lead in the next one too. That’s why it’s so important to always hunt for the new crop of leaders. More on that later.)

Like most stocks, Apple got hammered during the 2007–2008 financial crisis, but when the market turned around in 2009, Apple came roaring back. What gave it that kind of power? As you can see in the case study below, it still had the CAN SLIM traits, including big earnings and sales, hot new products, and growing demand from fund managers. And that was before it released yet another new innovation—the iPad.

Unlike Apple, the other two case studies, Green Mountain Coffee Roasters and Ulta Beauty, were not household names when they launched their big price moves. I had never heard of them before they started showing up in IBD’s stock lists—and until my teenage daughter tipped me off to the popularity of Ulta Beauty, which sells brand-name cosmetics at discount prices.

That brings up an important side note: Pay attention to where your children shop. They might steer you to a new leader in the retail industry, which has been a good source of CAN SLIM stocks over the years.

But back to the case studies. While you might not have tasted Green Mountain’s K-Cup gourmet coffee or visited an Ulta store, as a CAN SLIM investor, their superior earnings performance would have put them on your radar screen. Both companies had the traits we look for, and that’s why they started appearing in stock lists like the IBD 50 (known as the IBD 100 at the time) and Your Weekly Review.

As you look through these profiles, note how the 3 “big rocks” were all in place when these stocks launched their big moves:

The overall market was in an uptrend.

The overall market was in an uptrend.

Each company had explosive earnings growth and innovative products.

Each company had explosive earnings growth and innovative products.

Mutual funds were aggressively buying shares.

Mutual funds were aggressively buying shares.

These types of money-making opportunities appear in every bull market cycle. And by studying these examples and by using the checklists and routines we’ll go over throughout this book, you’ll see exactly what steps you can take to profit from them.

How to Find & Own America’s Greatest Opportunities by Bill O’Neil

Each week, Bill O’Neil personally writes a short column that walks you through the full “life cycle” of a winning stock. You’ll see what CAN SLIM traits it had before it made its big price move—and what sell signals it eventually flashed. Reading Bill’s insights each week will help you spot tomorrow’s big winners—and handle them profitably when you do. See a sample column at www.investors.com/GettingStartedBook.

Each week, Bill O’Neil personally writes a short column that walks you through the full “life cycle” of a winning stock. You’ll see what CAN SLIM traits it had before it made its big price move—and what sell signals it eventually flashed. Reading Bill’s insights each week will help you spot tomorrow’s big winners—and handle them profitably when you do. See a sample column at www.investors.com/GettingStartedBook.

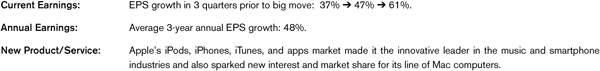

CAN SLIM Case Study: Apple (AAPL)

381% gain from July 2009-September 2012

All 3 “big rocks” and key CAN SLIM® traits in place before breakout.

Only buy stocks when the overall market is in an uptrend.

Focus on companies with big earnings growth and a new, innovative product or service.

Buy stocks being heavily bought by institutional investors.

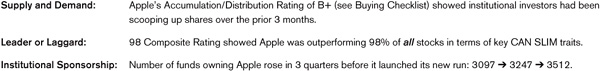

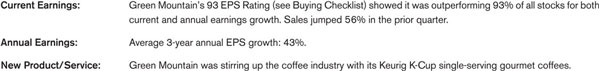

CAN SLIM Case Study: Green Mountain Coffee Roasters (GMCR)

1,104% gain from March 2009-September 2011

All 3 “big rocks” and key CAN SLIM® traits in place before breakout.

Only buy stocks when the overall market is in an uptrend.

Focus on companies with big earnings growth and a new, innovative product or service.

Buy stocks being heavily bought by institutional investors.

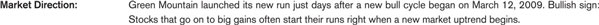

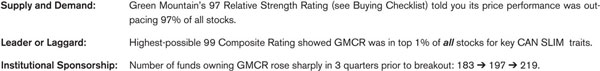

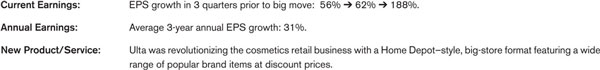

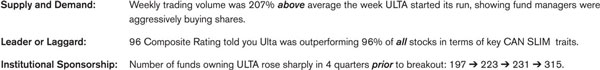

CAN SLIM Case Study: Ulta Beauty (ULTA)

165% gain from September 2010-July 2011

All 3 “big rocks” and key CAN SLIM® traits in place before breakout.

Only buy stocks when the overall market is in an uptrend.

Focus on companies with big earnings growth and a new, innovative product or service.

Buy stocks being heavily bought by institutional investors.

Now that you know what to look for, let’s see how to find stocks that have these same CAN SLIM traits right now. We’ll do that using a Buying Checklist that shows you what specific traits to look for before you invest.

But first, take the Action Steps below to help reinforce what we covered in this chapter.