Notes

Introduction

1. The interviews with members of the Business Council appeared as part of a special series of programs on money and elections. I served as a consultant to the series and appeared in several segments. Gregory MacArthur, its producer, kindly made available to me full transcripts of the interviews, which I checked against a video of the final program.

2. The comparison to Perot’s plan was initially encouraged by the administration, until the Texan declared against the program. See, e.g., the discussion in chapter 6 in this volume, as well as the news coverage in the major media, which is easily available and, to save space, will not be traced here unless some particular detail is vital. Many business figures weighed in with their various views on the president’s plan soon after he introduced it. But a major document witnessing to its support among important parts of big business is the letter released by Illinois Congressman Dan Rostenkowski dated May 25, 1993. This is signed by some fifty of the largest businesses in the United States and flatly endorses the bill reported out by Rostenkowski’s committee, which contained virtually all the parts of the proposal that occasioned most of the controversy and were subsequently modified in the Senate. Among the firms which enlisted on the president’s side in the alleged class war were AlliedSignal, Ameritech, Anheuser-Busch, Avon, BP America, Colgate-Palmolive, Delta Air Lines, Dow Corning, Electronic Data Systems, Emerson Electric, the GAP, GenCorp, General Electric, General Mills, General Motors, General Signal, Hallmark Cards, Honeywell, Hughes Aircraft, IBM, Jim Walter, Kellogg, Levi Strauss, 3M, Marriott, Mars, Owens-Corning Fiberglas, Philip Morris, Procter & Gamble, Quaker Oats, Ryder, Sara Lee, Southern California Edison, Southland, Tenneco, Time Warner, Walt Disney, and Westinghouse. General Electric’s chair attached a brief comment asking for more spending cuts, and a few other firms added other observations.

I suppose it is too much to hope that appending this list of firms will save us from a flock of articles and dissertations in the coming years about “Bill Clinton and the dilemmas of the autonomous state.”

3. Measuring the tone of press coverage is in its infancy in the social sciences. All one can do is try one’s best to carefully summarize main themes. In this and other essays in the book, I have, accordingly, stuck wherever possible to noting truly repetitious themes that I hope can command general assent. But see the discussion of media coverage following Clinton’s speech in Fairness and Accuracy in Reporting’s very helpful Extra, April/May 1993, p. 8; this reviews many programs and articles such as the Washington Post’s “Is Clinton Pitting Class Against Class?” of February 21, 1993. This article also quotes David Brinkley’s criticism, in a speech to a trucking association after the 1992 election, of the Democrats for practicing “long-standing class warfare.” The article also notes that many of the journalists making such comments are themselves very affluent.

University presses are forced to operate in what one school of French historians is wont to call la longue durée. Thus some parts of chapter 6’s analysis of the Clinton administration, and particularly the likely fate of its economic program, that were originally written as forecasts have become contemporary history. It may, accordingly, be worth mentioning that chapter 6 was essentially completed within a week or so of the president’s budget speech of February 1993. At that time I sent to press a much shorter analysis of the Clinton program, with a very direct prediction of the likelihood of the dollar difficulties that actually materialized in the summer of 1994. This appeared as “‘Organized Capitalism,’ Fiscal Policy, and the 1992 Democratic Campaign,” in Lawrence Dodd and Calvin Jillson, eds., New Perspectives On American Politics (Washington, D.C.: Congressional Quarterly Press, 1993), pp. 118–39.

4. This book went to press long before the conclusion of the great debate over the North American Free Trade Agreement, and an extended comment on the final outcome is obviously out of the question. I daresay, however, that readers of chapter 6 are unlikely to find anything surprising about the president’s stance, or those of his allies.

Note, however, in relation to the Gergen appointment and the Clinton administration’s efforts to redramatize itself, the discussion in the Boston Globe, November 12, 1993. There Robert Kuttner reports that during the summer of 1993 the administration discussed the possibility of pushing for a version of the NAFTA accord that would have contained much stronger labor provisions, including one that would have linked reductions in tariffs to rises in Mexican wages. A number of major unions were prepared to support the treaty in the event the administration opted for this alternative, as were key House Democratic leaders such as Richard Gephardt.

But urged on by, among others, the Democratic Leadership Council, which wanted to weaken unions and attract more business support, the Clinton administration rejected this approach in favor of one built around an appeal to Republican votes and, of course, massive lobbying by the business community.

I have independently confirmed the gist of Kuttner’s account. My sources add that while some American consumer goods producers did support efforts to raise Mexican wages, the rest of the business community favored the more sweeping approach the president eventually adopted. Is it too much to hope that no one will ever ask again whether the investment banking presence in the Democratic Party matters?

5. See, e.g., a typical comment by William Safire in the New York Times, September 20, 1993 (referring to the earlier period). Given the multiplicity of editions that the Times and most other papers now issue, it is impractical and potentially very misleading to note the pages of particular articles in references. Note that when articles are retrieved from computer-assisted data banks, there often are no page numbers supplied at all, even in the original indexes.

6. See USA Today, March 6–8, 1992.

7. Thomas Ferguson, “Money and Politics,” in vol. 2 of Godfrey Hodgson, ed., Handbooks to the Modern World—The United States (New York: Facts On File, 1992), reviews the main facts and literature that addresses these questions. See also Frank Sorauf, Money in American Elections (Glenview, Il.; Scott, Foresman, 1988). There are numerous reviews of the PAC literature. See, e.g., Larry J. Sabato, PAC Power (New York: Norton, 1985). Mark S. Mizruchi, The Structure of Corporate Political Action (Cambridge: Harvard University Press, 1992) is another particularly thoughtful contribution, although I would disagree with a number of points in his discussion, as well as his reliance on PAC data for much, although not all, of his analysis. A particularly unfortunate feature of the recent PAC literature is a concentration on congressional elections in the early eighties, when much of the business community coalesced in political movements designed to move the U.S. political agenda sharply to the right. The discovery by some researchers that this process—which I and others wrote about at the time—in fact occurred, along with experimental designs that often obscure (weaker, but eventually important) countertendencies, nourishes the view that significant political differences within the business community do not in fact exist.

All students of money and politics, incidentally, owe substantial debts to Herbert Alexander, whose publications and data archives are invaluable and quite literally irreplaceable.

The extent to which reality has outstripped the scholarly literature on these questions is hard to convey, but one example may be telling. In many parliamentary democracies it is now quite common for corporations and investors formally to retain members of parliament as advisers for fees. In the United States, on the other hand, it is becoming increasingly common for congressional staffers to strike up various arrangements whereby they are paid (sometimes through one or another legal dodge, such as “consulting fees”) by interested parties. The degree of statistical misspecification in ordinary voting models of politics is thus becoming ever more baroque.

8. The text of every previously published essay in this book has been revised and expanded, often considerably, and a substantial amount of material appears here for the first time.

Earlier versions of chapters (or parts of chapters) appeared as follows. Chap. 1: in Paul Zarembka, ed., Research in Political Economy 6 (1983); reprinted by permission of JAI Press, Inc. Chap. 2: in International Organization 38, no. 1 (Winter 1984); reprinted with the permission of MIT Press. Chap. 3: in The Journal of Economic History, vol. 44 (December 1984); reprinted by permission. Chap. 4: in Sociological Perspectives, 34, no. 4 (1991); reprinted by permission of JAI Press, Inc. Chap. 5: in Socialist Review 19, no. 4 (1989); reprinted by permission of Duke University Press. And in “Unbearable Lightness of Being,” in Benjamin Ginsberg and Alan Stone, eds., Do Elections Matter? (Armonk, N.Y.: M. E. Sharpe, 1986); reprinted with permission. Chap. 6: in Lawrence C. Dodd and Calvin Jillson, eds., New Perspectives on American Politics (Washington, D.C.: Congressional Quarterly, Inc., forthcoming); reprinted with permission. Appendix: in American Review of Politics (Winter 1993); reprinted with permission.

9. See Lance Bennett, The Governing Crisis (New York: St. Martin’s, 1992) and the discussion in the appendix. At a couple of points in his discussion, Bennett asks whether the main effect of money in the political system does not consist in bringing about the disintegration of the system to the exclusion of larger patterns such as those suggested in the various studies in this book (in which investment banks, various multinationals, and other definite business groups play major roles even in the Democratic Party). The NAFTA debate should now have resolved this question. American politics is not simply disintegrating; new, historically specific, political coalitions and patterns of policies are emerging.

10. Thomas Ferguson and Joel Rogers, Right Turn: The Decline of the Democrats and the Future of American Politics (New York: Hill & Wang, 1986).

Chapter One

* Readers unfamiliar with this work and the issues it raises may wish to skim over the next few pages. Nothing essential will be lost, and the later historical sections of the paper should be readily intelligible.

1. Frank Vanderlip to James Stillman, September 20, 1912, Frank Vanderlip Papers, Rare Book and Manuscript Library, Columbia University. On the controversy about the National City Co., the Taft and Wilson administrations’ inaction, and subsequent developments in defining the relationship between commercial banks and the securities markets, see Ferguson (n.d.). I have added the comments in brackets to provide background for non-specialist readers.

2. The literature on realignments, voting behavior, and party systems is vast. Since Ferguson (1986) discusses much of it, and extensively references other discussions and bibliographies, this paper will not attempt another inventory of the literature. Also, the summary of critical realignment theory which follows sticks closely to the theory’s “core” propositions, leaving aside many nuances and disputed points.

3. Some realignment theorists, including Burnham, Ginsberg, and David Brady, argue that effective popular control of public policy is most likely during critical realignments; at other times institutional obstacles to effective majorities inhibit the impact of voting on public policy. For a more extensive discussion see Ferguson (1986).

4. Note that with the possible exception of Lichtman (1980), whose closing chapters begin an analysis of the role of the business community which could lead toward an investment theory of parties, the critics of critical realignment theory draw few general conclusions about elections and the control of public policy. They largely concentrate on the facts of voting behavior during elections.

5. For example, Clubb, Flanigan, and Zingale (1980). Such efforts normally also propose intensive examinations of the content of public policy.

6. Ferguson (1986) summarizes the evidence on this score and makes use of data collected in Ginsberg (1982) to provide some quantitative evidence of the tenuous and unstable relationships between elections and public policy.

7. For example, Downs (1957a, pp. 247 ff.).

8. Some friendly critics of an earlier draft of this paper have suggested that Downs’s work ultimately takes a more jaundiced view of the possibilities for voter control of the polity than suggested here. Now, if consistently maintained, the discussion of “producer bias” in the closing chapters of An Economic Theory of Democracy leads toward an investment theory of parties. Also, as I suggest elsewhere, other parts of Downs’s work broach important lines of argument that could undermine “electoral control” theories. But these sections have been almost entirely ignored in the subsequent literature. Even Downs’s own summary of his views (1957b) did not develop the “producer bias” arguments at all but instead presented his analysis as a more rigorous and modernized updating of quite traditional voting models of politics. It is therefore unsurprising that neither reviewers nor the author of an excellent general discussion of economic “influence” in politics (Bartlett, 1973) considered such efforts essentially “Downsian.” See also the discussion later, on the principle of noncompetition and other quite non-Downsian consequences of the investment theory of parties.

9. It should hardly be necessary to observe that this brief discussion cannot hope to cover the nuances of the “socialization” approach or the differences that divide its exponents. For a more extensive discussion, see, inter multa alia, Campbell et al. (1960).

10. As discussed above; it is surprising that an application of Downs along Popkin and associates’ lines took as long to arrive as it did.

11. Olson (1971, Chap 1) briefly summarizes the notion of a “collective good.” See also the discussion of his work later in this paper.

12. Popkin et al. (1976, p. 786); the “simple act of voting” reference is to Kelley and Mirer (1974).

13. Roemer (1978); note that Roemer restricts his point here to what this paper refers to as “major investors.”

14. This is technically incorrect. Party competition takes place until investors in both parties feel their overall losses from mobilizing voters through appeals that lead to sacrifices of vital investor interests exceed the gains that might come from control of the state. But since what is at stake are vital interests—such as labor legislation, or perhaps even the existence of private property itself—virtually any erosion along these dimensions results in massive investor losses. Virtually no investors, accordingly, finance campaigns that involve such appeals, and so practically no competition occurs along these dimensions.

15. For a somewhat untypical case, see the description of the organizational structure established to help manage the Rockefeller fortune in P. Collier and D. Horowitz’s book The Rockefellers (1976). It should be noted here that this discussion of the advantages business enjoys in acting politically cannot be exhaustive. Nor, perhaps more importantly, is it intended as a contribution to the growing theoretical literature on the relationship of the state and market. Most of the considerations advanced in works like Lindblom (1977) are taken for granted here, where the concern is much more concrete.

16. For the evolution of modern management structures, see Chandler (1977) and also DuBoff and Herman (1980). While they make their argument cautiously, Bauer et al. (1972) come close to asserting that large firms do not have reliable cost data—a point which, I venture, will find little support in the mass of business history writings.

Several other observations about this frequently urged position are probably also worth making here. First of all, no one denies that lower-level bureaucrats occasionally escape from the control of their supervisors in the manner described in Allison (1971) (though later analysis suggests his examples may not have been well chosen), or that personality differences and other disputes are not endemic in large business organizations. The point, however, is that management structures have been continuously redesigned to reach and enforce a working policy consensus in the face of such obstacles. When internal divisions over basic policy surface in an important case, their consequences are fairly easy to observe: there will be visible signs of turmoil in the organization and, often, clear attempts by higher-level executives to deliberately take back control.

My own studies of internal documents and memoranda relating to corporate decision making on major public policy issues during the New Deal turned up only a few cases in which major issue-related differences persisted inside corporate managements. Where they did, the usual procedure was to call a committee meeting to hammer out policy. In this connection, see also William Baumol’s observations on the use of operations research after World War II to put such decision-making procedures even more firmly in place [quoted in Walsh (1970, p. 113)].

17. Strictly speaking, as Olson himself notes, his account of collective action also covers altruistic behavior (1971, p. 64). But many politically relevant applications of the theory probably require the stronger assumption of self-interest.

18. See, e.g., Roemer (1978), which rather clearly assumes that fairly concrete issues of work, distribution, and such are sources of frustrations that lead to collective action.

19. Many of these cases, including perhaps most of those discussed here, should perhaps be more properly described as private transactions which have important external effects on the rest of the population. But Olson himself continues to refer to “the group” provision of “public goods” in such cases (see, e.g., p. 48, n. 68), and this chapter will follow that usage.

20. After more than two decades of work on game and coalition theory, it is rather surprising, and cause for some alarm, that this sort of thing continues to happen. Even the most elementary acquaintance with the “prisoner’s dilemma” or oligopoly pricing theories should make it clear that “perfect competition” in a neoclassical sense is a wholly inappropriate assumption for the analysis of many important social outcomes. Like the Justice Department’s claim about the American antiwar movement in the 1960s, a confusion of such “imperfectly competitive” or interdependent situations with conspiracies reveals more about the speaker’s goodwill and clarity of mind than the merits of any actual case.

It is, after all, a sad day for social science when, for example, Morris Fiorina’s Congress: Keystone of the Washington Establishment (1977) has to perform a virtual ritual dance of purity in the introduction merely to advance the suggestion that congressmen vote for spending programs in part because they want to be reelected.

21. Personal communication from Lawrence Goodwyn, who has extensively researched this incident.

22. For more details see Ferguson (1984, n.d.) which relies on extensive primary sources.

23. See Olson’s (1971) discussion, pp. 24–25, especially n. 42, and p. 48.

24. This is apparent even from the example Olson uses in presenting his formal analysis. He considers the case of a group of property owners lobbying for a property tax rebate. Then he sets up the following model.

T = the rate at which the collective good is supplied;

Sg = the “size” of the group, “which depends not only upon the number of individuals in the group, but also on the value of a unit of a collective good to each individual in the group” (p. 23).

The “group gain” (SgT) = Vg. Now, Vi/Vg = Fi, the “fraction” of the collective good an individual obtains; the total gain to an individual therefore is FiSgT.

For an individual to act, a positive advantage (Ai) must accrue to him or her.

To use the model to discover how much of the collective good will be supplied, Olson therefore analyzes how Ai varies with T.

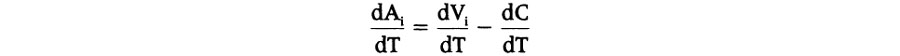

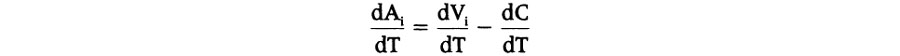

Since the first order condition for Ai to be at a maximum is dAi/dT = O, Olson evaluates

Now, because

the right-hand side becomes

For an individual to act,

Now, all of this is well and good. But what Olson does next is to argue that, because increases in the size of the group drive down Fi, individuals in large groups will not be able to meet this condition, which defines situations under which it is rational for individuals acting by themselves to bear the whole cost of collective action and, by their action, benefit the group as a whole. So, here is a reason, Olson concludes, why large groups will not be provided with collective goods.

But there is clearly something wrong with this analysis. As more than one real estate group in recent American history has discovered to its delight, rewriting a proposed tax rebate to include half or more of the potential electorate does not automatically reduce benefits to itself. Despite Olsons claim that increasing the size of the group should decrease individual benefits, such a strategy is often precisely the high road to success.

In terms of Olson’s discussion on pp. 22–23 of his book, this is to say that Fi does not necessarily change as additional property owners are added. Of course, whether collective action occurs depends on more than the maintenance of the Fi’s, but they, at least, need not pose a problem in a large group.

Note, however, the differences between this example and the Cournot market case Olson discusses on pp. 26–27. In the latter, the demand curve limits total sales, so that increases in individual Fi’s really do take directly away from someone else. This distinction is clearly recognized by Olson in the next section, which distinguishes between “inclusive” and “exclusive” groups (pp. 36–43), but the original claim that increases in group size lead directly to lower probabilities of collective action because of changing Fi’s is repeated thereafter.

It may also be worth observing that the point at issue here differs from the criticisms of Frohlich, Oppenheimer, and Young (1971). Their main argument centered on the possibility of introducing marginal cost-sharing arrangements (pp. 146–48).

25. This is, of course, far from the only problem with the neoclassical approach to “aggregate” concentration.

26. A good discussion of the U.S. experience in this respect is in Kotz, (1979), though its discussion of the New Deal should be supplemented by Ferguson (1984, n.d.).

27. For evidence on the CED see Burch (1979); among many sources on the Business Council see Collins (1981, passim). The only study known to me that failed to confirm the special significance of large financial institutions in major business organizations is Useem (1980). But this study included organizations like the National Association of Manufacturers (NAM) that formally prohibit financiers from being on the board in the sample it analyzed, thus imparting a downward bias to its estimate of the importance of financiers. Of course, the NAM is not without significance, but as Burch (1973) observed, the NAM only occasionally has represented really large firms. As Ferguson (n.d.) argues, when, as in the 1930s, the NAM’s national significance increases, it is because a core of large firms has subsidized organizational growth.

28. See Carle Conway to Thomas Lamont, Dec. 2, 1943; Lamont to E. T. Stannard, Dec. 3, 1943; Conway to Lamont, Dec. 15, 1943; Lamont Papers, Baker Library, Harvard University. Conway, the president of Continental Can and a CED activist, asked Lamont to intervene with Kennecott Copper. The famous Morgan partner did, and Kennecott increased its contribution.

29. See Olson (1971), e.g., Chap. 4.

30. For extensive discussion and references see Bernstein (1950), Fusfeld (1980), Goldstein (1978), Ferguson (1984, n.d.), and Zilg (1976, pp. 327–30). What appears to have happened to Zilg’s excellent study after its publication underscores this essay’s general analysis of the role major investors play in American life. See the chilling discussion in Sherrill (1981).

31. A close examination of smaller business support for Pennsylvania’s “Little New Deal,” I suspect, would be very revealing in regard to the abolition of the Coal and Iron Police.

32. See the discussion in Mowry (1946, pp. 225, 249, and 292–93); and Kolko (1963, Chap. 8). A few details of Kolko’s interpretation of the Perkins-J. P. Morgan links perhaps are mistaken, though there is no space here to discuss the question.

33. For the “leapfrog” reference, see Downs (1957a, Chaps. 8 and 9); and Barry (1970, pp. 118 ff).

34. See the discussion of relief in section 4 and the references cited there.

35. For the individual cases just mentioned, consult any detailed history of political parties and election campaigns, e.g., Polakoff (1981); for Carter in 1980, see Ferguson and Rogers (1980, pp. 28 ff).

36. Though not all analysts using an ethnocultural framework have claimed their results refute explanations of American politics that rely chiefly on economic arguments, many have. See, e.g., Bogue (1980), who cites Kleppner, Formisano, and Jensen to this effect. In fact, however, all but strong formulations of the “ethnocultural synthesis” are entirely compatible with this essay. And the strong formulations are clearly wrong. Almost none of the best-known studies in this tradition have employed adequate controls for economic factors, not have they tested analyses relying on sophisticated economic theories. Where sensible economic controls have been tried, the results show significant and powerful direct economic effects on voting behavior even in cases where ethnocultural theories should show to best advantage. See, for example, Lichtman’s (1980, Chap. 8) striking discussion of voting in the 1920s (whose analysis, especially when read in the light of his final chapter’s remarks on the utility for business elites of race and other noneconomic appeals, is highly compatible with this essay’s analysis) and Williamson’s (1981) study of Kansas in the 1890s.

Ethnoculturally oriented voting analysts have also made life easy for themselves by avoiding any detailed analyses of class structure and the churches (as is briefly discussed later, in section 4). Nor does it help the cause of either theory or clarity when Morris Fiorina, in his analysis of Retrospective Voting in American National Elections (1981), adopts a definition of “economic” influence on voting that excludes cases in which workers who have lost their jobs in a world recession accept Jesus Christ as their savior and then come out vigorously in favor of, for example, aid to Taiwan, South Africa, or the B-1 bomber (not to mention “right-to-work” laws).

37. See the discussion in Key (1959).

38. As Ferguson (1984, n.d.) suggests, often the best and most practical way to define “large” investors makes reference to (whoever controls) the largest corporations and banks in the country, and as many large individual fortunes as data can be gathered for. Also, as Ferguson (1986) observes, in this sort of work, as in other parts of the social sciences, missing data often represent a hazard which is to be worked around as best as one can.

39. It is obviously absurd to think that some fixed percentage of major investors somehow exercise an unvarying amount of influence at all moments in the life of a national economy. Any serious attempt to analyze concrete cases has to recognize that relations between large and small investors are dynamic and historically ever-changing. That said, it remains true that large investors are uniquely important to analyze within any given historical circumstance—even on the rare occasions in which many small investors become politically active and the level of class conflict rises.

40. It is obvious, for example, that many existing archives are missing any number of potentially important documents, including not only many which were inadvertently destroyed or mislaid but also many that were deliberately suppressed or which still exist but continue to be withheld by interested parties or their descendants. Material that has been recovered sometimes contains errors and can also mislead simply because it must sometimes be interpreted without a complete understanding of the context. More subtly, the kinds of material one examines most frequently can bias one’s conclusions. Excessive concentration on readily available government agency records, for example, makes it easy to exaggerate the importance of bureaucrats in historical events; the same is potentially true, mutatis mutandis, with all other kinds of records, including those in private business archives.

Memoirs and eyewitness accounts of major historical events contain additional sources of bias as well. Most kings, presidents, ministers, and such are prone to exaggerate their own roles in key decisions. Such sources also contain all sorts of other confusions, good-faith mistakes, and occasionally outright fraud.

It should also be obvious that no one has done more to damage the historical record than Alexander Graham Bell, and that written documents help little where the groups and persons concerned do not write at all or rarely articulate their views extensively.

41. Oral interviews, however, are probably the least useful and reliable of all possible sources. It is probably no accident, for example, that virtually all accounts of the business community that cast doubt on its general political skills and power rely extensively on oral interviews for their “facts.” For some striking comparisons of what high business and political figures told interviewers about their behavior in the New Deal and what archival evidence revealed about their actual behavior, see Ferguson (n.d.).

42. See the discussion of recent literature on appointments and the analysis of political power in Ferguson (1986).

43. For example, the analyses in Ferguson (n.d.).

44. Note the restriction of this condition to major investors. While it probably fits most other investors to varying degrees at different points in time, this paper is not basically concerned with how to analyze mass politics. It is important to note, however, that a special interest in profit maximization does not derive from any unusual deductive powers unique to large investors. Their behavior, in this respect, faces constraints that may not operate evenly on the rest of the population. As is not the case for lesser investors, in many situations the resources available to major investors ensure that what they do matters, visibly, tangibly, and often immediately. An error, or inaction, accordingly, imposes real costs.

45. In this paper there is little point in taking a turn on the income/wealth/maximization/optimization/satisficing/time horizon/discount rate carousels. Nor is there time to do more than pause ritually to acknowledge that, of course, the role profits play in capitalist economies is unique and not at all comparable with other sources of income.

Nor is there space to discuss how this analysis of wealthy investors relates to current discussions of cultural and ideological factors in social development. While these will have to wait for another occasion, it may be noted here—as it should be plain from parts of section 4—that investments in “culture” and information represent a major share of all politically relevant investments by major investors.

46. For the notion of a nondecision, see Bachrach and Baratz (1970). All these cautionary remarks, of course, provide no excuse for endorsing vacuous searches for “perfect” or “comprehensive” indicators. One point in favor of careful working procedures in the social sciences is that they permit cumulative improvement. See also the remarks in Ferguson (1986) on so-called thick description as a social science strategy for advancing knowledge.

47. For the original, more complex models, and many more details and references to the literature on the System of ’96, see Ferguson (1984, n.d.).

48. Which means that, unlike the first, this dimension is not continuous, but takes only two values. It also, of course, oversimplifies the relation of firms to the international economy.

49. It is perfectly sensible to plot the financial system on these graphs, as in Ferguson (1984). But financial markets are often highly decentralized and individual banks are frequently tied to very specific sectors and regional economies. Depending on the issues involved, accordingly, banks may simply support their borrowers. For example, it was surely not their own labor problems, but concern for labor problems that afflicted their investments (“borrowers”) that persuaded most nineteenth-century bankers to support government policy actions against labor. The assignment of the financial sectors to spaces on graphs like those discussed here is, therefore, more complicated than it appears at first sight. It is perhaps also worth noting that membership on boards of directors and trusteeships can often provide important evidence for further analysis by this scattergraph method. Note, however, that in such cases, the directorships merely function as data to support or negate a theory whose explanatory force depends upon the model of the underlying political economic relationships implicit in the dimensional analysis of the coalition. “Networks” by themselves explain nothing; their significance derives entirely from the demonstration they can provide that certain actors really are interacting in accordance with a theory of how they should act. I mention this point because previous (informal) statements of the methods discussed in this paper have been misunderstood as advocating “network analysis,” or as suggesting that the mere discovery of some sort of social tie between actors counts as definite evidence of joint, effective action. Obviously, it does not, and, a fortiori, it is substantive considerations of political economy, not the abstract fact of a “network,” that explains political outcomes.

50. It should not, however, be too difficult to form an impression of what these will look like when published. The sketches of various party systems which follow all clearly label outcomes and principal actors, and discuss the broad dynamics of the various transitions. It is perhaps also worth noticing that nothing in this analysis prejudices the possibility that a normally stable party system could be briefly disrupted by some intensely but briefly contested issue unrelated to other elections within the period. In that case, graphs for one election would be scrambled, requiring an extra dimension useless for analyzing the system as a whole. But if the basic long-run industrial alignment is not disrupted, then the “exceptional” character of such an election will be evident.

51. See section 4.

52. Now a major theme of much work inspired by Immanuel Wallerstein’s research.

53. See section 2.

54. Perhaps in reaction to the last generation of “consensus historians,” many recent studies of American history make a determined effort to discuss the often very painful daily-life experiences of ordinary people. This research has produced many significant works that amount to a powerful indictment of conventional pluralist theories of American politics. But while I am totally in sympathy with efforts to “assert the dignity of work,” “reveal the thoughts and actions of the rank and file,” or show ordinary people as “active, articulate participants in a historical process,” and similar aims, I am very skeptical about this literature’s frequent unwillingness and inability to come finally to a point. That ordinary people are historical subjects is a vital truth; that they are the primary shapers of the American past seems to me either a triviality or a highly dubious theory about the control of both political and economic investment in American history.

55. See, for example, Goldstein (1978, passim).

56. Except in specialist works like that of Goldstein (1978), such cases are normally neglected by all varieties of “consensus” historiography.

57. See, e.g., Ratner (1967). Taxes, of course, always remain one side of a problem whose other face is expenditures, though this essay cannot afford more than the briefest consideration of either.

58. “Ethnocultural” histories have produced much work on particular periods and elections, but no synoptic interpretations of American critical realignments. Perhaps the closest approach to one, though it scarcely represents a “pure” example of the genre, is Polakoff (1981). See also the works cited in Bogue (1980) and for a view that stands between these works and this paper, Shefter (1978).

A few other reservations may also be noted here for the record. First, because this is a paper and not a book, the sketches which follow pass over any number of major events in American history, from the political adventures of John C. Calhoun to the Vietnam War. This is unfortunate, but there is no alternative. Second, similar limitations of space preclude much discussion of the role of “intellectuals” and ideas in the realignment movements discussed here. I hope to return to this theme in the separate studies of the party systems I expect to publish in the future. For the time being, it must suffice to note that virtually all the major business figures discussed here maintained close, often intimate, relations with channels for the dissemination of ideas. Third, while a few of the most obvious and outstanding facts that bear on the daily life of average Americans are discussed here as crude benchmarks, an enormous amount of demographic, statistical, and personal facts have had to be left out. Only the barest details of how women, minority groups, or even workers as a whole fared [as well discussed, for example, in Gordon, Edwards, and Reich (1982)] can be put into an essay that must concentrate on the process of bloc formation among major investors. Finally, this essay has to focus on broad trends at the national level, without regard to differences between levels of government.

On many of these topics, however, an industrially sensitive analysis could contribute much. In regard to the progress of the movement for women’s rights, for example, it surely mattered a great deal that two of the biggest and fastest-growing sectors in the early stages of industrialization—textiles, and the brewing and liquor sectors—were dead set against women’s suffrage. One was opposed because initially women’s suffrage would likely have led to a stronger political position for its own workforce (which included many women and children); the other because of the leading roles women played in the Temperance campaign. Nor was it accidental that the final successful campaign for women’s voting rights coincided with World War I, when public hysteria and official investigations had virtually immobilized the heavily German-oriented brewers.

The gradual passage of laws giving women the right to hold property in their own names in the nineteenth century also had major consequences once the trust movement appeared. Combined with the somewhat misnamed “managerial revolution” (which enabled shareholders to control large blocks of shares without having to actively manage the enterprises), this development led directly to the ironic fact that some women (e.g., Mrs. Russell Sage) ended up in command of enormous fortunes upon the deaths of their husbands. They could then redirect (some of) the money to social causes. But more of this another time.

59. For example, the discussion in Formisano (1981); Ferguson (1986) discusses some of the ramifications of taking positions on this question.

60. Elbridge Gerry and his allies, for example, were certainly not poor, provincial farmers.

61. In this and most of the remaining notes in this paper, it would be easily possible to reel off a plethora of references. But there is simply not enough space for this. Accordingly, subsequent references are strictly limited to the minimum number necessary to support the argument and make no attempt to index even a minimally adequate list of major works on each period.

62. See the excellent summary of Hamilton and other Federalist leaders’ wealth and kinship ties in Burch (1981a, Chap. 2); this source also has a brief summary of Hamilton’s fiscal program.

63. See the discussion of banking practices in regard to loanable assets in Hammond (1957, pp. 74–75).

64. Among many discussions see, e.g., Polakoff (1981, Chap. 2), La Feber (1972), and Van Alstyne (1972).

65. Burch (1981a, p. 88) is most illuminating. Dallas himself represented Stephen Girard on several occasions. His very close associate Jared Ingersoll regularly represented Girard. Dallas seems also to have served as a sort of courier between Philadelphia’s Republican business community and the administration.

66. Reliable trade figures showing the dramatic reorientation of American trade after the Revolution away from Britain have only recently become available. See Robertson and Walton (1979, pp. 126–28). For John Jacob Astor and the other Republican merchants, see Burch (1981a, p. 88).

67. Hammond (1957, pp. 145–461); Van Alstyne (1972); and Burch (1981a, Chap. 3). Note that Joseph Story did not support Jefferson’s embargo policies. For the Western movement, see Van Alstyne (1972); for background, La Feber (1972). Paying for the weaponry necessary for this imperial venture, however, was a contentious issue in both Jefferson’s and Madison’s regimes.

68. A word about the significance of this brief increase in turnout may be advisable here. There is no reason in principle why the dream of conquering the West, or Canada, or Florida, should not also have captured a large mass of voters, as well as the elites this paper dwells on. Indeed, it almost certainly did. But the very steep decline in turnout in the elections following, as well as the considerations advanced below, in the discussion of the Jacksonian era, make it difficult to claim that voters were determining policy in general. On the contrary, the rise in turnout probably testifies to massive mobilization by sharply divided elites.

69. Hammond (1957, pp. 146–47); for Story, see Burch (1981a, p. 110). In this paper it is not possible to pursue the question of how the Supreme Court relates to the various party systems discussed here. Burch’s discussion of Supreme Court appointments (1980, 1981a, b) suggests, however, a variety of ways this issue can be approached that have so far not been widely explored, even in the growing literature on so-called critical legal studies.

70. Hammond (1957, Chaps. 6 and 8) is a superb discussion. For Girard’s plans, see Brown (1942).

71. Brown (1942) and Hammond (1957, Chap. 9) have excellent discussions. See also Burch (1981a, pp. 99–100).

72. The origin of Southern support for tariffs in this period has been debated extensively. For references and a perhaps less than wholly convincing analysis, see Preyer (1959).

73. For a vivid account of the distress that accompanied the depression of 1819, see Rezeck (1933). The 20 percent unemployment figure (in some cities) is a guess. It assumes that the figures for particular locations mentioned in Rezeck (1933, pp. 29–31) are exaggerations and that the panic of 1819 probably was not as severe as later depressions, such as those in the 1890s or 1930s.

74. See Burch (1981a, p. 100 and p. 122, n. 69). Astor evidently did not seek repayment of principal until after Monroe left the White House.

75. Shade (1981), which is an exceptionally interesting essay; McCormick (1960); and Polakoff (1981, Chap. 4). Note that local rivalries in this period remained intense. For some of the tensions associated with this development, see Welter (1960).

76. Taussig (1964), and Pincus (1977) are sources on the early tariffs. See also a fine and very stimulating study by Chase-Dunn (1980), which, however, attaches more importance to manufacturing during the period before 1860 than its weight in the economy warranted and greatly underestimates the significance of railroads.

77. Hammond (1957); compare the reception accorded this book with the earlier study of Schlesinger (1945) which Hammond had brilliantly reviewed (Hammond, 1946). Hammond, perhaps, could have made a bit more than he did of the support the Bank commanded among some large state banks (including some in New York City), though he was aware of it and indeed briefly discusses it most intelligently.

78. See Burch (1981a, p. 171, n. 126) and Sobel (1977, pp. 8 ff. and 26). For Philadelphia’s crucial role in finance during this period, see Chandler (1954).

79. Hammond (1957, Chaps. 12–14); but see especially Burch (1981a, p. 147), which demonstrates major errors of fact in earlier criticisms of Hammond by Remini (1967) and especially by F. O. Gattell (1966).

80. See the discussion in Haeger (1981, pp. 138 and especially 139), which is a nice case study of what American “radicalism” is frequently all about. Hammond made the same point in general but not in detail. On New York parties in general, see Bridges (1982).

81. See the discussion in Trimble (1919, pp. 410–11); for Cambreleng’s business ties, see Burch (1981a, p. 152, p. 170, n. 119 and 123, and p. 171, n. 126).

82. Compare the indications of increasing party cohesion in, e.g., Russel (1972). On the basis of a wealth of data, Shade (1981) argues convincingly that national parties properly “emerged” only toward the end of the 1830s. This is also the present essay’s argument; but I am somewhat puzzled why Shade believes this development is difficult to explain, or how relabeling capitalist development as “social mobilization” advances the inquiry. Nevertheless, his broad argument is compelling and merits a wide readership.

83. Evans, 1981, p. 34.

84. A good survey of the American experience with laws regulating wage and hours is Ratner (1980). See also Dankert, Mann, and Northrup (1965). David and Solar (1977) summarize trends in real wages and the cost of living. Williamson and Lindert (1980) provide a comprehensive analysis of wealth and income differentials over the course of American history. The minuscule nature of relief (less than 1 percent of GNP) all through the nineteenth century is clear in Peterson (1935) and can be directly estimated from what are probably reliable data for the 1890s in Mills (1894). Note that Peterson suggests that relief was much better organized in the 1890s than previously. It is also probably worth noting that relief expenditures ran highest in the largest American cities.

85. The illiteracy figures are taken from Cremin (1980, pp. 490–91), who cautions that variations in census procedures affected results at different points and that blacks’ illiteracy rates ran far higher than whites’. The 1854 Census estimates of newspapers show 852 papers in the United States in 1828, 1,631 in 1840, and 2,526 in 1850. The estimate of prolabor papers comes from Sumner (1936, p. 286) and is for the years 1828–1832—years before the panic of 1837, which wrecked unions across the country.

86. I have not been able to find any reliable estimates of the economic value of the output of political machines in this period. For slightly later dates, Yearly (1970, passim, but especially pp. 265–66) is suggestive. Much of the literature on political machines in America is highly romantic. A more accurate and less sentimental treatment seems now to be emerging, however; see, for example, Shefter (1976) or Erie (1980).

Note that a few voting analysts have raised questions about the reliability of the figures for voting turnout in this and later periods. In particular, it is sometimes suggested, the U.S. Census population reports might induce important errors. This chapter does not have space for a full consideration of such arguments, but it should be pointed out that Burnham, who is the most frequently cited source of turnout figures, made important use of state rather than federal censuses whenever he believed the federal government’s figures could be improved upon. Accordingly, calculations of errors based on experience with the U.S. Census miss the point; and the Burnham estimates, which were very carefully done, are probably as good as any that will ever be produced.

87. See, e.g., the discussion in Cremin (1980, pp. 338 and 341 ff.); this source perhaps exaggerates the number of actively involved farmers who did more than read papers or magazines.

88. The literature is immense, but see, for example, Beard and Beard (1934, Chaps. 15 and 17).

89. See the review of these various studies in Lee and Passell (1979, Chap. 10).

90. For references and a discussion of these theories, see Lee and Passell (1979, pp. 214–18).

91. For example, Robert Toombs, in a speech to the Senate, in the Congressional Globe (Jan. 7, 1861), pp. 270–71; though this is quoted in Lebergott (1972, p. 214), its point seems not to have been taken up in the subsequent literature, although Lebergott himself makes it clearly.

92. See the discussion in Polakoff (1981, p. 165), although he perhaps underestimates the pro-Southern sentiment that grew in parts of southern California. Note also that further settlement was certain to follow a successful transcontinental railroad, which many Southerners promoted.

93. Jones (1970) is one of many discussions.

94. For Walker, see LaFeber (1993, pp. 28–30); for Cuba, see, e.g., Jones (1970, pp. 66, 69).

95. Expansion into Mexico, for example, virtually required that the states remain united. Not surprisingly, therefore, many early Southern supporters of territorial expansion, such as South Carolina’s Joel Poinsett, opposed efforts to bring North-South conflicts to a head. See also Draughton (1966) on the role played by Sam Houston’s brother George in sparking opposition to Calhoun in the late 1840s.

96. Note also that parts of several of these states fell well below the Mason-Dixon line, the traditional dividing point between North and South.

97. See, among many sources, Russel (1948, passim). Jefferson Davis, future president of the Confederate States of America, was a major player in some of these struggles.

98. See Sorin (1970) for a statistical study of leading New York abolitionists. A leading abolitionist, New York’s Gerit Smith, was for some years probably the largest landowner in the United States. Lewis Tappan, another abolitionist leader, founded the firm that is today Dun & Bradstreet.

99. “James F. Joy,” National Cyclopedia, XVIII, p. 121; Forbes (1900, p. 171).

100. “James F. Joy,” National Cyclopedia, XVIII, p. 121; Dodd (1911, p. 787); Stover, (1975, p. 90).

101. Edelstein (1968, pp. 216–17). Forbes had earlier helped ship guns to Kansas. Gerit Smith also contributed to Brown. See “Gerit Smith,” National Cyclopedia, XVIII, p. 332.

102. See, e.g., Forbes (1900, p. 186).

103. Dodd (1911, p. 787) identifies several prominent New York Democrats as controlling the Illinois Central in this period. But while Dodd may be correct, neither the United States Railroad Directory for 1856 nor Low’s Railway Directory for 1858 records any of the men Dodd discusses as serving on the board. These directories do, however, show clearly that Dodd was right in claiming that New York interests maintained a dominant position on the board. The next directory I have been able to locate dates from 1861. This shows a continued heavy representation of New Yorkers, but also some turnover, including the removal of one director listed as living in Chicago, and the arrival of Nathaniel Banks. The seriously incomplete accounts of Lincoln’s relationship to the Illinois Central in Sunderland, (1955, pp. 24 and 39) and Corliss (1950, pp. 108, 117 ff., and 121) are consistent with the view that the Central’s top officers and directors were far more favorably inclined to Lincoln in 1860 than in 1858. It should also be observed that railroads in certain areas (like the Baltimore & Ohio, which ran through border states) were not at all enthusiastic about either Lincoln or conflict with the South.

104. Forbes (1900, p. 182); “James F. Joy,” National Cyclopedia, XVIII, p. 121.

105. While the full network of ties between all the principals in the Lincoln campaign is too dense to discuss here, for Ogden’s business relations with Thomas Scott of the Pennsylvania Railroad, see Burgess’ Railway Directory (1861), p. 88. Note also that most of these men still hoped to avoid war with the South.

106. For Cornell, see Dorf (1952, pp. 199 and 227); for Chase and Cooke, see Burch (1981b, pp. 20–21).

107. Almost all accounts of Lincoln’s election mention Pennsylvania and the tariff; for banking reform, see Rezeck (1942) or Hammond (1957, Chaps. 21 and 22). See also Burch (1981b, p. 22).

108. The literature on these matters is immense; see, e.g., Polakoff (1981, pp. 196 ff.) for a brief account.

109. Of many accounts, see e.g., the discussion of McClellan’s candidacy in Burch (1981b, p. 55, n. 70). In this period many railroads also shifted back and forth among the parties in a complex pattern that defies summary here.

110. Polakoff (1981, Chaps. 6 and 7); Burch (1981b, pp. 74–75).

111. For the railroad and other bargains in the Compromise of 1877, see Burch (1981b, p. 74). See also Josephson (1963) for many of the events of this period and Goodwyn (1976) or Schwartz (1976) for the subsequent nightmares Southern elites visited upon their subject population.

112. Schirmer (1972, Chap. 2). For civil service reform in this period see especially Roy (1981); for Forbes, see “John Murray Forbes,” National Cyclopedia, XXXV, pp. 331–32.

113. For the New York Central and the Democrats, see inter alia, Shefter (1976); for the turnout efforts in this period, see Polakoff (1981, pp. 232–33). In the 1880s the New York Central drew closer to the GOP.

114. I am presently preparing a study of “The System of ’96: A Reconsideration,” which attempts a rough quantitative evaluation of these trends.

115. See the sensitive discussion in Polakoff (1981, pp. 249 ff.); note his discussion of the importance of distinguishing among levels of government.

116. Goodwyn (1976) presents a wealth of new and very important information on the origins of Populism and the dynamics of its ascent. Schwartz (1976) adds important information on the Populist press, which Goodwyn also discusses, and has a penetrating discussion of some of the larger background reasons for the Populists’ eventual demise and the emergence of a racist planter-industrialist coalition in the South.

117. For example, Burnham (1970, 1974, 1981).

118. See Ferguson (n.d.).

119. Montgomery (1979) and Brecher (1972); the best strike statistics are those presented in Griffin (1939).

120. Where everyone admits that blacks and poor whites were deliberately pushed out of the electorate; I regret that space limitations preclude my discussing these developments in any more detail. Note, however, that Northern elites were very deliberate parties to this scheme. Northern bar associations and law reviews, for example, worked overtime thinking up reasons why the courts should not hear suits brought by disenfranchised Southern blacks.

121. Turnout dropoff is figured by averaging each states’ turnout in 1888, 1892, 1896, and 1900, then subtracting from this figure the average of the turnouts in 1920 and 1924. The turnout data came from Walter Dean Burnham and incorporate a minor correction for Delaware that he has not yet published. The figures for manufacturing value added per capita come from Kuznets, Miller, and Easterlin (1960, p. 131). For each state I have subtracted value added per capita in 1889 from the same category for 1929, yielding the difference per capita that appears in the graph on the X axis. The three exceptional states (which are not included in the calculations for the regression line drawn on the scattergraph) are Maryland, Rhode Island, and Wyoming. (Arizona and several other states not then in the Union also had to be eliminated since they provided no totals for 1888–1896 to compute.)

In all three cases, the special circumstances that produced the original low turnouts are too obvious to require elaborate analysis. Maryland was simply the northernmost state to have adopted the Southern system of voter disenfranchisement (around 1907). (It should be recalled that if the Battle of Antietam had gone the other way, Maryland would probably have made the transition much earlier.) Rhode Island in the nineteenth century was less a political jurisdiction than the name of America’s largest company town, as the elites of this early industrializing textile center, lacking any rural smallholders to strike alliances with, installed a succession of fantastically restrictive suffrage laws that at times excluded as much as 75 percent of the white male population of voting age from participation. (They also had to put down a series of revolts against their new order, of which Dorr’s Rebellion, in 1842, is perhaps the best known.) And Wyoming, for much of the System of ’96 the least populated state in the Union, probably eluded mass disenfranchisement for the same reason that Andorra escaped occupation by the Nazis during World War II—some places with more sheep than people are not worth the trouble of taking them over.

The full statistics for the regression equation are as follows. The equation itself is Y = 8.104 + .057x, R2 = 0.45.

The standard errors for the first and second terms, respectively, are (2.426) and (0.0118); t-values are (3.34) and (4.81); F(1/28) = 23.231. These are all significant results, and tests did not suggest significant heteroscedasticity.

All regressions of this sort face various pitfalls. Spatial autocorrelation, for example, is a possibility. But with the limited number of cases there is little point in testing. Since the Southern states are not in the equation at all, the most obvious source of spatial autocorrelation is not a problem; nor does there appear to be a problem with the other states. Omitted variables, of course, are another possibility, but any discussion of particular candidates would be very lengthy; I believe there are good reasons for cautiously accepting the equation as is.

122. See Ferguson (n.d.) for more details.

123. Note that there is no reason to assume that changes in election laws by themselves necessarily produced the total turnout decline. All the factors mentioned in this paragraph doubtless played a role. At some point, also, “negative bandwagons” would doubtless form, pushing turnout much lower as voters realized that such incidents as the wholesale fraud that defeated Henry George in the New York mayoralty race of 1887 meant that they would never be permitted to assume power.

124. For the basic statistics and an excellent discussion of the merger wave, see Edwards (1979, Chap. 3) and Reid (1976, pp. 66–68).

125. See the discussion in my “System of ’96.”

126. Goodwyn (1976, Chap. 13); for Hearst’s copper (and, thus silver) interests, see Lundberg (1937, p. 65).

127. See the longer discussion in my 1984 and n.d. papers. Note that rivalries with European companies sometimes complicated the partisan choices of the copper companies in ways too complex to discuss here.

128. Ibid.; Weinstein (1968); and Kolko (1963). For reasons of space no further discussion of the Progressive era is possible here.

129. See Kolko (1963); but especially Ferguson (n.d.).

130. Oil imports, where they became an issue, of course ended demands for totally “free” trade by independent oilmen.

An outstanding review of the relations between big business and the press in this period is Debouzy (1972), pp. 153–56; see also pp. 210–22 on the relations of business to the churches and universities. Analyses of mass politics that slide past the facts discussed so well in this French study are unlikely to produce anything except confusion in regard to such topics as “rational expectations.”

131. Ferguson (1984, n.d.) and Ferguson and Rogers (1981). As originally published, the next few paragraphs of this chapter borrowed liberally from the brief summary in Ferguson (1984); the 1984 essay was also indicated as the appropriate source for details and references. In this book, a revised version of the 1984 essay follows immediately. Removing the paragraphs, however, seemed likely to significantly impair the unity and pedagogical value of the overview of American history presented here. I therefore left them in.

132. Virtually all the discussion which follows is based on Ferguson (1984, n.d.), so more specific references will be kept to a minimum. Both of these papers present a formal model of the processes discussed here along the lines discussed in section 3.

133. The quotation comes from an entry in Raymond Moley’s Journal for June 13, 1936, now in the Moley Papers, Hoover Institution. Astor and Harriman were major owners of the publication.

134. To such an extent that when a bank with ties to top union officials failed in the Depression, Standard Oil of New Jersey and other large companies raised a fund for its recapitalization. See Ferguson (n.d.) for details.

135. Ferguson and Rogers (1980, pp. 267–75; 1981, pp. 20–26).

136. Ibid.

137. See, e.g., Goulden (1971, pp. 257 ff.) for a striking example.

138. See the discussion in Ferguson and Rogers (1981, pp. 13 ff.).

139. Kalt (1981) presents convincing estimates of the size of these transfers.

140. This subject merits more discussion than it can be given here. I hope in the near future to consider it at greater length and with extensive documentation.

Note that the aggressive fundamentalism displayed by many elite Texas churches in the 1970s has a powerful “elective affinity” for decontrol because of its emphasis on individual action.

141. No single institutional change can possibly undo the effects of a whole system of influences. Still, consider the likely consequences of a federal campaign spending reform that established individual tax credits for contributions to political campaigns instead of guaranteeing money to the nominees of the two major parties. If these contributions were allowed up to, say, $100, then masses of ordinary voters would have resources that really counted. Some quite striking developments in the American party system would probably occur as these pools of money found their way to new candidates and parties, and as venturesome candidates discovered that even nonvoters now had resources worth pursuing.

Chapter Two

1. See, among many other comments on Fisher’s unfortunate pronouncement, John Kenneth Galbraith, The Great Crash (Boston: Houghton Mifflin, 1961), p. 75. The Irving Fisher Papers at Sterling Library, Yale University, contain many references to his service on boards of investment companies and Remington Rand, a major manufacturer. Fisher’s later role in New Deal monetary controversies made these ties an object of extensive comment. The final copy and various drafts of Lamont’s letter to Herbert Hoover of October 19, 1929 are in the Lamont Papers, Baker Library, Harvard University. (Most archives used in this project are adequately indexed; box numbers are provided for the readers’ convenience only where confusion seems likely.)

2. For a review of debates on the stock market’s contribution to the Depression, see Peter Temin, Did Monetary Forces Cause the Great Depression? (New York: W. W. Norton, 1976).

3. For a good summary of the Depression’s effects on the economy, see Lester Chandler, America’s Greatest Depression (New York: Harper, 1970).

4. Ibid. For the Depression in comparative context, see Charles Kindleberger, The World in Depression (London: Allen Lane, 1973).

5. The 1933 Banking Act, also commonly referred to as the Glass-Steagall Act, should not be confused with a 1932 bill that bore the names of the same senator and representative but dealt with different financial issues. The Emergency Banking Legislation, rammed through Congress in a matter of days in March 1933, was also a different bill.

6. The first of several New Deal reciprocal trade measures passed rather early in Roosevelt’s first term, but, as explained in this chapter, it had virtually no immediate effect on the administration’s essentially protectionist trade policy.

7. The role of Keynesian public finance versus a bulging export surplus in leading the Swedish revival of the mid- and latter-1930s has been extensively debated; the weight of the evidence suggests that the Swedish government did not vigorously implement the advanced monetary and fiscal proposals that were undeniably in the air. In view of this paragraph’s clear distinctions and exact datings of the New Deal’s “Keynesian turn,” I find inexplicable the recent claim by M. Weir and T. Skocpol that my essay “mistakenly conflates the labor regulation and social insurance reforms of 1935–36 with Keynesianism.” See their “State Structures and the Possibilities for ‘Keynesian’ Responses to the Great Depression in Sweden, Britain, and the United States,” in P. Evans, D. Rueschemeyer, and T. Skocpol, eds., Bringing the State Back In (New York: Cambridge University Press, 1985), p. 154.

8. See, for example, Arthur Schlesinger Jr., The Age of Roosevelt, 3 vols. (Boston: Houghton Mifflin, 1957–60); William Leuchtenburg, Franklin D. Roosevelt and the New Deal (New York: Harper, 1963); and Frank Freidel, Franklin D. Roosevelt, 4 vols. (Boston: Little, Brown, 1952-). Erwin Hargrove observes how images of Roosevelt and the presidency derived from such works have dominated postwar political science, in his The Power of the Modern Presidency (New York: Knopf, 1974), Chap. 1.

9. See, for example, Barton Bernstein, “The New Deal: The Conservative Achievements of Liberal Reform,” in Bernstein, ed., Toward a New Past: Dissenting Essays in American History (New York: Pantheon, 1968), and Ronald Radosh, “The Myth of the New Deal,” in Radosh and Murray N. Rothbard, eds., A New History of Leviathan (New York: Dutton, 1972), pp. 146–86.

10. See, for example, Ellis Hawley’s “The Discovery and Study of a Corporate Liberalism,” Business History Review 52, 3 (1978), pp. 309–20. In contrast, his classic The New Deal and the Problem of Monopoly (Princeton: Princeton University Press, 1962) does not emphasize these themes. See also Alfred Chandler and Louis Galambos, “The Development of Large Scale Economic Organizations in Modern America,” in E. J. Perkins, ed., Men and Organizations (New York: Putnam, 1977). It appears that Weir and Skocpol’s “Keynesian Responses,” and other recent essays in the “state managers” vein, represent something of a synthesis of this view and the older “pluralist” approach—with the conspicuous difference that the state manager theorists rely mostly on secondary sources.

11. For a review of the German work, see H. A. Winkler, ed., Die Grosse Krise in America (Göttingen: Vandenhoech & Ruprecht, 1973); perhaps the finest of the libertarian writings are those by Murray Rothbard—see his “War Collectivism in World War I,” and “Herbert Hoover and the Myth of Laissez-Faire,” both in Radosh and Rothbard, eds., New History of Leviathan; for Kolko’s views, see his Main Currents in Modern American History (New York: Harper & Row, 1976).

12. Some commentators, such as Elliot Rosen in his very stimulating Hoover, Roosevelt and the Brains Trust (New York: Columbia University Press, 1977, hereafter Brains Trust), have questioned the existence of “two New Deals.” These doubts, however, are difficult to sustain if one systematically compares the policies pursued during each period.

13. Sidney Verba and Kay Schlozman’s recent suggestion that American workers remained captivated by the “American dream” all through the New Deal does not constitute an answer. The “American dream,” before the 1930s, had not included mass unionization or social security—the term is elastic. See their “Unemployment, Class Consciousness, and Radical Politics: What Didn’t Happen in the Thirties,” Journal of Politics 39, 2 (1977), pp. 291–323.

14. See the discussion in Milton Friedman and Anna Schwartz, A Monetary History of the United States (Princeton: Princeton University Press, 1963); Temin, Monetary Forces; Karl Brunner and Alan Meltzer, “What Did We Learn from the Monetary Experience of the United States in the Great Depression,” Canadian Journal of Economics 1, 2 (1968), pp. 334–48; Elmus Wicker, “Federal Reserve Monetary Policy, 1922–33—A Reinterpretation,” Journal of Political Economy 53 (August 1965), pp. 325–43, and later writings.

15. Kurth, “The Political Consequences of the Product Cycle: Industrial History and Political Outcomes,” International Organization 33 (winter 1979), pp. 1–34; Gourevitch, “International Trade, Domestic Coalitions and Liberty: Comparative Responses to the Crisis of 1873–96,” Journal of Interdisciplinary History 8, 2 (1977), pp. 281–313; Hibbs, “Political Parties and Macroeconomic Policy,” American Political Science Review 71, 4 (1977), pp. 1467–87.

16. I build here on my “Elites and Elections; Or What Have They Done to You Lately? Toward an Investment Theory of Political Parties and Critical Realignment,” in Benjamin Ginsberg and Alan Stone (eds.), Do Elections Matter? (1st ed.; Armonk, N.Y.: Sharpe, 1986); and “Party Realignment and American Industrial Structure: The Investment Theory of Political Parties in Historical Perspective,” in chapter 1 of this volume.

17. Hibbs, “Political Parties,” p. 1470.

18. For representative cross-national data on some of the large differences see ibid., and Edward Tufte, Political Control of the Economy (Princeton: Princeton University Press, 1978), chap. 4.

19. See, for example, Kurth, “Political Consequences”; Gourevitch, “International Trade”; and David Abraham’s The Collapse of the Weimar Republic (2nd ed.; New York: Holmes & Meier, 1986); Abraham’s “Introduction to the Second Edition” should be consulted on the long controversy. The honored ancestors of this general approach include Alexander Gerschenkron, Bread and Democracy in Germany (Berkeley: University of California Press, 1943); Eckhart Kehr, Battleship Building and Party Politics (Chicago: University of Chicago Press, 1975); and Arthur Rosenberg, Democracy and Socialism (New York: Knopf, 1939).

20. Taxes, for example, might be one issue that would not disappear entirely.

21. Indeed, many exceptions exist; for example, firms whose hazardous working conditions are more likely to be detected by a union (which can bear the detection costs) than by unorganized individuals (who may never realize the danger) will resist unionization far more fiercely than one might expect from the role wages play in their value added. Ability to pass through wage increases and, consequently, a firm’s location in the flow of production will also affect concessions vs. opposition to labor. Nevertheless, as a first testable approximation, the rule is probably the best available.

22. The (rounded) data for all but chemicals and copper come from the 1929 Census of Manufacturers as presented in Charles A. Bliss, The Structure of Manufacturing Production (New York: National Bureau of Economic Research, 1939), appendices, especially p. 214. My “automobiles” category is a weighted average of two of Bliss’s categories (parts and assembly). The chemicals figure has been calculated as per note 39, below. The copper data, for 1929, have been calculated from the 1963 Census of Mineral Industries (Washington, D.C.), vol. 1, 10C-10, table 1 (the figure is for “copper ores”). The “refining and smelting” part of the industry shows up in the 1929 Census of Manufacturers (Washington, D.C.), vol. 2, p. 1085. The most reasonable method of weighting and combining all the data yields a corrected estimate of 36.2 percent; but the difference in terms of this article are meaningless. Note that all figures are for industries; data for individual firms are not available, causing problems for estimates of individual firms (see note 39, below). Note also that the estimates for petroleum probably greatly understate the industry’s capital intensity. Finally, industries are listed on the chart if at least one firm in the top 20 as listed in table 2.1 did substantial business in them in both 1929 and 1935. I have also added textiles, by far the largest industry in terms of employment during most of this period, and shoes, as a representative “old” industry also with substantial employment.

23. The assumption that vectors of class conflict indicators and public policies can be treated as scalers is not strictly necessary to this analysis. But it is in accord with both ordinary language and many social science treatments of “rising” or “falling” social strife and labor activity. Note also that while, as suggested in this chapter, this analysis scarcely adds up to a theory of the labor movement and while this essay focuses on the business community, labor is not being treated as a passive element—note carefully the horizontal axis on figure 2.1, which reflects changing levels of social class conflict.

24. I choose this language carefully, to cover instances where a business firm supports both parties. Such instances are much less common or important than generally believed. As I argue at greater length in my “Party Realignment,” chapter 1, no more in politics than in the stock market can everyone profit by buying into the same stock. No less important, most cases of apparent “bipartisanship” rest on undiscriminating evidence—usually public campaign expenditure records. In most cases, more institutionally subtle behavior signals a preference for one or the other candidate.

25. For this, obviously, archival evidence has a privileged position. See, however, my “Party Realignment” chapter 1, for a discussion of the whole question of “evidence.” My experience with corporate records convinces me that the single most important form of business influence on American politics is not the actual transfer of money but the power major businessmen have to influence associates and cultural institutions, especially the media.

26. As with all modeling in the social sciences, of course, more dimensions become necessary the finer the context. “Broadly” labor-related issues include most “social welfare” policies.

27. On these definitions, note 1) the “free” market may well be an oligopoly maintained by a few firms; 2) “internationalists” often have to live in a world full of nationalists and accordingly modify their behavior; 3) occasionally “nationalism” and “protectionism” are not equivalents; 4) occasionally “internationalism” could helpfully be broken down into several dimensions; 5) “internationalism” is usually a matter of degree—any number of firms oriented toward international competition in an open world economy have been happy to welcome government aid where that would not upset a larger equilibrium.

To use this dimension for a real economy requires some impression of the positions of the various industries and firms. I use an independent source: with one exception noted in this essay, subsequent scattergraphs rely largely on summaries of the changing world economic positions of major American businesses presented by Mira Wilkins in her The Maturing of Multinational Enterprise (Cambridge: Harvard University Press, 1974). Based on a judgment about which policies objectively advanced the interests of firms as Wilkins depicts them (where “interest” is equated with profitability), I have placed firms and industries into one of five arbitrarily defined, ordinally ranked spaces along the nationalist-internationalist dimension. Some argument about particular cases is to be expected, especially with General Motors in the ’20s, where most analysts have underestimated the pressures from GM’s major owner, DuPont, to limit its overseas commitments and the importance of the so-called “rubber war.” However, nothing of importance here is sensitive to this imprecision; indeed, the ordinal scale is of some advantage. On the copper industry I follow James Ridgeway, Who Owns the Earth? (New York: Macmillan, 1980), p. 106.

28. Because only one of these axes has a true metric the definition of a “quadrant” is arbitrary: what is at issue is proximity in the defined spaces. Here, however, it is convenient to speak of “quadrants.”

29. See the discussion in my “Party Realignment,” which also contains a longer and more general statement of the “scattergraph” approach to the analysis of American party systems applied in the present article, a detailed justification for concentrating on big business in the analysis of political change, and some qualifications—unimportant in this article but of considerable significance in general—on the treatment of the financial sector in such graphs.

A word should probably be added about how agriculture figures into the analysis presented here. While reasons of space make it impossible to justify the claim, the politics of farm policy in the New Deal has received more attention than it deserves; while agriculture constituted an important part of Roosevelt’s coalition, most of what defined the New Deal derived from other constituencies. Furthermore, agriculture, like industry, is marked by both class and sectoral conflicts, and its political behavior can be analyzed on lines analogous to those for industry.

30. Complicating issues do not, of course, only appear during transition to a new party system, I simply claim that additional issues sometimes complicate such transitions.

31. See the discussion in my “Elites and Elections.” Severe but brief downturns, like that in 1920–21, do not last long enough to generate the processes described below in other than feeble, symptomatic form.

32. Because of this “cumulative” role played by past financial and other secondary cleavages, the actual sequence of historical events makes a real difference even in the model.

33. This expression refers to a party system before decay. See, for example, Paul Kleppner, “Critical Realignments and Electoral Systems,” in Kleppner et al., The Evolution of American Electoral Systems (Westport, Conn.: Greenwood Press, 1981), pp. 1–33.