Alain Wegmann, Paavo Ritala, Gorica Tapandjieva, and Arash Golnam

Introduction

In the mid-1990s, Brandenburger and Nalebuff (1995, 1996) defined coopetition as a win-win strategy among the company, its suppliers, its customers, its substitutors, and its complementors. This seminal definition focuses on the parallel nature of substitutive/competitive and collaborative relationships. Later, a distinct literature on coopetition emerged; the focus was on how firms organize into relationships and networks in which they simultaneously collaborate and compete in their pursuit to create and appropriate value (Bengtsson & Kock, 2000; Ritala & Hurmelinna-Laukkanen, 2009).

Recently, the coopetition literature has become increasingly interested in how collaboration and competition coincide in multi-actor networks and systems. Examples include studies on how individual firms build business models and platforms that involve collaboration with competitors (Ritala et al., 2014), how firms organize into competing multi-actor coalitions including coopetitors (Carayannis & Alexander, 2001; Gueguen, 2009), and how coopetition affects industry evolution and dynamics (Basole et al., 2015; Choi et al., 2010; Rusko, 2011).

Coopetition is therefore integrally linked with another relevant concept in contemporary strategy—business and innovation ecosystems. The ecosystem literature focuses on the systems of actors who create value together over a shared context, purpose, or value proposition (e.g., Adner, 2017; Moore, 1993, 2013), and on the efforts to lead and manage such ecosystems (Iansiti & Levien, 2004; Ritala et al., 2013; Rohrbeck et al., 2009; Williamson & De Meyer, 2012). Ecosystems involve actors who represent inter-organizational networks, but they also span across different industries (Moore, 1993), as well as involve individual customers and other market and institutional actors, thus providing a broad level of analysis that explains the connectivity of contemporary markets (Lusch et al., 2016; Tsujimoto et al., 2017; Vargo & Lusch, 2011). In addition, there is a rapidly developing discussion on platform ecosystems that enable different market actors—including competitors—to jointly create value via interacting through digital platforms (e.g., Ceccagnoli et al., 2012; Eloranta & Turunen, 2016; Gawer, 2014; Gawer & Cusumano, 2008; Ondrus et al., 2015; Thomas et al., 2014).

Although the literature of ecosystems and platforms has acknowledged the relevance of coopetitive interactions and dynamics (Basole et al., 2015; Gueguen, 2009; Ondrus et al., 2015; Ritala et al., 2013), it lacks a systematic means to understanding how different actors in ecosystems perceive the coopetitive dynamics, and how this can be modeled. To this end, we build on systemic enterprise architecture methodology (SEAM), as it helps us to examine business activities from various perspectives in a systems context (Wegmann, 2003). We use the example of Amazon.com (later: “Amazon”) and its ecosystem to illustrate these issues.

Conceptual background: Ecosystems, coopetition, and the SEAM approach

The literature on business and innovation ecosystems is still nascent, and conceptual and boundary issues are continuously debated (Oh et al., 2016; Ritala & Almpanopoulou, 2017). An emerging consensus is beginning to surface over the key components and approaches (for reviews and discussion, see, e.g., Aarikka-Stenroos & Ritala, 2017; Järvi & Kortelainen, 2017; Tsujimoto et al., 2017; Valkokari, 2015). Recently, strategy and management scholars have begun viewing ecosystem as a distinct theoretical construct (Adner, 2017; Lusch et al., 2016).

Adner (2017) provides the following definition, upon which we base also our approach: “The ecosystem is defined by the alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize”. The ecosystem is typically built around a focal firm, product, or platform, which creates a shared context for the value creation and structure for the ecosystem actors (Adner, 2017; Eloranta & Turunen, 2016; Thomas et al., 2014).

This definition helps us to not only identify the boundaries of the ecosystem but also the relevant actors and their interconnections. In this definition, the “focal value proposition” is an important determinant around which ecosystems can be viewed as a “structure.” This enables us to adopt actor-specific perspectives of the ecosystem, typically that of the focal actor. Furthermore, Adner (2017) proposes an ecosystem strategy: “the way in which a focal firm approaches the alignment of partners and secures its role in a competitive ecosystem”. Together, these definitions can be the used for understanding strategies of coopetitive ecosystems.

We focus on coopetition in an ecosystems context that relates to the interdependence and co-existence of competitive and collaborative relationships within the ecosystem. Our illustrative analysis is based on Amazon, a prime example of coopetition strategies with a diverse amount of ecosystem actors. Coopetition perspectives in the Amazon case have been previously documented from the business model and platform perspective by Ritala et al. (2014), as well as from a value network perspective (Golnam et al., 2014). We take these discussions further, as we examine both the overall view of coopetition in ecosystems and the different actor perspectives. For instance, an ecosystem leader might be willing to orchestrate competitive and collaborative interactions within its ecosystem, whereas, for some actors, coopetition in ecosystems is a given condition that these actors must accept.

Our approach further develops the concept of ValueMap (Golnam et al., 2013) that was developed as part of method called SEAM (Wegmann, 2003). SEAM is a method used to model service offerings and service implementation; the offering delivers the value for the customer, and the implementation is the means for providing this value. SEAM was originally developed for analyzing and designing business and IT alignment and their related value creation. However, given its universal applicability and recent extensions (Golnam et al., 2013), it can also be used understand how an ecosystem’s leader and partners can collaborate to bring value to their customers. This background helps us study ecosystems with a clearly identified leader or platform, as in the mainstream strategy literature. We adopt a more overarching system lens. In particular, we examine the ecosystem configurations from an overall perspective and from the perspectives of different actors in the ecosystem.

Example and principles of the modeling approach

We base our discussion on a concrete example, as examples are important for embodying theories (Barsalou, 2008). Using the example of product sales of Amazon, we analyze the structure of the Amazon’s coopetitive ecosystem and make explicit how each actor perceives collaboration and competition. This extends the ecosystem literature, which typically adopts a focal-actor-centric view (e.g., Ritala et al., 2013; Rohrbeck et al., 2009; Williamson and De Meyer, 2012). It also contributes to the coopetition literature by providing lenses for analyzing coopetition strategy from an ecosystem perspective.

SEAM was designed to illustrate a situation with precision and concreteness; it creates diagrams more detailed than those typically used in management studies. In our example, precise means that we can understand the specific responsibility of each actor. Concrete means that we can understand who or what, in the perceived reality, is represented by each model element. This is based on the principle that models can be abstract and precise at the same time (D’Souza & Wills, 1998).

We present an example of Amazon selling alkaline batteries (e.g., a pack of eight AA batteries). It illustrates the Amazon Marketplace—a website that allows Amazon and many other partners to do e-commerce in a coopetitive manner. Amazon is the leader of the Marketplace and provides the technological platform to manage the collaboration. We consider five actors: Energizer, the battery producer; BestDeal, one particular third-party seller; Paul King, a customer; and Amazon as the ecosystem and platform leader. We also discuss the case in which Amazon itself also sells Energizer batteries, and the case in which Amazon sells batteries branded Amazon Basics (hypothetically produced by Energizer for Amazon). These examples are interesting as there are relatively few roles (producer, seller, customer, ecosystem leader) but various companies fulfilling these roles. Furthermore, the large number of similar competitive actors makes the ecosystem highly coopetitive.

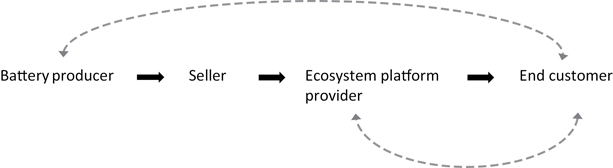

Figure 23.1 represents the ecosystem by using the notation proposed by Adner (2017). The figure provides a baseline illustration of the interaction between the four key ecosystem roles: battery producer, seller, ecosystem-platform provider (Amazon.com), and end customer. The dashed lines indicate that all actors can communicate to the end customer. Although we can understand the basic ecosystem value-proposition rationale through this view, it should be extended to cover the broader ecosystem logic, the competitive and collaborative relational interdependencies and, eventually, to explain the role of coopetition. For instance, as we do not know which company fulfills which role, it is difficult to perceive the complexity of the ecosystem (e.g., the fact that Amazon can compete with the sellers). Coopetition is not yet visible either, as we see only one actor for each role.

In Figure 23.1, there is an implicit product flow: the batteries “flow” from the producers to the customers. In a coopetitive ecosystem, this is still the baseline logic. To represent the coopetitive roles within the ecosystem in more detail, it is necessary to make explicit the number of actors of each category and thus further elaborate the above-described baseline model. Here, we use the SEAM method for this purpose, as it enables an examination of both the overall systems view and the actor-specific perspectives.

To understand multiple perspectives of the ecosystem, we need to understand the value each actor gains by their participation in it. Therefore, it is useful to analyze its collaborations and responsibilities, moving away from the linear baseline logic described earlier. We also develop separate models by using concrete labels and actor names, as it helps to understand the motivation of each actor.

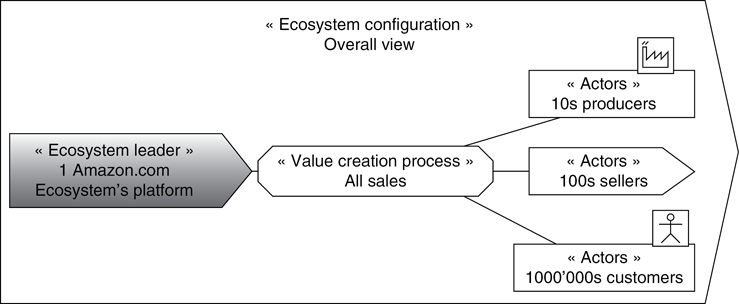

Figure 23.2 shows the Amazon coopetitive ecosystem from a super observer viewpoint, examining the overall ecosystem configuration. The next three figures represent the Amazon coopetitive ecosystem, from four different viewpoints. Figure 23.3 shows the view of the seller; Figure 23.4 shows the view of the producer; and Figure 23.5 shows the view of the consumer. Using these models, we illustrate how the value is created for the actors in each role and how they perceive their role in a coopetitive ecosystem.

In all figures, we provide an order of magnitude for the number of each kind of actor. In this example, there are tens of producers, hundreds of sellers and millions of customers. Only one platform exists that provides the connectivity for these actors (by the definition of an ecosystem as a structure). These numbers are one of the important specificities of this ecosystem. Coopetition occurs between actors with the same role. For example, there are hundreds of sellers. These sellers compete; i.e., they are substitutors. They can also be complementors by selling complementary products (e.g., battery testers). Amazon organizes the interactions between the actors and brings to the sellers and producers millions of customers.

In Figure 23.2, it is possible to already see the essence of coopetition. The collaboration between these roles, however, is shown abstractly. It is only when we model the interaction from the viewpoint of one specific actor that the behavior is represented precisely.

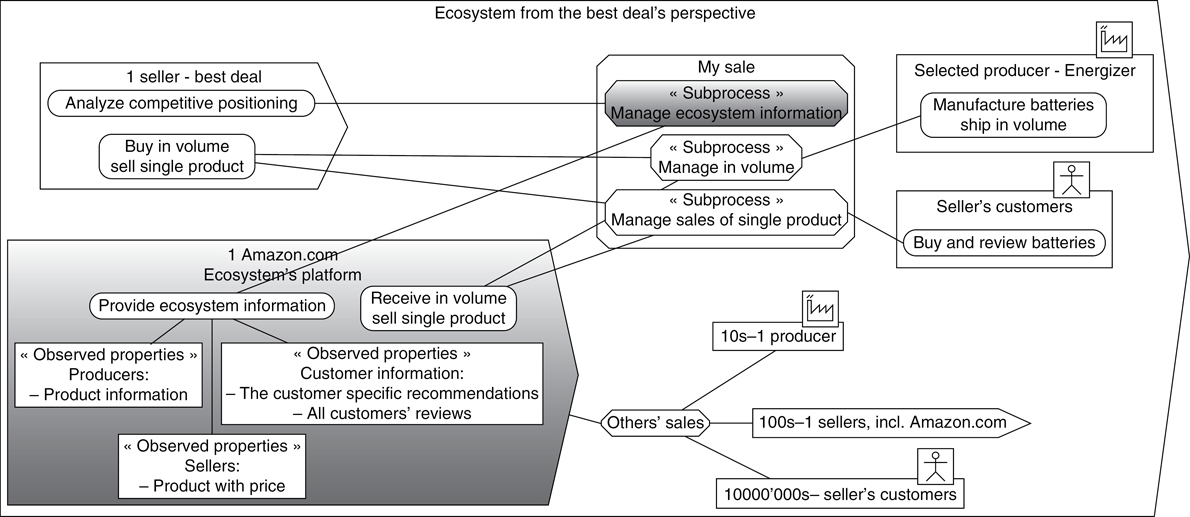

In Figure 23.3, we focus on the view of one seller: BestDeal.

In our scenario, the logistics are managed by Amazon. The seller buys in volume from the battery manufacturer; a few palettes are delivered to Amazon, who then manages the thousands of individual shipments to the customers. The seller is responsible for the sales transaction to the customers (mostly setting the price and accepting/monitoring the customers’ orders).

The coopetitive positioning is explained as follows. First, to sell batteries, BestDeal competes with hundreds of other sellers but it can also collaborate with other sellers to sell complementary products. Note that BestDeal also competes with a special competitor: the internal unit of Amazon that sells batteries (either branded as Energizer, or branded as Amazon Basics). In Figure 23.3, the actor named “100–1 Sellers incl. Amazon” represents all the sellers (except BestDeal) and includes Amazon’s retail unit that sells against BestDeal. Amazon, in the role of the seller, is considered a separate entity from the Amazon ecosystem leader. If needed, we can make explicit the potential conflict of interest by showing a link between Amazon as ecosystem leader and Amazon as seller. Note that in the current implementation of the Marketplace, Amazon sellers usually do not appear explicitly on the website. So, for the consumer, there is no visible difference between the platform and the seller. This gives an advantage to Amazon’s internal sales’ function, compared to its competitors. Despite this disadvantage, the independent sellers still choose to be present on the platform in order to access the millions of potential customers.

By their simultaneous presence on the Marketplace’s platform, the sellers complement each other’s offerings; this contributes to retaining existing consumers and attracting new ones, which is a condition of success for the Marketplace.

The interest of the sellers is access to the large number of pre-existing customers. The Marketplace was created about six years after Amazon’s inception (1994). In 2000, Amazon had twenty million customers. Hence the sellers’ market shares are likely to be larger, compared to those of online sellers in an open market. This is probably why the Marketplace attracts mostly relatively small and lesser-known sellers. Amazon also provides the infrastructure for managing and accessing these customers (product selection and ordering, shipment logistic, payment logistic, etc.). This reduces the barrier of entry for the sellers and reduces their risks.

Another benefit provided by Amazon to the sellers is the ecosystem’s information. The sellers can find precise information about their buyers and can find aggregate information on all customers (e.g., ecosystem share), and on individual customers (i.e., product reviews). For instance, the seller might acquire its ranking among other vendors, possibly where its price is compared to the competitors; and it can obtain information on all the battery providers. To adjust their coopetition strategy within the ecosystem, such information is useful for the individual sellers.

Overall, we can state that Marketplace is intrinsically coopetitive. It is similar to the “physical” market, with the difference that—by being virtual—customers worldwide can be accessed by one seller. Thus, by cohabiting the Marketplace together, with the help of the platform leader, the sellers can reach a huge market in which even a small market share provides lucrative opportunities.

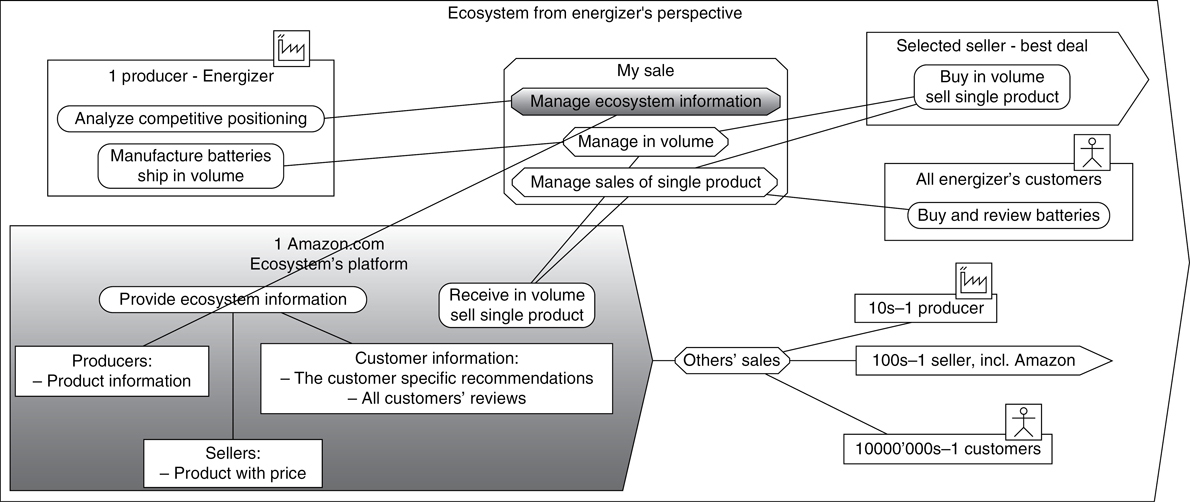

In Figure 23.4, we focus on the view of the producer. The producer is also in a coopetitive situation, as it co-exists with other battery producers. As for the seller, the Marketplace is interesting due to its size as it significantly outweighs the downside of the competition. For the battery producer, who is one step further from the customer, the Marketplace might appear as yet another marketing channel. Hence, the coopetitive aspects for the customer are less critical than for the seller.

Last, we focus on one customer (Figure 23.5)—labeled here as Paul King (ideally, we should represent a “concrete” person; this helps us keep in mind that the ecosystem needs to create “concrete” values for “concrete” people). The consumer appreciates the diversity of the battery sellers and producers; he manages this diversity through the information provided by the ecosystem leader.

Discussion and implications

This chapter has provided a brief overview of the role of coopetition in ecosystems, using Amazon ecosystem strategy as an empirical illustration. In doing so, we have provided several scholarly and practical implications to both coopetition and ecosystems research streams.

Implications for researchers

First, we have illustrated how to build the impetus for partners to join a coopetitive ecosystem. Between 1994 and 2000, by developing the sale of approximately ten product categories, Amazon created a customer base of about twenty million customers worldwide. They did not hesitate to share this customer base with the other sellers, who are also their direct competitors. The millions of customers, together with the pre-built Amazon infrastructure to access them, were the compelling impetus that made sellers and producers join the Marketplace, which enabled the creation of a successful long-term coopetition strategy (for further discussion, see also Ritala et al., 2014). These implications show the prominence of an ecosystem as a concept for the analysis of coopetitive interdependencies, thus furthering research on coopetition in ecosystems and networks.

Second, our results lead us to propose an alternative approach to the definition and analysis of an ecosystem. Adner (2017) defines the ecosystem as “the alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize.” We have shown that the Marketplace was and continues to be possible because all actors gain value from the market. Hence, ecosystems can also be seen from a more overarching, external, and configurational perspective: “the alignment structure of the multilateral set of partners that need to interact in order for both joint and actor-specific value propositions to materialize”. This means that in addition to the focal value-proposition perspective, ecosystems could also be analyzed as systems that enable stakeholder-specific value propositions. Furthermore, analysis of broad-spanning platform ecosystems such as Amazon Marketplace might require viewing ecosystem linkages beyond the immediate structure, or in other words, “affiliations” (cf. Adner, 2017). Such loosely coupled ecosystem actors (such as individual or prospective customers) might be affiliated to the ecosystem merely via shared logic (Autio & Thomas, 2014).

Third, our analysis enable us to better understand the concept of an ecosystem strategy, i.e., “the way in which a focal firm approaches the alignment of partners and secures its role in a competitive ecosystem” (Adner, 2017). In particular, we have examined the perspective of both focal actors and peripheral actors. The Amazon platform provides an infrastructure that, for small and mid-size sellers and producers, dramatically reduces the cost and risks of e-commerce. It provides all services for managing the goods and insures the financial and information flow, information on the ecosystem, and access to millions of customers. Thus, Amazon has clearly defined and secured the roles of all players in the ecosystem. These issues provide a better understanding of how focal actors can act as ecosystem leaders and platform providers by ensuring value creation for both focal and peripheral actors (Eloranta & Turunen, 2016; Iansiti & Levien, 2004; Williamson & De Meyer, 2012).

Implications for practitioners

When designing an ecosystem, the ecosystem leader needs to identify how to attract its partners/competitors and how to attract their collaborative inputs. This requires designing how each actor contributes to the overall ecosystem, what value it receives, and how the actors compete. This calls for defining precisely the role of each actor and understanding what resources (e.g., information) are possessed by whom, and where such resources are needed. All of the above is what is usually called the ecosystem governance or design. The diagrams presented in this study provide a set of useful tools for designing these aspects.

In our case, the power of attraction of Amazon was its large customer base and the convenient access to the Amazon platform connecting all actors. Before being an ecosystem leader, Amazon already had a large customer base. To sustain its growth Amazon decided to give access to its customer base to its competitors. To access Amazon’s customer base was so compelling that almost no external seller or producer could resist collaborating, despite the inherent competition with Amazon and the open competition with the other partners. At that point, Amazon became the leader of a new ecosystem. The internal business units of Amazon (who were selling and possibly producing products) became competitors with their new partners.

To analyze the motivation of each actor for joining the ecosystem, we propose the following design process. First the ecosystem designer (i.e., Amazon in our case) needs to identify all potential actors in the ecosystem and analyze how they would collaborate and compete (Golnam et al., 2014). For each actor, the designer needs to identify its motivation (Regev & Wegmann, 2004). To do so, it analyzes each actor’s strategic goal (e.g., to stay in business, to broaden the market, to diversify). Knowing the strategic goals, it is possible to analyze what each actor perceives in its environment (e.g., e-commerce growth), how it evaluates this perception (e.g., absolute necessity to become an e-commerce actor), and the resulting tactical goals (e.g., becoming member of the Amazon ecosystem) (Regev et al., 2011). From this analysis, it is possible to assess what each actor provides and what value it receives from being in the ecosystem (Golnam et al., 2013). Using the same technique, it is possible to further specify the functionality of the Amazon platform and of other systems that will support the ecosystem.

On the other hand, due to the special nature of our case, it is also important to recognize that not all ecosystem leaders can create designs that are as compelling to other actors. Therefore, ecosystem strategy and coopetitive interactions require careful assessment, where different actors’ roles, motivations, resources, and interdependencies are taken into account. The tools introduced in this chapter could be helpful in identifying these and other aspects.

Coopetition and ecosystems: Future research agenda

There are many interesting research trajectories in the intersection of coopetition and ecosystems literatures, which we briefly iterate here.

First, the dynamics of competition and collaboration change a lot when the examination is brought to the level of ecosystem. In dyadic coopetition relationships, competition often influences collaboration in one way or another, and vice-versa. In networked contexts, competition and collaboration affect each other as well. However, they do not always interact, as they might also merely co-exist, due to the multiplicity of within-network linkages between actors (see, e.g., Bengtsson & Kock, 2000; Ritala & Tidström, 2014). In an ecosystem context, these dynamics are much more complex, scalable, and sometimes subject to network effects. For instance, in platform ecosystems (such as in our Amazon Marketplace case) benefits of competitor involvement on one side of the platform (here, the third-party seller side) provides both supply-side network effects and cross-side, indirect network effects that benefit individual customers. This shows how ecosystem contexts might generate substantial benefits of coopetition, beyond the typical logic examined in coopetition studies. Future studies on coopetition and ecosystems could look at these and other types of mechanisms of how collaboration and competition interact and how their benefits can be scaled in ecosystems and platforms.

Second, future studies on coopetition strategy could explore the special features of ecosystem context further. A well-known argument in the coopetition literature is that involving competitors in value creation provides possibilities for increasing the size of the “pie,” and thus all actors are able to capture more value in the end (Brandenburger & Nalebuff, 1996; Ritala & Hurmelinna-Laukkanen, 2009). In an ecosystem context, the boundaries of inquiry are broader and multiple industries are often involved (Moore, 1993; Williamson & De Meyer, 2012). Thus, it might be that some competitors are involved in capturing the value, while some merely participate in the value creation aspect, and eventually end up capturing value from different markets. Future studies could examine how the ecosystem context influences coopetition strategy by providing more alternatives and mechanisms for both deliberate and emergent value creation and capture dynamics.

Third, longitudinal research designs could look into how coopetition (or lack of it) affects ecosystem emergence, evolution, and decline. Coopetition has been noted as being influential in industrial evolution and competitiveness (Choi et al., 2010; Rusko, 2011). Similarly, for ecosystems, coopetition might play a role in improving the legitimacy and breadth of new ecosystems, as well as affecting their evolution over time (for better or worse). These types of issues provide fertile ground for research integrating coopetition and ecosystem perspectives.

Conclusion

Coopetition research has provided a lot of knowledge of competitive and collaborative interaction in alliance and network contexts, while ecosystem context has remained less explored. As a remedy, we have discussed the role of coopetition in ecosystems, and reviewed the contributions in this field. We also utilized Amazon and its Marketplace platform as an example to illustrate the ecosystem strategy and coopetition from a multi-actor perspective. Using a visual modeling method, SEAM, we illustrated how Amazon is able to create value for itself and other stakeholders by making clear choices of how to design the structure, platform, and interactions in the ecosystem. Overall, we can conclude that coopetition is an integral phenomenon in the ecosystem context, given the importance of competitive and collaborative actors, and their interdependencies in the ecosystem.

References

Aarikka-Stenroos, L. & Ritala, P. (2017) Network management in the era of ecosystems: Systematic review and management framework. Industrial Marketing Management.

Adner, R. (2017). Ecosystem as structure an actionable construct for strategy. Journal of Management, 43(1), 39–58.

Autio, E. & Thomas, L. (2014). Innovation ecosystems: Implications for innovation management. In M. Dodgson, N. Philips, & D. M. Gann (Eds), The Oxford Handbook of Innovation Management (pp. 204–228). Oxford: Oxford University Press.

Barsalou, L. (2008). Grounded cognition, Annual Review of Psychology, 59, 617–645.

Basole, R. C., Park, H., & Barnett, B. C. (2015). Coopetition and convergence in the ICT ecosystem. Telecommunications Policy, 39(7), 537–552.

Bengtsson, M. & Kock, S. (2000). “Coopetition” in business networks—to cooperate and compete simultaneously. Industrial Marketing Management, 29(5), 411–426.

Brandenburger, A. M. & Nalebuff, B. J. (1995). The right game: Use game theory to shape strategy. Harvard Business Review, 73(4), 57–71.

Brandenburger, A. M. & Nalebuff, B. J. (1996). Co-opetition. New York: Doubleday.

Carayannis, E. G. & Alexander, J. (2001). Virtual, wireless mannah: a co-opetitive analysis of the broadband satellite industry. Technovation, 21(12), 759–766.

Ceccagnoli, M., Forman, C., Huang, P., & Wu, D. J. (2012). Cocreation of value in a platform ecosystem: The case of enterprise software. MIS Quarterly, 36(1), 263–290.

Choi, P., Garcia, R., & Friedrich, C. (2010). The drivers for collective horizontal coopetition: a case study of screwcap initiatives in the international wine industry. International Journal of Strategic Business Alliances, 1(3), 271–290.

D’Souza, D. F. & Wills, A. C. (1998). Objects, Components, and Frameworks with UML: The Catalysis(SM) Approach. Addison-Wesley Professional, 1 edition.

Eloranta, V. & Turunen, T. (2016). Platforms in service-driven manufacturing: Leveraging complexity by connecting, sharing, and integrating. Industrial Marketing Management, 55, 178–186.

Gawer, A. & Cusumano, M. A. (2008). How companies become platform leaders. MIT Sloan Management Review, 49(2), 28–35.

Gawer, A. (2014). Bridging differing perspectives on technological platforms: Toward an integrative framework. Research Policy, 43(7), 1239–1249.

Golnam, A., Ritala, P., & Wegmann, A. (2014). Coopetition within and between value networks—a typology and a modelling framework. International Journal of Business Environment, 5, 6(1), 47–68.

Golnam A., Viswanathan V., Moser C. I., & Ritala P. (2013). Value map: A diagnostic framework to improve value creation and capture in service systems. In Proceedings of the Third International Symposium on Business Modeling and Software Design, Noordwijkerhout, the Netherlands, July 8–10, 2013.

Gueguen, G. (2009). Coopetition and business ecosystems in the information technology sector: the example of Intelligent Mobile Terminals. International Journal of Entrepreneurship and Small Business, 8(1), 135–153.

Iansiti, M. & Levien, R. (2004). Strategy as ecology. Harvard Business Review, 82(3), 68–81.

Järvi, K. & Kortelainen, S. (2017). Taking stock on empirical research on business ecosystems: A literature review. International Journal of Business and Systems Research, 11(3), 215–228.

Lusch, R. F., Vargo, S. L., & Gustafsson, A. (2016). Fostering a trans-disciplinary perspectives of service ecosystems. Journal of Business Research, 69(8), 2957–2963.

Moore, J. F. (1993). Predators and prey: A new ecology of competition. Harvard Business Review, 71(3), 75–83.

Moore, J. F. (2013). Shared purpose: A thousand business ecosystems, a worldwide connected community, and the future. Available online: www.arm.com/files/pdf/Shared_Purpose.pdf.

Ondrus, J., Gannamaneni, A., & Lyytinen, K. (2015). The impact of openness on the market potential of multi-sided platforms: a case study of mobile payment platforms. Journal of Information Technology, 30(3), 260–275.

Oh, D. S., Phillips, F., Park, S., & Lee, E. (2016). Innovation ecosystems: A critical examination. Technovation, 54, 1–6.

Regev, G. & Wegmann, A. (2004). Defining early IT system requirements with regulation principles: the lightswitch approach. Requirements Engineering Conference, 2004. Proceedings. 12th IEEE International (pp. 144–153). Kyoto, Japan, September 6–10, 2004.

Regev G., Hayard O., & Wegmann A. (2011). Service systems and value modeling from an appreciative system perspective. In: Snene M., Ralyté J., & Morin J. H. (Eds), Exploring Services Science. IESS 2011. Lecture Notes in Business Information Processing, 82, 146–157. Berlin, Heidelberg: Springer.

Ritala, P., Agouridas, V., Assimakopoulos, D., & Gies, O. (2013). Value creation and capture mechanisms in innovation ecosystems: a comparative case study. International Journal of Technology Management, 63(3–4), 244–267.

Ritala, P. & Almpanopoulou, A. (2017). In defense of “eco” in innovation ecosystem. Technovation, 60–61, 39–42.

Ritala, P., Golnam, A., & Wegmann, A. (2014). Coopetition-based business models: The case of Amazon.com. Industrial Marketing Management, 43(2), 236–249.

Ritala, P. & Hurmelinna-Laukkanen, P. (2009). What’s in it for me? Creating and appropriating value in innovation-related coopetition. Technovation, 29(12), 819–828.

Ritala, P. & Tidström, A. (2014). Untangling the value-creation and value-appropriation elements of coopetition strategy: A longitudinal analysis on the firm and relational levels. Scandinavian Journal of Management, 30(4), 498–515.

Rohrbeck, R., Hölzle, K., & Gemünden, H. G. (2009). Opening up for competitive advantage – How Deutsche Telekom creates an open innovation ecosystem. R&D Management, 39(4), 420–430.

Rusko, R. (2011). Exploring the concept of coopetition: A typology for the strategic moves of the Finnish forest industry. Industrial Marketing Management, 40(2), 311–320.

Thomas, L. D., Autio, E., & Gann, D. M. (2014). Architectural leverage: putting platforms in context. Academy of Management Perspectives, 28(2), 198–219.

Tsujimoto, M., Kajikawa, Y., Tomita, J., & Matsumoto, Y. (2017). A review of the ecosystem concept—Towards coherent ecosystem design. Technological Forecasting and Social Change.

Valkokari, K. (2015) Business, innovation, and knowledge ecosystems: How they differ and how to survive and thrive within them. Technology Innovation Management Review, 5(8), 17–24.

Vargo, S. L. & Lusch, R. F. (2011). It’s all B2B… and beyond: Toward a systems perspective of the market. Industrial Marketing Management, 40(2), 181–187.

Wegmann, A. (2003). On the Systemic Enterprise Architecture Methodology (SEAM). Proceedings of the 5th International Conference on Enterprise Information Systems, pp. 483–490. Angers, France, April 23–26, 2003.

Williamson, P. J. & De Meyer, A. (2012). Ecosystem advantage. California Management Review, 55(1), 24–46.