CHAPTER 3

Money Went Around

the World and Made

the World Go Round

Since the first discovery of America, the market for the produce of its silver mines has been growing gradually more and more extensive…[and] the greater part of Europe has been much improved…. The East Indies is another market for the silver mines of America, and a market which…has been continually taking off a greater and greater quantity of silver…. Particularly in China and Indostan, the value of the precious metals…was much higher than in Europe; and it continues to be so…. Upon all these accounts, the precious metals are a commodity which it has always been, and still continues to be, extremely advantageous to carry to India. There is scarce any commodity which brings a better price there…because in China, and the greater part of the other markets in India,…ten, or at most twelve ounces of silver will purchase an ounce of gold; in Europe it requires from fourteen to fifteen ounces…. The silver of the new continent seems in this manner to be one of the principal commodities by which the commerce between the two extremities of the old one is carried on, and by means of it, in great measure, that those distant parts of the world are connected with one another.

Adam Smith ([1776] 1937: 202, 204, 205, 206, 207)

World Money: Its Production and Exchange

An Afro-Eurasian-wide market for gold and silver has existed since time immemorial. The great fourteenth-century historian Ibn Khaldun observed that “if money is scarce in the Maghrib and Ifri-quiyah, it is not scarce in the countries of the Slavs and the European Christians. If it is scarce in Egypt and Syria, it is not scarce in India and China…. Such things…have often been transferred from one region to another” (Ibn Khaldun 1969: 303). Caribbean gold was added by the Spaniards from the voyages of Columbus and his followers. A major new infusion of America silver began with the discovery of the silver mines at Potos! in Peru (now Bolivia) in 1545 and at Zacatecas in Mexico in 1548. This new silver made a far-reaching impact on the world economy, beginning in 1600 if not earlier in various parts of Asia. For instance in 1621, a Portuguese merchant observed in a treatise on silver that it “wanders throughout all the world in its peregrinations before flocking to China, where it remains, as if at its natural center” (cited by von Glahn 1996a: 433). How silver went around the world has also been summarized more recently:

The usual pattern of trade with the Far East was to transship some of the silver imported either from Europe or from Mexico…on the China-bound ships and exchange it for gold or commodities in China which were then imported back to India and the proceeds used to purchase return cargo for Europe. (Chaudhuri 1978:182)

In fact, American silver was so ubiquitous that merchants from Boston to Havana, Seville to Antwerp, Murmansk to Alexandria, Constantinople to Coromandel, Macao to Canton, Nagasaki to Manila all used the Spanish peso or piece of eight (real) as a standard medium of exchange; the same merchants even knew the relative fineness of the silver coins minted at Potosý, Lima, Mexico, and other sites in the Indies thousands of miles away. (TePaske 1983: 425)

So, “no one disputes the existence of a world market for silver. The issue is how to model it” (Flynn 1991: 337). “The price of silver in Peru…must have some influence on its price, not only at all the silver mines of Europe, but at those of China,” observed Adam Smith ([1776] 1937: 168). He regarded the matter important enough to devote sixty-four pages of his book to “A Digression on the Variations in the Value of Silver during the Course of the Four Last Centuries” and to discuss its effects in numerous places elsewhere in his book.

The existence and operation of a global world market is reviewed in chapter 2. Money and especially silver money was the blood that flowed through its circulatory system and oiled the wheels of production and exchange. Every kind of money acted as a store of value and as a medium of exchange both among other types of money and for other commodities. The multiplicity of coin types, in various denominations and purity, were exchanged or arbitraged against each other and against all other goods. Thus, this arbitrage of money and its exchange for commodities all around the globe also made the world market operationally practical for practically all goods!

MICRO-AND MACRO-ATTRACTIONS

IN THE GLOBAL CASINO

Perhaps it is necessary to address the question first of why this money moved around the world, where and when it did, and indeed why it was produced in the first place. A later section examines the worldwide consequences of the flow of money around the globe. In chapter 2, the main “answer” to the question of where and why the money moved was that it was used to “settle the accounts” of the trade deficit at each link of the chain by those who wanted to import from the next link but did not have enough to export in return. Therefore, they had to settle the difference in money. However, that still leaves at least three related questions unanswered: (1) Why did some want to import commodities without having enough export commodities to pay for them? (2) Why did others want to export commodities they produced and be paid for many of them with money, rather than in other commodities? That is, why did they have a demand for money? (3) Why was this money produced in the first place? After all, to produce, transport, safeguard, mint, and exchange this money required considerable expenditure of labor, materials, and also of money itself.

It is easiest to offer an answer to the last question, and that answer will be a guide as well to answering the other two. Money was produced because it (in the form of silver, gold, copper, coins, shells, and the like) was—and remains—a commodity like any other, the production, sale, and purchase of which can generate a profit just as any other commodity can—only easier and better! Of course to be profitable, the costs of production, transport, and so on have to be lower than the anticipated sale price. And so generally this was the case, except if and when the supply of silver, for instance, increased so much or so rapidly as to drive its sale price down below the costs of production. That did happen sometimes to Spanish (American) and other producers. Then they had to find technological or other ways to reduce costs of production and/or to reduce the amount of production and supply until the price again rose enough to cover their costs. The same was true for gold, copper, cowries, textiles, food, and all other commodities.

Once the money was produced, it could be sold at a profit wherever its price was higher—in terms of some other commodity, be that some other kind of money or whatever. Since the price of the money was largely determined by supply and demand, both locally and worldwide, the money traveled from here to there if and when the supply was high here relative to its supply and demand there. That made the price of silver lower here where the supply was higher relative to demand and the price higher there where the demand was higher relative to the supply, and attracted the silver from here to there. Therefore, it was in the profit-making interest of any private company, or public (or state) producer to send the money from a low-price market here to a high-price market there, even and especially if the low-price market was at home and the high-price one was somewhere else—like half way around the world.

That was one, indeed often the main, business of the major trading companies and state governments, as of course it was of bankers, money lenders, and often of merchants, consumers, indeed anybody and everybody. The supply price of silver was relatively low where it was abundant at the mine head, especially in the Americas, and it was relatively higher farther and farther around the world to Asia. So that is why and where the silver money went on its predominantly eastward journey around the world, although it also went westward across the Pacific and from Japan across the China Sea. And that was the primary, indeed almost the only, world economic business of the Europeans, who were not able to sell anything else—especially of their own noncompetitive production—in the thriving markets of Asia. Asians would buy nothing else from Europe other than the silver it got out of its colonies in the Americas.

That this monetary arbitrage had a long history and became worldwide not long after the incorporation of the Americas into the world economy can be illustrated as follows. From the eleventh to the sixteenth centuries, during the Song dynasty, later under Mongol rule, and during much of the Ming dynasty, the predominant direction of monetary metal exports was of silver and copper from China to Japan and of gold from Japan to China. Reflecting changes in supply and demand from the sixteenth century onward, this flow was essentially reversed, as Japan became a major exporter of silver and then of copper, and an importer of gold (Yamamura and Kamiki 1983). In China, the gold/silver ratio increased (that is, gold increased and silver decreased in relative values) from 1:8 around 1600 to 1:10 at both mid and end century, and then doubled to 1:20 toward the end of the eighteenth century (Yang 1952: 48). However, the gold/silver ratio usually remained lower and sometimes far lower, and the price of silver far higher, in China than elsewhere in the world. As Han-Sheng Chuan explained in his 1969 article on the inflow of American silver into China,

from 1592 to the early seventeenth century gold was exchanged for silver in Canton at the rate of 1:5.5 to 1:7, while in Spain the exchange rate was 1:12.5 to 1:14, thus indicating that the value of silver was twice as high in China as in Spain, (cited in Flynn and Giraldez 1994: 75)

Similar ratios were observed in 1609 by the Spaniard Pedro de Baeza, who also noted that arbitrage between them offered a profit of 75 or 80 percent (von Glahn 1996a: 435).

In the 1590s also, the gold/silver ratio was 1:10 in Japan and 1:9 in Mughal India (Flynn and Giraldez 1994: 76). As long as the relative price of gold was lower and that of silver was almost two times higher in China, silver was attracted to China and exchanged for gold, which was exported. European trading company spokesmen, quoted below, testified to China as one of their sources of gold. As is well known, from the early sixteenth century onward, first Portuguese and then Dutch middlemen were very active in this Sino-Japanese trade, and drew large profits—and precious metals themselves—from it. A Portuguese memo in about 1600 indicates a profit of 45 percent between Portuguese Macao on the China coast and Japan (von Glahn 1996a: 435).

The Europeans then used these profits to support their trade between various parts of Southeast, South, and West Asia and Europe and the Americas. Their merchants and trading companies, especially the Dutch East India Company (usually known by its Dutch initials, VOC) and then also the English East India Company (EIC), engaged in gold/ silver/copper arbitrage as major and essential parts of their worldwide business dealings. Of course, they also arbitraged with or exchanged these metals to buy and sell all the other commodities in which they, like the Asians also, traded in Asia and around the world.

Copper coin was the most predominant and widespread currency of daily use in most of Asia, though it was gradually and partially displaced by silver. So there was at least a trimetallic world market, which however was predominantly on a de facto silver standard. Or rather, the more rapidly increasing world supply of silver, and its concomitant decline in price relative to gold and copper (as well as other monetary commodities), induced and permitted the silver standard increasingly to impose itself in the world market economy.

The rapid increase in the world supply of silver produced especially by the Americas and Japan lowered its price relative to that of gold. However, gold/silver ratios varied regionally, reflecting differences in supply and demand, as did those of silver and copper, which was in greater use for minor coinage. Trimetallic gold/silver/copper and indeed multimetallic and commodity arbitrage extended all around the world and everywhere locally. This arbitrage also included especially cowrie shells, textiles, and other media of exchange, as well as baser metals such as lead, tin, and iron.

Cowrie shells were in much demand as currency and for the slave trade in Africa; and cowries and badam (an inedible almond) were also in widespread use at the most popular level in many parts of India, where they competed with copper coin. The high cost of mining copper and of minting copper coins, relative to that of silver or even gold ones, allowed cowries, which did not have to be minted, to displace coins at the lowest end of the market when copper shortages or coining costs rendered the latter too expensive in India and parts of China. When on the other hand, the slave (and later the palm oil) trade grew and absorbed more shells in Africa, relatively fewer went to India, where some were again replaced in circulation by copper coin in low-value transactions.

Indeed following the “lowly” cowrie around is illustrative of several themes in this book. Cowries were already in use in West Africa when Ibn Batuta reported their gold exchange values in the fourteenth century. By the seventeenth century, their gold exchange value had fallen, presumably because of the intervening increase in their supply relative to that of gold. First the Portuguese and then also the Dutch and English brought them to West Africa in large numbers, which rose and declined with the slave trade. The cowries took two main routes from their centers of production in the Maldives, where they were purchased by Indians and Europeans. One was to Bengal and the other was to Ceylon, at both of which they were then transferred to and used as ballast in European ships bound primarily for England and Holland. From there they were reshipped to the coasts of West and Southwest Africa in payment for slaves. The contemporary John Bardot observed in 1732 that

according to the occasion of several trading nations of Europe…to carry on their traffic at the coast of Guinea and of Angola; to purchase slaves or other goods of Africa…proportionately to the occasion the European Guinea adventurers have for those cuaris [cowries], and the quantity or scarcity there happens to be of them, either in England or in Holland, their price by the hundredweight is higher or lower, (quoted in Hagendorn and Johnson 1986: 47)

So the price of cowries reflected supply and demand changes both in Europe and in Africa as well those emanating in the producing islands, the Maldives, and in the “consuming” regions of South and East Asia.

Another eighteenth-century observer complained that “formerly Twelve thousand Weight of these Cowries would purchase a cargo of five or six Hundred Negroes; but these lucrative times are no more…[so that now] there is no such thing as having a Cargo under twelve or fourteen Tuns of Cowries” (quoted in Hagendorn and Johnson 1986: HI). Similarly, a merchant in West Africa complained that prices for a slave had increased from 100 to 136 pounds of cowries, or from 12 to 16 guns, or from 5 to 7 rolls of Brazilian tobacco, or from 25 to 36 pieces of Silesian linen, or from one anker of French brandy to one and a half, or from 15 to 150 pounds of gunpowder (Hagendorn and Johnson 1986). Not only was there cowrie inflation, but relative prices of commodities also changed, and apparently those of brandy and gunpowder rose most of all!

During the apogee of the eighteenth-century slave trade, there were 26 million pounds, or 10 billion individual shells, of registered cowrie imports, in decade totals averaging from 2 to 3 million pounds but ranging from about 1 to 5 million pounds (Hagendorn and Johnson 1986: 58–62). So, as Perlin (1993: 143) remarks, even the lowly cowrie shell connected economic, political, and social processes and events in the Indian and Atlantic oceans and the lands and peoples adjoining them on all sides. For all of them were part and parcel of a single global marketplace, in which supply and demand regulated relative prices. These differential and fluctuating world prices were arbitraged and “balanced” even in terms of cowries and between them and metallic currencies (including most importantly, copper) or other currencies and among these and all other commodities as well.

Money, as Perlin also insists, no more than any other commodity, is paid out only to balance a trade deficit. No, money is also a commodity like any other in its own right; and it is the demand for money that makes possible both the market supply of goods and the use of the money to purchase them. So, this universal practice of arbitrage in itself already reflects—or helped create—a world market in every sense of the term. To observe as Flynn and Giraldez (1991: 341) do that “the ‘world market' was really a series of interconnected regional markets dispersed and overlapping around the globe” does not alter anything fundamental, precisely because these “markets” were overlapping and interconnected.

But why and how did this money make the world go round? Why did anybody—indeed everybody!—want this money so much as to drive up its price, and in Asia and especially in China to keep the money that arrived from elsewhere? Because people and companies and governments there were able to use money to buy other commodities, including precious metals such as gold and silver. Both at the individual and firm micro-level and at the local, regional, “national,” and world economic macro-level, money literally oiled the machinery and greased the palms of those who produced or ran that machinery in manufacturing, agriculture, trade, state expenses, or whatever. No less and no more than anywhere else, either then or today. That is, the money supported and generated effective demand, and the demand elicited supply. Of course, additional demand could only elicit additional supply where and when it could. That is, there had to be productive capacity and/or the possibility to expand it through investment and improved productivity.

The argument here is that that expansion was possible and did happen, especially in many parts of Asia. Otherwise, the Asians would not have demanded and bought the additional foreign and domestic money either by supplying commodities or other money for it. If supplies of commodities had not been able to expand, any increased demand for them would just have driven up the price of existing commodities through what is called inflation—and/or there would not have been demand to import this additional new money in the first place! That is, the new silver and copper money, not to mention the additional credit it supported, increasingly monetized and stimulated production in the world, regional, “national,” and many local “economies,” that is in these parts of the single global economy.

The macro-supply part of this argument has been made by all those who have emphasized that the production and/or export of money was necessary to cover deficits in the balance of trade. The macro-demand part of this argument has been emphasized particularly by Perlin (1993, 1994) and others like myself, who observe that this money really did oil the wheels of production and trade and was not just “dug up in the Americas to be buried again in Asia.” The related and complementary micro supply-and-demand argument is that individual producers and companies or even public producers and traders had to have their own profit interests to induce them to do their part in oiling or monetizing macro supply and demand around the world. This argument has been stressed particularly by Flynn (1986), Flynn and Giraldez (1995c), but also by Perlin, who contends that “a demand-centric framework incorporates the question of supply; that is, it establishes a broader, more inclusive, and also far more complex, range of empirical phenomena that need to be taken into account in an adequate explanation” (Perlin 1994: 95).

The combination of these arguments here supports my thesis that there was only one world economy/system and that it had its own structure and dynamic. Money played an important part during the period of global development from 1400 to 1800. Money went around the world and made the world go round in this global casino in which it supplied and vastly increased the lifeblood that fueled and oiled the wheels of agriculture, industry, and commerce.

DEALING AND PLAYING IN THE GLOBAL

CASINO

Among the main exporters of precious metals were the Spanish American colonies and Japan. Europe, the Ottomans, Persia, and India also were exporters, but they largely though not entirely reexported precious metals that they had themselves imported.

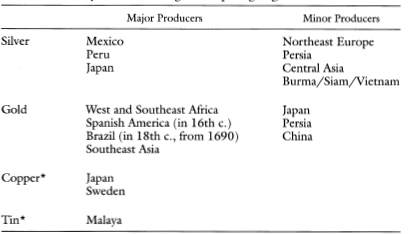

Africa and Southeast Asia produced and exported gold. China produced copper coin predominantly for domestic use but also for export to Southeast Asia and elsewhere. China also produced and exported gold, which Japan and others imported. Japan became probably the world's major copper exporter from the mid-seventeenth century onward. Daily and small transactions in East, Southeast, and South Asia were mostly in copper coin. Asians no less than Europeans devoted enormous amounts of economic, social, political, military, and other “energy” and attention to this money business, which often was more profitable than any other. The world's major and some minor producing and exporting regions of monetary silver, gold, copper, and tin, which were exchanged and arbitraged against each other, are summarized in table 3.1.

So for silver, the major producers and exporters were Spanish America and Japan; and of gold, the major producers were Africa, Spanish America, and Southeast Asia. Effectively, the world economy was on a silver standard, although gold and copper, and to a much lesser extent tin and cowrie shells, were also mutually interchangeable. The Ottomans, Ming China, and India used large quantities of silver to support their currency systems, ultimately sustained by the huge and cheap production of American, but also Japanese, mines.

Table 3.1 Monetary Metal Producing and Exporting Regions

* Copper and tin were sometimes alloyed; both were used for low-value coinage.

As had been the case for millennia, gold predominantly moved through Central Asia and to and around South Asia from east to west, in the direction opposite to that of silver, which moved from west to east. On the Indian subcontinent, gold moved to the south and silver to the north. Both were exchanged not only for each other but of course also for other commodities, as well as for local and especially imported foreign coins and other forms of currency. This profitable arbitrage was big business not only for Venetians and later Spaniards, Dutch, and other Europeans, but equally so for Ottomans, Persians, Indians all around the subcontinent, Southeast Asians, Japanese, and Chinese. Bullion and coins were produced and transported often halfway around the world and over other long distances. Sometimes these metals went as a single shipment, but more usually they were transmitted through chain-linked stages. The precious and also some baser metals were bought and sold in the form of bullion and coin like any other commodity to generate profit. That in turn was converted into and invested in other commodities, also including other currencies and of course wage, slave, and other “forms” of labor.

TePaske (1983) describes the chain-linked movement of silver:

The bullion flowed out of Spain to England, France, and the Low Countries for purchase of manufactured goods unavailable in Castile. From English, French, Flemish or Dutch ports Spanish pesos were transshipped through the Baltic or Murmansk into Scandinavia or Russia and traded for furs. In Russia…[silver] went southeastward along the Volga into the Caspian Sea to Persia, where it was sent overland or by sea to Asia. Spanish-American bullion also flowed out of Spain through the Mediterranean and eastward by land and water routes to the Levant. India procured its American silver by means of traffic from Suez through the Red Sea and into the Indian Ocean, overland from the eastern end of the Mediterranean through Turkey and Persia to the Black Sea, and finally into the Indian Ocean, or directly from Europe on ships rounding the Cape of Good Hope following the route discovered by Vasco da Gama. The latter way was also used by Portuguese, Dutch, and English ships to carry Spanish American treasure directly to Asian ports to exchange for Asian goods. Lastly—and long ignored—American silver found its way to the Orient by way of the Pacific route from Acapulco to Manila. (TePaske 1983: 433)

In India, Spanish American silver began to arrive via West Asia and around the Cape of Good Hope by the beginning of the seventeenth century. The Mughal empire was financed and maintained with silver, and its coinage and currency was henceforth heavily dependent on the influx of silver from abroad. Most of it ultimately came from the Americas and arrived via Europe and the Levant over the Persian Gulf or Red Sea routes, but some also originated in Ottoman lands and Safavid Persia. Most of the silver arrived, not by sea around the Cape of Good Hope, but by caravan and via either the Red Sea or the Persian Gulf from Egypt, the Levant, Turkey, and Russia (Brenning 1983: 479, 481, 493). At Surat, for a time India's most important port, the big trading companies (which were by no means the only suppliers) brought about half of the silver arriving from the west. Of that, less than 30 percent arrived via the Cape of Good Hope and most came via the Red Sea, the Persian Gulf, and overland, including from Russia. In 1643–1644, more than half the silver arrived via the Red Sea and the Persian Gulf (Steensgaard 1990a: 353). Another 20 percent came from Japan, via Taiwan, where the Dutch VOC had exchanged it for gold. Silver also flowed into the Punjab from Central Asia and probably into Bengal from Tibet/Sichuan/Yunnan and Burma. The British EIC also brought gold from the east to India and paid for it with silver. Gold also flowed into India, especially to the south of the subcontinent, both from West Asia and from Japan and China in East Asia and especially from Southeast Asia. However, India was only the penultimate “sink” for the world's silver, since India itself had to re-export some silver further eastward to remit it especially to China.

Chapter 2 offers evidence of the onward shipment of silver from India to Southeast Asia and China. However, John Richards (1987: 3) claims that Mughal silver coin sent eastward soon returned augmented by gold from Southeast Asia. Thus, unlike the Ottoman Turkish and the Safavid Persian empires, according to Richards, the Mughal empire was able to export enough goods to pay for its imports, so that it had no need for any net specie export, which instead flowed in to augment its own supply.

Increased inter- and intra-Asian trade and specie shipments by Indians and other Asian themselves, however, reduced the Europeans' share from half in 1640 to only one-fifth by 1700. Yet in 1715 during an already existing “silver famine,” a Spanish treasure fleet succumbed to a Caribbean hurricane, and “the economic shock waves reverberated all the way to India” (Day 1987: 159). Arguments and evidence regarding an important “silver famine” around 1640 are examined in chapter 5.

THE NUMBERS GAME

The world's stock and flows of money and their increase have been the subject of many estimates and their revisions from Alexander von Humboldt and Earl Hamilton to the present—and presumably will continue to be re-estimated in the future. It would be impossible to review or evaluate let alone to add to them here. Fortunately that is not necessary in order to inquire how some of this money oiled the wheels of commerce among the world's major regions—and affected their relations to each other.

Braudel and Spooner (1967) have estimated the existing stocks in Europe in 1500 to have been about 3,600 tons of gold and 37,000 tons of silver. Raychaudhuri and Habib (1982: 368) have revised these estimates downward, to 3,600 tons of gold and 35,000 tons of silver in the entire Old World in 1500. Ward Barrett's (1990) summary of world bullion flows from 1450 to 1800 reviews a number of previous estimates (by Alexander von Humboldt, Earl Hamilton, Adolf Soetbeer, Michel Morineau, B. H. Slichter van Bath, and others, including Nef, Attman, TePaske, Kobata, Yamamura and Kamiki cited in the references) and concludes that from 1493 to 1800, 85 percent of the world's silver and 70 percent of its gold came from the Americas.

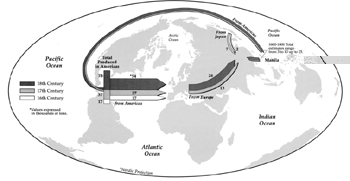

Silver. Disregarding variations over time and summarizing Barrett's estimates, in the sixteenth century American silver production was about 17,000 tons or an annual but of course rapidly growing average of 170 tons a year. In the seventeenth century annual average production rose to 420 tons a year or 42,000 tons for the century, of which about 31,000 tons arrived in Europe, with roughly one-quarter on public and three-quarters on private account (TePaske 1983). Europe in turn shipped 40 percent of this silver, or over 12,000 tons, to Asia, of which 4,000 to 5,000 tons each were transported directly by the Dutch VOC and the British EIC. Additionally, another 6,000 tons went to and via the Baltics, and 5,000 tons to and via the Levant, both of which kept some but also remitted some further eastward to Asia. In the eighteenth century, American average annual production was 740 tons for a total of 74,000 tons. Of these, 52,000 tons arrived in Europe and over 20,000 tons, or still 40 percent, were shipped onward to Asia.

Thus according to Barrett, in the seventeenth and eighteenth centuries, about 70 percent of the American production of silver arrived in Europe, and 40 percent of that was shipped on to Asia. TePaske (1983) estimates a higher—sometimes much higher and growing—retention of silver by the Americans themselves. From a world monetary point of view, this would only mean that the effective costs of production and its administration and defense in the Americas, as well as the provision of markets there, was that much higher. However, Flynn and others suggest that most of the silver that did not arrive in Europe was not retained in the Americas, but was shipped to Asia across the Pacific instead.

So by Barrett's estimates, of the 133,000 tons of silver produced in the Americas beginning in 1545 and until 1800, about 100,000 tons or 75 percent arrived in Europe. Of these in turn, 32,000 tons or 32 percent of European receipts (or 24 percent of American production) arrived in Asia. But since this onward shipment to Asia really started only around 1600, after that it represented about 40 percent of European receipts. By this estimate then, over the whole period Europe kept 68,000 tons; and the Americas retained less than 33,000 tons since some silver was also lost at sea. However, as we will note below, some of this American “retained” silver was also shipped across the Pacific directly to Asia.

American production thus increased world silver stocks by 17,000 tons or by half the total in the sixteenth century, by 42,000 tons or by another 80 percent to 1700, and by another 74,000 tons or again by almost 80 percent to 1800. That means that the world stock of silver increased from about 35,000 tons in 1500 to 168,000 tons in 1800, or by nearly five times. Yet this amount still does not include the 15 percent of the total world silver, which according to Barrett was produced elsewhere. Most of that, and perhaps more, was produced by Japan, as we will note below.

Artur Attman (1986a: 78) also compiles estimates from many sources and arrives at somewhat different totals for the last two centuries. Amman's figures are in rix-dollars, whose equivalents, according to his appendix, are 1 rix-dollar = 25 grams of silver, or 1 million rix dollars = 25 tons (25 million grams) of silver. Attman estimates American production at an average of 13 million rix-dollars (equivalent to 325 tons per year or 32,000 tons) in the seventeenth century and 30 million rix-dollars (750 tons per year or 75,000 tons) in the eighteenth century. Of these, Attman estimates shipments of about 75 percent to Europe, and remissions of these in turn of over 60 percent (compared to only 40 percent estimated by Barrett) of European receipts. If we take the average of the two estimates, at least a half and an ever rising share of American production was sent to the East. Of this half of American production, in turn over half of the also growing share was shipped directly to South and East Asia, while over 20 percent was remitted to the Baltics and another 20 percent to the Levant/West Asia—which in their turn however also had to remit a portion of their imports farther eastward (Attman 1981: 77). Thus, by Attman's estimates, the amount and share of American silver that ended up in Asia was even higher, that is, 48,000 tons rather than the approximately 32,000 tons we get by adding up the figures from Barrett (1990).

However, at least another 15 tons of silver annually, or 3,000 tons more, were shipped on the Manila Galleons from Acapulco in Mexico and earlier also from Peru directly to Manila. Almost all of this silver was then transshipped to China. However, the transpacific shipments of silver may have been much greater. Transpacific shipments averaged around 20 tons annually from 1610 to 1640 and then fell to less than 10 tons per year in the next two decades (Reid 1993: 27). Atwell (1982: 74) also mentions annual Acapulco-Manila shipments of 143 tons, and 345 in 1597. However, Pierre Chaunu estimated that as much as 25 percent of American silver was shipped directly across the Pacific (cited in Adshead 1988: 21). Han-Sheng Chuan in turn estimates shipment of as much as 50 tons of silver a year (or as much as through the Baltics) in the seventeenth century, all of which, of course, ended up in China (cited in Flynn and Giraldez 1995a: 204,1995b: 16, Flynn 1996).

A large but unknown share of the transpacific silver trade was contraband and so not registered. To maintain its monopoly rake-off in Spain itself, the Spanish crown tried to restrict the direct transpacific Manila Galleon trade, so an unknown share of it went as unregistered contraband. For this reason also, Flynn and Giraldez (1995b,c) believe the amount of transpacific silver is still underestimated. That would also mean that much of the Spanish American silver that according to TePaske did not make its way across the Atlantic did not really stay in the Americas but was shipped across the Pacific instead. Therefore, Flynn suggests the transpacific shipments of silver may well have sometimes equaled the amount of silver flowing to China via Europe. Flynn mostly uses Chuan's estimates of 2 million pesos, or 50 tons, of silver a year, which is already three times more than the 15 tons mentioned above. Atwell (1982: 74), citing a Chinese source, estimates 57 to 86 tons a year. However, Flynn also asks if it is “possible that over 5 million pesos [125 tons] per year traversed the Pacific? Supporting evidence does exist for such lofty figures”, and he goes on to suggest that the transpacific trade may not have declined in the seventeenth century as the trans-Atlantic one did (Flynn and Giraldez 1994: 81–82).

The big Asian supplier was Japan. It produced and supplied 50 tons a year between 1560 and 1600, and between 150 to 190 tons a year from 1600 to 1640, peaking at 200 tons in 1603 (Atwell 1982: 71 and Reid 1993: 27). Reid tabulates estimates from several sources to arrive at 130 tons a year from 1620 to 1640, declining to 70 tons a year in the 1640s, 50 tons in the 1650s, and 40 tons a year in the 1660s. Von Glahn (1996a: 439, table 3.1) constructs estimates of nearly 4,000 tons, and cites Yamamura and Kamiki's estimates of about 8,000 tons for the nearly one hundred years from 1550 to 1645. Japan had imported Korean engineers and technology to respond to the rising demand for and price of silver. Japan then became a major world producer and exporter of silver during the eighty years from 1560 to 1640. After that, Japanese silver production has been supposed to have declined, and copper production and exports to China increased instead. However, recent Japanese research reported by Ikeda (1996) and data cited by von Glahn (1996a) suggest that Japanese exports of silver continued until at least the mid-eighteenth century.

Noteworthy also is that Japanese silver exports to China were more than three to ten, and on average six to seven, times greater than that which arrived across the Pacific from the Americas. In any case the perhaps 8,000- or 9,000-ton total of Japanese silver exports between 1560 and 1640 must be compared with the about 19,000 tons received by Europe from the Americas (estimate from Barrett) plus the over 1,000 tons shipped across the Pacific during the same period. That is, Japan alone contributed 8,000 or 9,000 tons out of this 28,000-ton total, or almost 30 percent. Flynn and Giraldez (1995a: 202) suggest that it was 30 to 40 percent at its peak.

A couple of students of the era (Flynn 1991) have proposed the counterfactual speculation of how different the world—including Europe—would have been without this major Japanese contribution to world liquidity, especially to China. Or alternatively, without the American contribution and its competition with Japan, would the latter have been able to parlay a concomitantly much stronger position on the world silver market into an economic and/or also political conquest of China and Southeast Asia? The Europeans—for lack of any means of payment—would have been virtually excluded from world trade. Either one—and a fortiori both—of these eventualities would have made all subsequent world history very different from what it has been. Be that as it may, we must agree with Yamamura and Kamiki's (1983: 356) plea that “serious reexamination of the role played by Japan in the monetary system of the world during this period is long overdue.” Therefore from this world monetary perspective, all allegations about Japan's or China's isolation from the world economy are again belied by the evidence.

Yet the amount and share of the world's silver that ended up in China must have been even higher than all of the above estimates, since China received an unknown part of the remaining world supplies of silver as well. Reid (1993: 27) constructs estimates of about 6,000 tons in the 1601–1640 period, or 150 tons a year, in East Asia, of which 4,500 tons came from Japan; almost all the total ended up in China. For the period 1641–1670 this total supply declined to an average of 80 tons a year, or 2,400 tons total, of which 53 tons a year, or about 1,600 tons, came from Japan.

Thus between 1600 and 1800 and using Barrett's estimates, continental Asia absorbed at least 32,000 tons of silver from the Americas via Europe, 3,000 tons via Manila, and perhaps 10,000 tons from Japan, or a total of at least 45,000 tons. Using Attman's estimates of proportionately higher European remissions to Asia, the latter would have received 52,000 tons directly from Europe plus a share of the trans-Atlantic shipments of silver then remitted to and via the Baltics and the Levant, plus the transpacific shipments. That adds up to 68,000 tons, or half the silver production accounted for in the world between 1500 and 1800. However, Asia (outside of Japan) also produced silver for its own use, particularly in Asia Minor, Persia, and Central Asia, some of which was also remitted to China. Moreover, some silver was also produced in Yunnan and other parts of China for its own use.

So China received and used a very significant share of the world's supply of silver. Much came from Japan, some across the Pacific via Manila, and some arrived in China from the Americas via Europe, the Levant, and West, South, and Southeast Asia as well as from and through Central Asia. By Reid's (1993: 27) admittedly incomplete estimates, the European traders supplied about 14 percent of the Chinese silver imports between 1610 and 1630, then 10 percent until 1660, and 40 percent in the decade of the 1660s. Chaunu's early estimate was that one-third of the original American silver ended up in China and another third in India and the Ottoman Empire (cited in Adshead 1993). Frederic Wakeman (1986: 3) suggests that even as much as half of all American silver may have ended up in China.

The production and flow of silver around the world is graphically consolidated in map 3.1, primarily by averaging the estimates of Barrett and Attman. It shows American production of 17,000 tons in the sixteenth century, almost all of which were shipped to and remained in Europe. For the seventeenth and eighteenth centuries, the map shows American production of 37,000 and 75,000 tons respectively, of which 27,000 and 54,000 tons were shipped to Europe, for a two-century total of 81,000 tons. Of these European receipts of silver, about half (or 39,000 tons) were in turn remitted onward to Asia, 13,000 in the seventeenth century and 26,000 in the eighteenth. This silver ultimately went predominantly to China. Moreover, between 3,000 and 10,000 tons, and maybe up to 25,000 tons, were also shipped directly from the Americas to Asia via the Pacific; and almost all of this silver also ended up in China. Additionally, Japan produce at least 9,000 tons of silver, which were absorbed by China as well. Therefore over the two and a half centuries up to 1800, China ultimately received nearly 48,000 tons of silver from Europe and Japan, plus perhaps another 10,000 tons or even more via Manila, as well as other silver produced in continental Southeast and Central Asia and in China itself. That would add up to some 60,000 tons of silver for China or perhaps half the world's tallied production of about 120,000 tons after 1600 or 137,000 tons since 1545.

Map 3.1 World Silver Production, Exports, and Receipts

New estimates have been independently constructed by von Glahn (1996a). He uses data on silver shipments where available; and where not, he estimates them by converting 80 percent of the values of Chinese exports to imports of silver, calculated in metric tons. His total from all sources, including Japan, America via Manila, and the Indian Ocean (but not including overland across Asia) are about 2,200 tons for 1550 to 1600 and 5,000 tons for 1600 to 1645, or a total of 7,200 tons for the nearly one hundred years from 1550 to 1645. The estimates for the second period and therefore also for the whole period are 20 to 30 percent lower than those of Yamamura and Kamiki, probably in part because von Glahn uses data for commodity exports and converts them into imports of silver at a constant ratio of 80 percent. The legitimacy of this estimation procedure is questionable, however, insofar as over time the supply of silver increased, thus driving down its value in terms of other commodities. In that case the use of a constant conversion ratio of commodities to silver would result in an underestimate of the quantity of silver that was paid to China for these commodities and could help account for von Glahn's estimates being lower than all others. For more discussion in my review of his book, see Frank (1998b).

Combining some of the above estimates for the production and remission of silver from the mid-sixteenth to the mid-seventeenth centuries suggests production of some 30,000 tons in the Americas and about 8,000 tons in Japan, for a total of 38,000 tons. If we again subtract the uncertain amount that remained in the Americas and/or was lost in transit, the 7,000 to 10,000 tons that ended up in China certainly represent a very appreciable share. That is, even this very conservative estimate by van Glahn leaves China with between one-fourth and one-third of total world silver, production. That is still more than any of the shares left for the use individually of Europe and West, South, and Southeast Asia, not to mention Africa and Central Asia. (We have even less evidence for the last two, although some additional silver also reached China through the latter region).

Gold. Gold was supplied to the world market in the sixteenth century from the Caribbean, Mexico, and various Andean regions, from both previously existing and newly opened mines. Minas Gerais in Brazil had a major gold boom from 1690 to the mid-eighteenth century. However, there was also non-American production of gold, about 30 percent of the world's total, as Barrett noted. As had been the case for centuries before 1500, the bulk of this gold came from Africa, mostly from West Africa, which exported perhaps some 50 tons in the sixteenth century and nearly 100 tons, or a ton a year, in the seventeenth century. This gold export declined to 60 tons in the eighteenth century, before it ceased near the end of the century (Barrett 1983: 247, Curtin 1983: 240, 250).

Other supplies of gold came from Nubia, which exported gold via Egypt to Constantinople/Istanbul and from Ethiopia to Egypt, the Red Sea, and India. Zimbabwe, which for a millennium had been an important source of gold for the world, reached its peak production of one ton during the fifteenth century. The Ottomans also produced and/ or received gold (but absolutely if not relatively more silver) from the Balkans, Rumelia, Crimea, Caucasia, and the Urals. Gold was also produced in and exported from various parts of Southeast Asia, such as mainland Yunnan, Burma, Malaya, Thailand, Champa (Vietnam), and in some islands, especially in Sumatra. Some of this Southeast Asian gold went northward to East Asia, and some westward to South Asia. China also produced gold and, during much of the period from 1400 to 1800, exported it in exchange for silver.

Credit. Both the availability and scarcity of metallic currency stimulated an “unprecedented expansion of credit: loans, securities, bonds, credit transfers, bank-money, paper money and negotiable obligations—all were employed on an increasing scale to avoid the use of precious metals” (Parker 1974: 531). However, it is likely—as elsewhere and at other times as well—that the amount of credit also increased and decreased in tandem with the availability and scarcity of metallic currency and bullion to back it up. Politicians especially may have wanted to replace scarce real money by credit and paper. However, that same scarcity made or allowed money lenders to increase the rate of interest price that they charged for their money and credit—and thereby to limit the effective amount of credit. Indeed then as now, it usually took real (metallic) money to make or get paper money and credit.

But the bullion was mainly needed as a collateral on the loans of the Companies: the trade of all Companies and of the Estado [da India] floated on the credit of Indian bankers. If the Compagnie des Indes did not receive bullion its shaky credit would collapse and one would be unable to buy and sell anything…. To obtain loans and honour their bills of exchange merchants therefore had to remit bullion from abroad. Bullion not only served as collateral for the traffic in bills within India but between India and the Middle East as well. It was usual for merchants operating from Kerala and Gujarat to draft bills on Mocha and Aden; for merchants from Surat to draft bills on Kung—the major centre for banking within the Gulf. Yet this traffic in paper depended upon a steady flow of coin from the Middle East.

A lack of bullion, in turn, hampered the collection of land revenue in Gujarat; rural credit-rates would mount and so would the discount on bills of exchange drafted from Surat on Burhanpur or Ahmedabad to transfer the land revenues. For the land revenues and the incomes of nobles from their mansabs were largely remitted through bills too. (Barendse 1997: chap. 6)

If it is difficult to make or get reliable estimates of metallic money, it is all the more likely that we will never know how much the wheels of commerce, investment, and production were also oiled by credit—or indeed themselves produced credit, in its myriad of forms. Yet, credit must have been very significant, even if direct evidence about it is scarce and for the period from 1400 to 1800 a bit tardy, at least in the secondary literature. For instance between 1740 and 1745, bills of exchange accounted for about 20 percent (and commodities and precious metals 80 percent) of the British and Dutch East India companies' export payments for what they imported (Steensgaard 1990c: 14). Many bills, including British, were settled on the Amsterdam money market. These companies themselves also borrowed heavily on the money markets in Asia, which financed their exports. In Asia itself, bridging credits advanced to growers of indigo or merchants of coffee were normally made for periods up to twelve months, and for the supply of textiles for three or four months (Chaudhuri 1990b: 8). Chapter 4 discusses the role of credit in its examination of market and financial institutions.

How Did the Winners Use Their Money?

In a word, did they hoard the money (as the fable goes), or did they spend it, and if so on what?

THE HOARDING THESIS

For readers brought up in the Western tradition reaching from David Hume and Adam Smith to Immanuel Wallerstein today, it may be well to reexamine the thesis that “the money was dug up in the West only to be buried again in the East.” Under the title Spenders and Hoarders, Charles Kindleberger writes: “This brings us to the central issue, whether the traditional view that hoarding in India and China was a reflection of lack of financial sophistication or that their use of precious metals was much the same as that in Europe” (Kindleberger 1989: 35).

To deal with this issue, Kindleberger examines a wide variety of sources, some of which indicate that there also was some hoarding in Europe and many that indicate that there also was much “spending” in Asia. Nonetheless, all analysis to the contrary notwithstanding, Kindleberger is unwilling to abandon the traditional thesis:

Given this fascination with gold, it is hard to accept the experts' opinion—those of Chaudhuri, Perlin, Richards—that India did not have a strong propensity for hoarding gold, but needed silver imports to use as money…. It is difficult to accept the argument of the experts that the East is no different from the West. (Kindleberger 1989: 63, 64)

I find it difficult to accept Kindleberger's skepticism, which seems based in part on his claim that gold was never used as money in India, which at least for the south of India is not true. Moreover, albeit referring to copper coin, money had a “startling velocity and range of circulation…[and] travelled from the outer frontier provinces of the empire to its heartland within one year of minting. This is a startling feature of the Mughal system,” which also contradicts “anyone accustomed to thinking of ordinary coin as circulating within circumscribed localities and regions” (Richards 1987: 6–7).

Kindleberger continues:

What needs to be explained is why the silver stops when it comes to China…. It is hard in the light of this admittedly spotty and anecdotal evidence [of nonmonetary use mostly of gold in China] to share the conclusion of the experts that the Chinese appetite for silver was dominated by monetization and that the notion that the Chinese hoarded more that other countries is questionable. Monetization was important, especially in taxation…. (Kindleberger 1989: 71)

Despite this contemporary monetary expert's best efforts (including numerous references to anecdotes in newspapers from the 1930s to the 1980s) to keep the hoary old hoarding thesis alive, Kindleberger is unable to offer either a convincing theory or any persuasive evidence against the “argument of the experts that the East is no different from the West.”

Perhaps even more alarming is the recent echo of the hoary hoarding thesis by Wallerstein (1980:108–9): not only does he write (citing a 1962 source for the single quotes that follow) that “coin or bullion brought into Asia (and Russia) was largely used ‘for hoarding or jewellery’ and the ‘balance of trade’ (if one refuses to think of silver as a commodity) was persistently unfavourable and largely bilateral for a long period of time.” But to make matters still worse, he continues in the very next sentence: “These two facts are precisely evidence that the East Indies remained external to the European world-economy…. [That is] the distinction between trade within the capitalist world-economy and trade between any particular world-system and its external arena [his emphasis].”1 say “alarming” in two senses of the word. First, this Wallerstein citation in and of itself should be sufficient to alarm us about the limitations of his European world-economy/system perspective and theory, which renders him and others unable to take account of the real world, as I already argued with voluminous chapter and verse citations from both him and Fernand Braudel in Frank (1994,1995). Om Prakash (1995: 8–9) also remarks that there is no good theoretical or empirical basis for Wallerstein's contention that the influx of the same silver served and was necessary for the expansion of investment and capitalism in Europe but that in Asia it could have had no more than a decorative function for the aristocracy.

However, it is also alarming that Wallerstein's European blinders seem to oblige him both to be blind to and to misinterpret the very evidence which otherwise itself would pull the rug out from under his own theory. For, contrary to Wallerstein, the world-wide flow of money to Asia and Russia is evidence precisely that they were parts of the same world economy as Europe and the Americas.

INFLATION OR PRODUCTION IN THE

QUANTITY THEORY OF MONEY

The injection of new American (overwhelmingly silver) bullion and also Japanese silver and copper provided new liquidity and credit formation. That in turn facilitated an important, perhaps dramatic, increase in worldwide production, which rose to meet the new monetary demand. This “pull” factor therefore encouraged further industrial success and development in China, India, Southeast Asia, and West Asia (including Persia). As Chaudhuri observed,

the economies of the two great empires of Asia benefited from the expansion of economic relations with the West. The huge influx of bullion…was only one indication of the growth in income and employment. The export of textiles turned the coastal provinces of India into major industrial regions, and the bullion imported by the Companies passed directly into circulation as payment for the exported goods. (Chaudhuri 1978: 462)

A favorite economist's tool is the Fisher equation MV = PT. That means that the (increase in) the quantity of Money multiplied by the Velocity of its circulation in use equals the (increase of) the Prices of goods and services, multiplied by the (increase of) the Transactions of their production and sale. The quantity theory of money has it that if the quantity of money increases while its velocity and the number of transactions stay the same, then the prices of the goods and services transacted must rise proportionately to the increase in money. Hamilton and others observed that in the sixteenth century new American money arrived in Europe, and prices rose. That was called the great “price revolution.” Ceaseless debates have ensued about whether the amount of new money that arrived was really what Hamilton had calculated it to be, whether the velocity of its circulation changed as well, to what extent production and transactions also increased, in what sequence these events occurred, and therefore what really explains the rise of prices in Europe—and how much they really rose, and just when. Jack Goldstone (1991a, b) reviews many of the arguments and makes a persuasive case that the price inflation in Europe (outside of Spain) was generated by increases in population and demand rather than by new supplies of money from the Americas.

The debate spilled over also to refer to Asia, first because some of the American money left Europe again, and second because it arrived in Asia and thereby also increased the supply of money there. So the question becomes whether the new American money and/or population increases also generated inflation in Asia.

The effects of the new money on prices in India have been the subject of dispute. Aziza Hasan (1994) argues that silver imports did lead to price inflation. Her estimates show silver in circulation tripling between 1592, when inflows became significant, and 1639. Since production could not have kept this pace, prices must have risen, she reasons. After also examining price changes for a few commodities, though “we have little information about the prices of commodities of mass consumption” (Hasan 1994: 175), Hasan concludes that there was a significant price inflation. As we will see, Irfan Habib and others share this thesis at least in part.

However, Brenning (1983) challenges the thesis that India, like Europe earlier, was visited by a “price revolution” in the seventeenth century. Rather, Brenning contends, although there were brief periods of price rises in the 1620s and again the mid-1650S and 1660s, on the whole prices remained fairly stable at other times and only rose moderately over the whole seventeenth century. Indeed after their mid-century increase, prices stabilized after 1670 just when silver imports again accelerated. Brenning (1983: 493) appeals to “powerful local developments affecting regional monetary history,” but he does not spell them out. However, even Habib (1987: 138—89) equivocates on whether there indeed was inflation and, if so, how so:

The problem of the impact of the seventeenth-century silver “inflation” on the structure of Mughal Indian economy cannot be elucidated properly until one is able to establish in what coined metal, and at what time, payments were being made. There is the further question of whether the quantities of silver flowing into the country caused a rise in the price-level (or a depreciation in the value of silver) approximately proportionate to the additions they were making to the existing stock. (Habib 1987: 139)

Habib himself is otherwise inclined. Prices in terms of silver did not rise proportionately with its increased supply, and prices and wages in terms of the more commonly used copper did not rise at all. As silver became increasingly available, it declined in value relative to copper and in the seventeenth century increasingly replaced it as the medium of exchange. Moreover, the demand for copper was increased by its use to make bronze cannons. Moreover, Habib stresses that the influx of silver also reduced its price relative to that of gold. The value of the rupee certainly declined in terms of silver and gold, and it first rose and then also declined in terms of copper. “The agreement between the earlier trends in agricultural and silver prices is remarkable” (Habib 1963a: 89).

This evidence and analysis weakens even further the thesis that India suffered from inflation, since prices of goods were more a reflection of the reduced price of silver as a commodity itself (measured against gold and copper currency) rather than of a generalized inflationary price rise of all commodities. Indeed, Prakash (1995:13) observes that “a considerable body of work done over the last two decades…has consistently negated the possibility of a general price rise.” Rene Barendse's (1997) study relating to the Dutch VOC also shows no overall inflationary increase in Indian prices or wages. The most systematic inquiry into the prices of precious metals is Sanjay Subrahmanyam's (1994) review of previous writers and of the evidence in general as well as that specifically for Bengal, Surat, Masulipatam, and Agra. He also concludes that

overall then, the Indian evidence suggests that price inflation was at best sporadic, and limited to specific regions and specific commodities…. The case for a Price Revolution remains unproven…. The empirical materials do not support such a hypothesis…. [Indeed] rates of interest…showed a downward trend. (Subrahmanyam 1994: 209, 53–54)

Moreover, Subrahmanyam also reviews the analogous discussion for the Ottoman Empire and comes to the same conclusion, amended by Goldstone's (1991a) thesis that population growth pushed prices up. Elsewhere, Goldstone (1991b) argues similarly that inflation was maintained at low levels and that it was practically nonexistent in China, except during the mid-seventeenth century. The reason is that increases in output and velocity of circulation absorbed the growth in the supply of money. He also suspects substantial hoarding, or at least sterilization of silver, in Europe through use as conspicuous consumption in the form of silverware and plates. Of course, as usual, he attributes inflation to population growth. (We return to these issues in chapter 5.)

In China also, production and population increased, but the new money did not drive up prices significantly faster than the growth of population. Even for highly monetized South China, Marks (1997a, 1996) and Marks and Chunsheng (1995) found that, apart from some brief temporary periods of rapid inflation in the price of rice, over the centuries the rise in rice prices closely matched that of the growth of population; and the prices of other commodities tended to decrease. Moreover, they cite the findings of other scholars to the effect that “virtually all households responded to high [purchase] prices by reducing fertility and to low prices by increasing fertility.” Therefore, “if all Chinese peasants controlled their fertility in response to economic conditions, then the rise in population…may well have been a direct response to significant advances in economic growth.” Although their reference is to the eighteenth and nineteenth centuries, the same can hold equally for earlier centuries as well.

To conclude this review of whether there was inflation or not in Asia in general, we must agree with Subrahmanyam:

In the absence of widespread and rapid inflation of commodity prices in terms of major coinage metals in south and west Asia (at least at rates corresponding to the inflation of western Europe), it is evident that the rate of increase of money supply must largely be decomposed in terms of the rate of change of output, and that of the inverse of the income-velocity of money. (Subrahmanyam 1994: 218)

“The weight of the evidence” suggests there was no inflation in southern India (Subrahmanyam 1990a: 349) nor in Bengal, as Richard Eaton (1993: 204–6) stresses. Nor was there sustained inflation in China, to which we will return below.

That is, in terms of the MV = PT Fisher equation, the evidence suggests strongly that throughout most of Asia the increased arrival of money from the Americas and Japan did not substantially raise prices, as it did in Europe. In Asia instead, the infusion of additional new money generated increased production and transactions, as well as raising the velocity of money circulation through more extensive commercialization of the economy. What might be argued is that in proportion to the size of its population and economy, Europe not only received but even retained more new money that circulated around its economy than was the case in the much larger and more populous Asia. That might account for some of the higher rate of inflation in the European than in the Asian economies. Yet, not even this reasoning would be sufficient to undercut the present argument that the new money served to increase production and also population more in Asia, as we argue in chapters 4 and 6.

Moreover, prices should have risen more in Asia if Goldstone (1991a,b) is right that the growth of population more than that of the money supply drives prices up. But population rose significantly faster and more in Asia and especially in China than in Europe, as we note in chapter 2 and document in chapter 4. Yet the real price revolution was essentially limited to Europe. This observation lends further support to our inferential argument that the massive arrival of new American and Japanese money stimulated production and population more in Asia than in Europe. However, there is also direct evidence that this money stimulated the expansion of production, settlement, and population in Asia, and how it did so.

MONEY EXPANDED THE FRONTIERS

OF SETTLEMENT AND PRODUCTION

The evidence and reasoning about prices discussed above lends support to the thesis that the inflow of money stimulated expansion both of consumer demand for and the productive supply of goods in Asia. Let us examine some of the direct evidence as well.

In India. In India, the expansion of production was most strikingly evident in Bengal and Bihar after their conquest by and incorporation into the Mughal empire (Richards 1987: 5). Indeed, among prices in India, those in Bengal were relatively low and remained stable between 1657 and 1714, despite the large inflow of silver money from abroad (Prakash 1994: V-165). Prakash attempts various possible explanations in terms of the quantity theory of money. If the large increase in the supply of money did not evoke a corresponding increase in prices, it must have been because the velocity of circulation or turnover of the money supply increased with the progressive monetization of the economy and/or the amount of production increased. Prakash concludes that although increased money turnover may have absorbed or sterilized some of the increase in its supply, output must also have increased either through a better utilization of installed capacity to produce and/or through improved allocation of resources. However, Prakash does not seem to consider the possibility, indeed the probability, that production also rose as more resources were mobilized and productive capacity and production itself were increased. Yet he estimates that the number of workers in the Bengali textile industry grew to one million, of which no more than 10 percent were engaged in production for export by the British and Dutch East India companies (Prakash 1994: vii-175, 197). So the bulk of the productive expansion must have been for a combination of the Asian-managed internal and export markets. To give credit where credit is due, more recently Prakash (1995: 13) does refer to growing population and “a substantial net increase in output, income and employment. A rising output would occasion a growing need for money.” However, he sees these as the counterpart of an increase in exports, and even in this passage he still regards the “need for money” as derivative from the increase in output.

Moreover, after the Mughal decline and its regional replacement by Maharashtra rule, “the use of money, not barter, had spread to all levels of society in Maharashtra, and secondly,…all rural folk were tied into larger regional and world economies by a web of money, credit and market transactions” (Richards 1987: 11). Richards is commenting on the findings of Perlin (1987,1993), who himself summarizes that “briefly the documents [very detailed and prolonged research in private and governmental accounts of an extremely local level of economic life] reveal a society in which monetisation had developed to a relatively remarkable extent [accessible to relatively large numbers of people], and in marked contrast to what we know of conditions in early colonial times” (Perlin 1993:178–89). Elsewhere Perlin (1983: 75) is more specific:

Villagers…not only engaged in local market transactions in money, but were also paid daily and monthly money wages for agricultural labour, craft production, soldiery, and household service. I would argue that the import of copper and cowries indicates precisely the existence of vigorous, highly monetized, local market centres of this kind…. It is also important to demonstrate that such monetary “communications” also integrated areas primarily concerned with agricultural production with the rest of the subcontinent, and thereby with events and relationships on an international scale…. But it is also important to underline the fact that documentation exists with which to test it, although [it is] as yet astonishingly neglected. (Perlin 1983: 75, 74)

However, Perlin (1983: 78) also observes that “in contrast, early colonial rule led to a substantial reduction in the level of monetary life.” B. R. Grover (1994: 252) also observes that with the onset of British colonialism, there is a “definite deterioration in the commercial life in India, in comparison to conditions in the seventeenth century.”

The question is how this money fertilized—indeed opened up—the fields of agriculture, oiled the wheels of manufacturing, and of course greased the palms of trade into the farther reaches and among “subsistence” peasants. In Keynesian terms, the new means of payment generated new effective demand and thereby called forth additional production also in the domestic markets in Asia.

Eaton (1993) examines the spread of Islam in tandem with deforestation to clear the way to grow cotton for—and rice to feed the workers in—the textile industry in Bengal. The frontier was colonized to supply the growing Bengali production and export of textiles in the sixteenth and again at the end of the seventeenth and beginning of the eighteenth centuries. However, all of these, including the initial clearing of the jungle (as in the Amazon today) were financed by “countless intermediaries who were, in effect, capitalist speculators, or classical revenue farmers” (Eaton 1993: 221). They funneled the expanding supply of money, which was derived from the influx of silver from the outside, into the interior and even to the frontier of Bengal.

However, Bengal was only the newest frontier that was opened up and made productive with—if not by!—the new money; it was by no means the only one.

Extensive tracts of country became populated and settled by peasant populations during this long period, not only in the upland regions of the Deccan, but even in the Ganges basin itself; in Gujarat, where the countryside became more intensely settled, new villages were established, and the interstices between old ones filled in. As Hambly remarks in The Cambridge Economic History of India, it was also a period of accelerated urban growth at all levels, from small market town to major concentrations such as Agra…. The Punjab became an important centre of textile production, its products finding their way to the Middle East, Persia and central Asia…. Hambly has recently remarked that urban growth in the seventeenth and eighteenth centuries was closely linked to the development of textile production. (Perlin 1983: 67, 71)

The development of textile production and the growth, distribution and processing of cotton and dyes for textile production, and of course the production and distribution of food for the producers and traders, were all stimulated or even rendered possible by the massive infusion of new money. This influx of silver and the growing demand it generated was not inflationary precisely because they stimulated a concomitant increase in supply. The “long sixteenth century” cyclical expansion began in about 1400 and continued well into the eighteenth century. There was no “seventeenth-century crisis,” as we observe in chapter 5.

In China. Probably even more spectacular were the economically expansive effects of the infusion of silver into the Chinese economy from the mid-sixteenth century onward. The Ming economy was increasingly monetized on a silver standard and expanded rapidly at least through the 1620s. This expansion was only temporarily interrupted during the climatological/demographic/economic/political crisis and change from the Ming to Qing dynasties in the middle of the century (examined in chapter 5). However, the economy recovered again and resumed its expansion from the late seventeenth century onward through the eighteenth century.

The stimulatory and expansive effects of silver and trade were most dramatically notable in South China. Suffice it here to offer only a tip-of-the-iceberg indication of commercialization and economically rational choice in South China: in Marks's (1997a) study, a contemporary governor general is quoted as asserting that “all trade is conducted in silver, and it circulates throughout the province.” Merchants advanced capital (presumably also derived directly or indirectly from exports and the import of silver) to peasant producers in return for later receipt of their crop (Marks 1997a). Marks offers numerous summary accounts, among which the following two are particularly revealing:

The silver flowed back to China [in return for its exports]…. By 1600, this trade resulted in an annual inflow of perhaps two hundred thousand kilograms of silver into the coastal economies of south and southeast China, from Ningpo south to Guangzhou. The increased demand for silk induced significant changes in land use patterns…[and] by 1700 about half of the forest cover had been removed [to cultivate mulberry trees as food for silk worms, cotton, sugar, and rice in the low lands and maize and sweet potatoes on higher ground]. (Marks 1996: 60, 59)

The Nanyang [South China Sea] demand was mostly for Chinese manufactured goods produced either in or around areas like Guangzhou [Canton], or gathered in that great emporium from other parts of the empire. The impact of increased export trade upon Lingnan's [South China] agricultural economy was indirect, mediated by the need to import raw cotton: rather than growing cotton, peasant farmers grew sugar cane which, after being refined and processes, was exchanged for cotton from central and northern China. After being spun and woven, much of the cotton was then exported to Nanyang. The increased demand for cotton textiles thus drove the substitution of sugar cane for rice [in the same irrigated fields, while producing cotton would have required clearing another kind of land and although that]…did not result in [or require] the clearance of more land to grow sugar cane for sale in the market, it did decrease the amount of rice produced in and around the Pearl River delta, and thus increased the market demand for rice. A similar conversion of rice paddies to a nonfood, commercial crop occurred when the demand for silk increased. (Marks 1997a)

That is, it was economically rational—and market-institutionally quite feasible—that “peasant farmers who responded to the commercial impulse did so by converting existing rice paddies to sugar cane or sericulture, rather than clearing or creating new fields on which to grow commercial crops [like cotton]” (Marks 1997a). The institutional aspects of this process are examined further in chapter 4.

Thus, in South China the process was analogous to that in Bengal. The agricultural and settlement frontiers expanded along with their commercialization, stimulated by demand from the outside which also generated local demand—and supply—and which were financed by the inflow of new money from abroad.

Elsewhere in Asia. An analogous process also occurred in both mainland and island Southeast Asia, as documented and analyzed by Reid (1993). Moreover, as Victor Lieberman, a student especially of mainland Southeast Asia, writes of the sixteenth and seventeenth centuries,

Larger domestic aggregate demand and the extension of settlement to frontier zones with unique agricultural and mineral products encouraged internal exchange, as reflected in the proliferation of local markets, growing interprovincial complementarity, and monetization…[including the] diffusion of “capital” cultures into the countryside, and the simultaneous infiltration of some provincial forms of capital usage. Maritime trade, firearms, and imported bullion reenforced and modified these processes in complex ways….

[the] eighteenth century saw either a resumption or acceleration of population growth, land reclamation, and commercial exchange in key sectors of the mainland. These movements drew strength both from external demand, most obviously in Thailand and southern Vietnam and…from a constellation of internal forces similar to those which operated before 1680. (Lieberman 1996: 800–801, 802)

In Japan also, silver and copper production expanded rapidly during this period and supported exceptional growth in agricultural and manufacturing production, construction, urbanization, commerce, and commercialization (except for the 1630s and 1640s, two decades of climatic problems and monetary and economic difficulties examined in chapter 5). A sixteenth-century writer observed that by then there was no one “even among peasants and rustics…who have not handled gold and silver aplenty” (cited in Atwell 1990: 667). The observer may have exaggerated, but the tendency is confirmed by other contemporary observers, whose accounts all indicate that, when these contemporary observers wrote, monetization, commercialization, and economic growth had significantly grown to greater levels in Japan—even during their own lifetimes. Moreover, Ikeda (1996) also cites Japanese research to the effect that European trade, which means more than anything the money the Europeans brought, increased production and migration within Asia and for intra-Asian trade.