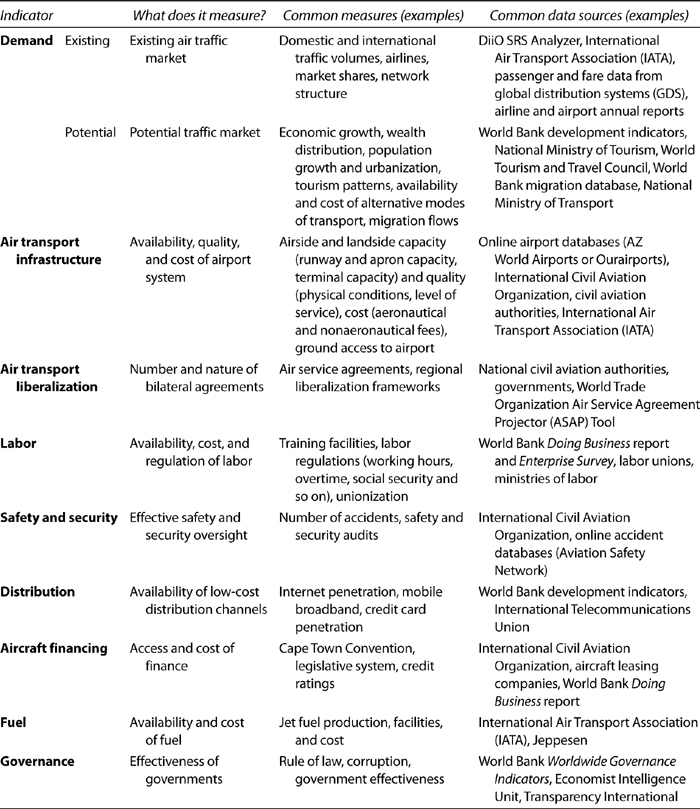

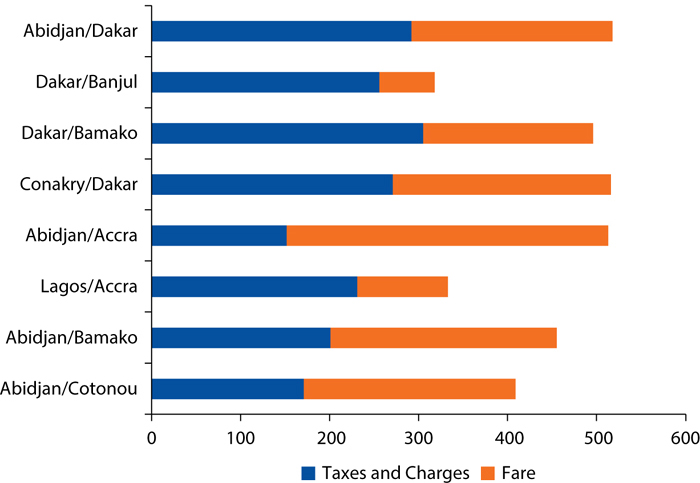

Table 4.1 The Framework

Setting up an airline anywhere in the world is a significant challenge— start-up costs are high, competition is often fierce, and the risks are significant. Diligent and extensive analysis has to be undertaken by prospective carriers to determine the viability of entrance into a market. Assessing the industry and its players, cost of infrastructure, forecasting demand and evolving customer preferences, and examining regulatory mechanisms are just some of the factors that airline executives and their teams have to explore. Yet, even in seemingly good conditions, success is not guaranteed. Since the inception of commercial air transport, many airlines have entered the market and failed within short periods of time. The European Regions Airline Association (ERA) calculated that in the short time period between January 2008 and August 2009, 85 airlines had failed worldwide (Kjelgaard 2011).

Taking into account the significant complexity and unpredictability of assessing market potential, the focus of this chapter is to establish a number of factors conducive to low-cost carrier (LCC) growth that will provide a basis for assessing the opportunities for the LCC model in developing countries. For the purpose of creating this framework, the authors have conducted a series of interviews with industry participants, including operators, aircraft manufacturers, and leasing companies. Out of the discussions and in consideration of the breadth of LCC models and country experiences, this book collates what are deemed to be the key market characteristics that allow LCCs to realize the gains of their particular business model. This chapter describes each of these factors, how they can be measured, and indications of some of the preliminary challenges that may be encountered by LCCs in developing countries are delineated. A summary of the framework’s indicators and measures can be found in table 4.1. In addition to framework, an empirical entry model was designed, which helps to provide an understanding of the factors and policies that are conducive to expansion of low-cost air transport on particular routes. The air transport market of the Arab Republic of Egypt served as a case study for the application of the model.

The framework is used in chapter 6 to look in more detail at one particular region, the East African Community (EAC), and assess the opportunities and challenges in that market. This will help in identifying concrete areas of intervention to facilitate LCC entry into developing countries.

Table 4.1 The Framework

For the development of air transport, as with any other industry, a certain level of existing or potential demand needs to be in place to allow new carriers to enter and succeed in the market. Although this appears to be a very obvious criterion, due to the traffic intensity needed for LCCs to operate profitably, the demand side of the equation requires particular attention and focus.

As elaborated in chapter 1, the key to success of the LCC model lies in its high level of productivity. This is achieved by maximizing the utilization of its most cost-intensive resources: aircraft and personnel. In order to achieve this utilization, LCCs rely on high output. This could be accomplished through high frequency, but is primarily achieved through high occupancy levels, or so-called load factors. In air transport, load factor is defined as “the number of revenue passenger miles (RPMs) expressed as a percentage of available seat miles (ASM), either on a particular flight or for the entire system. The load factor represents the proportion of airline output that is actually consumed” (MIT Airline Data Project 2013). The higher the load factor, the more efficiently an LCC’s assets are utilized. The result is lower operating costs per passenger, consequently enabling LCCs to offer low airfares (Campisi, Costa, and Mancuso 2010). Another reason for the reliance on high load factors lies in the inability of LCCs to cross-subsidize to the same extent as network carriers. Network carriers are known to cross-subsidize within their class offering (economy, business, and first), and between short- and long-haul flights, where they are dominant due to high entry barriers (Airline Leader 2013).

In order to achieve high load factors, there is a commensurate need for high levels of existing and/or latent customer demand. Whereas levels of existing demand can be more easily identified by looking at current passenger flows, network structures, and incumbent carriers, potential demand is more unpredictable. It can be said, however, that latent demand is driven primarily by two factors: the ability of the overall population to afford air travel, and conditions that encourage the usage of air transportation.

As disposable income rises and a country’s middle class grows, air travel becomes a more viable alternative for a broader part of society. Empirical studies such as those conducted by the International Air Transport Association (IATA) (IATA 2008) have highlighted that as households and individuals get more prosperous, they are likely to devote an increasing share of their incomes to discretionary spending, such as air travel.

According to the IATA study, the level of impact from increased income is not unilateral, meaning that there are substantial variations according to region and distance. In developing countries, for example, income elasticity for short-haul flights is higher than in more developed countries, demonstrating greater responsiveness to changes in income. The report also suggests that income elasticity becomes higher the longer the distance, as long-haul travel is seen as more “desirable” than commoditized short-haul travel (IATA 2008).

Figure 4.1 Flight Intensity, 2012

Sources: Based on World Bank (2013b) and DiiO SRS Analyzer data (2013).

Note: GDP = gross domestic product.

Gross domestic product (GDP) per capita has often been used as a metric for identifying the economic conditions of a country’s population and the potential for air transport demand. As figure 4.1 shows, there appears to be a strong correlation between per capita GDP and average weekly flights per million inhabitants. Although GDP per capita can be a good indicator for the economic conditions of a country’s population, the importance lies, not surprisingly, in the distribution of income and the level of inequality prevalent in a country. Particularly in resource-rich countries, GDP per capita can be a distorted indicator that does not capture the distributional effect of wealth. A recent report by the Africa Progress Panel analyzed the GDP per capita of different resource-rich countries in Sub-Saharan Africa. Although GDP per capita was generally higher, the revenues accrued from these resources have widened the gap between rich and poor significantly (Africa Progress Panel 2013).

In both the Asia and Central and Latin America regions, the growth of a strong middle classes has acted as an enabler for the emergence of LCCs. For example, Brazil’s Real Plan, an economic plan implemented in 1994 to curb inflation and increase long-term financing allowing for increased household spending, was an important factor for the entry of the first low-cost airline, GOL (Franco and others 2002). Likewise, in Mexico, economic stability and a burgeoning middle class provided favorable conditions for the entrance of Mexican LCCs Click and Interjet (Euromonitor International 2012).

The World Bank Development Report 2009 also found that urbanization has been a key driver in middle-class growth (World Bank 2010). A direct correlation has been established by air traffic forecasts, such as those conducted by Airbus and Bombardier, between urbanization and an increased propensity to travel (Airbus 2012; Bombardier 2012). According to Mason Florence, executive director of the Mekong Tourism Coordinating Office (MTCO), “Asia’s more sophisticated urban life will create demand for more specialized products, such as heritage and culture, ‘edutainment’ theme parks, soft adventure, luxury holidays, and sports tourism.” Florence predicts that outbound travel from China and India, as well as from Indonesia and Vietnam—all countries with rapid urbanization—will grow further in the coming years due to increased purchasing power (Mason and Mekong Tourism Coordination Office 2011). Between 2001 and 2012, the region experienced an average annual growth in traffic (in passenger-kilometers performed) of 6.4 percent (ICAO 2012).

The second factor driving demand entails an environment conducive to the usage of air transport. This includes a number of conditions, for example: inexistent or poor quality ground transport infrastructure; tourism (existing and potential); or high levels of migration flows (work or education related). These drive demand in the traditional LCC target markets which have been seen to be predominantly leisure and so-called visiting friends and relatives (VFR) travelers (Mason 2000). Existing bus and train travel patterns, for example, can be a good indicator of potential VFR demand in a market. A number of studies (Dobruszkes 2009; Olipra, Pancer-Cybulska, and Szostak 2011) have shown that migration patterns in Europe have had a considerable influence on the LCC network structure.

As described in chapter 1, the target market of LCCs in developed countries has been changing, with the emergence of hybridized LCC models and reduced travel budgets by companies attracting business travelers (IATA 1997).1 In this context, international businesses with a regional presence can also be a source of demand.

As elaborated in chapter 1, LCCs build their networks around airports with underutilized capacity, low levels of congestion, and low airport charges. This allows them to optimize their operations and minimize costs. In the European and U.S. markets, this has primarily been achieved through the usage of secondary airports and/or the usage of cheaper airport facilities. In addition, some primary airports have adjusted their offerings by operating, and, in some cases, even building low-cost terminals. However, in the context of developed countries, such a prerequisite would build on the assumption that the necessary infrastructure and efficient management are already in place. This is often not the case in developing countries. For an assessment of opportunities for LCCs in developing countries, the prerequisite has to be extended to include overall quality and management of airport systems. Although their simple service offering requires only very basic facilities, landside and airside infrastructure capacity and quality, including safety and security facilities, and equipment, as well as air traffic management, may pose a challenge in developing countries (Winston and de Rus 2008).2

There are various ways to assess the capacity of an airport, both of the airfield and passenger terminals. To estimate airfield capacity, most research typically focuses on its most constrained element, the runway(s). There are different approaches to defining and calculating runway capacity. One common definition applied is “maximum throughput,” defined as “the expected (average) number of runway operations (takeoffs and landings) that can be performed within one hour without violating air traffic control (ATC) rules, assuming continuous aircraft demand.” Another definition for determining the potential capacity of an airport is “declared capacity.” Declared capacity is defined as a “declared limit on the number of aircraft movements that can be scheduled per unit of time (typically one hour) at an airport” (Odoni 2009). Declared capacity is normally set at 85 to 90 percent of saturation capacity. Both measures are influenced by a variety of factors, including aspects such as the number and layout of active runways, separation requirements, weather conditions, and the mix of aircraft.

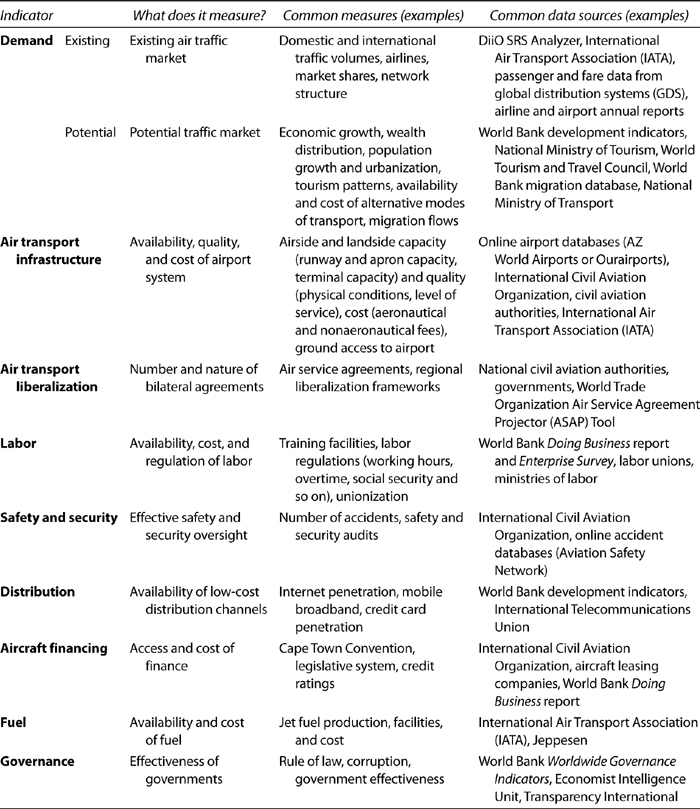

The capacity of airport infrastructure is inherently linked to the quality of an airport, both on the airside and on the landside. There are unfortunately only a few current and reliable reviews of the overall quality of air transport infrastructure on a global scale, making a remote assessment more difficult. One useful but high-level indicator is produced by the World Economic Forum (WEF) as part of their Global Competitiveness Report. A survey is conducted each year assessing the competitiveness of 144 economies. It includes an evaluation of the quality of air transport infrastructure, focusing on airport quality and connectivity. As highlighted in figure 4.2, the results show that air transport infrastructure in many countries in Africa, Asia, and Latin America, and even in Eastern Europe, are still considered of poor quality (WEF 2012a).

Although useful as a general indicator of quality on a country level, a more detailed airport-level assessment is needed to understand the quality of a country’s airport system—looking at not only the condition of the actual physical infrastructure itself (for example, the runway, equipment, passenger facilities, and so on), but also the quality of service provision. For airport terminals, for example, IATA and ACI have developed the Airport Development Reference Manual (ADRM), which categorizes airports in accordance with their level of service (LOS) taking into consideration a variety of elements. These include, for example, waiting times at key points such as security screening or passport control. Lower IATA classification of airports, meaning poorer LOS, is often related to airport capacity constraints and design, but can also be a result of poor management (for example, inefficient scheduling with uneven traffic distribution, a lack of adequate number of personnel, or inefficient processes at check-in or immigration).

Figure 4.2 Air Transport Infrastructure Quality, 2012

Sources: Based on data from World Economic Forum Global Competitiveness Report, Switzerland, 2012 (WEF 2012b); and International Monetary Fund World Economic Outlook (IMF 2013).

Note: GDP = gross domestic product; PPP = purchasing power parity.

A significant challenge of air transport infrastructure is related to facilities and equipment that ensure the safety of operations. This includes primarily communications, navigation, and surveillance (CNS) infrastructure. In many parts of the world, particularly in Africa, the lack of and/or insufficiently maintained ground-based navigation aids, has been an impediment to the development of air transport (Gwilliam and others 2011).

The reason for the dire state of airport infrastructure in many developing countries is related to the high levels of investment needed to improve and maintain airports. Funding for maintenance is often constrained by thin traffic and low passenger figures, as well as the inability of the central treasury to provide the needed capital. As a consequence, many of these countries are unable to meet basic international safety requirements (Winston and de Rus 2008).

For LCCs, reliance is also high on the efficient management of airport infrastructure. As elaborated in chapter 1, short turnaround times and consequently the maximization of aircraft usage are key for LCC profitability. In order to be able to achieve this, efficient processes need to be put in place by the airport operator (for example, the speed of ground handling or refueling) and ATC to manage operations smoothly. There are various methodologies available today that measure the efficiency and overall performance of airports, such as those established by the International Civil Aviation Organization (ICAO) or the Airports Council International (ACI). Many indicators are not applicable to smaller airport operations though and are not relevant for LCC operations generally. Some evidence has also been found that, inversely, LCCs can actually have a positive impact on airport performance. As airports become aware of the benefits gained from increased traffic, they adapt to LCC requirements (Botasso, Conti, and Piga 2012).

The level of airport charges, such as landing and passenger fees and other taxation, plays a major role in the development of affordable air services. Air travel charges are generally regulated by national laws. For domestic air travel, the national policy for charging taxes and fees is generally the only reference point. However, in domestic markets of states that belong to regional economic communities (RECs), such as the European Union, certain bloc principles on taxation may apply. The taxation of international air services is based on the principles of the “Convention on International Civil Aviation,” the so-called Chicago Convention of 1944 (ICAO 1944). Article 15 of the convention regulates “airport and similar charges.” However, the major part of the article only addresses impermissible price discrimination between national and foreign carriers. Nevertheless, the last sentence stipulates that charges should not be imposed solely for the right to enter and exit a territory on an aircraft. The underlying philosophy behind the rule is that international air transportation should not be taxed unreasonably, but can only be charged for services that are provided or for costs that are incurred from their operations.

Information on airport charges (aeronautical and nonaeronautical) for major airports can normally be found in a country’s Aeronautical Information Publication (AIP) or, when not available, from international sources such as the ICAO and ACI.3 Charges for smaller domestic airports are, in most cases, unavailable unless published by the respective civil aviation authority (CAA).

Airport charges can pose a significant challenge in developing countries. As secondary airports are less available, LCCs are forced to establish their operations at a country’s primary airports. These airports experience not only higher levels of congestion, but also often demand higher airport charges as justified by the complexity of their operations and expensive, and sometimes unnecessary, infrastructure investments. In Senegal, for example, international airports have been charging an ever-increasing infrastructure development charge of EUR54 (US$72 in 2011) since 2005, which is used to finance the country’s new airport, Dakar-Blaise Diagne International Airport, currently under construction (ICAO 2013a). Similarly in Zambia, the National Airports Corporation, a parastatal company, has recently introduced a new infrastructure and development charge to fund, develop, maintain, and manage four designated Zambian airports (Lusaka, Ndola, Livingston, Mfuwe) (Lusaka Times 2012).

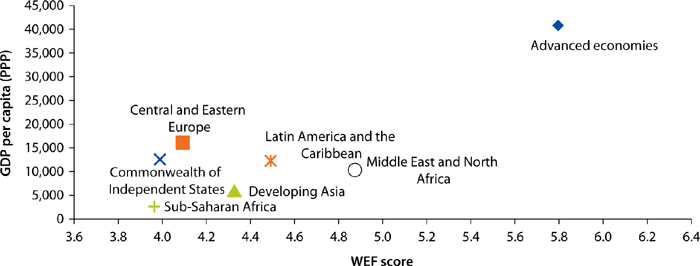

In some cases, airports in developing countries can also prove to be an important source of foreign revenue for governments, and are therefore seen as “cash cows” (Winston and de Rus 2008). Furthermore, at smaller airports, the lack of landside infrastructure and limited opportunities for commercial revenue creates a larger dependency on aeronautical charges (Winston and de Rus 2008).4 This can have a detrimental impact on ticket prices. As shown figure 4.3, charges and taxes on a sample of West African routes represent, in some cases, over 50 percent of the ticket price. Removing excessive charges and taxes can have a substantial positive impact on airfares, and the economy as a whole. According to a report by IATA (IATA 2013a), the removal of the infrastructure charge at Léopold Sédar Senghor International Airport in Senegal could increase economic benefits to Senegalese residents using air transport by US$31.5 million. It would decrease average round trip costs for foreign visitors by approximately 6.5 percent. Furthermore, the air transport industry’s overall contribution to GDP would grow by more than US$37 million and support an additional 6,700 jobs in Senegal.

Although these reasons help to explain why airport charges may be higher in developing countries, such generalizations are difficult to make. Further assessments need to be made on a country-by-country basis.

In cases where secondary airports are available or primary airports are located far from cities, LCCs are dependent on the provision of low-cost ground access. Multiple studies have shown that airport accessibility is a key determinant in passenger choice of an airport (Kouwenhoven 2008). The dilapidated condition of roads and the lack of public transport can therefore be a significant barrier in attracting consumers. In Europe, for example, Ryanair has recognized that costly ground access can act as a potential deterrent for customers using the airline. Therefore, it has developed a partnership with Terravision, a European coach operator (Ryanair 2008). In Mexico, the LCC VivaAerobus has been working in partnership with the bus company IAMSA to ensure accessibility (VivaAerobus 2012).

Figure 4.3 Selected Lowest Economy Fare for African Routes, August 2012

U.S. dollars

Sources: Analysis based on Senegal Airlines, Arik Air, and Air Cote d’Ivoire websites.

Note: Fares are for travel in August 2012.

Very few industries are as affected by regulation as the aviation industry. Other than market forces, government policy has been one of the most crucial components in shaping the operation and development of scheduled passenger air services. As in the case of Southwest Airlines and for most LCCs, deregulated domestic and international air transport markets have been a key prerequisite in their establishment.

In the air transport industry, regulation occurs on both a domestic and an international level, and covers a wide spectrum of responsibilities including safety, airspace policy, economic regulation, and consumer protection. These responsibilities traditionally lie with a country’s designated governmental body, in most cases the CAA. Of particular importance in this context is their economic regulatory function involving the regulation of entry and exit of airlines, access to individual routes, determination of fares, as well as control over subsidies (Hooper 1997).

Historically, and in some cases still today, the involvement of a country’s government in the aviation market extends even further through the presence of a state-owned national carrier, which is often supported by subsidies and fiscal incentives (Belobaba, Odoni, and Barnhart 2009). This would oftentimes have a strong influence on the way in which the air transport market is regulated, with preferential treatment being given in terms of route access and stringent or impossible entry criteria for new carriers.

Deregulation of domestic air transport was initiated in the United States in the 1970s. Since then domestic liberalization policies have also been implemented to varying degrees in many less developed countries. In recent years, liberalization policies have been introduced both in smaller domestic markets such as Papua New Guinea, Thailand, and Mongolia, as well as in larger markets with considerable scope for domestic services, such as Brazil, China and India (Hooper, Hutchinson, and Nyathi 1996). The privatization of national airlines is a particularly important factor in some developing countries, where state-owned carriers are still very common. This can partially be explained by the fact that government-owned carriers in developing countries are seen as a national asset and key for promoting economic and social development, particularly in countries with poor alternative modes of transport (Hooper 1997).

In larger developing countries, the opening of domestic routes has encouraged the development of efficient and affordable air services. For example, Brazil experienced a phased domestic liberalization from the 1990s onward, eliminating entry barriers to new airline enterprises and deregulating fare levels in order for new carriers, including low-cost airlines such as GOL, to enter the market (Franco and others 2002). Thailand is another example of a country that had historically protected its carrier Thai Airways by prohibiting private airlines from directly competing with the airline on its routes. Fares were also regulated according to route distances and types (trunk, local, and feeder routes). In the 2000s, however, Thailand gradually deregulated its domestic airline market by first allowing private carriers to enter domestic routes and subsequently removing fare restrictions—and even allowing for foreign ownership of up to 49 percent. Soon after deregulation, three new LCCs, Thai AirAsia, Nok Air, and One-Two-Go, started domestic operations and traffic increased by almost 40 percent in 2004 (Zhang and others 2008).

The regulation of international air transport is based on the Chicago Convention of 1944 (ICAO 1944). As a result of a disagreement on the regulation of air services at the time, a framework of bilateral air service agreements (ASAs) emerged regulating air transport between two countries on a country-by-country basis. Although multilateral agreements are becoming more common, most air transport today is still governed by bilateral ASAs. The convention also established the concept of “Freedom of the Air” with each freedom specifying the rights that the carrier of any country may have with respect to one another (see appendix D for the different freedoms of air) (Belobaba, Odoni, and Barnhart 2009). Depending on the type of freedom permitted between two countries, this may not only impact international, but may also affect domestic, traffic with the highest level of freedom, cabotage, allowing carriers to move passengers within a foreign domestic markets (Belobaba, Odoni, and Barnhart 2009).5 Table 4.2 below outlines the four critical aspects of an ASA.

Table 4.2 Elements of Air Service Agreements

Market access |

Potential city pairs to be served under ASAs, as well as all freedoms beyond the third and fourth, which may be granted under the ASA.a |

Airline designation, ownership, and control |

Number of airlines from each state that have the right to provide service in each city pair included in the agreement, and the ownership criteria airlines must meet to be designated under the bilateral agreement. This clause sometimes includes foreign ownership restrictions. |

Capacity |

Frequency of flights and the number of seats that can be offered on each city pair. |

Airfares (tariffs) |

The manner in which passenger fares and/or cargo rate charges are determined, and any steps necessary for government approval of these fares. |

Source: The Global Airline Industry (Belobaba, Odoni, and Barnhart 2009).

Note: ASA = air service agreement.

a. Third and fourth freedom rights allow basic international service between two countries. For an outline of all freedoms of the air, see appendix D.

The extent to which these rights are granted under an ASA range from traditional to open market or open skies, decreasing in restrictiveness. The least restrictive type of agreement, open skies, has been achieved in the United States and in Europe, but much of the developing world is still struggling with the implementation of such a liberalized regulatory framework.

Access to detailed ASAs is often difficult and has to be obtained directly from the respective CAA or ministry. The World Trade Organization (WTO) has been the only organization collecting information on ASAs worldwide. It has created an analytical tool, the air service agreement projector (ASAP), which measures the restrictiveness of a particular ASA between two countries. The degree of restrictiveness in the ASAP is based on the application of “standard provisions” (primarily third and fourth freedoms) under an ASA, but gives particular importance to the application of fifth freedom rights, liberal withholding/ownership provisions and multiple designations. The results for each ASA are categorized according to alphabetic letters, with A being the most and G being the least restrictive (WTO 2013).

According to the database, intra-regional, short- to medium-haul traffic, of particular importance for LCCs, is still highly regulated in most developing countries. Table 4.3 shows the number of intra-regional agreements by type in Africa, Latin America and the Caribbean, Asia Pacific, the Middle East, and the Commonwealth of Independent States (CIS). The only Asia Pacific intra-regional agreements that are categorized as Type G are between more developed countries, such as New Zealand, Australia, Singapore, and Brunei Darussalem.6 In Latin America, the only fully liberalized intra-regional ASA is between Costa Rica and Chile. In the intra-African market, no such agreements exist. There are, however, a number of F type agreements between countries.

Table 4.3 Intra-Regional Traffic by Type of Agreement

Sources: Analysis based on WTO (World Trade Organization) Quantitative Air Services Agreement Review (QUASAR) data.

Note: I refers to incomplete information available and O refers to combinations not covered in types A to G. CIS = Commonwealth of Independent States.

Some progress has been achieved with the emergence of multilateral agreements in certain regions. In the Latin America and Caribbean region, for example, an effort has been made by the Latin American Civil Aviation Commission (LACAC) to enforce a “Multilateral Skies Agreement.” In Africa, an open skies framework for intra-African air transport, the Yamoussoukro Decision, has been established and became binding for 44 countries. Unfortunately the framework has not been widely applied (Schlumberger 2010). This particular framework will be discussed in more detail in chapter 5.

RECs have played an important part in the liberalization of regional networks. The European Union has achieved complete liberalization between its member states, even including eighth freedom rights (Schlumberger 2010).7 Member countries of the Association of Southeast Asian Nations (ASEAN) have also been gradually moving toward the implementation of an open skies agreement. It is planned that by 2015, an open skies agreement with unlimited 5th freedom rights—and without restrictions on frequency, pricing, and type of airlines—should be fully enforced. Monitoring current progress, however, this seems less likely to be achieved in this time frame (CAPA 2013a). There are also a number of RECs in Africa that have achieved some progress in liberalizing air transport, including the Arab Maghreb Union (AMU), the West African Economic and Monetary Union (WAEMU), and the Economic Community of Central African States (CEMAC) (Schlumberger 2010).

The implementation of regional agreements would be of significant benefit for LCCs, as it would open several secondary city pairs that are currently not served by network airlines and where LCCs could operate successfully with their business model. In the case of Southeast Asia, for example, many of the region’s routes are short- to medium-haul, and can be operated by single-aisle aircraft such as A320 and B737 aircraft (Forsyth, King, and Rodolfo 2006; Zhang and others 2008).

As labor represents a substantial component of the LCC cost structure, the availability and cost of qualified staff, as well as a regulatory environment conducive to efficient labor utilization, are crucial to the development of LCCs.

The availability of qualified staff is a particular concern in developing countries where there is significant lack of experienced personnel, including pilots, crews, air traffic controllers, ground handling staff, aircraft maintenance, and many other vital human components of the air transport system. Many of these roles require a highly qualified workforce and a significant amount of training, which is often not available.

Even in more developed regions, a lack of pilots has become a particular concern. Boeing estimated in its “Pilot and Technician Outlook” that about one million new commercial airline pilots and maintenance technicians will be needed by 2031 (Boeing 2012). This includes 460,000 new commercial airline pilots and 601,000 maintenance technicians. Similar predictions have been made by ICAO, stating that with 151,000 aircraft expected to be in operation by 2030, 980,000 pilots will be required in the market—double the number there is today (ICAO 2011). This translates to 52,000 additional pilots per year, as compared with a total of 44,354 currently. The difference of 8,146 pilots a year will likely result in longer working hours, which may become a safety problem given pilot fatigue. This will be a particular issue for regions where air traffic is increasing rapidly, such as Asia Pacific (with a 9,048 shortfall per year), Latin America (4,305), and the Middle East (1,598). India alone is expected to require 1,150 new commercial planes over the next two decades (Boeing 2012), and China has just approved the building of 69 new regional airports by 2015 (CAPA 2013b). The impact of these shortages can already been seen in Asia, where delays and operational interruptions have been common due to pilot scheduling constraints. Similarly, there is an annual shortfall of maintenance and ATC personnel, although interestingly both the Latin America and the Africa regions currently appear to have a surplus of the latter (Coulter 2012).

A key reason for this shortage is the lack of adequate training facilities, and the high cost of training. In Asia, where demand is particularly high, the market for flight training facilities is still very fragmented with a significant number of smaller, mostly unsustainable flight schools. Many of these have already closed, and the ones still operating have a shortage of certified flight instructors (CFIs), airplanes, and appropriate equipment (Frost and Sullivan Market Insight 2007). Fortunately some larger independent flight schools are expanding rapidly across the region in response to the surging demand. Although these tend to reduce costs, they increasingly face training issues with regard to limited flying slots at larger airports and lack of air space. This hinders the development of large-scale local training programs, and forces aspiring pilots to rely on limited, often externally funded training opportunities abroad. These foreign-trained pilots often do not return to their country of origin because of more attractive working conditions abroad.

Unfortunately, the lack of pilots has also led to a rise in the number of unqualified aviation personnel taking to the skies. As a report issued by the Ministry of Transport in Tanzania highlighted, this shortage of pilots has increased the number of “unqualified pilot accidents,” and in India several pilots’ licenses had to be revoked in 2011 due to falsification of records (Arun 2011). Ensuring high quality standards is an issue that will need to be handled through better enforcement of regulations.

These problems have forced more established airlines in developing countries to find pilots abroad. Indonesia’s Susi Air, for example, relies entirely on foreign pilots, which were able to be hired given the economic crisis in Europe and the United States. However, having recognized the issues this may pose in the future, the government is fostering the development of two new flight schools in addition to the 13 already in operation. The country’s Ministry of Transport is also working with the private sector and the Indonesian National Air Carrier Association (INACA) to organize conferences on airport development, airline technology, and aviation training and education (Schonhardt 2012).

The limited supply of qualified staff and higher training costs often translate into higher cost for airlines. In some cases, this is further aggravated by unfavorable regulations and labor laws in developing countries. This could include, for example, limiting restrictions to working hours, the mandatory use of overly expensive social security systems, high labor taxes, or very high minimum wages. In Tanzania, labor costs often represent a high percentage of the overall operating costs of firms due to gaps in labor laws, for example, retrenchment procedures or remedies for unfair termination (Association of Tanzania Employers 2011).

In Europe, stringent labor regulations and high levels of government and union interventions have played an important role in the creation of LCCs. Both Ryanair and easyJet have purposely chosen to base their operations in England, despite the fact that most of their operations are located across Europe. The airlines have also been involved in legal battles in France where they have tried to avoid restrictive labor regulations by contracting all of their staff, including those based in France, under British labor law (Peanuts! 2007). French labor law is seen by many institutions, such as the Organisation for Economic Co-operation and Development (OECD) and the European Central Bank, as overly regulated, hindering the productivity of the labor market (Carnegy 2013). Although many LCCs have pointed to their general avoidance of unions as a factor in labor productivity, as highlighted in chapter 1, this has not been proved in the literature (Belobaba, Odoni, and Barnhart 2009).

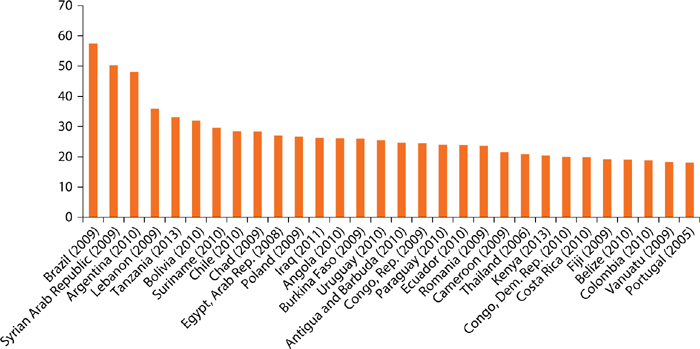

The International Finance Corporation (IFC) and World Bank Enterprise Surveys has served as a good indicator for identifying overregulated labor markets. Based on a firm-level survey of a representative sample of an economy’s private sector, the survey measures labor regulation across the world by quantifying the number of firms that identify labor regulation as a major constraint to their operations (World Bank and IFC 2013). Figure 4.4 shows that many developing countries still face constrained labor environments that could hinder the development of the private sector, and consequently the market for LCCs.

In addition, the World Bank’s Doing Business report (World Bank 2013a) measures business regulations and their enforcement across 185 economies and selected cities at the subnational and regional level. As part of its country-level assessments, the report also measures flexibility in the regulation of employment as it affects hiring and redundancy of workers and the rigidity of working hours— all of crucial importance for businesses.

Figure 4.4 Percentage of Firms Identifying Labor Regulation as a Major Constraint

Source: World Bank and IFC Enterprise Survey 2013.

Adequate safety and security standards are of critical importance for air operations as technical malfunctions, human errors, and equipment failures can have catastrophic consequences. Due to the nature of air travel, the loss of human life is often greater per single occurrence compared to car or train accidents. The state of air transport safety and security in a country also plays a critical role with regard to aircraft financing and insurance as the cost of purchasing or leasing aircraft can be significantly higher when standards are perceived to be inadequate in the markets in which they operate (World Bank 2011). Indeed, aircraft manufacturers may be reluctant to sell aircraft due to reputational risk.

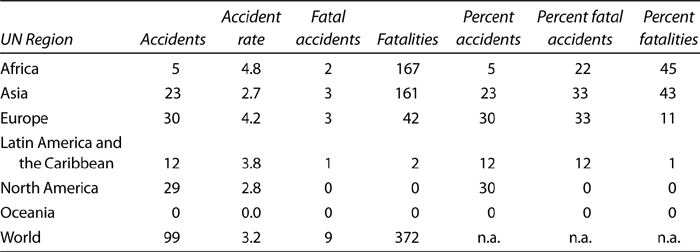

Although the aviation industry has come a long way to ensuring safe air travel, aviation safety still remains a major issue in the developing world, particularly in Africa and Asia (see table 4.4). While Africa only accounted for 5 percent of total accidents in 2012, 45 percent of all fatalities occurred in the region, and it still has the largest number of accidents per million passengers. Although the percentage of fatalities is followed closely by Asia, the region has a significantly lower overall accident rate.

The higher number of accidents can be attributed to various factors such as operational shortfalls, insufficient and defective equipment, inadequate maintenance of aircraft, poor oversight, and/or lack of properly trained staff. These derive primarily from a lack of adequate infrastructure, insufficiently trained human resources, and, most importantly, poor oversight.

Table 4.4 Accident Statistics and Accident Rates, 2012

Source: International Civil Aviation Organization (ICAO 2013b).

Note: n.a. = not applicable; UN = United Nations.

The regulation of safety and security by the CAA plays an important role in verifying that the nationally registered carriers and airports comply with required safety and security standards. In order to assess the effectiveness of a country’s safety and security oversight capacity, ICAO has established the Universal Safety Oversight Audit Programme (USOAP). Under the USOAP, so-called ICAO comprehensive system approach (CSA) audits are conducted by assessing eight critical elements which are considered essential for a state to establish, implement, and maintain an effective safety oversight system. These include

• Primary aviation legislation: the establishment of civil aviation legislation that supports the state’s civil aviation system and regulatory functions in compliance with the Convention on International Civil Aviation (Chicago Convention).

• Specific operating regulations: the establishment of aeronautical regulations (rules) addressing all aviation activities, and implementing applicable ICAO provisions and standards and recommended practices (SARPs).

• State’s civil aviation system and safety oversight functions: the establishment of a CAA or other authorities with safety regulatory functions, objectives, and safety policies, provided with sufficient financial resources and qualified staff.

• Technical personnel qualification and training: the establishment of minimum requirements for knowledge and experience of the technical personnel performing safety oversight functions, and the provision of appropriate training to maintain and enhance their competency at the desired level.

• Technical guidance, tools, and the provision of safety critical information: the provision of procedures and guidelines, adequate facilities and equipment, and safety critical information to the technical personnel to enable them to perform their safety oversight functions; this includes the provision of technical guidance to the aviation industry on the implementation of regulations and instructions.

• Licensing, certification, authorization, and approval obligations: the implementation of systems to ensure that personnel and organizations performing an aviation activity meet the established requirements before they are allowed to exercise the privileges of holding a license, certificate, authorization, and/or approval.

• Surveillance obligations: the implementation of a continuous surveillance program consisting of inspections and audits to ensure that aviation licenses, certificates, authorization, and/or approval holders continue to meet the established requirements and functions at the level of competency and safety as required by the state.

• Resolution of safety concerns: the implementation of processes and procedures to resolve identified deficiencies impacting aviation safety, which may have been residing in the system, and been detected by the regulatory authority or other appropriate bodies.

The audit looks across eight key areas for safety including legislation and regulation, civil aviation organization, personnel licensing and training, aircraft operations, airworthiness of aircraft,8 aircraft accident and incident investigation, air navigation services, and aerodromes and ground aids (ICAO n.d.).

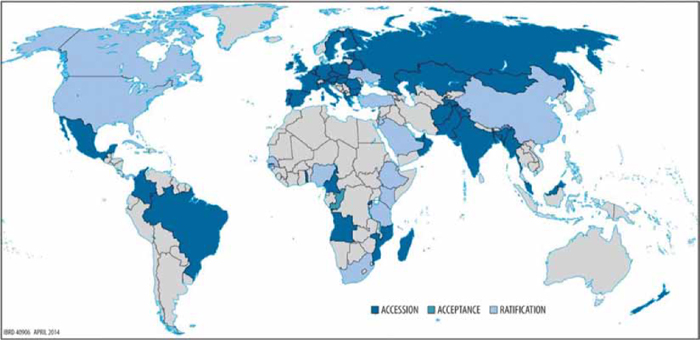

As map 4.1 shows, many developing countries still maintain poor safety oversight, with limited or negligible regulation. This allows carriers and airports to operate without complying with safety standards. Historically, the so-called CSA audits were conducted under USOAP only at a specific point in time and to be repeated after a number of years. Trying to monitor safety oversight performance on a more continuous basis, ICAO has now moved toward implementing a continuous monitoring approach (CMA).

Map 4.1 USOAP Results, 2012

Source: International Civil Aviation Organization (ICAO 2013b).

Note: USOAP = Universal Safety Oversight Audit Programme.

To assess security oversight, ICAO has established a Universal Security Audit Programme (USAP), which measures the capacity of civil aviation authorities to oversee the enforcement of security standards. After decades of declining security challenges, the events of September 11, 2001, made security a renewed concern for some airports. The necessary infrastructure and principally the right training and enforcement, are required to ensure security at airports and on-board the aircraft.

A cost-efficient network to advertise and sell air services is crucial for LCCs. Airline tickets are traditionally sold through travel agents, call centers, and global distribution systems (GDSs), all of which normally come at a considerable cost. As elaborated in chapter 1, LCCs try to avoid these expensive distribution channels and focus primarily on direct selling over the Internet. This represents a considerable cost saving. In order to realize the benefits of direct selling, the availability and quality of information and communications technology (ICT) infrastructure, as well as credit card market penetration, are major factors.

Internet penetration is still very low in most developing countries, and reliance is therefore much higher on costly travel and tourism agents. Although this has been identified as an important factor for LCC development, carriers have often found alternative ways of addressing this challenge. Nok Air in Thailand, for example, has used a mix of distribution channels including cash machines, convenience stores such as 7-Elevens, and even movie rental shops. Similarly, Mango in South Africa has used retail stores and bus operators as sales channels (Sobie 2006). This not only reduces costs, but also makes the purchasing process more accessible for customers.

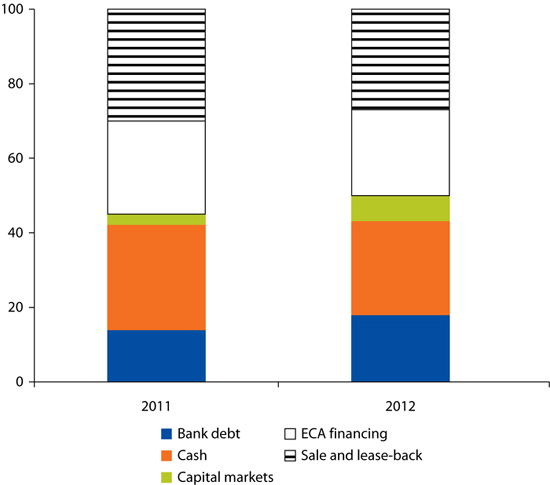

The financing of aircraft can be a significant hurdle for new carriers because of the required capital intensity and associated industry risk. Due to the complexity of aircraft financing mechanisms, only the basics of aircraft finance are covered here. The highlights of some of the most frequently applied financing mechanisms and their accessibility for developing countries are discussed below. Most importantly, however, this section examines the new policy measures to address the challenge of financing newer and more fuel-efficient aircraft in developing countries. Indeed, financing plays a major role in the setup and success of an LCC.

Most commonly, airlines have to decide whether to purchase or lease their aircraft. Under a direct purchase arrangement, the airline simply purchases the plane directly from the manufacturer or vendor. Due to the capital intensity of aircraft, however, many airlines resort to leasing agreements with leasing companies, or in some cases directly with aircraft manufacturers. An airline has to decide whether to lease an aircraft with the attendant responsibility of maintenance, registration, and insurance being with the lessee. This is a so-called dry lease, whereas a wet lease includes crew, maintenance, and insurance. There are various kinds of leasing agreements in the market today, the most common are finance leases and operating leases. Wet leases are normally operating leases, whereas dry leases can be either in the form of a finance or operating lease (Vasigh, Taleghani, and Jenkins 2012).

Finance leases are long-term, noncancellable lease contracts. The nature of a finance lease is such that the lessor typically agrees to transfer the title of the asset to the lessee at the end of the lease period at a nominal cost. The lessee normally bears the cost of maintenance, insurance, and repairs with only the title of the aircraft remaining with the lessor. In an operating lease, a lessor acquires or already owns an aircraft and leases it to an airline over a set period of time. This type of lease is mostly short term (less than 10 years), and allows carriers a certain level of flexibility in up- or downscaling their operations. There are also so-called “sale-and-lease-back” arrangements. In a sale-and-lease-back contract, an airline sells its aircraft and immediately enters into a leasing agreement with the purchaser (Vasigh, Taleghani, and Jenkins 2012).

Although some airlines have the capital available to pay for the direct financing or leasing of their aircraft in cash, over two-thirds of aircraft financing relies on other financing mechanisms (see figure 4.5) (PWC 2013).

Figure 4.5 Aircraft Financing: 2011 versus 2012

percent

Source: Reproduced from PricewaterhouseCoopers, Aviation Finance (PwC 2013).

Note: The figure also captures sale and lease-back, which refers to a self-funding purchase by the lessors. ECA financing refers to financing obtained through export credit agencies (ECAs). Manufacturers’ supported aircraft finance appears negligible and therefore is not shown in the graph.

The most common mechanisms for financing aircraft include bank loans/lease financing, export credit guaranteed loans and credits, manufacturer support, enhanced equipment trust certificates (EETC), Islamic finance, and loans from development banks such as the World Bank and other regional development banks. Table 4.5 summarizes some of the key elements, accessibility, and challenges of each financing type (Vasigh, Taleghani, and Jenkins 2012).

Table 4.5 Aircraft Financing Sources and Mechanisms

Any aircraft financier/investor, regardless of the mechanism applied, aims to minimize exposure to potential risk resulting from debtor failure (U.S. Department of Transportation 2004). This requires a legal system that has the ability to protect the financier’s title, security interests,9 and ensure enforcement (Bunker 1989). In the case of aircraft financing, this risk exposure is further aggravated by the mobility of aircraft being able to move across borders with varying legal systems.

The weakness of many legal systems, and the generally volatile environments in developing countries, increase this risk considerably. This leads aircraft financiers to restrict their exposure or to significantly increase financing costs for airlines in developing countries. The World Bank’s Doing Business report (World Bank 2013a) serves as a good measure for the protection of lenders and borrowers in a given country. It provides a review of the legal rights of both parties in secured transactions as well as bankruptcy laws.

In addition to the high cost of financing, airlines in most developing countries face the disadvantage of a lack of economies of scale due to their smaller size operations, resulting in less favorable purchasing conditions. Larger LCCs, such as Ryanair, have been able to negotiate much lower prices due to their purchasing power. In 2013, Ryanair claimed that for its order of 175 Boeing 737 aircraft, the airline managed to negotiate its prices down to the level of its acquisition of a similar purchase arrangement in 2005. The carrier apparently only paid about 50 percent of the aircraft’s list price in 2005 (Tobin 2013).

The most important initiative to address the challenge of aircraft finance has been the 2001 Cape Town Convention on “International Interests in Mobile Equipment,” and the associated “Protocol to the Convention on International Interests in Mobile Equipment on Matters Specific to Aircraft Equipment.” This Convention enables the financing of aircraft by “providing creditors with an internationally recognized set of rights in the event of a debtor’s default or insolvency, and is allowing creditors to register their interests in an international register to guarantee the priority of their claim against other parties” (Government of Australia, Department of Infrastructure and Transport 2013). It includes, for example, the right of a lender to deregister aircraft and procure its export upon default of a debtor or to take possession or control of aircraft. As of March 2012, the protocol had 44 contracting states (see map 4.2).

Map 4.2 Ratification of Cape Town Convention

Source: Map based on information from Unidroit (International Institute for the Unification of Private Law n.d.).

The ratification of the Cape Town Convention should increase accessibility to funding and reduce associated costs for airlines. In the case of Boeing aircraft purchases, for example, the U.S. Export-Import Bank offers discounts on its exposure fees and longer-term finance for U.S. manufactured engines to airlines in countries that have ratified the Cape Town Convention. Furthermore, it provides favorable terms when both lessor and lessee country have endorsed the convention in their contractual frameworks (Hewitt 2009). Through ratification of the Cape Town Convention, EETCs are also expected to become more available to non-U.S. airlines in the future (Gewirtz 2011). This will particularly benefit developing countries, which have been unable to access commercial credit markets or have had to pay very high interest rates (U.S. Department of Transportation 2004).

Stronger carriers in developing countries also increasingly support smaller carriers in their region with regard to aircraft financing. Ethiopian Airlines has, for example, been involved with ASKY, a passenger airline in Togo, through a management contract. The contract provides the airline with managerial support and facilitates aircraft financing (Davidson 2012).

The cost of fuel is a crucial, if not the most crucial factor impacting the profitability of low-cost airlines and the aviation industry in general. IATA estimated that the industry’s fuel bill amounted to US$213 billion in 2013 (IATA 2013b). As fuel represents between 35 to 40 percent of direct operating costs, inflated fuel costs can therefore be detrimental (Vasigh, Fleming, and Tacker). Many of the factors influencing jet fuel prices, such as the cost of crude oil, increased international energy demand, and a stagnating supply of oil will impact airlines on a global level. However, these conditions can also vary on a local level due to taxation, government regulations as well as foreign exchange, geographic location, infrastructure, distribution channels, or local competition (Caltex Petroleum n.d.).

Landlocked countries, for instance, have faced higher costs and endured longer waits for fuel due to the lack of direct access to ports. Malawi, for example, imports all of its fuel through either Mozambique or Tanzania by rail and truck. Because of the high transport costs, as well as high levies, taxes, duties, and other costs, the inbound landed price for gasoline quadruples from the port in Dar es Salaam until it’s sold (Mitchell 2011). Zambia has had to pay as much as 50 percent more for fuel than in other countries in the region, even before the recent oil price jumps (World Bank 2008).

Taxation and customs duties are other key factors, which can increase fuel costs. Under ICAO’s policies on aviation fuel, it is clearly stated, “Aviation fuel used in the provision of international air transportation services is exempt from federal customs duties and excise taxes” (ICAO 2009). However, in accordance with Article 24 of the policy, this applies only to charging duty on aviation fuel already on board any aircraft that has arrived in a territory from another contracting state of the Chicago Convention. Furthermore, the exemption of airlines from national taxes and customs duties on a range of aviation-related goods, including parts, stores, and fuel is a principle that is anchored in most bilateral ASAs between individual countries.

However, many countries do not comply with this regulation. In India, for example, all fuel is subject to an 8.24 percent excise duty, and state fuel taxes of up to 30 percent on domestic flights, incurring considerably higher costs for airlines (Asiana Aviation 2012). In Africa, according to IATA, aviation fuel is about 21 percent more expensive than the global average, partly because of government taxation (IATA 2013c).

A final, very important criterion concerns an issue that is fundamental for every industry: good governance. Good governance has been defined in various manners by the World Bank and other institutions. The essence of good governance in the context of this book lies in creating an operating environment in which “the process of decision-making and the process by which decisions are implemented (or not implemented)” (UNESCAP 2013) are not an impediment to the establishment and growth of an industry or company.

The lack of good governance on a national, but also on an airport and airline, level has proved to hamper the development of air services in developing countries considerably. This has often resulted in hesitation of foreign companies to invest and bring the much needed managerial skills into the market. State ownership of the national airline and the resulting favorable conditions for the carrier have been a particularly prevalent example of bad governance in developing countries.

An often-cited example is the case of Virgin Nigeria. The joint venture between the now defunct Nigeria Airways and the Virgin Group started operations out of Lagos in 2004, but had to withdraw in 2008. The exit was triggered by a dispute over the relocation of the airline to the remote new Terminal 2, despite a clear memorandum of understanding granting the airline the rights to operate from the original terminal. The reasons for the failure of the carrier have often been linked to a nontransparent environment (Thome 2008).

Many organizations have produced measures for governance, covering various viewpoints and a wide scope of specific indicators. Some, such as the Economist Intelligence Unit (Economist Intelligence Unit 2013) or the Global Competitiveness Report (WEF 2013), predominantly measure indicators linked to economic development, whereas others, such as the International Country Risk Guide (ICRG) (PRS Group 2013), are concerned with challenges pertaining to businesses and investors. Many measures look at a multidimensional assessment of governance, whereas some focus on only one indicator such as the Perceived Corruption Index of Transparency International. The World Bank, together with the Brookings Institution, has developed its own measures, building upon some of the elements of the other indexes named above. The Worldwide Governance Indicators (WGI) Project looks at six different indicators including voice and accountability, political stability and absence of violence, government effectiveness, regulatory quality, rule of law, and control of corruption. A total of 215 economies have been assessed (World Bank 2013c).

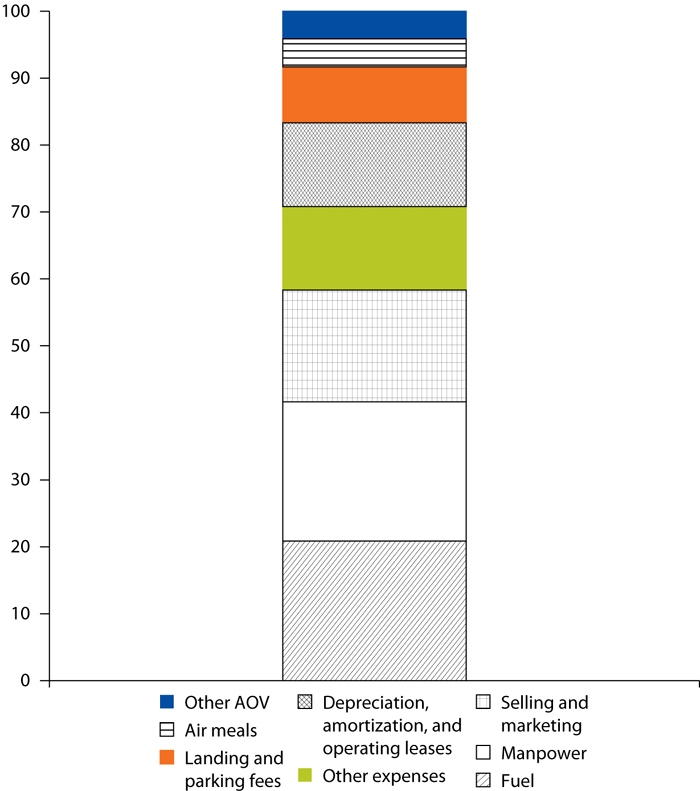

All of the above-mentioned factors play a key role in the development of LCCs, but it is important to prioritize between the “make-or-break” and the potentially less essential market characteristics. Some elements are undeniably prerequisite—such as demand, deregulated air transport markets, and good governance. However, measuring the role of other, more operational, characteristics can be more complex and needs to take into account a multitude of country-specific factors. One approach to identifying their importance is to quantify the cost-reducing factors in the LCC business model discussed in chapter 1, and to link these directly to the elements outlined above. Based on information published by the consultancy KPMG’s Airline Disclosure Handbook (KPMG 2013), figure 4.6 shows the typical breakdown of LCC cost advantages.

Figure 4.6 Cost Advantage by Element, 2011

percentage of cost per available seat kilometers

Source: Based on information from KPMG Airline Disclosure Handbook (Ramsay 2013).

Note: Airline operating variable (AOV) represents other operating costs. The sample compares 25 legacy carriers and 6 LCCs from Asia, Latin America, North America, the Middle East, and Europe.

Figure 4.6 shows that fuel cost advantages still play a key role in the LCC cost structure, despite the convergence in fuel expenditures between network carriers and LCCs mentioned in chapter 1. Being able to obtain newer fuel-efficient aircraft and not being burdened by high taxation and stringent regulations on fuel is therefore crucial. The former is also intrinsically linked to safety oversight as it has a considerable impact on aircraft financing costs. The importance of aircraft type and its financing is further stressed by cost reductions related to depreciation, amortization, and operating leases.

Of equal importance are costs related to labor. The sample of LCCs shows that around 21 percent of their cost advantage comes from labor costs, making the required availability of human resources and favorable labor conditions paramount. This is followed by sales and marketing linked to inexpensive distribution channels. Landing and parking fees can also comprise considerable cost savings. Interestingly, cost advantages derived from a reduced service offering, represented here as “air meals,” are relatively low.

In order to assess the actual statistical significance of certain market criteria on a route rather than market environment level, the next section examines LCC market entry behavior through the example of the Arab Republic of Egypt.

Airline networks are built upon a series of sequential decisions that involve market entry and exit. Along with other elements (for example, product type to be offered, value proposition to customers, competitive advantages over other carriers, organization of operations to deliver highest value at the lowest possible cost), the choice of geographical markets in which to operate is at the core of any carrier’s competitive strategy (Holloway 2008). In making these decisions, management has to, among other things, assess the attractiveness of candidate markets. A simplified vision of this process assumes that the expected profitability in a particular market is a key determinant in an airline’s entry decision. This may ultimately depend on demand conditions, intensity of competition, and the extent of sunk costs and barriers to entry.

Low-cost airline market entry behavior is well documented for U.S. LCCs. Evidence for the case of Southwest Airlines, for example, indicates that high passenger density, short distances, lower income areas, prior airport presence, and lack of within-route competition are core determinants of market presence (Boguslaski, Ito, and Lee 2004). However, LCC entry behavior in middle- and low-income countries has not been studied in great detail, with a few exceptions (for example, Brazil; see Oliveira 2008). In lesser-developed economies, market characteristics and regulations can radically depart from those found in high-income countries. To understand how LCCs have adapted (if at all) their entry strategies to cope with changing environments around the world is no longer a purely research-oriented question. In turn, this issue is key to understanding how the low-cost air transport market in developing countries can serve as a catalyst for higher economic growth.

Egypt presents an interesting case study for LCC entry behavior. With a total population of over 80 million inhabitants, more than 12 million tourist arrivals per year, and strong migratory, cultural, and business links with the Arab world, LCC penetration in Egypt is still a relatively new phenomenon. In June 2010, Air Arabia Egypt (AAE)—a joint venture between Air Arabia and a local travel company—started its low-cost operations out of the city of Alexandria (and previously from the cities of Luxor, Asyut, and Sohag). Its main destinations have been concentrated almost exclusively in the Middle East. Based on their observed route entry patterns, a city pair airline entry model was built following the empirical work put forward by Oliveira (2008); Müller, Bilotkach, and Huschelrath (2011); Lederman and Januszewski (2003); and Boguslaski, Ito, and Lee (2004).

The underlying theoretical framework assumes that an airline will enter a route if the expected net profits from serving that route are positive. In the model, a latent variable captures the expected profitability10—one that cannot be directly observed ex-ante—but instead inferred from other variables that can be directly observed. Hence, a probit regression estimates the likelihood of a positive outcome in the latent variable,11 associated with LCC route entry in a particular airport pair. This probability is determined by market-specific characteristics at the airport, city, and country level, including demand factors, the extent of competition intensity, and barriers to entry, among others. Dummy variables by time period are used as well to control for any unobserved common shocks.12

The data set is constructed using monthly airline schedule information between 2007 and 2013, available from commercial vendors (DiiO SRS Analyzer 2013). The binary dependent variable takes a unitary value when AAE enters a route previously not served.13 With regard to the explanatory variables in the model,14 demand characteristics include GDP per capita at the destination airport (taken from World Bank development indicators), distance between origin and destination airports (CEPII bilateral data set; CEPII 2013), and dummy variables for seasonal and religious dates to specific destinations (for example, the Hajj or pilgrimage to Mecca). A dummy variable controlling for common ethnic and cultural ties at origin and destination was built using the CEPII bilateral data set. At the same time, bilateral migratory flows were obtained from the World Bank’s Bilateral Migration Database. Meanwhile, for concentration measures like route-level and destination airport, Herfindahl indexes were put together using schedule data.15 Finally, entry barrier measures, such as the level of slot coordination at destination airports, were obtained from IATA (n.d.).

The model aims to understand how different explanatory variables (size and type of demand, competition, barriers to entry, and so on) affect the probability of a positive outcome, that is, the entry of the carrier, as identified with AAE’s market presence on a particular route. The most important results generated from the model are highlighted in table 4.6.

Table 4.6 Key Results Entry Behavior Model

Source: Daniel Saslavsky, trade specialist, the World Bank.

Note: Standard errors in parentheses. CAI = Cairo International Airport; GDP = gross domestic product; HHI = Herfindahl-Hirschman Index; LCC = low-cost carrier.

***p <0.01, **p <0.05, *p <0.1.

Regarding demand characteristics, results indicate that higher market density (proxied by scheduled capacity in seats) and higher purchasing power at the destination country (measured by per capita GDP) are positively correlated with AAE’s city pair entry decisions. Longer distances, as found in similar studies, deter LCC entry. Meanwhile, other factors such as larger migratory flows (number of migrants living abroad), as well as the extent of cultural and ethnic ties between origin and destination, seem to increase the likelihood of low-cost airline entry. Furthermore, increased air travel demand associated with religious pilgrimage destinations (that is, Mecca in Saudi Arabia) is also positively linked to LCC presence.

With regard to competition and its effect on LCC market presence, route-level concentration is seemingly associated with low-cost operator route entry. A higher concentration may indicate less competition, and consequently higher margins and larger expected benefits from entry. However, capacity concentration at the destination airport acts as a deterrent for entry. The latter might be explained by, among other things, the higher likelihood of encountering a dominant incumbent carrier at the destination willing to react more aggressively to AAE’s entry. Interestingly, the presence of other LCCs did not seem to discourage AAE from entering a route. Regression analysis also indicates that the availability of competing charter services greatly reduces the likelihood of LCC presence in the same market. At the same time, higher availability of flights connecting over EgyptAir’s hub in Cairo reduces the likelihood of LCC presence when competing in the same origin and destination markets.16

Finally, sunk costs and other entry barriers seem to have an effect on an LCC’s decision to operate a route, as observed from AAE’s paradigm. In addition to the seemingly restricted access to the domestic market for LCCs, slot-controlled destination airports are also less likely to attract AAE, as they are usually more expensive to operate in, have longer turnaround times, and are more prone to delays.

As a final step, a prediction as to how likely an LCC following AAE’s paradigm might enter a specific city pair can be computed using the same model.17 This exercise takes all domestic and international routes flown into/out of Egypt and predicts the probability of entry in each case, depending on route and country-level conditions related to demand, competition, and other factors. Routes such as: Taba–Aqaba, Egypt; Sharm el Sheik–Amman, Jordan; Sharm el Sheik–Jeddah, Saudi Arabia; Sharm el Sheik–Kuwait; Luxor–Doha, Qatar; Luxor–Medina, Saudi Arabia; Luxor–Dubai, the United Arab Emirates (UAE);18 Hurghada–Kuwait; Asyut–Dubai, UAE; and Alexandria–Damman, Saudi Arabia, are the routes with the highest chances of being served by a low-cost operator based on AAE’s observed route entry patterns.

Identifying a suitable framework for LCC market entry can be challenging. As market conditions are different across the globe, finding the one formula for success for LCCs has proven to be difficult. Therefore, throughout this chapter, a variety of conditions have been identified that should be taken into consideration when assessing if a country has the right conditions for LCCs to develop and succeed.

In developing countries, LCCs may face a significant number of obstacles to entry. As illustrated by means of a few examples, certain challenges can be significant to LCC growth in developing countries. Many regions of the world are still lagging behind in creating a sound environment for the development of air transport, and in particular for LCC entry.

Weighing the costs. The importance of each of these conditions varies significantly. Factors influencing fuel and labor costs play the most important role, followed by the availability of distribution channels and infrastructure conditions. LCCs have found various ways to circumvent restrictions, but will need to weigh the costs that these alternatives will incur. Empirical evidence for the market in Egypt provides an indication of the statistical importance of certain criteria for the entry of LCCs on a given route. Route concentration is, for example, positively associated with LCC entry. However, capacity concentration at the destination airport as well as the availability of competing charter services may deter entry of an LCC. Models, such as the one offered here, can be useful in identifying which factors and policies can lead to the growth of LCCs on certain routes.

Having identified some of the key factors in LCC development, chapter 5 assesses the market opportunities for LCCs in the EAC, and discusses some of the challenges that the region must overcome to enable their successful emergence.

1. “Hybridized” refers to the convergence between the LCC and the traditional network carrier model, which has created a number of carriers displaying both types of characteristics.

2. Landside infrastructure includes passenger services (terminal), food and beverage concessions, duty-free shopping, car parking, and so on. Airside infrastructure includes airfield, gates, air bridges, runways, aprons, and taxiways.

3. An Aeronautical Information Publication is defined by ICAO as a publication issued by or with the authority of a state and containing aeronautical information of a lasting character essential to air navigation.

4. Aeronautical charges include landing fees, terminal-area air navigation, passenger and cargo services, aircraft parking and hangars, security, airport noise, noxious emissions (air pollution), ground handling, and en route air navigation.

5. “Cabotage” refers to the right of a carrier from one country to operate within the domestic borders of another country.

6. Type G are ASAs that allow third, fourth, and fifth freedom rights, multidesignation of airlines, free pricing, substantive ownership, and free determination of capacity.

7. The unofficial eighth freedom is the right to carry passengers or cargo between two or more points within a foreign country and is also known as cabotage.

8. Airworthiness assesses an aircraft’s suitability for safe flight.

9. A security interest involves the grant of a right in an asset which the grantor owns or in which he has an interest.

10. Latent variables are random variables, hypothetical constructs, whose realized values are hidden, and by definition, impossible to observe directly. Hence their properties must be inferred indirectly using statistical models linking them to observable variables.

11. A probit model is an econometric method used to estimate the probability of a positive outcome in a binary event (when only two mutually exclusive outcomes exist), based on a set of explanatory independent exogenous variables.

12. In econometrics, a dummy variable is a binary variable (0 or 1) utilized to indicate the absence or presence of some categorical effect that might shift a particular outcome in a regression.

13. A dependent variable or explained variable represents the output or the realization of a certain state, which can be explained by the explanatory or predictor variables.

14. An explanatory variable is a predictor variable. Intuitively, changes in the predictor variable will cause—all else being equal—a change in the dependent or explained variable.

15. The Herfindal Index is a measure of the size of firms in relation to the industry. It is an indicator of the amount of competition among them.

16. For instance, in the Alexandria (HBE)–Kuwait (KWI) market where AAE offers nonstop scheduled services (HBE–KWI) which directly compete with EgyptAir’s connecting services via Cairo (HBE–CAI–KWI).

17. See Boguslaski, Ito, and Lee 2004.

18. Air Arabia operated from Luxor as late as 2012.

Africa Progress Panel. 2013. Equity in Extractives: Stewarding Africa’s Natural Resources for All. http://africaprogresspanel.org/en/publications/africa-progress-report-2013/.

Airbus. 2012. Global Market Forecast 2012–2031. http://www.airbus.com/company/market/forecast/.

Airline Leader. 2013. “Virtual Alliances and Virtual Airlines.” Issue 16. http://www.airlineleader.com/pdfs/Airline%20Leader%20-%20Issue%2016.pdf.

Arun, B. 2011. “These Dangerous Pilots.” Deccan Herald. http://www.deccanherald.com/content/150955/these-dangerous-pilots.html#.

Asiana Aviation. 2012. “IATA Warns India on Fuel Tax.” Asiana Aviation, March 15. http://www.asianaviation.com/articles/242/IATA-warns-India-on-fuel-tax.

Association of Tanzania Employers. 2011. Business Agenda 2011–2014. http://lempnet.itcilo.org/en/hidden-folder/ate-tanzania-business-agenda.

Belobaba, P., A. Odoni, and C. Barnhart. 2009. The Global Airline Industry. West Sussex: John Wiley & Sons Ltd.

Boeing. 2012. Current Market Outlook 2013–2032. http://www.boeing.com/boeing/commercial/cmo/.

Boguslaski, C., H. Ito, and D. Lee. 2004. “Entry Patterns in the Southwest Airlines Route System.” Review of Industrial Organization 25 (3): 317–50.

Bombardier. 2012. Market Forecast. http://www2.bombardier.com/en/3_0/3_8/market_forecast/BCA_2012_Market_Forecast.pdf.

Botasso, A., M. Conti, and C. Piga. 2012. “Low-Cost Carriers and Airport Performance: Empirical Evidence from a Panel of UK Airports.” Industrial and Corporate Change 22 (3): 745–69.

Bunker, D. 1989. Canadian Aviation Finance Legislation. Montreal: Institute and Centre of Air and Space Law, McGill University.

Caltex Petroleum. n.d. Determining Fuel Prices. www.caltex.com/global/resources/determining-fuel-prices.

Campisi, D., R. Costa, and P. Mancuso. 2010. “The Effects of Low Cost Airlines Growth in Italy.” Modern Economy 1 (2): 59–67.

CAPA (Centre for Asia Pacific Aviation). 2013a. “ASEAN Single Aviation Market: Many Miles to Go.” Centre for Asia Pacific Aviation, March 13. http://centreforaviation.com/analysis/aseans-single-aviation-market-many-miles-to-go-100831.

———. 2013b. “CAAC Outlines Support for Regional Aviation Development, 69 New Regional Airports by 2015.” Centre for Asia Pacific Aviation, September 3. http://centreforaviation.com/news/caac-outlines-support-for-regional-aviation-development-69-new-regional-airports-by-2015-260720.

Carnegy, H. 2013. “France Battles with Labour Market Reform.” Financial Times, January 9. http://www.ft.com/intl/cms/s/0/05b54c84-5a63-11e2-bc93-00144feab49a.html#axzz2ZGQU1vji.

CEPII (Centre d’Etudes Prospectives et d’Informations Internationales). 2013. Base de Données. GeoDist. http://www.cepii.fr/CEPII/fr/bdd_modele/bdd.asp.

Coulter, A. 2012. “Flying on Autopilot.” Routes, August 23. http://www.routes-news.com/more-features/item/577-flying-on-autopilot.

Davidson, W. 2012. “Ethiopian Airlines Expansion Targets Five-Fold Revenue Increase.” Bloomberg, September 7. http://www.bloomberg.com/news/2012-09-07/ethiopian-airlines-expansion-targets-five-fold-revenue-increase.html.

Dobruszkes, F. 2009. “New Europe, New Low-Cost Air Services.” Journal of Transport Geography 17 (6): 423–32.

DiiO SRS Analyzer. 2013. DiiO Online Database. http://www.diio.net.

Economist Intelligence Unit. 2013. Country, Industry and Risk Analysis. http://www.eiu.com/default.aspx.

Euromonitor International. 2012. Low-Cost Airlines Land in Mexico. Excerpt from Mexico Travel and Tourism Report. http://www.marketresearchworld.net/content/view/1078/48/.

Forsyth, P., J. King, and C. L. Rodolfo. 2006. “Open Skies in ASEAN.” Journal of Air Transport Management 12 (3): 143–52.

Franco, F., P. Santana, C. de Almeida, and R. de João. 2002. “Recent Deregulation of the Air Transport Sector in Brazil.” Paper prepared by members of the Secretariat for Economic Monitoring of the Ministry of Finance.

Frost and Sullivan Market Insight. 2007. Growing Asian Aviation Pilot Demand. http://www.frost.com/sublib/display-market-insight-top.do?id=97586944.

Gewirtz, E. 2011. “The EETC in the Post–Cape Town Convention World.” Airfinance. http://network.airfinancejournal.com/Post/The-EETC-in-the-Post-Cape-Town-Convention-World/4970/True.

Government of Australia, Department of Infrastructure and Transport. 2013. The Cape Town Convention. http://www.infrastructure.gov.au/aviation/international/consultation_cape_town.aspx.