Any investment program requires due diligence to ensure that policies can be implemented with discipline. Performing due diligence is always daunting. The volatility, chicanery, and uncertainty of 2008 and 2009 have made that task seem almost impossible. Indeed, one might say that today due diligence is the gold standard of investment management. It has become the most important function to execute well to ensure the proper management of significant wealth. Due diligence is broader than simply investigating and monitoring investment managers. Due diligence in its broadest terms is ensuring that all assumptions are correct, that all assets believed to be owned are owned, that all risks are considered, and that all facts are as they are represented. The question to ask yourself is, “Have I considered every risk and do I have the information I need to evaluate every risk?”

In the previous step, we discussed how to develop a wealth management strategy based on the wealth holder’s RATE inputs; ensure that the strategy was consistent with the Standards Director’s implementation and monitoring constraints; and prepare the business plan for managing the strategy—the PWPS.

What starts out as strategy must be translated into reality with implementation. Step 4 includes an overview of a due diligence process that can be used to select money managers and service providers, whether lawyers, accountants, advisors, employees, or others; procedures on how to select the right investment vehicle (separate account manager, mutual fund, or commingled trust) to implement the investment strategy; procedures to ensure that service agreements and contracts with employees and service providers do not have provisions that conflict with the wealth management strategy; procedures to align loyalty and prevent self-dealing; procedures to govern philanthropic grants and programs; and procedures relating to how to consider governance, capitalization standards, values and legacy, and next generation education.

Dimension 4.1: Define the process for selecting key personnel to implement the strategy

Leadership Behavior: Exemplary

Standard

The Standards Director defines a process for selecting money managers, which includes, at a minimum, the following due diligence screens:

a. The money manager has a defined investment strategy that is consistent with the goals and objectives of the wealth holder and can be understood and monitored by others.

b. The money manager provides transparency of investment holdings.

c. The same investment management team has been in place for a period commensurate with the period of the performance evaluation.

d. Securities in the portfolio are consistent with the stated investment strategy and are liquid.

e. Investment performance has been verified by an independent third party and compared to the money manager’s peers.

f. Investment performance adjusted for risk has been compared to the money manager’s peers.

g. The money manager’s fees and expenses have been compared to the money manager’s peers.

h. The investment structure (separate account, mutual fund, commingled trust, or hedge fund) is appropriate for the given strategy and the Standards Director’s ability to monitor the strategy.

The Standards Director also defines a process for evaluating custodians and broker-dealers, which includes, at a minimum, the following:

a. As a best practice, custodians are independent of money managers, except as may be required by trust law, or by the necessity of employing a commingled investment vehicle.

b. Custodian can provide appropriate security of assets, with insurance or otherwise.

c. Custodial statements provide sufficient detail that the Standards Director can monitor the money manager’s best execution of trades (generation of soft dollars).

d. The expense ratio of the custodian’s cash sweep and money market fund is compared to peers.

e. Custodian can provide investment performance reports and tax reporting.

Whether and how a private wealth holder diversifies managers must be considered strategically. It is not easy to diversify managers without a sound due diligence process to analyze the managers individually and in relationship to each other. One must consider the following questions:

![]() Does the manager’s philosophy seem sound and do you understand it?

Does the manager’s philosophy seem sound and do you understand it?

![]() Is the manager’s operation and history consistent with that philosophy or style?

Is the manager’s operation and history consistent with that philosophy or style?

![]() Does the manager do what it says it does?

Does the manager do what it says it does?

![]() Are the manager’s benchmarks reasonable?

Are the manager’s benchmarks reasonable?

![]() Will the manager understand the wealth holder well enough to customize his or her portfolio to meet that individual’s needs?

Will the manager understand the wealth holder well enough to customize his or her portfolio to meet that individual’s needs?

![]() How do the manager’s portfolios relate to one another?

How do the manager’s portfolios relate to one another?

This dimension continues with the decision-making process involved in implementing the wealth management strategy, specifically the development of due diligence criteria for selecting money managers.

Effective management skills are most critical at this stage, not because the Standards Director needs to become the money manager—just the opposite. We would strongly encourage Directors to follow the time-proven maxim of doing what one does best and delegating the rest to other qualified professionals. The Director’s primary function is to set the overall strategy, and the primary function of the money manager is to maximize returns within the parameters defined by that strategy.

The ability to develop uniform search criteria that can be applied to each and every asset class is difficult, and it is made even more challenging if you are considering managers from different countries subject to different rules and regulations. Nevertheless, it is strongly suggested that the Standards Director develop a process that (1) can be consistently applied in any manager search; (2) can be easily communicated to the wealth holder; and (3) can be used in both the search and monitoring phases of the decision-making process.

The Standards Director should keep in mind several points when developing due diligence criteria:

![]() Simple is preferable to complex when operating in a complex and dynamic environment (same philosophy used to develop the decision-making framework described in this book).

Simple is preferable to complex when operating in a complex and dynamic environment (same philosophy used to develop the decision-making framework described in this book).

![]() Know the strengths and weaknesses of the various databases. For example, if separate account manager returns are being reported by a database provider, have the returns been independently verified, or were they provided by the manager?

Know the strengths and weaknesses of the various databases. For example, if separate account manager returns are being reported by a database provider, have the returns been independently verified, or were they provided by the manager?

![]() Know how peer groups have been constructed, particularly when comparing information on two managers who are providing performance comparisons from two different database providers. Was the manager’s peer group based on the manager’s returns being correlated with other managers, or were they based on the actual holdings of the manager?

Know how peer groups have been constructed, particularly when comparing information on two managers who are providing performance comparisons from two different database providers. Was the manager’s peer group based on the manager’s returns being correlated with other managers, or were they based on the actual holdings of the manager?

![]() When comparing managers, make sure statistics are compared with the same end points (time periods) and benchmarks (e.g., both compared to the S&P 500, instead of one to the S&P 500 and the other to the Russell 1000).

When comparing managers, make sure statistics are compared with the same end points (time periods) and benchmarks (e.g., both compared to the S&P 500, instead of one to the S&P 500 and the other to the Russell 1000).

The following (Tables 19.1–19.4) is a comprehensive due diligence process. It is intended to provide the Standards Director both the breadth and depth of an institutional approach. The Director probably will need to consult more than one database to conduct this thorough due diligence process, so the best advice is to start with a handful of the criteria (for example, risk-adjusted performance and consistency to peer group) to come up with a short list (six to ten candidates), and then apply the more comprehensive process to identify the finalists.

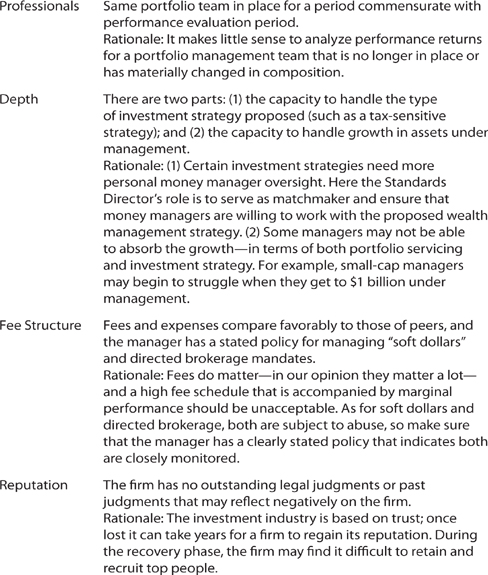

TABLE 19.1 Due Diligence Process: Organization

TABLE 19.2 Due Diligence Process: Philosophy/Strategy

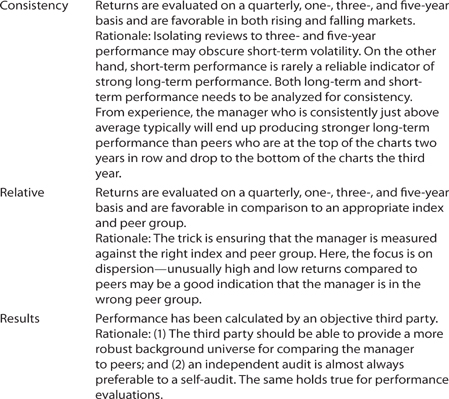

TABLE 19.3 Due Diligence Process: Return Performance

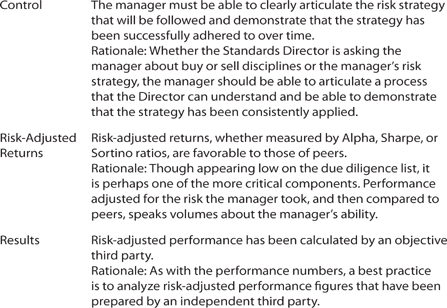

TABLE 19.4 Due Diligence Process: Risk Performance

Another service provider that needs to be prudently selected is the custodian for the investment portfolio—a greatly unappreciated key player—for the choice of custodian will greatly impact the quality of the monitoring of the wealth management strategy (Step 5).

In considering custodians, a wealth holder must apply due diligence to determine the distinctions among custodians based on business organization, business model, and jurisdiction of incorporation. The old belief that banks are safer than brokers may be misplaced in a world where banks are brokers and brokers are banks; structural and auditing differences can exist between two companies in the same business so that in fact Schwab may be quite different from Fidelity with respect to security of assets held. Even after the due diligence is finished, the conclusions will not be clear. Then it becomes reasonable to have several custodians to protect against failure of one.

The role of the custodian is to:

![]() Maintain separate accounts by legal registration

Maintain separate accounts by legal registration

![]() Value the holdings

Value the holdings

![]() Collect all income and dividends

Collect all income and dividends

![]() Settle all transactions (buy-sell orders) initiated by money managers

Settle all transactions (buy-sell orders) initiated by money managers

![]() Provide monthly reports that detail transactions, cash flows, securities held and their current value, and change in value of each security and the overall portfolio since the previous report

Provide monthly reports that detail transactions, cash flows, securities held and their current value, and change in value of each security and the overall portfolio since the previous report

In conducting due diligence on the custodian, consider the following:

![]() What is the quality of the custodian’s electronic protocol (connection between the Standards Director, money managers, and the custodian), such as ease of use and the frequency of their updates?

What is the quality of the custodian’s electronic protocol (connection between the Standards Director, money managers, and the custodian), such as ease of use and the frequency of their updates?

![]() What is the expense ratio of the money market accounts attached to the portfolio’s account? (If one doesn’t ask, the cash portion of a portfolio most likely will be invested in a retail money market account; ask and often the cash can be invested in an institutional share class that will have a considerably lower expense ratio.)

What is the expense ratio of the money market accounts attached to the portfolio’s account? (If one doesn’t ask, the cash portion of a portfolio most likely will be invested in a retail money market account; ask and often the cash can be invested in an institutional share class that will have a considerably lower expense ratio.)

![]() Will the custodian provide tax reporting and performance measurement services? (As with the money market accounts, often one has to inquire and, if negotiated at the start of the engagement, may be provided at no extra charge.)

Will the custodian provide tax reporting and performance measurement services? (As with the money market accounts, often one has to inquire and, if negotiated at the start of the engagement, may be provided at no extra charge.)

![]() Will the custodian provide a monthly statement that provides the details of any trading that was conducted by the money managers? [The details are necessary for the Standards Director to properly monitor whether the manager is seeking best price and execution in trading the portfolio’s account (Dimension 5.2).]

Will the custodian provide a monthly statement that provides the details of any trading that was conducted by the money managers? [The details are necessary for the Standards Director to properly monitor whether the manager is seeking best price and execution in trading the portfolio’s account (Dimension 5.2).]

Dimension 4.2: Define the process for selecting tools, methodologies, and budgets to implement the strategy

Leadership Behavior: Disciplined

Standard

The Standards Director defines a process to periodically evaluate the process for selecting tools, methodologies, and budgets to implement strategies.

Effective diversification of managers requires hard work, transparency, and complete understanding of manager after manager. Substantial due diligence infrastructure must be in place if one is to gain strategic benefit from diversifying managers. Is the wealth holder willing to invest the time and effort to build or secure that infrastructure? Does the wealth holder have the capacity to insist on full transparency? If the infrastructure is to be outsourced, is the wealth holder willing to invest the time and effort in evaluating managers of managers or consultants, and are the “industrial-strength” consultants actually available?

Now that the Standards Director has defined the wealth management strategy (Dimension 3.1) and identified the money managers to implement the strategy (Dimension 4.1), the next two decisions that need to be prudently managed are:

![]() Whether to implement an asset class with a passive or active strategy

Whether to implement an asset class with a passive or active strategy

![]() Whether to engage a manager on a separate account basis or through a mutual fund or commingled trust

Whether to engage a manager on a separate account basis or through a mutual fund or commingled trust

Much has been written about the virtues of passive investing, and we cannot add to the arguments that have been made by more scholarly authorities. However, here are what we believe to be the salient arguments:

![]() It’s not an “either/or” decision. Prudent investors will use both passive and active strategies in a portfolio.

It’s not an “either/or” decision. Prudent investors will use both passive and active strategies in a portfolio.

![]() If the wealth holder is indifferent regarding the use of active or passive strategies, go passive in implementing the large-cap, core portions of the investment strategy. Use active managers in small-cap mandates or emerging markets, where managers have a greater probability of finding a gold nugget that has not been discovered by all the research analysts who are focused on the large-cap stocks.

If the wealth holder is indifferent regarding the use of active or passive strategies, go passive in implementing the large-cap, core portions of the investment strategy. Use active managers in small-cap mandates or emerging markets, where managers have a greater probability of finding a gold nugget that has not been discovered by all the research analysts who are focused on the large-cap stocks.

The portfolio’s account size may limit the wealth holder’s choices to a mutual fund or commingled trust. But improved electronic protocol among managers, custodians, and intermediaries has made it easier for managers to lower their account size minimums, thereby making it easier for a Standards Director to access good managers on a separate account basis.

However, just because a portfolio meets the minimum account size requirement for a particular money manager doesn’t mean that a separate account is the best vehicle for the portfolio. For this reason, we provide an outline of some of the pros and cons for each of the different types of investment vehicles so that an appropriate choice can be made.

![]() Costs: Mutual funds spread their costs across all shareholders—a good thing if a wealth holder has a small investment in the mutual fund; a potentially bad thing if the wealth holder has a large investment. Also, the Standards Director may be able to negotiate lower fees with a separate account manager; in some jurisdictions, regulations prohibit mutual funds from such negotiations.

Costs: Mutual funds spread their costs across all shareholders—a good thing if a wealth holder has a small investment in the mutual fund; a potentially bad thing if the wealth holder has a large investment. Also, the Standards Director may be able to negotiate lower fees with a separate account manager; in some jurisdictions, regulations prohibit mutual funds from such negotiations.

![]() Audits: In some jurisdictions, mutual funds are required to be audited by independent accounting firms. In most jurisdictions, separate account managers are only encouraged to have their performance audited.

Audits: In some jurisdictions, mutual funds are required to be audited by independent accounting firms. In most jurisdictions, separate account managers are only encouraged to have their performance audited.

![]() Performance information: Despite advances in technology, mutual fund databases are still a bit more reliable; in addition, performance information is reported sooner than separate account data and probably always will be. The mutual fund only needs to calculate the performance of only one portfolio, whereas the separate account manager needs to calculate performance across a wide range of portfolios.

Performance information: Despite advances in technology, mutual fund databases are still a bit more reliable; in addition, performance information is reported sooner than separate account data and probably always will be. The mutual fund only needs to calculate the performance of only one portfolio, whereas the separate account manager needs to calculate performance across a wide range of portfolios.

![]() Tax management: The taxable portfolio, particularly one with low-basis stock, will likely fare better with a separate account manager that is willing, and has the ability, to provide a taxsensitive investment strategy.

Tax management: The taxable portfolio, particularly one with low-basis stock, will likely fare better with a separate account manager that is willing, and has the ability, to provide a taxsensitive investment strategy.

![]() Fund liquidations and purchases: The mutual fund manager is disadvantaged in that the manager must also contend with purchases and liquidations within the fund. This can be a major problem in a down market when the investing herd tries to move out of a fund, forcing the manager to sell securities against the better judgment of the manager.

Fund liquidations and purchases: The mutual fund manager is disadvantaged in that the manager must also contend with purchases and liquidations within the fund. This can be a major problem in a down market when the investing herd tries to move out of a fund, forcing the manager to sell securities against the better judgment of the manager.

![]() Diversification: Generally speaking, mutual funds tend to be more diversified than separate account managers. For this reason, if the wealth holder is willing to accept more volatility, he or she may prefer a concentrated, separately managed account.

Diversification: Generally speaking, mutual funds tend to be more diversified than separate account managers. For this reason, if the wealth holder is willing to accept more volatility, he or she may prefer a concentrated, separately managed account.

![]() Specific identification of securities: Some wealth holders prefer seeing “their” portfolio as opposed to being invested with the masses.

Specific identification of securities: Some wealth holders prefer seeing “their” portfolio as opposed to being invested with the masses.

Dimension 4.3: Ensure that service agreements and contracts do not contain provisions that conflict with objectives

Leadership Behavior: Fair-minded

Standard

The Standards Director ensures that service agreements and contracts with money managers and service providers do not contain provisions that conflict with the wealth holder’s goals and objectives.

Blind trust alone should not provide comfort in wealth management any more than in air travel. But the industry of wealth management exalts trust; it does not demand process and discipline of its clients because discipline and process would remove the sense of complexity and powerlessness that requires customers to pay so much for so little. People trusted Madoff, Lehman, Weavering, AIG, and so on. Trustworthiness is the garb of the scoundrel who can sell his fraud, so long as he is clothed with trust.

The purpose of this dimension is to ensure that money managers and other service providers understand the role they are intended to play and the performance objectives or conditions that must be met to achieve that purpose. Successful implementation of a wealth management strategy is a combination of rigorous process and execution, and like any other worthy endeavor, no job is complete until the paperwork is done!

The review of contracts and agreements is an important additional step to ensure that there are no misunderstandings between the roles and responsibilities of all parties involved in the wealth management strategy. Our suggestions regarding the review of contracts and agreements are very general in nature, and again we need to caution the Standards Director to discuss legal matters with a knowledgeable attorney.

![]() Define the scope of the relationship.

Define the scope of the relationship.

![]() Refer to regulations or trust documents that establish the legal character of a portfolio and may define or limit certain investment practices.

Refer to regulations or trust documents that establish the legal character of a portfolio and may define or limit certain investment practices.

![]() Refer to documents that govern the investment strategy (such as a PWPS), particularly documents that define performance criteria.

Refer to documents that govern the investment strategy (such as a PWPS), particularly documents that define performance criteria.

A good practice is to periodically review contracts and service agreements to ensure that the wealth management strategy still requires the contracted services and that the money manager’s or service provider’s pricing is still competitive; or to discover new services the service provider may be able to provide the wealth management program.