HOWARD W. BUFFETT

When organizations spanning multiple sectors decide to collaborate, they often enter the partnership with different ideas about what they hope to accomplish. As discussed in previous chapters, they may use dissimilar terminology to describe their objectives and intended outcomes.1 In addition, their respective preferences and priorities will drive the metrics they choose to analyze programs against a partnership’s goals (see chapter 8). Even when partners determine mutual measures of success, it can be difficult to predict which programs will be best at creating social value. This chapter discusses a standardized approach for doing so. Called Impact Rate of Return (iRR), it provides organizations in a cross-sector partnership with a common platform to forecast a project’s or a program’s performance and calculate an assumed intrinsic value for society.2 Using this methodology, partners can estimate which programs will yield the greatest social return per dollar expended, based on how they collaboratively define success.

Organizations measure success based on how they define it. In the private sector, the universality of currency allows firms to define success using straightforward financial measures, such as an investment’s total gain or its dollar-in per dollar-out rate of return. Making capital allocation decisions in finance requires context and a comparative analysis of projected return across investment alternatives.3 Organizations in a cross-sector partnership should think about capital allocation for social improvement in a similar way. However, program selection is more challenging without a universal unit of measure for public benefit.4 How might the Fire Department of New York City (see chapter 11) compare different program options to reduce the number of fire-related deaths? In the Afghanistan case (see chapter 7), how might partners compare the social good created by providing irrigation to one set of farmers over another?

There is no right or wrong answer, but the Impact Rate of Return methodology helps to overcome some of these comparative challenges. Using a formula that mirrors traditional financial models, it translates a program’s potential performance into a uniform output.5 By comparing the iRR output of similar programs against an appropriately established goal for social improvement, partners can make more efficient and better informed capital allocation decisions. Using iRR is very much a starting point, but we believe this method will develop into a set of tools that provides rigor, reliability, and comparability similar to the methods available for analysis of financial investments. This chapter outlines a number of measurement approaches and their applicability to cross-sector partnerships before introducing the full iRR methodology. Comparative examples across four areas—fire safety, renewable energy, smallholder agriculture, and sustainable mixed-use real estate development—are then analyzed.

DEFINING MEASURES OF SOCIAL IMPACT

Scholars and practitioners have yet to agree universally on terminology or measurements for calculating a program’s or capital allocation’s potential costs or benefits to society (often referred to as social impact).6 The evolving field of social impact measurement has made tremendous progress in recent years, including newly developed frameworks such as the Impact Reporting and Investment Standards (IRIS) discussed later in this chapter. Governments, foundations, and other partners are constantly looking for ways to apply improved thinking around measurement, especially for significant collaborative efforts such as the Sustainable Development Goals (discussed in chapter 1). Numerous approaches to measuring results and wide-ranging measurement tools have emerged over the past few decades, but a lack of consensus hampers the ability of organizations to assess the performance of programs in a cross-sector partnership.7 Having a positive or negative social impact on something means different things, even in similar contexts, and is measurable in many different ways.8 Positive impact, for instance, may include improvements in standards of living, increases in life expectancy, decreases in carbon emissions, additional students graduating, and so on. As a result, the field has many examples of tools, approaches, or programs related to social impact measurement that are diverse in their scopes, methodologies, and purposes. The next section looks at a few notable examples and discusses their limitations and applications to the types of cross-sector partnerships profiled in this book.

Disability-Adjusted Life Year

The United Nations World Health Organization uses a technique that quantifies the negative social impact of an individual’s poor health and disease.9 The Disability-Adjusted Life Year (DALY) measures both mortality (as years of life lost due to early or premature death) and morbidity (as nonfatal health problems).10 Programs that reduce or avoid the highest number of DALYs accomplish the most social good. DALY is useful because it combines these factors into a single output, which organizations can use to compare the cost-effectiveness of various relevant programs.11 However, the approach is not without drawbacks (critics argue there are flaws in its design and validation), and it has limited applicability for cross-sector partnerships outside of health-related fields.12

Best Available Charitable Option

Acumen is a nonprofit organization that applies entrepreneurial principles through venture funding to address global poverty issues. They have invested over $100 million in more than one hundred companies across thirteen countries in areas such as agriculture, education, and health.13 In 2007, Acumen detailed a social impact measurement methodology comparing a potential investment for social good against the “best available charitable option” (BACO).14 They sought to understand how much social good they could create per dollar invested over the lifetime of an investment compared to a traditional philanthropic grant with similar goals. Acumen provided a comparative analysis by examining which of two options were likely to create more good for society: for example, a loan to a manufacturer of malaria-preventing bed nets or a “sunk cost” grant in the same amount to an international NGO to procure and distribute bed nets.15 The resulting analysis showed that the loan option could be fifty-two times more effective.16 The BACO methodology is a useful approach for thinking through the cost effectiveness per unit of defined social impact. However, as Acumen points out, it requires careful selection of a “right” charitable alternative for comparison. Similar to monetization approaches discussed later in the chapter, BACO focuses mainly on financially based cost-effectiveness comparisons.17 As originally presented by Acumen, this does not necessarily account for important aspects of varying impact quality or program delivery between alternatives.

Social Internal Rate of Return

Another example is a method used by the intergovernmental Organisation for Economic Co-operation and Development (OECD), called social internal rate of return.18 The OECD initially used it to compare the social costs and benefits of education at a countrywide level. Among other things, the calculation captures various aspects of related economic activity in addition to numerous positive externalities resulting from a country’s investment in education (such as reduced crime, improved health, and increased productivity).19 Others have applied the social internal rate of return calculus to fields outside of education, such as infrastructure investment.20 Overall, the method focuses mainly on economic evaluation and the aggregate output of public investments from the societal perspective. It has little or no focus on program quality or organizational or stakeholder preferences, which are critical design elements in cross-sector partnerships.

Social Progress Index

A broader methodology, also at a countrywide level (but increasingly at subnational levels as well), is the Social Progress Index.21 This index aggregates social and environmental indicators from 128 countries, and across three aspects of social progress: basic human needs (such as nutrition and shelter), foundations of well-being (such as access to information and a sustainable environment), and opportunity (such as freedom of expression and access to higher education).22 The index purposely excludes economic indicators so that others can use its data to “rigorously and systematically analyze the relationship between economic development (measured for example by GDP per capita) and social development.”23 By design, the index does not provide a rate of return output, an impact measurement, or assessment at a programmatic level. However, the data are useful in guiding program priorities or coordinating program activities across numerous cross-sector partnerships.24

B Impact Assessment

Another tool, B Impact Assessment, standardizes and indexes the measure of benefit created by corporations that undergo its evaluation.25 It provides comparative, organization-level impact scores in areas such as corporate governance, workforce advancement, and effects the company has on the community and the environment.26 The tool does not assess collaborative programs or cross-sector partnerships, but it does perform an important benchmarking function for participating groups. Moreover, establishing “social impact” baselines is helpful for comparing relative performance measurement regardless of the sector. The nonprofit B Lab operates the tool and certifies companies that meet minimum levels of social and environmental performance, transparency, and legal accountability.27

DEVELOPING INDUSTRY STANDARDS

Perhaps the most widely known work to establish industry standards for social impact measurement is that of the Global Impact Investing Network (GIIN). Originated by the Rockefeller Foundation (among others) in 2007, GIIN is a self-described “nonprofit organization dedicated to increasing the scale and effectiveness of impact investing.”28 Impact investing, a developing category of finance, attempts to combine social improvement and profitability, with an expectation that results are quantifiable.29 GIIN defines impact investments as those “made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return.”30 A number of the financial tools discussed in chapter 10, including some program-related investments and most mission-related investments, qualify under this definition.

GIIN argues that the practice of impact investing has the following characteristics:31

1. An “intention to have a positive social or environmental impact;”32

2. An “expectation of generating a financial return;”33

3. A “range of return expectations and asset classes targeted;”34 and

4. A “commitment to measure and report the social and environmental performance of investments.”35

To further the practice of impact investing, GIIN, the U.S. Agency for International Development, the Rockefeller Foundation, and JP Morgan Chase launched a joint initiative in 2009.36 This cross-sector partnership focused on developing a broad catalog of impact performance measurements, which are likely the most widely accepted in the field of impact investing.37 The Impact Reporting and Investment Standards (IRIS) provide more than five hundred metrics to define and track social change, and GIIN updates it with some frequency.38 These social impact measurements range from the number of part-time employee jobs created, to the amount of waste reduced, to the number of forest rangers trained for conservation initiatives.

One of the catalog’s most direct applications to social value investing relates to the program analysis framework (or the Impact Balance Sheet) outlined in chapter 8. Partners can use the metrics in IRIS to guide development of their program evaluation criteria, which also helps them differentiate between low- and high-quality impact. This, in turn, informs iRR’s Impact Multiplier variable, discussed later in this chapter. Given its expansive size, the catalog has many metrics relevant to performance measurement for the types of cross-sector partnerships described in this book.39

IRIS is, therefore, a valuable resource, even if the breadth of its scope can be intimidating. This scope illustrates the extensive number of items partners may want to consider when defining social impact, as well as the complexity of social issues and their associated indicators. Moreover, the catalog is useful for articulating a program’s or partnership’s social impact goals to practitioners from other industries. IRIS is free and open to all, and the metrics can be easily simplified and adapted to other platforms to support streamlined reporting.40

BENEFITS OF A FORWARD-LOOKING APPROACH

Many social impact organizations outline broad intended or hoped-for outcomes from a program, and then they examine what took place in retrospect. This ex-post or after-the-fact analysis is particularly important for understanding what aspects of program design and implementation worked and which did not work. This process also supports progressive or milestone-based monitoring, which is especially useful for programs implemented over long time periods.

Some organizations, such as the Robin Hood Foundation, have developed impact assessments that take a forward-looking or predictive-based approach. Robin Hood very clearly defines its mission: poverty fighting in New York City.41 They fund what they consider the most effective poverty fighting programs; efforts that reduce poverty or increase future earnings for low-income New Yorkers fall within their mission’s purview.42 To assist in this, Robin Hood uses an approach called “relentless monetization,” which computes the dollar value of social benefits created by a grant.43

To analyze program effectiveness relative to its mission, Robin Hood developed an extensive set of metrics—as well as 163 formulas spelled out across 168 pages—to assist their team in monetizing the particular outcomes of a program.44 Robin Hood then compares the outcomes of a given program to what they predict would have happened in the absence of their funding; in this way, they are developing counterfactual estimates of the true value created due to their support. By dividing the total estimated benefit created from the program by investment in the program (the size of the grant), Robin Hood calculates a benefit-cost ratio.45

For example, Robin Hood estimates that a low-income adult who attends a dental health care program can, through a variety of dependent factors, expect an approximately 1 percent increase in future earnings. They base this claim on research and available data cited in their metrics manual. On average, they estimate that every low-income adult who receives such dental work will have roughly an additional $20,000 of future lifetime earnings because of the program.46 By multiplying the future earnings by the number of individuals who receive the treatment and then dividing by Robin Hood’s investment in the program, the organization calculates its benefit-cost ratio.

Another example looks at the benefit-cost ratio of a program designed to increase the number of high school graduates at a particular school. With a $400,000 grant, Robin Hood estimates that a hypothetical program would lead to twenty-five more students graduating than would have absent the program. Furthermore, twenty of those students would go on to attend some college who otherwise would not have done so. In monetizing the outcomes, Robin Hood estimates that each of the high school graduates will have a $6,500 earnings boost per year, and each will live a healthier and longer life (which itself carries a benefit of $90,000 over an individual’s lifetime). Furthermore, by attending some college, twenty of the students increase their future earnings by an additional $2,000 per year. Robin Hood estimates that this adds up to just over $6 million in benefits to low-income individuals participating in the program, and by dividing the benefits by the initial investment of $400,000, this leads to a 15:1 benefit-cost ratio. That is, for every dollar invested, Robin Hood can forecast that low-income participants will receive lifetime benefits equivalent to $15.47

The Robin Hood Foundation’s assessment philosophy articulates a social return on investment for its programs and illustrates how economic benefit and anticipated outcomes combine into a uniform and straightforward monetary output.48 This allows the organization to distill a wide variety of poverty fighting programs into a simple benefit-cost ratio that is informative and broadly applicable. It also illustrates a very effective method for conducting social impact performance measurement at the programmatic level.49

The monetization approach, and other cost-benefit calculations, are well suited for programs that define success in terms of economic benefit created or monetary value added.50 However, many cross-sector partnerships (including some profiled in this book) use measures of a different kind, or ones that cannot be monetized.51 Substituting monetary value in place of certain outcomes runs the risk of leaving out important information or relevant program factors that cannot, or should not, be captured in dollars.52 Because of this, groups such as Robin Hood may choose to incorporate additional, non-monetary measures into their evaluation for a more comprehensive analysis.53 Measuring performance may need to consider subjective viewpoints, cultural nuance, or design aspects of program delivery. For instance, think back to the Digital India case (chapter 3) and imagine that the government and Apollo Telemedicine are considering new healthcare services for eUrban Primary Health Centers. What happens if they evaluate two dental care programs that yield nearly identical benefit-cost ratios but differ in the quality of care, customer satisfaction, or the experience and credentials of the dental care practitioners?54 Comparing programs in a case such as this is an area where the iRR approach has some advantages.

OUTLINING THE iRR METHODOLOGY

Social impact means something different to everyone, so quantifying it requires a customizable approach that can take into account partners’ various preferences and priorities. Despite the difficulties inherent in impact measurement models, Impact Rate of Return shows promise because it incorporates flexibility yet maintains a standardized framework. By doing so, organizations in a cross-sector partnership can compare relative social impact performance between programs against specific goals to improve society. Organizations can do this in a manner that is uniform regardless of the type of impact they choose to measure. In effect, iRR allows organizations to estimate how much future impact they can expect to achieve per dollar expended in comparison to projects of a similar type, and to do so consistently.

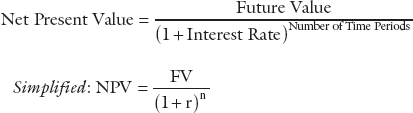

Similar to financial analysis for Net Present Value (NPV), which calculates the time value of money, iRR estimates the impact value of money. The formula divides future (or expected) impact from an investment by the effectiveness and quality of that impact over time. Doing so solves for a program’s potential rate of impact. For the sake of comparison, we represent Net Present Value as:

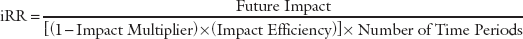

In comparing the variables of the Net Present Value formula to the iRR formula (below), we find that iRR replaces “Future Value” with “Future Impact.” Instead of calculating an “Interest Rate,” as NPV does, the denominator of iRR calculates a “Net Impact Rate”—a product of a program’s “Impact Multiplier” and “Impact Efficiency.” Finally, the “Number of Time Periods” represents the same in both formulas. Therefore, we represent iRR as:

We further simplify the iRR formula by representing the “Impact Multiplier” and “Impact Efficiency” variables as “Net Impact Rate” as follows:

Customizing the iRR Formula

To set up the iRR formula, organizations in a cross-sector partnership must do the following:

1. Determine the impact theme: this is a categorical type of impact related to the desired outcome of the cross-sector partnership (e.g., fire safety, renewable energy, smallholder agriculture). This categorization guides the formula’s customization.

2. Establish a Key Impact Indicator: this is a unit of measurement for the type of positive social impact delivered by programs or projects in the cross-sector partnership’s theme.

For example, indicators could include the number of lives lost that were prevented by a new fire department safety program, the megawatt hours generated by a solar power energy project, acres of farmland improved, or the number of square feet developed for a sustainable real estate project. In each case, the Key Impact Indicator is a clearly defined and straightforward metric directly tied to the social impact goals of the organization or partnership.55 The greater the number of Key Impact Indicator units, the greater the potential social impact of the program.

3. Set an impact goal for the theme: this establishes desired impact in terms of the theme’s Key Impact Indicator and creates a comparative baseline for any programs evaluated in that theme.

For the purpose of the iRR formula, an organization’s impact goal is the number of Key Impact Indicator units it hopes to reach within a theme (e.g., forty-eight lives lost will be prevented, 150 MWs will be generated, 10,000 acres of farmland will be improved).

4. Define a uniform scale for quality of impact: this is iRR’s Impact Multiplier, and it outlines the qualifications or attributes a project must meet or adhere to in order to achieve a given rating within an impact theme.

The Impact Multiplier rating is a numeric scale ranging from “highest-quality impact” (measuring a 0.99) down to “lowest-quality impact” (as low as 0). Quality of impact may be based on existing and widely accepted standards, such as LEED Certification for sustainable construction, which uses ratings classified as “Platinum” (highest), “Gold” (second highest), “Silver,” and so on.56

In many cross-sector partnerships, the Impact Multiplier will be custom defined by partners based on their preferences and priorities. Partners may choose to use a program analysis framework (such as the Impact Balance Sheet), outlined in chapter 8, to determine weighted points-based evaluation criteria. Alternatively, a simpler scale may be used. For example, a project meeting twelve out of fourteen specific impact qualifications might be considered “very high quality” and earn a 0.86 (which is twelve divided by fourteen). A project meeting eleven out of fourteen qualifications might earn a 0.79, and so on.

This is a critical component of the tool because organizations will have different ways of defining what qualifies as high-quality impact, as well as which metrics should factor into the rating system. Organizations should use the same rating framework (whether customized or based on existing standards) to compare all projects within a given theme.

Once the formula is set, organizations must calculate two figures to determine the iRR for a given project or program:

1. Estimate the project’s Future Impact: this is the percentage of an organization’s or partnership’s thematic impact goal it expects to achieve with a given project. For example, if a project is expected to prevent six fire-related deaths out of a goal of forty-eight, its Future Impact is represented as 0.125 (or 12.5 percent).

2. Calculate the project’s Impact Efficiency: this variable combines the measure of dollars expended per Key Impact Indicator (KII) unit reached with a standard logarithmic scale (using a uniform log base of 100 for the examples in this chapter). This merits further explanation:

Because the cost per unit of impact can vary significantly between comparable projects—and quite dramatically between different types of thematic impact—a logarithmic function allows us to normalize the value into a more consistent output.

For example, cost per KII unit may range from millions or hundreds of thousands of dollars per solar MW, to thousands of dollars per acre of farmland, to hundreds of dollars per square foot of mixed-use real estate developed. The resulting logarithmic output provides a useful and structured scale regardless of the cost expended per KII unit. As one might expect, the lower the cost per unit of projected impact, the more cost efficient that impact will be. The Impact Efficiency figure reflects this inverse relationship by showing a lower value for greater cost efficiency.57

In general, the information required for these two calculations is available through due diligence or is provided in a grant application, project proposal, or program prospectus. The following sections illustrate iRR’s customization and calculation process across four thematic examples.

iRR and the FDNY

iRR’s predictive, goal-based approach is an important aspect of its formulation. As discussed in chapter 11, the Fire Department of New York City (FDNY) uses predictive methodologies to determine the most effective allocation of its resources. Through risk-based fire inspections, the department redesigned operations based on clearly established goals and the way in which it measures success.58

Here we consider an application of the iRR formula using an impact goal relevant to the department.59 The FDNY may use the number of fire-related deaths prevented as their Key Impact Indicator, and we can assume that they have a goal of preventing all fire-related deaths. In 2016, the number of fire-related deaths was a historically low forty-eight (despite responding to more than 26,000 structural fires across the city).60 To calculate iRR’s Future Impact quantity in this example, we use the percent of the expected impact goal achieved (fire-related deaths prevented) by a given project.

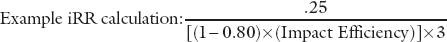

For the sake of illustration, say that the FDNY is evaluating a number of similar projects to deploy new “smart” home smoke detectors in the highest risk areas of the city (faulty detectors are a contributing factor to in-home fire-related deaths).61 The first project the FDNY evaluates costs $8 million to develop and deploy, will take three years to test and implement, and is expected to reduce annual fire-related deaths by twelve. In reducing fire-related deaths by twelve, the project would accomplish 12/48ths, or 25 percent of the FDNY’s overall impact goal. This number represents the amount of Future Impact expected by this project, and three years is the number of time periods. We enter these amounts into the formula as follows:

At this point, we have established our measurement units (deaths prevented), our goal (forty-eight), and the expected amount of the goal accomplished by the first proposed project (twelve, or 25 percent). We also know the project’s cost ($8 million) and the number of time periods required for implementation (three years).

The next step in the iRR process is to determine the project’s Impact Multiplier. In this hypothetical case, the FDNY uses a customized program analysis framework to establish a number of straightforward impact qualifications for its smart detector program. This includes variables such as the complexity of user installation, the type of failsafe system (such as a low-battery warning), the frequency of safety inspections required, previous successful deployments of similar programs, overall efficacy of the detectors, and so forth. Upon analysis by the FDNY, the first smart detector project meets sixteen out of twenty qualifications, and scores an Impact Multiplier rating of 0.80. We enter that value into the formula as follows:

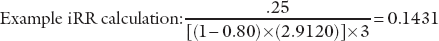

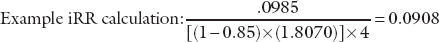

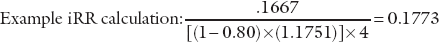

Our final calculation is the Impact Efficiency of the project. In the case of this first smart detector project, the cost per KII unit (fire-related death prevented) is $666,667. The logarithm base 100 of 666,667, written log100 (666,667), equals 2.9120. Entering this value into the formula results in the following:

Therefore, the Impact Rate of Return for this example project is 14.31 percent (table 12.1).

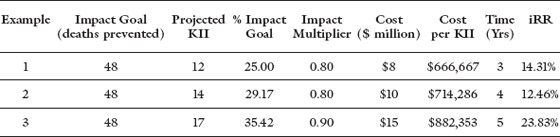

TABLE 12.1 Fire Safety

Given this outline, the FDNY can easily compare the iRR of this project to any other potential smart detector project. For example, it can compare a similar project that costs $10 million to implement over four years, and prevents fourteen deaths with a similar quality of impact rating.

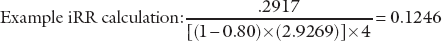

The formula and corresponding outputs are as follows:

The Impact Rate of Return for this second example project is 12.46 percent, slightly lower than the first example. Although estimated future impact is higher (fourteen versus twelve), the “quality” of impact is the same (both score a 0.80), the cost per KII is higher, and the time to implement the project is longer.

In a third similar project example, we evaluate an option that costs $15 million over five years, will prevent seventeen fire-related deaths, and achieves a higher impact rating. The corresponding outputs are as follows:

The Impact Rate of Return for this third project example is 23.83 percent. The significant increase in iRR is due mainly to the “quality” of impact in the Impact Multiplier evaluation. In this case, the project receives such a high rating because end-user installation is much simpler than the other two projects and because it has an effective failsafe system that actively communicates with FDNY’s central command. Further, the smart detectors in this project do not require ongoing in-person safety inspections due to their design. This project takes more up-front time compared to the first two examples (and organizations may want to factor in opportunity cost), and it cost more per KII, but it has a greater longer-term impact and a higher likelihood of success.

Had this example only achieved a 0.80 rating, similar to the previous two project examples, it would have received the lowest iRR of the group. This illustrates the importance of the impact rating system used in the iRR calculation.

In the following pages, three additional sets of examples illustrate the diverse applicability of the iRR formula and the potential utility of the tool for a variety of calculations.

In 2007, New York City mayor Michael Bloomberg launched PlaNYC,62 a city-wide effort that included a series of large-scale sustainability initiatives.63 With an initial goal of improving quality of life in the city and reducing carbon emissions by 30 percent by 2030, PlaNYC kicked off a number of new programs.64 For example, the New York City Department of Parks and Recreation led an effort to plant a million new trees within ten years (MillionTreesNYC).65 More than two hundred miles of bike lanes were added in the city between 2007 and 2009,66 and major bike-sharing programs launched through new cross-sector partnerships.67 In 2010, New York City Parks Commissioner Adrian Benepe started an expansive citywide Sustainable Parks initiative,68 including performance scorecards with detailed metrics and measurement methodologies.69

The city’s commitment to sustainability continued under Mayor Bill de Blasio. In 2014, Mayor de Blasio announced New York City’s goal to reduce greenhouse gas emissions by 80 percent by 2050.70 His plan also included major goals for renewable energy production, with targets for home and commercial solar power generation.71 Similar trends took place at the state level as well. In 2016, New York Governor Andrew Cuomo announced an ambitious plan mandating that half of the state’s electricity would come from renewable sources by 2030, including solar, to reduce carbon emissions and protect the environment.72

As cities and states plan for sustainability commitments and increase renewable energy production to meet growing demands, they will have to collaborate across sectors and stakeholder interests.73 In this section, we examine a scenario where a city and state government plan to cofinance a large solar power project in partnership with private sector developers and a non-profit economic development corporation.

To begin, the partners establish an impact goal of replacing 150 megawatts (MW) of fossil-based energy capacity through new solar-based production. With the KII measurement units (megawatts) and goal (150 MW capacity) established, we are able to calculate the Future Impact figure for any potential solar project. An example three-year, $80 million project with production capacity of 46 MW would accomplish 30.67 percent of our previously established 150 MW goal.74 The cost per KII for this example rounds to $1.739 million, which equals 3.1202 on the logarithmic scale. This project scores the equivalent of a 0.80 rating when taking into account variables such as its energy output efficiency, power grid availability, transmission disruption, net carbon offset, and constraints in project construction.75

The following formula illustrates this example and the corresponding iRR output:

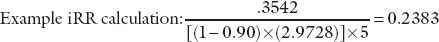

Therefore, the Impact Rate of Return for this example project is 16.38 percent (table 12.2).

TABLE 12.2 Renewable Energy

Understandably, that output in isolation has limited value. There is benefit in going through the process of establishing a well-defined social impact goal and the exercise of defining and applying a multiplier rating for that impact. However, comparable iRR outputs are required to evaluate which resource allocation has the greatest potential relative impact.

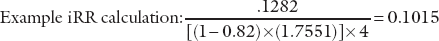

Here we examine a second three-year solar project, assuming the same partnering organizations with the same Impact Goal and Multiplier Rating system. In this example, the project is slightly smaller (roughly $76 million), with a capacity of 42 MW, and achieves a similar 0.80 rating.

The following formula illustrates this example and the corresponding iRR output:

The calculated Impact Rate of Return for this second solar example is 14.92 percent. We can expect this slightly lower output because the project yields fewer MWs of sustainably produced energy and costs more per KII in comparison to the first.

Our third example evaluates another three-year solar project, again with the same Impact Goal and Multiplier Rating system. This solar project has a 44 MW capacity for the same roughly $76 million cost as the previous project. However, this project’s profile only scored a 0.70 rating.

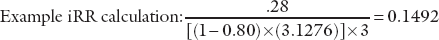

The following formula illustrates this example and the corresponding iRR output:

Therefore, the iRR for this third solar example is 10.45 percent. Although the project’s cost per KII was the lowest of all three examples, the fact that its Impact Multiplier was lower had an understandably dramatic effect on this project’s overall projected iRR performance.

Smallholder Agriculture iRR

Social value investing guides organizations in the development of place-based, or regionally focused cross-sector partnerships (see chapter 8). In addition to important aspects of stakeholder engagement, it outlines collaborative planning through a scoping exercise and a program analysis framework. We examined a detailed example of this in the Afghanistan case (chapter 7), specifically related to smallholder farmers and increases in farm productivity through investments in irrigation and agricultural cooperatives.

Using a similar scenario, imagine a local NGO in Rwanda that engages a foundation and a university to develop a cross-sector partnership focused on goals analogous to the programs in Afghanistan76 (agriculture employs roughly the same percentage of people in each country).77 The group begins by surveying numerous communities to learn residents’ preferences and priorities regarding improved agricultural practices and needs. Partners draft initial plans with ongoing community participation while conducting a value-chain analysis across regions. They also involve the Rwandan government, which in 2010 established an ambitious ten-year goal to increase domestic agricultural production by 8.5 percent annually.78 Collaboratively the group develops the partnership’s program analysis framework, and settles on a place-based strategy in a regional area of approximately 10,000 acres (this size based on the administrative locality in Rwanda where the NGO has the most experience).79 As a result, the partners use land area (acres) for their iRR Key Impact Indicator, and set an impact goal of improving 10,000 acres of farmland using economically and ecologically sustainable production practices.80

The group plans to evaluate clusters of cooperative-sized development projects (ranging from a few hundred acres to over a thousand acres, depending on location) and will then cross-compare consolidated, averaged iRR outputs between clusters in similarly sized regions. Factors that contribute to the partnership’s Impact Multiplier rating include the number of farming households reached by a given project, the gender demographic of project participants,81 whether a given approach is conducive to the needs of farmers with uneven plots of land (82 percent of farmland in Rwanda is on hillsides82), opportunities for mechanization,83 and an evaluation of what other developments are already underway in the area. The evaluation also takes into account how well a project addresses gaps in surrounding agricultural value chains (discussed in chapter 4), such as logistical constraints, access to local markets, availability of crop inputs, and so on.

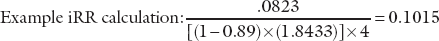

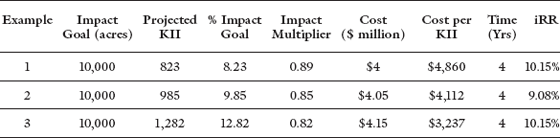

In this scenario, the first set of evaluations consider three similar opportunities, each with comparable size, cost, time required, and impact profiles. One is a four-year, $4 million agricultural development project consisting of 823 acres, which is just over 8 percent of the partnership’s 10,000 acre goal. In this case, project evaluation against the program analysis framework results in a fairly high impact multiplier rating of 0.89. The project is well suited for the topography of the area, represents a model easily replicated to other regions, reaches a significant number of female farmers, and meets many of the impact requirements outlined in the program analysis framework.

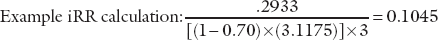

Calculating this project’s Impact Efficiency shows that it costs $4,860 per Key Impact Indicator (acre), which converts to 1.8433 on the logarithmic scale. Combining these various components, the corresponding iRR output is:

Therefore, the Impact Rate of Return for this example project is 10.15 percent (table 12.3).

TABLE 12.3 Smallholder Agriculture

The second project opportunity evaluated by the group covers more area (985 acres), accounting for 9.85 percent of the partnership’s Impact Goal. Its total cost is slightly higher ($4.05 million), but the implementation per KII is lower than that of the first example ($4,112). Partners, however, do not expect the project to adequately address soil erosion challenges, and its participants comprise a less diverse gender profile than the first project opportunity. Despite these limitations, the project still meets many of the other qualifications outlined in the program analysis framework, and scores an Impact Multiplier rating of 0.85.

Therefore, the iRR for this example project is 9.08 percent.

In the final example the partners evaluate a project proposal costing $4.15 million, and reaching the most number of acres (1,282). Its cost per KII is the lowest ($3,237) and, like the others, is expected to require four years for implementation. This project provides less access to mechanization, and is less effective in how it prepares farmers for market-readiness—important components of Rwanda’s Vision 2020 plan. Because aspects of its program design are somewhat less comprehensive than the others, it is limited in its program analysis score. Although, this particular project includes intercropping for high intensity agroforestry plots, which the others do not.84 Overall, it scores an Impact Multiplier rating of 0.82.

The iRR for this project is 10.15 percent, which is the same as the first example.

The identical results between the first and third projects underscore a difficult trade-off organizations face when planning cross-sector partnerships: depth of impact versus breadth of impact (which we discussed in the scoping exercise in chapter 8). The first project covers less area than the third, but it does so with a higher quality of impact as defined by the organizations and stakeholders in the partnership.

In practice, these types of project opportunities would not likely be as similar in size, cost, and projected impact as they are in this scenario. However, this example illustrates how partners can combine a program analysis framework and the iRR methodology into place-based partnership planning.

Sustainable Mixed-Use Real Estate Development iRR

In chapter 9 we learned about Comunitas and its Juntos program in Brazil. In addition to working with municipal governments to improve the effectiveness of city services, Comunitas is also committed to advancing sustainable development through partnerships with businesses and communities.85 The Comunitas headquarters is in São Paulo, where our final iRR scenario takes place.

In this scenario, Comunitas partners with a newly formed, university-led urban development coalition focused on a major, environmentally sustainable mixed-use real estate initiative.86 In addition to commercial, university, and residential tenants, the initiative aims to pilot a newly designed government services center, as well as a state-of-the-art community health clinic.

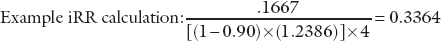

The primary organizing principle of the coalition is environmentally sustainable development, which defines this partnership’s overall impact theme. The partners use square feet as their Key Impact Indicator, and establish an impact goal of developing 3,000,000 square feet in a highly sustainable manner over a multi-year period. In the beginning phase of the project, the coalition analyzes three similar development opportunities. The first is a four-year project consisting of 500,000 square feet, which would accomplish 16.67 percent of the 3,000,000 square feet goal.87

In determining this project’s Impact Multiplier, it accomplishes a rating of 0.90 by implementing the requirements for LEED Platinum certification and compliance with specific environmental, social, and governance (ESG) measures—two factors adopted by the partners considering this project.88 Finally, the cost of development is equal to $300 per Key Impact Indicator (square foot), which equals 1.2386 on the logarithmic scale. In this case, the iRR output is as follows:

The resulting iRR for this example project is 33.64 percent (table 12.4).

TABLE 12.4 Sustainable Mixed-Use Real Estate Development

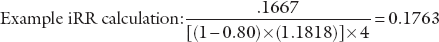

The second example illustrates a similarly sized opportunity, and assumes the same Impact Goal and Multiplier Rating system. This hypothetical project costs less ($115.5 million), and taking into account build-out restrictions, only meets a LEED Gold standard. It therefore receives a lower Multiplier Rating, which significantly affects its Impact Rate of Return.

The overall square footage developed is the same, as is the time horizon for the project:

The resulting iRR for this example project is only 17.63 percent, despite having a lower up-front cost and lower dollar per KII than the first example. Like the examples in the previous themes, this further illustrates the importance of the Impact Multiplier in the overall framework.

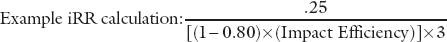

The final example is a nearly identical project opportunity. The calculation uses the same formula customization, and the project’s profile differs only in that it has a marginally lower cost ($112 million) and, therefore, better (lower) impact efficiency value:

Due to the lower cost per KII ($224), the iRR for this project is slightly better than the previous one, yielding 17.73 percent. The second and third examples illustrate how the formula responds when cost differs but all other factors are the same.

With the analysis framework established, and the partnership’s iRR formula customized, partners in this scenario will be able to calculate and compare the iRR of future project opportunities throughout the phases of development.

CONSIDERATIONS ABOUT THE MODEL

The iRR model has both advantages and disadvantages. It lends itself well to situations that can use clear Key Impact Indicator units as a basis for defining projected impact. Furthermore, in situations where it is desirable to use multiple indicator units (or where the partners do not want to roll secondary units into a rating system), the formula can be easily modified for additional KII calculations, and the outputs averaged or weighted depending on partner preferences.89

In cases where profitability is a consideration, such as impact- or mission-related investments, groups can apply a combined financial and impact analysis. For instance, partners may analyze particular investments or projects within a partnership and average scores based on weighted values assigned to both the financial internal rate of return (IRR) and the iRR—depending on their preferences. In this way, the iRR model can combine goals for financial return with discrete goals to improve society when such goals are not mutually exclusive.

Moreover, iRR is not limited to ex-ante analysis. Partners may wish to establish escalating target iRR values across time periods and compare or average delivered iRR throughout the life cycle of a partnership. Partners also can conduct a retrospective evaluation following a program’s completion to determine the actual iRR achieved. Comparing program outputs to initial projections allows partners to measure the variance between predicted and actual impact accomplished on a per-dollar basis, resulting in a powerful assessment tool.90

Disadvantages of the Model

One of the greatest strengths of the Impact Rate of Return model—its customizability—is also the source of its greatest vulnerability. The model relies on the expertise and judgment of those who customize it. If an evaluator poorly defines or haphazardly selects its subjective qualities of impact, its output may result in wasted resources. Worse yet, it may direct resources toward programs that have unintended negative consequences, or that cause societal harm.

This is where the combined knowledge and experience of teams becomes so important. Inclusive planning is critical. Engaging stakeholders in the model’s design and analysis helps reduce the risk that uninformed assumptions will affect its output. Partners can further mitigate risk by conducting program or partnership evaluation within a broader, comprehensive value-chain analysis.

Another drawback to iRR is that some partners may find it time consuming or impractical to gather required data, or to integrate qualitative attributes into the formula. For example, it may be prohibitively costly to design and thoroughly test a uniquely customized impact rating scale, especially in a new field or area that has limited reliable research. Some organizations may find it easier to use or improve on the model if they have a budget for monitoring and evaluation or have experience with other similar tools. This is an area where flexible funding in a partnership, such as philanthropic capital, can offset programmatic or project impact–evaluation costs.

Finally, the success of the model’s predictability depends on certainty related to program output. For example, in the sustainable real estate scenario, a proven developer with a successful track record can project, with a reasonably high degree of certainty, that $150 million will in fact result in 500,000 square feet developed. Or in the smallholder agriculture example, there is fair certainty that a $4 million project will in fact result in expected farmland improvements. If we use measures such as the number of students projected to graduate from high school, our certainty could fall. In such cases, it may help to integrate discount factors in addition to the confidence levels discussed in the program analysis framework in chapter 8.

CONCLUSION

All impact performance models have limitations—including iRR, even with the flexibility of its Impact Multiplier rating system. Many programs carry complexities, or partners may have preferences, that are difficult to capture in any model’s format. Furthermore, some qualitative attributes are simply too complex to capture in any formula.91

The Impact Rate of Return methodology is simply a first step. We hope it will lead to new ways of thinking about social impact performance and encourage standardized formulae by which to describe the impact effectiveness of various programs in a cross-sector partnership. The methodology lends itself well to many of the financial tools discussed in chapter 10, and it has the potential to begin influencing an expanding pool of impact-oriented capital. As the breadth and number of partnerships grow and expand, we hope that the Impact Rate of Return methodology may lead some organizations to reconsider how they measure their performance and, therefore, how they define success.