The basic financial calculations in Microsoft Excel can be divided into the following areas:

Simple interest calculation. Simple interest calculation is characterized by the fact that the interest is not added to the capital at the due date. This kind of calculation is mostly used for periods shorter than a year (sometimes only a few days).

Financial mathematics recognizes many different interest terms. In every case, the interest is the price for borrowed (borrowing rate) or lent (loan interest) capital. The price is based on the interest rate for 100 monetary units or one monetary unit. The interest rate always relates to a certain period (usually an entire year). To denote a period of a year, p.a. (per annum) is added.

You will encounter two different basic interest calculations over and over in this chapter: anticipative interest yield and interest yield in arrears.

Anticipative interest yield is paid for the capital due at the end, calculated based on the interest rate and paid at the beginning of the period. For interest yield in arrears, the interest is calculated and paid at the end of the interest period for the capital it started with.

Compound interest calculation. In this case, interest is added to the capital at maturity. This results in compound interest. Because Excel formulas are used frequently, it is assumed that the interest rate doesn’t change in the entire given period.

Annuity calculation. An annuity is a periodic payment of the same amount. All functions available in Excel assume that the payment date for the annuity is the same as the interest date. The only difference is between anticipative annuities and annuities in arrears, which are paid at the end of the period.

Repayment calculation. Financial mathematics uses at least three basic forms for the repayment of a loan: repayment via a single payment at the end, repayment via installments in the same amounts, and repayment via annuity payments for which the repayment amount plus interest stays the same. The last type is basically a type of annuity calculation.

The Excel functions for calculating repayments refer only to the first and the third type. This does not mean that you cannot reproduce other situations on worksheets by using many different means without using functions.

Price calculation. Calculations of the price and yield and the overall return on an investment are an especially complex area of financial mathematics. Many of the integrated functions focus on these areas. The exchange rate is always defined as the relative cash value of future payments after the accrued interest is subtracted, if necessary. The rate of return is the figure (as an interest rate) that implements an actual market interest rate.

Investment calculation. Investments are often calculated with a static or dynamic investment analysis. This might include cost/revenue comparisons as well as the amortization calculation. These are based on cost and payment calculations. Dynamic methods consider the compound interest and evaluate deposits and disbursements. Excel provides several functions for dynamic investment calculations (capital value method and internal interest rate method).

Amortization calculation. This is important for understanding financial mathematics processes: Payments are not only defined by the amount but also by the payment date. It makes a difference whether a debtor pays his debt today or a year from today. The longer it takes to pay the debt back, the higher the amount due; interest is added to the debt. Sometimes this principle can be defined the other way around: Late money is worth little. This has nothing to do with inflation. From a financial point of view, it is irrelevant whether $110 is repaid in a year or $100 is repaid today (based on an annual interest rate of 10 percent).

Therefore, amortization calculations are not really part of financial mathematics. Traditionally, amortization calculations are discussed in textbooks, and Excel provides the corresponding functions in a separate group. The meaning of the depreciation methods provided by Excel varies according to country/region because depreciation is regulated by the country’s specific tax laws.

Important

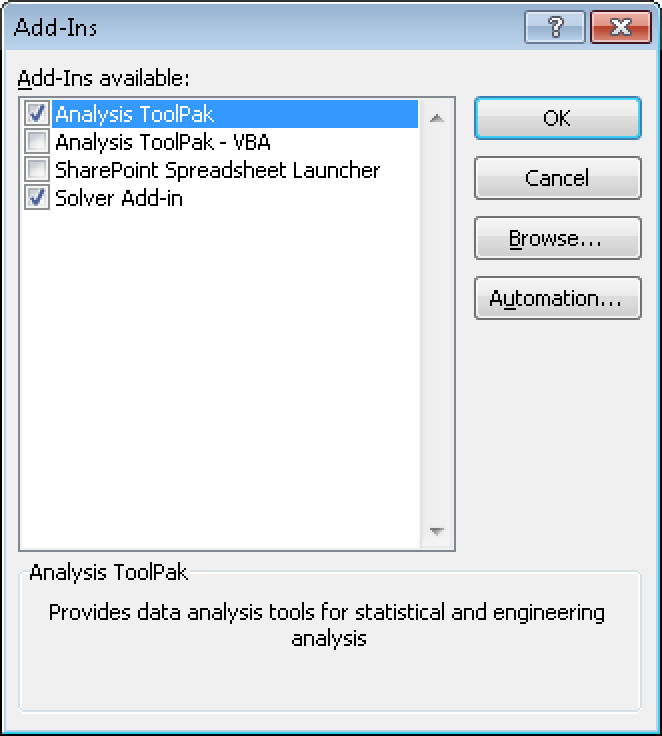

In the standard Microsoft Office Excel 2003 installation, most financial mathematics functions are not easily accessible. Before you can use the Analysis Functions group, you need to enable it by selecting Tools/Add-Ins in the Add-Ins dialog box (see Figure 15-1). This does not apply to Excel 2007 and Excel 2010.

When it comes to financial functions (see Table 15-1), the descriptions in Excel Help are not always the descriptions of the financial functions themselves. Therefore, you should compare it to the background information in this chapter and, if necessary, use the examples and consult additional literature for clarification.

Table 15-1. Overview of the Financial Functions