American Political Ideologies and Beliefs (Unit 4) |

4 |

This unit explores how American political beliefs are formed by the linkage institutions of elections, interest groups, and the media. What factors influence voting behavior and party identification? How does the media influence public opinion and political discourse?

This unit also explores why people either vote or stay home on Election Day. By looking at the demographics of America, you will be able to understand voter trends. Even though Americans are notorious for their lack of voter participation when compared to other Western democracies, recent elections have provided optimism that voter turnout is on the increase. When you view the constitutional basis of voting and its history, you should see how long it has taken for suffrage to be obtained by all citizens.

In recent elections, public opinion, measured through polls, became a primary barometer of how and why voters behave. Political polls were conducted to gauge the feelings and attitudes of the electorate. We will evaluate how polls are conducted, how candidates rely on polls and the media, and the impact of exit polls and the media.

The role of the media, including its historical development and its impact on public opinion and the political agenda, will be the focus in the last section of the unit. Topics such as the limits placed on the media, bias in the media, whether real or perceived, and the importance of the Internet and social media will be discussed.

The translation of public opinion into public policy takes place when policy makers truly understand opinion trends. This is one of the most difficult aspects of policy makers. They rely on such things as polls, letters, and personal input from constituents. The definitive measure of whether the institutions of government and the components of our political system succeed is the implementation of public policy.

Methods of Political Analysis utilize various scientific tools to measure political socialization and voter ideology.

Competing Policy-Making Interests are essential to the development and implementation of public policy.

Conservative ideology

Equality of opportunity

Federal Reserve

Fiscal policy

Focus group

Free enterprise

Globalization

Individualism

Keynesian economics

Liberal ideology

Libertarian ideology

Limited government

Monetary policy

Planned Parenthood v Casey

Political culture

Political socialization

Rule of law

Scientific polling sample

Supply-side economics

Tracking polls

What are the core values of Americans? How are they formed, and how do they shape the beliefs people have about what government is supposed to do? These are the key questions that impact the relationship that citizens have with the federal government and how citizens interact with each other.

■ The first core value of Americans is individualism, the moral stance, political philosophy, ideology, or social outlook that emphasizes a person’s moral worth. If you are an individualist, you believe in the exercise of freedom and the ability to achieve goals and desires. You also value independence and self-reliance and advocate that the interests of the individual should take precedence over the state or a social group. Individualists also oppose unwanted interference by society or the government.

Optional Reading That Illustrates Individualism

Democracy in America, by Alexis de Tocqueville, Chapters 2 and 3

Chapter 2: Origin of the Anglo–Americans, and Importance of this Origin in Relation to Their Future Condition

Key Quote:

“These men had, however, certain features in common, and they were all placed in an analogous situation. The tie of language is, perhaps, the strongest and the most durable that can unite mankind. All the emigrants spoke the same language; they were all children of the same people. Born in a country which had been agitated for centuries by the struggles of faction, and in which all parties had been obliged in their turn to place themselves under the protection of the laws, their political education had been perfected in this rude school; and they were more conversant with the notions of right and the principles of true freedom than the greater part of their European contemporaries. At the period of the first emigrations the township system, that fruitful germ of free institutions, was deeply rooted in the habits of the English; and with it the doctrine of the sovereignty of the people had been introduced into the very bosom of the monarchy of the house of Tudor.”

Chapter 3: Social Condition of the Anglo–Americans

Key Quote:

“There is, in fact, a manly and lawful passion for equality that incites men to wish all to be powerful and honored. This passion tends to elevate the humble to the rank of the great; but there exists also in the human heart a depraved taste for equality, which impels the weak to attempt to lower the powerful to their own level and reduces men to prefer equality in slavery to inequality with freedom. Not that those nations whose social condition is democratic naturally despise liberty; on the contrary, they have an instinctive love of it. But liberty is not the chief and constant object of their desires; equality is their idol: they make rapid and sudden efforts to obtain liberty and, if they miss their aim, resign themselves to their disappointment; but nothing can satisfy them without equality, and they would rather perish than lose it.”

■ The second American core value is equality of opportunity, which arises out of the belief that every individual should be given the same chance to succeed. If that is hampered by socioeconomic factors, then people who believe in equality of opportunity believe it is the government’s responsibility to provide that opportunity through legislation or court decisions.

Optional Reading That Illustrates Equality of Opportunity

The Submerged State: How Invisible Government Policies Undermine American Democracy, by Suzanne Mettler (2011)

From the publisher’s description of the book:

“‘Keep your government hands off my Medicare!’ Such comments spotlight a central question animating Suzanne Mettler’s provocative and timely book: Why are many Americans unaware of government social benefits and so hostile to them in principle, even though they receive them? The Obama administration has been roundly criticized for its inability to convey how much it has accomplished for ordinary citizens. Mettler argues that this difficulty is not merely a failure of communication; rather it is endemic to the formidable presence of the ‘submerged state.’”

This book effectively shows how the government provides many important benefits and programs that provide equality of opportunity, but many people are either unaware of them or hostile to them in principle.

■ The third core value is free enterprise, the basis of American capitalism, and advocates of free enterprise believe the government should allow open markets and competition in the marketplace with limited interference. In contemporary terms, a belief in free enterprise would also encompass laissez-faire government policies over regulatory policies.

The other core beliefs that define citizen relationships with government are limited government and rule of law. The federal government and state governments are told they do not have unlimited power. The three branches are limited through the system of checks and balances. Congress is told it cannot deny the writ of habeas corpus or the right of appeal, cannot pass bills of attainder or impose predetermined jail sentences before a trial. There are, however, exceptions to some of these limitations. In times of national emergency, the Supreme Court has determined that the federal government can place major restrictions on the civil liberties of its citizens. During the Civil War, Lincoln suspended the writ of habeas corpus in the border states. During World War II, Roosevelt ordered Japanese–American citizens to internment camps.

Political Socialization Helps Form an Individual’s Political Ideology and Beliefs

Political socialization is the factor that determines voting behavior. There is growing interest in how people actually develop their political orientation, thus making it more likely they will vote. Studies have determined that these attitudes are formed by family, media, and public schools. Party identification, the voter’s evaluation of the candidates, and policy voting—the actual decision to vote for a particular candidate based on these factors—all come into play in evaluating the overall voting process.

What are the factors, then, that influence political socialization? They can be classified under two major categories: sociological and psychological. Sociological factors include:

■ income and occupation,

■ education,

■ sex and age,

■ religious and ethnic background,

■ region of the country where you live, and

■ family makeup.

Psychological factors include:

■ party affiliation and identification,

■ perception of candidate’s policies and/or image, and

■ the belief that your vote will make a statement.

Based on these factors we can state the following about who votes, what party those who vote lean toward, and who does not vote:

■ Voters in the lower income brackets and “blue-collar” workers were traditional Democratic voters, but many voted for Donald Trump in 2016 in the swing states of Michigan, Pennsylvania, and Wisconsin. Upper-middle to upper-income voters, many of whom are business and professional “white-collar” workers, tend to vote Republican. Citizens with higher incomes and greater education vote in greater numbers than those with lower incomes and less education. Education is the number-one factor in determining voter turnout. This pattern held true in the 1976–2016 presidential elections.

■ There is a gender gap in national politics, a significant deviation between the way men and women vote. Since 1988 a trend has developed for a greater percentage of women to vote for Democratic candidates than men do. This was particularly true in the 2016 presidential election, when polls showed that white male voters heavily supported Republican candidates, whereas women supported Democratic candidates. The trend was even greater in the 2018 midterm elections, when 39 women were newly elected to Congress.

■ In 2016, 54 percent of women voted for Hillary Clinton while 42 percent of women voted for Donald Trump. However, when the women’s vote is divided by race, it becomes clear that black women largely drove the so-called gender gap against Trump. Donald Trump’s most enthusiastic supporters were white men, with 54 percent of college-educated white men and 72 percent of non-college-educated white men backing him.

■ The youth vote is undergoing a major change. Ever since the Twenty-sixth Amendment was passed, political parties have wanted to capture the young voter. Even though they seem to vote more Democratic than Republican (with the exception of youth supporting Reagan and Bush), the fact remains that they have voted in much lower numbers than other groups. From 1976 to 1988, for instance, the turnout among the youngest voters, those 18–20 years old, was less than 40 percent of the eligible voters. From 1992 to 2016, MTV ran a “Choose or Lose” campaign, resulting in increased registration and turnout of young voters. In the 2008 and 2012 elections, 18–24-year-olds voted in large numbers for Barack Obama. In the 2010 and 2014 midterms, the youth voter turnout declined significantly from the presidential-election years of 2008 and 2012. Of the estimated 24 million people under 30 who voted in the 2016 presidential election, a large majority supported Hillary Clinton. However, Clinton received notably less support from young voters (18–29) than Barack Obama did in 2008 and 2012, particularly in the crucial battleground states she lost to Donald Trump.

■ Religious and ethnic background highly influences voter choice and voter turnout. Since the late nineteenth century waves of immigration, Catholics and Jews have tended to vote Democratic (Republicans traditionally supported anti-immigration legislation), whereas northern Protestants tend to vote Republican. Strongly affiliated religious groups also tend to vote more often in general elections, compared to those people who do not identify as being closely connected to a religion. Minority groups, although voting heavily for Democratic candidates, do not turn out as much as white voters. Jesse Jackson and his Rainbow Coalition, minority groups of “color” rallying around causes espoused by Jackson, have been attempting to increase minority registration and voter turnout. Minority groups can be a fertile field for campaigning political parties. After the 2000 election, a religious gap became evident. Those who were regular churchgoers tended to vote Republican, while those who did not attend religious services regularly tended to vote Democratic. This trend continued from 2004–2016.

■ Historically, geography has dictated a voter preference. The South voted solidly Democratic after the Civil War. However, the “solid South” has become much more Republican since the 1960s, when national Democratic leaders won several key civil rights victories. Comparing voter turnout: proportionally, northerners vote in greater numbers than southerners. This difference is explained by a large number of southern minority voters who are still not registered. New England and Sunbelt voters tend to vote Republican, whereas the big industrial states, especially in the major cities, lean to the Democrats, although they are considered toss-ups in close presidential elections.

■ The 2012 election was characterized by a Democratic coalition of Hispanics, African Americans, Asians, and women. Governor Mitt Romney won almost 60 percent of the white vote, but the white share of the electorate has been falling steadily: 20 years ago, whites were 87 percent of the electorate; in 2012 they were 72 percent. The 2016 election reflected a Democratic coalition that included minorities, women, and youth. However, it could not be called the “Obama coalition” since there was a lower turnout among these groups for Hillary Clinton. The Republican coalition featured white men, non-college-educated women, and evangelicals. The white share of the electorate was 75 percent.

■ The impact the world economy has on the United States (globalization) has a profound influence on how affected individuals develop political and social values. For instance, if your job has been eliminated because of globalization, you will react negatively to open trade treaties.

Optional Readings

Making Globalization Work, by Joseph Stiglitz (2006)

From the publisher:

“Joseph E. Stiglitz offers here an agenda of inventive solutions to our most pressing economic, social, and environmental challenges, with each proposal guided by the fundamental insight that economic globalization continues to outpace both the political structures and the moral sensitivity required to ensure a just and sustainable world. As economic interdependence continues to gather the peoples of the world into a single community, it brings with it the need to think and act globally.”

Bowling Alone: America’s Declining Social Capital, by Robert D. Putnam (1995)

Key Quote:

“The concept of ‘civil society’ has played a central role in the recent global debate about the preconditions for democracy and democratization. In the newer democracies, this phrase has properly focused attention on the need to foster a vibrant civic life in soils traditionally inhospitable to self-government. In the established democracies, ironically, growing numbers of citizens are questioning the effectiveness of their public institutions at the very moment when liberal democracy has swept the battlefield, both ideologically and geopolitically.”

How Class-Based Society Impacts Political Socialization

First, we must define some basic terms. Income distribution refers to the portion of national income that individuals and groups earn. Even though there has not been a significant comparative change in income distribution between the lowest and highest fifth of the American population from 1953 to 2017, since then there has developed over that period of time a wider disparity in levels of income for those groups. Specifically, from 1980 to 2016, the incomes of the wealthiest Americans rose at a much greater level than those of the poorest fifth. The median income in 2016 was a little over $59,000 compared with $24,250 for a family of four living below the poverty level.

Income is defined as the specific level of money earned over a specific period of time, whereas wealth is what is actually owned, such as stocks, bonds, property, bank accounts, and cars. Wealth, unlike levels of income, has been even more disproportionate, with the top 1 percent of the country’s rich having about 25 percent of the wealth. Taking into account this disparity of the distribution of income and wealth, the U.S. Census Bureau has adopted a poverty line. This line measures what a typical family of four would need to spend to achieve what the bureau calls an “austere” standard of living.

Which groups become part of this culture of poverty? People who are poor because they cannot find work, have broken families, lack adequate housing, and often face a hostile environment. The Census Bureau views families as being above or below the poverty level by using a poverty index developed by the Social Security Administration. According to the bureau, “the Index is based solely on money income and does not reflect the fact that many low-income persons receive noncash benefits such as food stamps, Medicaid, and public housing.” People living below the poverty level include a disproportionate number of minorities living in cities.

Elections Affect Political Socialization

In 2000 the electorate could not make up its mind between George W. Bush, who promised to bring “honor and integrity” back to the Oval Office, and the incumbent vice president, Al Gore, who had to separate himself from Bill Clinton’s scandals while still identifying himself with the longest period of prosperity in U.S. history. In the end, Gore narrowly won the popular vote but lost the Electoral College in one of the closest and most-disputed elections in history.

Bush campaigned for reelection in 2004 emphasizing that he would “build a safer world and a more hopeful America.” His Democratic opponent, Senator John F. Kerry, told the voters that he was the “real deal” and that “America deserves better.” The voters decided not to change a commander in chief during a time of war and gave the incumbent both a popular and electoral vote majority.

In the first election since 1952 that did not feature an incumbent president or vice president, Barack Obama, the first African–American nominee of a major political party, campaigned in 2008 using the theme “change we can believe in.” His opponent, Arizona senator John McCain, chose “country first,” emphasizing his military credentials. The country elected Obama, giving him a majority of the popular vote and more than 350 electoral votes.

In 2012, incumbent president Barack Obama ran for reelection against former Massachusetts governor Mitt Romney. Even though the economic climate favored the challenger, President Obama was able to define Governor Romney as the candidate who identified with the wealthiest Americans. Obama was reelected with 332 electoral votes.

In 2016, former secretary of state Hillary Clinton ran against businessman Donald Trump. In what ultimately became a “change election,” Trump defeated Clinton in the Electoral College 304–227, while Clinton won the popular vote by almost 2.9 million. There were also seven electors, called “faithless electors,” who voted for other candidates, the most in U.S. political history.

All these controversial elections either reinforced or changed political attitudes.

Optional Reading

Democracy Remixed: Black Youth and the Future of American Politics, by Cathy J. Cohen (2010)

From the publisher:

“In Democracy Remixed, award-winning scholar Cathy J. Cohen offers an authoritative and empirically powerful analysis of the state of black youth in America today. Utilizing the results from the Black Youth Project, a groundbreaking nationwide survey, Cohen focuses on what young black Americans actually experience and think—and underscores the political repercussions. Featuring stories from cities across the country, she reveals that black youth want, in large part, what most Americans want—a good job, a fulfilling life, safety, respect, and equality. But while this generation has much in common with the rest of America, they also believe that equality does not yet exist, at least not in their lives. Many believe that they are treated as second-class citizens. Moreover, for many the future seems bleak when they look at their neighborhoods, their schools, and even their own lives and choices. Through their words, these young people provide a complex and balanced picture of the intersection of opportunity and discrimination in their lives. Democracy Remixed provides the insight we need to transform the future of young black Americans and American democracy.”

Opinion Polls Measure Public Opinion and Affect Public Policy and Elections

In recent years, polling has increased in scope and importance. Pollsters want to determine what the American public is thinking. The results are widely reported in the media and, in a number of cases, polls themselves are newsworthy. The qualities measured in polls include:

■ how intense people are in their beliefs and attitudes;

■ the real wants and needs of individuals that can be translated into policy;

■ whether public opinion on any given issue is constant or changing; and

■ the extent to which the public is polarized or has a consensus on any given issue, for example, issues such as health care and care for veterans reveal the public’s polarization or consensus

Using scientific methodology and computer technology, professional pollsters such as Gallup, CNN, and daily newspapers have mastered the art of measuring public opinion. In presidential election years, pollsters aggregate (take the average of) all the tracking polls. When looking at political polls, these pollsters consider

■ who conducts the poll: there is a real difference between a candidate who reports polling results and a neutral organization that conducts a poll;

■ the sample size: assuring that a random sample was obtained;

■ whether clear distinctions have been made regarding the population sample;

■ when the poll was conducted;

■ the poll methodology;

■ the sampling error, which gives the poll statistical validity: ±3 percent is usually an acceptable standard; and

■ how clearly the questions were worded.

During recent presidential campaigns, CNN and other media outlets took daily tracking polls of both likely voters and those who were eligible to vote. The results differed significantly. In 1996, the increased popularity of the Internet contributed to the proliferation of daily tracking polls. On any given day, one could find as many as a dozen polls broken down nationally and by state, by registered voter, by likely voters, by electoral vote, by popular vote, and taken over a three-day period as well as over a one-day period. The result gave conflicting data. By 2008, polling techniques became so sophisticated that some websites were able to accurately predict both the popular vote and electoral vote margins Barack Obama received. In 2012, a New York Times blogger correctly predicted the electoral result using an aggregate of the tracking polls. After the unexpected Donald Trump victory in 2016, polling firms came under fire for how they were predicting the probability of a Hillary Clinton victory. Respected pollsters were giving her a 99 percent chance of winning the presidency. Even though the Real Clear Politics polling aggregate was close in predicting a 1.7 percent margin in the popular vote for Clinton (she actually won by 2.1 percent), most battleground polls in Pennsylvania, Michigan, and Wisconsin were wrong. Some critics maintained that inflated poll numbers for Clinton drove down overall turnout, especially in the key battleground states that she lost.

Public-opinion polls have become so sophisticated that the use of exit polls in carefully selected precincts can accurately predict the outcome of an election minutes after the polls close. In addition, these polls can give valuable information regarding why people voted the way they did. A serious question has been raised regarding the prediction of elections using exit polls in presidential elections. If the East Coast results are reported right after the polls close, will it influence West Coast voters to stay home? There even have been attempts to legislate restrictions on the use of exit polls.

In the 2000 presidential election, polling organizations also came under fire. The Voter News Service, a conglomerate of the major media organizations pooling their resources to provide exit-poll information, gave inaccurate statistics to the networks regarding the results of the Florida vote. This caused the networks to first call the election for Vice President Gore. Then, when additional information was evaluated, the networks pulled back their initial projections and the state remained in the “too close to call” column until the networks again, based on faulty information, gave the state to George W. Bush in the early hours of the next morning. Based on this, Gore called Bush and conceded the election until it became clear that the real results were so close that a recount of Florida’s votes was required. Voter News Service took responsibility for the questionable methodology used and, along with the networks, implemented new procedures for the 2004 election.

Although considered unimportant by many, party platforms are perhaps a better barometer of party identification than traditional measurements. If you look at the 2012 national party platform of the Democratic and Republican Parties, you can see the effect ideological differences had on voter support.

Even though party positions differ significantly, it is interesting to note that, when actual legislation is proposed, there is very rarely bloc voting on these issues.

Then how do you determine what constitutes a liberal or conservative ideology? Political labels are deceptive. You may be a social liberal or a civil libertarian but be a conservative when it comes to the role of government in regulating business. If you have a single issue like abortion that is most important, it will make very little difference whether a candidate is a Democrat or Republican. In 2014 a widely reported poll asked people to classify themselves as liberal, moderate, or conservative; 42 percent identified themselves as Independent, 31 percent as Democrat, and 25 percent as Republican. In another poll, when asked what it means to be labeled a liberal, people responded in terms of

■ accepting change.

■ supporting programs that increase spending.

■ favoring social programs.

■ believing in the rights of all people.

Conservatives who were asked to answer what it means to be conservative responded in terms of

■ resisting change forced upon them by the government.

■ opposing programs that increase spending except when it comes to defense.

■ opposing the government legislating social programs.

■ favoring Second Amendment gun rights.

In 2012–2016 the Democratic and Republican parties stressed economic and national security issues. The stands on social issues remained the same as the 2008 platforms. Health care was a major plank of both platforms. The Democrats supported the president’s Affordable Care Act, which the Supreme Court affirmed, while the Republicans supported its repeal, calling it Obamacare. The Republican platform accused President Obama of being unable to reduce the unemployment rate to under 8 percent, while the Democrats pointed to the number of jobs that were created since the president took office in 2009. There were also significant differences in the areas of support of labor unions (Democrats supporting them; Republicans critical) and repeal of the so-called Bush-era tax cuts (the Democrats favoring repeal of cuts for those who made more than $250,000, while Republicans were against repeal).

Liberals, Conservatives, and Libertarians Have Different Political Ideologies

These general areas translate into specific liberal/conservative/libertarian differences when applied to actual issues. For instance, on foreign policy, liberals favor defense cuts. Conservatives, on the other hand, favor government spending on defense over social welfare programs. Libertarians are against intervention in foreign affairs. On social issues liberals favor freedom of choice for abortions, whereas conservatives favor the right to life. Libertarians favor less government-imposed laws dealing with social issues. Liberals and libertarians are opposed to school prayer of any kind; conservatives favor moments of silent prayer. Liberals generally view the government as a means of dealing with the problems facing society, whereas conservatives and libertarians favor a more laissez-faire position. Liberals and libertarians have been more sympathetic to the rights of the accused, and conservatives have been critical of many of the Warren Supreme Court decisions. Yet when you apply these standards to specific bills, there is a clouding up of which party is liberal and which party is conservative, though most libertarians usually vote Republican.

Both the Republican Party and the Democratic Party have members who want to pull their party further to the right or to the left. The Republican’s Tea Party movement and the progressive Democrats elected in 2018 illustrate how there are ideological differences even within the parties. Serious differences do exist between the parties. Some differences derive from the fact that one party is in power and controls the agenda and the party out of power must fight to keep its own agenda alive. And there are still constituencies that are attracted to the two parties—for instance big business to the Republicans and labor unions to the Democrats.

Optional Supreme Court Cases That Illustrate Liberal vs. Conservative Ideology

Planned Parenthood v Casey (1992)

The court’s plurality opinion reaffirmed the central holding of Roe v Wade, stating that “matters, involving the most intimate and personal choices a person may make in a lifetime, choices central to personal dignity and autonomy, are central to the liberty protected by the Fourteenth Amendment.” The court’s plurality opinion upheld the constitutional right to have an abortion, and it altered the standard for restrictions on that right, crafting the “undue burden” standard for abortion restrictions. Planned Parenthood v Casey differs from Roe, however, because under Roe the state could not regulate abortions in the first trimester whereas under Planned Parenthood v Casey the state can regulate abortions in the first trimester, or any point before the point of viability, and beyond as long as that regulation does not pose an undue burden on a woman’s fundamental right to an abortion. Applying this new standard of review, the court upheld four regulations and invalidated the requirement of spousal notification. This case reflected the liberal vs. conservative divide when it comes to the controversial issue of abortion. Liberals wanted the court to uphold Roe v Wade and not place any restrictions on a woman’s right to have an abortion. Conservatives wanted the court to overturn Roe v Wade and favored other restrictions on the right to an abortion.

Obergefell v Hodges (2015)

Required all states to issue marriage licenses to same-sex couples and to recognize same-sex marriages validly performed in other jurisdictions. This legalized same-sex marriage throughout the United States, its possessions and territories. The court examined the nature of fundamental rights guaranteed to all by the Constitution, the harm done to individuals by delaying the implementation of such rights, and the evolving understanding of discrimination and inequality. Liberals favored this decision, conservatives were against it.

Democratic and Republican Parties Have Different Economic Philosophies

Basic differences between Republicans and Democrats and ideological differences between conservatives and liberals are great when economic issues are raised. Traditionally, Republicans have been identified as the party favoring the rich and big business, whereas the Democrats have been viewed as being sympathetic to labor and the poor. Democrats have accused Republican presidents of having unsuccessful “trickle-down, supply-side” economic policies, resulting in a recessionary trend and higher unemployment. Republicans accuse Democratic presidents of following “tax and spend” programs, causing runaway inflation. The conservative congressional coalition sides with policies aimed at dramatically reducing the deficit, whereas liberals believe government-sponsored economic stimulus programs result in a strong economy. Political philosophy also changes the public perception and, as a result, how government views traditional government programs. An example of this was the transition and evolution of how government legislated welfare. The social-welfare era began with New Deal relief measures under the Social Security Act. It was the most far-reaching piece of legislation ever passed. Its primary aim was to help one segment of the society—senior citizens. The act established the principle that it was the government’s responsibility to aid retirees, even if the aid came from the forced savings of the workforce.

Social Welfare Programs Rely on Federal Support

The “Great Society” programs of Lyndon Johnson provided an even greater reliance on the federal government. Such actions as Medicare, Medicaid, the War on Poverty, and increased civil rights legislation forced the states to rely more heavily on federally funded programs. This also created an era of further cooperation among the many levels of government. The following components describe this creative approach to federalism:

■ sharing the costs between the national and state governments for programs that typically would fall under the purview of state control;

■ guidelines and rules set down by the federal government in order for the states to reap the benefits of federally funded programs; and

■ providing for the dual administration of programs such as Medicaid, which has a shared approach financially as well as administratively.

Great Society Programs

The turning point in the federal era occurred in large part because of Lyndon Johnson’s Great Society programs. Much legislation was passed as a response to the civil rights movement and also because there was a significant Democratic majority in both houses who agreed with Johnson that the government’s role should be to develop programs including

■ Medicare—covering hospital and medical costs of people 65 years of age and older as well as disabled individuals receiving Social Security.

■ the war on poverty extending benefits to the poor.

■ the food stamp program—giving food coupons to people determined to be eligible based on income and family size.

■ Medicaid (a shared program between the federal and local governments)—covering hospital, doctor, prescription-drug, and nursing-home costs of low-income people.

During the Nixon, Carter, and Ford years, the Great Society programs were sustained and, in some cases, expanded. In 1972 the Equal Opportunity Act provided for legal recourse as a result of job discrimination. In 1972 cost-of-living indexing was attached to Social Security and other welfare programs and, in 1973 a job-training act, Comprehensive Employment Training Administration (CETA), was passed. The first hint that there were problems with Social Security also occurred in 1973 when the Board of Trustees of the Social Security System reported that the system was running a large deficit.

The “Reagan revolution” of the 1980s, with his assurance that there would always be a “safety net” for those people receiving the benefits of the many programs previously described, attempted to cut back the scope of the Great Society programs. He received the cooperation of the Democrats and cut the rate of increase to Old-Age Survivor’s Disability Insurance and Medicare. He also succeeded in reducing some of the need assistance programs. However, after 1984 these programs again began to increase. In addition, special-interest groups such as the American Association of Retired Persons (AARP) lobbied effectively against cuts in Social Security and Medicare. During the 1995 congressional term, the Republicans passed a series of bills that would substantially cut Medicare and Medicaid in an effort to prevent their collapse and with the goal of moving toward a balanced budget. President Clinton vetoed these measures. A broader agreement was reached in 1997, however. It also became apparent that for the long-term survival of Social Security, it would require testing and increased costs for senior citizens.

Optional Reading

American Exceptionalism: A Double-Edged Sword, by Seymour Martin Lipset (1996)

From the publisher:

“American values are quite complex,” writes Seymour Martin Lipset, “particularly because of paradoxes within our culture that permit pernicious and beneficial social phenomena to arise simultaneously from the same basic beliefs.”

Born out of revolution, the United States has always considered itself an exceptional country of citizens unified by an allegiance to a common set of ideals, individualism, anti-statism, populism, and egalitarianism. This ideology, Professor Lipset observes, defines the limits of political debate in the United States and shapes our society.

American Exceptionalism explains why socialism has never taken hold in the United States, why Americans are resistant to absolute quotas as a way to integrate blacks and other minorities, and why American religion and foreign policy have a moralistic, crusading streak.

Government Economic Policy is Based on Different Ideologies and Carried Out by the President, Congress, and Federal Reserve.

THE DEVELOPMENT OF THE FEDERAL BUDGET REFLECTS COMPETING POLICY PHILOSOPHIES

Quick Constitutional Review: The Basis of the Federal Government’s Budgetary Power

■ In Article I, Section 8, Clause 1, the Congress is given the power to “lay and collect taxes, to pay the debts, and provide for the common defense and general welfare of the United States.”

■ Article I also gives the House of Representatives the power to initiate the process of passing all appropriations.

■ Article I establishes the power of Congress to impose excise taxes in the form of tariffs.

■ However, Article I Section 9 prohibits export taxes.

■ Article I directs Congress to impose taxes that are equally apportioned.

■ Thus, as a result of the ratification of the Sixteenth Amendment, the income tax is the only direct tax levied.

■ Any indirect taxes, such as gasoline, tobacco, and liquor, must be uniform.

■ The Supreme Court’s decision in McCulloch v Maryland (1819) established the principle that states could not tax the federal government.

■ Article I gives Congress the power to “borrow money on the credit of the United States.”

■ Congress can appropriate only money that is budgeted.

By evaluating the monetary policies of the Federal Reserve System and the fiscal policies of the government, you will be able to see how specific public policy is developed, and how it affects the major areas of American life—agricultural, business, labor, and consumer. Viewing the history of government regulation, we will conclude the chapter by looking at recent attempts at deregulation and focus on the economy’s future.

Perhaps the most definitive indicator of the overall public policy direction the government is taking is the development of the federal budget. This involves key players, a prescribed process, and inherent problems. We will explain the players’ roles and what happens each step of the way in the budget process. Problems are caused by the growing budget, and decisions must be made by the president and Congress when considering budget priorities.

We will also look at the specific type of taxes that exist, how they affect people who have different levels of income and wealth, and the types of welfare and entitlement programs—Social Security, Medicare, Medicaid, food stamps, aid to the disabled, and welfare.

Government plays a dual role in being linked to the nation’s economy. It measures the economic status of the nation and attempts to develop effective measures to keep the economy on the right track. The Department of Labor (Bureau of Labor Statistics), the Congressional Budget Office, and the Executive Office of the Council of Economic Advisers all report to the country vital economic statistics such as the

■ unemployment rate (adjusted index of people obtaining jobs).

■ Consumer Price Index (CPI)—According to the U.S. Census Bureau, “the CPI is a measure of the average change in prices over time in a fixed ‘market basket’ of goods and services purchased either by urban wage earners and clerical workers or by all urban consumers.” It is also a primary measure of inflation when the index rises over a defined period of time.

■ Gross National Product (GNP)—The Census Bureau defines GNP as “the total output of goods and services produced by labor and property located in the United States, valued at market prices.”

■ Gross Domestic Product (GDP)—Lately the GDP has become the key economic measure analyzing an upward or downward economic trend, on a quarterly basis, of the monetary value of all the goods and services produced within the nation. Other factors such as consumer confidence, the actual inflation rate, and the stock market give a complete picture of the economy.

The government’s primary policy role, therefore, is to develop a healthy economic policy. Programs such as the New Deal’s three Rs—Relief, Recovery, and Reform—set in motion policies that have succeeded in preventing the country from experiencing a depression of the magnitude of the one that occurred in the 1930s. Many of Roosevelt’s programs, such as Social Security (relief), the Securities and Exchange Commission (reform), and jobs program prototypes (recovery) are still part of the economic fabric of the country today.

Monetary Policy of the Federal Reserve

Monetary policy is defined as control of the money supply and the cost of credit. Many leading economists believe there is a direct relationship between the country’s money supply and the rate of economic growth. The Federal Reserve System, or “the Fed,” was established in 1913. It consists of a seven-member board of governors serving by appointment of the president for staggered 14-year terms. The Fed’s chairman, appointed by the president and confirmed by the Senate, is a powerful spokesperson for the system and serves four-year renewable terms. The Federal Reserve Board is an independent agency, free of presidential or congressional control. Its chairman during the 1990s, Alan Greenspan, was very effective and influential in setting monetary policy. More than 6,000 member banks are affected by Fed policy and then influence monetary policies of other banks, ultimately having an impact on the interest rates consumers pay.

The Federal Reserve System regulates the money supply through

■ open-market operations—buying and selling of government securities, which affect the money supply and cost of money.

■ reserve requirements—establishing the legal limitations on money reserves that banks must keep against the amount of money they have deposited in Federal Reserve Banks (which earn the banks interest). These limits affect the ability of banks to loan money to consumers because actions in this area can increase the availability of money for credit.

■ discount rates—determining the rate at which banks can borrow money from the Federal Reserve System. If rates are raised, interest rates for consumers also rise. The Federal Reserve System uses this tactic to keep inflation in check. This is probably the most publicized action taken by the Fed.

A good example of how the Federal Reserve’s monetary policy is used in conjunction with a president’s fiscal policy was in 1981 after Ronald Reagan was inaugurated. The country’s number-one economic problem was double-digit inflation. The Federal Reserve forced a recession by raising the discount rate. The action had the immediate impact of reducing inflation. However, unemployment continued to be a problem. Reagan’s fiscal policies (which we will discuss fully in the next section), although eventually creating a long period of prosperity, also saw the greatest increase in the deficit in the nation’s history. In 1999, after President Clinton’s deficit reduction economic package succeeded in reversing some of the nation’s deficit and increased employment, the Fed was forced to raise discount rates as a precautionary measure. It feared that, because the economy was again improving, inflation would tend to increase. The question of having an independent agency be the sole arbiter in these very important functions upsets many economists.

On the other hand, the board must be immune from political pressure and pressure from special interests that would benefit if they had the inside track or could influence the monetary policy of the Fed. Most economists give the Federal Reserve high praise for the way it monitored the economy during the 1990s. The Federal Reserve has also been a key player, lowering interest rates during the economic recession that began in 2008.

In 2010, the Federal Reserve launched a controversial program to buy $600 billion in longer-term Treasury securities to support a weak economic recovery that was failing to generate jobs. As the economy improved, the Fed reduced the amount of securities it bought. This practice ended in 2017, when the Federal Reserve feared that inflation would increase. The Fed also began to increase interest rates in an effort to ward off inflation.

Fiscal Policy

Fiscal policy is primarily established by an economic philosophy that determines how the economy is managed as a result of government spending and borrowing and the amount of money collected from taxes. The two contrasting philosophies related to fiscal policy are Keynesian economics, developed by English economist John Maynard Keynes, and supply-side economics, developed by Ronald Reagan’s economic team. Keynes advocated an increase in national income so that consumers could spend more money either through investments or purchases of goods and services. He also believed the best strategy to counter an economic recession was an increase in government spending. A corollary to this viewpoint would be that government would also adopt regulatory, distributive, and redistributive policies as tools to ensure consumer enterprise.

To a large extent the differing philosophies can be traced to the laissez-faire philosophy of Hoover versus the regulatory philosophy of Roosevelt. Both presidents’ fiscal policies attempted to manage the country when it was facing an economic downturn or when it was facing too much growth. The key to success is to find the best way to use the fiscal tools available to the government. Should it raise or lower taxes? Should it increase or decrease spending levels? How much regulation is really necessary? These are issues that have perplexed American economists and presidents since the Great Depression.

Regulation and Deregulation

As much as we have seen the government involved in regulations during the 1970s and 1980s there has also been significant government deregulation of the airline industry, trucking and railroads, and the banking industry. Though the government followed a course of environmental regulation during the 1990s and early 2000s, the government continued deregulation of the banking industry and charted the country through deregulation of the housing industry. As a result, abuses led to a housing bubble that burst in 2008 causing the collapse of many major financial institutions and ushering in a major economic recession. In 2009 and 2010, President Obama signed legislation that reversed the trend creating regulatory reform for banks and Wall Street. After President Trump’s election, he implemented a deregulation program that resulted in federal agencies issuing 67 deregulatory actions and only three regulatory actions (or 22 deregulations to every one regulation) in 2017. Agencies such as the Environmental Protection Agency (EPA) rolled back many Obama-era regulations.

Banking Reforms

When the banking industry was deregulated in the 1980s, it caused one of the most far-reaching scandals in banking history. Savings and loan (S&L) problems included consumers losing money that was not protected under the Federal Savings and Loan Insurance Corporation; banks closing; and heads of S&Ls under investigation for misconduct and criminality improprieties. The federal government under President George H. W. Bush was forced to bail out the industry, resulting in an increase in the already-inflated federal deficit. The administration was highly criticized for allowing the banks to mismanage their affairs and, after congressional oversight hearings, there was no doubt that the federal government would have to again regulate that industry. The regulation came in the form of a massive government bailout of the banking industry in 2008, after the country’s worst recession since the Great Depression. The largest banks failed as a result of their investments in what was called “sub-prime” mortgages. Others had to sell out. Both the George W. Bush and Obama administrations, working closely with the Federal Reserve, the Treasury Department, and Congress, had to pump money into the failing banks. New laws were passed tightening banking regulations and consumer rights.

In looking at the federal budget, we will also trace the history of key legislation affecting the players and the process. Then we will analyze the components of the budget, including where the government gets its income and how it is allocated. Finally, we will discuss some of the reforms that have been proposed to keep the budget in check.

Budget Approval

Even though Congress has the constitutional “power of the purse,” the players involved in the process include:

■ the president,

■ executive staff and agencies,

■ special-interest groups,

■ the media, and

■ the public.

The president by law must submit a budget proposal to Congress the first Monday after January 3rd. Prior to that date, each federal agency submits detailed proposals outlining its expenses for the next fiscal year. This spending plan is submitted to the Office of Management and Budget, responsible for putting the budget requests together. Following a budget review and analysis, the OMB revises many of the recommendations and prepares a budget for the president to submit to Congress. By the middle of February, the Congressional Budget Office (CBO) evaluates the president’s budget and submits a report to the House and Senate budget committees. It is interesting to note that the CBO is a staff agency of the Congress, whereas the OMB is a staff agency of the president. Therefore, the results of budgetary analysis by each group may differ.

Once the appropriations committees of each house receive the proposed budget, they review it and submit budget resolutions to their respective chambers. These resolutions include estimates of expenditures and recommendations for revenues. By April 15 a common budget direction must be passed. This provides the basis for the actual passage of the following year’s budget. The fiscal year begins on October 1, and by that date both houses must pass a budget that includes 13 major appropriations bills. If any of these bills are not passed, Congress must then pass emergency spending legislation, called a continuing resolution, to avoid the shutdown of any department that did not receive funding from legislation passed. Shutdowns have occurred during the Reagan, George H. W. Bush, Clinton, Bush, and Obama administrations. The battle over the 1995–1996 budget was particularly significant. It caused not only the most prolonged government shutdown, but also created unique political consequences. After the Republicans assumed control of Congress in 1994, led by conservative freshmen and spurred on by what was called the “Gingrich Revolution,” the GOP believed they could force President Clinton to capitulate when the Congress passed a balanced budget.

By September 30, 1995, the end of the fiscal year, it became apparent that the Republicans’ balanced budget, which included major social program reductions and an overall objective of reducing the size and scope of the federal government, would be vetoed by President Clinton. After Clinton’s veto, the budget battle began. Republicans refused to pass continuing resolutions—a stopgap measure to keep the government operating—unless the president agreed in principle to their budgetary demands. President Clinton, using his bully pulpit in a most effective manner, refused and in fact went on the offensive by suggesting that the Republicans were holding the American people hostage. When the media focused their attention on how the shutdown was affecting government workers and showed dramatic pictures of closed signs posted outside shuttered government agencies and national parks, the Republicans were forced to pass continuing resolutions and reformulate their own budget proposal.

The 1995 and 1996 government shutdowns created an election issue that would carry through the entire 1996 campaign. Shutdowns that occurred in the Obama and Trump administrations reinforced the public perception that the government is broken. December 2018 saw the beginning of a partial U.S. government shutdown that lasted 35 days. The cause was a dispute over funding for a wall along the border of the United States and Mexico. President Trump refused to sign a continuing resolution unless the Congress allocated more money for a wall. The president backed down but announced a national emergency in 2019 that would enable him to reallocate funds for a border wall. His decree was challenged in the courts.

During this entire process, special-interest groups, heads of bureaucratic agencies, the media, and the public are also involved in trying to influence the nature of the budget. Private sector lobbyists argue for increased funding for programs such as entitlements and federal aid, whereas bureaucratic chiefs attend congressional hearings to fight for their departments. The media publicizes the process through news reports and editorials. The public through its contacts with legislators (letter writing and phone calls) also gives its viewpoint regarding such issues as tax increases.

Deficit Spending

What exactly is deficit spending? Third-party presidential candidate Ross Perot, during the 1992 campaign, suggested that deficit spending was so serious that his grandchildren would potentially face the problem of a nation going broke. Very simply put, deficit spending is when expenditures exceed revenues. Beginning with the Revolutionary War, the United States has been forced to be a nation in debt. The debt usually increased after the United States had to react to either a domestic or foreign-policy crisis. For instance, during the Depression the country faced one of the largest deficits in its history as a result of the implementation of Roosevelt’s New Deal programs. However, the extent of the deficit became unmanageable beginning in the 1990s and reaching new heights in 2010 because of its size and the interest on the debt. To place the figures in some perspective, during World War I we borrowed $23 billion; during the Depression, another $13 billion, and during World War II, $200 billion. By 2009 the deficit was up to over $1 trillion. The federal government is the only level of government able to borrow more money than it receives. State budgets must be balanced by law. To make matters worse, the interest on the deficit also increases the size of the debt. So, even if the government can reduce the size of the debt over a number of years, it still must repay the interest. Who does the federal government borrow money from? It borrows from

■ trust funds such as Social Security;

■ foreign investors;

■ Federal Reserve banks;

■ commercial banks;

■ state and local governments;

■ individuals who own savings bonds;

■ money market funds in the form of treasury bonds;

■ insurance companies;

■ corporations; and

■ places such as pension funds, brokers, and other groups.

Because the Constitution does not place limits on the extent or method of borrowing, Congress sets limits on the debt. However, the debt limit has been inching upward and, until the passage of the 1993 budget, had not decreased since 1969, the last time the country showed a surplus. By 1997, the deficit was reduced by more than half of what it had been when President Clinton assumed the presidency in 1992. As a result of the Balanced Budget Agreement in 1996, and an economy that showed high economic growth, the 1998 proposed budget eliminated the deficit and actually reflected a budget surplus. This surplus was projected to increase throughout the first decades of the new century. But because of a recession in early 2000, the effects of 9/11, and the impact of the war on terrorism, the surplus vanished, and record deficits returned.

The deficit increased rapidly in the 1980s, caused by a massive tax cut proposed by Reagan and passed by Congress without a corresponding cut in expenses. In fact, the defense budget showed a dramatic increase, while the cost of entitlement programs continued to escalate. Bush made campaign promises to reduce the deficit but became frustrated with the Democratic-controlled Congress, which refused to cut social programs. George H. W. Bush was forced to renege on his “read my lips, no new taxes” pledge made during the campaign in order to get a budget passed. For the country, the consequence of this debt and a runaway deficit was a recession that retarded the rate of economic growth and caused an increase in unemployment and failed businesses. Add to the deficit a huge trade imbalance, and you can understand why Congress has attempted to find ways of setting budgetary limits. During the 1990s, President Clinton, working with the Republican-controlled Congress, signed a balanced budget that led to a surplus in 2000. After George W. Bush’s election, there was a mild economic recession followed by the events of September 11th and the wars in Afghanistan and Iraq. These events, along with one of the largest tax cuts signed into law (by George W. Bush), again led to large deficits. These deficits were made worse after President Obama took office and signed an economic stimulus bill, which he said would help end the economic recession that began in 2008. Deficits were reduced by the end of the Obama administration but increased again during the first two years of the Trump administration.

In 2010 the Congress and president faced mounting pressure from the American people to deal with the nation’s unemployment rate, which was almost 10 percent, and the rising national debt and deficit that was over a trillion dollars. A bipartisan debt commission made a number of recommendations that would have reduced the deficit by dealing with spending and entitlement programs. The Democrats and Republicans have not agreed on a common approach to solve these issues.

Budget Reforms

Attempting to find a way of helping the economy and closing tax loopholes, President Reagan asked Congress to pass the most far-reaching tax-reform measure since the income tax was instituted. Supported by liberal Democratic Senator Bill Bradley of New Jersey, this law called for tax-code changes that would result in a restructuring of tax brackets and eliminating many tax deductions. The law, supported by both Democrats and Republicans, passed in 1986 and succeeded in these two objectives.

The result was that many Americans received a tax cut. And because many loopholes were addressed, it was hoped that additional income would offset the loss of revenue from the tax cut received by the middle class. The law reduced the number of brackets from 15 to 3, it slightly increased deductions for individuals and families, and it eliminated many other deductions. Even though the law succeeded in its objectives, because the expense side of the budget was not kept in check, the deficit still increased dramatically. From 1981 to 1992 the overall deficit quadrupled. However, Clinton’s deficit-reduction programs eliminated the deficit during his administration. By 1998, the federal budget was balanced, and there was an anticipated budget surplus. The political argument then arose as to what should be done with any surplus. Some of the suggested uses for the surplus included reducing the national debt, saving Social Security, decreasing tax rates for all Americans, and increasing spending for government programs. This surplus was short lived.

The Federal Budget

Let us look at some characteristics of recent budgets adopted by Congress.

Money comes from

■ federal income taxes—46 percent;

■ Social Security and payroll taxes—32 percent;

■ corporate taxes—10–15 percent;

■ excise taxes on such as liquor, gasoline, and luxury items—2–4 percent; and

■ customs and duties collected and other sources—2–4 percent.

Money is expended for

■ entitlements (Social Security, Medicare, Medicaid)—40 percent;

■ national defense—16 (mandatory) percent;

■ interest on the debt—10 percent;

■ other mandatory—16 percent; and

■ discretionary spending—20 percent.

By 2016 the total budget had risen to over $3 trillion.

As stated earlier, taxes are the major source of income for federal, state, and local governments. Taxes are recognized as an essential ingredient in the ability of government to provide services to the population. The three types of personal taxes are progressive taxes, regressive taxes, and proportional taxes. They each affect taxpayers in different ways. A progressive tax such as the current federal income tax collects more money from the rich than the poor on a sliding scale. If the government takes an equal share from everybody regardless of income, it is a proportional tax, also called a flat tax. California Governor Jerry Brown suggested this approach during the 1992 presidential campaign. After the 1994 election many Republicans suggested this as an alternative to the present tax structure. A regressive tax such as a sales tax has the poor paying a greater share than the rich. After the 1996 election, some Republicans even demanded the abolition of the Internal Revenue Service as well as called for the implementation of a flat-tax structure.

Yet, governments have few alternatives other than collection of taxes to pay for the services they provide, especially for social welfare programs. The foundation for these programs stems from the grandparent of entitlement, Social Security, which mandates contributory payments in the form of payroll taxes from employers and employees. Part of the payments also go to a Medicare program established as part of the Great Society. Because this program is predicated on forced savings, it differs from other programs such as public assistance programs, which are based on a noncontributory approach.

Finally, if government has these programs, are they making a difference in income distribution? Studies have concluded that despite all the efforts made on the part of federal, state, and local governments, the problem of income inequality still exists.

Universal health care became the battle cry of the Clinton administration. However, the issue had been originally placed on the public agenda by Presidents Truman and Nixon. One would expect that the United States would be a health care world leader. In fact, other countries such as Canada and Great Britain have had universal health care for years. Critics of America’s system pointed to the fact that the United States has a lower life expectancy and higher infant mortality rate than countries providing universal coverage. There are those who state that, even without a universal system, America still spends over 15 percent of its Gross National Product on health. But because of such factors as medical malpractice suits, skyrocketing insurance, and health costs, as well as the loss of coverage for many workers who have changed or lost jobs, the cry for reform was taken up. In addition, it became evident that access to health insurance was closely tied to race and income, with whites, who have higher incomes on average than African Americans, more likely to have coverage.

Even with Medicare and Medicaid, the country still lags behind in dealing with health-related coverage. The Family Medical Leave Act of 1993 gave unpaid emergency medical leave for employees with a guarantee that their jobs would not be taken away in the interim. But what President Clinton hoped would be the benchmark of his administration was the adoption of a national health security plan as extensive as the original Social Security Act. Standing before Congress in 1993, Clinton held up a “Health Security Card” and threatened to veto any health security bill that did not include universal health care as its foundation. The bill itself was well over a thousand pages, and spearheading the drive was First Lady Hillary Rodham Clinton. During the summer of 1994 both houses introduced watered-down versions of Clinton’s bill. However, the legislation remained tied up as a massive lobbying effort took place. The issues of employer mandates, timing, and the extent of the coverage provided kept Congress from acting on the measure. As a result of the Republican electoral victory in the midterm elections, the issue of health care was placed on the back burner. However, in 1996, a health-reform bill guaranteeing the portability of health insurance if a worker left a job was signed into law.

In 2010, President Obama signed historic health-care legislation called the Affordable Care Act of 2010. The opponents of the law called it “Obamacare,” and made the claim that it was a government takeover of the health system. The law’s goal was to fully insure an additional 35 million Americans, reduce the costs of health care, and reduce the federal deficit over a 10-year period. After the law was signed, those who had health insurance policies received additional benefits, such as increased coverage and protection from being dropped from a policy as a result of a preexisting condition. The law was challenged, and in 2012 the Supreme Court ruled it was constitutional. The initial rollout in 2014 had major problems. The government website crashed, making it very hard to sign up. Even though President Obama promised that if you liked your current health care plan, then you could keep it, many Americans were informed that they had to change their policies to comply with the law. Even with these problems, by 2015 over 16.4 million people gained health insurance coverage since the Affordable Care Act became law nearly five years ago. The coverage gains have delivered the largest drop in the uninsured rate in four decades, bringing that rate down to 13.2 percent by the end of the first quarter of 2015. The law was also challenged in 2015. The United States Supreme Court ruled in King v Burwell that tax credits are available to individuals purchasing health insurance on federal and state exchanges. During the first two years of the Trump presidency, the Republican-controlled Congress failed to fulfill their campaign pledge to “repeal and replace Obamacare.” President Trump was able to eliminate the individual mandate, but the law was still in effect as of 2019.

Spotlight on Social Security

To illustrate the point, you have to go only as far as to look at the Social Security System. After its board informed the public of the program’s deficit, Congress began considering ways of saving the system. The National Commission on Social Security Reform had been created in 1983 by President Reagan. Among the commission’s suggestions adopted by Congress were

■ a six-month delay in the cost-of-living index adjustment in July 1983;

■ a rescheduling of previously approved increases in Social Security payroll taxes, which would have the effect of kicking in scheduled increases at a slower rate;

■ a gradual increase in the age when an individual could first receive Social Security benefits (as a result of an increase in life expectancy, it was believed people could also work longer);

■ having federal employees contribute to the Social Security System; and

■ a portion of Social Security benefits being subject to federal taxes for those people with incomes over $20,000.

These reforms resulted in a surplus in the system. The government began borrowing from the reserve, and as a result the system is again in trouble. Projections indicate that by the second decade of the twenty-first century, the Social Security System will not be able to pay everybody who is eligible. A new bipartisan commission was appointed by President George W. Bush in 2001. Its mission was to investigate alternatives and enhancements to Social Security such as partial privatization. The report suggested that the Social Security System would need to be reformed through means testing and included the feasibility of creating privatized Social Security accounts. Congress did not adopt these reforms. One reason Congress refused to pass any legislation dealing with the recommendations was that Social Security was traditionally considered to be “the third rail” of American politics. After President George W. Bush was reelected in 2004, he made Social Security reform his number one legislative priority. He proposed the creation of “Personal Retirement Accounts” for anyone born after 1950. His critics called it privatization.

The proposals were never voted on by Congress and, in 2006, a newly elected Democratic Congress refused to bring it up. In 2010, a new bipartisan debt commission came out with suggestions regarding Social Security and Medicare. The report aimed to make Social Security solvent over 75 years through a number of measures, including smaller benefits for wealthier recipients, a less generous cost-of-living adjustment for benefits, and a very slow rise in the retirement age (from 67 to 68 by 2050; rising to 69 by 2075). It would have expanded over 40 years the amount of workers’ income subject to the payroll tax. The report also recommended capping growth in total federal health spending—everything from Medicare to health insurance subsidies—to the rate of economic growth plus 1 percent. These recommendations were highly controversial, and they were not considered by the newly elected 2010 Congress.

The debate regarding the nation’s debt and deficit in 2012 ignored what was the major contributing factor that contributed to the deficit—the cost of Social Security and Medicare, and the viability of the two programs. Even though these entitlement programs, along with Medicaid, account for almost 40 percent of the federal budget, there has not been any serious action to curb costs, such as extending the age when a senior citizen can get Social Security and Medicare, testing the programs, or increasing the payroll tax limits for Social Security and Medicare.

REVIEW MULTIPLE-CHOICE QUESTIONS

Question Type: Qualitative Analysis Question with a Primary Document

“The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death. The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them. The total of all of these items is your ‘Gross Estate.’ The includible property may consist of cash and securities, real estate, insurance, trusts, annuities, business interests, and other assets.”

—Internal Revenue tax publication 559

1. Which of the following best explains what the IRS is telling taxpayers about the Estate Tax?

(A) The Estate Tax consists of the value of the property when it was originally bought.

(B) The Estate Tax can be paid at any time prior to your death.

(C) The Estate Tax is also called the inheritance tax.

(D) The Estate Tax is imposed on anyone who owns property.

2. Which of the following groups would favor an Estate Tax?

(A) Republicans

(B) Democrats

(C) Libertarians

(D) Farmers

3. What principle does the passage support?

(A) Ideological positions drive government regulation of the economy.

(B) The Federal Reserve could impose rate hikes to increase tax revenue.

(C) The president could eliminate this tax.

(D) The Supreme Court could rule this tax unconstitutional.

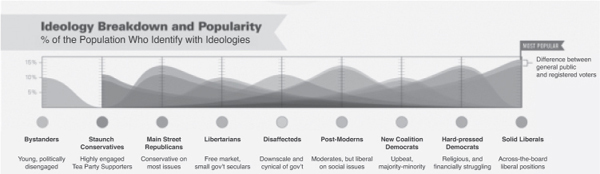

Question Type: Quantitative Analysis Question with an Informational Graphic

4. Based on the information in this graphic which group would most likely identify with capitalism?

(A) Post-Moderns

(B) New Coalition Democrats

(C) Bystanders

(D) Libertarians

5. Based on the information in this graphic, what conclusion can you reach about Main Street Republicans?

(A) They would like to see Roe v Wade overturned by the Supreme Court.

(B) They believe there should be more gun control legislation.

(C) They want Supreme Court justices appointed who are judicial activists.

(D) They favor affirmative action programs for minorities.

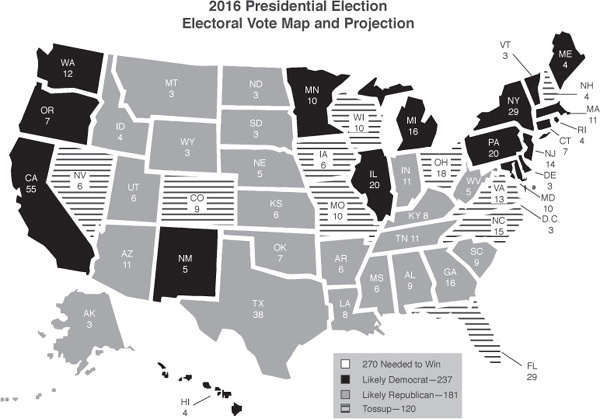

Type of Question: Visual Analysis Using a Map

Source: Freedom Lighthouse

6. Which of the following represents the best polling method used to determine the information on this map?

(A) A landline telephone survey of registered voters

(B) An online survey of Republicans and Democrats

(C) A random sample of the population from each state

(D) A mail-in survey of likely voters

7. Which is a consequence of the results shown in the map?

(A) The election would have to be determined by the House of Representatives.

(B) The election would be determined by ten states.

(C) The Republicans have a popular vote advantage since they have more likely states than the Democrats.

(D) Toss-up states will remain that way through Election Day.

Type of Question: Comparison That Asks for a Similarity or Difference

8. Which is an accurate difference between a Libertarian and a conservative Republican?

|

Libertarian |

Conservative Republican |

(A) |

Supports individual privacy |

Supports government transparency |

(B) |

Opposes death penalty |

Favors death penalty |

(C) |

Supports free-market health care system |

Supports government subsidies for Medicaid |

(D) |

Supports same-sex marriage |

Supports religious liberty |

Question Type: Concept Application and Knowledge Questions That Have a Concept, Process, Policy, or Scenario

9. Which of the following explains the validity of a political poll?

(A) A sample that represents more than half of the people in the population polled

(B) Partisan groups taking and reporting the results of the poll

(C) Complex questions answered by the people polled

(D) A margin of error of those polled under 5 percent

10. Which of the following would a supporter of supply-side economics favor?

(A) Government stimulation of the economy

(B) An increase in the borrowing of money by the government

(C) Management of the economy by the government

(D) Large tax cuts by the government

Answers

1. (C) Choice (C) is the correct answer because when property is transferred after someone dies, another party, usually family, inherits that property if the proper tax is paid. Choice (A) is incorrect because the value of the property is the “gross estate,” which consists of the current value of the property and other assets. Choice (B) is incorrect because the Estate Tax is only imposed upon the death of the property owner. Choice (D) is incorrect because the Estate Tax has to be paid on property worth over $5.6 million.

2. (B) Choice (B) is the correct answer because Democrats believe that taxing real estate worth more than $5.6 million is an ideologically sound position because the wealthy are able to pay this tax. Choices (A) and (C) are incorrect because Republicans are against this tax, which they believe is a double tax. Libertarians are against the tax because they are against the tax system and the IRS. Choice (D) is incorrect because farmers are against this because many farmers own property worth over $5.6 million and do not think it is a fair tax.

3. (A) Choice (A) is correct because advocates of the inheritance tax want to limit a free-market economy, and people opposed to the tax favor a greater free-market economy. Choice (B) is incorrect because even though the Federal Reserve could impose rate hikes, that move would not increase tax revenue. Choice (C) is incorrect because the president does not have the power to eliminate this tax. The president can ask Congress to repeal the tax. Choice (D) is incorrect because Congress has the right to pass taxes.

4. (D) Choice (D) is the correct answer because Libertarians identify themselves with a free market, which is another definition of capitalism. Choices (A), (B), and (C) are incorrect because the info-graphic indicates that these groups identify with other ideologies.