CHAPTER 15

Valuation and Cash Flows (Sungreen A)

At the start of this book, we stated the three key tasks of a CFO are:

- Make good financing decisions.

- Make good investment decisions.

- Don't run out of cash while doing the first two.

Chapters 2 through 4 focused on working capital management, which involves not running out of cash. Those chapters featured a number of tools (sources and uses, ratios, and pro formas). Chapters 5 through 13 then focused on how to make good financing decisions. We discussed M&M (1958, 1961, and 1963), the advantages of tax shields, the costs of financial distress, signaling, asymmetric information, the pecking order theory, and dividend policy.

The current chapter begins our section on how to make good investment decisions. We concentrate primarily on how to do valuation. The idea is to see if expected investment returns are high enough to justify the initial investment and expected risk. As with the prior sections, it may be a little frustrating at first since we are climbing up the knowledge curve, but we believe it will all come together at the end. So here we go.

INVESTMENT DECISIONS

All investment decisions have three major elements:

- The strategic element: Does the project under consideration make economic sense? Does it fit with the firm's business and objectives?

- The valuation analysis: What is the project worth? Is it a good investment from a valuation point of view?

- Execution: How do we bring the investment to fruition? What are the important institutional factors?

Firms should normally consider the strategic element first, but because this is first and foremost a finance text, we will begin with valuation.1

HOW TO VALUE A PROJECT

There are five major ways to value any investment. (Within each of these five there are various iterations, but your authors organize valuation around five “families.”)

- Discounted cash flows (e.g., free cash flow to the firm, free cash flow to equity, APV, EVA, etc.)

- Earnings or cash flow multiples (e.g., P/E, EBIT, EBITDA, EBIAT, etc.)

- Asset multiples (e.g., book value, market to book, replacement value, etc.)

- Comparables (e.g., barrels of oil reserves, ounces of gold, acres of timber, square footage of retail space, population, number of visits to a website, etc.)

- Contingent claims (i.e., an option valuation approach)

We are going to focus on the first four here. We will not cover contingent claims in this book as it requires knowledge of option pricing, which many readers may not have. Contingent claims are also infrequently used to value projects in corporate finance.

Of the five ways to value a project, the one that academics prefer most is discounted cash flows. And, since your authors are both academics, and also prefer this method, it is the method we will start with. There are several discounted cash flow techniques. The one that is used most commonly, and the one with which we will begin, is free cash flows to the firm (FCFf). FCFf is the name of the technique, but it really means free cash flows from the investment project we are evaluating.

Project, Project, Project

An important rule in valuation is project, project, project. That is, use the project's cash flows, the project's capital structure, and the project's cost of capital. This is an important rule and one that is often missed in valuation analysis.

If a firm is considering acquiring another firm or building a new plant, the cash flows included in the valuation are only those related to the new investment or project. It is important not to include any cash flows that are not new (incremental) to the project. In addition, these cash flows must be evaluated at the risk level of the project. This means discounting them at the cost of capital appropriate for the investment. Amazingly, many finance professionals who would never use a firm's cash flows to value a project will, however, incorrectly use the firm's cost of capital to value a project. As we will explain, determining the project's cost of capital means first determining the project's capital structure.

We will explore these issues in more detail in this and the next chapter.

Cash Is King

The first thing to remember when doing valuation is that cash is king. Cash makes you or breaks you. Although accountants talk about earnings, in finance it is cash flows that matters most. Now, earnings are a large part of cash flows, and they absolutely matter, but cash flows dominate earnings. Firms can survive a long time with negative earnings (e.g., Amazon.com lost $3 billion in its first eight years of operations), but they die quickly if they run out of cash. During the dot-com bubble, a dot-com's short-term survival depended on its burn rate (i.e., how quickly the firm used up cash). Very few of the dot-coms ever had positive earnings. In Chapter 1, we noted an old expression, “You buy champagne with earnings, but you buy your beer with cash.” If a firm has positive earnings, everyone can celebrate, but what keeps you going day to day is cash. In sum, valuation is all about cash flows. Earnings only matter in valuation because they are part of cash flows. Different valuation techniques use different definitions of cash flows (e.g., free cash flows to the firm, free cash flows to equity, etc.). To understand the distinction between different cash flows, it is useful to start with a Balance Sheet. Consider the following simple Balance Sheet:

| Balance Sheet | |

| Assets | Liabilities and Net Worth |

| Net Spontaneous Working Capital | Short-Term Debt |

| (Cash + A/R + Inv. – A/P) | Bank Debt |

| Long-Term Assets | Long-Term Debt |

| Equity | |

On the asset side, we have net spontaneous working capital. What is it? It is an unusual term today. Net spontaneous working capital is current assets minus current liabilities, except for those liabilities that are interest bearing.2 This means that current portions of long-term debt, bank debt, interest-bearing notes, and so on are all excluded from net spontaneous working capital. Adding net PP&E to spontaneous working capital equals total assets. This is the left-hand side of the Balance Sheet. On the right-hand side, we have interest-bearing debt (which is total interest-bearing debt, bank, short-term, and long-term debt), and we have net worth (equity).

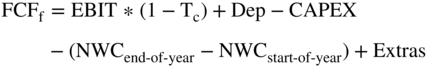

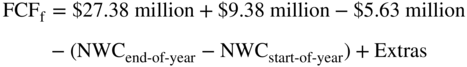

Let's start by considering the cash flows that come from the asset side (i.e., the cash flows that the assets generate). We call the cash flows from the assets side the free cash flows to the firm (FCFf). These include the firm's earnings, plus depreciation, minus its required capital expenditure and then minus (plus) the increase (decrease) in net spontaneous working capital. More formally our formula for free cash flows to the firm (FCFf) is as follows:

where:

- FCFf = free cash flow to the firm

- EBIT = earnings before interest and taxes

- Tc = the average tax rate the firm pays

- Dep = depreciation and amortization

- CAPEX = capital expenditures

- NWCend,begin = net working capital at the end or start of the year

- (net working capital is required cash plus receivables plus inventory minus payables)

- Extras = items such as subsidies (which do not arise in all cases)3

Shortly we will go over each of these components. However, first let us note again that this formula is called the free cash flows to the firm (FCFf).4

We can also calculate the cash flows from the right-hand side of the Balance Sheet. These are the cash flows to debt and the cash flows to equity (and we will discuss each of these later). It is important not to mix up the cash flows from one side of the Balance Sheet and the other. For example, the FCFf does not include interest payments, dividends, debt repayments, and so on. The cash flows from the left-hand side of the Balance Sheet and the cash flows to the right-hand side of the Balance Sheet are two separate concepts. You do not want to mix up the two.

Commercial bankers sometimes make this mistake because they want to look at the cash flows available to the bank. In their credit analysis, they may take the cash flows from the assets minus the cash flows to equity to determine which cash flows are available for the debt holders (i.e., for the bank). This may be the proper way to do credit analysis, but it is an incorrect way to do valuation.

An Example of Valuation: Sungreen Corporation

Let us now introduce Sungreen Corporation, a fictional company, to demonstrate how to value an investment project by generating its free cash flows to the firm and its discount rate.

It is early 2018. Sungreen Corporation is a large forest products and paper firm with 2017 sales of $6.5 billion and net income of $221 million. The firm competes in three businesses: building products, paper and pulp, and chemicals. Sungreen's Income Statements, Balance Sheets, and select other financial information for the past three years are given in Tables 15.1 through 15.3. Analysts classify Sungreen as a “forest products” firm due to the fact that 60% of its 2017 sales and 70% of its operating profits stemmed from the firm's building products division.

TABLE 15.1 Sungreen Corp. Income Statements for the Year Ending December 31

| ($ millions) | 2015 | 2016 | 2017 |

| Net sales | 5,414 | 5,402 | 6,469 |

| COGS | 4,720 | 4,791 | 5,653 |

| SG&A | 327 | 377 | 399 |

| EBIT | 367 | 234 | 417 |

| Interest | 87 | 89 | 77 |

| Profit before tax | 280 | 145 | 340 |

| Tax (35%) | 98 | 51 | 119 |

| Net income | 182 | 94 | 221 |

TABLE 15.2 Sungreen Corp. Balance Sheets as of December 31

| ($ millions) | 2015 | 2016 | 2017 |

| Current assets | 1,417 | 1,449 | 1,516 |

| Net fixed assets | 3,643 | 3,701 | 3,463 |

| Total assets | 5,060 | 5,150 | 4,979 |

| Short-term debt | 257 | 167 | 10 |

| Accounts payable | 552 | 568 | 627 |

| LTD, current portion | 85 | 95 | 95 |

| Long-term debt | 1,487 | 1,618 | 1,523 |

| Other liabilities | 475 | 480 | 482 |

| Owner's equity | 2,204 | 2,222 | 2,242 |

| Total liabilities and equity | 5,060 | 5,150 | 4,979 |

TABLE 15.3 Sungreen Corp. Selected Financial Information

| 2015 | 2016 | 2017 | |

| COGS/Sales | 87.2% | 88.7% | 87.4% |

| SG&A/Sales | 6.0% | 7.0% | 6.2% |

| Current assets/Sales | 26.2% | 26.8% | 23.4% |

| Net fixed assets/Sales | 67.3% | 68.5% | 53.5% |

| Accounts payable/Sales | 10.2% | 10.5% | 9.7% |

| Tax as % of profit before tax | 35% | 35% | 35% |

| Debt/(Debt + common equity) | 45.4% | 45.8% | 42.1% |

| Shares outstanding (millions) | 100.00 | 100.00 | 100.00 |

| Price per share at year end | 30.15 | 36.25 | 37.75 |

| Market capitalization | 3,015 | 3,625 | 3,775 |

| Debt/(Debt + market capitalization) | 37.8% | 34.2% | 30.1% |

| Beta | 1.1 |

The forest products industry, on the whole, responds rapidly and dramatically to changes in the overall economy. Sales and profits of the industries products, such as plywood, are tied to construction activity, which in turn is very sensitive to the economic cycle and to interest rates.

Our main characters are Pat Lahey and Hanna Summers, Chairman and Chief Financial Officer of Sungreen Corporation, respectively. The two are scheduled to meet over lunch to discuss an expansion project for a new paper mill and printing plant to produce wrapping paper.

The Market for Wrapping Paper

Wrapping paper, a colorful and often artistic paper product, is used by consumers mainly to wrap gifts but also as packaging for clothes and toys. Competition between suppliers of wrapping paper is on the basis of price, product design, and the quality of the paper and print. Wrapping paper begins with paper that is produced in special mills from wood pulp. The pulp is usually made from trees classified as softwoods. For wrapping paper, the pulp is bleached before it is turned into paper, and the paper is then coated. Today, environmental concerns require both the paper-making and chemical suppliers to choose bleach and pigments that are environmentally friendly.

Once the design team has chosen a paper design, a machine that engraves the image onto a printing cylinder reads a computer file containing the digitized artwork. Wrapping paper producers have state-of-the-art printing equipment that can apply multiple colors simultaneously and add special finishes like foil, iridescent, pearlescent, and flocked finishes. As the paper emerges from the press, it is rolled onto large rolls and transferred to another part of the factory.

If the wrapping paper is intended for sale to consumers, machines cut and wrap the paper in much smaller rolls or fold it into flat packages for sale. Rolls of gift wrap are shrink-wrapped immediately with preprinted clear wrap bearing the manufacturer's information and price. Flat packages are also wrapped and sealed. Both types of wrapping paper are bulk-packed in cartons for shipment to card shops, department stores, and other retail outlets.

The wrapping paper industry is seasonal, with approximately 60% of sales in the second half of the calendar year. Since gift giving, and especially the use of high-quality gift wrap, is something of a luxury, the wrapping paper industry's performance is also tied to the overall economy. Consequently, prices for wrapping paper have historically been quite volatile, with annual volatility ranging from 10% to 15%. At the same time, the wrapping paper industry is much less cyclical than the building products industry. This is mainly because in periods of high interest rates, new housing starts can be brought practically to a halt, but gift giving and the packaging of consumer goods does not stop.

Producers and analysts expected 2019 to be healthy for the wrapping paper industry. Strong demand, limited supply, and limited new capacity are expected to cause the industry to operate at nearly 100% utilization. Given that a high percentage of costs in the industry are fixed, high operating rates mean high profits.5 Wrapping paper sales were predicted to rise nearly 7% as real GNP and consumer demand strengthened with the economic recovery. Much of the measured sales increase was due to an expected inflation of 5%. Yet, only 1–2% of new capacity was expected to become available before the end of 2021. Wrapping paper makers would therefore have to operate at historically high levels of production, with operating rates expected to be stable at around 96% (operating 350 days a year). Wrapping paper prices were expected to rise from $740 per ton in 2004 to $882 by the end of 2023.

Sungreen's Interest in Wrapping Paper

Sungreen's intention to add wrapping paper capacity was well known in the paper and pulp industry. The firm's existing Toledo, Ohio, wrapping paper mill produced 780 tons of blank wrapping and tissue paper per day. This was a small percentage of domestic capacity, meaning Sungreen would share in only a small way in the expected healthy growth of the wrapping paper market. More importantly, Sungreen did not produce enough blank paper for its own printing presses and was the only major paper producer that was a net buyer of blank paper. Sungreen purchased some 150,000 tons of blank wrapping paper each year from competitors to feed its printing plants. Given the current tight market, blank wrapping paper could become available only at very high prices and could even become unavailable. Sungreen's printing plants might be forced to turn away orders, and the printing division's profits could be eroded.

Sungreen had studied possible remedies. The firm began by surveying and rating (A, B, or C) the existing U.S. wrapping paper mills depending on capacity, age, and so on. Unlike business school student grades, many received a C. Lahey called the owners of the 11 A-rated mills, testing whether they had any interest in selling their mills. None were interested.

In early 2018, Lahey became aware that the Continental Group, Inc. was interested in selling a package including three of its paper mills, with a combined capacity of over 1.1 million tons per year (or 3,143 daily tons), which was about four times Sungreen's existing capacity. However, Sungreen lost the bid to Cyperus Corp. (also fictional), whose product line consisted almost exclusively of wrapping and tissue paper. David Stone, Cyperus's chairman and CEO, summarized the deal:

The three mills were purchased for around $288,000 per daily ton, excluding working capital and without assigning any value to the printing plants included in the deal. This represents about 80% of the cost of building new capacity, which, if started today, could not become operational in less than a year nor be built for less than $360,000 per daily ton.

Building New Capacity

After being unable to find a suitable mill and plant to buy, Mr. Lahey asked Ms. Summers to run the numbers to determine whether it was worth building a new paper mill and printing plant. The idea was to build a plant with a capacity of about 350,000 annual tons (or 1,000 daily tons times 350 days of operations). Part of the output would be transformed into finished wrapping paper at a new, state-of-the-art printing plant, and Sungreen's current printing plants could utilize the rest. The expected cost (budget) was $410 million ($330 million for the mill, $45 million for the printing plant, and about $35 million for working capital requirements). The new mill and plant would be located in Kingsport, Tennessee. The construction contract required the full payment once the plant was operational, which was expected at the start of 2019.

Ms. Summers's first goal is to project future cash flows. How many years of future cash flows should she project? The easy answer is: as many years as there are good forecasts. If a firm provides projections for five years, then the analyst should use five years. A five-year projection is somewhat standard, but it really depends on the nature of the project and what can be reasonably predicted. Regardless of the time period selected, there is a terminal point at which some type of steady state (constant, steady increase, or steady decrease) must be assumed. The value at that point is called the terminal value.

What data does Sungreen need to forecast the free cash flow to the firm? From our earlier equation, our definition of free cash flow to the firm is:

So we need to forecast each of these variables. They can be derived from the pro forma Income Statements and Balance Sheets.

Tables 15.4 and 15.5 show the pro forma Income Statements and Balance Sheets prepared by Hanna Summers' staff for Kingsport's mill and printing plant. They are for the next five years, ending with 2023. After 2023, her staff expected sales of the mill and the plant to grow at the rate of inflation, which was forecasted to be 3%. After 2023, they also projected net working capital to grow in line with sales and for CAPEX to equal depreciation. Other assumptions are listed in the pro formas and at the end of Table 15.5.

TABLE 15.4 Sungreen's Projected Income Statements for Kingsport

| ($ millions) | 2019 | 2020 | 2021 | 2022 | 2023 |

| Sales | 259.00 | 271.95 | 285.54 | 296.97 | 308.85 |

| Cost of goods sold | 186.48 | 195.80 | 205.59 | 213.82 | 222.37 |

| Gross profit | 72.52 | 76.15 | 79.95 | 83.15 | 86.48 |

| Selling and distribution (11%) | 28.49 | 29.91 | 31.41 | 32.67 | 33.97 |

| Depreciation PP&E+CAPEX/40 | 9.38 | 9.28 | 9.21 | 9.17 | 9.14 |

| Operating profit | 34.66 | 36.96 | 39.33 | 41.31 | 43.37 |

| Interest expense (4.48% * Debt) | 4.13 | 4.11 | 4.10 | 4.10 | 4.11 |

| Profit before tax | 30.53 | 32.85 | 35.23 | 37.21 | 39.26 |

| Income tax 21% | 6.41 | 6.90 | 7.40 | 7.81 | 8.24 |

| Net profit | 24.12 | 25.95 | 27.83 | 29.40 | 31.02 |

TABLE 15.5 Sungreen's Projected Balance Sheets for Kingsport

| ($ millions) | 2019open | 2019end | 2020 | 2021 | 2022 | 2023 |

| Cash | 0 | 0 | 0 | 0 | 0 | 0 |

| Receivables (13% sales) | 33.00 | 33.67 | 35.35 | 37.12 | 38.61 | 40.15 |

| Inventory (12% sales) | 30.00 | 31.08 | 32.63 | 34.27 | 35.64 | 37.06 |

| PP&E (Open – Dep. + CAPEX) | 375.00 | 371.25 | 368.47 | 366.62 | 365.70 | 365.70 |

| Total assets | 438.00 | 436.00 | 436.45 | 438.01 | 439.95 | 442.91 |

| Accounts payable (11% sales) | 28.00 | 28.49 | 29.91 | 31.41 | 32.67 | 33.97 |

| Debt (set at 22.5% of D+E) | 92.25 | 91.69 | 91.47 | 91.49 | 91.64 | 92.01 |

| Equity (set at 77.5% of D+E) | 317.75 | 315.82 | 315.07 | 315.11 | 315.64 | 316.93 |

| Total liabilities and equity | 438.00 | 436.00 | 436.45 | 438.01 | 439.95 | 442.91 |

Key assumptions for 2019–2023:

- 2019 sales are set at an annual output of 350,000 tons times at a price or $740 per ton. Prices are increased by 5% in 2020, 5% in 2021, 4% in 2022, and 4% in 2023 (to $882 at the end of 2023).

- Cost of goods sold is projected to be 72% of sales.

- Selling and distribution costs are projected to be 11% of sales.

- Depreciation on the plant and mill is assumed to be straight line over 40 years. This is calculated as the opening balance in PP&E divided by 40.

- CAPEX is set at 60%, 70%, 80%, 90% and 100% of Depreciation from 2019 through 2023. Depreciation is increased each year by the prior year's CAPEX divided by 40.

- Interest expense is 4.48% (explained in the next chapter) of the prior year-end debt.

- An income tax rate of 21% is expected.

- Cash is set to zero for simplicity (since this is a plant, a line of credit could fund all its cash requirements).

- Accounts receivable are projected to be 13% of sales (while technically accounts receivable would start the year at $0, they would be at the year-end level midway through the second month, so for simplicity we assume the amounts at the start of the year).

- Inventory is projected to be 12% of sales (with constant sales, this amount would be required at the start of the year).

- The plant is expected to open in early 2019. Once the plant and mill are up and running, payables are expected to be 11% of sales.

- The debt level is set at a constant 22.5% of debt and equity. Why we chose that percentage will be discussed in the next chapter.

- Equity is the opening balance plus net income minus dividends. Dividends are set to keep equity at a constant 77.5% of debt plus equity.

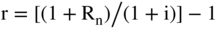

Nominal or Real Cash Flows

Cash flows can be discounted using nominal or real discount rates. Most people use nominal rates, which are the rates quoted in the financial press. Nominal rates include both the real return and a return for expected inflation. By contrast, real rates exclude inflation. For example, if a bond is earning a nominal yield of 6% and inflation is 4%, then the real rate of return is approximately 2%.

The relationship between the two rates can be formulated as follows:

where

- r = the real rate,

- i = inflation rate, and

- Rn = the nominal rate

Today, it is common to calculate nominal discount rates and therefore use nominal cash flows. Historically, firms sometimes used real cash flows, in which case, to be correct, they needed to use real discount rates. The reverse is also true. If a firm uses nominal discount rates, then it must use nominal cash flows. If a firm uses real discount rates (i.e., rates excluding inflation), then it must use real cash flows.

To repeat, the typical (vast majority) of valuation today is done using nominal cash flows and nominal discount rates (i.e., nominal, nominal). This occurs because we normally use market rates for the cost of debt and equity, and market rates are nominal. To get a real rate would require taking the market rate and adjusting it for inflation.

Additionally, when projecting cash flows, it is often better to project nominal cash flows, which include inflation. Why? Nominal cash flows include the projection of prices and costs at their expected future values. This makes nominal cash flows more precise (albeit with more chance of errors). If different items on a firm's Income Statement grow at different rates (e.g., labor rates grow at 3% because of a long-term contract, while oil costs grow at 7%), these differences can be more easily incorporated into the valuation with nominal cash flows. When using real cash flows, adjusting for different growth rates is more complex and is rarely done.

Calculating the Elements of Free Cash Flow to the Firm

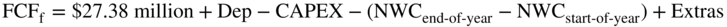

From above, the free cash flow to the firm formula is:

Starting with estimated Earnings before Interest and Taxes (EBIT), we adjust for our estimated taxes to calculate EBIT * (1 – Tc). Which tax rate should we use, the marginal rate or the average rate? We use the average rate because we want the average cash flows available. Note, for corporations, the average and marginal are usually very close (unlike the rates for individuals). The average tax rate here, as noted in Table 15.4, is 21%. Reducing EBIT by the tax rate gives us EBIT * (1 – Tc) or Earnings before Interest After Taxes (EBIAT).

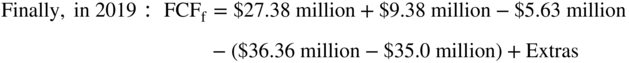

Since EBIT in 2019 is forecasted at $34.66 million (EBIT is operating profit), then EBIT * (1 – Tc) is $27.38 million ($34.26 * (1 – 0.21)).

So,

An aside: This calculation has an implicit assumption that the EBIT is positive. If the EBIT is negative, there is no tax shield unless the firm has other income. In other words, there is no benefit from a tax shield if the firm pays no tax. This seemingly minor point is important: tax shields only work if a firm pays taxes.

For example, imagine you decide to do a project in your garage with expenditures of $1 million a year for the first five years and no revenue. Thus, you will have a loss of $1 million a year for each of the next five years. Now, imagine that Microsoft decides to start the same project in its lab, and its cash flows are the same negative $1 million a year for the first five years. Is there any difference between you and Microsoft when it comes to cash flows? Absolutely. Microsoft will almost certainly be able to write off the $1 million annual cost of the project against other corporate income. This means their loss before tax of $1 million is an after-tax loss of $790,000 ($1 million * (1 – Tc) after taxes, assuming a 21% tax rate). In other words, both you and Microsoft may have the same cash flows before tax, but very different cash flows after tax. Even if you will be able to obtain the tax savings from profits at some point in the future (assuming you have future income), the present value of the cash flows is very different.

After computing EBIT and adjusting for taxes, the next item in our cash flow formula is depreciation. Depreciation expense, as shown in Table 15.4, is calculated by reducing the investment of $375 million in the plant and mill evenly over its expected life (in this case, 40 years). The depreciation in 2020 and later years must be increased by each year's additional capital expenditures (CAPEX). (We will make the assumption that additional capital expenditures are also depreciated in a straight line over 40 years.)

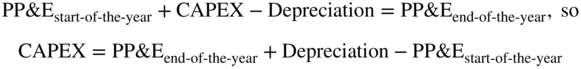

Unfortunately, neither Table 15.4 nor Table 15.5 provides the amount of estimated CAPEX for future years. We are making an assumption that CAPEX goes from 60% to 100% of Depreciation, in equal increments, over the years 2019 to 2023. We require this number both to complete our depreciation estimates and as the next item in our cash flow formula. How do we calculate CAPEX from pro forma financial statements? We calculate it from the following accounting relationship: the change in net fixed assets equals CAPEX minus depreciation. Or the change in net fixed assets plus depreciation equals CAPEX. That is:

A simple explanation for this formula was previously discussed in Chapter 3 in our pantry example. Assume you had $100 in groceries in a pantry at the beginning of the week. You consume (eat) $70 of groceries during the week. If you purchased nothing during the week, you would have $30 of groceries in the pantry. However, if you consumed $70 of groceries during the week but ended the week with $80 of groceries in the pantry, it means you must have purchased $50 of groceries during the week. the analogy is as follows: the $100 of groceries in the pantry at the beginning of the week is opening PP&E. The $80 in groceries at the end of the week is ending PP&E. The $70 of groceries you eat during the week is your depreciation. The $50 you spent at the store during the week is CAPEX.

Table 15.6, which is generated using the assumptions listed earlier, computes the pro forma CAPEX for the Kingsport project from 2019 through 2023:

TABLE 15.6 Sungreen's Pro Forma New Working Capital CAPEX Kingsport

| ($ millions) | 2019 | 2020 | 2021 | 2022 | 2023 |

| PP&E end | 371.25 | 368.47 | 366.62 | 365.70 | 365.70 |

| Dep | 9.38 | 9.28 | 9.21 | 9.17 | 9.14 |

| PP&E open | 375.00 | 371.25 | 368.47 | 366.62 | 365.70 |

| CAPEX | 5.63 | 6.50 | 7.37 | 8.25 | 9.14 |

| CAPEX is set at | 60%dep | 70%dep | 80%dep | 90%dep | 100%dep |

Thus, our free cash formula for 2019 is as follows:

The last required item to calculate the free cash flow to the firm is the change in net working capital (shown in Table 15.7). Increases in net working capital are just like capital expenditures: a firm funds an increase in net working capital (cash plus receivables plus inventory less payables),6 and this decreases the free cash flow to the firm. This is no different from an increase in CAPEX. A reduction in net working capital increases the cash flow to the firm. Thus, we must determine net working capital for each year and then calculate the change from year to year. (If net working capital stays the same each year, there is no change in net working capital and thus no effect on the firm's cash flows.)

TABLE 15.7 Sungreen's Pro Forma Net Working Capital Kingsport

| ($ millions) | 2019open | 2019end | 2020 | 2021 | 2022 | 2023 |

| Receivables | 33.00 | 33.67 | 35.35 | 37.12 | 38.61 | 40.15 |

| Inventory | 30.00 | 31.08 | 32.63 | 34.27 | 35.64 | 37.06 |

| Payable | 28.00 | 28.49 | 29.91 | 31.41 | 32.67 | 33.97 |

| Net working capital | 35.00 | 36.26 | 38.07 | 39.98 | 41.58 | 43.24 |

| Change | 1.26 | 1.81 | 1.91 | 1.60 | 1.66 |

Let's now look at Sungreen's net working capital year by year. The mill and plant are due to come online at the beginning of 2019. Net working capital at the beginning of the year is $35 million. Why? This is the inventory and the related payables required to run the plant. Receivables would technically start at $0 and grow with sales. They would be at year-end level by the middle of the second month—so for simplicity, they are assumed at the start as well.

If opening net working capital in 2019 is $35.0 million, what is it at the end of 2019? The numbers, presented in Table 15.7, are taken from the projected Balance Sheets in Table 15.5. At the end of the year, the firm is expected to have $33.67 million of receivables plus $31.08 million in inventory less $28.49 million of accounts payable for a net working capital position of $36.26 million ($33.67 + 31.08 – 28.49).7 Working capital began the year at $35 million and ended the year at $36.26 million. This is an increase of $1.26 million during the year. The firm has to fund this increase in working capital, which means it is a reduction from the free cash flow to the firm.

Putting All the Elements Together

Using the data from Tables 15.5, 15.6, and 15.7 allows us to compute the free cash flow to the firm for the Kingsport mill and plant as shown in Table 15.8. Remember that we are using the term free cash flows to the firm technique, but really mean the free cash flows to the project (i.e., to the new Kingsport mill and plant).

TABLE 15.8 Sungreen's Pro Forma Free Cash Flows to the Firm Kingsport

| ($ millions) | 2019 | 2020 | 2021 | 2022 | 2023 |

| Earnings before interest and taxes | 34.66 | 36.96 | 39.33 | 41.31 | 43.37 |

| (1 − Tc)= 1 − 0.21 | 0.79 | 0.79 | 0.79 | 0.79 | 0.79 |

| EBIT*(1 − Tc) | 27.38 | 29.19 | 31.07 | 32.64 | 34.26 |

| Plus depreciation | 9.38 | 9.28 | 9.21 | 9.17 | 9.14 |

| Less CAPEX | (5.63) | (6.50) | (7.37) | (8.25) | (9.14) |

| Less increase in working capital | (1.26) | (1.81) | (1.91) | (1.60) | (1.66) |

| Free cash flow to the firm | 29.87 | 30.16 | 31.00 | 31.96 | 32.60 |

This is not magic. There is nothing hidden here, nothing up our sleeves. The underlying numbers in Table 15.8 result from generating Kingsport's pro forma Income Statements and Balance Sheets as described above.

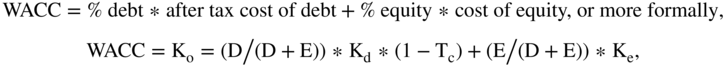

THE WEIGHTED AVERAGE COST OF CAPITAL (WACC)

Once we compute the free cash flows, our next question is: What are these future cash flows worth today? More specifically, are Sungreen's future cash flows from Kingsport more or less than the purchase price (or construction cost)? To answer this question, we must discount the cash flows, and to do that we need a discount rate. We will introduce how to get a discount rate in this section, but we will wait until the next chapter to do it in detail. Discount rates depend on the cost of capital and can be quite complex. As such, we believe the subject is best handled in depth in its own chapter.

Note, we are using the free cash flows to the firm for the Kingsport mill and plant. These cash flows must be discounted at the cost of capital for the Kingsport mill and plant using its expected capital structure, not at the cost of capital for Sungreen as a whole. This is a key concept and one that is often missed in valuation analysis, as previously noted. It is incorrect to value the Kingsport mill and plant cash flows using Sungreen's cost of capital. The rule is project, project, project. That is, use the project's cash flows, the project's capital structure, and the project's cost of capital.

Now, the cash flows to the firm represent the cash flows from the left-hand side of the Balance Sheet. They are the cash flows from the assets and are labeled “free cash flows to the firm” (FCFf). They will go to the debt holders and equity holders (i.e., the suppliers of capital). Cash flows to the firm need to be discounted at a discount rate for the firm (or project). Cash flows just to equity are discounted at the cost of equity, and cash flows to debt are discounted at the cost of debt. However, when using the cash flows to the firm, the discount rate is the blended cost of debt and cost of equity. This blended rate is called the weighted average cost of capital, or WACC.

The cost of capital should reflect two things:

- The risk of the cash flows

- The cost of the funds in the capital market

We want a discount rate that reflects the risk of the cash flows and also what the capital market will charge the firm for the capital. Most of the time, what the capital market charges to fund a project is equal to the risk of the project's cash flows. However, this is not always the case because sometimes the capital market rate includes a subsidy or something else (i.e., in some states of the world, the market charges a rate that is different from the real risk). For our purposes right now, we will assume the market rate fully reflects the project's risk (we will relax this assumption later in Chapter 17).

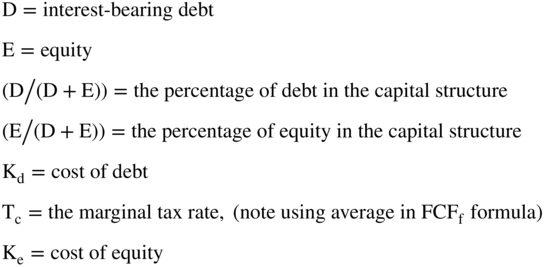

The formula for the weighted average cost of capital (WACC) is as follows:

where:

So to determine the WACC, we need to determine its components. That is, we have to define the “weights and rates.” We will estimate these components in great detail in the next chapter.

TERMINAL VALUES

Are we done with valuing the project once we've calculated the free cash flows to the firm and discounted them to the present year? Not quite, since Table 15.8 only provides the projections for the first five years. We still have to compute the value of the cash flows for 2024 and beyond. However, we don't try to project cash flows out forever. Instead, we calculate a terminal value, which is supposed to capture the value of all the cash flows from that point forward. How do we do this? There are a number of techniques to compute terminal values. The most common are:

- Perpetuity formulas

- Earnings multiples

- Asset multiples

Whoa, that looks familiar. If you recall, we said at the start of this chapter that there are only five ways to value an asset: discounted cash flows, earnings multiples, asset multiples, comparables, and contingent claims. All five methods are also used to calculate terminal values, but the first three are the most commonly used.

Just as we started with discounted cash flows above, let's begin with the perpetuity formula, which is a variation on discounted cash flows. What's the perpetuity formula?

where:

- k = the discount rate

- g = the growth rate of future cash flows

This formula is used in finance, but it is really driven by mathematics. Let's first assume there is no growth, that is, g = 0. If the expected annual cash flow is $1,000 forever and the annual discount rate, k, is 10%, then the value of the perpetuity is $10,000 ($1,000/10%). This makes sense because if we invest $10,000 at an annual rate of 10% today, we expect to get $1,000 a year now and each year after that.

It is important mathematically (and financially) that if you invest $10,000 today, you have to wait an entire year to receive the $1,000 return. The key point is that the perpetuity terminal value formula gives the present value today of all future cash flows starting one year from today.

Cash flows may not always stay constant, however. For example, cash flows are normally expected to grow with inflation (remember that we are using nominal cash flows and a nominal discount rate). But, remember, the perpetuity formula takes the cash flows one year in the future and brings it back to today. So if the $1,000 cash flow is expected to grow at 5% a year forever, the cash flow one year from today is $1,050. Mathematically, the formula takes the terminal year's cash flow and grows it by g. Thus, in our example, we would use $1,050 in the numerator, not $1,000.8 Then we have to discount this by the cost of capital (k) minus the growth rate (g) in the future cash flows.

Returning to Sungreen, and its terminal value estimation, we start with its expected growth. Lahey's finance staff expects sales from the Kingsport mill and plant to grow at the rate of inflation after 2023, which is forecast at 3%. Net working capital is projected to grow in line with sales after 2023, and CAPEX is assumed to equal depreciation. Operating margins are assumed to remain unchanged, and tax rates are expected to remain constant at 21%. Using these assumptions, we assume that the growth rate for FCF after 2023 is 3%.9

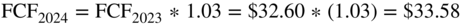

Following our earlier discussion, the free cash flow in the terminal year 2023 is $32.60 but grows by 3% to $33.58 in 2024. That is:

Using the formula for a growing perpetuity, the terminal value at the end of 2023 is:

where:

- k = the discount rate

- g = the growth rate

- TV2023 = $33.58/(k – 3%)

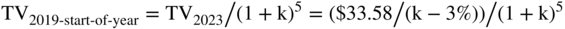

This is the terminal value at the end of 2023. However, we need the present value at the time of the start of 2019, so we must take the 2023 terminal value and discount it back to the start of 2019:

The one remaining variable to solve the growing perpetuity terminal value (and to discount the free cash flows for the first five years) is the discount rate k. When we are using the FCFfirm technique, the discount rate is the WACC, which is the focus of the next chapter.

What about the other ways to compute a terminal value? As stated above, the methods to determine the terminal value are the same five methods used for valuation (discounted cash flows, earnings of cash flow multiple, asset multiples, comparables, and contingent claims). We will drill down on terminal value in Chapter 17.

SUMMARY

This chapter began by listing the five primary valuation techniques. We then presented one of the techniques—discounted free cash flows to the firm—in detail. We introduced Sungreen Corporation and its decision about whether to build a new mill and printing plant in order to show how to calculate the free cash flows to the firm (project). The free cash flows to the firm were generated using pro forma Income Statements and Balance Sheets.

We next briefly introduced how to estimate the cost of capital, which is then used as the discount rate in valuing the free cash flows. Finally, we introduced the various techniques used to calculate terminal values. These last two points (cost of capital and terminal values) were not covered in as much detail as the free cash flows. Thus, if the reader is less at ease about these parts of valuation, that is to be expected.

Coming Attractions

In the next chapter, we will use Sungreen to calculate the cost of capital and terminal value. In subsequent chapters, we will return to all three pieces (cash flows, WACC, and terminal values) in more depth.