The liability for end-of-service-life objects and materials (‘waste’) is with the last owner, for consumer goods – toys – often municipalities. By defining waste as ‘objects without positive value or ultimate liable owner’, policies introducing an Extended Producer Liability which includes objects at the end of their service life would create an individual rather than collective accountability for waste. Changes in taxation, carbon credits and jumps in technology could further promote the circular industrial economy.

7.1 Extended Producer Liability (EPL): closing the invisible liability loop

The centre of the circular economy is YOU, the policymaker:

- If you introduce policy instruments, which oblige producers and sellers to take back their goods if they have no positive value and no liable owner at the end of the service-life, then you are boosting the circular industrial economy. The same is true if you create legal instruments obliging producers and sellers of materials to buy-back or take-back their used materials and to recover pure atoms and molecules to be remarketed.

The sustainability impact of the circular industrial economy can be greatly enhanced by closing the invisible liability loops both for objects and materials (Figure 7.1), in addition to closing the physical loops of objects in the era of ‘R’ and of molecules in the era of ‘D’.

Figure 7.1 Extended Producer Liability: closing the immaterial and invisible liability loop

In the linear industrial economy, liability for the use of objects lies with the user-owner of goods. Weapon manufacturers maintain that guns do not kill, the person pulling the trigger does. But this manufacturer strategy of the linear industrial economy, to limit producer liability after the point of sale to short warranty periods, has started to fade in the second half of the twentieth century. Nestlé was accused of ‘potentially harming babies’ by selling milk powder in less developed countries without detailed instructions on how to prepare drinks using infant formula; the tobacco industry was accused of killing smokers and even passive smokers through its products; and the asbestos industry of causing the death of workers having produced or worked with asbestos cement goods, even decades after the end of the production. The movement could now spread to services, such as the gambling industry and even, in the eyes of some people, ‘social media as the new cigarette’. This could herald tougher legislation and punitive fines for producers, especially in the United States.

Yet this development is less revolutionary than it may sound. It continues the philosophy of the 1976 US Resource Conservation and Recovery Act, the 1980 US Superfund legislation and the Polluter Pays Principle (PPP), which was first mentioned in the OECD recommendation of 26 May 1972 and reaffirmed in the recommendation of 14 November 1974. It makes the party responsible for producing pollution also responsible for paying for the damage done to the natural environment. In 2003, European policymakers imposed an Extended Producer Responsibility (EPR) on manufacturers and importers of electronic and electric objects (EU 2003). But this EPR is only financial, typically a small fee added at the point of sale. The responsibility for the end-of-service-life can be delegated to third party waste managers. But as the latter have no access to producer knowledge and lack the expertise – or by contractual obligations are not allowed – to exploit the highest value conservation option of reusing components or materials, they aim for the cheapest recycling or disposal methods, thus waiving the opportunities in Figure 5.2.

As a result, only few electrical and electronic equipment (EEE) producers have changed their industrial design priorities or installed buy-back strategies to recover goods, components or molecules for reuse.

7.2 Objects: EPL and Ultimate Liable Owners in the era of ‘R’

The present policy framework of the circular industrial economy, such as the EU’s Circular Economy Package, aims to close the highly visible material loops of the era of ‘R’. It misses a major driver to reach sustainability by closing the liability loop through an Extended Producer Liability.

Defining waste as ‘objects without positive value or ultimate liable owner’ opens up:

- industrial solutions – use materials with inherent value, such as gold or copper, to give used objects a positive value – and;

- policy solutions – define the original producer as the Ultimate Liable Owner.

Closing the liability loop means that goods with no value at the end of their service-life can be returned to their producer as Ultimate Liable Owner (ULO).The author has derived the concept of the ULO from that of the Ultimate Beneficial Owner (UBO), which was introduced in the United States in the 1980s to reduce tax evasion through chain ownerships of companies in tax havens.

An Extended Producer Liability will give producers strong incentives to prevent future liabilities by designing goods for maximum end-of-service-life value and minimum liability. Extended Producer Liability furthermore puts manufacturers selling goods on a level playing field with economic actors selling goods as a service that already retain the ownership and liability of their objects and materials over the full service-life.

The objective of the circular industrial economy is to maintain the highest value and utility of manufactured objects, for instance through reuse and service-life extension strategies. A number of developments could accelerate the introduction of an Extended Producer Liability, such as:

- if the objective of law is to protect victims, and considering the digitalisation of the economy and the absence of a liable ‘owner-user’ in smart goods, an Extended Producer Liability for systems would protect users (consumers) and the environment;

- if the objective is to achieve zero waste, the producers of manufactured objects, who designed and produced them and whose name or code is shown on the product, know best how the object was constructed, what materials were used, how the objects can be dismantled and materials reused. In addition, the producer controls the value added and distribution chains, fixes the sales price and can internalise the end of life costs into the price at the point of sale. Producers are thus the logical ‘Ultimate Liable Owners’ of their objects.

Applying an Ultimate Liable Owner responsibility to tools – manufactured objects used by economic actors to create revenue (such as machine tools, commercial vehicles, production equipment) – reinforces the owner’s present responsibility for end-of-service-life costs and his economic interest in achieving the highest reuse value by selling:

- components suitable for remanufacture, e.g. bearings, to the original equipment manufacturer (OEM);

- materials suitable for molecule recovery, e.g. ferrous and non-ferrous metals, to resource managers; or

- buildings, or the land on which they stand, to a developer.

Applying an Ultimate Liable Owner responsibility to toys – manufactured objects owned and used by individuals – changes the present responsibility for end-of-service-life costs (collection and disposal) with municipalities or recyclers. For toys that have a negative value, municipalities and nation states today become the waste owners and managers of last resort. Typical examples are abandoned objects in municipal waste streams and plastic in the oceans.

Toys is where the concepts of Extended Producer Liability and Ultimate Liable Owner will bite most; they will give producers a strong incentive to avoid a liability for future products. However, the concept of Extended Producer Liability will only tackle the legacy problems, such as plastic in the oceans, if applied retroactively, similar to the tobacco and asbestos cases.

7.3 Materials: EPL and Ultimate Liable Owners in the era of ‘D’

The objective of the circular industrial economy is to maintain the highest value and purity of stocks of atoms and molecules. But the objective of traditional end-of-pipe recycling activities is to minimise recyclers’ costs, not to retain the highest material value for society. This clash between micro- and macro-economic optimisation today leads to substantial macro-economic losses, despite high recycling rates. In Sweden, a recent report with a value perspective on material recycling (Material Economics 2018) analyses the use of materials in the Swedish economy in monetary terms instead of tonnes and cubic metres. Aluminium and steel recycling rates of 85 per cent (measured in tonnes), compare with retained value rates of 40 per cent (measured in SEK) after one use cycle. For plastics, a recycling rate of 53 per cent in tonnes compares with a retained value rate of 15 per cent. The report seeks to answer questions such as: For each 100 SEK of raw material entering the Swedish economy, how much value is retained after one use cycle? What are the main reasons that material value is lost? What measures could retain more materials value, and how much could be recovered? What business opportunities arise as a result?

An Extended Producer Liability, defining waste as materials without positive value or Ultimate Liable Owner, would give producers of manufactured materials, such as metal alloys and polymers, strong incentives to design molecules, which can be identified and recovered through sorting technologies, in order to maintain a positive value and prevent future liabilities.

Note that the concepts of Ultimate Liable Owner and Extended Producer Liability will not solve the problem of molecules ending up in ‘free’ waste dumps, such as the atmosphere (CO2 and other GHG emissions), oceans (micro plastic and toxic chemicals) and space (abandoned satellites and spacecraft). This problem, known as ‘Tragedy of the Commons’ (Hardin 1968), today also embraces natural capital, biodiversity, biogenetics and society’s knowledge pool and demands international political action.

7.4 Labour in the circular economy: a suitable case for research

Few research studies or publications have looked at the impact of time on production factors (Giarini and Stahel 1989).1 An obvious obstacle to research in this topic is time itself: how to analyse the labour input in the use of an automobile over 30 years, for example, for a PhD thesis? By the time the student has finished his thesis, he has nearly reached the age of retirement. Many fleet managers use equipment over long periods of time – witness the B52 bombers from 1952, or the 30-year-old Airforce One – but may not keep the data over the full service-life. Railways typically delete service-life data of rolling stock after each general overhaul to ‘as good as new’ condition. As a result, data that could be used to justify political decisions in favour of a shift to a circular industrial economy is rare and can easily be ignored as not representative.

This aspect of research will gain in importance in the future with the shift to long-life technologies, sketched in Section 10.2.

One existing analysis of total expenses – total monies spent excluding fuel and insurance – over a service-life period of 30 years was done by the author for his car (Bierter et al. 1999; Figure 7.2).2 As could be expected, the factory’s share continuously diminishes, whereas the share of labour costs constantly increases:

- from 18 per cent after ten years,

- to 34 per cent after 20 years, and

- 48 per cent after 30 years.

Figure 7.2 Analysis of the running costs of a car over a 30-year period

An extended service-life of objects thus clearly corresponds to a substitution of local labour for energy and materials consumed in production. Other cost factors, such as oil and parts, remain relatively constant. Not taxing labour would thus make service-life extension activities more competitive. The car is still in use today, especially for oldtimer events; it can be expected that labour costs will reach a glass ceiling around 75 per cent of total costs.

In this case – a Toyota produced in Japan, used and serviced in Switzerland – service-life extension also means that Swiss car mechanics have replaced Japanese factory workers.

7.5 The role of policy and labour taxation

Policymakers are struggling with a number of global problems, which are grouped under the umbrella of Sustainable Development Goals (SDG). Defined by the United Nations in 2015, 17 global goals cover a broad range of social and economic development issues.

Through the circular industrial economy’s characteristic of high-labour but low carbon and low-resource input, and its strong reliance on small and medium-size decentralised enterprises, policies to promote the circular industrial economy contribute to many of the SDGs in a holistic way. To appreciate the contribution of the circular industrial economy to the SDGs, the 17 separate goals or ‘silos’ and 169 targets need to be replaced by a holistic or performance approach.

Take ‘sustainable taxation’ (Stahel 2013), a concept which considers the relative weight of labour and material resources as production factors. It greatly differs in the linear and the circular industrial economy:

- the linear industrial economy is resource- and capital-intensive, with a high labour productivity equal to a small labour input;

- the circular industrial economy is labour-intensive, with a high resource productivity equal to a minor consumption of material, water and energy resources.

In many countries, today’s fiscal policies heavily tax labour and subsidise the production and consumption of fossil fuels and other non-renewable resources – the opposite of sustainability.

Reversing this situation, by not taxing renewable resources like human labour and taxing non-renewable ones instead, would give individuals and economic actors direct incentives to shift towards the circular industrial economy, managing their belongings instead of replacing them with new ones. It would motivate people to ‘build ships’ in Saint-Exupéry’s image.

Economic success does not depend on income taxes. Florida and Texas, two powerhouses of the US economy, are among the 11 US states that do not tax labour income and yet flourish economically. And human labour is a renewable low-waste low-carbon resource; taxing non-renewable resources instead will:

- speed up the transformation from flow to stock optimisation, from the linear to the circular industrial economy;

- broaden the application of the circular economy to new economic actors and new sectors; and

- strengthen the competitiveness of the existing economic actors of the circular industrial economy as well as of all other activities involving caring, such as health, education and looking after natural and cultural capitals.

Sustainable taxation should also respect the nature of the circular economy by:

- not charging Value Added Tax (VAT) in Europe on such value preserving activities as reuse, repair and remanufacture (without value added); and

- giving carbon credits for the prevention of greenhouse gas (GHG) emissions to the same degree as for their reduction, considering activities of the era of ‘R’ as CDM projects (see Chapter 10).

The era of ‘R’ and partly the era of ‘D’ prevent large GHG emissions (and waste) but receive no carbon credits under any of the existing or planned CO2 compensation programmes, which are based on the linear thinking of today’s industrial economy: first pollute, then be rewarded for reducing pollution!

Adapting the framework conditions to this fact has begun in some countries. At the end of 2016, the Swedish parliament decided to half VAT levied on repairs and to make the labour costs of repairs deductible from income tax. At the 2017 EU summit in Luxembourg, EU Commissioner for Finance Moscovici suggested that all EU Member States, which have sole authority to change national taxation policy, do the same. A halt to subsidising the production and consumption of fossil fuels is part of the same strategy.

Depreciation rules strongly influence the service-life of investment goods, or tools. Governments can therefore promote the transition to the circular industrial economy through longer fiscal depreciation periods. The long average service-life of aircraft stems from fiscal depreciation periods of 15 years, which entails a product liability by manufacturers of 18–22 years. There is a strong correlation between the service-life of goods, manufacturers’ liability periods and tax depreciation periods (Stahel 2010, pp. 185–186). Legislators can use longer tax depreciation and product liability periods as a policy to create jobs at home, prevent waste and boost regional economic development.

Policymakers will increasingly be challenged to adapt existing policies to changes in the real world. Use value as the new central economic value of the circular economy demands a redefinition of compensations in third party liability, for instance in insurance contracts, replacing depreciated value. The emergence of long-life technologies calls for equally long tax depreciation periods, in order to prevent service-life abortion for corporate tax reasons; efforts to halt global climate change calls for recognition of the CO2 emission prevention by the circular economy and rewarding its economic actors with carbon compensation credits (see Chapter 10).

Public procurement policies are another approach for governments to speed up the shift to a circular industrial economy, both as major buyer-owners of objects and through subsidies to buyer-owners. Public procurement and public subsidies together have an impact on about 35 per cent of the GDP of industrialised countries.

7.6 The role of appropriate economic indicators

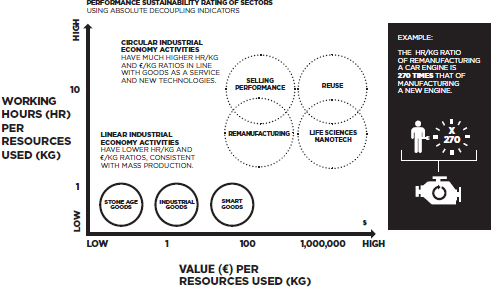

By introducing absolute decoupling indicators (Figure 7.3), governments can make the impact of changes visible to policymakers, economic actors and consumers. The 2000 EU Lisbon strategy3 stated as objectives more wealth, more jobs and lower resource consumption, which coincides with the aims of the circular industrial economy. Figure 7.3 puts these factors into perspective and shows the two absolute decoupling indicators that can be derived:

- value per weight, in euro per kilogram (€/kg);

- labour input per weight, in hour per kilogram (hr/kg).

These indicators can be used to compare the sustainability of products commercialised through different business models, measured at the point of sale in ‘net €/kg’ and ‘net hr/kg’ (Stahel 2006, pp. 62 and 127). Kilograms and hours refer to the resources invested in the relevant processes and embodied in the objects; reuse of an object needs zero kilogram.

Sustainability performance ratings of economic sectors can now be derived using these two absolute decoupling indicators (Figure 7.4).4 Comparing typical manufactured objects and activities of the linear and the circular industrial economy shows two distinct clusters of economic activities:

- the linear industrial economy with low hr/kg (labour input per weight) ratios, coherent with mass production in highly mechanised processes, and low to medium €/kg (value per weight) ratios, in a range from basic materials like cement to smart goods like USB memory sticks;

- the circular industrial economy with much higher hr/kg and €/kg ratios for reuse, remanufacture and selling performance (goods as a service), in a group with new technologies, such as life sciences and nanotechnologies, which by nature produce dematerialised objects.

Some exceptionally high-value goods, such as diamonds and saffron, an agricultural produce, are situated outside the diagram.

7.7 The role of governments and policymakers

If a government wants to contribute to making the circular industrial economy the default option for manufactured objects and materials, it:

- will have to overcome a transition phase of contradicting objectives;

- can choose from several policy options; and

- has to quantify and sell the winnings.

In the transition phase from the present dominating linear to a circular industrial economy, there will be a competition of the two systems, such as globalised production versus intelligent decentralised services. In a mature circular industrial economy, production will have become an integral part of the former (see Figure 3.3). Communicating the vision of a mature circular industrial economy from the very beginning will be crucial; showing its close relation with accepted trends, such as organic farming, intelligent decentralisation and zero waste, will ease oppositions to the transition.

A number of policy options are available:

- spreading the knowledge of the opportunities offered by the circular industrial economy through education and information;

- leading the way through public procurement policies to speed up and broaden the shift to a circular industrial economy;

- not taxing renewable resources including labour, and taxing virgin non-renewable resources instead, would motivate individuals to preserve their belongings rather than replace them, for the simple reason that repairs are cheaper than buying new;

- longer fiscal depreciation periods and depreciation beyond zero would motivate many corporates to extend the service-life of their tools, thus creating jobs, preventing waste, boosting innovation into technological upgrading options and promoting regional economic development without top-down governance.

A multitude of winnings will result from the shift to a circular industrial economy, ranging from substantially reduced GHG emissions, the creation of skilled jobs locally – also for ‘silver’ and manual workers – and a reindustrialisation of regions, to the preservation of the cultural capital and technical heritage of regions.

To quantify, document and sell these winnings, governments will need to adopt novel reporting tools, such as absolute decoupling indicators, reports on the increasing wealth of the nation in natural, human, cultural, manufactured and financial assets or capitals, as well as revising existing ones, such as Input/Output models (Wijkman and Skanberg 2016). The World Bank has started to periodically publish reports on the changes of the wealth of nations for a number of countries (World Bank Group 2018).

Other efforts to quantify, document and sell the winnings of a shift to a circular industrial economy are possible for specific topics, such as emission reductions and resource preservation. However, to grasp the wealth of these winnings, policymakers will have to develop and communicate in more holistic ways than today.

Today’s focus on waste minimisation needs to shift to resource preservation, giving priority to promoting:

- reuse and longer service-life options (the era of ‘R’), as stipulated in the 2015 EU Circular Economy Package;

- the development of methods to collect and sort clean material fractions; and

- the development of technologies to recover molecules and atoms (the era of ‘D’)

In the era of ‘D’, a novel policy approach is needed to measure the annual resource efficiency of fast-moving flows. Legislation should define the maximum acceptable annual value loss of a resource stock instead of the minimal recycling rates for two reasons:

- recovery processes with an efficiency of 50 per cent conserve 50 per cent of material stock; in serial recycling, this means that 50 per cent of the material is preserved in the first loop, 25 per cent in the second and only 12.5 per cent in the third – what the author calls the ‘reverse compound principle’.

- If the object involved has a ten year service-life, such as a combustion engine, that means an annual material loss of 5 per cent. But if the object is a drink can with a one-month service-life, the total resource stock has been lost after only six months, despite a recycling rate of 50 per cent.

- maximal acceptable annual value loss because the economic losses (in monetary terms) due to the loss of quality are considerably higher than the material quantity losses (in tonnages or volume). Only the former represent changes in societal wealth.

This policy change will call for new ‘D’ approaches and technologies. Who should pay for these, which will primarily benefit the environment, secondly improve national resource security? Following the Polluter Pays Principle, the logic answer is: the producers. An Extended Producer Liability wold give manufacturers strong financial incentives to change the choice of materials, or the strategy of commercialising objects to retain ownership and thus be able to recover products after use.

A recent Swedish study arrived at the following conclusions:

Policy will have a central role in achieving improved handling of materials. A first step could be to re-examine pre-existing policies. Current targets for materials collection could be reformulated to take aim at secondary materials production and material value instead. The current ‘producer responsibility’ framework creates weak or non-existent incentives, but could be steered towards some degree of individual rather than collective accountability, underpinned by new technology for the marking and tracking of products. Without the introduction of these types of policies, secondary material will continue to face an uphill battle. Today’s playing field is far from level, and therefore other types of measures may also be required – such as requirements for the use of recycled material (recovered molecules) in new products. International cooperation will be crucial. Most products and materials are international commodities, and it is necessary to coordinate policies, first and foremost at EU level (the European Commission took an important first step with the 2015 Circular Economy Package, but its implementation now requires additional initiatives).

(Material Economics 2018)

References

Bierter, Willy, Buhrow, Julian and Stahel, Walter R. (1999) Langzeit-Kostenanalyse von Fahrzeugen (PKW und LKW) (LCA of cars and trucks). http://product-life.org/de/archive/case-studies/langzeit-kostenanalyse-von-fahrzeugen-pkw-und-lkw, accessed 9 January 2019.

EU 2003 WEEE Directive (2003) European Community Directive 2012/19/EU on waste electrical and electronic equipment (WEEE) which, together with the RoHS Directive 2011/65/EU, became European Law in February 2003.

Giarini, Orio and Stahel, Walter R. (1989) The limits to certainty, facing risks in the new service economy. Kluwer Academic Publishers, Dordrecht.

Hardin, Garret (1968) Tragedy of the commons. Science, vol. 162, no. 3859, pp. 1243–1248.

Material Economics (2018) Ett värdebeständigt svenskt materialsystem (Retaining value in the Swedish materials system). Economic value measured in billion Swedish Kroner versus material measured in tonnes. Research study, unpublished.

Stahel, Walter (2006) The performance economy, first edition. Palgrave Macmillan, Houndmills.

Stahel, Walter (2010) The performance economy,second edition. Palgrave Macmillan, Houndmills.

Stahel, Walter (2013) Policy for material efficiency: Sustainable taxation as a departure from the throwaway society. Philosophical Transactions A of the Royal Society, vol. 371, pp. 1–19.

Wijkman, Anders and Skanberg, Kristian (2016) The circular economy and benefits for society jobs and climate clear winners in an economy based on renewable energy and resource efficiency. The Club of Rome, Winterthur. www.clubofrome.org/wp-content/uploads/2016/03/The-Circular-Economy-and-Benefits-for-Society.pdf, accessed 9 January 2019.

World Bank Group (2018) The changing wealth of nations report 2018. https://openknowledge.worldbank.org/bitstream/handle/10986/29001/9781464810466.pdf, accessed 9 January 2019.